What is Bitcoin Hash Rate?

Bitcoin hash rate refers to the total computational power that miners are using to secure the Bitcoin blockchain at any given moment. In simpler terms, it's a measure of how many guesses (hash computations) the entire Bitcoin network can perform each second in the race to solve a new block. Bitcoin mining is essentially a competition among specialized computers (miners) to solve a complex mathematical puzzle. Each hash is like a lottery ticket: the more hashes per second (H/s) the network performs, the greater the chance that some miner finds the winning solution for the next block of transactions. The hash rate is typically measured in exahashes per second (EH/s) or even zettahashes as it grows (1 EH/s is one quintillion hashes per second). A higher hash rate means more total mining power is being devoted to Bitcoin.

Why does this matter? A high hash rate indicates that many miners (or very powerful miners) are actively participating. This makes the network more secure because any malicious attacker would need to control at least 51% of that enormous computational power to have a chance at overtaking the honest miners. For perspective, as the network grows, the likelihood of a single entity controlling 51% becomes astronomically small, which is why Bitcoin's record-high hash rate in 2025 is a very positive sign for its security.

Why Is Hash Rate Important for Bitcoin?

Hash Rate, Mining Difficulty, and Bitcoin Halving

There is a strong interplay between hash rate, difficulty, and mining rewards. As miners add more hash power, difficulty rises; if miners shut off machines (for example, due to low profitability), difficulty will fall to compensate. Miners are competing for the reward Bitcoin gives for each new block mined. Currently (post-2024 halving) the block reward is 3.125 BTC plus any transaction fees. Approximately every four years, a Bitcoin halving event cuts this block reward in half. The most recent halving occurred in April 2024, reducing the reward from 6.25 BTC to 3.125 BTC per block.

How do these factors tie together? When a halving cuts the block reward, miners suddenly earn fewer bitcoins for the same work. If Bitcoin’s price does not rise enough to offset this, some miners with higher costs might turn off their machines, causing a temporary hash rate drop. Indeed, right after the 2024 halving, there was some miner turnover. But historically, Bitcoin’s price tends to increase after halvings (due to the reduction in new supply), which can make mining profitable again and incentivize more miners to join, ultimately pushing the hash rate higher in the long run. By 2025, we see this dynamic playing out: despite the halved rewards, Bitcoin’s price increase has made mining lucrative, and hash rate has climbed to new heights as miners deploy more machines.

It’s a balancing act: Mining difficulty adjusts to the hash rate to keep block times stable. If hash rate plummeted (say many miners quit at once), difficulty would decrease on the next adjustment, making it easier to mine blocks and restoring equilibrium. Conversely, if hash power surges, difficulty rises to avoid blocks being found too quickly. This feedback loop, along with periodic halvings, defines the economics of Bitcoin mining. Miners invest in faster, energy-efficient hardware to gain an edge, increasing hash rate; Bitcoin then boosts difficulty, and the cycle continues.

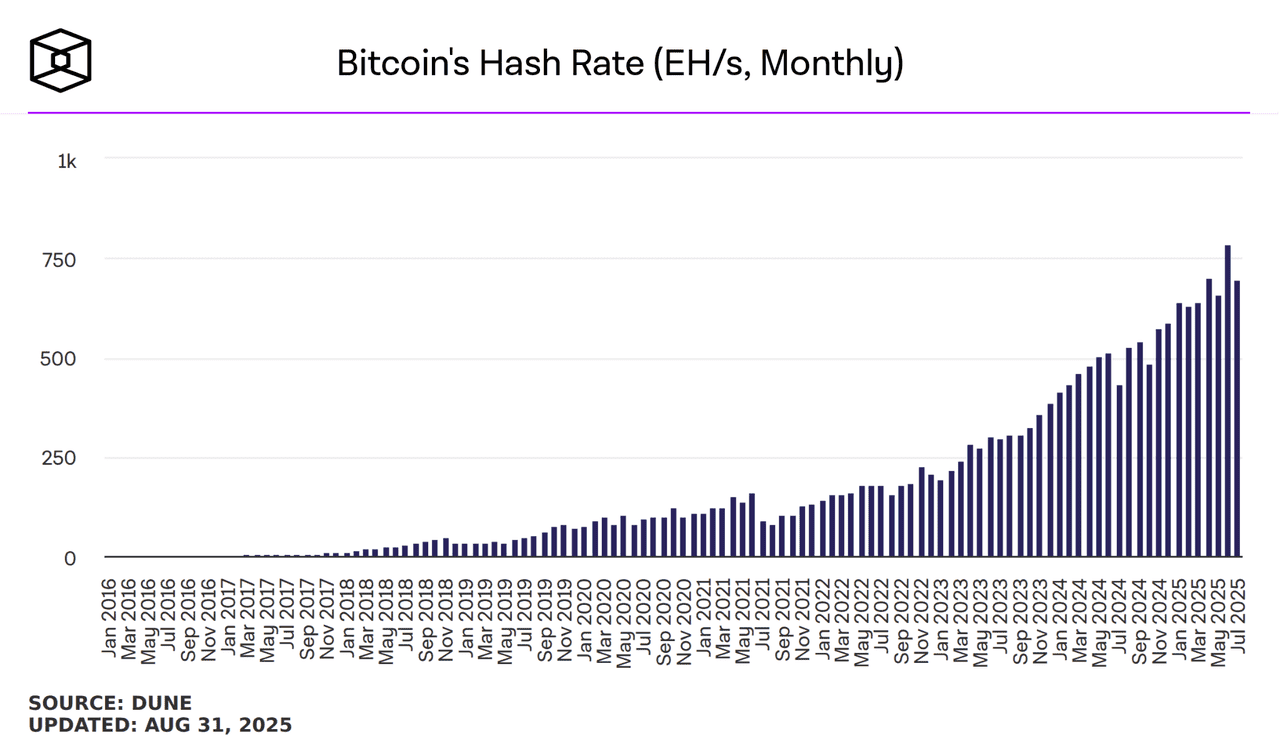

Bitcoin Hash Rate (source)

Recent Hash Rate Trends and Record Highs (2023–2025)

Bitcoin’s network hash rate has been on a remarkable rise over the past couple of years, repeatedly breaking records. In 2023, despite a bear market in crypto prices, the hash rate kept climbing as miners deployed next-generation machines. By early 2024, global hash power had recovered from any post-halving dip and started to soar. This trend accelerated through 2024 and into 2025.

By mid-2025, the Bitcoin hash rate reached unparalleled levels. In August 2025, industry trackers noted the network hitting around 955 exahashes per second (EH/s) – that’s 955 quintillion hashes every second, an all-time high for Bitcoin. To put that in perspective, the network was below 200 EH/s just a few years prior. This roughly five-fold increase in mining power underscores how much investment and confidence has poured into Bitcoin mining. In fact, in the first two weeks of August 2025 alone, the network’s hash rate jumped about 4% to an average of ~937 EH/s, according to a JPMorgan report. Some estimates even briefly showed the network above 1 zettahash per second on certain days (a zettahash is 1,000 EH/s), an almost unfathomable level of computation.

Several factors drove this hash rate growth. One is the deployment of more efficient mining rigs. Companies released miners with improved chips (smaller nanometer designs and better energy efficiency), allowing miners to generate more hashes for the same electricity. Large-scale mining farms expanded, especially in regions with cheap energy. There’s also been an influx of capital – many mining firms went public or raised funds to buy hardware throughout 2023-2024, anticipating Bitcoin’s price recovery. By 2025, those machines are fully online, contributing to the climbing hash rate.

Another interesting trend is the increasing share of hash rate coming from publicly-listed mining companies, especially in North America. By August 2025, the combined hash power of 13 major publicly traded miners accounted for 33.6% of the global Bitcoin network hash rate – the highest level on record. This suggests that large, professional mining operations (with better access to capital and technology) are capturing a significant chunk of the network. For example, U.S.-based mining firms like Marathon Digital, Riot Platforms, and others have been steadily expanding capacity. While this professionalization brings more stability and transparency to mining, the flip side is a concentration of mining power among fewer, big players. Fortunately, even the largest of these control only single-digit percentages of the network, so power is still fairly distributed compared to the total 955 EH/s.

Global Mining Power and Distribution in 2025

Bitcoin mining is a global enterprise, and the geographic distribution of hash rate has shifted over the years. In 2021, China famously banned Bitcoin mining, which at the time caused a huge drop in hash rate (as China contributed over half of the global mining power before the ban). That void was quickly filled as miners relocated to other countries. The United States emerged as the new mining leader, and by 2022 it accounted for roughly 37% of the world’s hash rate. This trend continued into 2023 and 2024. As of 2023, estimates suggested the U.S. was responsible for about 40% of global Bitcoin mining, solidifying its position at the top. States like Texas, Kentucky, and Wyoming became mining hotspots, thanks to relatively favorable regulations, abundant land for data centers, and access to cheap energy (often natural gas, wind, or solar).

What about the rest of the world? Interestingly, even after the ban, China still contributes a significant share of hash rate through operations that went underground or moved to neighboring countries. Researchers believe that around 20% or more of Bitcoin’s hash rate in 2022-2023 was effectively coming from China (despite the ban) through covert mining facilities. Other notable players include Kazakhstan, which had around 13% of global hash rate in 2022, leveraging its coal energy resources (though Kazakhstan has since tried to regulate and tax mining more). Russia and Canada each hold notable portions too (Canada around 6-7% in 2022, and Russia possibly similar, though exact figures vary).

In 2024 and 2025, mining has further diversified. We’ve seen growth in places like Latin America (for example, Paraguay and Argentina with cheap hydro or gas power, and El Salvador which embraced Bitcoin mining using geothermal energy), and continued operations in parts of Asia (Malaysia, Kazakhstan, Russia). There’s also interest in the Middle East: countries like Oman and UAE have started investing in mining projects, capitalizing on energy resources.

The global distribution of hash rate is important for decentralization. Ideally, mining is spread across many countries so that no single government can easily control a majority of miners. The post-2021 landscape is healthier in this regard – mining power is less concentrated in one country than it was during the China-dominated era. The U.S. leading with ~40% is significant but still means 60% is elsewhere around the globe. Additionally, within the U.S., mining operations are dispersed across multiple states and companies.

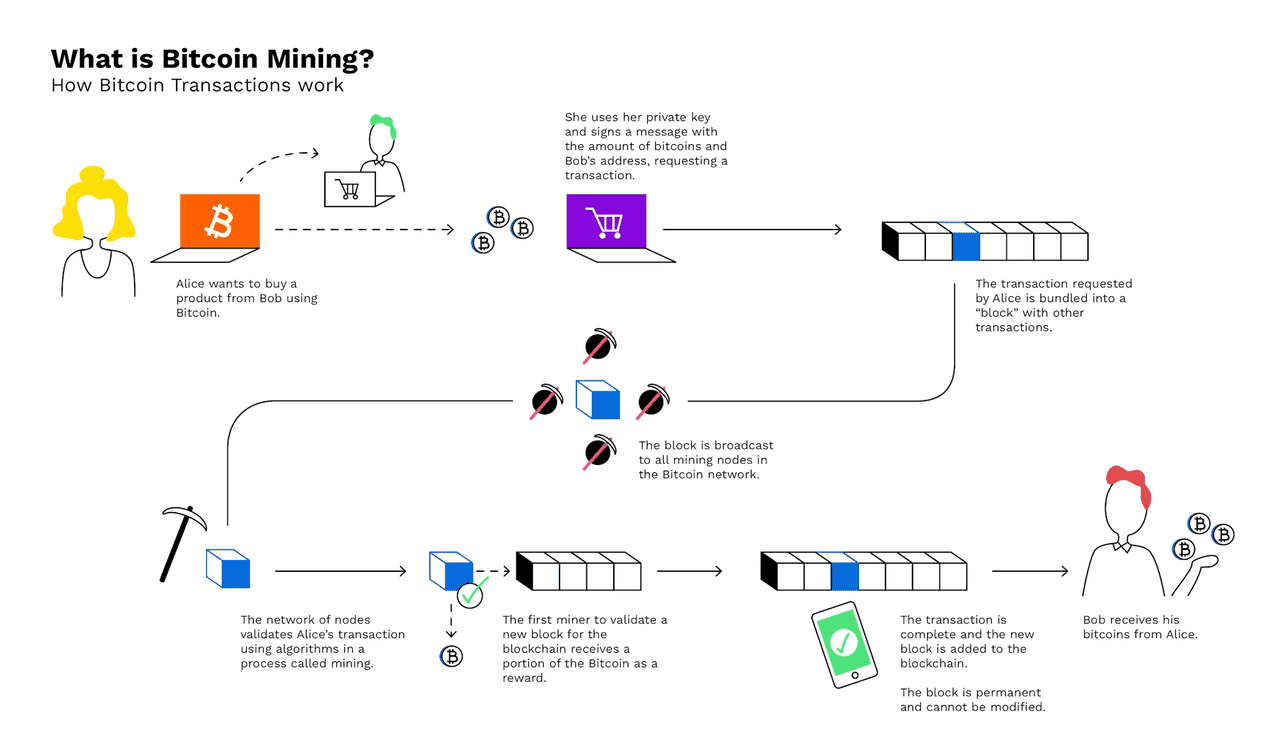

How Bitcoin Mining Works

Factors Influencing Hash Rate Growth

Several key factors have driven Bitcoin’s hash rate to its 2025 peak and will continue to shape it:

-

Bitcoin’s Price: The profitability of mining directly correlates with Bitcoin's price. As prices rose during the 2023–2025 bull cycle, attracting more miners and prompting existing ones to expand operations. By August 2025, prices ranged between $100k-$110k, justifying investments in hardware.

-

Mining Hardware Advances: Technology improvements, especially with new, more efficient ASICs, have significantly boosted hash output without increasing power costs. Companies like Bitmain and MicroBT launched models that miners quickly adopted between 2023 and 2025.

-

Infrastructure and Capital: Institutional investments into mining have led to the construction of larger facilities and innovative energy sources. Many miners have partnered with renewable energy projects, enhancing hash rates while addressing environmental concerns.

-

Global Events and Regulation: Regulations can impact the hash rate. Miners have adapted to past challenges, like the 2021 China ban, by relocating. Areas with favorable regulations and stable infrastructures attract mining investments.

-

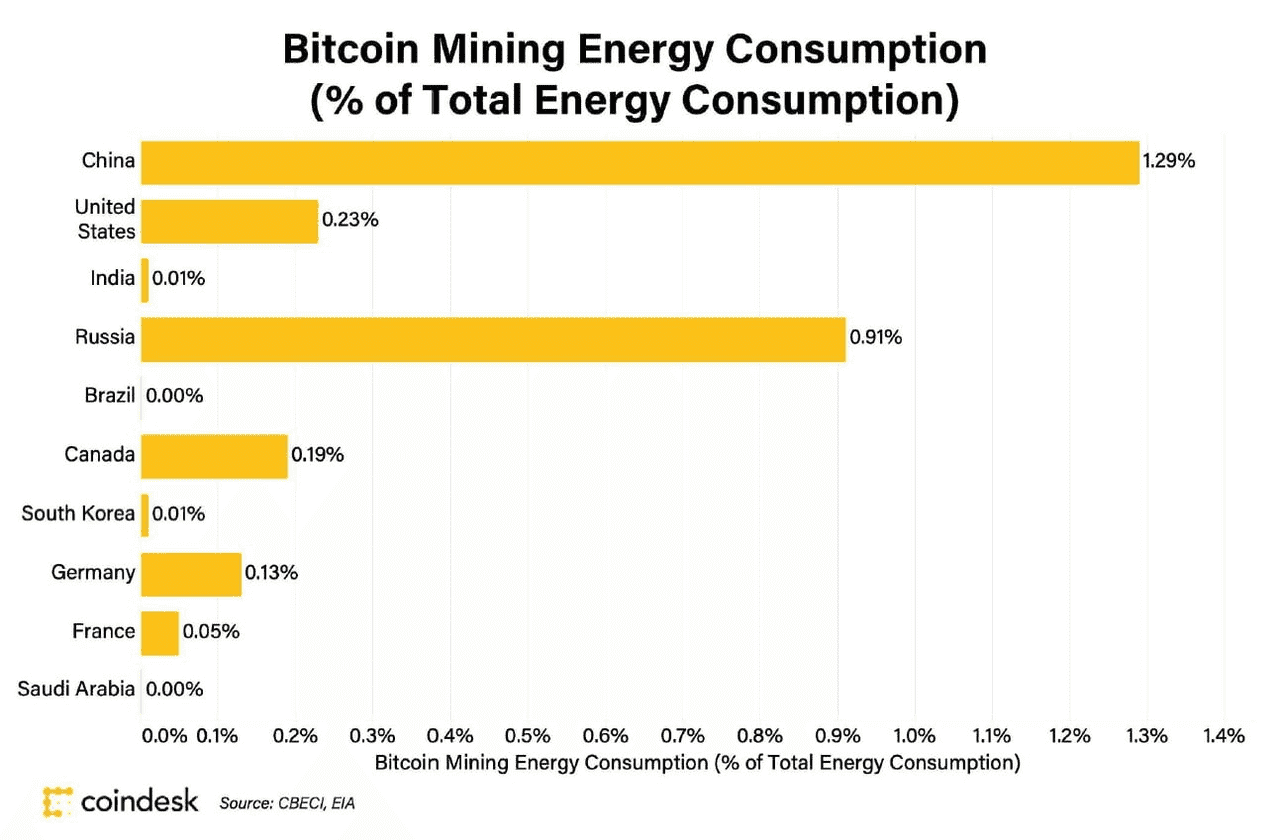

Energy Prices: Electricity costs are crucial for miners. Low-cost power availability drives hash rate growth, with regions experiencing energy surpluses seeing more operations. By 2025, over 50% of the Bitcoin network's energy was estimated to come from sustainable sources, as renewables often provide cheaper electricity.

Impact of Hash Rate on Bitcoin’s Network and Price

A surging hash rate is generally viewed as a bullish sign for Bitcoin’s fundamentals. It means the network is highly secure and that miners are optimistic about the future (since they wouldn’t invest in mining if they expected losses). Investors and analysts often interpret rising hash rate as a sign of growing confidence in the network. Indeed, Bitcoin’s hash rate and price have shown a correlation over the long term – both tend to climb during bull markets. A famous concept, "hash rate follows price", suggests that as Bitcoin’s market value increases, more miners can profit, so hash rate rises. The reverse can also be true in downturns (hash rate can level off or drop if prolonged low prices squeeze miners).

In 2025, we see a reinforcing cycle: Bitcoin’s price increase (year-over-year) outpaced the difficulty increase, giving miners larger USD revenues. Those profits allowed miners to keep expanding. Some experts even see hash rate as a leading indicator – miners often upgrade and expand anticipating future price appreciation (for example, ahead of the 2024 halving and subsequent rally). A robust hash rate may thus foreshadow long-term price strength, as it did in previous cycles.

For the Bitcoin network users, a high hash rate means peace of mind. Transactions are incredibly secure. The likelihood of a successful double-spend attack on Bitcoin is practically nil with the current hash power – an attacker would need an absurd amount of mining equipment and energy to even attempt it, and even then, they'd be competing against a global decentralized army of miners. Network reliability is also improved; the more miners there are, the more decentralized the network is. Even if some miners go offline (due to power outages or maintenance), other miners pick up the slack and keep blocks coming.

One thing hash rate doesn’t directly affect for users is transaction speed or fees – those are more influenced by network usage (number of transactions vs. block space). However, indirectly, a high hash rate and resulting high difficulty mean each block is packed with as much reward (fees + subsidy) as possible to justify the mining cost. In 2025, miners will earn most of their revenue from the block subsidy (3.125 BTC) and a smaller portion from transaction fees. Over time as halvings continue, fees may become more important. But as of now, price and hash rate growth have kept mining rewarding.

Bitcoin’s Environmental Impact (source)

2025 Outlook: Hash Rate and Beyond

As of August 31, 2025, Bitcoin’s hash rate sits near record highs around the mid-900 EH/s range, and it shows little sign of leveling off. Looking ahead, many mining experts predict the network could consistently exceed 1 zettahash per second in the coming year, especially if Bitcoin’s price continues to rise. Next year (2026) will be interesting because miners will be operating fully in a post-halving environment with only 3.125 BTC rewards, yet many have hedged this with newer machines and efficient operations.

One looming factor is the global macroeconomic environment. If bitcoin prices stay strong or climb, hash rate will likely follow. If there’s a downturn or a prolonged bear market, we might finally see some miners capitulate and hash rate growth pause. Thus far, 2025’s story has been miners thriving despite challenges – even with higher energy prices in some regions and increased difficulty, miners benefited from Bitcoin’s roughly 75% price rise year-on-year. This has even led to expanding profit margins for efficient miners.

Another aspect to watch is innovation in mining: new cooling techniques (like immersion cooling in liquid to run machines faster), better semiconductor tech, and even the integration of Bitcoin mining with power grids as demand response. These could allow hash rate to grow without waste, by using energy that would otherwise be unused or by improving grid stability.

In summary, Bitcoin’s hash rate in 2025 represents a network more secure and powerful than ever before. It has grown into a globally distributed powerhouse of computing, underpinning the first and largest cryptocurrency. For beginners and crypto enthusiasts, the hash rate can be seen as a confidence barometer: when it’s climbing, it means a lot of stakeholders believe in Bitcoin’s future. And right now, it's near an all-time high – a testament to Bitcoin’s resilience and continued growth in the world of crypto. Whether you're mining or just holding BTC, the hash rate’s rise is a reassuring signal that the Bitcoin network is alive, well, and stronger each day.