Is Ethereum (ETH) gearing up for its next massive breakout—or are traders bracing for a deeper correction? Can ETH truly reclaim its all-time highs, or will regulatory headwinds and network challenges keep it subdued? As one of the most pivotal players in the crypto ecosystem, Ethereum’s price action holds the key to broader market sentiment. In this in-depth analysis, we’ll uncover what’s driving Ethereum’s price in 2025, explore whale accumulation patterns, dive into Vitalik Buterin’s latest vision for scalability, and break down realistic price targets for 2025–2030. Whether you’re an ETH holder or an onlooker wondering “Is Ethereum a good investment?”, this guide has the data and insights you need to make informed decisions. Let’s decode Ethereum’s future—one block at a time.

? Summary Box (Fast Facts)

-

Ticker Symbol: ETH

-

Current Price: $2,601.43

-

Chain: Ethereum (Layer 1 Blockchain)

-

Contract Address: Native to Ethereum blockchain (no specific contract address required for ETH)

-

Market Cap: $314.04 billion

-

Circulating/Max Supply: 120,723,347 ETH / No Max Supply

-

ATH / ATL Price: $4,878.26 / $0.43

-

All-Time ROI: ~600,646%

? What Is Ethereum?

What is Ethereum? Ethereum is a decentralized, open-source blockchain platform designed to power smart contracts and decentralized applications (dApps). As a Layer 1 (L1) blockchain, Ethereum serves as the foundation for a vast ecosystem of DeFi protocols, NFT marketplaces, and Web3 innovations. Its programmability and flexibility have made it the most popular blockchain for building decentralized applications, driving billions in transaction volume and influencing the direction of the entire crypto industry.

Ethereum was created to address the inefficiencies of centralized systems, offering a trustless, censorship-resistant infrastructure where anyone can deploy applications, exchange value, and interact with decentralized services. From decentralized exchanges and lending platforms to gaming economies and digital art marketplaces, Ethereum’s versatility fuels an ever-expanding universe of blockchain use cases. This unique position has made Ethereum a cornerstone of the Web3 movement and a magnet for developers, users, and investors alike.

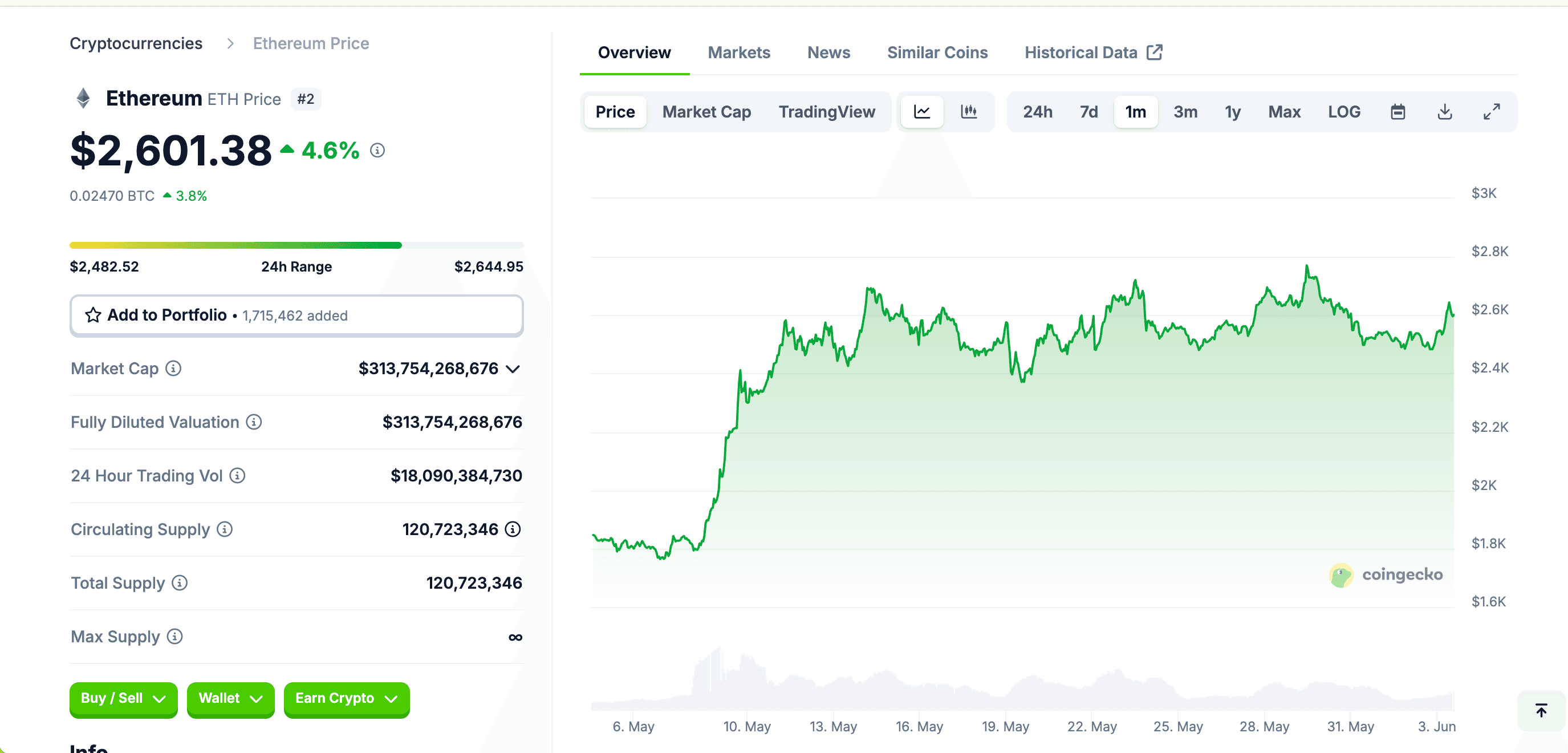

? Current Price & Market Data (as of June 3, 2025)

-

Price: $2,601.38

-

24h Change: +4.6%

-

7d Change: +1.7%

-

30d Change: +42.2%

-

Market Cap: $313.75 billion

-

Volume (24h): $18.09 billion

-

Circulating Supply: 120,723,346 ETH

-

ATH / ATL: $4,878.26 / $0.43

? Price History & Performance Overview

Ethereum's price journey has been nothing short of remarkable. Launched in 2015 at an ICO price of $0.30, ETH quickly gained traction among developers and early adopters. The 2017 bull run propelled ETH past $1,400, establishing it as the leading smart contract platform. However, the subsequent 2018 bear market saw ETH plummet below $100, a stark reminder of crypto volatility.

In 2021, ETH surged to an all-time high (ATH) of $4,891.70, driven by the DeFi and NFT boom. The 2022–2023 period was marked by market corrections, regulatory uncertainty, and macroeconomic headwinds, yet Ethereum maintained its dominance. By 2024, Ethereum began a strong recovery, fueled by growing network activity, scaling solutions like rollups, and the transition to Proof-of-Stake (PoS). As of mid-2025, Ethereum has surged approximately 50% since May, consolidating between $2,800 and $2,300—a phase suggesting accumulation and potential for a breakout.

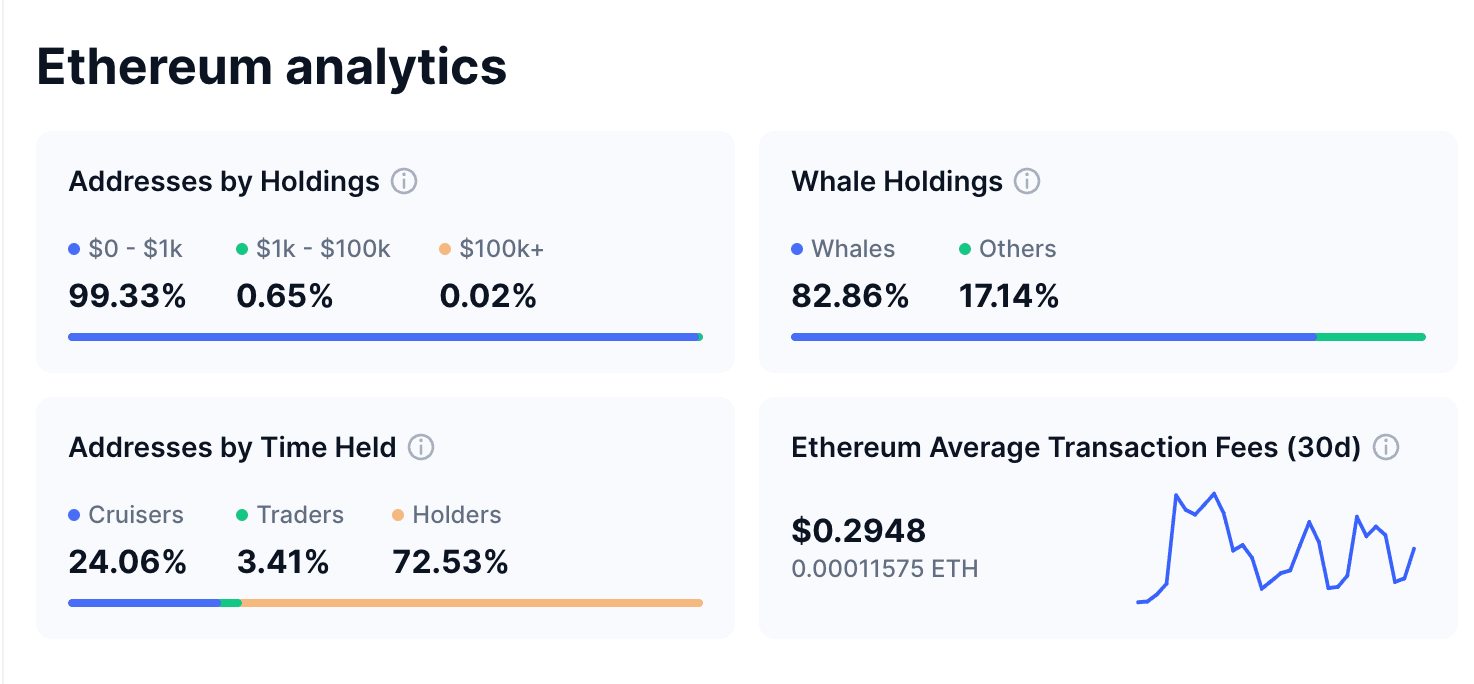

? Whale Activity & Smart Money Flows

Whale activity in Ethereum has shown compelling trends in 2025. On-chain data reveals that addresses holding 10,000 to 100,000 ETH have steadily increased their balances, signaling strategic accumulation by institutional players and high-net-worth individuals. Over 301,000 ETH have been added to major wallets in recent months, suggesting growing confidence in Ethereum’s long-term fundamentals.

1️⃣Addresses by Holdings

-

$0–$1k Holdings: 99.33%

-

$1k–$100k Holdings: 0.65%

-

$100k+ Holdings: 0.02%

Interpretation:

The overwhelming majority (99.33%) of Ethereum addresses hold less than $1,000 worth of ETH. This indicates that Ethereum has a broad retail investor base, with most participants holding small amounts. Larger wallets, representing institutional players or high-net-worth individuals, make up a tiny fraction—just 0.67% combined (0.65% + 0.02%). This distribution is typical in crypto markets but also highlights the concentration of capital among a few whales.

2️⃣ Whale Holdings

-

Whales: 82.86%

-

Others: 17.14%

Interpretation:

A staggering 82.86% of Ethereum’s total supply is held by whales, which underscores significant concentration risk in the ecosystem. Whales can exert substantial influence over price movements, either through coordinated buying/selling or market-making strategies. This level of dominance suggests that large players are key drivers of ETH market dynamics.

3️⃣ Addresses by Time Held

-

Cruisers (Mid-Term Holders): 24.06%

-

Traders (Short-Term Holders): 3.41%

-

Holders (Long-Term Holders): 72.53%

Interpretation:

Over 72.5% of ETH addresses are classified as long-term holders, indicating strong conviction and long-term belief in the Ethereum ecosystem. This is a positive sign for Ethereum’s stability, as it suggests a majority of users are holding ETH for future growth rather than quick profits. The 3.41% of traders represent short-term market participants, while 24.06% are mid-term holders.

4️⃣ Ethereum Average Transaction Fees (30 Days)

-

Fee: $0.2948 (~0.00011575 ETH)

Interpretation:

Ethereum’s average 30-day transaction fee remains low—just under $0.30. This indicates an efficient network in its current state, likely benefiting from Layer 2 scaling solutions and protocol optimizations. For users, low fees enhance accessibility and usability, particularly for smaller transactions and retail adoption.

? Key Takeaways

-

Ethereum’s wealth distribution is highly skewed toward whales, suggesting market influence by a few large players.

-

The vast majority of holders are small retail wallets (<$1,000), emphasizing Ethereum’s broad user base.

-

A strong 72.5% of addresses are long-term holders, reinforcing Ethereum’s narrative as a long-term store of value.

-

Transaction fees remain low, supporting continued network activity and encouraging user engagement.

? On-Chain & Technical Analysis

Ethereum’s current price structure reflects a period of consolidation. After a 50% rally since early May, ETH is trading between $2,300 and $2,800, forming a clear range. Technical indicators provide mixed signals, demanding caution and strategy. The 50-day and 100-day EMAs are converging near $2,550, suggesting a potential inflection point. The Relative Strength Index (RSI) hovers in the neutral zone, while the MACD shows a potential shift toward bullish momentum, albeit with caution due to prior divergences.

Notably, a potential inverse head and shoulders pattern is forming on the daily chart, hinting at a bullish reversal if confirmed. Key support levels include $2,450 and $2,300, while resistance is firm around $2,600 and $2,855. A decisive break above $2,855, with sustained volume, would likely signal the start of a new bullish leg, while a rejection at this level could push ETH back toward $2,320 or lower.

? Short-Term Price Prediction (2025–2026)

Bull Case: If Ethereum breaks the $2,855 resistance with strong volume and continued accumulation by whales, it could target $2,800–$3,000, potentially retesting the psychological $3,000 barrier. Catalysts include ETF inflows, network upgrades, and increased institutional demand.

Neutral Case: Ethereum may continue to trade in a sideways range between $2,300 and $2,800, reflecting market uncertainty, macroeconomic pressures, and regulatory developments.

Bear Case: If ETH fails to hold the $2,450 support level, a decline toward $2,300 or even $1,750 could occur, especially if broader market sentiment turns risk-off or major token unlocks exert selling pressure.

? Long-Term Price Forecast (2027–2030)

Ethereum’s long-term outlook hinges on several key factors:

-

Ecosystem Adoption: Ethereum remains the hub for DeFi, NFTs, and enterprise blockchain solutions.

-

Scalability Solutions: The Ethereum Foundation’s "Protocol" team, restructured in 2025, is dedicated to scaling Layer 1, expanding blobspace, and enhancing UX, setting the stage for long-term growth.

-

Vitalik Buterin’s Vision: Vitalik advocates for a 10x L1 scalability improvement over the next year, focusing on deferred transaction execution, block-level access lists, and modular network architecture (SimpleL1).

-

Institutional Integration: SharpLink Gaming’s $425M Ethereum treasury strategy, backed by ConsenSys and Joseph Lubin, highlights ETH’s appeal to mainstream finance.

Speculative Price Range: $5,000–$14,000 by 2030, contingent on adoption rates, regulatory clarity, and market dynamics. (Not financial advice.)

Ethereum (ETH) Price Prediction Table 2025-2030

To address your curiosity about "How high will ETH rise in the coming years?", below is a detailed price prediction table for Ethereum (ETH) from 2025 to 2030. These projections are based on a synthesis of expert analyses, technical indicators, and market trends from various sources, reflecting the potential impact of institutional adoption, Ethereum's Pectra upgrades, and growing DeFi and Web3 ecosystems. Note that cryptocurrency markets are highly volatile, and these forecasts are speculative. Always conduct your own research before investing.

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Key Drivers |

|---|---|---|---|---|

| 2025 | 2,300 | 5,000 | 10,000 | ETF inflows, Pectra upgrades, Layer 2 adoption, and post-halving market recovery. |

| 2026 | 2,759 | 5,500 | 11,111 | Continued institutional interest, scalability improvements, and DeFi growth. |

| 2027 | 3,008 | 6,000 | 12,245 | Broader blockchain adoption, Osaka-Fulu upgrades, and potential AI integration. |

| 2028 | 3,284 | 7,000 | 15,000 | Increased Web3 applications, tokenized assets, and market momentum from Bitcoin halving. |

| 2029 | 4,142 | 8,500 | 17,658 | Maturing staking ecosystem and global adoption of decentralized finance. |

| 2030 | 9,850 | 12,000 | 20,643 | Convergence of blockchain with AI, widespread DeFi/Web3 adoption, and deflationary ETH supply. |

Sources: Projections are aggregated from analyses by Coinpedia, Changelly, Finder, Cryptonews, InvestingHaven, CoinCodex, Forbes Advisor, and Cryptonewsz, among others.

Disclaimer: These predictions are for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risks due to market volatility. Always consult a financial advisor and conduct thorough research before making investment decisions.

? Fundamental Drivers of Growth

Ethereum (ETH) continues to solidify its position as a leading blockchain platform, driven by ongoing technological advancements and strategic initiatives. Recent developments highlight Ethereum's commitment to scalability, decentralization, and broader adoption.

Vitalik Buterin's Vision for Ethereum's Scalability

At the ETHGlobal Prague 2025 conference, Ethereum co-founder Vitalik Buterin outlined an ambitious plan to enhance Ethereum's Layer 1 (L1) scalability by tenfold within the next year. This initiative aims to address network congestion and improve transaction speeds without compromising decentralization.

Buterin emphasized a cautious approach, stating, "My view is generally I think we should scale L1 by about 10x over the next year and a bit." He highlighted the importance of implementing upgrades such as deferred transaction execution, block-level access lists, network layer optimization, and distributed storage of blockchain history. These enhancements are designed to streamline the protocol and reduce the burden on node operators.

Furthermore, Buterin introduced the concept of "SimpleL1," which proposes decoupling consensus and execution layers. This architectural shift would offload complex execution logic to Layer 2 solutions, allowing the base layer to focus on security and finality. Such a modular approach aims to simplify the protocol, reduce attack vectors, and facilitate independent upgrades.

Ethereum Foundation's Strategic Restructuring

In alignment with the goal of enhancing scalability and user experience, the Ethereum Foundation announced a significant restructuring of its research and development team. The newly formed "Protocol" team will concentrate on three strategic objectives: scaling Ethereum's base layer, expanding blobspace for improved data availability, and enhancing user experience.

Key figures such as Tim Beiko, Alex Stokes, and Barnabé Monnot have been appointed to lead these initiatives. The Foundation believes that this focused approach will empower internal teams to drive key projects forward, ultimately benefiting the broader Ethereum ecosystem.

SharpLink Gaming's Ethereum Treasury Strategy

In a notable intersection of traditional finance and cryptocurrency, SharpLink Gaming Inc. (NASDAQ: SBET) announced a $425 million private placement aimed at establishing an Ethereum treasury strategy. The company plans to use the funds to acquire ETH, positioning itself as one of the first Nasdaq-listed firms to adopt such a strategy.

The investment round was led by ConsenSys Software Inc., with participation from prominent crypto venture capital firms. Ethereum co-founder Joseph Lubin has joined SharpLink's board as Chairman, signaling strong support for the company's strategic pivot.

Following the announcement, SharpLink's stock experienced a dramatic surge, climbing over 1,000% in a single week. However, the stock later corrected by approximately 30%, reflecting market volatility and investor caution.

This move by SharpLink underscores the growing trend of traditional companies integrating cryptocurrency assets into their financial strategies, further validating Ethereum's role as a valuable asset in the broader financial ecosystem.

? Key Risks to Consider

Risks of investing in Ethereum include:

-

Competition from alternative L1s

-

Regulatory uncertainty globally

-

Potential token dilution and economic shifts

-

Developer and user activity decline

? Analyst Sentiment & Community Insights

Analysts remain cautiously optimistic, with predictions of Ethereum outperforming Bitcoin in the next 12–24 months. Community discussions on Reddit, Twitter, and crypto forums are active, highlighting both enthusiasm for Ethereum’s technological roadmap and concerns over regulatory challenges. Google Trends shows sustained interest in Ethereum, reflecting its cultural and financial relevance.

✅ Is Ethereum a Good Investment?

This is not financial advice. Ethereum’s robust technology, vibrant ecosystem, and continuous innovation make it a promising long-term asset. However, risks exist, and investors should remain informed, practice risk management, and align investments with their personal goals.

The Ethereum investment potential remains strong heading into 2025–2030.

? Why Trade Ethereum on Phemex?

Phemex is a leading centralized exchange known for security, speed, and trader-focused features. It offers:

-

Spot Trading: Trade 100+ assets with deep liquidity.

-

Futures Contracts: Access high-leverage perpetuals (up to 100x) on top coins.

-

Trading Bots: Automate strategies with AI-powered bots.

-

Phemex Earn: Earn passive income through flexible and fixed savings.

-

Pulse (SocialFi): Share insights and earn rewards in a Web3-native social trading app.

Ethereum is fully supported on Phemex, available for spot and futures trading. Enhance your ETH strategy with trading bots, earn products, and cutting-edge tools.