Summary

- HODL is a cryptocurrency investment strategy that means to hold on and do not sell. Traders that are HODLers generally hold on to their cryptocurrency assets and ignore short-term market fluctuations.

- There are two reasons why a trader wants to HODL: the first is they really believe in the asset or technology; and second, if they HODL long enough, then the gains from their initial investment and patience will pay off in the long run and they will realize a larger percentage gain than by day trading.

The HODLer History

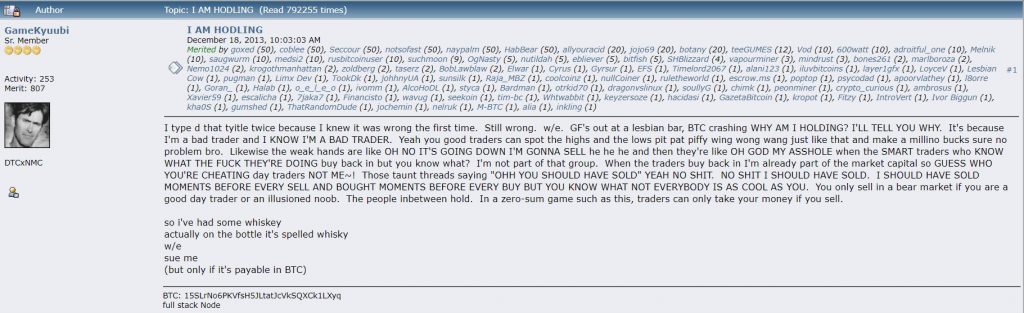

The term HODL, which means «hold on for dear life» became popular following a drunken rant on a Reddit Bitcoin forum in 2013. It came as a result of bearish news in the Bitcoin market when the Chinese government first banned Bitcoin for purchasing and selling goods or services.

Although GameKyuubi (the author of the term) misspelled the word «hold,» which is probably what he meant, the HODL typo soon caught on and became famous, and now it has become one of the most widely used crypto investing terms out there.

What Does HODL Mean?

If you’re new to cryptocurrency, have googled Bitcoin, or frequently look at Twitter, then you’ve probably read the phrase HODL, HODL Bitcoin, or HODL your crypto. Essentially, it means to «hold on and never sell» or «hold on for dear life.»

Interestingly, at the end of his post GameKyuubi made an eye-catching statement, which states his trading philosophy: “In a zero-sum game such as this, traders can only take your money if you sell.” This is the core concept behind HODLing, if you sell your investment and it increases in value while you’re out of the market, then you’re the one that loses.

How Do You HODL?

The main theory and motivation behind HOLD is to buy low and resist the temptation to sell (even as prices rise). This is how you do it: you buy, accumulate, and HODL.

Trading vs. HODL: Who Makes The Biggest Profit?

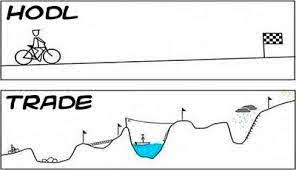

The crypto market crashes that happened in 2018 and 2020 are perfect case studies that support the HODL investing strategy. In December 2017, the price of Bitcoin reached $19,700, but by November 2018 Bitcoin fell to a low of $5,500. Then, from 2018 to middle 2020 the price of Bitcoin (more or less) stayed below $10,000, and rarely broke the $10,000 mark. However, by summer 2020 a bull market began and Bitcoin saw its price go from $10,000 in June to $60,000 by April 2021. It went parabolic, and as a result some day traders made money, but also many people lost out on the action (not the HODLers).

This is why HODL would have prevailed, which relates back to what GameKyuubi said in his post, «I’m a bad trader, and you good traders can spot the highs and the lows and make a million bucks.» Some people (mainly the professionals) are great at day trading and timing the market, but not everyone is a professional trader and not everyone can spend every minute analyzing the charts to find to perfect moment to execute their trades.

Therefore, a day trader would have spent all their energy timing the market and making trades on the technicals, but a HODLER, who bought the dip and accumulated throughout 2018-2020 would likely have profited more than the swing traders.

Why Should I HODL?

Cryptocurrency traders and investors should HODL because the crypto bull market is running, there is a lot of retail investor enthusiasm, we are seeing increased institutional adoption, and the economy is rapidly moving in the «digital» services direction.

Moreover, in a normal crypto trading environment, people make money by buying and selling coins as their prices fluctuate. However, it’s actually this trading activity that causes cryptocurrency markets to fluctuate, this is because they’re largely based on the forces of supply and demand. Increased demand pushes prices upwards while significant selling pressure drives prices lower. It’s a tricky game and quite challenging for traders to time their transactions exactly right so as to maximize their profits each time. However, as a HODLer, all you need to do is hold on and ignore all market fluctuations.

When Do I Stop HODLing?

The endgame varies for different people. Some say you should HODL until your coin is worth a sum that you’re happy with and then sell and take the profits. However, there’s always a chance that prices may continue to rise after you’ve sold and you may end up regretting your decision to not wait longer.

Others say HODL until your coin becomes a fully spendable currency and you won’t need to worry about having to sell it back anymore. Instead, you’ll be able to simply spend what you have as is. The risk here is that not all coins are created equal, and no one can guarantee the future of any crypto and its ability to become a full-fledged currency. This is especially true with all the new Central Bank Digital Currencies (CBDC) that many governments around the world are developing.

In the case of Bitcoin, if you’d purchased and HODLed your coins from the start, your profits would be unprecedented. Luckily, many believe that Bitcoin is still in its infancy and you may still be early if you start investing now.

HODL or…?

People are always asking the questions: how long should I HODL? Should I HODL or take the profit? What is better, HODL or day trading? Should I HODL or sell? Or should I HODL or stake?

1 HODL or Take Profits

If you’re deliberating whether to HODL or take profits you should ask yourself the question: Do I believe the price of this crypto will increase in the future? If your answer is yes, then your investing strategy should lean more towards HODLing.

2 HODL or Day Trade

If you’re deliberating whether to HODL or day trade you should ask yourself the questions: Am I a good day trader and am I good at timing the market? Also, is this a very volatile crypto? If your answer to the first question is no and your answer to the second question is yes, then you should HODL.

3 HODL or Sell

If you’re deliberating whether to HODL or sell you should ask yourself: Do I believe the price of this crypto will increase in the future? If the answer to the question is yes then you should HODL.

4 HODL or Stake

If you’re an investor thinking about HODLing or staking you can ask yourself: Do I want to earn interest on the asset I am HODLing? If the answer is yes then you can find a staking service where you deposit your coin of choice into a centralized exchange staking service or you can participate in more DeFi related staking services. But it’s important to note on the latter that participating in DeFi is more risky and more for the advanced crypto traders.

What Is The Best Coin To HODL?

When looking for what coins to invest in to HODL, traders and investors can first look at the specific cryptocurrency’s historical chart. Let’s look at Bitcoin’s historical data in the picture below.

For example, if you’re a prospective HODLer and you purchased Bitcoin in late 2017/early 2018 at a price of $19,700 and you HODLed until April 2021, and sold your investment at the peak of approximately $63,500, you would have earned a 222% increase on your initial investment. Even though traders don’t often sell their positions at the absolute peak (because they cannot predict it), HODLing over time generally will give you positive returns. Even if you bought in late 2017 at $19,000 and sold in early 2021 at $40,000, you would have had a 110% increase on your investment.

In conclusion, HODLing is an investment strategy that many wealthy investors, traders, and institutions employ in their own operations, and thus, it should also be a part of yours. Investing in cryptocurrencies is risky and is not for the faint hearted, however, it can give you a foot forward in achieving your greater investing goals.