In the evolving world of digital assets, the spotlight in 2025 is increasingly on transactional privacy. The privacy crypto sector has gained attention as investors and users grow more concerned about financial surveillance and data confidentiality. This article offers a neutral, educational privacy token list of the top privacy tokens in 2025 – highlighting ten prominent projects in this niche. We’ll explore what each project does, how it contributes to the crypto sector privacy landscape, and key features and risks. Disclaimer: This overview is for informational purposes only and is not financial advice. Crypto assets are highly volatile and risky, so always do your own research and consider your risk tolerance.

What Is the Privacy Crypto Sector?

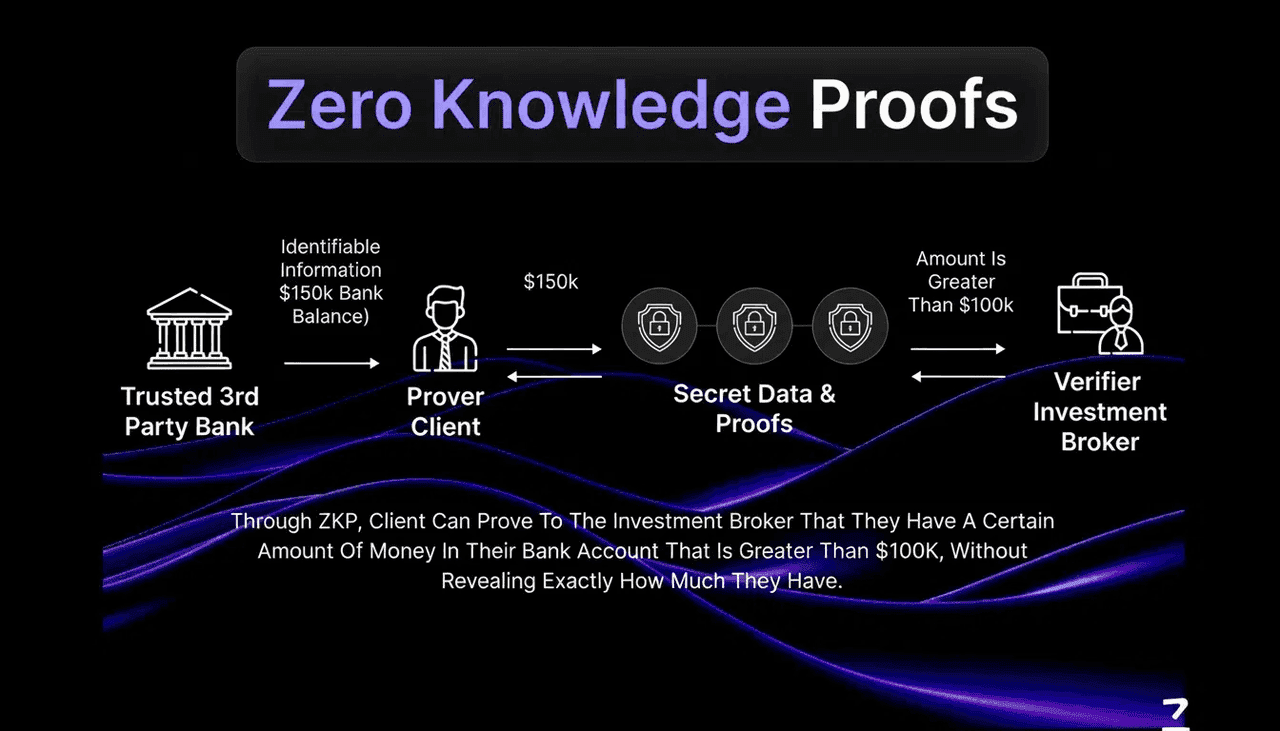

Privacy cryptocurrencies (privacy coins or tokens) are digital assets designed to enhance anonymity in blockchain transactions. Unlike Bitcoin or Ethereum, where transactions are broadcast on a public ledger, privacy-focused projects use advanced cryptography to conceal user identities, addresses, and transaction amounts. Common techniques include stealth addresses, ring signatures, and zero-knowledge proofs, which together hide the sender, receiver, and value of transactions. The result is a level of confidentiality similar to cash – observers cannot easily trace who paid whom or how much.

This sector serves use cases where financial privacy is paramount. Individuals may use privacy tokens for personal transactions they prefer to keep confidential (e.g. private payments or donations), and businesses can leverage them to protect sensitive financial information (such as payroll or B2B transactions) from competitors and prying eyes. Privacy crypto projects also improve fungibility in cryptocurrency: by breaking the traceable history of coins, they ensure that each token is interchangeable without a “tainted” history. Some privacy platforms even enable private messaging and data sharing, providing tools for identity protection and secure communication in the broader crypto ecosystem.

It’s important to note that “privacy” in crypto doesn’t always mean complete anonymity – there’s a spectrum. Some projects offer opt-in privacy or view keys that let users reveal transaction details selectively. For example, Zcash, Secret, and Oasis allow either transparent or private transactions, arguing that striking a balance between transparency and privacy may be necessary for mainstream adoption. Such features can help with compliance or auditing when needed, distinguishing them from coins like Monero that enforce privacy by default with no option to go transparent.

Zero Knowledge Proofs (source)

How We Selected These Top Privacy Tokens

The following tokens were selected based on a combination of neutral criteria: market capitalization and liquidity, development activity and longevity, ecosystem traction, and each project’s core relevance to privacy. Generally, larger and more active projects (by market cap and community) earned a spot, as well as a few innovative newer entrants in the privacy niche. We’ve aimed to include a diverse range of technologies (from cryptographic coins to privacy-focused smart contract platforms) to represent the breadth of the sector.

This list is neither exhaustive nor an endorsement. Inclusion on this list does not mean a project is recommended for investment – it simply signals that the project is notable in the privacy niche by late 2025. There are other privacy projects beyond these ten, and the sector continues to evolve. As always, do your own research on any project of interest, and remember that privacy tokens, like all cryptocurrencies, carry risks alongside their potential.

Top 10 Privacy Tokens in 2025

Below we profile ten significant privacy-focused crypto projects. Each is listed with its rank, name, and ticker symbol, followed by an overview of its purpose, technology, token usage, strengths, and risks. (Note: Descriptions are current as of December 2025.)

-

Monero (XMR)

Monero is widely regarded as the gold standard for privacy coins. Launched in 2014, it pioneered on-chain privacy by making anonymity the default – every single Monero transaction is private by design. Monero’s mission is to be untraceable digital cash, meaning it allows users to send value without revealing sender, receiver, or amount. It achieves this through the CryptoNote protocol and a suite of privacy techniques: ring signatures hide the sender by mixing it with decoy signers, stealth addresses conceal the recipient by generating one-time addresses, and RingCT (Ring Confidential Transactions) obscures the transaction amount. Unlike some other coins, Monero does not offer a public transaction option – all activity is anonymized on-chain. This makes Monero highly valued among privacy advocates and a benchmark against which other privacy projects are measured.

-

Zcash (ZEC)

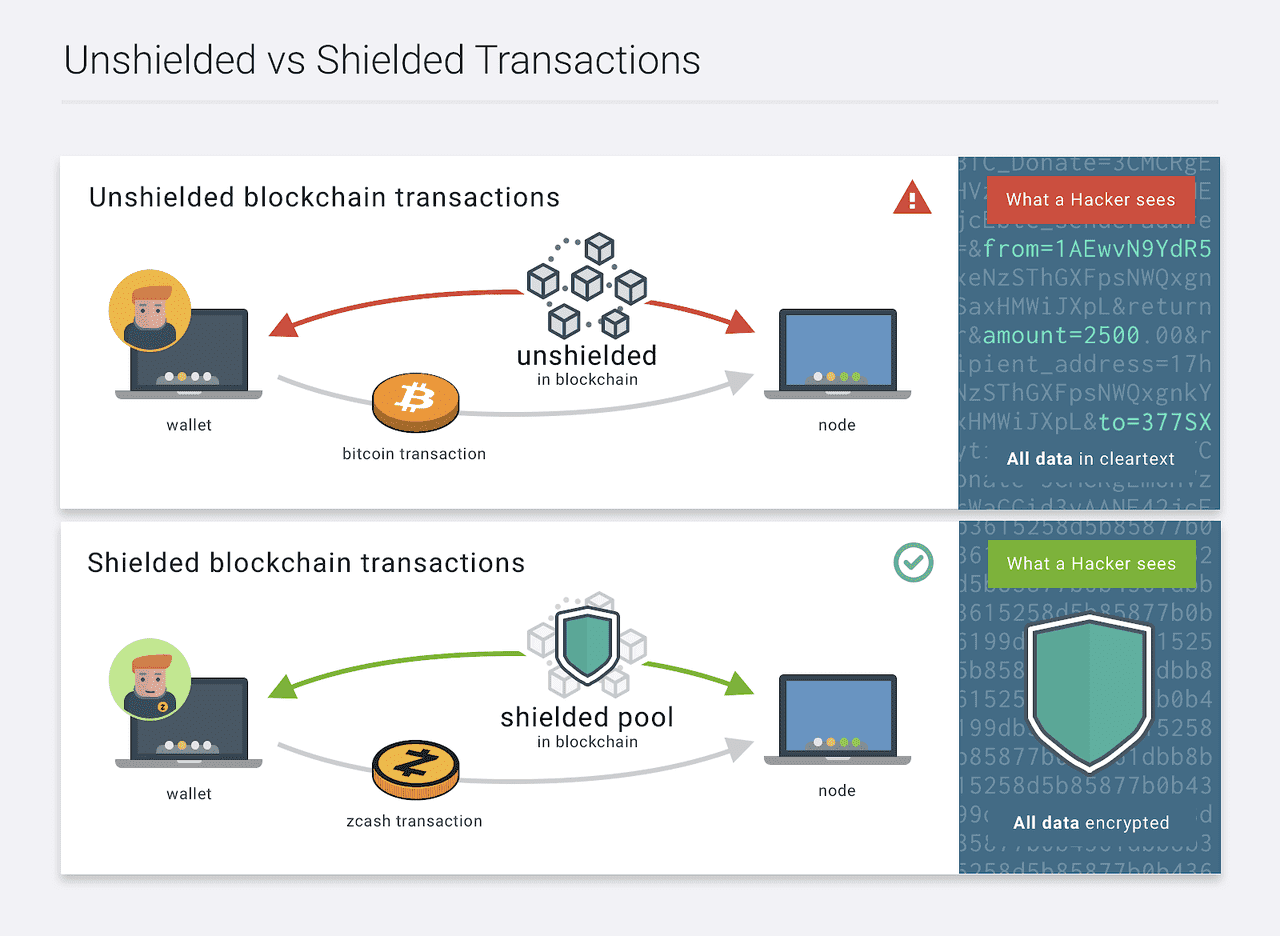

Zcash is a well-known privacy coin that launched in 2016, introducing cutting-edge cryptography to the blockchain world. It was the first project to implement zk-SNARKs (zero-knowledge succinct non-interactive arguments of knowledge) on a broad scale, allowing transactions to be verified without revealing their details. Zcash effectively offers two modes of operation: transparent addresses (which work like a normal Bitcoin address, fully public) and shielded addresses (which employ zk-SNARK encryption to hide sender, receiver, and amount). Users can choose to send “shielded” transactions for privacy or “transparent” transactions for full visibility. This optional privacy model means not every ZEC transaction is private – but those that are shielded benefit from very strong cryptographic anonymity. The ability to switch between modes is seen as a flexibility for usability and compliance.

Shielded vs Unshielded Transactions (source)

-

Dash (DASH)

Dash is a cryptocurrency that originated as “Darkcoin” in 2014 and rebranded to Dash (Digital Cash) in 2015, focusing on fast payments and user-friendly digital money. Dash is not a privacy coin in the strictest sense, but it historically offered an optional privacy feature called PrivateSend. PrivateSend is essentially a built-in coin-mixing service (using a technique similar to CoinJoin) that lets users mix their DASH tokens with others to obfuscate transaction trails. By mixing funds through cooperating master nodes, Dash can break the link between sender and receiver addresses for those who opt to use PrivateSend. However, it’s important to highlight that Dash’s primary identity now is as a payments-focused coin with instant transaction features (InstantSend) and a two-tier node system (masternodes) for governance and speed. In fact, Dash’s developers have de-emphasized the privacy aspect in recent years – Dash no longer markets itself as heavily as a privacy coin (and some exchanges categorize it as a regular coin). Still, because PrivateSend is available, Dash often gets mentioned in the privacy token conversation.

-

Oasis Network (ROSE)

Oasis Network is a Layer-1 blockchain platform designed with a strong focus on data privacy and scalability for decentralized applications. Rather than solely protecting transaction details, Oasis enables privacy-preserving smart contracts – meaning dApps can process sensitive data (like personal information, financial data, or health records) in a secure, confidential manner. It accomplishes this by integrating confidential computing technologies and secure enclaves (hardware-based trusted execution environments) that keep data encrypted even while it’s being processed. In essence, Oasis allows smart contracts to run with hidden inputs/outputs, so that only authorized parties can view the data, while the blockchain ensures integrity and correctness. This capability opens the door to a “tokenized data” economy, where users could share or monetize data to applications without compromising privacy.

-

Secret Network (SCRT)

Secret Network is another Layer-1 blockchain focused on enabling privacy by default for smart contracts, making it a direct parallel to Oasis in vision, but with some different approaches. Secret originated from the Enigma project and launched its own independent network in 2020 (as part of the Cosmos ecosystem). The core idea of Secret Network is to allow “secret” smart contracts where all data (inputs, outputs, state) is encrypted and cannot be read by the nodes or any observer, while still allowing the network to verify computations. To achieve this, Secret uses a network of nodes that utilize trusted execution environments (TEE) – similar to Oasis, it leverages hardware-based secure enclaves to perform private computation. The result is that you can have dApps where, for example, you could swap tokens or interact with financial contracts without revealing amounts or addresses to the public. Secret Network extends privacy beyond transactions (like Monero or Zcash) to general programmability – it’s about private DeFi, NFTs, and applications. For instance, Secret Network has had applications like SecretSwap (a privacy-first AMM/DEX) and Secret NFTs (where ownership and metadata can be private). By 2025, Secret Network has established itself as a prominent platform for privacy-preserving dApps, often mentioned in the same breath as Oasis when discussing blockchain privacy solutions.

-

Worldcoin (WLD)

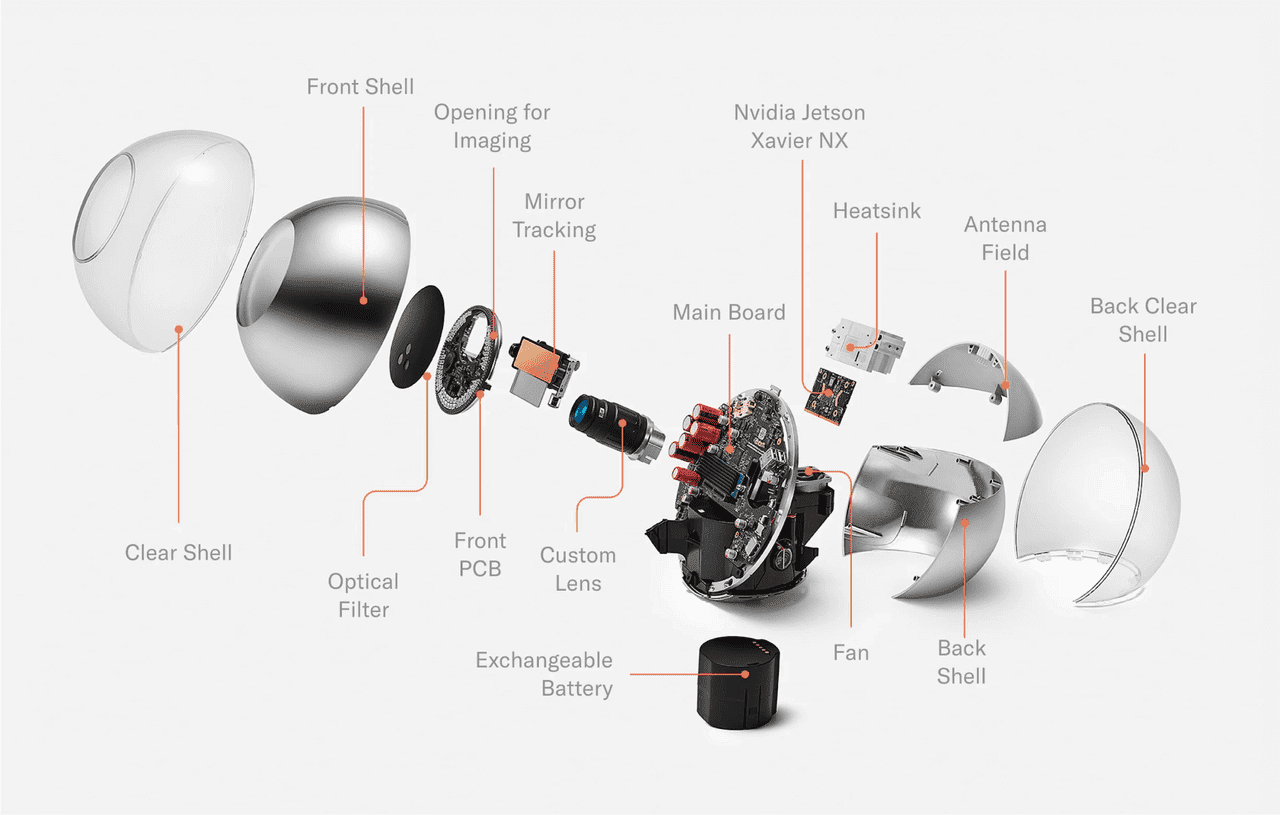

Worldcoin is a rather different project in the privacy token space – its primary focus is on digital identity with privacy rather than transaction anonymity. Launched in 2023, Worldcoin’s ambitious goal is to create a global identity network (World ID) and cryptocurrency that can be distributed to every human on Earth. The project is notable (and controversial) for its use of a biometric imaging device called the Orb, which scans people’s irises to ensure each person only signs up once. The Orb converts an iris scan into a unique code (a hash) and confirms you’re a real and unique human, but importantly it doesn’t store the iris image – it’s using zero-knowledge proofs to preserve privacy. Once verified, a user is issued a World ID (a kind of digital passport that proves “I am a unique human”) and can claim Worldcoin’s cryptocurrency WLD as a reward. The privacy angle is that Worldcoin uses advanced cryptography so that you can prove you have a valid World ID (i.e., you’ve done the Orb verification and you are a unique person) without revealing your actual identity or any personal data. In practice, this involves zero-knowledge proofs that the user holds a credential signed by the Orb network, without exposing the credential itself. WLD tokens serve as both a governance token and an incentive mechanism in this ecosystem.

Worldcoin Orb (source)

-

Beldex (BDX)

Beldex is a privacy-centric blockchain project that positions itself as more than just a private cryptocurrency – it aims to be a privacy ecosystem. Launched in 2018, Beldex started as a fork of Monero’s codebase (thus inheriting some of Monero’s privacy features like RingCT and stealth addresses) and has since developed additional layers such as a Masternode network and applications like private messaging. The BDX coin transactions are privacy-enhanced: Beldex uses RingCT (Ring Confidential Transactions) and stealth addresses to ensure that sender identities, recipient addresses, and transaction amounts are concealed. In that sense, transacting BDX has similar anonymity properties to Monero. Beyond transactions, the Beldex team has built dApps including BChat, a decentralized encrypted messenger, and is exploring private VoIP calls and a privacy-focused Web3 browser. Beldex runs on a proof-of-stake consensus with masternodes (rather than Monero’s proof-of-work), meaning BDX holders can stake coins to run masternodes which facilitate the network’s privacy services and earn rewards.

-

Firo (FIRO)

Firo (formerly known as Zcoin) is a privacy-focused cryptocurrency that emphasizes on-chain anonymity through advanced cryptographic techniques. Launched in 2016 as Zcoin, it rebranded to Firo in 2020 to avoid confusion with Zcash and to mark its evolution. Firo’s approach to privacy has evolved over time: it pioneered the use of the Zerocoin protocol (one of the first implementations of burn-and-redeem privacy) and later introduced its own innovations like Lelantus and now Lelantus Spark. The core idea in Firo’s privacy is to allow users to destroy (burn) coins and then redeem (spend) brand new ones that have no link to the originals – effectively breaking the transaction trail. With Lelantus Spark, users can burn an arbitrary amount of FIRO and then later redeem it in parts to new addresses, all while the amounts are hidden and there’s no way to connect the redemption to the burn. Firo also employs Dandelion++ routing for network-level privacy, which helps obscure the originating IP address of transactions by spreading them out in random paths. Firo uses a hybrid consensus: it was originally proof-of-work (with a focus on being ASIC-resistant via the MTP algorithm), and it introduced a secondary layer of masternodes that enable features like instant send and governance (the masternodes do not compromise privacy though – the privacy comes from cryptography).

-

Pirate Chain (ARRR)

-

Grin (GRIN)

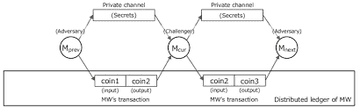

Grin is a privacy-focused cryptocurrency notable for its implementation of the Mimblewimble protocol and its ethos of simplicity and community-driven development. Launched in early 2019, Grin was introduced without an ICO, pre-mine, or founder rewards – it was a fair launch with a lot of excitement from developers and cypherpunks. Mimblewimble, the protocol Grin uses, is fundamentally different from Bitcoin or Monero’s design. In Mimblewimble, there are no addresses in the traditional sense, and it uses Confidential Transactions and Cut-Through to make the blockchain extremely compact and private. Transaction details (amounts and the participants) are not revealed publicly, and multiple transactions can be merged (cut-through) in a block so that much less data is stored. Grin embraces this to achieve privacy and scalability. Every Grin transaction by default is private – you can’t look at the chain and see how much was sent or from which address, because addresses aren’t there and amounts are encrypted. However, Grin’s transactions do require interactive exchange (at least in early versions; you needed to interact with the receiver to build a transaction). Grin has an infinite supply emission schedule, releasing 1 GRIN every second forever (which means linear inflation that decreases in percentage terms over time). This was chosen to discourage hoarding and to keep Grin as a medium of exchange with low unit price.

Mimblewimble process (source)

Trends Shaping the Privacy Token Landscape in 2025

The privacy coin sector in 2025 is influenced by several important macro trends:

-

Regulatory Scrutiny and Compliance: Governments worldwide are increasingly focusing on privacy tokens, with some countries, such as Japan, South Korea, Australia, and parts of the EU, imposing restrictions or banning privacy coins due to AML concerns. These regulations have prompted exchanges to delist coins like Monero and Zcash to avoid backlash. Paradoxically, the scrutiny has heightened awareness of privacy tools, compelling some projects to adopt compliance features while emphasizing responsible privacy. As a result, many are moving toward decentralized exchanges (DEX) to enhance accessibility.

-

Advances in Privacy Technology: Rapid advancements in cryptography are benefiting privacy coins. Techniques like zk-SNARKs, zk-STARKs, and Mimblewimble enhance efficiency and scalability for privacy transactions. Furthermore, developments in Fully Homomorphic Encryption (FHE) and multi-party computation suggest future potential for encrypted data processing. Additionally, integrating network-layer privacy through routing techniques and incorporating privacy layers on smart contract platforms are making privacy features more modular and user-friendly.

-

Integration with DeFi and Web3: The realization of the need for financial confidentiality in DeFi has led to projects like Railgun, which provides shielded pool privacy on Ethereum, and privacy-focused smart contracts on networks like Secret and Oasis. Traditional DeFi protocols are also exploring privacy enhancements, including zero-knowledge proofs for user data protection. Privacy bridges, allowing asset swaps between privacy-centric and transparent chains, are emerging, alongside compliance-focused privacy tools that facilitate selective disclosure to authorities.

-

Changing User Demand and Market Sentiment: User attitudes toward privacy in crypto are shifting as retail users recognize the importance of financial privacy for everyday security, moving beyond the idea that privacy is solely for illicit activities. This has sparked interest in privacy-focused wallets, although many still prioritize ease of use over privacy features. The narrative is changing to view privacy as a right, partly due to increased advocacy and education. In late 2024 and 2025, privacy coins saw renewed interest as traders sought undervalued assets. Notably, Zcash experienced significant price spikes, briefly surpassing Monero’s market cap. While institutions typically avoid privacy coins for compliance reasons, discussions about using privacy tech in banks are growing, potentially validating this sector. Current demand comes mainly from retail users, but it is expanding as societal concerns about data privacy and surveillance rise.

-

Enhanced Privacy vs. Regulatory Balance: By 2025, privacy coins are expected to persist, even as they navigate regulatory challenges. Some projects, like Zcash and Monero, are exploring solutions that allow for compliance while maintaining privacy. Regulators are beginning to distinguish between coins that permit opt-in compliance and those that do not, providing narrative benefits for use cases that protect corporate secrets or personal safety. Innovations are emerging, such as coins that keep data private but can cooperate with regulatory requests. The dynamics between regulatory crackdowns and innovation are shaping the future of privacy coins, with developments like decentralized mixers stemming from past sanctions. Thus, the sector is at a crossroads, seeking integration with the broader crypto economy while responding to external legal influences.

Final Thoughts and Disclaimer Reminder

Privacy tokens in 2025 represent a diverse and evolving niche of the crypto world. We’ve seen that no single project “owns” this sector – instead, there’s a spectrum ranging from long-established coins like Monero and Zcash to innovative newcomers like Secret Network and Pirate Chain. Each approaches the core problem of privacy from a different angle, whether it’s on-chain mixing, zero-knowledge proofs, or private smart contracts. This diversity means users and investors have options to choose a solution that best fits their needs and risk tolerance.

It’s clear that privacy coins play a crucial role for those who value financial confidentiality. They challenge the notion that all blockchain activity must be transparent, and they provide a haven for individuals seeking to regain control over their personal financial information.

For readers intrigued by privacy tokens, remember that this article is for educational purposes and not financial advice. The intent is to provide a neutral overview of the sector’s landscape, strengths, and challenges. Stay informed, stay safe, and make decisions that align with your own financial goals and principles.