Decentralized Finance (DeFi) has grown into a major segment of the crypto ecosystem, with the top DeFi tokens 2025 attracting significant attention from investors and enthusiasts. These tokens are tied to protocols that let people trade, lend, and invest crypto assets without traditional intermediaries. By late 2025, DeFi platforms collectively hold over $170 billion in value locked as collateral or liquidity, underscoring their importance in the crypto market. This article provides an educational overview of ten prominent DeFi project tokens as of 2025. We’ll explain what each project does and why it’s notable – but this list is not financial advice. The goal is to give a neutral, fact-based look at the DeFi crypto sector’s leading tokens, not to recommend buying anything. Crypto assets are volatile and risky, so consider this a starting point for your own research.

What Is the DeFi Crypto Sector?

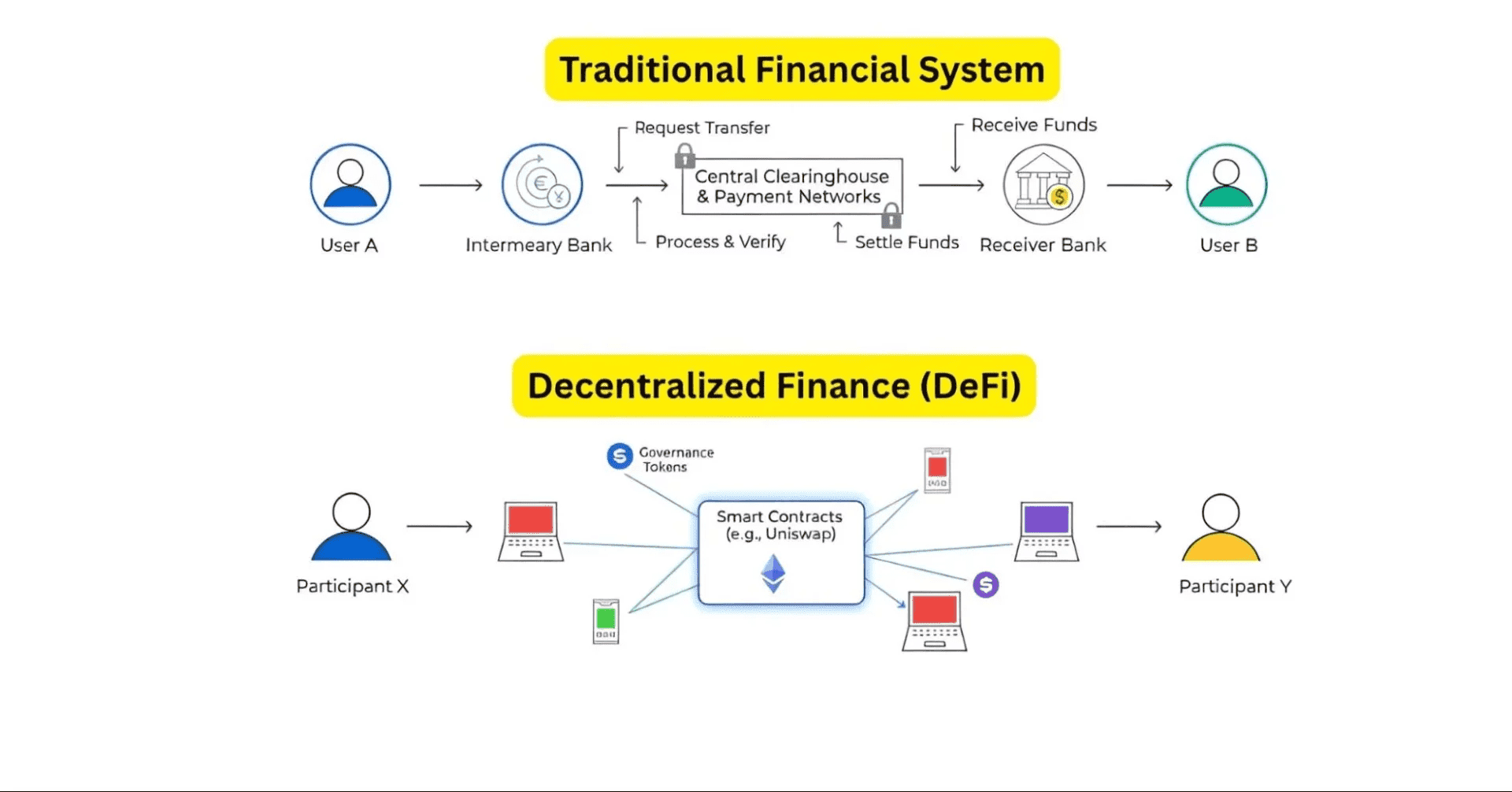

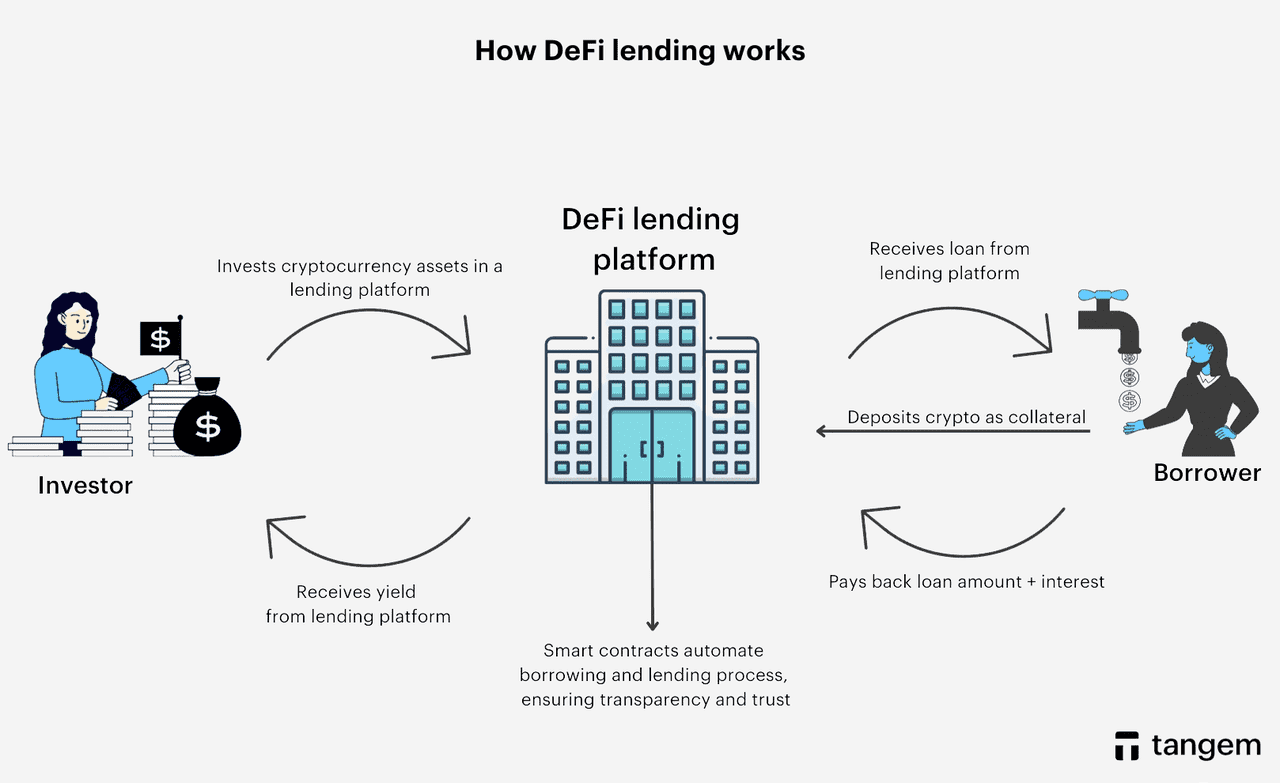

Decentralized finance (DeFi) refers to blockchain-based platforms that recreate financial services without centralized intermediaries like banks. In DeFi, users interact through smart contracts – self-executing code on networks like Ethereum – to do things like lending, borrowing, trading, and earning interest on crypto assets. Popular DeFi use cases include decentralized exchanges (DEXs) for token trading, lending protocols that let users earn yield or take collateralized loans, decentralized stablecoins (cryptocurrencies pegged to real currencies), liquidity pools and yield farming, insurance against smart contract hacks, and more. All of this occurs in a peer-to-peer manner: you hold your own assets in a wallet and transact directly with protocols or other users, without needing permission from a central authority.

This sector matters because it opens financial access. Anyone with crypto and an Internet connection can participate in markets or obtain a loan by providing collateral, often with greater speed and transparency than traditional finance. By 2025, DeFi has matured from the experimental “DeFi summer” of 2020 into a diverse ecosystem spanning multiple blockchains. Ethereum remains the primary hub, but many DeFi projects now deploy on Layer-2 networks (like Arbitrum or Optimism) and other chains to reduce fees. Despite its growth, DeFi still faces challenges: hacks and exploits have occurred due to bugs, and using DeFi apps can be complex for newcomers. Nonetheless, it continues to innovate with new financial models (for example, automated market makers for exchanges, or over-collateralized stablecoins) and has become an integral part of the broader crypto economy.

DeFi vs. TradFi (source)

DeFi vs. TradFi (source)How We Selected These Top DeFi Tokens

The ten tokens below were chosen based on a combination of market prominence and role in the DeFi ecosystem. Key factors include each project’s market capitalization and liquidity (i.e. how large and actively traded the token is), longevity and development activity (projects that have proven themselves over several years with ongoing improvements), and user adoption and integrations (how widely the protocol is used or integrated by other apps). We also considered relevance to core DeFi use cases – for example, whether the project is a major player in decentralized trading, lending, stablecoins, or other important niches.

This list isn’t exhaustive; there are many more DeFi tokens out there, and “top” can be defined in different ways. We focused on well-known projects that represent different categories of DeFi. Importantly, inclusion on this list does not mean endorsement. A token’s presence here is not a recommendation to invest – it simply indicates the project has been influential in the DeFi sector up to 2025. Always evaluate carefully and do your own due diligence beyond just reading this overview.

Top 10 DeFi Tokens in 2025

-

Uniswap (UNI)

Uniswap is the flagship decentralized exchange (DEX) protocol in the crypto space. Launched in 2018 as one of the first DeFi applications, Uniswap popularized the automated market maker (AMM) model that allows users to swap between Ethereum-based tokens directly from their wallets. Instead of a traditional order book, Uniswap pools liquidity supplied by users and uses algorithms to quote prices. This innovation made it easy for anyone to list or trade tokens without a centralized exchange. Today, Uniswap is the largest decentralized crypto exchange by trading volume, supporting hundreds of tokens across Ethereum and several other chains (it has expanded to networks like Arbitrum, Polygon, and more). The platform’s latest version introduced features like concentrated liquidity, improving capital efficiency for liquidity providers.

-

Aave (AAVE)

Aave is a leading decentralized lending and borrowing protocol. Often described as a money market, Aave allows users to deposit their crypto into liquidity pools and earn interest from borrowers, who take collateralized loans from those pools. Launched in 2020 (evolving from an earlier project called ETHLend), Aave has grown into the largest lending dApp in DeFi, with deployments on Ethereum mainnet and multiple Layer-1 and Layer-2 networks (like Polygon, Avalanche, Arbitrum, and others). By 2024 Aave was the top lending/borrowing platform with around $2 billion in total value locked, and it has continued to innovate with features like credit delegation and a decentralized stablecoin (Aave’s GHO stablecoin was introduced to the market).

-

Maker (MKR)

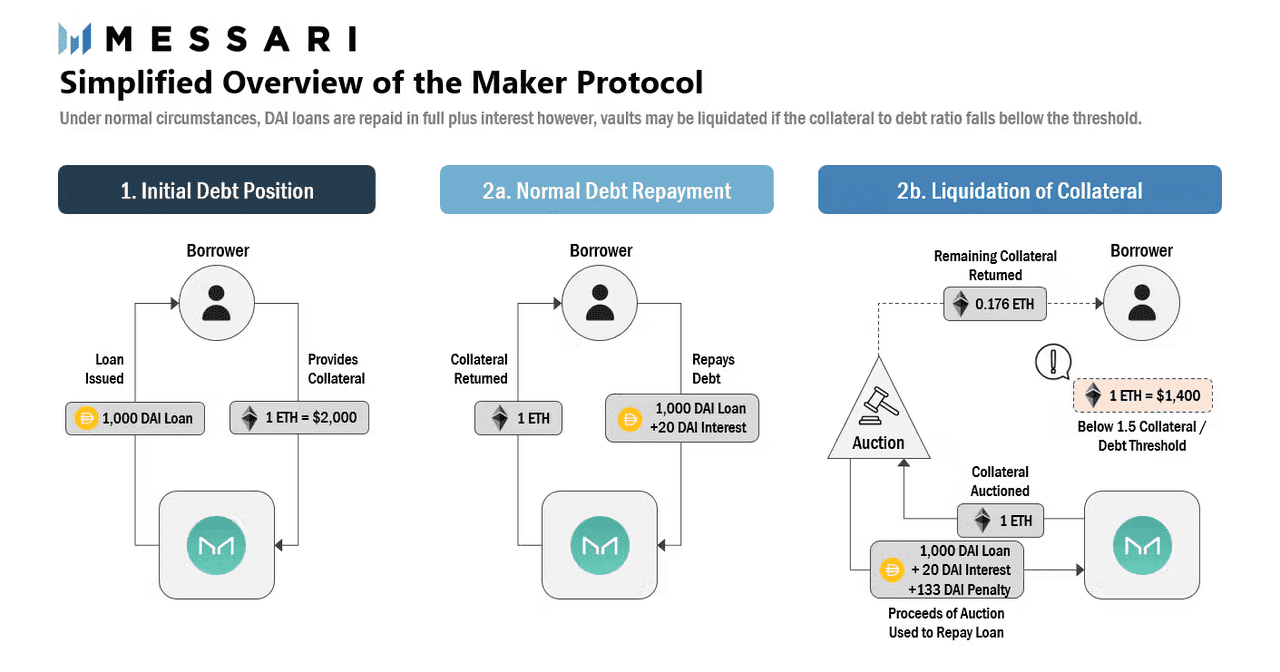

MakerDAO is the project behind DAI, the longest-standing decentralized stablecoin. Maker’s system allows users to lock crypto assets (like ETH and others) in smart contracts and generate DAI as a loan against that collateral. DAI aims to maintain a soft peg to the US dollar, providing a stable currency in the DeFi ecosystem. MakerDAO launched in 2017, making it one of DeFi’s pioneers. The Maker protocol is essentially a collateralized debt platform: users create “vaults” (formerly called CDPs) to borrow DAI, and those loans must be over-collateralized (e.g., you might lock $150 of ETH to borrow $100 of DAI, ensuring the DAI is fully backed). MakerDAO has continually evolved – by 2025 it has diversified collateral (accepting assets from ETH to tokenized real-world assets like government bonds) and introduced the “Endgame” plan to further decentralize and grow the ecosystem.

How Maker Works (source)

-

Lido (LDO)

Lido is the largest liquid staking protocol in crypto, best known for its staked Ether product stETH. It tackles a specific problem: in Proof-of-Stake networks like Ethereum, users who stake their ETH to secure the network normally have their funds locked up and must run validator nodes (with technical and capital requirements). Lido offers a solution by letting users stake any amount of ETH (or other PoS coins like SOL, MATIC, etc.) and receive a liquid token in return (e.g. stETH for Ethereum). This liquid token represents their staked assets plus accrued rewards, and it can be traded or used in DeFi while the underlying asset remains staked. In essence, Lido makes staking easy and liquid – you get the benefits of network staking rewards without the drawbacks of illiquidity or needing 32 ETH and node expertise.

-

Chainlink (LINK)

Chainlink occupies a unique niche: it’s not a DeFi application per se, but a decentralized oracle network that is an essential piece of infrastructure for DeFi. Blockchains cannot easily access external data on their own (like prices, weather, or any off-chain information). Chainlink provides feeds of trusted data – for example, the price of ETH in USD – that smart contracts can use. Most major DeFi protocols rely on Chainlink price oracles to function securely. Launched in 2017, Chainlink grew to become the standard oracle provider in the industry by offering a network of independent node operators that fetch and aggregate data from multiple sources to ensure accuracy and tamper-resistance.

-

Curve DAO (CRV)

Curve Finance is a decentralized exchange optimized for a specific niche: swapping between assets that have the same value pegs, such as stablecoin-to-stablecoin trades (USDC to DAI, for example) or trades between similar assets like staking derivatives (stETH to ETH). Launched in 2020, Curve’s automated market maker uses a specialized formula that offers extremely low slippage and fees for trades within those “stable” pairs. It quickly became the backbone for stablecoin liquidity in DeFi. By focusing on assets that trade 1:1, Curve can concentrate liquidity around the peg and give traders better rates than general-purpose exchanges. In 2024, Curve was the second-largest DEX protocol by total value locked, deployed across many chains (Ethereum mainnet and a dozen others including Avalanche, Polygon, Arbitrum, etc., to tap into various ecosystems).

-

Synthetix (SNX)

Synthetix is a decentralized derivatives protocol that enables the creation of on-chain synthetic assets, called “Synths,” which track the value of real-world assets. In simpler terms, Synthetix lets you gain price exposure to assets like gold, USD, Bitcoin, or even stock indices via tokens on Ethereum, without holding the actual underlying asset. The platform was founded in 2018 (initially as Havven, a stablecoin project, before pivoting to synthetic assets). It became one of the early DeFi dApps to demonstrate how any asset’s price could be brought onto the blockchain for trading. Synthetix uses a mechanism where users can create Synths by staking its native token SNX as collateral and minting a synthetic asset (for example, sUSD, a synthetic dollar, or sBTC, a synthetic Bitcoin). Because all Synths are collateralized by SNX and pooled together, users can trade Synths with each other indirectly through smart contracts with no order book – trades are executed against the pooled collateral at prices provided by oracles.

-

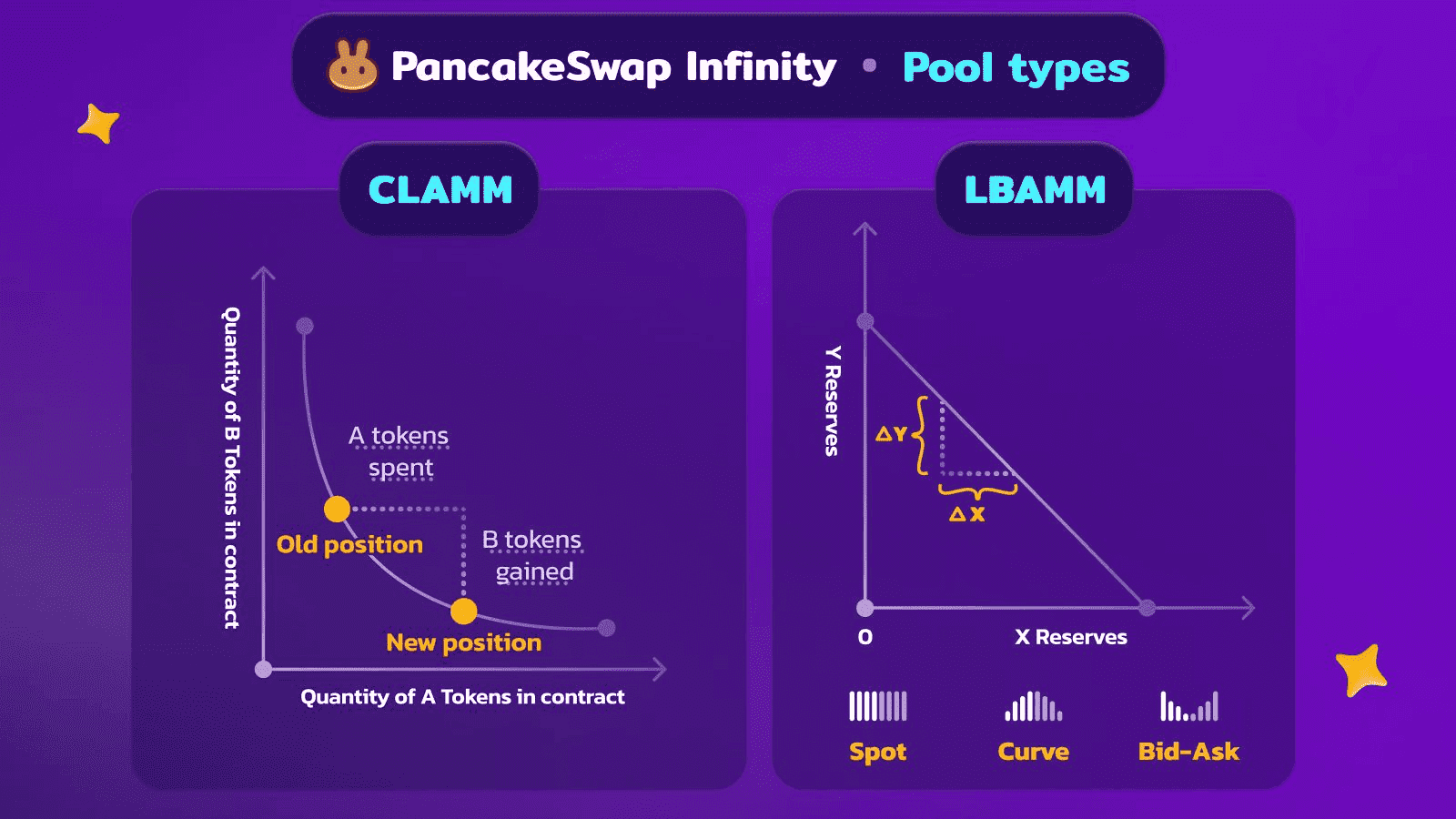

PancakeSwap (CAKE)

PancakeSwap is a decentralized exchange very similar in function to Uniswap, but it operates primarily on the BNB Smart Chain (formerly Binance Smart Chain) instead of Ethereum. It became the dominant DEX on BNB Chain, benefiting from that network’s low fees and high throughput to attract a large user base, especially among retail users looking for cheaper transactions. Launched in late 2020 by anonymous developers (with the branding of pancakes and bunnies), PancakeSwap quickly rose in popularity during the 2021 bull market as many new BEP-20 tokens launched on BNB Chain. It uses the familiar AMM model for swaps and also offers a suite of other features: yield farming, staking, lotteries, NFT marketplace, and more.

PancakeSwap Liquidity Pool Curve (source)

-

Compound (COMP)

Compound is another cornerstone DeFi lending protocol, often mentioned alongside Aave as its primary competitor. Launched in 2018, Compound was actually one of the first DeFi lending platforms on Ethereum, allowing users to supply assets to earn interest and to borrow by providing collateral. In 2020, Compound gained fame for kickstarting the yield farming trend when it introduced the COMP token distribution – users who lent or borrowed on Compound started earning COMP rewards, which in turn drove a huge influx of liquidity. This event arguably ignited the entire DeFi summer craze, as other projects followed with their own liquidity mining incentives. Compound’s model is similar to Aave’s: algorithmic interest rates, over-collateralized loans, and a focus on blue-chip assets (ETH, stablecoins, WBTC, etc.).

-

GMX (GMX)

GMX is a newer entrant (launched in 2021) that has quickly become a top decentralized platform for perpetual futures and spot trading. It operates on the Arbitrum and Avalanche networks, offering users the ability to trade cryptocurrencies with up to 50x leverage, directly from their wallets. Think of GMX as a decentralized alternative to centralized crypto derivatives exchanges (like BitMEX or Binance Futures), providing perpetual swap contracts but without an intermediary holding your funds. GMX’s innovation is in its liquidity model: instead of using an order book or individual AMMs for each trading pair, it has a single unified multi-asset liquidity pool called GLP. Liquidity providers deposit a basket of assets (ETH, BTC, stablecoins, etc.) into GLP, and this pool acts as the counterparty to traders. When traders profit, the pool loses and vice versa – historically, traders on average lose (due to funding fees and liquidations), which means liquidity providers often gain, but they also bear the risk of trader wins.

Trends Shaping the DeFi Token Landscape in 2025

-

Regulatory Developments: In 2025, regulation is a key theme in crypto, particularly for DeFi. Authorities globally are debating KYC/AML compliance for DeFi platforms and jurisdictional controls on stablecoins. In the U.S., discussions are ongoing about the regulatory status of governance tokens and DeFi tokens, while the EU's MiCA regulation increases scrutiny on crypto assets. Regulatory uncertainty can create market volatility, but some DeFi projects are proactively engaging policymakers. The environment is moving toward clearer guidelines and possible stricter oversight, impacting token listings and marketing strategies.

-

Layer-2 Scaling and Cross-Chain Growth: Ethereum’s Layer-2 networks, such as Optimism and Arbitrum, have matured, allowing many DeFi protocols to offer lower fees and faster transactions. This enables DeFi activity to spread across multiple chains and L2s, enhancing accessibility and scalability. Cross-chain bridges and interoperability protocols are improving liquidity movement. Despite past bridge hacks, newer designs and insurance are increasing confidence in these systems.

-

Real World Assets (RWAs) and Institutional DeFi: The tokenization of real-world assets is a significant trend, with assets like U.S. Treasury bills being integrated into DeFi. Platforms like MakerDAO are pioneering this space, attracting institutional interest by blending DeFi's transparency with traditional asset income. This could stabilize protocols like Aave and Maker while driving revenue growth, as firms experiment with “Institutional DeFi,” which combines CeFi and DeFi models.

-

Improved User Experience and Security: DeFi is evolving to enhance user experience and security to attract a broader audience. Innovations like smart contract wallets support features such as social recovery and simplified fee payments. User interfaces are becoming more intuitive, often accessed through aggregators, making DeFi more approachable. Enhanced security measures are also being implemented to protect users, moving beyond the "for geeks only" reputation of the past.

In summary, 2025’s DeFi landscape is shaped by a push-pull between decentralization and real-world integration. Regulation and institutions are knocking on DeFi’s door, L2s and technical advancements are scaling it, and continuous improvements aim to make it both safer and simpler. How the top DeFi tokens navigate these trends – by adapting or innovating – will likely determine their trajectory moving forward.

DeFi Lending (source)

Risks, Volatility, and Things to Consider

Even the top DeFi tokens come with a variety of risks. Before engaging with this sector, it’s important to keep the following in mind:

-

Market Risk & Price Volatility: DeFi tokens can experience extreme price fluctuations, often more than Bitcoin or Ether. Market sentiment can change rapidly, so invest only what you can afford to lose and be ready for significant volatility.

-

Smart Contract and Protocol Risk: DeFi protocols are code-based and can contain bugs or vulnerabilities. Despite audits, no contract is completely safe, and administrative risks can arise if upgrade keys are misused. Users must trust that contracts will function correctly.

-

Liquidity and Market Depth: Smaller-cap tokens may lack liquidity, leading to rapid price crashes during sell-offs. Changes in protocol usage can also affect demand and token utility. Always assess trading volumes and market robustness.

-

Governance and Centralization Risks: Governance rights can lead to centralization, especially if a few holders dominate voting power. Decisions made by these holders can impact token value and, although admin keys can provide safety, they also introduce trust issues.

-

Regulatory and Compliance Uncertainty: The legal landscape for DeFi is evolving, and new regulations may restrict activities or affect liquidity. If a token is classified as an unregistered security, it could face delisting on exchanges.

In summary, investing in DeFi entails both financial and technical risks. Always conduct thorough research (DYOR), understand the project mechanics, and consider risk management strategies like diversifying investments and utilizing insurance or stop-loss options when available.

Final Thoughts and Disclaimer Reminder

The DeFi landscape in 2025 is diverse and evolving, with various tokens representing exchanges, lending platforms, stablecoins, and derivatives. Each project seeks to redefine finance by enhancing market efficiency, accessibility, or yield potential. For retail crypto users and investors, exploring these tokens reveals unique mechanics and risk profiles, highlighting that a one-size-fits-all approach doesn’t apply.

Stay informed about trends, governance votes, and market conditions, as the competitive landscape can shift rapidly. It’s essential to treat engagement with DeFi tokens as a continual learning process.

Remember, this is not financial advice; it's an educational overview. Crypto assets, especially DeFi tokens, are volatile and risky. Conduct your own research and consider consulting financial advisors for substantial investment decisions. By understanding both the potential and risks of DeFi, you can navigate this exciting frontier with caution. Stay safe, stay informed, and enjoy your exploration!