A negociação de contratos é uma modalidade de negociação de derivativos de criptomoedas em que você firma um acordo (um contrato) para especular sobre o preço de um ativo cripto sem realmente possuir o ativo subjacente. Em termos simples, um trader e uma exchange (como a Phemex) concordam em liquidar a diferença no preço de um ativo, desde o momento em que o contrato é aberto até quando é fechado. Isso permite que traders lucrem com a variação de preço do Bitcoin, Ethereum e outras criptomoedas, indo “long” (apostando na alta) ou “short” (apostando na baixa) — tudo isso sem nunca tocar nas moedas de fato. Em 2025, a negociação de contratos (também conhecida como negociação de futuros de cripto) tornou-se extremamente popular, oferecendo alta alavancagem e novos produtos como contratos perpétuos, porém apresenta riscos significativos que novos traders precisam compreender.

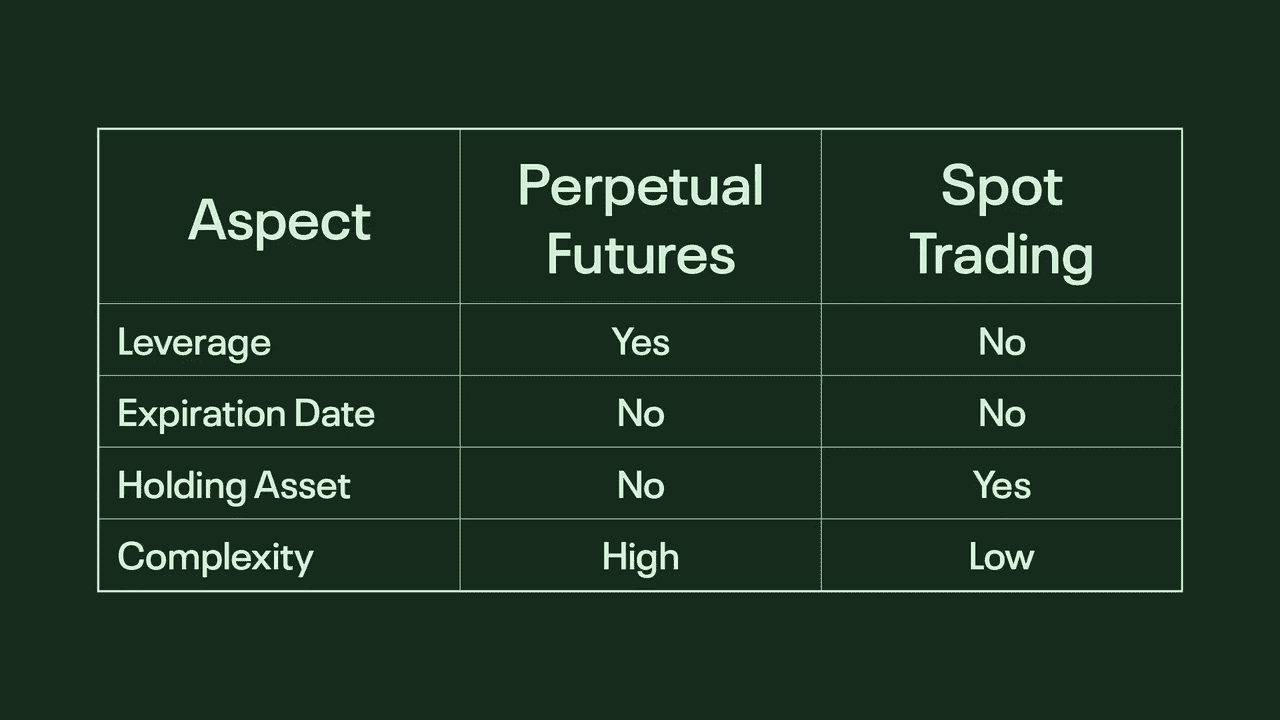

A negociação de contratos difere da negociação spot tradicional. No mercado spot, você compra e possui a criptomoeda de fato. Na negociação de contratos, você negocia contratos atrelados ao preço da cripto — você não possui a moeda, mas sim um derivativo, que deriva seu valor do preço do ativo. Essa diferença fundamental permite ao trader usar alavancagem para multiplicar sua exposição, podendo obter lucro tanto em mercados de alta quanto de baixa.

O que é um contrato em trading?

Um contrato, no trading, é um acordo legal em que duas partes concordam com determinados termos:

-

Exchanges: Concordam em pagar um valor superior proporcional ao investimento inicial do trader, caso sua operação seja lucrativa.

-

Traders: Concordam em aportar margem como garantia e aceitar o risco de perder os criptoativos caso a operação vá na direção oposta.

Os traders devem escolher a margem para negociar opções de contratos. A margem é o valor de alavancagem que um trader utiliza para aumentar o potencial de lucro proporcionalmente ao valor inicial investido. É possível operar com 2x, 3x, 5x, 10x, 50x e até 100x de alavancagem.

O risco-retorno na negociação de margem é proporcional. Quanto maior o multiplicador de alavancagem, maior o potencial de lucro. O risco de liquidação também cresce com a alavancagem elevada, já que o trader negocia com capital emprestado.

Exemplo de Negociação de Contrato de Bitcoin

Um trader deseja negociar 1 Bitcoin na Phemex (a um preço de US$ 40.000 USDT), mas possui apenas US$ 400 USDT em conta. Uma operação com alavancagem 100x permite que ele faça um trade com o valor total de 1 Bitcoin (US$ 40.000), tomando dinheiro emprestado com razão de 100:1.

A diferença de US$ 39.600 é considerada capital emprestado. Com esse tipo de alavancagem, a exchange pode liquidar o trader se a posição se mover por uma fração de 1%. Com margens menores, como 3x, o Bitcoin pode oscilar mais de 10% contra a posição e mesmo assim não ser liquidado.

Se a posição está aberta, o saldo restante depositado fica como garantia para a negociação. O trader não pode perder mais do que o valor disponível em sua conta como colateral.

Traders podem abrir e fechar operações usando ordens limit e market — semelhante ao spot. A única diferença está no número de contratos comprados e na alavancagem utilizada.

Contratos Perpétuos e Taxas de Financiamento Explicadas

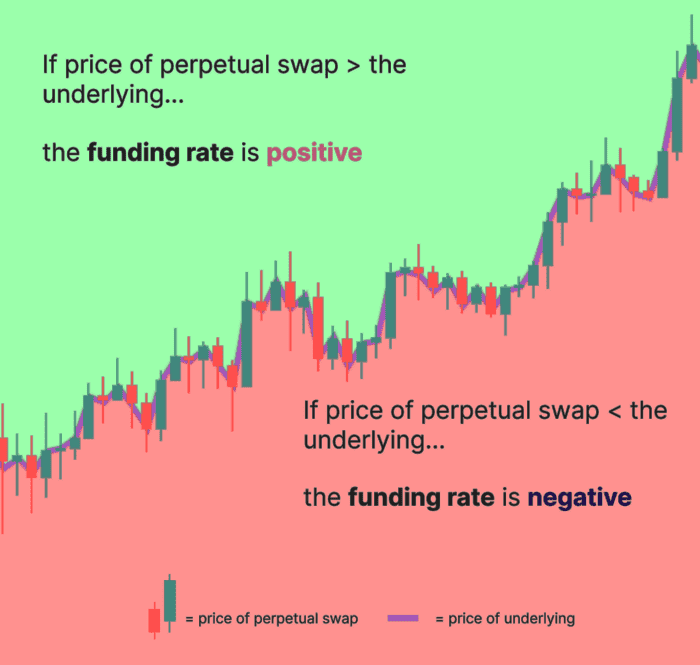

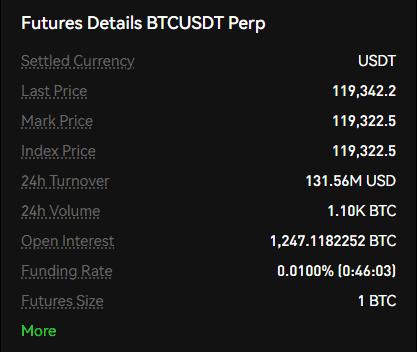

Contratos perpétuos são um derivativo cripto muito popular em 2025, e se diferenciam dos futuros tradicionais por não possuírem data de expiração, permitindo manter a posição indefinidamente. Exchanges usam as taxas de financiamento (funding) para alinhar o preço dos perpétuos ao do ativo subjacente no mercado spot.

Um contrato perpétuo funciona como um contrato futuro, porém sem data de vencimento. Por exemplo, um perpétuo de BTC na Phemex acompanha o preço do Bitcoin continuamente, oferecendo flexibilidade ao trader, que não precisa se preocupar com rolagem ou expiração.

Taxas de financiamento são necessárias para evitar que o preço dos perpétuos se distancie indefinidamente do spot. Essas taxas são pagamentos periódicos trocados entre traders long e short. Se o preço do perpétuo excede o spot, os comprados (longs) pagam uma taxa aos vendidos (shorts). Isso faz o preço tender ao spot. O oposto ocorre se o perpétuo estiver abaixo do spot.

Por exemplo, se o perpétuo de BTC na Phemex negocia a US$ 30.100 e o spot está em US$ 30.000, uma taxa de financiamento de +0,03% significa que uma posição long de US$ 100.000 paga US$ 30, enquanto shorts recebem esse valor. Esses pagamentos se acumulam e são importantes para posições de longo prazo.

Traders devem monitorar as taxas de financiamento, pois taxas altas podem impactar a lucratividade. Em mercados em tendência, o funding pode tornar-se caro para longs ou vantajoso para shorts. As taxas estão disponíveis nas plataformas e servem como indicadores de sentimento de mercado.

Em resumo, contratos perpétuos oferecem flexibilidade de negociação, porém exigem atenção especial às taxas de financiamento. Traders, especialmente swing e position traders, devem sempre verificar essas taxas antes de operar.

Tamanho do Mercado de Derivativos Cripto

Os dados dos agregadores de mercado mostram que o volume diário de derivativos cripto em todas as exchanges supera US$ 100 bilhões. Desse total, a Phemex representa cerca de 2-3%, com volume diário acima de US$ 2-3 bilhões.

O mercado de derivativos de Bitcoin compreende mais de 50% de todo o mercado de derivativos de cripto. Em 2021, derivativos de cripto superaram o mercado spot em volume pela primeira vez na história. Os derivativos cripto ainda são recentes e estão amadurecendo, oferecendo ferramentas similares aos mercados de derivativos tradicionais.

O mercado mundial de derivativos não-cripto estima-se acima de US$ 1 quatrilhão, combinando ativos como ações, forex, metais preciosos e outros.

Futuros vs Negociação Spot

No mercado spot, você adquire e detém os ativos de forma permanente. Na negociação de derivativos, você compra contratos relacionados ao ativo e o preço spot dita a rentabilidade desses contratos.

Ativos como Bitcoin não são de posse do trader em negociações de derivativos. Mesmo em bolsas de ações, negociantes de derivativos não possuem as ações de fato. Usuários da Phemex podem negociar derivativos para a maioria das moedas listadas no mercado spot. Como uma das principais exchanges de derivativos de cripto, buscamos expandir nossa oferta de contratos para todos os pares spot listados na plataforma.

Ao negociar derivativos, o trader mantém controle total da operação. Por exemplo, pode operar long/short, ajustar alavancagem, definir take profit/stop loss e encerrar posições com ordens limitadas ou a mercado.

Estratégias para Derivativos e Contratos

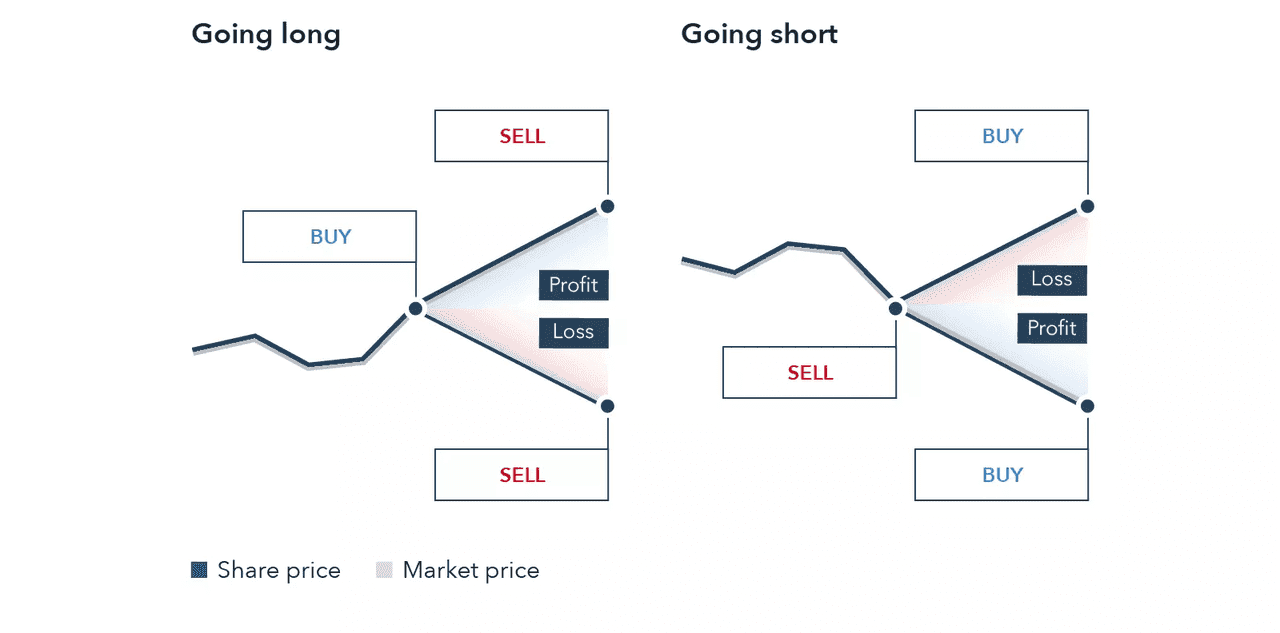

Negociar derivativos de criptomoedas pode ser simples. Long e short são as estratégias mais usadas, geralmente combinadas com alavancagem.

-

Long (Compra): Posições contratuais que apostam na valorização do Bitcoin ou de um altcoin.

-

Short (Venda): Posições contratuais que apostam na desvalorização do Bitcoin ou de um altcoin.

Ao abrir uma posição long (Compra) em Bitcoin, o preço spot precisa subir desde a abertura da operação para gerar lucro. Caso o preço caia, o trader corre o risco de perder parte do capital.

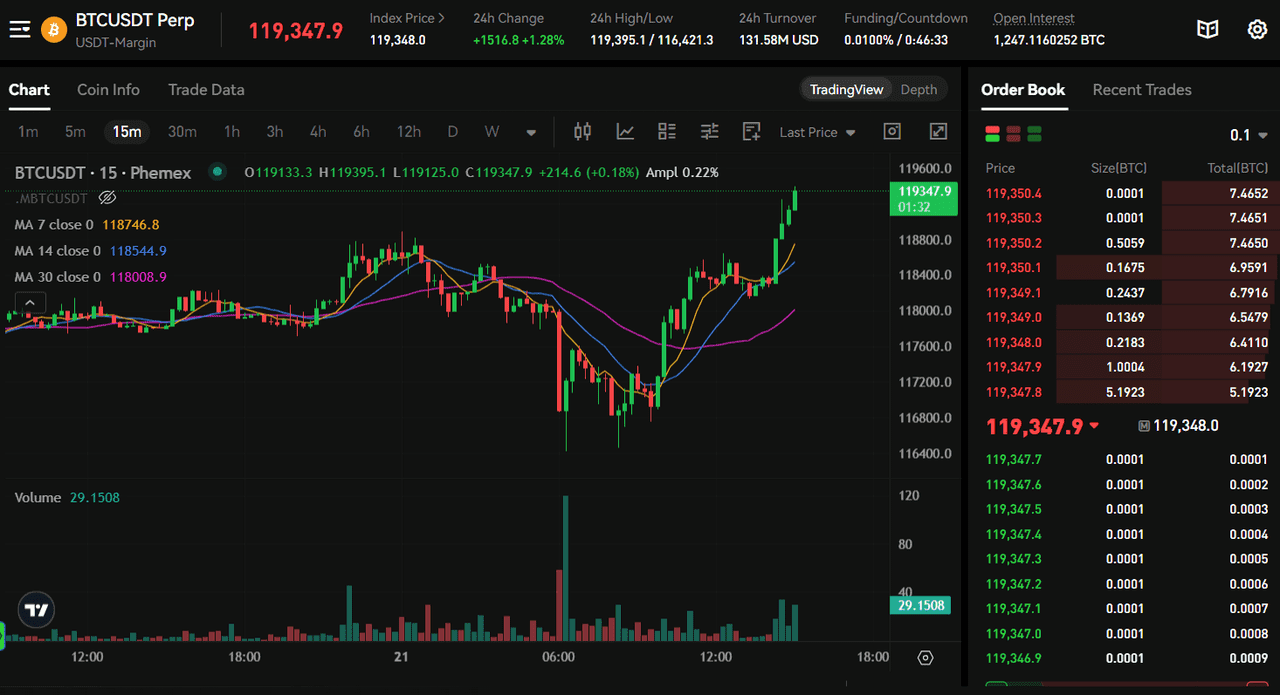

Se o trader utiliza 100x de alavancagem, a melhor estratégia é analisar gráficos de minuto (1M, 5M, 15M) para capturar pequenas oscilações. Em alavancagem 3x, é possível usar gráficos horários (1H, 4H), diários (1D) ou semanais (1W) para prever movimentos de preço.

Trades com contratos são geralmente mais curtos que no spot devido à maior alavancagem. Traders realizam lucro mais cedo para se proteger (hedge) contra variações contrárias e encerram posições rapidamente caso o movimento seja desfavorável.

Vantagens da Negociação de Contratos em Cripto (Guia Passo a Passo)

Negociar contratos de cripto proporciona várias vantagens em relação à negociação spot tradicional:

Alavancagem para maiores ganhos: A alavancagem permite controlar posições maiores com menos capital, aumentando substancialmente o potencial de lucro. Por exemplo, com 10×, um movimento de 1% resulta em retorno de 10%.

Lucro em ambos os sentidos: É fácil operar comprado ou vendido, permitindo lucrar mesmo em mercados de baixa. Muitos traders aproveitaram para operar short durante o mercado bear de 2022–2023.

Sem necessidade de posse de criptoativos: Operando derivativos, você não precisa guardar as moedas, reduzindo riscos como hacks. Contudo, fique atento ao risco de contraparte nas exchanges.

Eficiência de capital: Requer menos capital e a margem libera recursos para outras exposições de mercado. Algumas exchanges permitem stablecoins como colateral multimercado.

Ferramentas de hedge: Investidores podem fazer hedge do portfólio, como vendendo ETH em contratos caso prevejam queda, protegendo a carteira.

Liquidez 24/7 e execução: Mercados de contratos cripto funcionam o tempo todo e têm alta liquidez, garantindo execução ágil com baixa slippage e taxas competitivas.

Diversidade de estratégias: Suporta várias estratégias como day trading, swing trading e arbitragem, permitindo lucrar além do simples hold.

Contratos perpétuos: Não têm vencimento, permitindo manter posições indefinidamente, desde que haja gestão do funding e evite liquidação.

Acesso a vários mercados: Muitas exchanges oferecem contratos de uma ampla gama de ativos, tornando mais fácil operar tokens menos populares sem necessidade de compra direta.

Resumindo: negociação de contratos proporciona flexibilidade e oportunidades estratégicas que o spot não oferece, sendo muito atrativa para traders ativos. No entanto, envolve riscos e complexidade maiores, demandando boa gestão de risco.

Riscos da Negociação de Contratos e Como Gerenciá-los

Apesar de atraente, a negociação de contratos apresenta riscos relevantes diante da volatilidade do mercado cripto. Veja os principais riscos e dicas de gestão:

-

Risco de alta alavancagem: Alavancagem pode destruir o capital rapidamente. Uma movimentação adversa de 1% com alavancagem 100× resulta em perda total da margem. Iniciantes devem usar alavancagem baixa (até 5×) e calcular sempre o risco máximo.

-

Volatilidade do mercado e spikes de preço: Notícias e eventos inesperados podem provocar saltos de preço, acionando stops ou liquidações. Evite alta alavancagem em períodos voláteis e monitore o calendário econômico.

-

Cascatas de liquidação: Liquidações podem gerar vendas em massa, causando quedas abruptas. Mantenha sua margem saudável para suportar volatilidade.

-

Custos de funding fee: Taxas de financiamento elevadas corroem lucro ao longo do tempo. Monitore as taxas e considere sair de posições caras.

-

Complexidade e conhecimento de plataforma: Cada exchange possui regras e dinâmicas próprias. Faça operações de pequeno valor para aprender o funcionamento da plataforma.

-

Risco emocional: Emoções fortes levam a decisões ruins. Siga um plano de trading e evite impulsividade.

-

Riscos técnicos: Garanta conexão de internet estável e esteja atento a eventuais indisponibilidades da exchange, especialmente em day trading.

Mantenha-se atento, nunca opere mais do que pode perder, use ferramentas de gestão de risco e prepare-se para cenários adversos.

Como Negociar Contratos de Cripto na Phemex

Se você é iniciante, veja um passo a passo para começar a operar contratos de cripto na Phemex – uma das principais exchanges de derivativos de cripto. Em 2025, a Phemex oferece uma plataforma robusta para negociação de futuros perpétuos de diversas criptos, com até 100× de alavancagem.

-

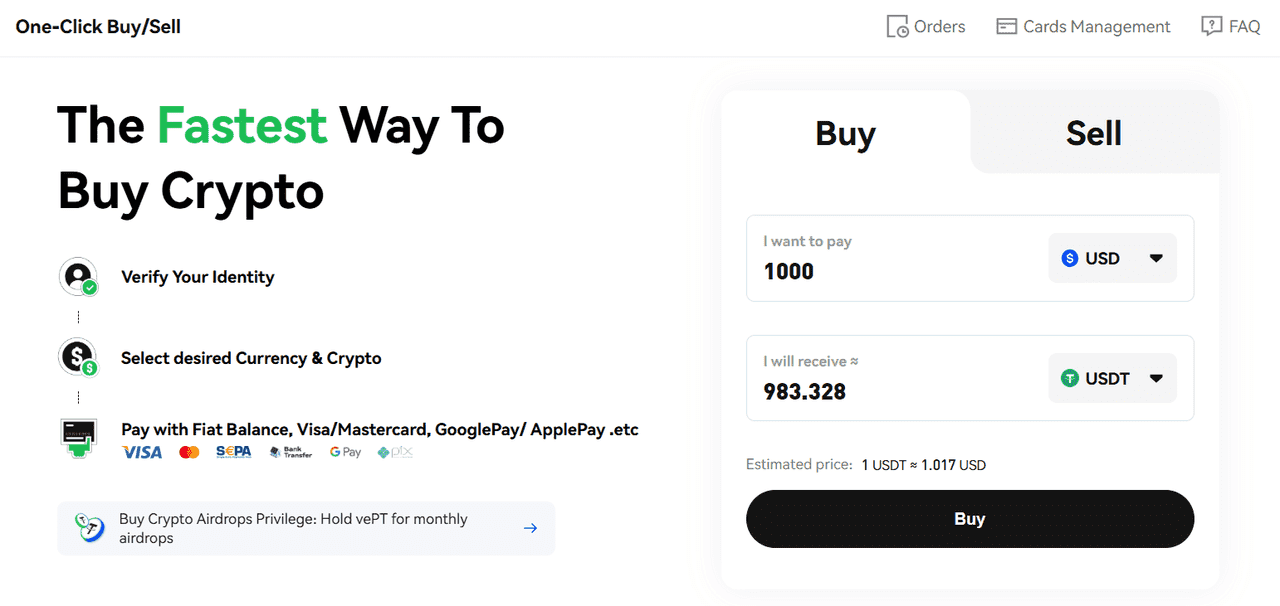

Crie e faça depósito em sua conta Phemex: Caso ainda não tenha, abra uma conta na Phemex. Ative a autenticação em dois fatores para segurança. Depois, deposite fundos. Você pode transferir cripto (como USDT, BTC, ETH) de outra wallet/exchange para sua wallet Phemex. Caso ainda não possua criptomoedas, pode usar o serviço “Comprar Cripto” da Phemex e comprar via cartão ou transferência bancária.

-

Transfira fundos para a conta de contratos: Normalmente, a Phemex separa sua conta Spot (operações à vista) da conta de Contratos (futuros). Após o depósito, acesse sua página de ativos e transfira o valor desejado do wallet spot para o wallet de contratos.

-

Escolha o mercado de contratos: Navegue até “Mercados” ou “Futuros” na Phemex. Você verá a lista de contratos perpétuos e possivelmente futuros a prazo fixo. Pares comuns: BTC/USDT perpétuo, ETH/USDT perpétuo, além de vários altcoins. A Phemex adiciona frequentemente futuros populares.

-

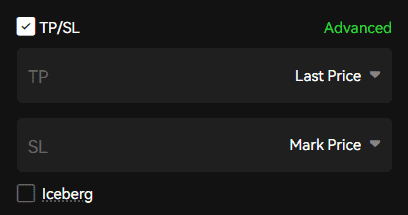

Entenda a interface de negociação: Ao abrir o painel de contratos, você verá gráficos de velas, book de ofertas e o painel de ordens. Elementos essenciais: seleção de alavancagem, tipo de ordem, quantidade, take profit e stop loss.

-

Abrindo a posição: Revise todos os dados (principalmente se quer mesmo “Comprar/Long” ou “Vender/Short”). Se estiver tudo certo, confirme a ordem. Se for uma ordem de mercado, a posição é aberta imediatamente. Se ordem limitada, será aberta ao preço definido. Após aberta, os detalhes ficam disponíveis abaixo do gráfico:

-

Tamanho da posição: Exemplo, 0,5 BTC (notional) long ou 10.000 contratos, etc.

-

Preço de entrada: Preço médio de abertura da posição.

-

Preço de marcação: Preço de referência para cálculo de P/L e liquidação (geralmente de um índice).

-

P&L não realizado: Lucro ou prejuízo atual da posição (varia conforme o preço).

-

Preço de liquidação: Valor fundamental — se atingido, você será liquidado. Monitore a distância deste preço até o de entrada.

-

Margem utilizada: Valor do saldo bloqueado como garantia desta operação.

-

-

Gerencie e monitore o trade: Com a posição aberta, você pode adicionar stop-loss ou take-profit (caso não tenha feito no início, ou ajustar). Fique atento a notícias e volatilidade. Monitore também o funding rate se for manter a posição por muito tempo, para não ser surpreendido por taxas.

-

Feche a posição: Você pode encerrar sua posição de contrato a qualquer momento. Seja por lucro ou por decisão de sair, basta executar um fechamento a mercado ou criar uma ordem limitada para encerrar a determinado preço. Pronto — você concluiu uma negociação de contrato!

Seguindo esses passos, iniciantes podem experimentar a negociação de contratos de modo relativamente seguro. Comece sempre pequeno — negocie valor mínimo para aprender. Com o tempo e experiência, aumente o tamanho das operações. A plataforma da Phemex em 2025 é intuitiva, porém a responsabilidade pela gestão do risco é sua como trader.

Conclusão

A negociação de contratos é parte do trading de derivativos cripto que permite aumentar o potencial de lucro usando alavancagem. Para compreender de fato, o usuário deve conhecer negociação spot e leitura de gráficos. O trading de derivativos de criptomoedas é indicado para usuários intermediários e avançados. Como envolve riscos superiores, deve ser feito por quem domina bem ferramentas e volatilidade do mercado. Para iniciantes, o universo dos derivativos pode parecer complexo, mas com estudo e prática cautelosa, vira recurso valioso no toolkit do trader. Lembre-se sempre: educação e boa gestão de risco são indispensáveis. Use ordens de stop loss, opere com alavancagem responsável e jamais coloque no mercado mais do que pode perder. Os mercados cripto em 2025 ainda são cheios de oportunidades, mas podem ser implacáveis para quem entra sem preparo.

Leia mais

- O que é Negociação de Contratos em Cripto & Como Funciona?

- Como Negociar Cripto: O Guia Definitivo para Investimento

- O que são Derivativos de Cripto & Como Funcionam?

- O que são Derivativos de Cripto: Os Principais Derivativos de Bitcoin Explicados

- O que são Opções de Cripto & Como Funcionam?

- Trading de Cripto vs. Investimento: Diferenças Chave Explicadas

- O que são Futuros de Cripto & Como Funcionam?

- O que é CFD Trading? Vale para Iniciantes?