The crypto market of 2025 and beyond is fast-paced, more mature, yet still as volatile as ever. To trade crypto successfully in 2026, it’s crucial to follow time-tested rules and adapt to new market conditions. Whether you’re a beginner or an intermediate trader, having a clear set of trading principles will help you navigate everything from Bitcoin’s price swings to the latest DeFi token hype. This updated guide presents the Top 10 crypto trading rules you should live by. We’ll cover risk management, psychological discipline, adapting to market trends, and strategy tips that incorporate lessons learned through the big bull runs and bear markets of recent years. These rules emphasize a clear and educational tone, focusing on practical steps and real-world examples, so you can improve your trading outcomes and avoid common pitfalls. Let’s dive in!

1. Always Have a Trading Plan and Clear Goals

“Failing to plan is planning to fail.” This adage is extremely relevant in crypto trading. Before entering any trade, define your plan:

-

What asset are you trading and why? (Is there a fundamental catalyst, a technical pattern, etc.?)

-

What is your entry point?

-

Where will you take profits? (Set target levels or a method, like selling half at a 20% gain, etc.)

-

What is your stop-loss level? (How much loss will you tolerate before exiting to prevent a bigger disaster?)

By answering these questions, you turn random gambling into a structured approach. For instance, suppose you’re trading Ethereum. Your plan might be: “I’ll buy ETH at $1800 because it’s at a strong support and the network upgrade is next week (catalyst). I aim to sell around $2000 where there’s resistance. I’ll cut losses if ETH drops to $1700, as that likely means support failed.” With this plan, you’re not making decisions on the fly – you’ve pre-set criteria. This removes a lot of emotion and guesswork.

Set Clear Goals: Decide if this trade is short-term (a quick flip) or long-term. If it’s short-term, perhaps your goal is a 10% profit. If it’s long-term, maybe you believe in the project and aim for a higher return over months. Your goal will affect how you manage the trade. A day trader might plan to exit by end of day regardless, while a swing trader might hold for weeks. Clarity prevents confusion like “It’s down 5%, should I sell or hold?” – if your goal was a multi-month hold, a 5% dip might not scare you because it’s within your plan’s tolerance.

2. Manage Your Risk – Never Risk Too Much on One Trade

Successful traders emphasize that protecting your capital is the top priority. In the volatile crypto markets, it's crucial to limit losses on any single trade. Here are essential risk management rules:

-

Position Sizing (The 2% Rule): Risk no more than 1-2% of your trading capital on a trade. For instance, with a $10,000 account, risking 2% means at most $200. Calculate your position size based on the difference between your entry and stop-loss to ensure you stay within this limit.

-

Don’t Over-leverage: While leverage can amplify profits, it also magnifies losses. Avoid high leverage (like 50x or 100x) unless you fully understand the risks. Modest leverage (2-5x) is safer, allowing you to manage your capital effectively.

-

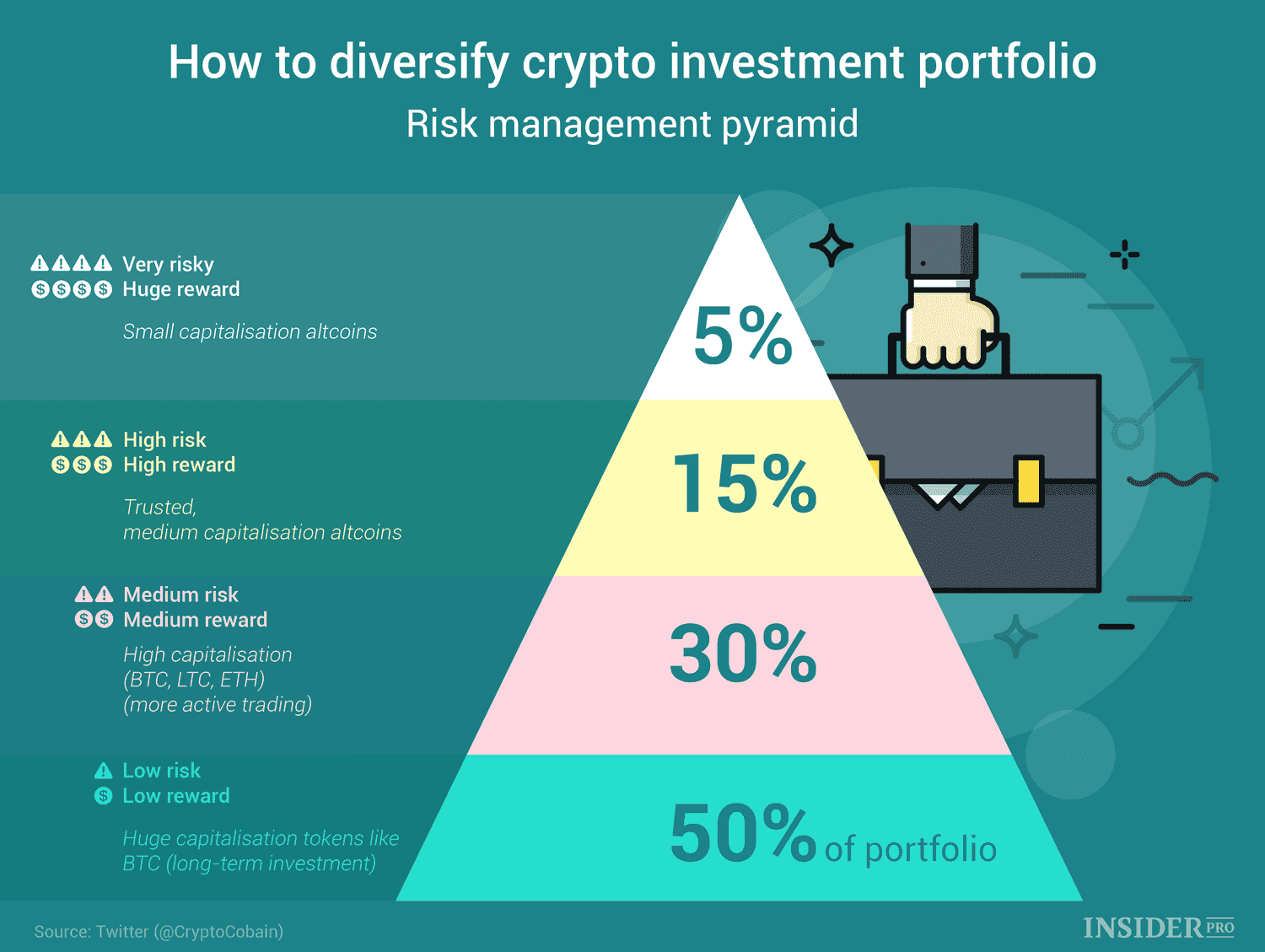

Diversify Your Trades: Don’t concentrate all your capital in one coin or trade. Spread your investments across different assets to mitigate risk. For instance, if you risk only 10% of your capital on a high-risk trade, a significant drop would only affect a small portion of your account.

By following these guidelines, you can navigate the crypto landscape more securely and recover from setbacks more easily.

Crypto Diversification Example (source)

3. Never Revenge Trade – Control Your Emotions After a Loss

Revenge trading is the impulsive urge to quickly recover losses, often leading to poor decisions and further losses. After a significant loss, it's crucial to take a step back and cool off instead of letting frustration dictate your next move.

To avoid revenge trading:

-

Take a Break: After a loss, close your trading charts and take a breather. Step away for 24 hours to prevent impulsive decisions. Engaging in activities like exercise can help clear your mind.

-

Analyze, Don’t Agonize: Once you’re calm, objectively review your losing trade. Did you stick to your plan? Learn from the experience instead of letting it haunt you.

-

Set Loss Limits: Implement daily or weekly loss limits (e.g., stopping trading after losing 5% in a day) to prevent one bad day from derailing your progress.

-

Mindset – It’s a Marathon: Accept that losses are part of trading. Focus on long-term success rather than a single loss. This mindset helps reduce the impulse to retaliate against the market.

By controlling the urge to revenge trade, you can maintain consistency and protect your capital. Avoid emotional decisions – if you feel heated, take a step back.

4. Keep Emotions in Check – Don’t Get Attached or Panic

Emotional discipline is a cornerstone of successful trading. In crypto, where prices can swing wildly, it’s easy to let fear or greed override logical decision-making. Two specific emotions to guard against are:

-

Attachment to Assets: Getting too attached to a particular coin or token (“I love this project, it has to succeed!”) can cloud your judgment.

-

Panic and Fear: Conversely, getting overly scared during dips or volatility can lead to selling at the worst times or missing out on opportunities.

Don’t Fall in Love with Your Bags: It’s common for crypto enthusiasts to develop a sort of emotional bond with their favorite project. Maybe you deeply believe in the tech or the community. While conviction is good for investing, in trading it can be dangerous. You must be willing to flip bias or exit if the market tells you to, regardless of personal feelings. For example, say you’re a big fan of a DeFi token and you’ve been bullish on it. But then it breaks a key support level or the trend turns bearish. If you’re too attached, you might hold (or even add) because you “believe in it,” and end up riding it way down. A disciplined trader would cut the position when the trade setup is invalidated, even if they love the project. Your trading account doesn’t get bonus points for loyalty – quite the opposite, stubbornly holding losers is a top account killer. Treat every trade coldly: it’s just numbers and charts, not your identity or a pet to care for.

5. Keep It Simple – Avoid Overthinking and Analysis Paralysis

In the crypto world of 2026, traders face the risk of analysis paralysis due to an overwhelming amount of information and indicators. Simplifying your approach can lead to better decision-making.

Use a Few Reliable Indicators: Choose a limited number of technical tools, such as trend lines and RSI or moving averages and MACD. Avoid conflicting signals by mastering a simple strategy instead of overcomplicating it. Many successful traders stick to basic methods like support/resistance breakouts or moving average crossovers.

Limit News Consumption: Stay updated on major events, but resist the urge to follow every bit of news or social media speculation. Not all information is reliable, and conflicting opinions can lead to indecision. Use news as context for your strategy rather than a primary driver for trades.

Stick to Your Strategy: Define your approach, such as trading chart patterns on a specific timeframe, and rely on it even during significant news events.

Prevent Information Overload: Some traders avoid consuming new analysis while in a trade to reduce second-guessing. This helps avoid overtrading and keeps your strategy intact.

Focus on High-Quality Setups: Select opportunities where you have an edge. Waiting for ideal conditions rather than forcing trades can lead to more consistent outcomes.

Trust Your System: Simplicity builds confidence. A tested, straightforward strategy helps you avoid unnecessary complexity and second-guessing.

For example, John trades using just support/resistance and RSI while Jane uses ten indicators and multiple chatrooms. John's simplified approach leads to better performance and consistency, while Jane often struggles with indecision.

The main takeaway: in chaotic crypto markets, a simple and well-executed strategy outperforms a complex one.

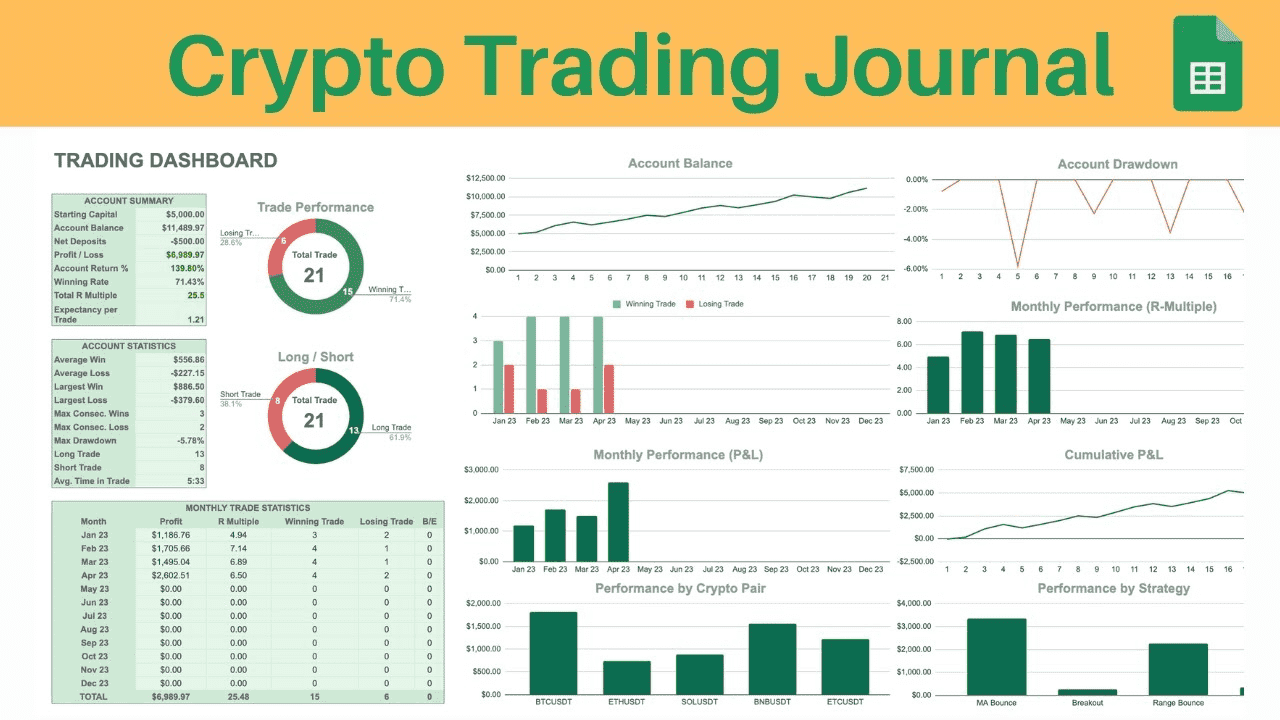

Crypto Trading Journal (source)

6. Practice with Paper Trading or Small Positions First

Jumping into crypto trading with large sums is like learning to fly a plane by taking a jumbo jet out on day one – it often ends badly. A smart approach is to practice in a simulated or low-risk environment before scaling up, which helps build skills and confidence without risking significant capital. Paper Trading involves trading on paper or using a simulator without real money. You can track hypothetical trades and outcomes, which helps you test strategies and understand market behavior without financial risk. Phemex, for example, offers a Mock Trading environment for practice.

-

Get Familiar with Tools: Practicing order types and execution in a simulator makes you more comfortable with trading platforms, reducing the likelihood of costly mistakes when you start trading live.

-

Emotional Training: While the adrenaline of real trading isn’t replicated, paper trading allows you to practice discipline and identify emotional patterns in your trading behavior.

-

Start Small: When transitioning to real trading, begin with small positions to minimize losses during the learning process. Even trades as small as $100 can provide insights into slippage and volatility.

-

Multiple Repetitions: Execute numerous trades through paper or micro trading to build market intuition, which prepares you for unexpected market events without heavy losses.

-

Combining with Data Analysis: Use trading journals to evaluate your performance and refine your strategies based on insights from your trades. Adjust your approach based on what works and what doesn’t.

-

Don’t Skip the Step: While it may seem slow to paper trade, rushing leads to costly mistakes. Many successful traders wish they had been more patient at the start.

In summary, practicing through paper trading is essential for success in the unforgiving crypto markets. Take the time to learn in a forgiving environment to boost your future performance and confidence.7.

7. Beware the “Falling Knife” – Wait for Confirmation Before Entering

There’s an old market saying: “Don’t catch a falling knife.” This refers to buying an asset that’s plummeting in price in the hope of catching the bottom, only to get cut as it keeps dropping. In crypto, where drops of 20-30% in days or even hours can happen, this rule is critical: avoid jumping into a rapidly falling market without signs of stabilization.

When prices are in freefall (the “falling knife”), emotions like fear and hope mix. You might think, “Wow, it’s down 50%, it’s cheap now!” But remember, something down 50% can still drop another 50% (which would be 75% off the original). If you buy too early, you could be immediately deep in the red. Instead of guessing where the absolute bottom is, wait for evidence that selling is exhausted and buyers are stepping in.

8. Don’t Overtrade – Quality Over Quantity

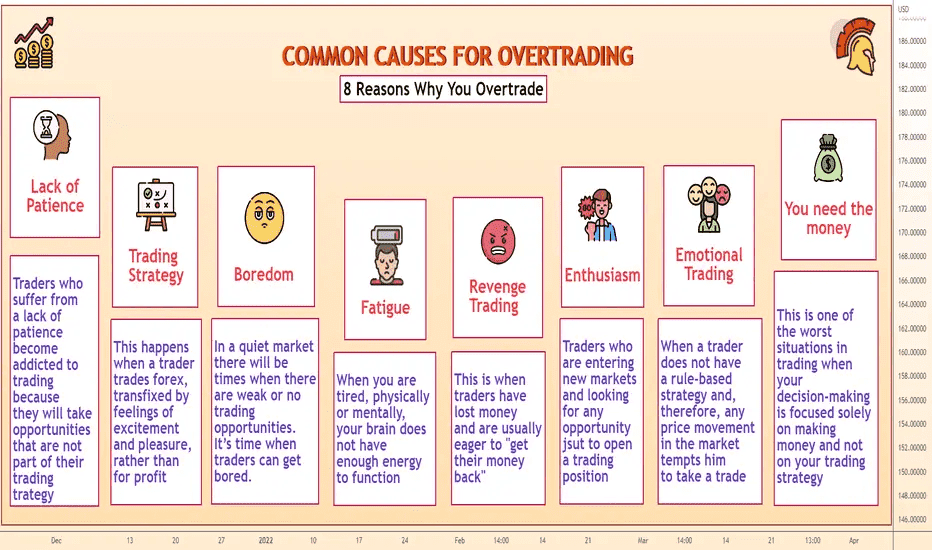

With crypto markets open 24/7 and thousands of coins available, one of the easiest traps to fall into is overtrading – taking too many trades, too frequently, without sufficient reasons. Overtrading can erode profits through fees, spread you too thin to manage positions properly, and often indicates you’re chasing noise rather than high-quality setups.

It’s often said in trading that you get paid for being right, not for working hard or being busy. Five well-planned trades in a month that follow your edge can yield more profit than 50 impulsive ones. For instance, perhaps you identify a handful of high-probability setups: a clear breakout on Bitcoin, an oversold bounce on a major altcoin, a DeFi token reacting positively to some news, etc. If you execute those well and stay out when there’s nothing good, you might hit, say, 3 winners out of 5 and be solidly profitable. If you force trades every day, you might tally lots of small losses or break-even churn that waste time and create stress.

One practical tip is to set a rule for maximum trades per day or week. This makes you pick only the best ones. If you’ve already done 3 today, you’ll only take a 4th if you’re extremely confident – which likely means it’s indeed a great setup. For swing traders, maybe it’s “no more than 10 open positions at a time, ideally under 5.” This forces you to rank opportunities and not just pile into everything. Another angle is to define certain hours or times you trade and when you don’t. Having a routine prevents aimless trading at 3 AM, for example, just because crypto is open.

Causes for Overtrading (source)

9. Continuously Educate Yourself and Adapt to Market Conditions

The crypto market is constantly evolving – new technologies, new regulations, shifting trends (from ICOs to DeFi to NFTs to metaverse, etc.). What worked last year might not work this year. A successful trader treats education as an ongoing journey, not a one-time thing. Always be learning and ready to adjust your strategies for 2026’s market conditions and beyond.

Stay Informed on Industry Developments: This doesn’t mean chasing every rumor, but do follow major macro trends and news that can alter the trading landscape. As you gain experience, expand your toolkit. Maybe you started purely as a technical trader; you could learn some on-chain analysis basics to complement your TA for Bitcoin. Or if you’ve never tried options, perhaps study how basic options strategies (like protective puts or covered calls) work – these might become more accessible as crypto options markets grow, giving you more ways to hedge or profit. Or dive into algorithmic trading if that intrigues you – some traders eventually automate parts of their strategy.

By continuously educating yourself, you avoid stagnation. The traders who last decades are those who adapt. Markets will throw curveballs (like the sudden COVID crash in 2020 or the unexpected altcoin mania of 2021) – if you’re nimble and knowledgeable, you can survive and even thrive through these. Conversely, if you stick rigidly to one approach and never update your knowledge, the market will eventually change in a way that blindsides you.

10. Maintain a Healthy Trading Routine and Life Balance

Trading successfully involves not just market strategies but also effective management of your time, energy, and well-being. The 24/7 nature of crypto can lead to burnout, so establishing a balanced routine is essential.

-

Set Trading Hours and Take Breaks: Choose specific times to trade, such as 9 AM to 5 PM, and avoid trading late at night. Consider taking weekends off to avoid low-volume volatility unless clear opportunities arise.

-

Prioritize Sleep and Health: Sleep deprivation hampers decision-making. Maintain a healthy diet and exercise regimen to stay sharp. If trading causes insomnia, reassess your leverage and trading volume to ease stress.

-

Keep a Trading Journal and Routine: Begin your day with a structured routine, including market analysis and goals. Log your trades and observations to create closure at the end of the day, allowing you to relax afterward.

-

Balance Other Life Aspects: Engage with family, friends, and hobbies to reduce stress and avoid emotional attachment to trading results. A well-rounded life improves perspective and longevity in trading.

-

Psychological Well-being: Handle emotional stress through coping mechanisms like meditation or discussions with mentors. Strengthening mental resilience is crucial.

-

Discipline in Routine: Treat trading like a profession by maintaining a consistent schedule. Adapt your routine only during extraordinary market conditions, but revert to a balanced approach afterward.

Conclusion

Trading crypto successfully in 2026 requires a blend of solid strategy, disciplined execution, and personal balance. We’ve covered ten key rules: from having a detailed plan and managing risk diligently, to controlling emotions and avoiding common pitfalls like overtrading and revenge trading. We’ve highlighted the importance of continuous learning and adapting, as well as taking care of your mental and physical well-being to sustain high performance.

By following these principles, beginner and intermediate traders can significantly improve their odds of success. You’ll be better equipped to handle the thrilling yet volatile nature of crypto markets. Remember, every trader faces ups and downs – what separates the successful ones is how they navigate those challenges. Use these rules as your compass. Stick to them with patience and consistency, and over time you’ll develop the confidence and skill set to thrive in any market environment.

Happy trading, stay safe, and may your 2026 trading journey be profitable and rewarding!