Key Takeaways

- Layer 2 Purpose & Impact: Layer 2 networks scale Layer 1 blockchains (mainly Ethereum, some Bitcoin) by processing transactions off-chain while maintaining mainnet security, delivering thousands of TPS, low fees, and enabling widespread use of DeFi, NFTs, gaming, and dApps. In 2026, L2s handle ~2 million daily transactions — roughly double Ethereum mainnet volume.

- Top 10 Notable L2 Tokens (Educational Only): The article profiles 10 prominent Layer 2 tokens based on market cap, liquidity, development activity, TVL, and scaling relevance: Mantle (MNT), Polygon (POL), Arbitrum (ARB), Stacks (STX), Optimism (OP), Immutable X (IMX), StarkNet (STRK), ZKSync (ZK), Merlin (MERL), and Zora (ZORA). These cover optimistic rollups, ZK-rollups, Bitcoin layers, and specialized ecosystems.

- 2026 Trends & Considerations: Key trends include modular/multi-chain designs, improved interoperability, rapid growth in DeFi/gaming/social apps, and deeper integration with Ethereum’s roadmap. The sector offers diverse scaling solutions but remains young and volatile — the list is for information only, not an endorsement. Always DYOR and exercise caution.

Introduction

The Layer 2 crypto sector has emerged as one of the most dynamic areas in blockchain, addressing the critical need for scalability. In 2026, combined Layer 2 networks process close to 2 million transactions per day, roughly double the Ethereum mainnet’s volume. This article examines the top Layer 2 tokens 2026 has to offer and why these projects are in the spotlight. We’ll explore what Layer 2 networks are, highlight ten notable Layer 2 project tokens (for educational purposes only), and discuss broader trends and risks.

What Is the Layer 2 Crypto Sector?

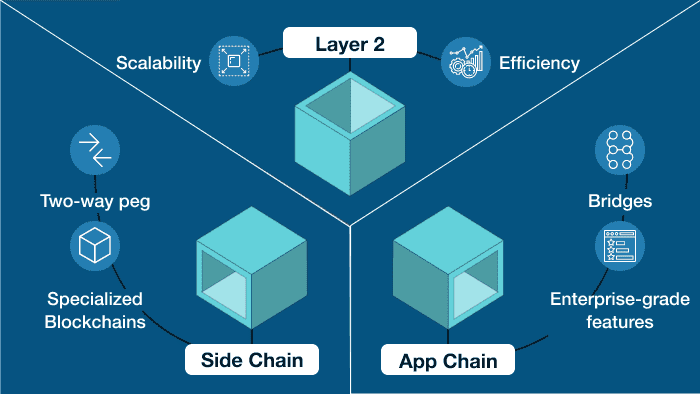

Layer 2 refers to networks built on top of base layer blockchains (Layer 1) like Ethereum and Bitcoin to enhance speed and reduce costs. These networks offload transaction processing from the main chain and summarize data back to Layer 1 for security, significantly increasing throughput (often thousands of transactions per second) while lowering fees. Popular Layer 2 solutions include optimistic and zero-knowledge rollups, state channels, and sidechains.

Layer 2 networks are vital in 2026’s crypto landscape, enabling fast, low-cost decentralized applications (dApps) that would otherwise be expensive on Layer 1. They support DeFi protocols, NFT marketplaces, and blockchain gaming with near-instant transactions while inheriting Layer 1 security. For example, Ethereum’s rollups can handle over 4,000 transactions per second compared to just 15 on Layer 1. Even Bitcoin is seeing Layer 2 projects enhance its capabilities.

Polygon Layer Architecture (source)

How We Selected These Top Layer-2 Tokens

In identifying ten prominent Layer 2 tokens for 2026, we used criteria such as:

-

Market capitalization and liquidity: Focusing on tokens with high market caps and trading volumes indicates user interest.

-

Development activity and longevity: Projects with active teams and regular upgrades demonstrate tech maturity.

-

Ecosystem traction: We considered networks with significant adoption, measured by total value locked (TVL) and user base.

-

Relevance to Layer 2 use case: Selected tokens must directly power Layer 2 networks or solutions.

This list is not exhaustive or an endorsement; it aims to highlight some of the best-known Layer 2 tokens based on these criteria.

Top 10 Layer 2 Tokens in 2026

Below we profile ten notable Layer 2 tokens. Each of these projects contributes to scaling blockchain technology, but they vary in design – from Ethereum rollups (optimistic or ZK) to Bitcoin layers and specialized networks.

1. Mantle (MNT)

Mantle Network is an Ethereum Layer 2 ecosystem that launched in 2023 with an ambitious modular design. Backed by the BitDAO community, Mantle is notable as the first DAO-governed Layer 2 – its development and treasury are overseen by token holders. Mantle’s core mission is to scale Ethereum while remaining EVM-compatible for easy dApp deployment. Its architecture separates execution, data availability, and finality into different layers for flexibility and upgrades.

Mantle is an optimistic rollup at heart, using Ethereum as the base layer for security. It batches transactions off-chain and periodically submits proofs back to Ethereum. Uniquely, Mantle introduced a modular data availability solution in partnership with EigenLayer in its early design (though it continues to evolve). By unbundling components, Mantle aims to adopt the latest innovations in each area (execution engine, DA layer, etc.) without overhauling the entire network.

2. Polygon (POL) – formerly MATIC

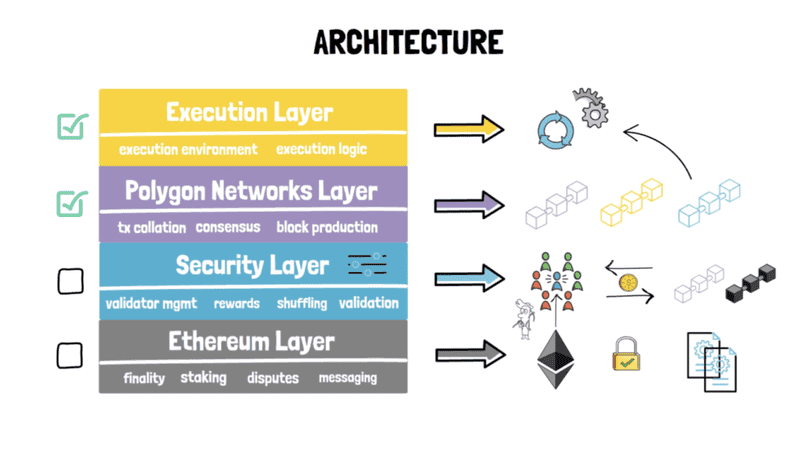

Polygon has been a leading name in Ethereum scaling since 2021, known originally for its Polygon PoS sidechain (often called Matic network). By 2026, Polygon has evolved into a multi-solution ecosystem including Polygon PoS and several Layer 2 rollups. In 2023, the project announced a major token upgrade from MATIC to POL, aiming to make POL a unified token for all Polygon chains. Polygon’s mission is to provide an “Internet of Blockchains” for Ethereum – a suite of scaling solutions from sidechains to zero-knowledge rollups, all connected via the Polygon ecosystem.

Polygon’s PoS chain was sometimes debated as “L2 or sidechain” (it has its own validators and checkpointing to Ethereum). However, Polygon has firmly entered the Layer 2 arena with technologies like Polygon zkEVM (a ZK-rollup launched in 2023) and Polygon Miden (another ZK-based rollup in development). These rollups submit proofs to Ethereum, inheriting L1 security. Polygon’s vision also includes “Polygon 2.0”, a future where POL secures multiple chains (possibly via shared staking or validity proofs) – effectively making every chain a layer-2 or partner chain with unified liquidity.

Polygon Layer Architecture (source)

Polygon Layer Architecture (source)

3. Arbitrum (ARB)

Arbitrum is a leading Ethereum Layer 2 network that uses optimistic rollup technology. Developed by Offchain Labs, Arbitrum went live with its mainnet in 2021 and quickly became one of the most popular L2s for Ethereum. It offers a developer-friendly platform that is EVM-compatible and significantly faster and cheaper than Ethereum L1. By January 2025, Arbitrum commanded over 50% of the Layer 2 market share in terms of total value locked, reflecting its strong adoption. The long-awaited ARB token was launched in March 2023 as part of Arbitrum’s move toward community governance.

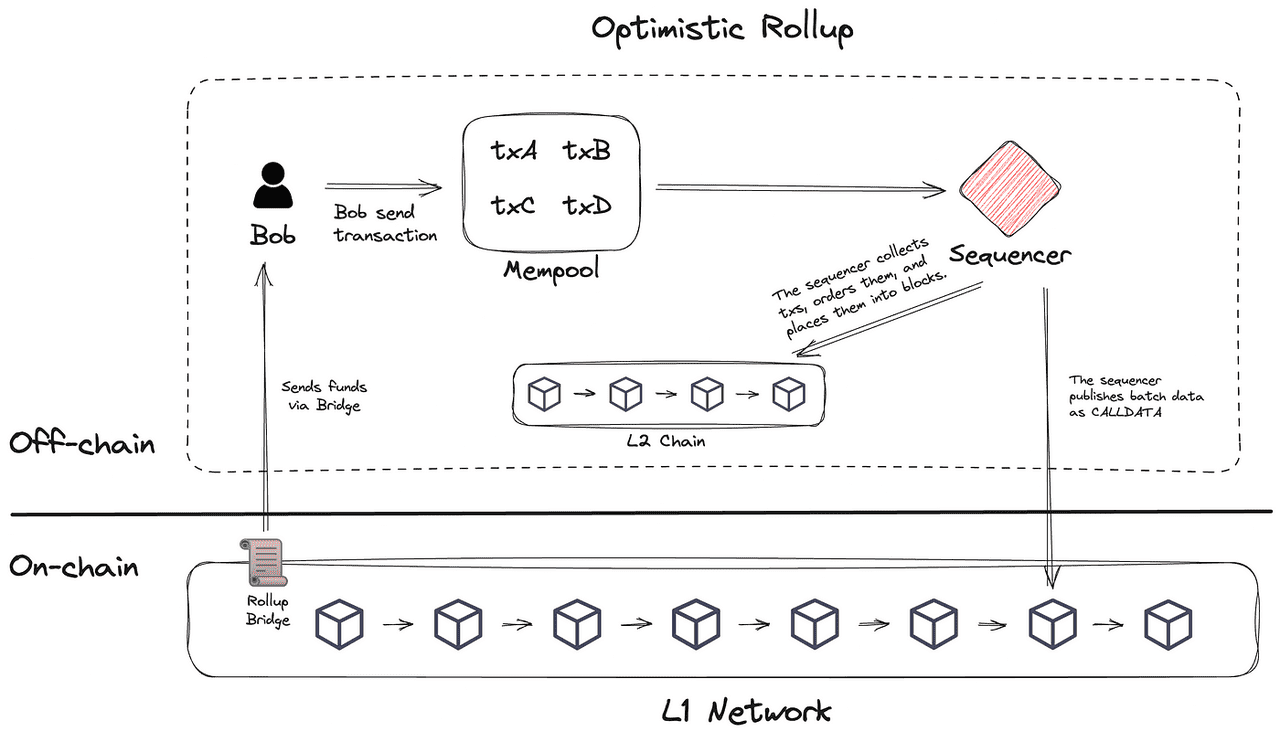

Arbitrum operates as an optimistic rollup: it batches transactions off-chain and posts a summary to Ethereum, assuming transactions are valid by default. In case of fraud, a challenge mechanism can roll back improper transactions (hence “optimistic”). Arbitrum’s rollup inherits security from Ethereum – all transaction data is ultimately posted on L1, and Ethereum would enforce any fraud proof. This gives Arbitrum users near-L1 security guarantees with much better performance. Arbitrum’s One chain was the flagship, and in 2022–2023 Offchain Labs also introduced Arbitrum Nitro (an upgrade improving throughput) and Arbitrum Nova (a separate chain optimized for ultra-low cost, using a data availability committee for social and gaming apps). Both chains use ARB for governance collectively.

4. Stacks (STX)

Stacks is a unique Layer 2 project in that it brings smart contracts and decentralized apps to Bitcoin. Launched in mainnet in 2021, Stacks operates as a Bitcoin Layer for smart contracts, extending Bitcoin’s functionality without altering Bitcoin itself. The Stacks blockchain runs in parallel to Bitcoin and uses Bitcoin as its final settlement layer. This enables the creation of smart contracts, NFTs, and DeFi applications that settle on Bitcoin. Stacks’ core idea is to leverage Bitcoin’s $500+ billion of capital and unparalleled security as a base layer, while offering more programmability on a secondary layer. The native token STX is central to Stacks’ consensus and smart contract execution.

Stacks is often categorized as a Layer 2 for Bitcoin (the project itself markets as the leading Bitcoin L2 for smart contracts). However, its architecture differs from typical Ethereum rollups. Stacks uses a unique consensus mechanism called Proof of Transfer (PoX), where Bitcoin miners participate in securing Stacks by transferring BTC in a sort of staking-like process. Every Stacks block is anchored to a Bitcoin block, which means all Stacks transactions are ultimately hashed and recorded in Bitcoin’s chain. In effect, Stacks creates a separate blockchain that settles to Bitcoin – Stacks blocks are finalized when their hashes are confirmed in Bitcoin blocks. This gives Stacks security tied to Bitcoin’s hashpower: an attacker would have to reorganize Bitcoin itself to undo Stacks transactions.

5. Optimism (OP)

Optimism is another major Ethereum Layer 2 network based on optimistic rollup technology. Launched to the public in 2021, Optimism was developed by the Optimism Foundation with a mission of scaling Ethereum while upholding the values of the Ethereum community. It is known for the concept of the “Optimistic Ethereum” stack. Optimism’s network is fast and low-cost, serving as a production L2 that many dApps have adopted. In mid-2022, Optimism introduced the OP token and a novel governance structure called the Optimism Collective, which includes a bicameral governance (Token House and Citizens’ House) to direct both technical upgrades and project incentives. By 2026, Optimism has positioned itself as a core infrastructure, and interestingly, its software (the OP Stack) is used by other chains as well – forming what they call the “Superchain” of interoperable L2s.

Optimism operates as an optimistic rollup on Ethereum, very much akin to Arbitrum in how it functions. Transactions are aggregated and executed off-chain (on Optimism’s execution layer), then periodically a batch is posted to Ethereum with the assumption of correctness. If something fraudulent is suspected, there’s a challenge window (typically 7 days) where a fraud proof can be submitted. Optimism inherits Ethereum’s security since ultimately Ethereum will validate any fraud proofs and settle disputes. Optimism’s philosophy has been “EVM-equivalence” – making its L2 closely match Ethereum’s L1 environment so that deploying contracts is straightforward.

6. Immutable X (IMX)

Immutable X is a Layer 2 network focused on the booming sector of blockchain gaming and NFTs. Launched in 2021, Immutable X utilizes ZK-rollup technology (specifically StarkWare’s STARK proofs) to achieve fast and zero-fee trading of NFTs on Ethereum. It was one of the first live implementations of a ZK-rollup for NFTs, allowing users to mint and trade in-game items or collectibles without worrying about Ethereum’s high gas costs. Immutable X has positioned itself as the go-to solution for game developers and marketplaces that need large throughput for NFTs.

The native token IMX powers this ecosystem, rewarding users and operators and enabling governance.

Immutable X is built as a ZK-rollup on Ethereum, meaning it batches transactions (like NFT mints, transfers, trades) and submits validity proofs to Ethereum to ensure everything was processed correctly. It leverages StarkWare’s technology (similar to StarkNet’s underpinnings) but is tailored for NFT use cases. By using a validity-proof system, Immutable X achieves instant finality – users don’t wait for a challenge period; transactions are finalized as soon as the ZK proof is accepted on L1. This is crucial for a smooth gaming experience (no one wants to wait to know if their in-game item purchase is confirmed). All the heavy lifting is done off-chain on Immutable’s engine, and periodically a proof compressing thousands of NFT actions is posted to Ethereum.

7. StarkNet (STRK)

StarkNet is a cutting-edge Layer 2 network for Ethereum that utilizes zero-knowledge proofs (STARKs) to achieve scalability. It is developed by StarkWare Industries, the pioneers of STARK-based scaling solutions. StarkNet launched its alpha on mainnet in late 2021, and by 2026 it has become a prominent platform for developers seeking high performance and L1-level security. Unlike some other L2s, StarkNet is a general-purpose ZK-rollup capable of supporting smart contracts. Its goal is to offer limitless scaling – potentially millions of transactions per second in the long run – without compromising on security or composability. The STRK token was introduced in 2024 to decentralize the network’s governance and future operations.

StarkNet operates as a validity rollup (ZK-rollup) on Ethereum. This means every bundle of transactions on StarkNet is accompanied by a cryptographic proof that attests to the correctness of the state changes. Ethereum verifies this proof, so unlike optimistic rollups, no challenge period is needed – transactions finalized on StarkNet can be considered final on Ethereum as soon as the proof is accepted. StarkNet uses STARK proofs, which are known for being fully transparent and highly scalable. It’s an independent L2 network where developers deploy contracts, and users can interact with those contracts with much lower gas fees than on L1.

8. ZKSync (ZK)

ZKSync is a prominent Layer 2 platform utilizing zero-knowledge proofs to scale Ethereum. Developed by Matter Labs, ZKSync has been through several iterations: ZKSync Lite (launched in 2020) for simple payments, and ZKSync Era (launched in 2023) as a full EVM-compatible ZK-rollup. By 2026, ZKSync has branded itself as the “Zero-Knowledge Elastic Network”, reflecting its vision of an interconnected ecosystem of ZK-rollups. ZKSync’s focus is on delivering fast, low-cost transactions with the security of Ethereum, and enabling developers to deploy smart contracts just like on Ethereum. The native token ZK (often just called “ZKSync token”) was launched in mid-2024, marking one of the largest token distribution events among L2s.

ZKSync Era is an EVM-compatible ZK-rollup. This means it uses validity proofs (specifically zkSNARKs in its current design) to prove to Ethereum that a batch of transactions is correct. With ZK-rollups, users enjoy near-instant finality – once the validity proof is accepted on Ethereum, all transactions in that batch are final. ZKSync aimed to overcome the complexity of ZK technology by making it feel like using Ethereum: developers can write contracts in Solidity/Vyper, and the rollup will handle proving in the background.

One of ZKSync’s differentiators is its early adoption of Account Abstraction – all accounts on ZKSync are smart contract accounts by default, which allows features like paying fees in any token (not just ETH) and more flexible wallet logic. ZKSync has also promoted the concept of Layer 3 deployments (they call it “HyperChains”) using their open-source ZK Stack, where anyone can launch their own chain that connects to ZKSync’s network, all settling back to Ethereum.

9. Merlin (MERL)

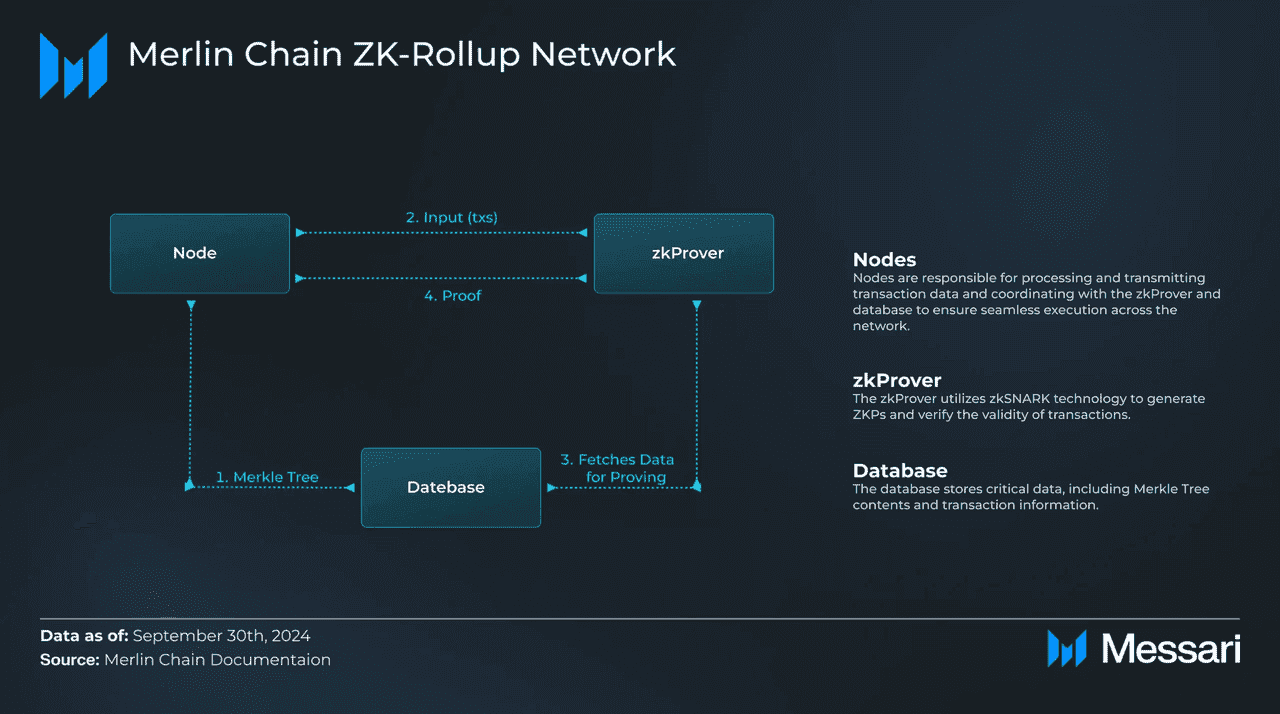

Merlin Chain is a Layer 2 solution in the Bitcoin ecosystem, aiming to bring Ethereum-like programmability and scalability to Bitcoin. Officially announced in early 2024, Merlin gained attention as a Bitcoin-native Layer 2 that incorporates advanced technologies like ZK-rollups and a decentralized oracle network. The idea is to unlock Bitcoin’s potential beyond simple payments, enabling DeFi, NFTs, and dApps that settle on the Bitcoin network. Merlin Chain is EVM-compatible, meaning developers can port Ethereum applications to work with Bitcoin liquidity via Merlin. The native token MERL was launched as a BRC-20 token (on Bitcoin’s ordinal-based token standard) and serves as the governance token for Merlin Chain.

Merlin is often described as a Bitcoin L2 or sidechain that uses a combination of zkRollup and optimistic techniques anchored to Bitcoin. It is technically a separate chain (somewhat like a sidechain) that relies on Bitcoin’s Layer 1 for finality and security. Merlin’s design includes EVM compatibility (so it can run smart contracts) and uses zero-knowledge proofs to roll up transactions. Transactions on Merlin are bundled and a STARK-proof (or possibly SNARK) is generated. However, since Bitcoin’s base layer doesn’t natively verify these proofs, Merlin uses an oracle network (Data Availability Committee) to post data to Bitcoin and attest to validity.

Merlin Chain ZK-rollup (source)

Merlin Chain ZK-rollup (source)

10. Zora (ZORA)

Zora Network is a Layer 2 blockchain tailored for the creator economy and NFTs, emerging from Zora – a popular NFT marketplace and protocol. In mid-2023, Zora launched its own L2 using the Optimism OP Stack, aiming to provide a home for on-chain creators with low fees and novel social features. The platform reimagines social media and content creation as on-chain activities: posts, art, music, etc., can be tokenized and traded. In April 2025, Zora introduced the ZORA token, marking its evolution from purely an NFT platform to a token-powered network.

Zora Network is essentially an Optimism-based Layer 2 – a custom instance of an optimistic rollup – designed for efficient NFT minting and trading and social actions. By building on the OP Stack, it inherits the security model of optimistic rollups (transactions are posted to Ethereum and can be challenged during a window). Zora’s integration with Base (Coinbase’s L2) and the wider OP Superchain means it’s interoperable with other OP-stack chains. For users, Zora L2 offers fast, cheap operations: e.g., creating an NFT post or “minting a meme” costs maybe pennies instead of tens of dollars on Ethereum. This enables new behaviors like casual creation and collecting that wouldn’t make sense with high fees. Zora specifically tailors the experience for creators – for instance, they launched features like “Creator Coins” where each social post becomes its own token (an ERC-20 that people can buy/sell, turning content virality into a market). All these actions occur on Zora’s Layer 2 and are settled to Ethereum for security.

Trends Shaping the Layer 2 Token Landscape in 2026

Several macro trends are influencing Layer 2 projects and their tokens in 2026:

-

Modular and Multi-Chain Architectures: A shift towards modularity is evident, with projects like Celestia enhancing data availability. Many L2s are exploring interconnected multi-chain ecosystems, allowing Layer 2 tokens to govern multiple networks and driving innovation through competition.

-

Regulatory Landscape and Clarity Efforts: As regulations catch up with the crypto sector, some L2 tokens have been classified as unregistered securities, prompting projects to engage proactively with regulators. Clearer guidelines are being sought, affecting how tokens are distributed and used, resulting in greater transparency for users.

-

DeFi, Gaming, and Social Adoption on L2s: L2s are experiencing significant growth in applications, with DeFi protocols and new dApps thriving due to low fees. Many popular crypto games and NFT activities now operate on L2s, increasing token visibility as users engage with these networks.

-

Interoperability and Bridging Improvements: Enhanced bridging protocols are enabling smoother asset transfers between L2s. Projects like Hop and LayerZero are facilitating these connections, which reduces fragmentation and promotes seamless cross-chain interactions.

-

Layer 2s and Ethereum’s Evolution: Ethereum is evolving to support L2s, with new features like Danksharding reducing costs for rollups and positioning Ethereum as a central settlement layer. This synergy suggests that the success of L2 tokens is tied to Ethereum’s broader adoption.

Overall, the Layer 2 landscape in 2026 is growing rapidly, with tokens becoming key components of the crypto ecosystem’s infrastructure.

Conclusion

Layer 2 solutions have transitioned from concept to reality, becoming the center of much of the crypto action by 2026. The variety of projects, from Arbitrum’s DeFi to Zora’s social media, highlights that “Layer 2” encompasses various technologies aimed at improving scalability. This diversity offers users alternatives, reducing reliance on congested or costly networks.

However, with opportunity comes responsibility. Each of the top 10 tokens features its own risk factors, and inclusion in this list does not imply endorsement. The crypto market is still young, and even prominent projects can falter. If engaging with Layer 2 ecosystems, prioritize security and stay informed, as the landscape evolves rapidly.

A reminder: This article is not financial advice and crypto investments are highly volatile. Always invest only what you can afford to lose, and consider consulting a knowledgeable financial advisor. Additionally, using crypto networks requires personal responsibility, as there is no support system for mistakes in decentralized spaces.

In summary, Layer 2 networks are enhancing blockchain accessibility and scalability. Whether you're a trader, developer, or user, navigate this landscape with curiosity and caution. Happy scaling, and stay safe!