Summary (Fast Facts)

-

Ticker Symbol: AVNT

-

Current Price (Sep 15, 2025): ~$1.24 USD (up ~47% in 24h)

-

Chain: Base (Ethereum Layer-2)

-

Market Cap: ~$295 million (rank ~#164 by market size)

-

Circulating/Max Supply: 241.6 million / 1.0 billion AVNT

-

All-Time High (ATH): $1.54 on Sept 15, 2025 (currently ~20% below ATH)

-

All-Time Low (ATL): $0.188 on Sept 9, 2025 (currently ~+550% above ATL)

-

All-Time ROI: +550% since launch (from initial trading price to today)

What Is Avantis?

Avantis is a decentralized perpetuals exchange (DEX) built on Base, an Ethereum Layer-2 network. It focuses on high-leverage trading across both crypto assets and real-world assets (RWAs) like forex, commodities, and indices. In essence, Avantis enables users to long or short synthetic versions of assets (BTC, ETH, gold, stocks, etc.) with leverage, directly from their Web3 wallets. This gives traders exposure to traditional markets on-chain, solving the problem of siloed liquidity by bringing commodities and FX markets into the crypto ecosystem.

As Base’s largest derivatives exchange by volume, Avantis provides institutional-grade trading experience within DeFi. It introduces innovations like zero-fee perpetuals (traders only pay fees on winning trades) and extreme leverage (up to 500× on crypto and even 1000× on some forex pairs). The $AVNT token is the platform’s native utility and governance token. AVNT powers protocol incentives, trader rewards, fee discounts, and governance decisions. Holders can stake AVNT to backstop losses (similar to an insurance fund) and earn rewards, vote on upgrades, and enjoy trading fee rebates for loyalty. By aligning token incentives with platform usage, Avantis aims to bootstrap a robust ecosystem of traders, liquidity providers, and community governance.

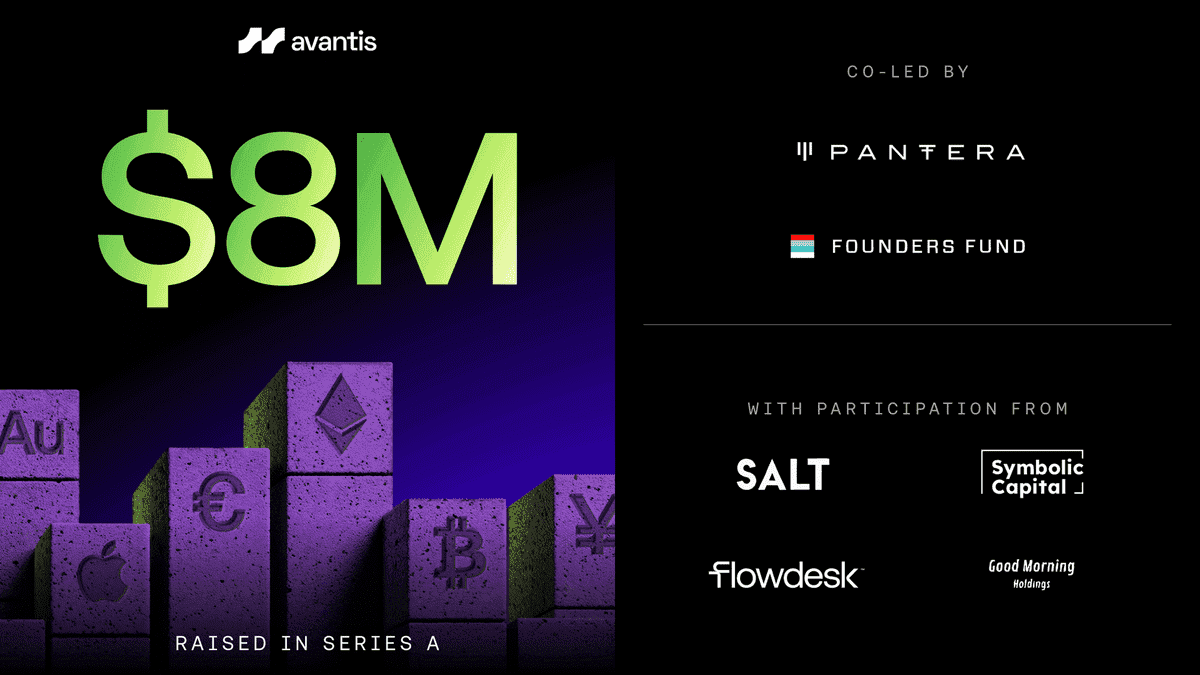

In summary, Avantis fits in the DeFi category (perpetual futures DEX) with a unique twist – it bridges crypto and real-world markets. It brings the “universal leverage” vision: a one-stop on-chain platform where you can trade Bitcoin alongside gold or S&P500 index futures. Backed by major crypto investors like Pantera Capital and Coinbase’s Base Ecosystem Fund, the project carries significant clout. Its value to the ecosystem lies in expanding DeFi’s scope to traditional finance markets, all while maintaining self-custody and decentralization. This broadens the appeal of DeFi to traders who want access to global markets 24/7 without intermediaries.

Avantis Price Chart (source)

Current Price & Market Data (as of Sept 15, 2025)

As of September 15, 2025, Avantis (AVNT) is trading at approximately $1.24 USD per token, following an explosive debut week with a 24-hour price surge of around +43–48%. In just seven days, the token’s price has skyrocketed roughly 5–6 times its initial value of ~$0.20, equating to a +500% gain since launch. With a market capitalization near $294–$300 million, Avantis ranks among the top ~200 cryptocurrencies, supported by a circulating supply of ~241.6 million AVNT out of a max supply of 1 billion.

Trading volume has been exceptionally high, reaching about $1.8–$1.9 billion in the past 24 hours, with AVNT available on over 30 exchanges worldwide and strong liquidity. The price ranged from a low of $0.7729 to a high of $1.54 (ATH) within a day, with current prices still about 20% below that peak. The all-time low (ATL) was around $0.1878, reflecting a dramatic rise of over +550% from that point. This volatility indicates the speculative interest in AVNT, and traders should be prepared for sharp price movements as the market searches for stability.

Price History & Performance Overview

AVNT’s price history is short yet eventful, starting with its launch and airdrop in September 2025. Avantis announced its token in late August, with 65,000 eligible addresses claiming AVNT on September 9. Initial trading was volatile, leading to a “post-airdrop dump” where the price fell from ~$0.50 to an all-time low of ~$0.19–$0.20.

Following this, AVNT experienced a quick recovery, reaching the ~$0.40–$0.46 range by September 13–14, fueled by whale accumulation and increasing trading volume. The significant surge occurred on September 15, when AVNT secured listings on major exchanges, skyrocketing to $1.54 before settling back to around $1.20–$1.30 by day’s end—a remarkable rise from its lows, reflecting a historic performance.

Early buyers saw over +500% gains, while volatility remained high, with daily swings of 30–50% during launch week. Key events like the initial airdrop, whale accumulation, and exchange listings fueled price movements, supported by strong fundamentals. However, sustaining this growth will depend on maintaining trading volumes and user engagement beyond the initial hype, as many tokens typically experience pullbacks after such surges.

Whale Activity & Smart Money Flows

On-chain data shows significant activity from whale and smart money wallets in AVNT since its launch, with over 22,000 unique addresses holding the token within the first week. According to Nansen analytics, “smart money” investors hold approximately 1.14 million AVNT, while whales control around 1.27 million, totaling about 2.4 million AVNT in accumulation. This trend began right after the airdrop, as larger investors took positions while weaker hands sold. Despite the accumulation, known whales only control around 1% of the circulating supply, indicating a healthy distribution without a single entity dominating the market.

Most accumulation has occurred on-chain, with platforms like the Base DEX (Aerodrome) facilitating early trading. So far, there hasn’t been a major whale dump, suggesting that whales are holding or accumulating rather than preparing to sell. Traders should monitor on-chain analytics for any significant transfers to exchanges, which could indicate potential sell pressure.

Currently, no non-project wallets hold over 1% of the supply, as the largest active whales own only a few million tokens. The distribution among top holders minimizes the risk of one whale crashing the market. Smart contract activity is also strong, with over 388,000 AVNT transfers reported in the first week. Initial outflows from airdrop contracts were observed, but many whales seem to be withdrawing to self-custody.

In summary, whale activity has been mainly accumulative, reflecting bullish confidence as top wallets have increased their positions. However, early investors may look to exit or trim their holdings if prices rise quickly. New buyers will need to step in to absorb any selling, and current signals indicate whales are optimistic about AVNT's long-term success.

On-Chain & Technical Analysis

From a combined on-chain and technical analysis perspective, AVNT is experiencing price discovery with evolving support and resistance levels. Immediate support is around $1.25, coinciding with the 20-period moving average and previous consolidation. Below this, $1.10 is a critical support level, followed by a key zone between $1.00 and $1.04. Resistance is faced at $1.40 and $1.47, with a bullish breakout above $1.47 potentially leading to targets of $1.60 and higher.

The Relative Strength Index (RSI) indicated that AVNT was overbought during its surge, hitting around 74–75 before a minor pullback, and has since cooled. AVNT is trading above key moving averages on the 4-hour chart, though they have limited data. Open interest in AVNT futures surged to ~$39 million, showing strong positions being taken. A slightly negative funding rate suggests balanced leverage.

On-chain metrics indicate a total value locked (TVL) of $22–23 million as of mid-September, with a high volume/TVL ratio reflecting considerable trading activity. The monthly trading volume remains strong, confirming platform usage.

Currently, AVNT may establish a trading range or continue upwards. A bullish pattern on strong volume would favor further gains, while losing $1.10 support could signal a deeper correction towards $0.80–$0.90. With volume tapering post-September 15 peak, traders should watch for volume spikes that confirm breakouts or consolidation. Order book dynamics are also important to monitor for potential buying or selling pressure.

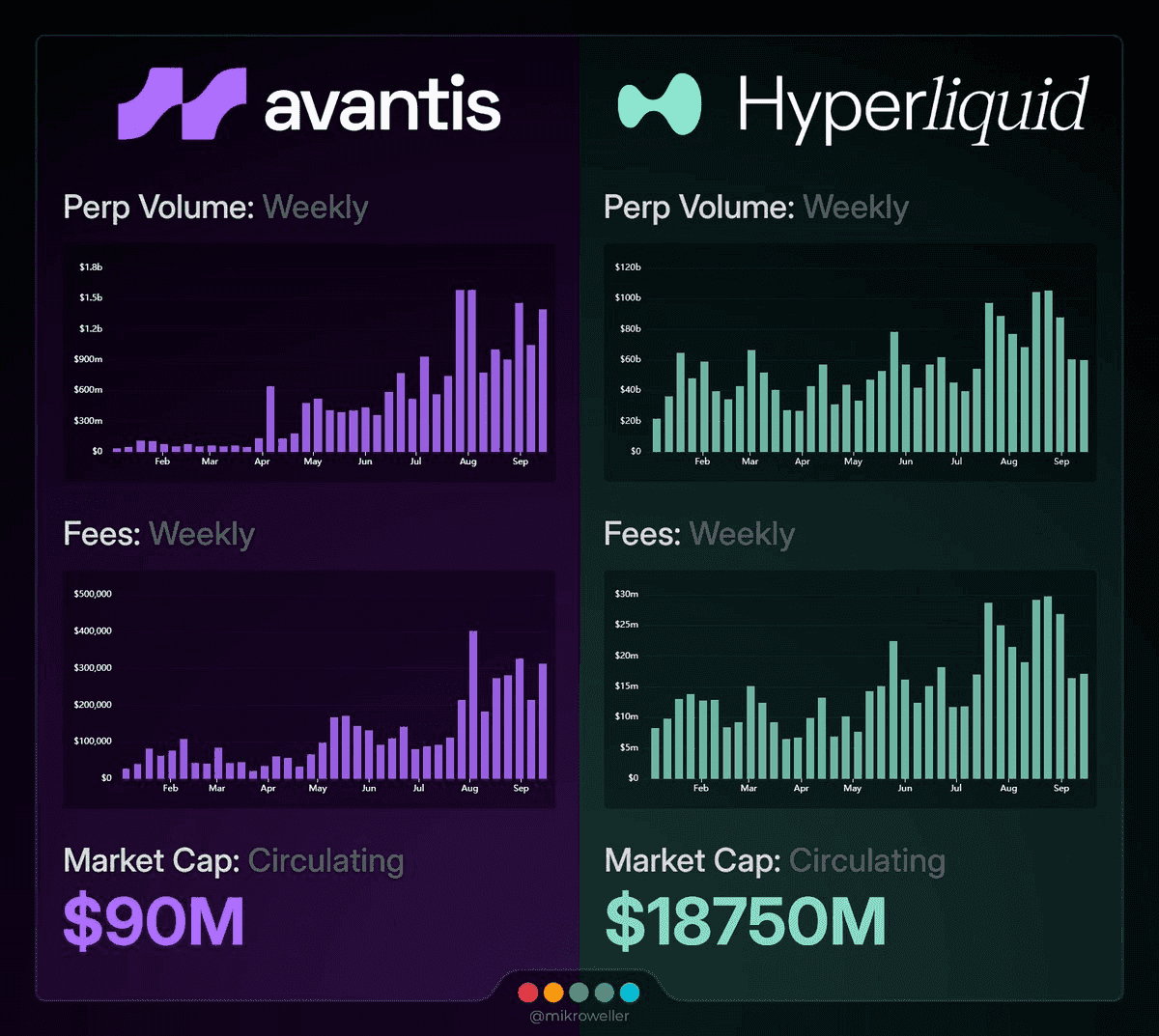

Avantis vs. Hyperliquid (source)

Fundamental Drivers of Growth

Several fundamental factors could drive AVNT’s growth in the coming years:

-

Innovative Tech & Features: Avantis differentiates itself with zero-fee perpetual swaps and unique risk management features like loss-protection rebates. It offers high leverage (up to 500× on crypto) and rewards like positive slippage. Continued innovation, including an upcoming Avantis v2, can enhance its appeal and user base.

-

Network Adoption & Volume: As the #1 perpetuals DEX on Base by volume, Avantis handled $4.7B in August 2025. Growing its monthly volume and maintaining liquidity would benefit AVNT token holders through staking rewards and fee accrual.

-

Integrations & Ecosystem Expansion: Avantis plans to diversify into on-chain equities, yield vaults, and prediction markets. Partnerships with other DeFi protocols and potential cross-chain expansion could enhance its market presence, fostering network effects and attracting more users.

-

Staking, Governance & Token Utility: AVNT holders can stake to earn fees and rewards. The utility includes governance rights, trading fee discounts, and XP boosts, driving long-term demand from traders who recognize these benefits.

-

Strong Backers & Partnerships: Backed by top-tier investors like Pantera Capital and Coinbase, Avantis benefits from credibility and industry connections that can facilitate growth and partnerships.

In summary, technical prowess, network effects, tokenomics, and industry support form the bedrock of AVNT’s long-term value. If Avantis continues to innovate technologically (e.g. zero-fee trading, high leverage), grows its user base and volumes, integrates widely and adds new assets, and leverages its strong backers for expansion – these fundamentals will drive sustainable growth for AVNT. It’s not just about hype; it’s about the platform delivering real utility and capturing a share of a large market. Investors will be watching metrics like trading volume, TVL, fee revenue, and active users as key indicators of fundamental growth in the coming years.

Key Risks to Consider

Like any crypto investment, Avantis comes with risks. It’s important to weigh these factors before getting carried away by the upside. Here are some key risks of investing in Avantis:

-

Competitive threats: The decentralized derivatives market is becoming crowded, with competition from established protocols (e.g., dYdX, GMX) and potential new entrants. If a competitor offers better fees or operates on more popular chains, Avantis could lose market share. Continuous innovation will be necessary to remain competitive.

-

Token dilution & supply unlocks: Currently, around 24% of AVNT’s total supply is circulating. The remaining 76% held for community rewards and insiders will unlock over time, which could flood the market and pressure the price if not managed carefully. Regular token emissions might lead to dilution if demand doesn't keep pace.

-

Regulatory impact: Operating within a regulatory gray area, Avantis's synthetic assets might attract scrutiny from regulators. Any regulatory action could affect asset listings and user access, impacting the platform's attractiveness and growth.

-

Security and smart contract risks: As a DeFi protocol, Avantis is vulnerable to smart contract risks. Exploits could lead to significant funds loss. A major security breach could detrimentally impact both price and user trust. Rigorous audits and security practices are vital.

-

Decreased developer or community activity: Ongoing development and community engagement are crucial for project longevity. If the Avantis team becomes inactive or if community interest wanes, the project could struggle. Maintaining a vibrant community and delivering updates will be essential for sustained success.

-

Macro and market risks: Finally, broader crypto market conditions will influence AVNT. If we enter a prolonged bear market in 2026–2027, even fundamentally strong projects can see their tokens drop significantly as capital flees risky assets. Avantis, being a trading-centric platform, might actually see higher usage in volatility, but generally, a shrinking overall crypto market cap would drag AVNT down as well.

In summary, while Avantis has a promising outlook, it is not without significant risks: competition, token dilution, regulatory headwinds, security issues, team execution, and macro factors are all points to consider. Diversification and position sizing are wise – and always do your own research. Remember that investing in AVNT (or any crypto) carries the risk of substantial loss, and one should only invest funds they can afford to lose.

Avantis Partnership and Fundraising (source)

Analyst Sentiment & Community Insights

Market sentiment around Avantis (AVNT) is currently positive, though it carries the typical hype of a new launch. Analysts have noted AVNT as a potential standout on Base, with Crispus Nyaga highlighting its growing market share in futures trading and predicting a strong price trajectory. Jesse Pollak, the lead at Base, endorsed Avantis as “the Hyperliquid of Base,” boosting community confidence in its advancements, such as zero-fee perps.

On Crypto Twitter, AVNT gained attention in mid-September, with traders excited about its exchange rollout and airdrop. Pseudonymous trader @AltcoinSniperTA pointed out that AVNT at a $60M cap could present a significant opportunity, fueling social media discussions.

CoinMarketCap and CoinGecko highlighted AVNT's trendiness, with over 40% daily gains on CoinMarketCap and a strong 86% bullish sentiment on CoinGecko, though early polls can be misleading. Avantis’s social media presence has surged, with a rapid increase in followers and active Discord/Telegram groups.

Reddit discussions have shifted from Airdrop excitement to long-term value considerations, with a mix of optimism and caution noted among users. Influencers in the DeFi space also cite whale accumulation as a bullish indicator.

Community feedback on the platform is largely favorable, with early users praising its ease of use and the concept of trading traditional assets alongside crypto. Overall, sentiment appears bullish, although some advise caution due to the speculative nature of initial pumps. The community is split between short-term traders and long-term investors.

Interest in “Avantis crypto” surged around its launch in mid-September 2025, reflecting growing public awareness. Maintaining this interest will depend on regular updates and developments. Positive news could keep sentiment high, while setbacks might lead to shifts.

Is Avantis a Good Investment?

Evaluating Avantis (AVNT) as an investment involves weighing its strong fundamentals against the risks of a speculative crypto project. This is not financial advice, and prospective investors should conduct their own research.

On paper, Avantis has a robust long-term use case, addressing the demand in DeFi for on-chain perpetual trading of both crypto and traditional assets. Its service offers high-speed, leveraged trading, potentially drawing a substantial user base. Built on Base with Coinbase's support and backed by significant venture capital, Avantis has credibility. The AVNT token has utility linked to the platform's success, enhancing its value proposition.

Strengths include a talented team, innovative products, and strong early traction. Its tokenomics are community-focused, and the platform's design aims to attract serious traders. If it executes well, AVNT could appreciate from actual user growth.

However, AVNT remains a speculative investment. It’s in early stages and faces macroeconomic challenges, regulatory risks, and the potential for token supply to pressure the market. Its current market cap of around $300M suggests some level of success is already priced in, so new investors must believe in its future growth potential.

In summary, while Avantis presents above-average potential and risk for long-term believers in DeFi innovation, it requires confidence in the team's ability to navigate challenges. If you’re optimistic about on-chain derivatives, AVNT could be a valuable hold. For risk-averse investors, a cautious approach may be prudent.

Phemex is a top-tier centralized exchange known for its security, speed, and trader-first innovation – making it an excellent venue to trade Avantis (AVNT). As one of the leading global exchanges, Phemex offers a robust suite of tools and features that cater to both beginners and professional traders.

Phemex is a top-tier centralized exchange known for its security, speed, and trader-first innovation – making it an excellent venue to trade Avantis (AVNT). As one of the leading global exchanges, Phemex offers a robust suite of tools and features that cater to both beginners and professional traders.

Ultimately, Avantis shows promising investment potential leading into 2025–2030, but consistent delivery is essential. For believers in its vision, AVNT is a high-upside bet with inherent risks. For more cautious investors, it may be best to observe until the project matures further.