Bitcoin vs. Bitcoin Cash is a debate that originated from a pivotal event in cryptocurrency history: the Bitcoin hard fork of August 2017. This split created Bitcoin Cash (BCH) as a separate cryptocurrency, distinct from Bitcoin (BTC), and it was born out of a long-standing dispute over how to scale the Bitcoin network. Even years later, the comparison between Bitcoin and Bitcoin Cash remains relevant, as it highlights different philosophies on blockchain design – “digital gold” vs. “peer-to-peer electronic cash.” For anyone involved in crypto, understanding the BTC vs. BCH story provides insight into how communities can diverge and how technical decisions impact factors like transaction fees, network security, and adoption.

At the heart of the split was a disagreement on how to handle Bitcoin’s growing usage. Bitcoin’s blockchain had a 1 MB block size limit (set by Satoshi Nakamoto and later maintained), which by 2016–2017 started causing network congestion and high fees during peak demand. One camp, which would become Bitcoin Cash supporters, argued that increasing the block size would allow more transactions per block, lowering fees and making Bitcoin usable as everyday money. The other camp (Bitcoin Core developers and many in the community) favored scaling off-chain via solutions like the Lightning Network and maintaining smaller blocks to keep it easy for anyone to run a full node (preserving decentralization). When compromise failed, a hard fork was initiated on August 1, 2017. Bitcoin Cash split off with a larger block size and a promise of cheap, fast transactions. Bitcoin, meanwhile, activated a protocol upgrade called Segregated Witness (SegWit) to slightly increase capacity and set the stage for layer-2 scaling. This historical schism still matters today because it influenced the development path of not only these two coins but the broader crypto ecosystem – it showcased how differing visions can lead to entirely separate networks, each with their own community and trajectory.

Origins of the Fork: The 2017 Block Size Debate

The Bitcoin vs. Bitcoin Cash split traces back to the scaling debates that raged in the Bitcoin community in the mid-2010s. Bitcoin’s design parameters (like the 1 MB per block limit, roughly 7 transactions per second throughput) worked fine in its early years, but as Bitcoin gained popularity, blocks began to fill up. By late 2016 and especially through 2017, users experienced backlogs (many transactions waiting in the mempool) and soaring transaction fees during busy periods. This raised a critical question: How should Bitcoin scale to accommodate more usage?

Two main factions emerged:

-

Big Blockers: This group advocated for increasing the block size limit on-chain. They argued that a simple protocol change to allow larger blocks (2 MB, 8 MB, or more) would immediately increase throughput and reduce transaction fees. Prominent voices included Roger Ver, a Bitcoin evangelist who would become one of Bitcoin Cash’s biggest proponents, and some China-based miners (like Jihan Wu of Bitmain) who were concerned that full blocks and high fees would suppress Bitcoin’s growth as a payment system. Big blockers believed Bitcoin should fulfill the vision in Satoshi’s whitepaper title – “a peer-to-peer electronic cash system” – meaning it should be usable for everyday transactions globally. They were willing to accept the trade-off that larger blocks might make running a node more resource-intensive (potentially reducing decentralization) in exchange for immediate on-chain scaling.

-

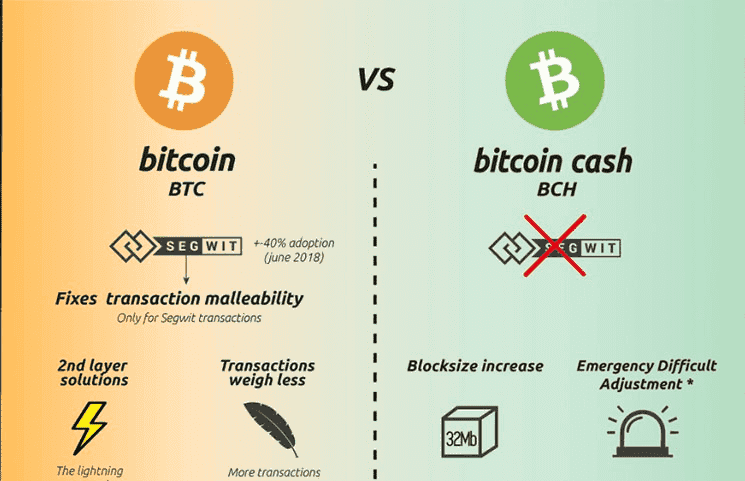

Small Blockers / Bitcoin Core: This group, including Bitcoin’s core development team and many others, prioritized decentralization and security over raw throughput. They pointed out that simply raising the block size could lead to an arms race where eventually only very powerful computers can run full nodes (because the blockchain would grow too quickly in size and bandwidth requirements), which could centralize control. Instead, they championed SegWit (a soft fork that effectively lifted the cap to about 4 MB of block “weight” and fixed transaction malleability) and Layer-2 solutions like the Lightning Network for scaling. They saw Bitcoin’s primary role evolving into a store of value (“digital gold”) and settlement network, where large-value transfers occur on-chain, and smaller transactions move to Lightning or other layers. This camp included folks like Adam Back, Andreas Antonopoulos, and many developers who had been steering Bitcoin’s roadmap.

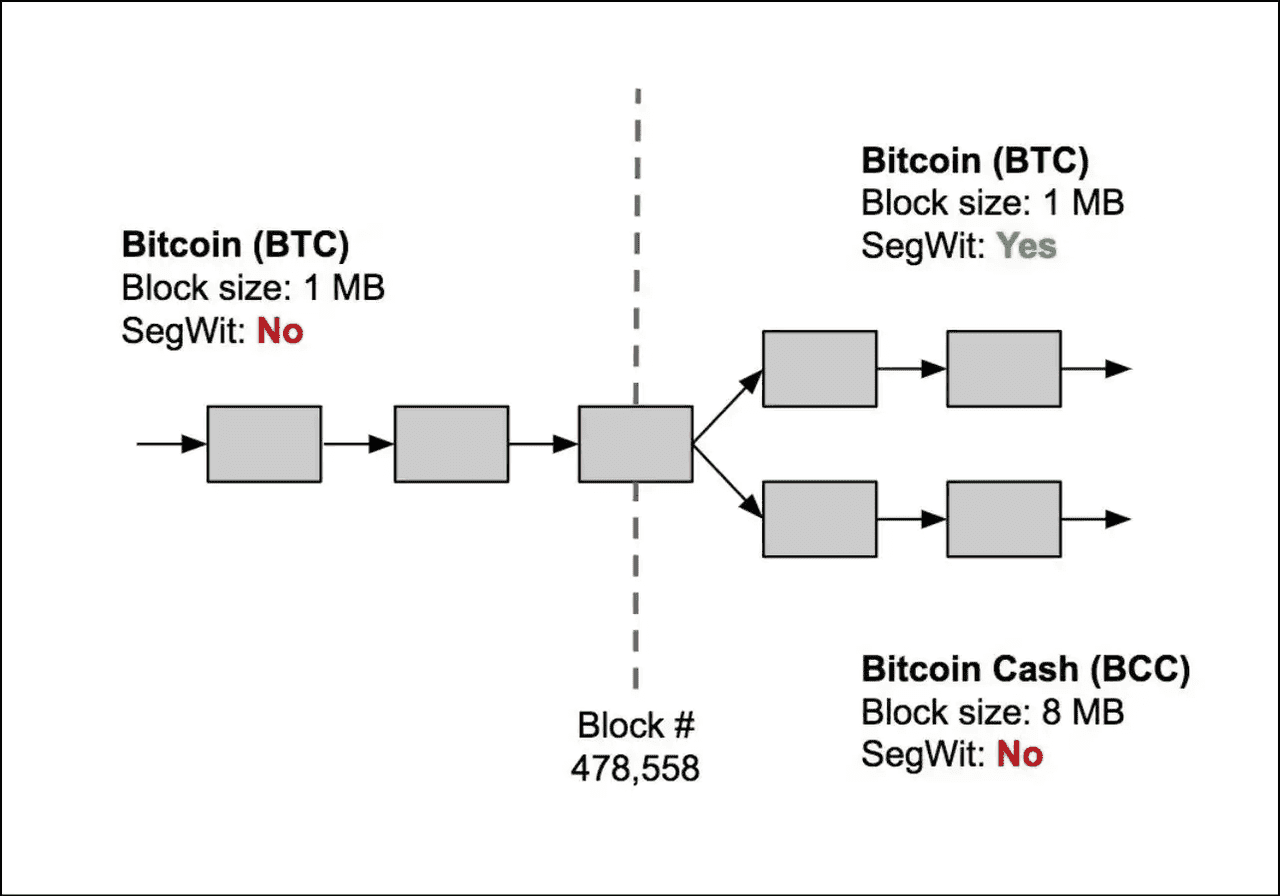

Tensions escalated through 2017. Various compromise proposals (like SegWit2x, which would have combined SegWit activation with a 2 MB block increase) were attempted, but the community could not fully agree. Eventually, those favoring bigger blocks took action. On August 1, 2017, at block height 478,559, a group of miners and developers initiated a hard fork, creating a new branch of the blockchain: Bitcoin Cash. Anyone holding BTC at that moment received an equal amount of BCH on the new chain. The split was characterized by a block size jump to 8 MB on Bitcoin Cash (and later to 32 MB), versus Bitcoin’s effective ~2 MB limit with SegWit (still often referred to as 1 MB base block size). This meant BCH immediately could handle far more transactions per second than BTC – in theory up to around 50–100 TPS at 8 MB, and even more at 32 MB (several hundred TPS) compared to Bitcoin’s ~7 TPS.

It’s worth noting that the fork was not just a technical split but an ideological one. The Bitcoin Cash community often emphasizes principles like “on-chain scaling” and keeping transaction fees very low to enable commerce (small retail payments, etc.), whereas the Bitcoin community emphasizes robust decentralization, security, and seeing Bitcoin as a new form of money that doesn’t necessarily need to handle every coffee purchase on the base layer. This philosophical divide has continued to define the two projects.

Bitcoin vs Bitcoin Cash Block Size (source)

Technical Differences Between Bitcoin and Bitcoin Cash

Despite sharing the same codebase initially (Bitcoin Cash started as a copy of Bitcoin’s software with modifications), Bitcoin and Bitcoin Cash have diverged in several key technical areas:

-

Block Size & Throughput: Bitcoin (BTC) retains a 1 MB block size (approximately 2–4 MB with SegWit), allowing for about 5–7 transactions per second on-chain. Bitcoin Cash (BCH) began with an 8 MB limit and now supports 32 MB per block, capable of processing over 100–200 transactions per second, though actual usage is much lower. While BCH’s larger blocks can hold more transactions, they require more bandwidth and storage, making it tougher to run nodes.

-

Hashing Algorithm & Mining Difficulty: Both BTC and BCH utilize the same proof-of-work algorithm. Bitcoin's network has a significantly higher hash rate, impacting security, with Bitcoin at around 900+ exahashes compared to BCH’s single-digit exahash range. BCH employs a new difficulty adjustment algorithm (ASERT) for quicker responses to changes in hashrate, keeping its block times around 10 minutes.

-

Development Communities & Governance: Bitcoin's development is led by the Bitcoin Core team, emphasizing conservative changes through Bitcoin Improvement Proposals (BIPs) and informal consensus. Meanwhile, Bitcoin Cash, initiated from Bitcoin ABC, follows a more centralized governance model with scheduled protocol upgrades (CHIPs) and has experienced internal splits, notably with the creation of BSV and eCash.

-

Smart Contracts and Features: BCH supports advanced features like CashTokens for native token creation and enhanced scripting, re-enabling certain opcodes. Bitcoin’s approach is more conservative, relying on external protocols for token support and smart contracts, favoring stability and slower changes.

In summary, Bitcoin Cash’s technical design maximizes on-chain capacity (large blocks, frequent upgrades, more opcodes) to prioritize cheap, fast transactions and additional features, at the potential cost of greater resource centralization and a smaller, less secure mining network. Bitcoin’s design prioritizes decentralization and security (small blocks, minimal changes, huge global hashrate) at the cost of higher on-chain fees and reliance on secondary layers for scaling. These technical differences have led the two networks to behave quite differently in terms of performance and usage.

Performance & Adoption: Transaction Fees, Speeds, and Usage in 2025

One of the key differences between Bitcoin (BTC) and Bitcoin Cash (BCH) lies in user experience, particularly regarding transaction fees and confirmation times.

Transaction Fees: Bitcoin fees are variable and can spike during high demand, with historical peaks around $40 in December 2017 and $20–$30 in April 2021. Even in 2023, fees reached $5–$10 due to increased transactions. In contrast, Bitcoin Cash maintains extremely low fees, typically around $0.001, making it ideal for small transactions. For instance, buying a coffee with BCH incurs minimal fees, whereas Bitcoin fees can sometimes exceed the cost of the item during busy times. However, Bitcoin’s Lightning Network allows for near-free instant transactions for smaller payments.

Confirmation Times: Both networks target ~10 minute block intervals. Bitcoin transactions with low fees may experience delays, while BCH reliably includes even low-fee transactions in the next block due to its ample capacity. BCH can handle high volumes, but if it were to reach full capacity, fees would likely rise. BCH also promotes “0-conf” transactions for small payments, which can be a risk on Bitcoin today.

Network Usage and Throughput: By 2025, Bitcoin's network sees significantly more transactions—around 300,000–400,000 per day—compared to Bitcoin Cash's 10,000–20,000. This indicates a much larger active user base for Bitcoin, with over 600,000 active addresses compared to around 100,000 for BCH.

In summary, Bitcoin is established as a widely-used investment asset with occasional high fees, while Bitcoin Cash offers low fees and fast transactions but has not seen the widespread adoption its proponents hoped for. Bitcoin is often seen as "sound money," while BCH is viewed as a "spending currency," though its usage for everyday transactions remains limited.

BTC vs. BCH Concepts (source)

Security & Decentralization

Security and decentralization are critical factors for any blockchain, and here Bitcoin and Bitcoin Cash differ greatly due to the disparity in network scale and design choices:

-

Hashrate and 51% Attack Risk: Bitcoin boasts a far higher hashrate than Bitcoin Cash, making it much more resistant to attacks. A 51% attack, where a miner gains majority control, is practically impossible for Bitcoin due to its immense hashpower, while Bitcoin Cash, with much lower hashpower, remains vulnerable. Although Bitcoin Cash has not experienced a successful 51% attack, its weaker security budget makes it easier to overwhelm compared to Bitcoin. The potential profit from attacking Bitcoin Cash is lower due to its lesser value.

-

Mining Decentralization: Mining pools for Bitcoin are more distributed, with none controlling over 25% of the network. In contrast, Bitcoin Cash has seen higher concentration levels, with certain pools occasionally controlling over 50% of BCH mining, creating a greater risk of centralization.

-

Node Decentralization: Bitcoin has thousands of full nodes (about 15,000-20,000), while Bitcoin Cash likely has only a few hundred to 1,000. This disparity results from community size and the technical challenges of running a full node, as Bitcoin’s blockchain is smaller and designed for easier node operation.

-

Double-Spend and Reorg Resistance: Due to its lower hashrate, Bitcoin Cash is generally considered less secure regarding transaction confirmations. Exchanges often require more confirmations (10+) for Bitcoin Cash deposits to ensure security, compared to Bitcoin’s 3-6 confirmations. Overall, Bitcoin is more secure and decentralized than Bitcoin Cash, leading to differing operational risks.

-

Smart Contract Security: Because Bitcoin Cash introduced new features like CashTokens and more flexible scripting, it also inherits some of the smart contract platform risks (bugs in contracts, etc., though it’s not as complex as Ethereum). Bitcoin’s approach is minimalist – by not changing or by slowly adding features like Taproot, it keeps the attack surface smaller. BCH’s additional opcodes or token features haven’t led to major security incidents so far, but it’s a vector to consider.

In summary, Bitcoin is far ahead in security and decentralization. Its massive hashpower and vast node network make it exceedingly resistant to attack and censorship. Bitcoin Cash, by virtue of its smaller size, has to accept a lower security margin. That doesn’t mean BCH is insecure for everyday use – it has operated since 2017 without major incident – but it does mean the confidence level in its immutability and attack-resistance is lower than Bitcoin’s.

Use Cases & Philosophy: Digital Gold vs. Digital Cash

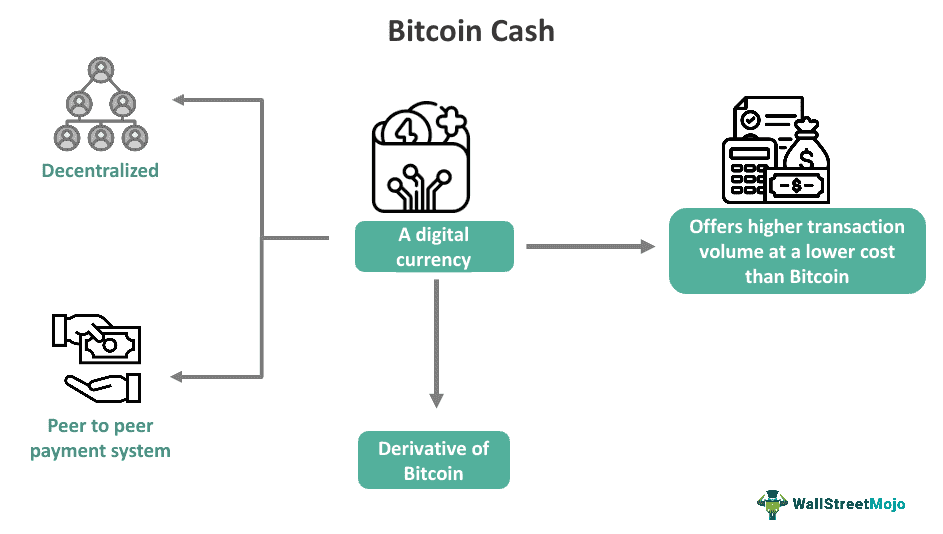

Bitcoin (BTC) and Bitcoin Cash (BCH) differ fundamentally in their goals and use cases.

Bitcoin (BTC) is often referred to as digital gold. It serves primarily as a store of value, with a capped supply of 21 million coins expected to appreciate over time due to scarcity and growing adoption. Its main function is as a decentralized, secure settlement layer for high-value transactions, emphasizing long-term value preservation. Smaller transactions utilize the Lightning Network or sidechains like Liquid and RSK, allowing low-fee, instant payments while keeping the main chain simple and secure.

Bitcoin Cash (BCH), on the other hand, aims to be a peer-to-peer electronic cash system. It focuses on facilitating everyday transactions with low fees and quick confirmations, aligning closely with Satoshi Nakamoto’s original vision. BCH promotes an on-chain approach, simplifying user experience without the need for channels, and incorporates features like smart contracts and CashTokens for added functionality.

While BCH has achieved low fees and decent confirmation speeds, its actual adoption as a cash system has been limited compared to BTC, which remains dominant in the crypto space. Users of BTC emphasize its security and ecosystem, while BCH supporters advocate for its original transaction-focused purpose.

Overall, Bitcoin's brand and network effects overshadow Bitcoin Cash, despite both having active communities with distinct philosophies.

Goal of Bitcoin Cash (source)

Future Outlook & Community Perspective

Looking ahead, both Bitcoin and Bitcoin Cash face their own set of opportunities and challenges:

Bitcoin’s Future Developments: The next Bitcoin halving is expected in 2028, reducing block rewards and emphasizing the need for a strong fee market to incentivize miners. While some skeptics doubt Bitcoin's long-term on-chain capacity to generate enough fees for security, high fees during peak activity periods suggest otherwise. Future upgrades will be incremental, focusing on Layer 2 solutions like the Lightning Network and potential improvements in user experience. Bitcoin's user base is likely to expand, especially if global trends favor hard assets, with increasing interest from institutional investors. Regulation will play a significant role in Bitcoin's adoption, but by 2025, clearer guidelines may enhance its legitimacy as an asset.

Bitcoin Cash’s Road Ahead: Bitcoin Cash is also evolving, having introduced CashTokens in 2023 and exploring potential scaling upgrades and privacy enhancements. Its primary challenge is reigniting adoption, particularly as it finds itself stable yet stagnant. For BCH to thrive, it needs significant real-world usage, possibly targeting demographics or regions where it can serve as a viable currency. Competing with numerous other low-fee cryptocurrencies and stablecoins for everyday transactions will be crucial.

If Bitcoin's transaction fees rise significantly, users may consider alternatives like BCH for cheaper transfers, although advancements in the Lightning Network could keep users within the Bitcoin ecosystem.

Community Relations: Historically, relations between BTC and BCH have been contentious, but hostility has lessened over time. While both communities retain differing views, it seems both chains will coexist as long as they have user support, with BCH likely remaining a niche player unless significant changes occur.

Conclusion

In conclusion, Bitcoin vs. Bitcoin Cash is a classic example of how differing visions can lead to very different outcomes. Bitcoin followed a conservative roadmap and solidified its status as a robust, highly-valued asset – sometimes at the expense of base-layer usability – while Bitcoin Cash took the road of aggressive on-chain scaling but struggled to gain corresponding network effect and value. The debate between “store of value vs. medium of exchange” in crypto is somewhat a false dichotomy (the best money ideally is both), but timing and strategy matter. Bitcoin chose store-of-value first, medium-of-exchange second (via layers), whereas Bitcoin Cash went for medium-of-exchange immediately, hoping value would follow. So far, Bitcoin’s approach has clearly won out in the market. That said, Bitcoin Cash continues to pursue the original “cash for the world” dream, and it remains an important case study in blockchain governance and trade-offs. Ultimately, which one is “better” depends on a user’s needs – but by 2025, it’s evident that Bitcoin and Bitcoin Cash serve different purposes within the crypto ecosystem, and they are no longer direct rivals in market share so much as distinct communities each marching forward with their interpretation of what Satoshi’s creation should be.