Bitcoin may often be thought of as a relatively new phenomenon, but its history stretches back to the late 2000s with roots even earlier. Since its launch in 2009, Bitcoin has gone from an obscure experiment to a global financial phenomenon. Understanding Bitcoin history - including its invention, major milestones, and evolution over the years – is key to appreciating how far this cryptocurrency has come.

Who Invented Bitcoin?

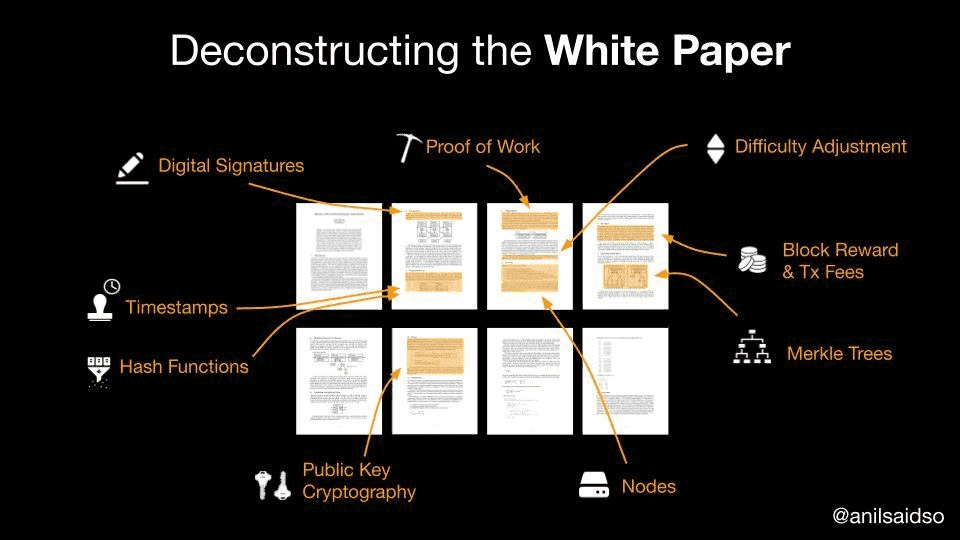

Bitcoin was invented in 2008 by a person (or group) using the pseudonym Satoshi Nakamoto. In October 2008, during the depths of a global financial crisis, Satoshi published the Bitcoin whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This nine-page paper outlined how to create a decentralized digital currency, describing a system where transactions could occur peer-to-peer without any bank or government in charge. To this day, the true identity of Satoshi Nakamoto remains a mystery – no one knows who Satoshi really is, whether it’s a single genius or a team of computer scientists. What we do know is that Satoshi’s creation drew on prior ideas and set in motion the entire cryptocurrency revolution.

Pre-Bitcoin Precursors: Bitcoin wasn’t an idea born in a vacuum. Earlier cryptographers and computer scientists had explored concepts for digital money. For example, in 1998, Wei Dai proposed “b-money,” an anonymous, distributed electronic cash system, and around the same time Nick Szabo worked on “bit gold,” a proposal for a digital currency that also never launched. These projects were never fully implemented, but they introduced key concepts like using cryptography to secure transactions. Satoshi Nakamoto’s breakthrough was to combine cryptography, game theory, and a blockchain (a public ledger maintained by a network of computers) to create a working decentralized currency.

Sections of Bitcoin Whitepaper

Early History of Bitcoin (2009–2012)

Launch of Bitcoin – 2009: Bitcoin's history began on January 3, 2009, when Satoshi Nakamoto mined the genesis block, Block 0, which contained a reward of 50 BTC bitcoins. Satoshi embedded a message referencing a newspaper headline about bank bailouts, highlighting concerns over traditional finance. On January 9, Satoshi released the first Bitcoin software, allowing public participation. In its early days, Bitcoin had no monetary value, used mainly by Satoshi and a few enthusiasts. Hal Finney received the first Bitcoin transaction on January 12, 2009, when Satoshi sent him 10 BTC.

Bitcoin in 2010 – Getting a Price: In 2010, Bitcoin gained its first market value. Laszlo Hanyecz made the famous "Bitcoin Pizza" purchase, trading 10,000 BTC for two pizzas, marking the first real-world transaction. By late 2010, Bitcoin's price rose to around $0.08, as interest grew.

2011 – Rise of Competitors and Media Attention: In 2011, Bitcoin reached parity with the US dollar and saw price fluctuations, peaking around $30 before a crash. This year also saw the emergence of altcoins, with Namecoin and Litecoin launching as competitors. Bitcoin gained media attention, although concerns arose about its use in illicit activities. By the end of 2011, Satoshi Nakamoto stepped back from public involvement.

2012 – Steady Growth and Community Building: In 2012, the Bitcoin Foundation was formed to promote development. More merchants began accepting Bitcoin, and by November, the first significant price increase occurred, leading to steady growth for the cryptocurrency.

Bitcoin’s Growth and Challenges (2013–2016)

2013 – Boom and Bust: If 2012 was a year of quiet growth, 2013 was the year Bitcoin truly entered the global stage. Bitcoin’s price skyrocketed from around $13 in January 2013 to over $1,000 in November 2013. This immense rally was driven by a surge of new buyers worldwide. People were excited by Bitcoin’s potential as “digital gold” or a revolutionary payment system, and media coverage of Bitcoin’s rapid rise spurred a frenzy of speculative investment. During this time, we saw increasing adoption: major websites like Reddit and WordPress started accepting Bitcoin for certain payments, and the first Bitcoin ATMs appeared (the world’s first Bitcoin ATM opened in late 2013 in Vancouver, Canada).

However, 2013’s exuberance was followed by a sharp crash. After peaking above $1,000 in late November, Bitcoin’s price plummeted and by early 2014 had fallen to around $200–$300. This volatile cycle (rapid run-up followed by a steep crash) would become a pattern seen again in Bitcoin’s history. The crash was exacerbated by regulatory news – for instance, China’s central bank announced in December 2013 that Chinese financial institutions could not handle Bitcoin transactions, casting uncertainty on crypto markets. Many early adopters learned that Bitcoin’s price could be extremely volatile, and new investors experienced their first major “crypto winter” as the excitement cooled off in 2014.

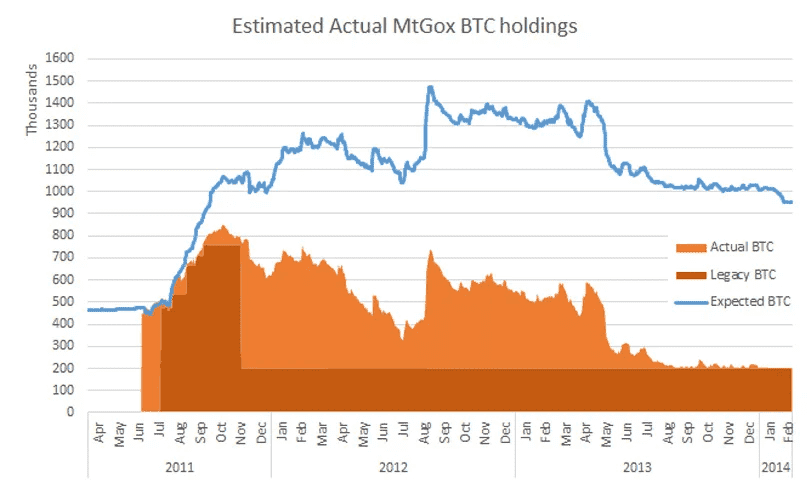

2014 – The Mt. Gox Hack and Other Setbacks: In early 2014, Bitcoin faced one of its biggest challenges to date: the collapse of Mt. Gox, which was the largest Bitcoin exchange at the time. In February 2014, Mt. Gox went offline and filed for bankruptcy amid reports that 850,000 BTC had been stolen – an amount that was worth about $450 million at that time. (By today’s values, that many bitcoins would be valued in the tens of billions of dollars.) The Mt. Gox disaster, stemming from alleged hacks and mismanagement, was a wakeup call about the risks in the young cryptocurrency industry. Thousands of users lost their bitcoins stored on the exchange, confidence was shaken, and Bitcoin’s price, which had already been sliding from its peak, took a further hit.

2014 also saw increased scrutiny of Bitcoin in connection with illicit activities. The Silk Road marketplace was shut down by the FBI in late 2013 and its operator arrested, demonstrating that authorities were watching Bitcoin-related sites more closely. Despite these setbacks, development and investment in the Bitcoin ecosystem continued. New exchanges and services stepped in to fill the void left by Mt. Gox, and entrepreneurs began building more robust infrastructure (such as more secure wallet services and exchanges with better practices). In 2014, companies like Microsoft even began to experiment with accepting Bitcoin for certain digital content, indicating that interest in cryptocurrency hadn’t disappeared.

Estimate MtGox BTC Holdings (source)

2015–2016 – Laying the Groundwork for Broader Adoption: After the tumult of 2013–2014, the next couple of years were more about steady progress and setting the stage for the future. By 2015, Bitcoin’s price stabilized in the mid-triple digits (between around $200 and $600 throughout the year). This period is sometimes seen as Bitcoin’s “adolescence,” when the hype had cooled, but important development work was ongoing behind the scenes.

In 2015, a significant event was the launch of Ethereum, a new blockchain platform that introduced smart contracts (self-executing code on the blockchain). Ethereum’s arrival in mid-2015 and the growth of its native currency Ether (ETH) showed that blockchain technology could be extended beyond Bitcoin’s use case. The emergence of Ethereum and other platforms sparked a wave of innovation and what would soon become the Initial Coin Offering (ICO) boom, as startups began raising funds by issuing new tokens on these blockchains.

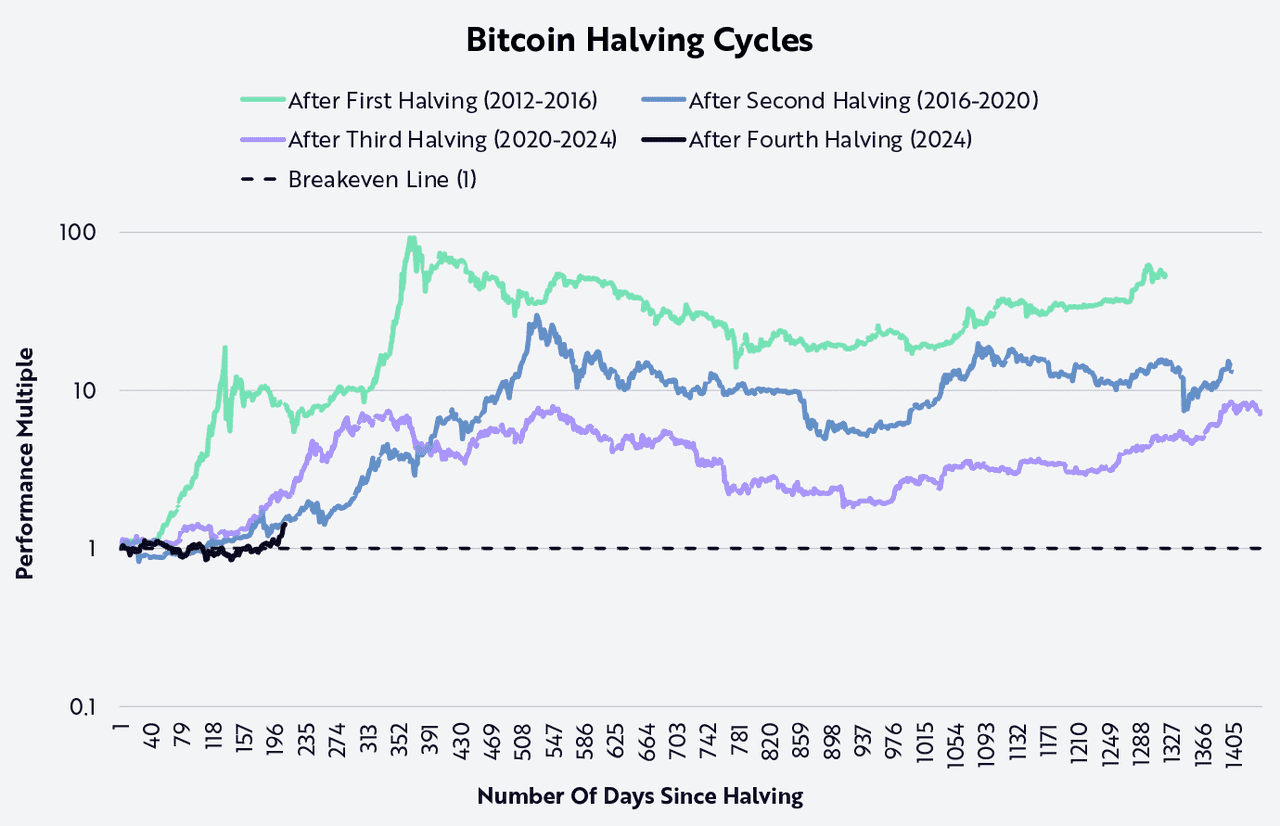

For Bitcoin itself, 2016 brought renewed optimism. In July 2016, Bitcoin experienced its second halving, reducing the block reward from 25 BTC to 12.5 BTC. By this time, awareness of Bitcoin’s halving cycles was greater, and many speculated that reducing the new supply would eventually help drive prices up (as had seemingly happened after the first halving). In the latter half of 2016, Bitcoin’s price began climbing again, breaking above $1,000 by the end of the year - the first time it had reached those levels since the 2013 boom.

Entering the Mainstream (2017–2021)

2017 – Bitcoin’s Big Bull Run: The year 2017 is remembered as a turning point when Bitcoin and cryptocurrencies at large hit mainstream consciousness. Bitcoin began 2017 trading around $1,000, and by the end of the year it had rocketed to nearly $20,000 per coin. This 20-fold increase in price within a year was driven by a perfect storm of factors: media hype, the ease of buying crypto increasing (with more exchanges and brokers serving retail customers), and a fear-of-missing-out (FOMO) among the public as they saw Bitcoin’s earlier investors reap huge gains. Throughout 2017, there was an explosion of new ICOs (startups issuing their own tokens, often on Ethereum), and thousands of new crypto projects appeared, riding on the hype. Bitcoin’s dominance (its share of the total crypto market value) actually dropped at times in 2017 as coins like Ether, Litecoin, and many others also surged in price.

During this period, Bitcoin also underwent some technical drama. There was a heated debate in the community about how to scale Bitcoin for more users, which led to a split in the blockchain. In August 2017, a group of developers and miners forked the Bitcoin network to create Bitcoin Cash (BCH), a separate cryptocurrency with larger block size intended to allow more transactions per block. This was one of the most prominent Bitcoin “forks,” and while it created a new coin, it did not detract from Bitcoin’s value.

Early 2018 – Crash After the Peak: Right after its peak in late 2017, Bitcoin’s price started a rapid decline. In the first quarter of 2018, the crypto bubble burst: Bitcoin fell from nearly $20k back to about $6k by February, and it would ultimately reach a low around $3,200 in December 2018. Many casual investors who bought in during the hype saw huge losses. The broader crypto market also crashed, and hundreds of smaller projects (especially those launched via ICO) lost most of their value or went bust. 2018 became a year of reckoning and consolidation. On the regulatory front, governments worldwide, which had been caught off-guard by the 2017 mania, began discussing tighter regulations for cryptocurrencies and ICOs to protect investors and prevent illegal use. Despite the price collapse, infrastructure kept improving: more companies built secure custody solutions for crypto, big names like the New York Stock Exchange and Fidelity Investments started ventures in the crypto space, and developers kept working on Bitcoin improvements (such as the Lightning Network, a “second layer” for faster, cheaper Bitcoin transactions that was in early testing stages around 2018).

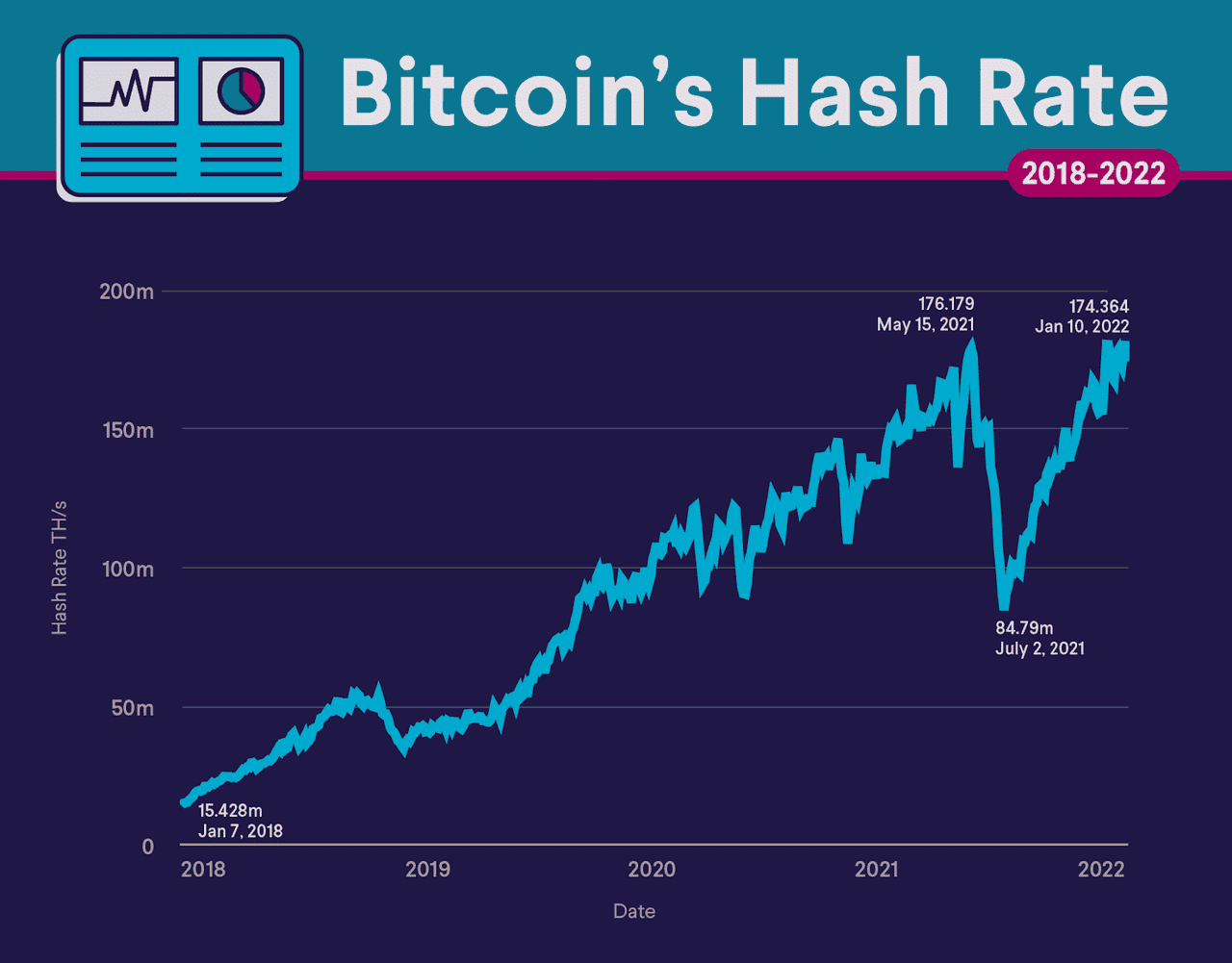

2019 – Signs of Recovery: In 2019, Bitcoin showed signs of recovering from the brutal 2018 bear market. The price gradually rose from the low $3,000s in early 2019 to about $10,000 by mid-year, before stabilizing. While it didn’t approach the previous all-time high, this rebound indicated renewed confidence. Part of the optimism came from increasing institutional interest. By 2019, several high-profile companies had publicly embraced Bitcoin or blockchain. Major corporations even explored launching their own digital currencies around that time, underscoring how far the concept had come. Additionally, Bitcoin’s fundamentals (such as the number of users and the computing power securing the network, called the hash rate) kept growing throughout the down-market – a sign that the ecosystem was strengthening despite price volatility.

Bitcoin Hash Rate (source)

2020–2021 – New Heights and Institutional Adoption: Bitcoin entered a new phase in 2020 and 2021, driven by the COVID-19 pandemic, which prompted economic uncertainty and vast government stimulus. Initially, Bitcoin's price plummeted from around $8,000 to about $3,800 in March 2020 amid a liquidity rush. However, interest surged later in the year as many viewed Bitcoin as a hedge against inflation.

A significant development in 2020 was the entry of institutional investors and corporations. MicroStrategy became one of the first public companies to invest in Bitcoin as a treasury reserve, accumulating over 100,000 BTC. Other major players, including Square and Tesla, followed suit, enhancing Bitcoin’s legitimacy. In May 2020, Bitcoin underwent its third halving, reducing rewards to 6.25 BTC, which highlighted its scarcity. By the end of 2020, Bitcoin's price exceeded its previous peak, reaching about $29,000, and it hit an all-time high of around $64,000 in April 2021, driven by institutional buying and mainstream awareness.

In September 2021, El Salvador became the first country to adopt Bitcoin as legal tender. However, the market faced challenges mid-2021, resulting in a price drop to around $30,000 due to issues like Elon Musk's concerns over energy use and China's crackdown on mining. This demonstrated Bitcoin’s resilience as miners relocated globally.

By late 2021, the market rebounded, with Bitcoin reaching a new record high of about $69,000 in November. The narrative shifted to viewing Bitcoin as “digital gold,” reflecting its growing status as a long-term store of value.

Market Cycles and Maturation (2022–2025)

2022 – A Difficult Year for Crypto: Following the highs of 2021, Bitcoin entered another bear market in 2022. Macroeconomic conditions turned challenging – with inflation surging, central banks (especially the U.S. Federal Reserve) raised interest rates sharply, which hurt speculative assets including tech stocks and crypto. In this environment, Bitcoin’s price steadily fell from about $47,000 at the start of 2022 to roughly $16,000 by the end of the year. Several events specific to the crypto industry also contributed to this decline. In mid-2022, the collapse of a major cryptocurrency project triggered a wider crisis among crypto companies, leading to several bankruptcies and heavy losses across the industry. Later that year, a large cryptocurrency exchange (FTX) imploded amid scandal, wiping out billions in customer funds and further eroding trust. While these events were not caused by any flaw in Bitcoin itself, they had a severe impact on market sentiment and prices, reminding investors that the crypto industry was still risky and loosely regulated.

Despite the price downturn and negative headlines, Bitcoin’s underlying network kept running reliably through 2022, and development continued. Notably, the Lightning Network grew in capacity, and more people continued to hold Bitcoin long-term even as speculators left the market. By the end of 2022, roughly 19 million of the eventual 21 million bitcoins had been mined, inching closer to the maximum supply.

2023 – Recovery and Building Momentum: In 2023, Bitcoin showed signs of recovery and resilience. Early in the year, even as some crypto-specific banks like Silvergate and Signature Bank failed or pulled back from the sector, Bitcoin’s price began climbing again. By mid-2023, Bitcoin was trading in the $30,000 range, roughly doubling from its cycle low. Several developments helped restore optimism. For one, mainstream financial institutions signaled renewed interest. In mid-2023, the world’s largest asset manager, BlackRock, filed an application to launch a spot Bitcoin ETF in the U.S., which many saw as a vote of confidence in Bitcoin’s future. This spurred a wave of similar filings from other institutions. While U.S. regulators had not yet approved a spot Bitcoin ETF as of 2023, the likelihood appeared to be increasing, suggesting that more traditional investors could soon get exposure to Bitcoin via familiar investment vehicles.

On the technological front, a new trend emerged on Bitcoin: the introduction of Ordinals (often described as Bitcoin NFTs) in 2023, which allowed data like images or text to be inscribed on the Bitcoin blockchain. This was an unexpected new use case for Bitcoin that briefly drove up on-chain activity and fees. It highlighted that even after 14 years, the Bitcoin network could see novel forms of usage. Throughout 2023, the narrative that Bitcoin is a long-term store of value solidified further, sometimes contrasted with the troubles faced by newer crypto projects. By late 2023, the stage was set for Bitcoin’s next chapter, with many analysts pointing to the upcoming halving in 2024 as a potential catalyst.

Bitcoin Halving Cycles (source)

2024 and Beyond – Continued Evolution: In April 2024, Bitcoin underwent its fourth halving, reducing the block reward to 3.125 BTC. As with previous halving events, this highlighted Bitcoin’s decreasing new supply and was widely anticipated by the community. Historically, Bitcoin’s biggest bull runs occurred after halving events, and many enthusiasts believed 2024–2025 could follow that pattern. Indeed, by mid-2024, Bitcoin was gaining more positive mainstream coverage again – some reports noted that the Bitcoin network had processed over 1 billion transactions since its inception, a testament to its growing usage over time. There were also talks in multiple countries about integrating Bitcoin or other cryptocurrencies into their economies, either through regulation or, as in El Salvador’s case, adoption as legal tender.

By August 2025, Bitcoin’s history was over 16 years in the making. From that first block in 2009, the blockchain had recorded nearly one million blocks and Bitcoin had reached millions of users worldwide. The price and market cycles of Bitcoin continue to be volatile, but each cycle generally sees higher lows and greater adoption than the last. Bitcoin’s resilience through multiple boom-and-bust cycles has only strengthened the community of users and developers that support it. More than ever, Bitcoin has transitioned from a niche cypherpunk experiment into a recognized asset class, often compared to gold as a hedge or store of value.

Looking Forward: Bitcoin’s history is still being written. The significant bitcoin milestones over the years – from who invented Bitcoin to its legal adoption in nations – provide valuable insight into its trajectory. There will likely be further challenges ahead (such as navigating regulations, improving scalability, and maintaining security), but understanding its past gives context for its future. Having evolved from its humble genesis block into a global phenomenon, Bitcoin now stands as a pioneering technology that continues to influence the future of money and decentralized trust.