Bitcoin futures allow traders to speculate on Bitcoin’s price movements without actually holding the cryptocurrency. By using futures contracts, you can profit from both rising and falling markets, and even apply leverage to amplify potential gains (and losses). Phemex and other crypto exchanges offer Bitcoin futures trading with up to 100x leverage for skilled traders.

Trading Bitcoin futures has become increasingly popular and accessible. Since the introduction of the first Bitcoin futures on regulated exchanges in 2017, the market for crypto futures has exploded. By 2025, crypto derivatives volumes reach trillions of dollars monthly – roughly four times larger than spot crypto trading volumes – as both institutions and individuals use futures for speculation and hedging. If you’re new to futures, this guide will walk you through what Bitcoin futures are, why people trade them, and how you can start trading Bitcoin futures on platforms like Phemex.

What Are Bitcoin Futures?

Bitcoin futures are contracts where two parties agree to exchange Bitcoin (or its cash equivalent) at a set price on a future date, allowing exposure to Bitcoin's price movements without owning it. Key features include:

-

Standardization: Futures contracts are standardized by exchanges, with specified lot sizes and expiration dates. For example, the CME offers Bitcoin futures where each contract represents 5 BTC with monthly expirations, while perpetual futures, like those from Phemex, have no expiration date.

-

Cash-Settled vs Physical-Settled: Most Bitcoin futures are cash-settled, meaning profits or losses are settled in fiat or stablecoins at expiration. Some platforms have experimented with physical delivery, but cash is the norm.

-

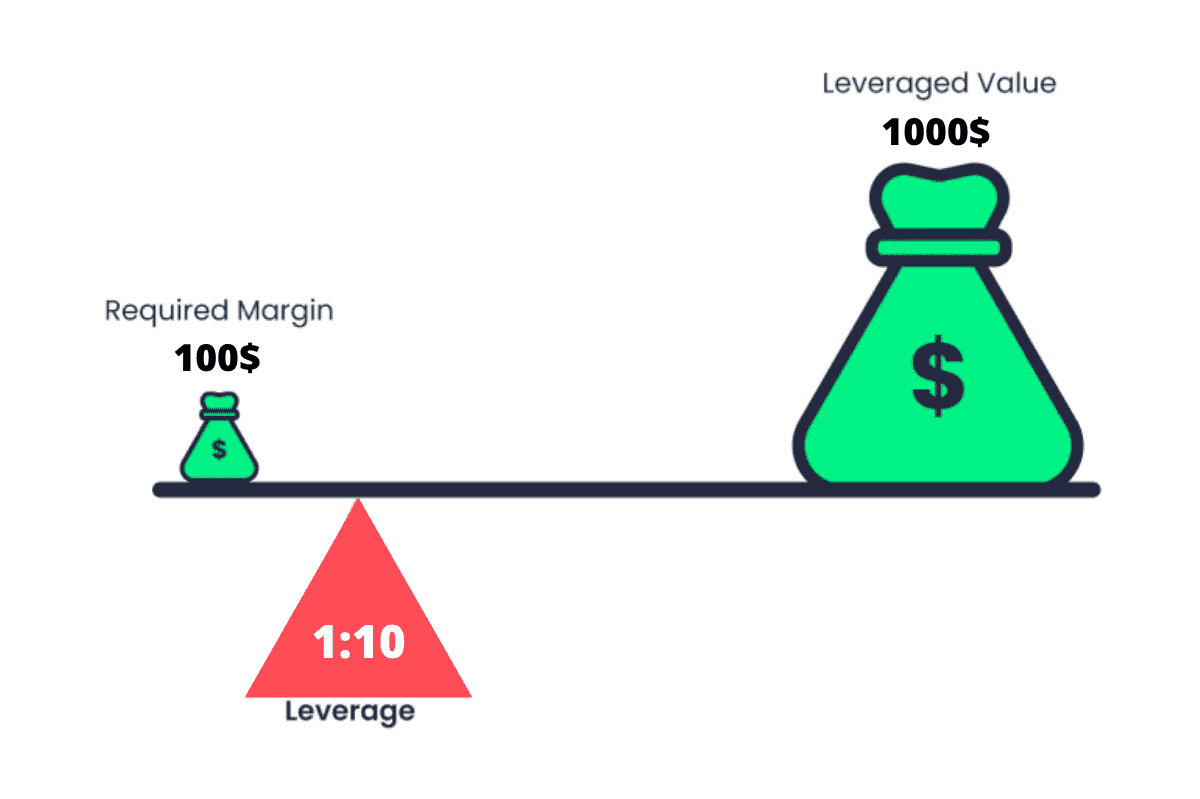

Leverage: Futures trading often allows leverage, meaning you can control larger positions with less capital. This can amplify both gains and losses, making it risky - especially with high leverage options available on platforms like Phemex.

-

Long and Short Positions: Futures allow for taking both long and short positions. You can bet on Bitcoin’s price rising by going long or on it falling by going short, providing a broader trading strategy.

-

No Need to Hold Bitcoin: You don’t need a Bitcoin wallet to trade futures on many platforms; you can use stablecoins or fiat as margin, making it accessible for institutional traders.

Overall, Bitcoin futures enhance market transparency and liquidity and are available on various exchanges, both regulated and crypto-native, with platforms like Phemex known for their fast trading and high leverage options.

Leveraged Trading (source)

Why Trade Bitcoin Futures?

There are several reasons traders might choose Bitcoin futures over simply trading Bitcoin on the spot market:

-

Leverage and Capital Efficiency: Futures allow control of large positions with smaller capital due to leverage. For example, buying 1 Bitcoin at $30,000 would require $30,000 on the spot market, but only about $3,000 with 10x leverage on futures. While this can enhance returns, it also increases the risk of liquidation if the market moves against you.

-

Shorting and Hedging: Futures make it easy to profit from price drops by simply selling. If you hold Bitcoin and are concerned about a price decline, you can short futures to hedge your position, offsetting potential losses.

-

24/7 Liquidity and Price Discovery: Crypto futures trade around the clock, enabling immediate responses to market news. Futures often lead price discoveries and have seen significant participation even during bear markets, resulting in high liquidity and potentially better pricing for larger orders.

-

Arbitrage and Profiting from Price Differences: Futures can differ from spot prices, allowing traders to engage in cash-and-carry arbitrage. For instance, if futures are priced higher than the spot, traders can exploit this for risk-free profits at expiry.

-

Regulation and Access: Some prefer the regulated nature of futures markets for compliance. The launch of Bitcoin futures ETFs has also made this trading more accessible to traditional investors, broadening participation.

In summary, Bitcoin futures offer the flexibility to profit in various market conditions and implement strategies like hedging or arbitrage. However, they come with significant risks, so careful management is essential. Next, we'll discuss how to start trading futures step by step.

Getting Started: What You Need to Trade Bitcoin Futures

Trading Bitcoin futures is a straightforward process, but if you’re new, you’ll want to follow these steps to set yourself up:

-

Choose a Reputable Futures Exchange: First, decide where you will trade. The exchange you choose will significantly shape your trading experience. Important factors include security, liquidity, fees, available leverage, and user interface. If you’re a beginner, you’ll likely want an exchange that is user-friendly and has strong safety measures (like two-factor authentication, proof of reserves, etc.). Phemex is an excellent choice for crypto futures: it’s known as one of the fastest crypto derivatives platforms and offers Bitcoin and many other crypto futures with up to 100x leverage. Phemex also provides a testnet (Mock Trading) for practice, and often has bonus promotions for new sign-ups.

-

Register and Secure Your Account: Once you’ve picked an exchange, sign up for an account. You’ll need to provide an email and create a strong password. Many platforms will also require some form of KYC (identity verification), especially if you’re depositing or withdrawing fiat currency or large amounts. Phemex, for instance, allows trading without KYC for a certain limit, making it quick to start. After registration, enable two-factor authentication (2FA) on your account (via Google Authenticator or similar) – this adds an extra layer of security, which is crucial when your funds are on the line. Also, take note of any anti-phishing codes or security tools the exchange offers and use them.

-

Fund Your Trading Account: To trade futures, you must deposit collateral into your futures trading account. Depending on the exchange, you might deposit Bitcoin, USDT (Tether), or other supported assets. Some exchanges let you deposit fiat and convert to stablecoin for margin. For example, on Phemex you can deposit USDT and use it to trade USDT-margined BTC futures, or deposit BTC to trade coin-margined contracts. Check the available payment options and choose the cheapest/easiest for you. If you don’t own any crypto yet, you might buy USDT/BTC on a platform like Phemex’s spot market and then transfer it. Always double-check you’re sending funds to the correct deposit address and network (e.g., ERC-20 vs TRC-20 for USDT). Note: Exchanges have a minimum deposit requirement – for instance, an exchange might require at least $10 or $50 worth to get started. Ensure your deposit meets any minimums.

-

Familiarize Yourself with the Interface: Before placing real trades, get to know the trading interface. A futures trading screen typically shows the order book, recent trades, price chart, and your position info. Key elements:

-

Contract Details: Understand the contract you’re trading – its size (lot), margin currency, and leverage rules. For instance, Phemex BTC/USD perpetual is coin-margined (uses BTC as collateral) whereas BTC/USDT perpetual is USDT-margined.

-

Leverage Setting: Many platforms allow you to adjust leverage for each position or contract. For example, you might set 10x leverage on BTC futures. The interface will show your available leverage or a slider to adjust it.

-

Order Types: Learn the order types available – market orders (execute immediately at current price), limit orders (set a specific price), stop-loss orders, take-profit orders, etc. If you’re new, it’s wise to use limit orders for entries/exits (for precision and avoiding slippage) and always set a stop-loss once your position is open.

-

Margin and Liquidation Info: The interface should display your margin balance, the initial margin used for a trade, and importantly the liquidation price of your position. The liquidation price is the level at which the exchange will automatically close your position because your margin can’t cover further losses. Keep an eye on this – you generally want to maintain a buffer (don’t push margin to absolute limits). Many exchanges also offer a calculator to simulate P&L, margin, and liquidation based on input values – use this tool to plan.

If the exchange offers a demo mode or testnet, take advantage of it at this stage. Phemex’s Mock Trading, for example, lets you practice trading with virtual money. This is invaluable for getting comfortable with how leverage and P&L work without risking real funds.

-

Plan Your Trading Strategy: Before executing any trade, have a plan. Determine your trade size (how many contracts or USD value), entry and exit strategy, and risk limits. A common beginner mistake is to jump into leveraged trading without a strategy, which often ends badly. Decide, for example, “I will go long 0.1 BTC worth of contracts at $30,000 because I see a support level; I’ll put a stop loss at $29,000 to limit risk, and take profit at $32,000.” Having these levels in mind (and ideally placing orders for them in advance) instills discipline. We’ll talk more about risk management later, but always trade with a strategy rather than pure emotion.

Once you’ve done the above, you’re technically ready to place a trade. Let’s go through the mechanics of opening and closing a Bitcoin futures position.

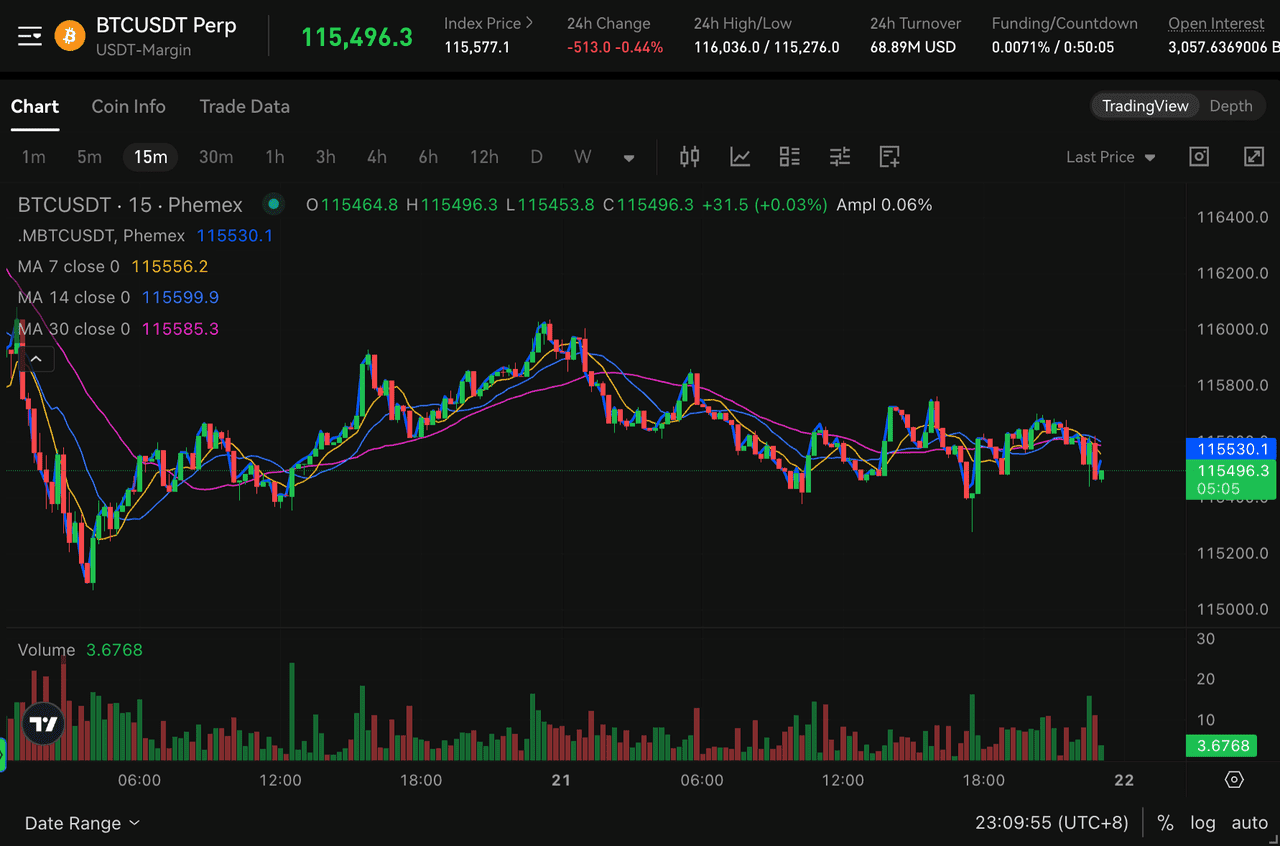

Bitcoin Futures Market on Phemex (source)

Risk Management Tips for Bitcoin Futures Trading

Bitcoin futures trading offers high profit potential, but it also comes with high risk. Here are some essential tips to help you trade safely and smartly.

Use Leverage Conservatively: Avoid extreme leverage (e.g., 100x) as it increases liquidation risk. Beginners should consider using no more than 5x leverage, or 2-3x for a wider margin of safety.

Never Risk More Than You Can Afford to Lose: Limit your risk to a small percentage of your trading capital (e.g., 2%). This protects your account from significant losses.

Implement Stop-Loss Orders: Stop-losses act as a safety net, preventing emotional decision-making. Always set your stop-loss in the exchange system.

Beware of Liquidation Cascades: Be cautious when trading near liquidation levels, as they can cause rapid price swings. Avoid over-leveraging and give your stops some breathing room.

Monitor Funding Rates (for Perpetuals): Understand the funding rates for perpetual futures as they can indicate market sentiment. High rates may suggest an overheated market.

Stay Informed but Avoid Noise: Keep track of major market events but don’t react to every rumor. Stick to your trading plan unless there's a fundamental change.

Practice and Continuous Learning: Use demo trading to refine your strategies and maintain a trading journal to analyze your decisions and patterns. Continue learning about technical analysis and risk management to improve your skills.

Trends and Developments in 2025

It’s worth noting how the landscape of Bitcoin futures has evolved up to 2025:

-

Institutional Adoption: What was once the domain of crypto enthusiasts and retail traders is now also populated by hedge funds, institutional traders, and even corporations. The launch of futures-based Bitcoin ETFs and the presence of CME’s regulated futures have brought many traditional players into the mix. CME’s Bitcoin futures saw a 154% year-over-year volume jump in early 2023, and open interest hit record highs, indicating robust growth in usage. This means the Bitcoin futures market is more liquid and mature than ever, but also sometimes influenced by macro trends (as institutions treat Bitcoin as a macro asset).

-

New Products: Exchanges have expanded offerings – now we have not just Bitcoin futures, but Ethereum futures, and futures for many altcoins. Micro futures contracts have been introduced (CME launched a micro Bitcoin futures contract at 0.1 BTC size, for example) to allow smaller investors to participate. There are also options on futures and other derivative combos that advanced traders use. However, for a beginner, it’s wise to start with the main Bitcoin futures contract to get a feel for how it works before branching out.

-

Regulatory Environment: Regulators globally have increased their focus on crypto derivatives. Some countries have banned retail high-leverage trading, others require exchanges to implement strict KYC/AML. The U.S. CFTC oversees Bitcoin futures on regulated venues and has taken action against some offshore exchanges. By 2025, we have clearer rules in some jurisdictions – for instance, in the EU, new laws under MiCA may govern crypto derivatives. As a trader, stay aware of your country’s stance and use exchanges that are compliant or at least reputable. Phemex, for example, has certain country restrictions but continues to serve a global user base under appropriate guidelines.

-

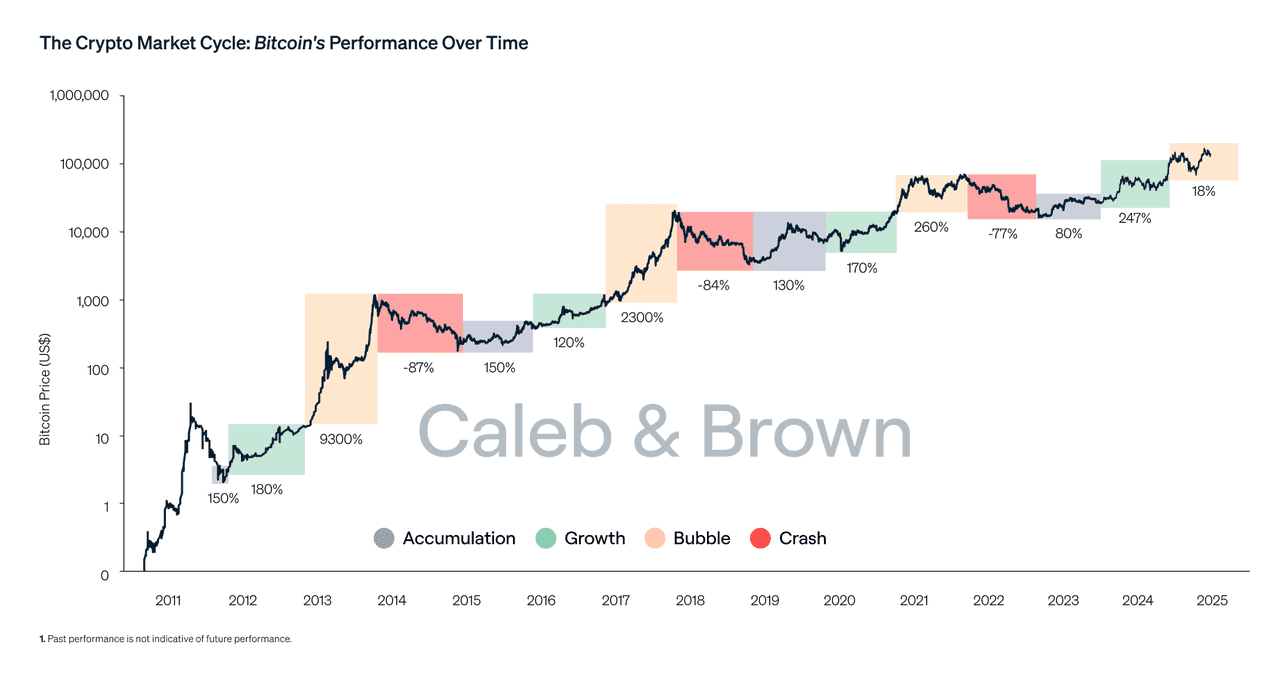

Market Volatility Cycles: Bitcoin has cycles of high volatility (e.g., during a bull run or panic crash) and periods of consolidation. Futures trading volumes and interest tend to spike during volatility peaks (because that’s when there’s more to gain or lose). In quieter times, ranges can tighten. Learning to adjust your trading style to the market environment is key – e.g., use tighter stops and perhaps smaller positions when volatility is extreme to avoid slippage, or conversely, be more patient with profit targets during big trending moves. The year 2025 might see new all-time highs or could be in a consolidation after one – be prepared for both scenarios.

Bitcoin Market Cycle (source)

Why Trade Bitcoin Futures on Phemex?

When it comes to choosing an exchange for Bitcoin futures, Phemex stands out as a top-tier platform designed with traders in mind. Here are a few reasons Phemex is an excellent place to start (or continue) your Bitcoin futures trading journey:

-

User-Friendly Experience: Phemex offers an intuitive trading interface suitable for both beginners and advanced traders, featuring customizable charting, one-click order adjustments, and a mobile app.

-

High Performance & Reliability: With a high-performance trade engine, Phemex ensures quick order execution and stability, even in fast-moving markets.

-

Flexible Leverage & Diverse Contracts: Phemex allows up to 100x leverage on Bitcoin and offers various contracts, including perpetual futures, along with copy trading and strategy bots.

-

Security and Trustworthiness: The platform prioritizes security with cold wallet storage and has a good track record for security. It is transparent and engages with its community, focusing on risk management through an insurance fund.

-

Bonuses and Low Fees: New users often benefit from welcome bonuses, and the fee structure is competitive, with low taker fees and rebates for maker orders.

-

Education and Community: Phemex provides educational resources through the Phemex Academy and Blog and has a great Learn & Earn program, which is beneficial for learning and growth.

In short, while you have many choices for trading Bitcoin futures, Phemex combines performance, security, and user-centric features that make it a compelling choice, especially if you value a professional environment without needing to be a big institutional player.

Final Thoughts

Bitcoin futures open up a world of trading opportunities beyond simple “buy low, sell high.” You can profit from any direction, use leverage to maximize efficient use of capital, and implement sophisticated strategies like hedging. In this 2025 landscape, futures are an integral part of the crypto market – they even play a significant role in price discovery and market sentiment. For example, heavy shorting in futures might signal bearish sentiment, while high open interest during a rally could signal either strong conviction or over-leverage in longs that could unwind. As a trader, watching the futures market (funding rates, open interest changes, etc.) can give insights into the spot market’s next moves.

However, always remember that with high reward comes high risk. The stories of traders making fortunes in a single Bitcoin rally often overshadow the quieter, more common stories of traders who, without proper risk management, lost their capital due to a few bad leveraged bets. The fact that crypto derivatives volume is so high (trillions monthly) means there’s ample opportunity, but also that you’re up against savvy participants. Take your time to practice, start small, and treat trading as a skill to refine.

If you’re ready to dive in, Phemex provides a safe and feature-rich venue to start trading Bitcoin futures. With its low fees, strong performance, and educational support, it’s an exchange geared to help you succeed. So whether you believe Bitcoin is headed to the moon or bracing for a dip, you can confidently try to profit from your view using futures. Just be sure to trade responsibly, keep learning, and may your trading journey be a successful one!