Summary Box (Fast Facts)

-

Ticker Symbol: UNI

-

Current Price (Nov 11, 2025): ~$8.27 (up ~20% in 24h)

-

Chain: Ethereum (ERC-20 DeFi token)

-

Contract Address: 0x1f9840a85d5af5bf1d1762f925bdaddc4201f984

-

Market Cap: ~$5.21 billion (rank #25)

-

Circulating/Max Supply: ~630.3 million / 1 billion (initial; 2% annual inflation from 2024)

-

ATH / ATL Price: $44.92 (May 3, 2021) / $1.03 (Sep 17, 2020)

-

All-Time ROI: ~+705% (from ATL to current price)

-

Availability on Phemex: Yes – Listed for spot trading (UNI/USDT), with futures and other trading tools available

What Is Uniswap?

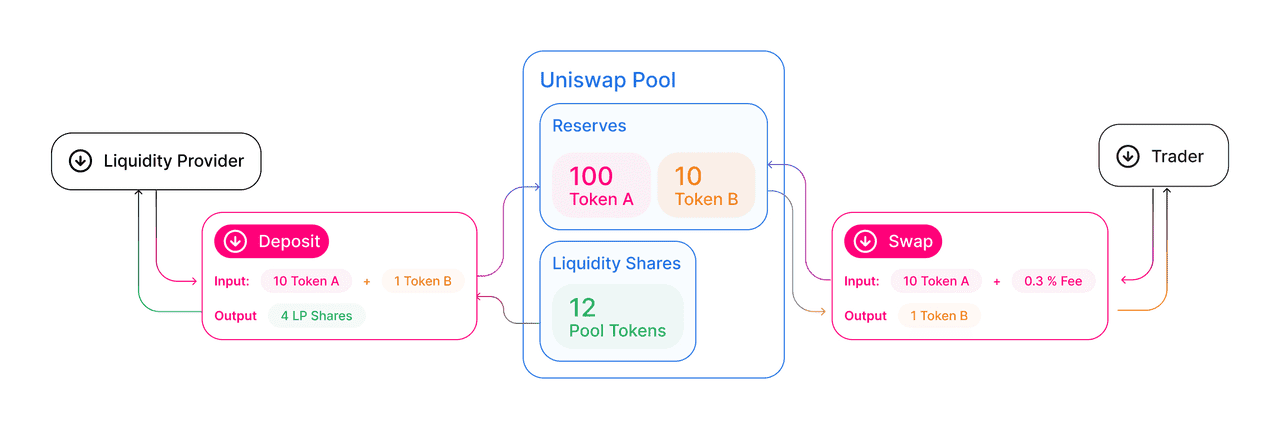

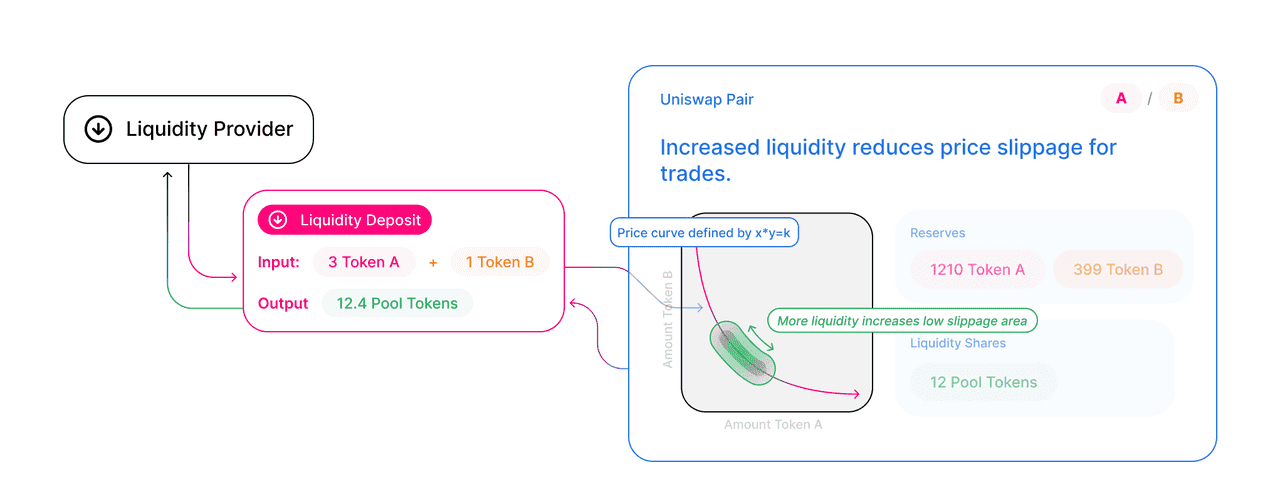

Uniswap is a decentralized exchange (DEX) protocol built on Ethereum that enables automated token swaps without intermediaries. Launched in 2018 by Hayden Adams, Uniswap pioneered the Automated Market Maker (AMM) model, solving liquidity issues that plagued earlier DEXs. Instead of traditional order books, Uniswap uses liquidity pools and a constant product formula (x * y = k) to price assets. Anyone with an Ethereum wallet can swap ERC-20 tokens permissionlessly, or provide liquidity to earn a share of trading fees. In September 2020, Uniswap introduced its UNI governance token via a retroactive airdrop, giving users a stake in protocol governance. UNI holders can vote on proposals and guide Uniswap’s future. Overall, Uniswap’s use case is in the DeFi category – it democratizes access to crypto trading, solves the problem of centralized custody, and has become a cornerstone of the DeFi ecosystem by facilitating billions in volume with no central authority.

Current Price & Market Data (as of Nov 11, 2025)

Uniswap’s UNI token is trading around $8–9 in mid-November 2025 after a nearly 50% price spike due to a new governance proposal, briefly reaching ~$9.9. While it’s still 81% below its all-time high of ~$45, UNI has delivered about a 7× return from its 2020 lows. Recent momentum is strong, with UNI up ~20% in the past day and over 60% this week, significantly outperforming the broader crypto market.

Its market capitalization is approximately $5.2 billion, ranking UNI among the top 30 crypto assets. Trading volume soared to $3.3 billion in the last 24 hours, a 580% increase from the previous day. With a circulating supply of roughly 630 million UNI out of a max supply of 1 billion, UNI has a 2% annual inflation rate to incentivize participation.

Technically, UNI has recently broken resistance near $7.00 and is now testing resistance around $9.50–$10. A close above $9.5 could signal bullish momentum, while support is found at $7.00 and stronger around $5–6. The price is at a pivotal point, with indicators suggesting potential volatility ahead. Traders are focused on whether UNI can break above $10 or if it will consolidate back to the mid-$6 to $8 range.

How Uniswap Works (source)

Price History & Performance Overview

Uniswap’s token, UNI, has gone through several market cycles since its launch in September 2020.

2020 (Launch and Airdrop): UNI debuted around $3 with an unexpected airdrop, briefly dropping to ~$1.03 before recovering to $4–5 by year-end, supported by increasing DeFi adoption.

2021 (DeFi Boom to Peak): In early 2021, UNI soared to an all-time high of $44.97, marking a +4,300% gain in just eight months. However, following the May crash, it retraced to ~$15–20, peaking again at ~$27 before a prolonged decline.

2022 (Bear Market Retreat): During the bear market, UNI fell to the $5–6 range by mid-2022, struggling with macroeconomic headwinds. Despite a $165M funding round in October, it ended the year near ~$5.

2023 (Range-Bound and Recovery Attempts): UNI traded between $4 and $7 in 2023, briefly exceeding $9 in February due to developer activity and market rallies. The year saw -50% ROI from 2022 but showed signs of recovery as volatility decreased.

2024 to Early 2025 (Consolidation): Early 2024 saw UNI struggle amid regulatory concerns and competition, hitting lows of ~$3–4. By mid-2025, the token bounced back to ~$6 with improved market sentiment.

Late 2025 (Recent Rally): November 2025 brought a surge to ~$9.50, driven by a notable governance proposal and a strong crypto market. This volatility highlights UNI's potential for rapid price changes.

Overall, UNI's history reflects significant long-term gains despite substantial downturns, rewarding early investors while presenting challenges for short-term traders.

Whale Activity & Smart Money Flows

Whale investors (large token holders) significantly influence Uniswap's market dynamics. Recent on-chain data indicates that smart money has been accumulating UNI, especially after governance hinted at protocol fee burns in November 2025, leading to a purchase of over 635,000 UNI (around $5.56 million) and a subsequent ~38% price surge.

UNI holdings are concentrated, with the top 10 addresses owning approximately 50% of the total supply, including the community treasury. This concentration makes tracking whale activity crucial, as their moves can signal market impact.

Recent on-chain flows show mixed behavior: several smart money addresses have increased their UNI holdings during price dips of $4–$5, and exchange reserves dropped before the November rally, suggesting bullish signs. New large buyers entered the market ahead of governance proposals, possibly anticipating future fee dividends.

Platforms like Nansen and Lookonchain report a shift in whale sentiment towards the end of 2025, heightening interest in how top holders will act if the protocol generates revenue. Any signs of whales staking or locking UNI could indicate confidence, while large transfers to exchanges might raise caution.

In summary, recent whale activity in Uniswap has been bullish, with significant accumulation and few signs of distribution. However, due to concentration risk, UNI’s price is sensitive to the actions of a small number of holders, making it essential for investors to monitor top holders and large transfers closely.

UNI Price Chart on Phemex (source)

On-Chain & Technical Analysis

Uniswap (UNI) is currently at a crucial point between support and resistance levels.

Support Levels: The long-term uptrend support line from June 2022 is around the mid-$4 range. The previous resistance at ~$7.00 should provide immediate support, followed by levels at $6.00 and $5.25, which have shown strong buying interest in the past.

Resistance Levels: Key resistance lies between $9.50 and $10.00, aligned with the 61.8% Fibonacci retracement from the 2021 ATH to the 2022 lows. A sustained break above $10 would signal a bullish trend, potentially leading to $12–$15, while $20 would require favorable macro conditions.

Trend Indicators: The weekly RSI is near the pivotal 50 mark, with a move above indicating bullish momentum. The daily RSI recently dipped from overbought levels to around 55, maintaining a bullish bias. UNI broke above its 50-day and 200-day moving averages, forming a "golden cross," which suggests improving trend strength.

Volume & On-Chain: Recent trading volumes reached multi-month highs, indicating strong conviction, while on-chain activity remains modest. A portion of UNI is held in governance contracts, limiting circulating liquidity and increasing volatility.

Summary: UNI is at a crossroads, showing potential for an uptrend toward $12+ if it clears the $10 resistance. However, a correction could occur if it fails to break this level, possibly pulling back to the $6–$7 range. With neutral-to-bullish indicators, the $9.5-$10 ceiling is crucial for determining the next trend.

Short-Term Price Prediction (2025–2026)

Over the next one to two years, Uniswap’s price will likely be influenced by current proposals, macro market trends, and user adoption. Here are three scenarios for 2025–2026:

Bull Case (Optimistic): If catalysts materialize and the crypto market remains strong, UNI could rise significantly. The fee switch proposal could increase UNI's value by directing trading fees toward buying/burning tokens and boosting demand. Analysts predict UNI could reach $15-$20 by the end of 2025, possibly hitting mid-$20s in 2026 if the overall sentiment is positive. Key drivers include fee burns and a crypto bull market.

Base Case (Neutral): In a neutral scenario, Uniswap may see moderate growth without major changes. The fee switch might only be partially implemented, stabilizing UNI between $7 and $12 through 2025. By 2026, UNI could trend modestly higher, potentially testing previous highs, and be priced in the low teens ($10–$15).

Bear Case (Pessimistic): A bearish outlook may arise from regulatory actions targeting DeFi, leading to fears about UNI's legality and dampened demand. This could result in UNI retracing to the mid-$4 or lower range, with some predictions seeing it drop to ~$2 in worst-case scenarios.

Most analysts have a cautiously positive outlook for 2025, with median expectations around $10–$12, and potential upside in the high teens if conditions are favorable. Traders should monitor key technical levels: maintaining above ~$10 favors the bull case, while falling below $6 might signal a shift to neutral or bearish trends.

Long-Term Price Forecast (2027–2030)

Uniswap’s long-term trajectory (2027–2030) will depend heavily on ecosystem adoption and the evolution of DeFi. A speculative forecast suggests that if decentralized exchanges gain market share and Uniswap continues to innovate (like the Unichain L2 and possible new revenue streams), the demand for UNI could increase significantly. Key metrics to watch will be Total Value Locked (TVL) and trading volume; if these metrics rise significantly by 2030, it could justify a higher token valuation.

Community engagement and governance will also influence UNI's success. A vibrant community could enhance token utility, such as staked UNI earning protocol fees or being used as collateral in major DeFi platforms. Conversely, stagnation in governance could hinder growth.

Price projections for UNI in 2027–2030 vary widely. Optimistic forecasts, like one from Changelly, suggest an average price of ~$144 by 2030, assuming significant DeFi expansion. More conservative estimates put UNI in the $30–$50 range, reflecting Ethereum’s growth. A $30 price would imply a market cap around $19 billion, which could be reasonable if DeFi grows considerably.

However, risks remain, such as regulatory challenges, security issues, or the emergence of new trading models that could diminish Uniswap's relevance. Ultimately, Uniswap's long-term success hinges on maintaining its leadership role in DeFi, and forecasts should be revisited as the market evolves.

Fundamental Drivers of Growth

Uniswap's future growth is driven by several key factors:

-

Protocol Revenue & Tokenomics: The activation of protocol fees (the “fee switch”) could redirect a portion of Uniswap’s trading fees to benefit UNI holders. This could make UNI a deflationary asset tied to exchange revenues, aligning its value with Uniswap’s usage.

-

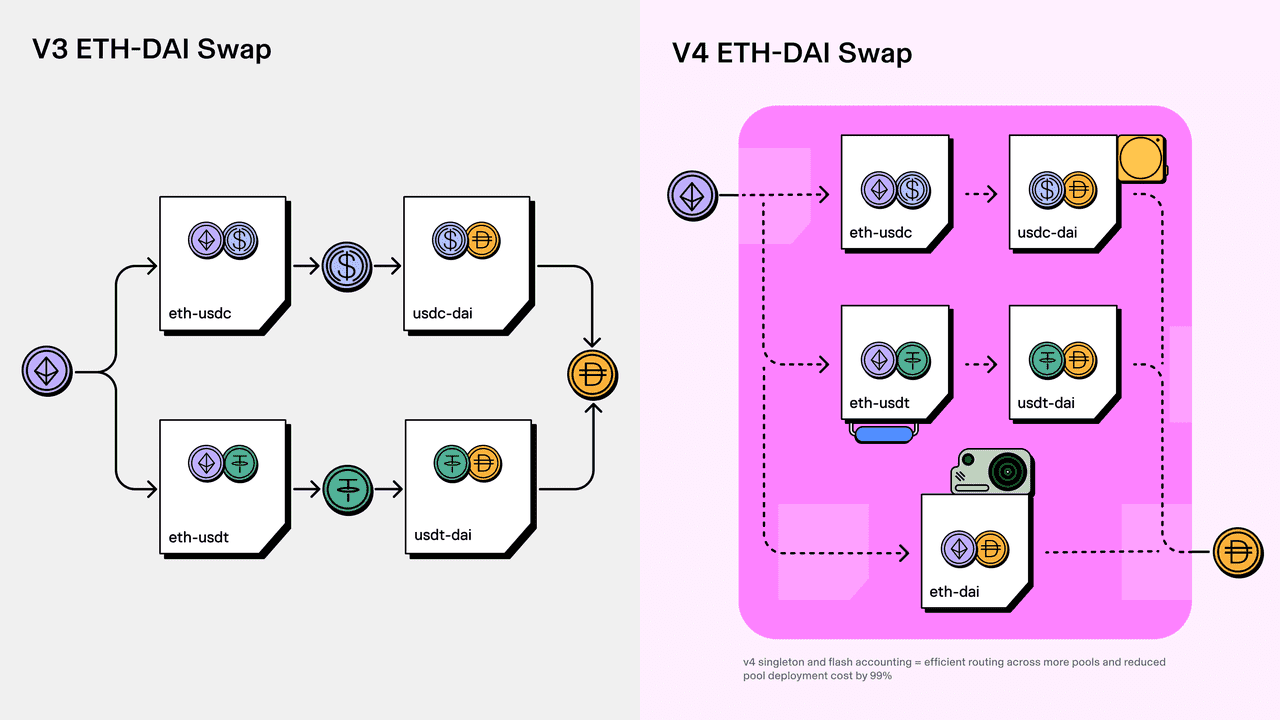

Tech Innovation: Uniswap v4 and ongoing developments like Unichain aim to enhance scalability and reduce costs, keeping Uniswap at the forefront of automated market maker (AMM) technology.

-

Network Adoption & Integrations: Expanding onto multiple chains and integrating with fintech apps increases Uniswap's user base and trading volume, while its move into NFTs diversifies usage.

-

Community and Brand Recognition: As a leading DeFi brand, Uniswap benefits from a strong developer community and user base, which drives word-of-mouth adoption and supports ecosystem growth through governance-funded projects.

-

Macro Trends in DeFi: An overall increase in DeFi adoption and improvements in Ethereum infrastructure could lead to greater trading volume on Uniswap, enhancing its appeal over centralized exchanges.

In summary, Uniswap's growth potential is supported by tokenomics improvements, technological advancements, expanding integrations, community strength, and favorable market trends, setting the stage for significant UNI token growth into 2030.

Proposed Evolution of Uniswap (source)

Key Risks to Consider

No investment is without risk, and Uniswap faces several challenges that investors should consider:

-

Competitive Threats: As a leader in decentralized exchanges (DEXes), Uniswap competes with other Automated Market Makers (AMMs) like Curve, SushiSwap, and PancakeSwap. Rival models, such as order book DEXs on Layer 2, could challenge Uniswap’s market share, especially if liquidity becomes fragmented across chains.

-

Token Dilution & Inflation: Uniswap's tokenomics include a 2% annual inflation rate starting after September 2024. This could dilute existing holders unless demand grows accordingly. Although the upcoming fee burn plan may help, inflation remains a concern until implemented.

-

Regulatory Impact: Regulatory uncertainty poses a risk to Uniswap and the broader DeFi space. Uniswap Labs, which manages the protocol, could face scrutiny regarding the UNI token. Potential regulations could affect its permissionless nature and overall usage.

-

Liquidity Provider Apathy: Deep liquidity is crucial for Uniswap's success. If liquidity providers (LPs) find it less profitable due to potential fee changes or competition, they may leave, leading to decreased liquidity and higher slippage for traders.

-

Security and Smart Contract Risks: Despite a strong track record, Uniswap is not immune to smart contract vulnerabilities. Bugs or exploits could lead to significant losses and reduced trust. Additionally, governance attacks are a risk if a malicious entity accumulates enough UNI tokens.

-

Declining Developer or Community Activity: A decrease in development or community engagement could undermine Uniswap's innovation and long-term success in a rapidly evolving crypto landscape.

Investors should weigh these risks carefully before engaging with Uniswap.

Analyst Sentiment & Community Insights

The sentiment surrounding Uniswap (UNI) has turned positive in late 2025 after a neutral phase. Analysts are upbeat due to a recent fee switch proposal, likening UNI to a dividend-paying stock that could see a higher valuation. Some experts caution about regulatory uncertainties, suggesting a “high risk, high reward” scenario. Community sentiment is also bullish, with 89% of CoinGecko users expressing positive feelings towards UNI. Social media discussions highlight excitement for the new revenue model and regret among some for not holding enough UNI.

In Uniswap’s governance circles, there's engaged support for the UNIfication proposal, with increased voter turnout and trust fostered by transparency reports. Google Trends data shows growing interest in Uniswap since October 2025, indicating potential retail investment.

Overall, while excitement is high and the community is re-energized, there is a balanced awareness of potential challenges ahead. If Uniswap successfully implements its initiatives, it could lead to further positive sentiment and price appreciation. However, any setbacks may dampen this enthusiasm, making monitoring progress crucial.

Liquidity Provider Calculation on Uniswap (source)

Is Uniswap a Good Investment?

With all the information considered, one big question remains: Is Uniswap (UNI) a good investment? The answer depends on your investment horizon, risk tolerance, and belief in the DeFi sector.

Uniswap is a leading DeFi project with a first-mover advantage, a large user base, strong liquidity, and a capable development team. The UNI token is transitioning from being a governance token to gaining real yield utility, which could enhance its investment appeal. If you believe in the growth of DeFi, Uniswap is well-positioned to capitalize on it, given its fundamental need for trustless asset exchange and consistent performance over time. Its low supply inflation and substantial treasury funds provide stability for future growth.

However, investors should remain aware of risks, including market volatility, regulatory challenges, and competition. UNI's success will depend on the broader crypto climate and the execution of its upcoming changes. It is more volatile than stablecoins or larger cryptocurrencies like BTC/ETH. While the potential upside is significant, patience is required.

In summary, Uniswap has strong long-term potential for those optimistic about DeFi, but it's essential to understand the risks involved. Treat UNI as part of a diversified crypto portfolio, and consider starting with a small position. Uniswap's growth has been impressive, and if you believe in its future, UNI may fit your investment strategy. If not, you can still use the platform without holding the token. Overall, UNI shows promise heading into 2025–2030, though its success will depend on ongoing innovation and market conditions.

Why Trade Uniswap (UNI) on Phemex?

When it comes to trading UNI, choosing the right exchange can make all the difference. Phemex is a top-tier centralized crypto exchange that offers the ideal environment for both beginners and advanced traders looking to trade Uniswap’s token.

Uniswap’s UNI token is fully listed on Phemex, meaning you can trade it right away with all the above tools at your disposal. On Phemex, you can buy UNI via the spot market or even with a credit card or bank transfer thanks to Phemex’s fiat on-ramps. Once you have UNI, you can seamlessly move between spot and futures: for instance, hold UNI in your spot wallet for long-term, or transfer some to your contract account to trade UNI futures for short-term opportunities. Phemex’s infrastructure allows quick transfers between accounts and low fees, so active traders can maneuver easily.

Moreover, if you’re interested in automation, Phemex’s trading bots can trade UNI pairs, leveraging market volatility to your advantage. And if you’re a passive holder, keep an eye on Phemex Earn – any introduction of UNI staking or saving products would let you generate passive yield on your tokens. All of this is underpinned by Phemex’s commitment to security and user asset protection.