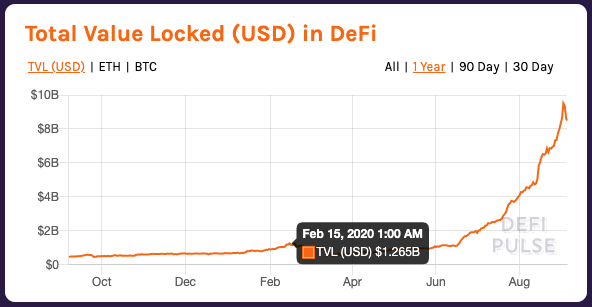

The current craze for all things DeFi is starting to become eerily reminiscent of the ICO boom in 2017 and early 2018. A year ago, there was less than $500 million locked in decentralized finance applications. Early in September, the total value locked spiked at over $9.5 billion, according to data on DeFi Pulse.

However, as you can see, this hasn’t been a gradual increase. In June this year, the DeFi bubble rapidly inflated when Compound launched its COMP governance token.

Since then, fueled by the hype, yield farming has become the phrase of the moment. One particular app that’s been garnering attention is yEarn Finance, which was providing yield farmers with returns of over 1,000% at one point. Its YFI governance token is now ranked in the top 30 cryptocurrencies and rose to over $30,000 in value at one point.

So, what does this craze mean for the price of ETH, and are the numbers really what they seem?

Question the Price of ETH

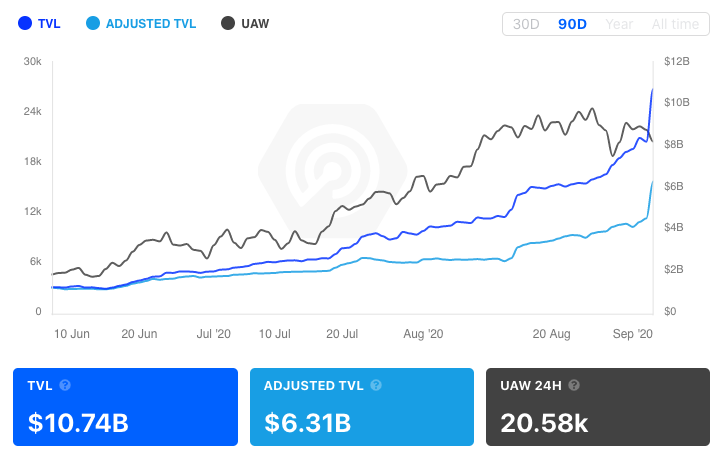

Digging deeper, there is good reason to question some of the numbers that are being thrown around. For example, the total value locked in DeFi is a direct function of the price of ETH. On the face of it, the total USD value locked in DeFi has increased six times since the beginning of June. However, the price of ETH has also doubled since then.

This hasn’t gone unnoticed. In a blog post in late August, dApp data aggregator DappRadar announced it was launching a new metric to track DeFi growth. Called “Adjusted Total Value Locked,” it takes the ETH price from 90 days ago as a more objective measure of DeFi expansion.

While the 90-day measurement is arguably somewhat arbitrary, it paints a less volatile growth picture than considering current ETH prices alone.

Is Restricted Supply Driving ETH Prices?

Is ETH’s bull market easily explained by DeFi’s popularity? The prospect of such significant returns is almost undoubtedly driving demand to some extent. Furthermore, locking ETH into DeFi creates a supply squeeze.

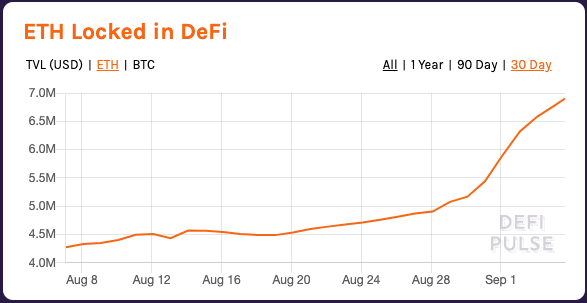

However, looking at the numbers, it’s questionable whether this supply squeeze is really a significant driver of ETH prices. According to DeFi Pulse, there are just short of 7 million ETH locked in DeFi. This amounts to around 6% of the total circulating supply.

Furthermore, over the week leading up to September 4, the number of ETH locked in DeFi rose sharply.

In the same week, the ETH price followed its well-trodden path of tracing the downward movement of BTC prices.

Therefore, it seems unlikely that a pure DeFi drive supply squeeze is directly responsible for ETH’s previous price increases.

This also makes sense if you consider that it’s probably very difficult to nail down the exact number of ETH locked in DeFi. By its very nature, yield farming involves sequential trades across multiple applications. For example, a user will lock their ETH into Maker to mint DAI, put that DAI down as collateral in Compound, and then put the cUSD they get in return into a liquidity pool on Curve Finance. Essentially, the same ETH is effectively recycled across multiple apps.

In light of this, it seems likely that even the pure number of ETH locked in DeFi is probably open to question, as it’s doubtful that any of the data aggregators are able to account for

What’s the Potential Impact on Proof of Stake?

Looking ahead, it’s intriguing to consider the impact that these insane DeFi yields will have on Ethereum’s upcoming move to Proof of Stake consensus. Currently, the estimated returns from becoming an ETH 2.0 staker are somewhere between 4-10%. Why would someone lock up 32 ETH in becoming a validator, if they can earn up to 1,000% for participating in DeFi?

Discover the difference between Proof of Stake and Proof of Work

Aside from the fact that becoming a validator is likely to be a far less risky proposition for investing 32 ETH, the spiraling gas fees on Ethereum are another factor at play here. The DeFi hype is pushing up transaction fees to new all-time highs.

Given that Ethereum’s scalability challenges won’t be solved until a later stage of the ETH 2.0 implementation, perhaps a year or more away, transaction fees aren’t likely to decrease any time soon, unless traffic drops off.

Therefore, the fees themselves may push up the returns for validating nodes beyond the original estimate of 10%, creating a more attractive proposition for would-be stakers.

how long the regulators will allow the DeFi bubble to keep inflating?

Finally, one huge question is how long the regulators will allow the DeFi bubble to keep inflating. If DeFi follows the same pattern as the ICO craze, it only takes a few negative rulings from the SEC to act as a giant pin that will pop the bubble for good. There’s already some speculation that this may happen.

However, for now, DeFi fans are making hay while the sun shines. With the 2.0 upgrade looming, and the price of ETH having hit new yearly highs, one thing is for sure – it’s a great time to be alive for Ethereum fans.

Check out our article on ETH 2.0 to learn the complete timeline of ETH 2.0

Read More

- Ethereum 2.0 – Everything You Need to Know

- What Is DeFi: How To Be Your Own Bank With $100

- Phemex Analysis in A Minute: How to Capitalize on ETH's Bull Run!

- What Is Ethereum: Ground Zero of the Next Digital Era

- https://phemex.com/academy/defi

- Phemex Analysis in A Minute: How to Trade Ethereum like a Pro Trader

- What is Defi 2.0 Protocol & How does it Work?

- July Crypto Market Analysis