Crypto copy trading is one of the easiest ways for beginners to start trading crypto by copying the moves of experienced traders. Instead of doing all the analysis and trading decisions yourself, you automatically mirror what top traders do in real time. This appeals to people who want passive trading, a chance to learn from the pros, and a time-saving approach to crypto investing. In simple terms, copy trading lets you piggyback on expert strategies – when they trade, your account trades too. It’s a form of social trading that can level the playing field for newcomers while still allowing you to stay in control of your funds.

In this comprehensive guide, we’ll break down everything you need to know about crypto copy trading. You’ll learn how it works, benefits for different users, and the risks and common mistakes to watch out for. Crypto copy trading can be a powerful tool in your trading arsenal – let’s dive into the details.

Understanding the Basics of Crypto Copy Trading

Let’s start with the fundamentals. Copy trading might sound complex, but the concept is straightforward: you’re following another trader’s moves. Below, we explain what crypto copy trading means in simple terms, how it fits into the broader crypto investing landscape, and how it compares to manual trading or using trading bots.

What Is Crypto Copy Trading in Simple Terms?

Crypto copy trading allows you to automatically replicate the trades of experienced investors in your own account. Instead of creating your own strategy, you choose a seasoned trader (often called a “lead” or “top” trader”) and link your account to theirs. When they buy or sell, your account mirrors those actions in real time, making it ideal for beginners or busy individuals who can’t monitor the market constantly. You still have control over your investments, choosing how much to invest per trade and setting stop-loss orders.

How It Fits Into Crypto Investing or Trading

Copy trading represents a middle ground between DIY trading and hands-off investing. It provides an easy entry point for those wanting to invest in crypto without becoming full-time traders. This approach also aligns with social trading trends, letting less-experienced users benefit from veteran insights. You can diversify your strategy by combining copy trading with long-term HODLing or manual trading.

While copy trading offers a way to engage with crypto investing, it’s not a guaranteed path to wealth and shouldn’t replace market understanding. Platforms like Phemex now offer copy trading, highlighting its popularity in modern crypto investing as a convenient and educational method.

Copy Trading vs. Manual Trading vs. Bots

It’s helpful to distinguish copy trading from other trading methods:

-

Manual Trading: This traditional approach gives you full control over your trades. You analyze coins, follow news, and execute trades yourself, which requires time, skill, and discipline. However, emotions like fear and greed can lead to impulsive decisions.

-

Copy Trading: Here, you let a lead trader make decisions while the platform automatically mirrors their trades in your account. This method lowers the entry barrier and reduces stress, but you rely on the chosen trader’s expertise, meaning their mistakes can impact you.

-

Trading Bots (Automation): Bots execute trades based on pre-programmed algorithms or signals. They can operate 24/7 and react quickly to market changes, but may require technical skills to set up. Unlike copy trading, which relies on human judgment, bots follow coded strategies.

Many crypto investors mix these methods, such as manually trading known coins, using bots for arbitrage, and copy trading successful strategies. The best approach depends on your goals and risk tolerance. Beginners often gravitate toward copy trading for its hands-off nature, while experienced traders may favor manual trading or advanced bot strategies for more control.

How Copy Trading Works (source)

How Copy Trading Works

Copy trading involves two main roles: the lead trader and the follower (or copier). The lead trader, often an experienced individual, executes trades that followers replicate on their own accounts. When the lead trader buys an asset, the copier will buy a proportional amount based on their allocated funds. This process is automated, meaning once you opt-in to copy a trader, all trades are executed in real-time without manual confirmation.

Copy trading platforms link accounts securely and often use separate “copy trading accounts” for followers, isolating copied trades from main funds to manage risk. Lead traders may receive a share of the profits made by their followers, creating a win-win relationship where both parties can benefit from successful trading strategies.

Example Scenario: Copy Trading in Action

To make this concrete, let’s walk through a simple example scenario of crypto copy trading:

Scenario: Alice, an experienced trader known for consistent profits, attracts Bob, a beginner who decides to copy her trades.

-

Setup: Bob signs up on a crypto exchange like Phemex and allocates $1,000 for copy trading. He finds Alice on the leaderboard, sees her 20% ROI over the past month, and clicks “Copy Now,” using the Smart Ratio mode with 5× leverage on futures trades.

-

Alice Opens a Trade: Alice buys 2 ETH/USDT perpetual contracts, using 10% of her capital. Bob’s account opens a proportional position worth $100, leveraging it to a $500 position.

-

Trade Management: As the price of ETH rises, Alice takes a 10% profit and closes her position. Consequently, Bob’s position is closed automatically, netting him about $10 profit after fees, benefiting from Alice’s successful trade.

-

Profit Share Kick In: The platform like Phemex takes a 10% performance fee from Bob’s profit, giving $1 to Alice. If Bob loses money on a trade, no fee is taken, aligning Alice's incentives with Bob’s success.

-

Bob’s Perspective: Bob's dashboard shows his net gain of $9 from the ETH trade. Throughout the week, Bob could accumulate a total profit of $50, with $5 deducted for Alice, leaving him with $45 overall.

-

If Things Went Differently: If Alice makes a losing trade, Bob mirrors that loss and does not pay a profit share. Bob must decide whether to continue copying Alice based on her performance.

This example highlights the synchronization of trades, proportional scaling, and the profit-sharing mechanism in copy trading, while emphasizing that results are tied to the lead trader's performance. Copy trading offers a hands-off approach for beginners like Bob.

Benefits and Use Cases of Copy Trading

Copy trading presents numerous benefits for various crypto market participants, including beginners and busy investors.

For Beginners

Copy trading simplifies entry into the complex crypto market for newcomers. It eliminates the need for extensive technical knowledge, allowing beginners to learn from experienced traders by following their moves. This mentorship-like experience helps beginners grasp strategies, timing, and risk management in a practical manner. Copy trading also reduces the emotional stress of decision-making, offering confidence and a more accessible way to engage with the market without being an expert from the start.

For Busy Investors

For those with full-time jobs or other commitments, copy trading is time-saving and convenient. Once set up, it allows for passive investment, enabling users to benefit from active trading strategies without constant market monitoring. This hands-off approach provides diversification without the need for extensive research. It’s an ideal solution for busy individuals who want to capitalize on crypto trends without the workload of trading, although periodic performance checks are still recommended.

Copy trading offers experienced traders a way to monetize their skills by becoming lead traders on platforms like Phemex. Proficient traders can earn extra income by receiving a profit share - even up to 20% of their copiers' gains. Over time, with many followers, this can lead to a substantial passive income stream.

In addition to financial incentives, expert traders gain social recognition and credibility, allowing them to build a reputation and influence within the trading community. Leading a group of followers can be rewarding, as it encourages responsible trading and risk management since others are relying on their strategies.

Moreover, expert traders can benefit from a diverse trading experience by observing and learning from their peers, which can enhance their own skills. Being a lead trader motivates them to maintain discipline in their trading practice, as their income depends on their performance.

In summary, copy trading platforms like Phemex can help expert traders earn passive income, boost their reputation, and refine their strategies, transforming trading into a leadership role in a social environment.

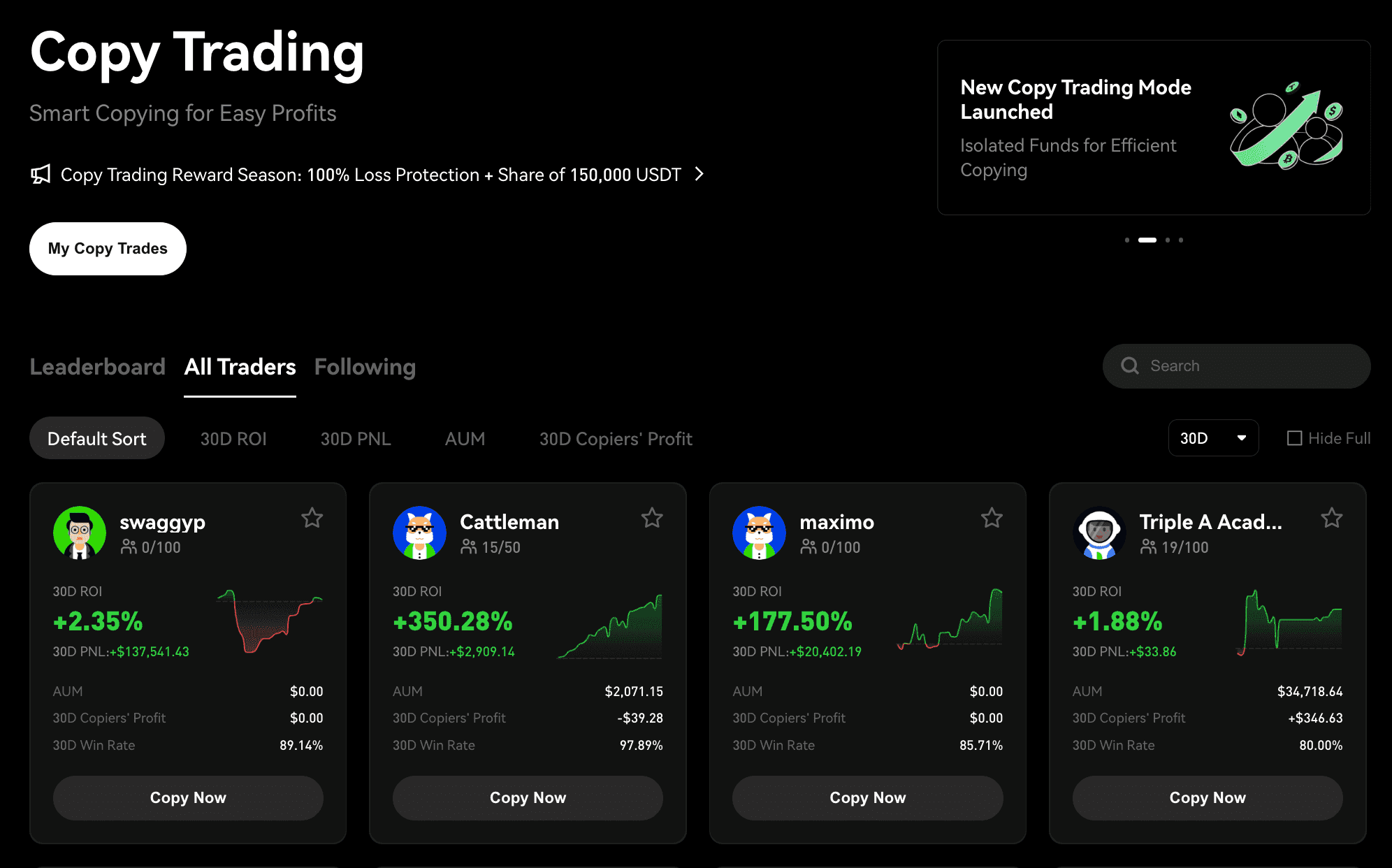

Copy Trading on Phemex (source)

Risks, Limitations, and Common Mistakes

While copy trading offers appealing benefits, it's important to understand the associated risks and limitations. It doesn't eliminate trading risks; instead, it introduces new ones.

Platform Risk, Market Risk, and Overconfidence

Platform Risk: Using a copy trading platform means trusting it to execute trades correctly and safeguard your funds. Issues like trade execution delays or slippage can occur, particularly in volatile markets. If a platform fails or is hacked, you could lose money or be unable to withdraw funds. To mitigate this risk, choose reputable platforms like Phemex and avoid putting all your capital in one place.

Market Risk: Copy trading does not shield you from market volatility. Both you and the lead trader are exposed to unpredictable swings, causing potential losses. Even experienced traders face losing streaks, so invest only what you can afford to lose.

Overconfidence in Others’ Trades: Relying too heavily on a lead trader can lead to complacency. It's crucial to remember that they can make mistakes or change strategies. Maintain oversight of your investments, and be prepared to adjust your approach if necessary. There’s also a risk of misalignment in trading strategies that you may not have fully understood.

Ultimately, while you can outsource some decision-making, you remain responsible for the outcomes. Stay vigilant and adopt a “trust but verify” mentality when following a trader.

Common Mistakes: Copying Blindly, Chasing Top PnL, Not Setting Limits

When using copy trading, beginners often fall into some avoidable mistakes. Being aware of these can save you a lot of trouble:

-

Copying Blindly Without Research: Avoid choosing traders solely based on their leaderboard rank or flashy profiles. Always review their performance history, trade strategy, and risk levels. A trader with a high ROI might have a history of risky swings.

-

Chasing Only the Highest PnL: It’s tempting to follow the top performer, but the highest returns often come with high risks. Look for traders with consistent, moderate gains instead of ones who may quickly lose it all. Avoid constantly switching traders; instead, have a selection plan and give it time.

-

Not Setting Any Limits or Risk Controls: Don’t just set and forget your investments. Use risk management tools like setting maximum allocations per trader and establishing stop-loss limits. Ensure your leverage matches your risk comfort.

-

Forgetting to Monitor (Set-and-Forget Syndrome): Regularly check in on your chosen traders. Markets change, and a strategy may stop working. Review performance at least weekly or monthly and adjust as needed.

In summary, avoid blind faith and laziness in copy trading. Do your homework on who you copy, don’t be seduced by eye-popping returns alone, use the tools to manage your risk, and stay engaged with your portfolio. By sidestepping these common pitfalls, you increase your chances of having a positive copy trading experience and actually achieving the “easy profits” that the concept promises (while remembering nothing is truly easy or guaranteed in trading). As a rule of thumb: copy trading is simple, but it’s not foolproof – you still need to act thoughtfully and responsibly.

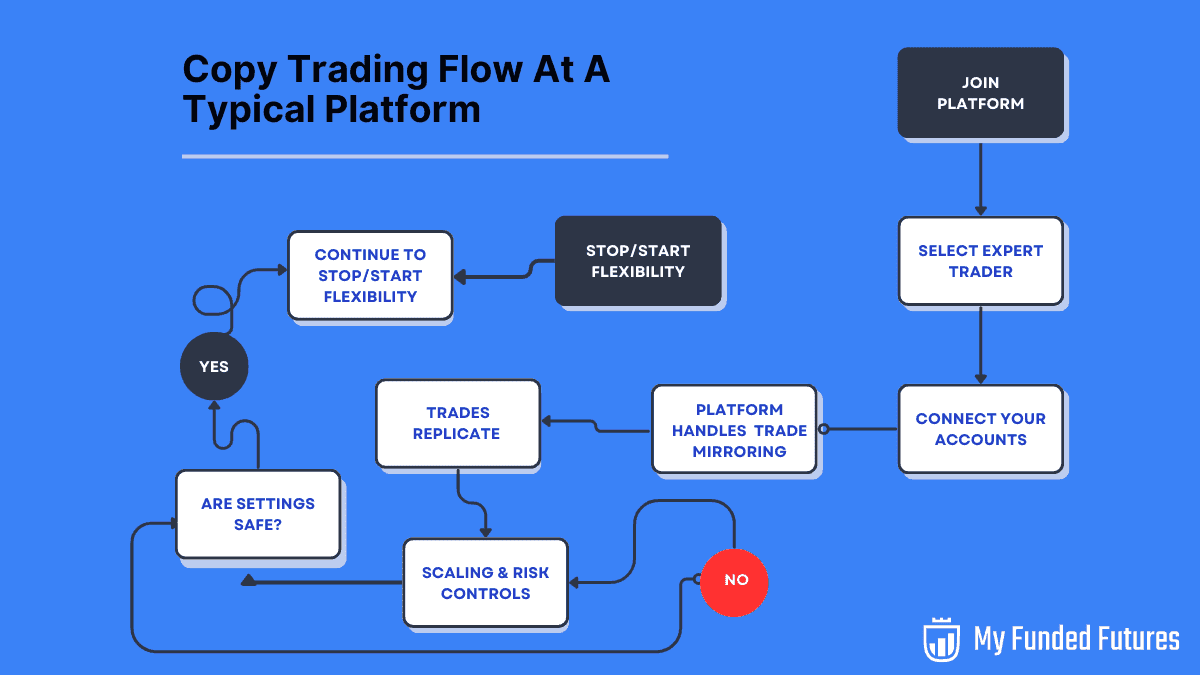

Strategies and Best Practices for Crypto Copy Trading

To optimize your crypto copy trading experience and manage risks effectively, consider these key strategies:

Risk-Adjusted Allocation

Allocate capital based on your risk tolerance and financial situation. Start with a small percentage of your portfolio, gradually increasing it as you gain confidence. Diversify funds among multiple traders, favoring those with lower risk profiles and consistent performance. Use stop-loss features to protect your funds and adjust position sizes to prevent significant losses.

Diversify Among Lead Traders

Avoid putting all your investment into one trader by following several with different strategies or markets. Copying 3 to 5 traders is a good start. Ensure they utilize uncorrelated strategies to truly diversify your risk.

Review and Adjust Regularly

Copy trading isn’t a “set it and forget it” process. Schedule regular evaluations of each trader’s performance, adapt to changing market conditions, and be willing to stop copying underperforming traders. Stay informed about market trends and fees to ensure alignment with your investment goals.

Think of copy trading as maintaining a garden—regular monitoring and adjustments are essential for a successful outcome.

Copy Trading Flow (source)

Final Thoughts on Using Crypto Copy Trading

Copy trading can be a powerful tool in your crypto trading journey, especially if you leverage it as a learning experience and a convenience rather than a get-rich-quick scheme. It’s best suited for those who want exposure to active trading strategies but lack the time or expertise to trade full-time – for example, beginners looking to learn the ropes, or busy investors who still want to participate in the market’s movements. By following seasoned traders, you gain insights into real trading decisions and potentially profit alongside them.

However, keep in mind that copy trading is not a substitute for prudent investing. It should complement your understanding of the market, not replace it. The most successful copiers are those who remain engaged: they choose traders carefully, diversify their copied portfolio, and monitor their accounts regularly. Always remember that crypto markets carry risk, and no trader, no matter how skilled, is infallible. Use copy trading as a way to shorten your learning curve and possibly enhance returns, but combine it with your own research and risk management.

If you’re ready to give it a try, consider exploring copy trading on an exchange like Phemex, which offers a transparent and user-friendly platform for this purpose. Phemex’s model, where lead traders can earn when you profit, creates a collaborative win-win environment. Phemex’s recent upgrade to its copy trading function now allows for users to segregate their copy trading funds to avoid conflicting trades and funding. These independent fund accounts also feature transparent data tracking and risk controls. By starting small, observing the process, and gradually increasing your involvement, you can see if copy trading aligns with your investment goals. Who knows – over time, you might gain enough experience to develop your own trading style or even become a lead trader yourself.

Approach copy trading with an open but cautious mind. It’s an innovative way to participate in crypto trading without going it alone. Done right, it can be flexible, educational, and potentially rewarding. So, if the idea of “trading like the experts” appeals to you, take the next step and explore the copy trading features on Phemex. Right now the platform is hosting the Copy Trading Reward Season event in which users can share a $150,000 prize pool and enjoy 100% trading loss protection.