Introduction: The "Lazy Portfolio" is Dead

It is late December 2025. You are likely looking at your portfolio, conducting your year-end review.

If you are like most crypto investors, your strategy for the last few years has likely been simple: Buy and HODL. You bought the dip, you weathered the volatility, and you are sitting on a stack of Bitcoin, Ethereum, or Solana. In the early days of crypto, simply holding the asset was enough. The appreciation alone was the alpha.

But as we look toward 2026, the game has changed.

The era of "Lazy Portfolios" is over. We have entered the era of Smart Yield.

In traditional finance, leaving cash under a mattress during a period of inflation is considered financial malpractice. In the crypto economy of 2026, leaving your digital assets idle in a non-interest-bearing wallet is essentially the same mistake. With the maturation of DeFi (Decentralized Finance) and CeFi (Centralized Finance), your assets should be working for you 24/7/365.

However, the "Yield" landscape is confusing. A quick Google search for "What does it mean to stake crypto" brings up a mix of gambling sites, complex developer documentation, and outdated 2021 advice.

This guide is your clarity.

We are going to dismantle the old way of thinking about crypto savings. We will explore why Phemex has completely overhauled its Earn engine with the New On-Chain Earn and BTC Vault, and we will provide a step-by-step strategy to turn your dormant portfolio into a cash-flow-generating machine for 2026.

The Evolution of Yield (Why 2026 is Different)

To understand why Phemex’s new features matter, we have to look at how "Earning" in crypto has evolved over the last five years.

The "Black Box" Era (2020-2022)

In the previous cycle, centralized platforms offered sky-high yields (20%, 50%, 100%). Users deposited funds, but they had no idea where the yield came from. It was a "Black Box." As we learned from the collapse of entities like Celsius and FTX, often those yields were generated through risky, over-leveraged lending or proprietary trading that users didn't consent to.

The "Fear" Era (2023-2024)

Following the market cleanse, investors swung to the opposite extreme. They moved everything to cold storage. Yields dried up. The focus was purely on survival. While safe, this meant billions of dollars in capital sat unproductive, missing out on the compounding effects of network inflation rewards.

The "Transparent" Era (2025-2026)

This is where we are now. Investors demand yield, but they demand Transparency and Provenance. They want to know: Is my yield coming from a borrower? Or is it coming from the blockchain protocol itself?

This shift is the driving force behind Phemex's latest product update. We have moved away from generic "Savings" accounts for everything and moved toward Source-Specific Earning.

-

On-Chain Earn: Direct access to Proof-of-Stake rewards (ETH, SOL).

-

Structured Vaults: Transparent strategies for Proof-of-Work assets (BTC).

Let’s break down exactly how these work and why they are safer and more profitable than the old models.

The New "On-Chain Earn" – The Death of Middlemen

Defining the Mechanism

When you search "Stake Crypto," you are looking for Proof of Stake (PoS).

In a PoS network like Ethereum, the network is secured by validators who lock up (stake) 32 ETH. In return, the network prints new ETH and gives it to them. This isn't "interest" paid by a bank; it is a network reward paid by the protocol. It is the "Native Yield" of the internet.

The Problem for Retail Investors

Historically, accessing this native yield was a nightmare:

-

The 32 ETH Barrier: You needed ~$100,000+ USD to run an ETH node.

-

Technical Risk: If your internet cut out or your software bugged, you got "slashed" (penalized).

-

Illiquidity: Once staked, your ETH was stuck for weeks.

The Phemex Solution: On-Chain Earn

Phemex’s On-Chain Earn module is an aggregator. We pool user funds to spin up enterprise-grade validators.

Why is this a "Game Changer" for 2026?

1. The "Airdrop" Multiplier

This is the feature savvy investors are most excited about. In the screenshot of our new interface, you will see a tag next to ETH Staking: "+ Airdrop".

In the DeFi world, new protocols (like Layer 2 networks, Restaking platforms like EigenLayer, or Liquid Staking Derivatives) often launch their own tokens. To distribute these tokens, they take a snapshot of the blockchain and send free tokens to addresses that are actively staking ETH.

In the old "Black Box" exchange model, the exchange would often keep these airdrops for themselves.

Phemex changes the rules. Because our On-Chain Earn connects you directly to the validator layer, when significant ecosystem airdrops occur, Phemex aims to distribute these rewards back to the stakers. You aren't just earning 3-5% APY on ETH; you are positioning yourself for "free money" from the wider ecosystem.

2. No Technical Overhead

You can stake as little as 0.01 ETH or 0.1 SOL. Phemex handles the node maintenance, client upgrades, and uptime requirements. You get the yield of a technical expert with the effort of a savings account holder.

3. One-Click Compounding

On-chain staking usually requires manual claiming of rewards, which incurs gas fees (network transaction costs) every time. Phemex automates this. We auto-compound your rewards, meaning your yield earns yield instantly.

| Coin | Strategy / Protocol | TVL (Liquidity) | Est. APR | Yield Asset | Redemption |

| ETH | XSTETH (xHASH) | $2.11 M | 9.98% | ETH | 14 Days |

| USDT | SUSDE (Ethena) | $3.44 B | 4.27% | USDT | 14 Days |

| SOL | JITOSOL (Jito) | $1.80 B | 6.60% | SOL | 7 Days |

The BTC Vault – Solving the "Bitcoin Yield" Problem

While Ethereum holders have enjoyed staking rewards for years, Bitcoiners have been left out. Bitcoin is Proof of Work. You cannot stake it.

For years, the only way to earn on BTC was to lend it out to short-sellers (people betting against Bitcoin). Many true Bitcoiners hated this idea ethically.

What is the BTC Vault?

The BTC Vault is a structured financial product designed to generate yield on Bitcoin without relying solely on simple lending. It utilizes advanced strategies (such as delta-neutral basis trading or options structures) to capture volatility and market inefficiencies.

The "Sats on Sats" Philosophy

The most critical aspect of the BTC Vault for 2026 is the Denomination of Yield.

-

The Old Way: You deposit BTC, and the platform pays you interest in USDT.

-

The Phemex Vault Way: You deposit BTC, and you earn BTC.

Why does this matter?

Let’s do the math for a 2026 Bull Case.

Imagine you have 1 BTC. The price is $90,000.

You put it in a "Savings" account earning 5% APY paid in USDT.

-

End of year: You have 1 BTC + $4,500 USDT.

-

Total Value if BTC hits 154,500.**

Now, imagine you use the BTC Vault earning 5% APY paid in BTC.

-

End of year: You have 1.05 BTC.

-

Total Value if BTC hits 157,500.

By earning in-kind (Satoshis), your yield captures the upside appreciation of the asset itself. This is the only strategy that makes sense for long-term believers.

The "Revenue Share" Tier List

Best for clearly showing the exact percentages users can earn from the BTC Futures Fees pool.

| VIP Level | BTC Net Deposit Tier | Your Share of Futures Fees |

| Level 1 | Tier 1 | 0.0005% |

| Level 2 | Tier 2 | 0.0010% |

| Level 3 | Tier 3 | 0.0030% |

| Level 4 | Tier 4 | 0.0050% |

| Level 5 | Tier 5 (Whale Status) | 0.0100% |

Unlike traditional savings accounts that pay out static interest, the Phemex BTC Vault operates like a dividend. You are earning a percentage of the platform's actual BTC Futures transaction fees. As you move up the tiers by depositing more BTC, your share of the 'fee pie' grows exponentially—up to 20x at Tier 5.

A Step-by-Step Strategy for Your 2026 Portfolio

Understanding the tools is step one. Using them effectively is step two. Here is a recommended workflow for optimizing your Phemex account for the coming year.

Step 1: The Audit (Clean House)

Log in to your Phemex Spot Wallet. Identify your "Lazy Assets."

-

Do you have ETH sitting in Spot?

-

Do you have USDT waiting for a dip?

-

Do you have BTC you plan to hold for 5+ years?

Step 2: The Allocation (The 3 Buckets)

We recommend dividing your portfolio into three "Buckets" within the Phemex Earn ecosystem.

Bucket A: The "Dry Powder" (USDT/USDC)

Product: Phemex Flexible Savings

Target Allocation: 20% of Portfolio.

Why: You always need liquidity to buy dips. However, inflation erodes stablecoins.

Action: Move your stablecoins to Flexible Savings. You will earn a competitive APY (often higher than traditional banks), but crucially, Redemption is Instant.

-

Scenario: Bitcoin crashes 10% on a Tuesday. You redeem your USDT from Savings instantly and buy the dip. You earned interest while you waited.

The "Full Savings Rates" Table

| Category | Coin | Max APR | Duration |

| Stablecoins | USDT | 66.00%* | Fixed / Flexible |

| USDC | 10.00% | Fixed / Flexible | |

| Blue Chips | BTC | 3.00% | Fixed / Flexible |

| ETH | 3.50% | Fixed / Flexible | |

| SOL | 4.00% | Fixed / Flexible | |

| Altcoins | ADA | 1.60% | Flexible |

| XRP | 0.30% | Flexible | |

| New Gems | TOWNS | 100.00% | Fixed / Flexible |

*Note: 66% APR for USDT is exclusive to new registered users.

Pro Tip: Watch for 'New Listing' vaults. As seen with the TOWNS token (100% APR), Phemex often offers hyper-competitive rates for newly listed assets. This is a great way to hedge a speculative bet—even if the price stays flat, the yield provides a massive buffer.

Bucket B: The "Core Growth" (ETH/SOL/DOT)

Product: Phemex On-Chain Earn

Target Allocation: 40% of Portfolio.

Why: These are your productive assets.

Action: Navigate to Earn > On-Chain Earn.

-

Select "ETH 2.0 Staking" or "SOL Staking."

-

Pro Tip: Look for the specific Redemption Period warnings. On-chain staking is not instant. It may take 1-4 days to unstake depending on the blockchain network conditions. This prevents panic selling, forcing you to be a disciplined investor.

Bucket C: The "Legacy Hold" (BTC)

Product: Phemex BTC Vault

Target Allocation: 40% of Portfolio.

Why: To stack sats.

Action: Subscribe to the BTC Vault.

-

Check the "Fixed" terms. Usually, locking your BTC for 7 or 30 days yields a higher rate than flexible terms. If you are a long-term HODLer, the lockup is irrelevant to you, so take the higher rate.

Step 3: Automation

The secret to wealth is consistency.

On the Phemex Earn dashboard, toggle the "Auto-Subscribe" feature.

Every day at 12:00 UTC, when your interest is paid out, Phemex will automatically take that interest and add it back to the principal.

-

The Magic of Compound Interest: $10,000 at 10% APR is $1,000 profit. 1,105. Over 5 years, that difference becomes massive.

Risk Management & Transparency (The Elephant in the Room)

We are writing this for a Western audience, and we know what you are thinking.

"Not your keys, not your coins."

It is the most famous mantra in crypto, and it has merit. However, self-custody comes with its own risks: lost seed phrases, phishing attacks, and complex inheritance issues.

For those who choose to use a CEX (Centralized Exchange) for convenience and yield, Trust is the product.

How Phemex Mitigates Risk for 2026

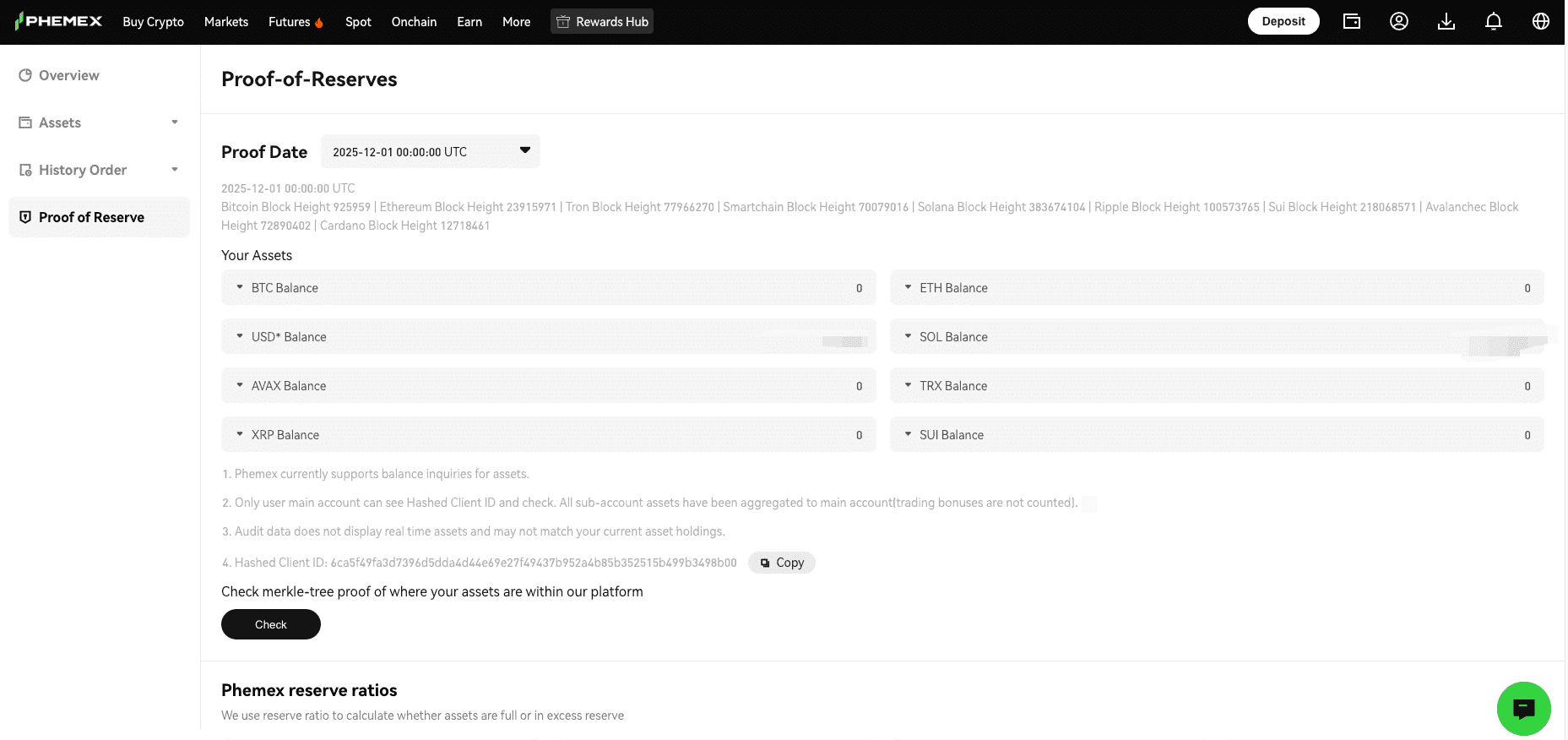

1. Merkle-Tree Proof of Reserves (PoR)

Phemex was one of the first exchanges to implement and publish transparent Proof of Reserves. You don't have to take our word for it. You can cryptographically verify that your specific user ID’s balance is included in the exchange's liabilities and that those liabilities are 100% matched by on-chain assets.

-

Note: The assets in On-Chain Earn are transparently visible on the blockchain validators.

The "Solvency Summary" Table

| Asset | Reserve Ratio | Status | Meaning |

| SUI | 218.19% | Over-Collateralized | Phemex holds 2x more SUI than users deposited. |

| ETH | 153.38% | Over-Collateralized | Massive safety buffer for Ethereum. |

| AVAX | 142.50% | Over-Collateralized | Fully backed + surplus. |

| SOL | 138.12% | Over-Collateralized | Fully backed + surplus. |

| BTC | 132.35% | Over-Collateralized | 32% surplus Bitcoin held in Cold Storage. |

| USD* | 113.33% | Over-Collateralized | Stablecoin reserves exceed liabilities. |

What does a ratio over 100% mean?

It means Phemex is Over-Collateralized. Unlike banks that lend out your money (Fractional Reserve Banking), Phemex keeps your assets 1:1, plus a surplus.

As shown in the live data above:

-

For every 1 BTC you deposit, Phemex holds 1.32 BTC in reserve.

-

For every 1 ETH you deposit, Phemex holds 1.53 ETH in reserve.

This surplus ensures that even in extreme market volatility, your withdrawals are always guaranteed.

2. Risk Segregation

This is the most important update for the new Earn system.

-

On-Chain Assets are segregated. When you stake ETH via Phemex, those funds are sent to the Beacon Chain. They are not used by Phemex to leverage trade, and they are not lent to hedge funds. They are doing exactly what they say they are doing: validating the network.

3. Slashing Insurance

For On-Chain staking, there is a small risk that a validator node malfunctions and gets "slashed" (fined) by the network. Phemex employs industry-leading infrastructure monitoring to prevent this. While no system is risk-free, Phemex’s institutional setup is significantly more robust than a user running a validator on a home laptop with spotty Wi-Fi.

The Macro View - Why Staking is the "New Oil"

To conclude, let’s zoom out.

In 2026, the global economy is shifting. Traditional interest rates are unpredictable. Real estate is illiquid. Stocks are at all-time highs.

Crypto Staking has emerged as the native "Risk-Free Rate" of the digital economy. (Note: "Risk-free" in terms of protocol function, not price value).

-

Ethereum pays you to secure the World Computer.

-

Solana pays you to secure the world's fastest transaction layer.

-

Bitcoin pays you (via Vaults) to provide liquidity to the hardest money ever created.

When you ask "What does it mean to stake crypto?", you are asking how to become a shareholder in the future of finance.

Phemex has spent the last six years building a platform that is fast enough for day traders but safe enough for long-term savers. With the introduction of On-Chain Earn and the BTC Vault, the ecosystem is complete.

You have the assets. You have the conviction. Now, you have the tools.

Key Takeaways for Your 2026 Strategy:

-

Stop "Lazy HODLing": Inflation is eating your purchasing power. Activate your assets.

-

Know the Source: Use On-Chain Earn for transparent, protocol-level yield on ETH/SOL.

-

Stack Sats: Use BTC Vault to grow your Bitcoin denomination, not just USD value.

-

Stay Liquid: Keep your dry powder in Flexible Savings to react to market volatility instantly.

-

Verify: Always check the Proof of Reserves.

Ready to upgrade your portfolio?

Don’t let another day of yield slip away.

Log In to Phemex Earn | View Today’s On-Chain APY Rates

Disclaimer: The information contained in this article is for educational and informational purposes only and does not constitute financial advice, investment advice, or trading advice. Cryptocurrency investment involves high market risks. Yields (APY) vary over time based on network conditions and market demand. Please perform your own due diligence (DYOR) before investing your funds.