Summary: Wrapped Bitcoin (WBTC)

- Wrapped Bitcoin is not Bitcoin “wrapped” up but an ERC20 token designed to track Bitcoin’s value 1:1 on the Ethereum blockchain.

- WBTC enables BTC holders to use DeFi lending/borrowing/trading apps and earn extra income without parting with their BTC.

- At the same time, WBTC increases overall liquidity in DeFi ecosystem; 279,506 Bitcoins locked up in WBTC so far at $11 billion market cap.

What Is WBTC Wrapped Crypto?

Contrary to what the name implies, Wrapped Bitcoin (WBTC) is not a Bitcoin “wrapped” in something else. WBTC is an Ethereum token designed on the ERC20 standard to track Bitcoin’s value on the Ethereum blockchain. In other words, WBTC is not actually Bitcoin, but a representation of it.

According to Etherscan, WBTC has a circulating supply of 279,506 tokens. At the prevailing value of $41,185.00, this translates into a market cap of $11.51 billion.

WBTC is a type of wrapped crypto token which is a token from one blockchain-backed, or “wrapped,” by another crypto or asset from a different blockchain/platform. Just as stablecoins like the USDC are tokens backed in a 1:1 ratio to the US Dollar, WBTC is backed by reserve assets of BTC at a 1:1 ratio. Very simply, this means that for every one WBTC issued there must be one BTC verifiably held in storage.

Like many other cryptos, WBTC can be bought from the Phemex exchange. If you hold BTC, you can also have it “wrapped” into WBTC (explained in greater detail further down in this post.)

But why would anyone buy WBTC if they can buy BTC?

Or, why trade a real Bitcoin for a Wrapped Bitcoin that is not actually a Bitcoin?

Wrapped Bitcoin: Why Was WBTC Created?

Many Bitcoin holders are HODLers who will not trade their BTC for their mother’s lives. Even though Bitcoin’s market dominance has dropped from nearly 70% in December 2020 to 41% at the time of writing according to data from Coinmarketcap, it is still the biggest and most valuable cryptocurrency in the world.

This means that a lot of value is just sitting there, doing nothing much.

At the same time, the DeFi space, which has seen rapid growth since 2020, needs liquidity to foster a more robust, stable, and efficient market, just like how cash liquidity is important for our current financial systems to work properly.

The obvious solution is to move some of that Bitcoin liquidity into the DeFi ecosystem.

The problem is that Bitcoin is not compatible with Ethereum’s blockchain, which is where many decentralized finance applications (DApps) are built.

Here is where WBTC comes in. Ethereum only supports tokens that use its ERC20 standard; WBTC, an ERC20 token, thus acts as a “wrapper” for BTC, allowing it to work where it usually would not, namely the Ethereum network.

As such, WBTC increases interoperability (i.e. the ability for cryptos to move from one blockchain to another) between these two powerhouse cryptocurrencies, effectively killing two birds with one stone.

First, it increases liquidity in the DeFi ecosystem as the value of BTC can now come into play on an Ethereum network. Secondly, BTC holders now have a way to use the dApps and earn additional income/rewards without giving up ownership of their BTC.

Now let’s look at some specific ways in which BTC holders can do this.

How To Use Wrapped Bitcoin (WBTC)?

Here are some of the most popular uses and corresponding dApps for Wrapped Bitcoin.

Lending: A BTC holder can convert or “wrap” his BTC into WBTC, and send it to Aave, a decentralized lending platform, in order to earn interest on his crypto assets. Similarly, Compound allows users to enjoy passive earnings by lending out their WBTC to other users in the network via yield farming pools.

Borrowing: At the same time, these users can also borrow cryptocurrency by converting their BTC into WBTC and putting it up as collateral in order to qualify for a loan on these very same platforms. Upon repayment of the loan, the WBTC collateral is returned and the user can convert it back into BTC.

DEX Trading: BTC holders who want to engage in token trading on decentralized exchanges (DEXs) can convert their BTC into WBTC and bring it to DEXs such as KyberSwap and Loopring. This is because Bitcoin cannot be directly traded on DEXs as these DEXs run on the Ethereum blockchain; the majority of BTC trading volume takes place on centralized exchanges.

Cool, you say, but we know what you’re thinking again–“So who’s holding my real BTC and how can I be sure that I will get it back later on?”

Who Is Behind Wrapped Bitcoin (WBTC) Crypto?

To know who holds the real BTC when it is converted or “wrapped” into WBTC, we need to understand who is involved in the process, and how this process works.

Wrapped Bitcoin was launched in January 2019 by a consortium of crypto-related technology companies. These include Bitgo, Ren (formerly Republic Protocol), Kyber Network, and other leading DeFi players, totaling around 40 members presently.

These members each play different roles in the “wrapping”process as we will see below, which involves three parties i.e. the user, merchant and custodian.

So what does each party do?

How Does The WBTC Wrapping Process Work?

- A user who wants some WBTC first approaches a third-party merchant e.g. Kyber Network and Ren, who then verifies his identity through KYC/AML procedures.

- Upon successful verification, the user transfers his Bitcoin to the merchant.

- The merchant then initiates what is called a minting process with the custodian i.e. Bitgo, who accepts the BTC and mints the equivalent WBTC to the merchant.

- The merchant transfers the WBTC to the user.

Source: WBTC.Network

The BTC is held by the custodian until the user wishes to convert his WBTC back into BTC. A burning process is then undertaken by the merchant to redeem Bitcoin from the custodian for the WBTC tokens. The amount to be ‘burnt’ is deducted from the merchant’s WBTC balance (on-chain), the supply of WBTC is then reduced, and the BTC is returned to the user.

Clearly, this whole system will only work if there is utmost transparency.

According to the WBTC website, all WBTC smart contracts are audited by third-party audit firms. “The proof of reserve is on-chain, which shows the exact 1:1 between minted WBTC tokens and Bitcoin stored by the custodians,” it states. “When WBTC token holders redeem their tokens for BTC, the tokens are burned. This minting and burning of tokens is, in turn, tracked and verifiable on the blockchain.”

This verification and transparency of records on the blockchain aims to assure users that the WBTC they are holding is backed by actual BTC 1:1, meaning they can convert their WBTC back into BTC at any time.

To repeat, ordinary retail users also have the option to purchase WBTC directly off centralized exchanges such as Phemex just as they would any other coins, skipping the entire “wrapping” process above.

Source: WBTC.Network

While detractors argue that the centralization of Bitcoin custody in the hands of the custodian BitGo presents a third-party risk, the WBTC protocol is governed by a DAO comprising members who play the roles of merchants, custodians, and exchanges. Any critical changes must be approved by the DAO members, who each hold a key to the multi-signature wallet that secures the system.

WBTC vs BTC: How Does Wrapped Bitcoin Compare With Bitcoin?

Similarities: WBTC is similar to Bitcoin only in terms of value and price action since it is pegged 1:1 to Bitcoin.

Differences: Because WBTC runs on the Ethereum blockchain, it can unlock and bring the value of BTC to an entire ecosystem of dApps and smart contracts, while BTC is more of a stand-alone asset.

At the end of the day, however, there is no point in comparing the two, as both are completely different cryptocurrencies. It really depends on what your investing strategy is and how you want to leverage your crypto assets.

WBTC Price: Is Wrapped Bitcoin a Good Investment?

As Wrapped Bitcoin tracks the price of Bitcoin 1:1, the more meaningful form of outlook analysis is not to look at its price per se, but to see how much of Bitcoin’s value is locked up in it.

In June 2021, WBTC achieved a milestone of locking up 1% of Bitcoin’s circulating supply of nearly 18.73 million in the Ethereum network, equating to about $6.2 million worth of BTC.

This 1% has since increased to 1.47% barely a year later. According to BTConEthereum, there are now 279,506 Bitcoins locked up in WBTC, out of a circulating supply of 19.02 million Bitcoins.

This may not seem like a huge jump…until you consider that its market cap is now well over $11 billion, almost double what it was previously. This clearly shows a steadily growing demand for wrapped crypto as the DeFi space evolves.

Growth in total market cap for WBTC (Source: CoinMarketCap)

Within the wrapped crypto sector, WBTC is also a dominant player–its holdings of BTC represent 83% of the total 338,197 Bitcoins that have been tokenized across various protocols for use on Ethereum.

As a market leader in a sector with growing demand and a DAO-led governance structure, WBTC has indisputably grown in credibility and attractiveness as a digital asset.

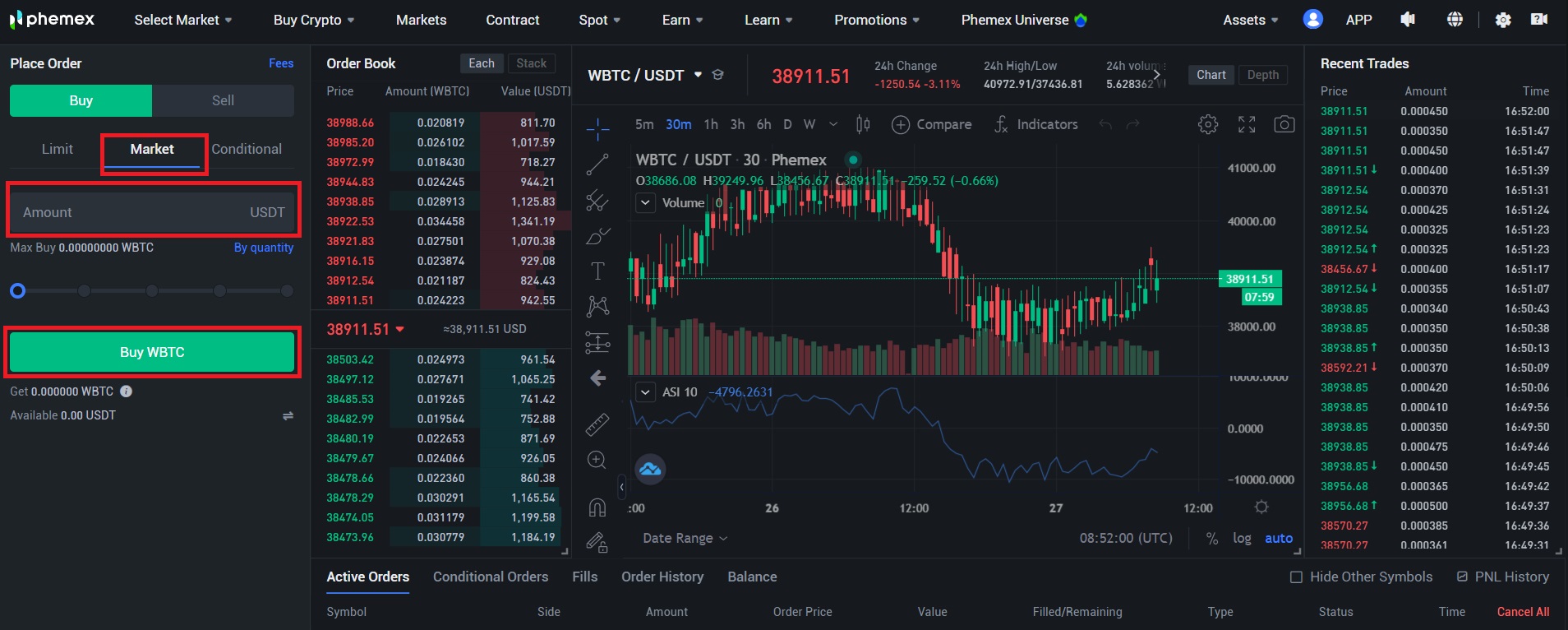

How To Buy WBTC on Phemex?

Phemex offers both spot and contract trading for investors to choose from. However, for beginning crypto buyers, spot trading is recommended. To buy WBTC on Phemex, follow the instructions below.

1 The first step to buying cryptocurrency on Phemex is to go to the Phemex homepage, register for an account, and select Markets.

2 On the Markets tab enter WBTC into the search bar on the top right, immediately after, the WBTC/USDT trading pair will appear below – select Trade to move on to the next step.

3 You will then be redirected to the Phemex trading platform for the WBTC/USDT pair. To do a simple spot trade we recommend doing a market order where you can buy WBTC at the market price. To do so, select Market, enter the amount of USDT you want to buy of WBTC, and click Buy WBTC.

Conclusion

Wrapped crypto tokens like WBTC offer a clear use case and a win-win solution to one of the crypto industry’s biggest issues–interoperability.

Bitcoin-only holders can use WBTC to benefit from DeFi functionalities such as lending and leveraged trading, and the DeFi space benefits from the increased liquidity locked up in BTC, thus boosting market stability and reducing transaction time while accelerating overall industry growth and innovation.

There are other tokenized Bitcoin projects in the making for sure, but WBTC has proved to be a steady frontrunner so far.

Read More

- Wrapped Tokens: Wrap Your Head Around These New Crypto Tokens

- What is WETH (Wrapped Ether): Expanding Use Cases for ETH Token

- What is Bitcoin: World’s Largest “Group Project”

- October BTC Market Analysis

- Why Does Bitcoin Have Value?

- What is a Bitcoin ETF?

- February 2021 BTC Market Analysis

- Bitcoin vs. Ethereum: Which is a Better Investment?