Summary

- An inflow means there is crypto being deposited on exchanges. A large Bitcoin capital inflow signals a price decrease and bearish sentiment.

- An outflow means there is more crypto being withdrawn from exchanges to wallets. During an outflow, Bitcoin becomes scarce and the price goes up.

- Liquidity is the cash money assets that back the value of crypto on exchanges. Users sell their Bitcoin and altcoins for liquidity such as Tether (USDT) on exchanges.

- If the liquidity is depleted from a large sell of Bitcoin, the ratio of the BTC/USDT balance decreases in favor of BTC and the price goes down. The reverse applies when less BTC is available – the price goes up.

- There are automatic tools that track inflows and outflows for exchanges combined and can tell a trader when there is a massive inflow or outflow of crypto.

- Social media accounts dedicated to tracing large transactions on the blockchain can provide strong inflow and outflow signals.

- Traders can manually check the balances of cold and hot wallets of exchanges on a public block explorer to determine if there is an inflow or outflow of crypto.

What are Outflows and Inflows?

Inflows and outflows are asset flows in and out of centralized exchanges (CEXs) such as Phemex. If there is an outflow of Bitcoin (BTC) from Phemex, it means more people are withdrawing Bitcoin to their personal wallets and the price could go up. If there is an inflow of Bitcoin, that means more people are selling on the exchange and the price could go down.

These occurrences are frequent and can help traders plan their trades accordingly. There are numerous tools to watch for crypto inflows and outflows in exchanges. Ethereum (ETH) holds a large share of the crypto market cap (over 20%) and altcoin inflows/outflows can also be used to measure the state of the crypto market. Dedicated tools track blockchain transactions and exchange wallets to send signals to traders when there are significant inflows and outflows.

What are Bitcoin Outflows and Inflows?

An inflow of Bitcoin is a bearish sign and an outflow of Bitcoin is a bullish sign. If the price goes down due to a downturn in the market, users start depositing their Bitcoin and selling it on the spot market. This depletes the exchange of liquidity and the Bitcoin supply rises – effectively knocking down the price. Conversely, if Bitcoin is withdrawn and becomes scarce, the price of the Bitcoin left on the exchange goes up significantly.

Inflow vs Outflow for Crypto

An inflow means there is more Bitcoin being deposited into the exchanges and an outflow means there is more Bitcoin being withdrawn from exchanges. Inflows are bearish and outflows are bullish for the price. When users deposit to an exchange, they do it to sell – depleting the exchange of liquidity. When users withdraw from an exchange, they do so to keep the Bitcoin in cold storage without selling it.

Large inflows occur when there is panic selling and bearish market sentiment as the price is going down. Large outflows occur when the Bitcoin price is going up and more people are buying and withdrawing. The liquidity (cash-backing) is the sole detrimental factor in the price trend of Bitcoin. Each Bitcoin pair is tied to a liquid asset such as a stablecoin (i.e. USDT, USDC) or fiat currency.

Liquidity is visible on decentralized exchanges (DEXs) where users can see exactly how much Ethereum is available for sale on a certain crypto coin like Shiba Inu (SHIB). Let’s say we have a coin with a $300 million market cap. Liquidity is often only 5-10% of the total market cap of a crypto. The liquidity for a coin with a $300 million market cap would only amount to $15-30 million on average.

That means that if $15-30 million are sold on the market, the price crashes the zero. If a user sells $15 million worth of a crypto with a liquidity of $30 million and a market cap of $300 million, the price will go down by -50%. The market cap would instantly slash from $300 million down to $150 million or less.

Liquidity is less visible on CEXs because it’s kept private. However, the same principles apply and the liquidity can be drained in the event of mass panic selling. By some estimates, almost 80% of the total Bitcoin supply is illiquid. This means that with a market cap of $900 billion, Bitcoin has liquid coverage in the area of $180 billion dollars spread across different exchanges.

If Bitcoin miners and other whales start offloading billions of dollars worth of crypto across different exchanges, the liquidity that backs Bitcoin could go down significantly and this could affect the price. Conversely, if institutions start purchasing billions of dollars worth of Bitcoin and adding it to their portfolios, the liquidity of Bitcoin will go up and there will be less Bitcoins available on exchangesm which will bump up the price.

4 Tools To Measure Inflow and Outflow of a Crypto Exchange

There are many analytics tools that have been developed to track crypto flow to and from exchanges. These tools track exchange wallets and measure the data by providing daily, weekly, and monthly charts. They present the net summary of all movement in USD for the top cryptocurrencies, including Bitcoin and Ethereum.

TokenAnalyst.IO

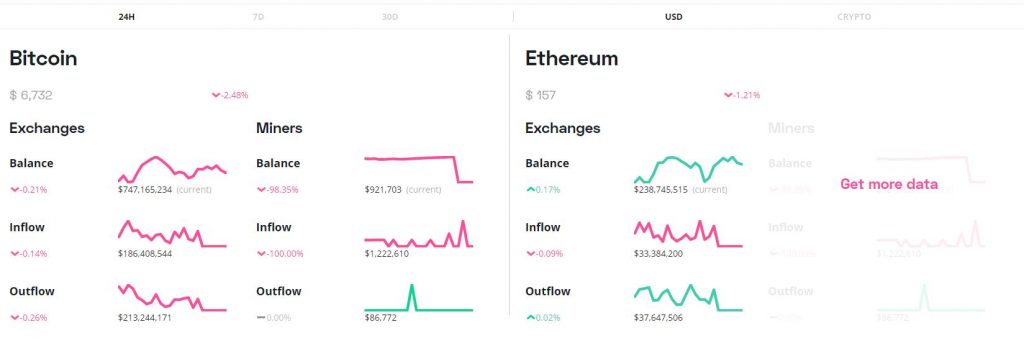

TokenAnalyst is a tool that tracks capital balances of exchanges and miners. They track data for more than 20 exchanges and offer crypto and fiat data analytics. The following is a review of the 1D inflow and outflow for Bitcoin and Ethereum:

According to this data, the Bitcoin inflow for the day is -0.14% and the outflow is -0.26%. This means more people are buying Bitcoin and withdrawing it than selling it. To get a better perspective of the price action correlation, we can switch to the weekly data chart:

The exchange inflow for Bitcoin was $1.4 billion while the outflow was $1.7 billion over the week. This means that $300 million more were withdrawn from exchanges to personal wallets. It’s a bullish signal and reflects Bitcoin’s price performance of +17% for the week. Etherem’s outflows are also higher than its inflows.

TheBlockCrypto

TheBlockCrypto is another tool that measures Bitcoin capital inflow, but it also measures crypto fiat inflows in currencies such as USD and USDT. The following is their daily chart that measures daily exchange balances and Bitcoin inflows:

The collective exchange balance dropped significantly last month and Bitcoin started seeing bullish price action around that time. The Ethereum balance chart is more stable than Bitcoin’s. They also provide analytics for USDT exchange balances and crypto miner insight:

According to this intel, the most common destination for freshly-mined Bitcoin is exchanges (blue) and other services (red). If Bitcoin miner’s activity peaks, this means they’re selling a lot of Bitcoin and if it drops this means they’re preserving their Bitcoin for a higher price. As of the last few weeks, we have seen a steady decrease in miner selloffs.

Whale Alert

Whale Alert is an inflow outflow crypto balance tracker with over 2 million followers on Twitter. They have live-tracking technology that tracks large whale transactions on different blockchains and exchanges and publicizes it on social media.

Whale Alert has a Telegram bot that can alert traders in real-time when there are big transactions occurring. They publish dozens or hundreds of transactions per day. These analytics also include data for large coin mints and transfers not related to exchanges.

Manual Tracking

A reliable option to track inflows and outflows from an exchange is to locate an exchange wallet on a block explorer and use the built-in capabilities to analyze the balances of that wallet. If an exchange wallet has depleted reserves, this means more people are withdrawing and there’s an outflow.

To find an exchange wallet, withdraw crypto from your exchange and copy the address that sent the crypto. Let’s say we want to trace an Ethereum address. We can input it in the search bar on Etherscan, then head down to “Analytics”:

The analytics show us when the ETH reserves for that exchange wallet peaked and when they depleted. It also shows data such as when the exchange held the most reserves. Notice this exchange switched wallets and emptied that wallet as a security measure.

When a wallet is active, a user can instantly track the Ethereum and Bitcoin inflows using block explorers. Bitcoin also has block explorers that allow users to track Bitcoin money inflow on the public blockchain ledger. However, Ethereum’s analytics tools are more advanced.

Conclusion

If a trader understands how liquidity affects the price of Bitcoin, they can start analyzing crypto transactions and anticipating price movements based on the momentum. Inflows are large batches of transactions that occur when Bitcoin is deposited on exchanges, and outflows are transactions that occur when Bitcoin is withdrawn. Either one can indicate when the price will move up or down.

Using the tools that measure collective inflows and outflows from exchanges, traders can long or short the market adequately. Bitcoin and Ethereum data is the most important because it concerns more than 50% of the total crypto market and their price action takes a toll on the crypto market as a whole.

Read More

- July Crypto Market Analysis

- What Is Crypto Trading Volume: How It Affects Price

- What is Bitcoin: World’s Largest “Group Project”

- Phemex Analysis in A Minute: How to Capitalize on ETH's Bull Run!

- How to Trade Bitcoin Safely: Trustworthy Bitcoin Trading

- What is Cryptocurrency & How It Differs From Digital Cash

- What is Inflation in Crypto?

- October BTC Market Analysis