United States Crypto Reserve (USCR) is a Solana-based cryptocurrency that launched in October 2025, aiming to represent a transparent, on-chain “crypto reserve” for the United States. Despite its patriotic branding, USCR is not an official government project – the team clarifies that the “GOV” in its website stands for “Go-Value,” not government. Instead, USCR is a community-driven experiment blending national symbolism with blockchain transparency. In this analysis, we’ll break down USCR’s current price stats, its volatile price history, technical trends, investor activity (including “whales”), exchange listings, community sentiment, and price predictions from now through 2030. Finally, we’ll evaluate USCR’s investment prospects, key risks, and growth drivers.

Current Price and Market Overview

|

Metric

|

Value

|

|

Price (USD)

|

~$0.074 (7.4 cents)

|

|

Market Capitalization

|

~$75 million (fully diluted)

|

|

24h Trading Volume

|

~$1.2 million

|

|

Circulating Supply

|

1,000,000,000 USCR (100% of max)

|

|

All-Time High

|

$0.0747 on Oct 28, 2025

|

|

All-Time Low

|

$0.0102 on Oct 8, 2025

|

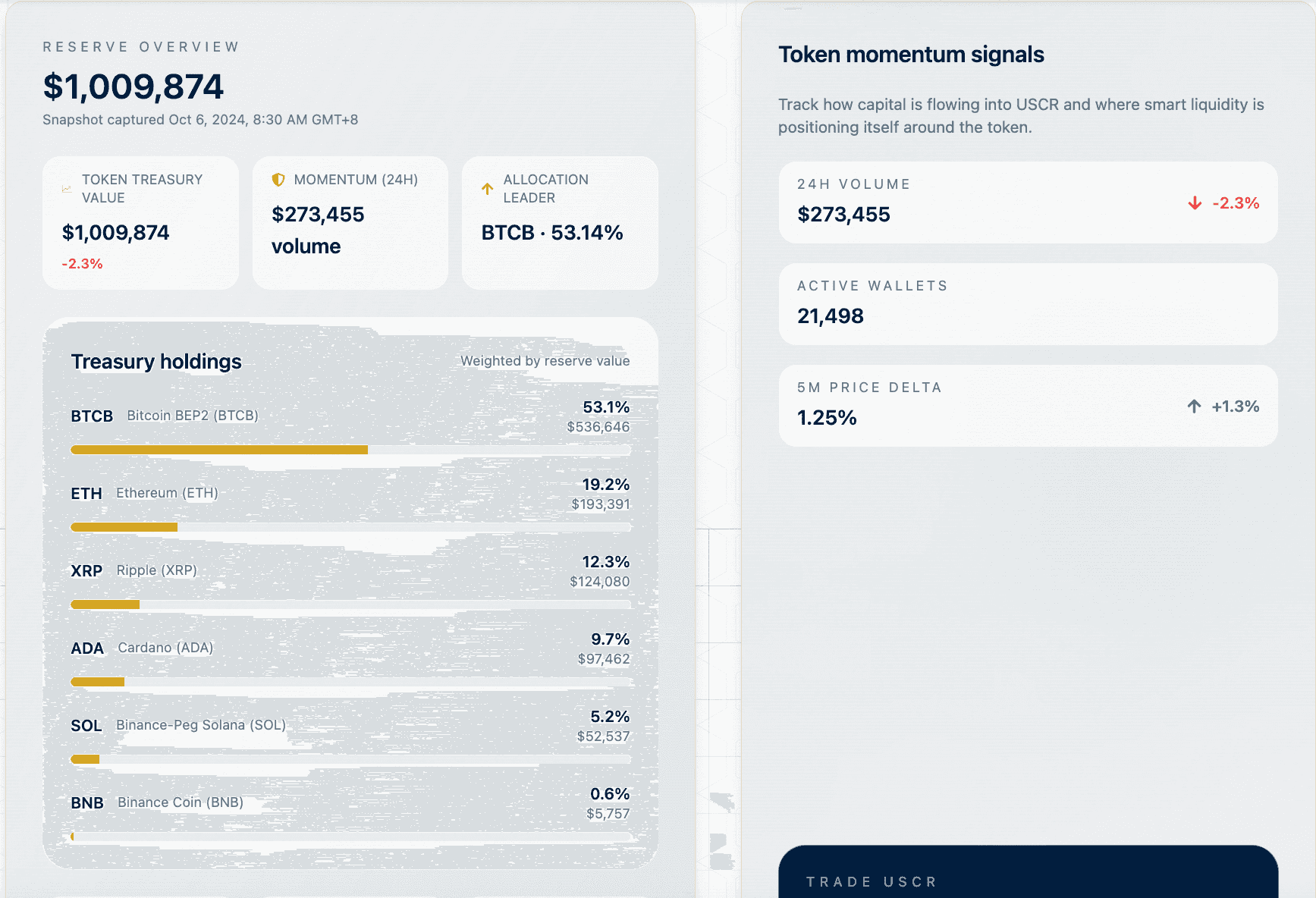

As of late October 2025, USCR is trading around $0.07–$0.08 (about 7 cents) per token. The token saw a 24-hour price jump of ~18%, reflecting strong recent momentum. With 1 billion USCR tokens in circulation, the fully diluted market capitalization stands near $75 million – making USCR a small-cap crypto asset. Daily trading volume is in the low millions of dollars (roughly $1–1.3 million in 24h volume lately), which is modest but notable for a newly launched token. USCR’s liquidity on Solana DEXes is also growing; for instance, the main USCR/USDC pool holds about $948K in liquidity on Orca/Meteora, indicating a decent buffer for trading.

In terms of extremes, USCR has already logged its all-time high (ATH) at ~$0.0747 (on Oct 28, 2025) – essentially its current price level – and an all-time low (ATL) around $0.0102 (1.02 cents on Oct 8, 2025). This means early buyers who caught the ATL have seen gains of over 600% to date. Such high volatility is typical for a new token, especially one driven by community hype and speculative interest.

USCR Reserve Overview (source)

Price History Timeline and Major Milestones

USCR launched quietly on Solana in early October 2025. Initially trading at fractions of a cent, it experienced an explosive rise shortly after:

-

October 8, 2025 – Meteoric 10,000% Rally: Within 24 hours of gaining attention, USCR’s price skyrocketed by over 10,000%, reaching around $0.02. Media labeled it a “meteoric” rise, as it hit a market cap of over $18 million despite lacking major exchange listings.

-

Catalysts for the Initial Spike: The token's backing of a $1 billion reserve in various cryptocurrencies and a high-profile purchase by “@alx,” linked to notable figures, created significant FOMO. The narrative of a “People’s Token” further fueled interest.

-

Mid-October 2025 – First Pullback and Consolidation: After peaking, USCR faced a correction, touching an all-time low of ~$0.0102 before rebounding. By mid-October, it stabilized within the $0.03–$0.05 range.

-

Late October 2025 – New Rally to All-Time Highs: With continued community support and a booming crypto market, USCR surged past previous highs, reaching around $0.0747 by late October. This marked a 630% increase from early lows and positioned USCR within the top 3800 rankings on CoinMarketCap.

Overall, USCR's first month reflected a classic hype cycle characterized by significant volatility and establishing higher lows, trending upwards by the end of October.

Technical Trends and Chart Patterns

Due to USCR’s brief trading history, traditional technical analysis is limited. However, there can be several observations made about its price action:

-

Strong Uptrend with Volatility: USCR has shown a parabolic uptrend since its launch, moving from ~$0.02 to ~$0.07 in October, with 20-30% intraday fluctuations. This indicates overall bullish momentum, but expect high volatility typical of a low-cap coin.

-

Support and Resistance Levels: The $0.02–$0.04 range now serves as potential support, while the recent high near $0.075 acts as resistance. A clean break above ~$0.07–$0.08 could trigger a strong upward move, but failure could result in a double-top and a deeper correction.

-

Trading Volume & Liquidity: Trading volume has been healthy, with strong buying pressure (873 buy transactions vs. 174 sells). Liquidity in the USCR-USDC pool has grown to nearly $950K, which could help stabilize prices but remains thin compared to major coins.

-

Indicators: Standard indicators are hard to rely on. RSI showed overbought conditions during the initial spike, and USCR mostly trades above short-term moving averages, confirming bullish momentum amid significant volatility.

In summary, USCR is in a unique position near its highs, suitable for momentum trading. However, risk management is crucial given the lack of long-term data.

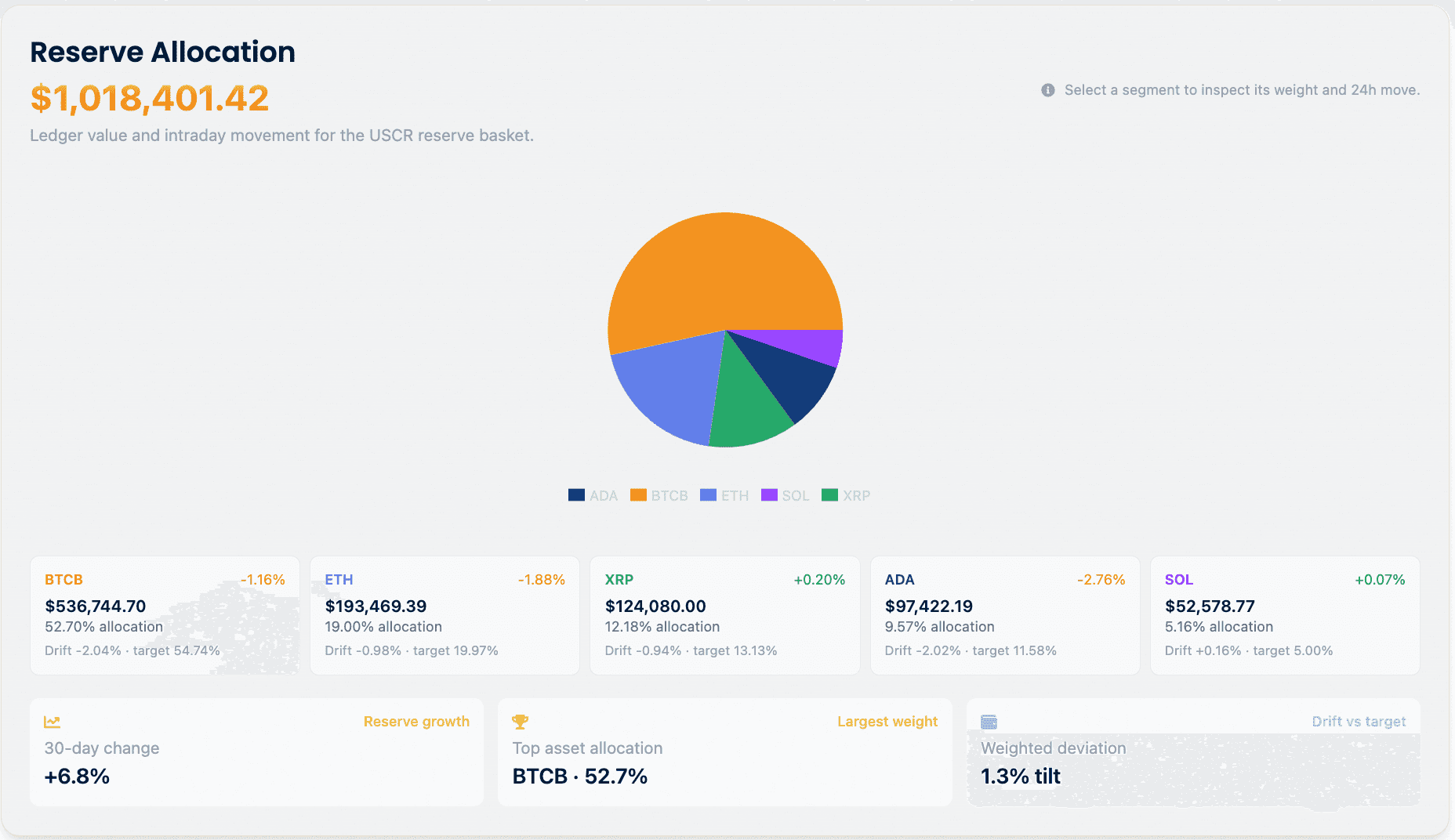

Reserve Allocation (source)

Whale Activity and “Smart Money” Trends

One concern with community-launched tokens like USCR is the concentration of ownership among a few “whales,” which can lead to risks of market dumps. Reports suggest that a small number of wallets control a significant portion of USCR, with one claim stating that “main wallets have 94% of supply.” If true, this concentration means the top holders, possibly insiders, have substantial influence over the price, posing risks if they decide to sell.

On Reddit, users noted unusual trading behaviors indicating active whale management. Some whales attempted large sell-offs (rug pulls), but other whales or a buying algorithm stepped in to support the price, suggesting a tug-of-war that could be market-making behavior.

A notable whale influencer is @alx, an intern supposedly connected to Elon Musk, whose endorsement raised speculation about USCR’s legitimacy. However, there’s little evidence of institutional support, with most backing coming from retail traders and crypto influencers.

The future stability of USCR depends heavily on these major holders. If they hold onto their tokens, the market may stay stable, but sudden exits could lead to steep drops. Monitoring wallet activities may provide early warnings of potential sell-offs.

In summary, USCR's value hinges on a few large holders who can both support and jeopardize the price. New investors should remain cautious of this concentration risk.

Community Sentiment and Buzz (Reddit & Twitter)

USCR has sparked considerable debate in the crypto community. As a meme coin with a nationalist twist, it has drawn both enthusiastic supporters and skeptics.

-

Hype and Enthusiasm: Many users on Twitter and Telegram celebrated USCR’s launch, viewing it as a “homegrown American crypto reserve.” Some see it as a symbol of financial transparency and patriotism, especially because of its on-chain reserves of major cryptocurrencies, which provided some legitimacy. Enthusiasts on Reddit shared their profits and excitement, noting that the project gained traction without heavy advertising.

-

Skepticism and Scam Warnings: However, many experienced traders are wary. Concerns include the anonymous team behind USCR, the emphasis on social media hype, and concentrated token ownership. Some have labeled it as a “scam pump-and-dump,” cautioning against investing based on influencer promotions.

-

Conspiracy Theories: Some users humorously speculated that USCR could be a covert government project, attributing its viral success to hidden backing from the government. While this theory lacks serious support, it reflects the unusual nature of USCR’s rise.

-

General Mood: Sentiment around USCR is polarized, with a FOMO-driven camp enthusiastic about its potential and a cautious camp urging skepticism. The community remains small compared to major cryptocurrencies.

-

Media Coverage: Crypto news outlets have varied in their coverage, with some applauding USCR's concept as innovative, while others warn of risks reminiscent of past hype cycles.

In summary, USCR has generated excitement and a dedicated following, but also significant caution due to its speculative nature. Potential investors should consider both perspectives to make informed decisions.

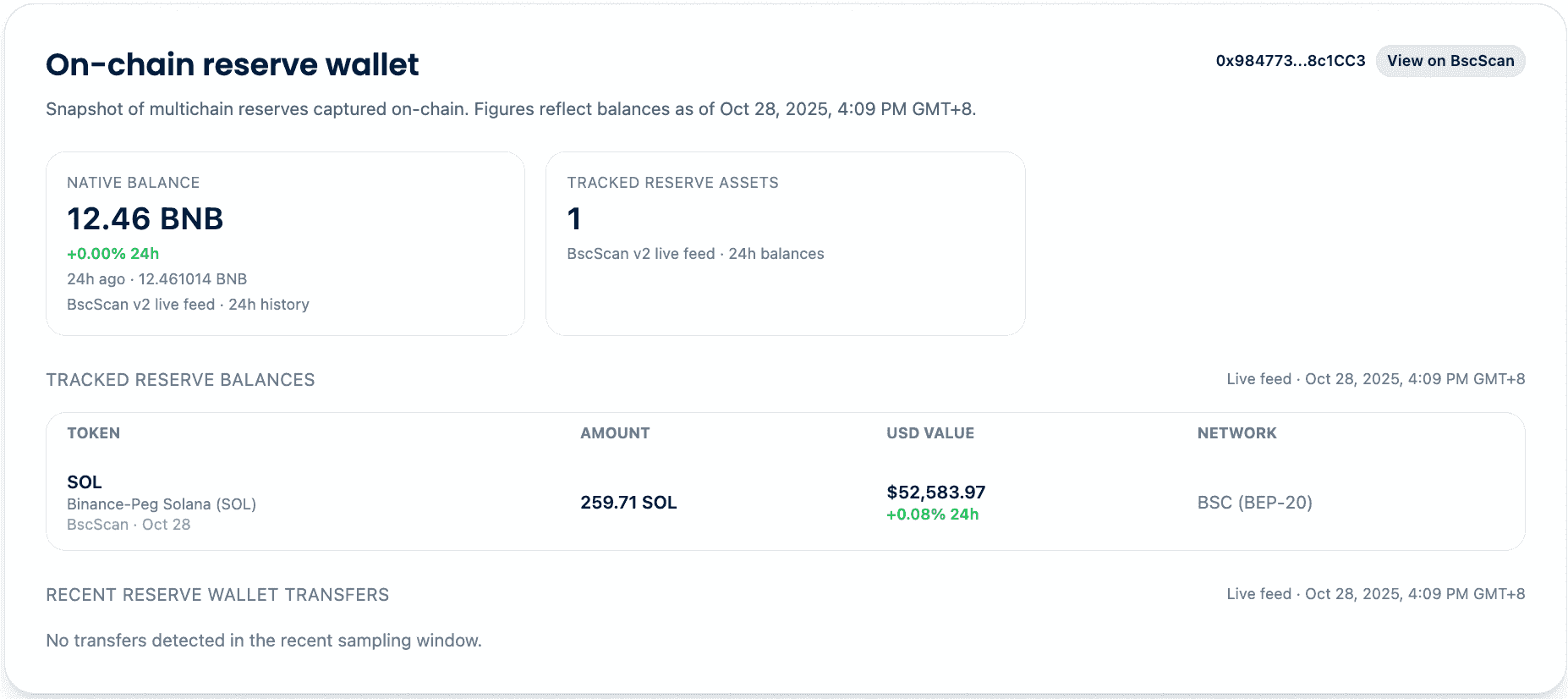

On-chain Reserve Wallet Statistics (source)

Conclusion – Is USCR a Good Investment? Key Drivers and Risks

United States Crypto Reserve (USCR) stands out as an ambitious and unusual project, merging the meme-coin energy with a narrative of transparency and patriotism. Deciding whether it’s a wise investment requires weighing its unique value proposition against the significant risks involved:

Potential Growth Drivers / Appeal:

-

Novel Concept and Narrative: USCR offers a unique “crypto reserve” storyline, essentially branding itself as a decentralized, people-powered alternative to a national reserve. This distinct positioning can attract speculative investors who find the idea cool or meaningful. It taps into a sense of American identity (stars-and-stripes imagery, etc.) combined with crypto – a combination that, if it catches on, could drive a strong community following. Early uptake shows there is an appetite for tokens with a “bigger story.”

-

Transparency and On-Chain Backing: Unlike many meme coins that are pure hype, USCR claims to hold a basket of real crypto assets on-chain as a reserve (BTC, ETH, XRP, ADA, etc.). All reserve transactions are supposedly visible on Solana’s blockchain for anyone to audit. This transparency could build trust over time – investors can literally verify if the project treasury has the funds it claims. It’s a point of differentiation: whereas other projects might just promise backing, USCR encourages “don’t trust, verify” by design. If maintained, this transparency might help USCR sustain credibility where other meme tokens falter.

-

Fixed Supply and No Dilution: USCR has a capped supply of 1 billion tokens with no inflation and no future unlocks. For investors, this means the tokenomics are simple – you won’t wake up to find the supply doubled. All else equal, a fixed supply could support price appreciation if demand increases (basic supply-demand dynamics). This scarcity aspect is often a talking point in the community (comparisons are made to Bitcoin’s fixed supply ethos, albeit at a much smaller scale).

-

Community Governance Potential: The team’s roadmap hints that USCR holders may eventually get governance rights – e.g. voting on which assets the reserve holds or other proposals. If implemented, this could increase engagement and give the token a bit of utility (governance tokens sometimes attract long-term holders who want a say in the project’s direction). A passionate, voting community can be a moat, as seen in some DAOs. While these features aren’t live yet, the promise of future utility is a factor that some investors might bet on.

-

Patriotic “Meme Power”: Similar to how Dogecoin leveraged community humor or how Shiba Inu leveraged the dog-coin trend, USCR leverages a form of patriotism and curiosity about government crypto. If geopolitical or macro events put focus on national crypto reserves (for example, if the US government’s crypto holdings make news), USCR could benefit from a sympathy bid. It’s almost like holding an index on U.S. crypto sentiment – if that meme catches fire (say, during election season or major financial news), USCR might surge simply due to its name and meme value.

Key Risks and Downsides:

-

Lack of Intrinsic Utility: Despite the grand idea, holding USCR does not confer ownership of the reserve assets nor any dividends or yield. Its value is not directly backed by the reserve (no redemption mechanism exists). So, beyond speculative trading and potential governance, the token’s utility is minimal. This raises the question: what sustains demand long-term? If the novelty wears off, there isn’t much fundamental usage to fall back on. As some critics note, “actual governance or real-world reserve backing remains minimal” at this stage.

-

Extreme Volatility & Shallow Market Depth: USCR’s trading is highly volatile, and while liquidity has improved, the market depth is still relatively shallow. This means prices can move violently on modest capital flows. Entering or exiting large positions could be difficult without slippage. If one isn’t careful, it’s easy to lose a large percentage in a short time due to volatility. This also complicates using stop-loss orders on DEXs (since slippage could bypass them). In short, USCR is a high-risk, speculative asset, not suitable for those who can’t stomach big swings. The low liquidity also opens it up to manipulation (as discussed with whale activity).

-

Regulatory and Branding Risk: USCR’s heavy use of United States imagery and wording could attract regulatory attention or even legal challenges. The project has tried to clarify it’s not a government entity, but one could see a scenario where regulators view the branding as misleading to unsophisticated investors. If any regulatory body were to label USCR a scam or take action (cease-and-desist on certain promotions, for example), it could severely impact the project. Moreover, if the U.S. ever pursues an official digital currency or reserve, they might not appreciate an unofficial project in the same space. Regulatory crackdowns remain a risk overhanging many crypto projects, especially ones that flirt with national symbolism.

-

Centralization & Execution Risk: A handful of unknown developers and insiders appear to control USCR’s fate. There is significant execution risk – will they continue updating the project, growing the reserves, and engaging the community responsibly? Or was this just a quick pump experiment? Without a proven team (the team remains mostly anonymous), investors are effectively betting on the continued goodwill and competence of an unknown group. If the team disappears or fails to follow through on promises (like governance features or maintaining transparency), USCR’s value could evaporate. The nonexistent marketing so far can be seen positively (organic growth) or negatively (no clear plan or support). Either way, the project is young and could easily falter if mismanaged.

-

Competition and Copycats: Already, USCR’s success might inspire imitators (e.g., other country-themed crypto reserves, or just unrelated meme coins trying to ride the wave). If dozens of similar tokens pop up, it could dilute the “unique” aspect of USCR and split the community interest. Additionally, in the broader sense, USCR competes for investor attention with all other crypto opportunities. In a bull market, it’s easy to attract attention; in a stagnant market, traders might rotate out of USCR into whatever is hot next. Maintaining relevance in the hyper-competitive crypto space is a constant battle.

Bottom Line: USCR is a high-risk, high-reward play. It has strong growth drivers in its compelling narrative, community intrigue, and transparent approach – factors that could indeed drive further price increases if things go well. On the other hand, it carries all the classic red flags of speculative altcoins: huge volatility, uncertain fundamentals, and reliance on continued hype. For risk-tolerant investors who believe in USCR’s vision (or simply in its meme potential), a small allocation might be considered – essentially as a bet that this experiment gains broader traction. However, it’s vital to only invest what one can afford to lose, and to keep an eye on those on-chain metrics (reserve holdings, token distribution) that the project prides itself on.

For most investors, USCR should be approached as a speculative gamble rather than a core investment. Its story is still unfolding; it could explode further if the stars align, or it could implode if early excitement dies out. In any case, USCR has already made a mark by sparking conversation on how a transparent, community-driven reserve might look. Whether it ultimately becomes the next big thing or a cautionary tale, only time will tell. As always in crypto, do thorough research and exercise caution before diving into the latest hype. USCR’s journey from here will be a fascinating one to watch – with high stakes for those along for the ride.