The convergence of artificial intelligence (AI) and blockchain has spawned a new niche of crypto projects and tokens. In this article we explain what “AI crypto” means and survey the top AI crypto tokens in 2025, purely for educational purposes. We outline ten notable AI-related tokens and their projects (based on factors like market cap and development activity), explain our selection criteria, and discuss sector trends and risks. This is not financial advice – just a neutral overview to help readers understand the space.

What Is the AI Crypto Sector?

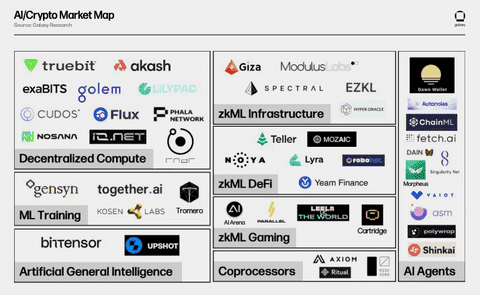

The AI crypto sector refers to blockchain projects that incorporate machine learning, data markets, autonomous agents, or similar AI-driven features. Unlike a generic coin, an AI token typically has a clear utility in an AI-powered network. For example, one industry write-up notes that AI tokens “pay for AI services (like compute or models), reward contributors (data providers or GPU operators), and secure a decentralized AI network”. Common use cases include decentralized machine-learning marketplaces (where users train or sell models), data marketplaces for training AI, on‑chain AI inference, and networks of autonomous “agents” that act on users’ behalf. In effect, AI tokens expand the crypto ecosystem into areas like data markets, prediction markets, GPU compute (for training/models), or on-chain smart applications. Major crypto platforms now even categorize these projects under “AI & Big Data”. Overall, the AI crypto sector fits within the broader blockchain ecosystem as a specialized niche: it still relies on underlying chains (Ethereum, Solana, etc.) but adds AI-specific protocols or marketplaces on top.

AI Crypto Market Diagram (source)

How We Selected These Top AI Tokens

We ranked the following projects by a combination of market capitalization, developer activity, AI relevance, and ecosystem traction – not by price performance or hype. In other words, inclusion in our list is not an endorsement or investment advice. Key criteria include:

-

Market Capitalization: Preference for tokens with larger or rapidly growing market caps in the AI/data category, indicating broad interest.

-

Developer and Community Activity: Active GitHub or protocol development, partnerships, and community engagement.

-

AI Utility: How central AI is to the project’s mission (e.g. ML model marketplace vs. general blockchain).

-

Ecosystem Traction: Real-world adoption, integrations with other AI or Web3 projects, and visibility in the crypto community.

Even with these criteria, readers should do their own research (DYOR). We simply aim to highlight notable AI projects of 2025 without “buy” signals.

Top 10 AI Tokens in 2025

-

Bittensor (TAO)

Bittensor is “a decentralized, peer-to-peer machine learning network” built on a novel “proof-of-intelligence” consensus. In plain terms, it’s an open platform where anyone can contribute AI models or data. The network evaluates models on specialized sub-networks (called subnets) and pays out rewards based on performance. Contributors who train models that produce high-quality outputs earn the native TAO token, while under-performing nodes earn less.

Role in AI: Bittensor aims to create an on-chain “intelligence marketplace”, democratizing AI training. Instead of training being confined to Google/AWS, Bittensor spreads training across many independent nodes. External users (even other apps) can query the network’s models via an API and receive outputs from the collectively-trained AI.

Key Features: The protocol uses blockchain incentives to coordinate learning. Validators rank contributions and allocate TAO tokens accordingly. The network is open-source and permissionless: anyone can join as a miner (model provider) or data provider. A notable technical feature is subnets for specialized tasks (e.g. text generation, prediction), allowing focused competition. Bittensor also mirrors Bitcoin by scheduling halving events to control inflation; for example, its daily issuance of TAO will halve from 7,200 to 3,600 coins.

-

NEAR Protocol (NEAR)

NEAR is a general-purpose, layer-1 blockchain known for its high performance and developer-friendliness. In 2025, NEAR is increasingly positioning itself as a foundation for AI-enabled apps. According to NEAR’s own documentation, it is a “modular, high-speed protocol designed for AI to act on behalf of users”. In practice, NEAR supports things like AI Intents and AI Agents on-chain, where smart contracts facilitate AI-driven user experiences.

Role in AI: NEAR doesn’t exclusively serve AI, but the platform hosts many AI projects. For example, NEAR ecosystem tools (like “Near Tasks”) provide human-verified datasets (crowdsourced labeling) for training AI models. It also enables developer tools for AI apps – such as auto-generating smart contracts or code debugging – to make dApp development easier. NEAR’s vision is that AI can be the front-end interface (smart agents acting on our behalf), while NEAR’s blockchain handles identity and trust.

Key Features: NEAR uses sharding and a novel consensus (Nightshade) for scalability, allowing many transactions per second. It offers low fees (sub-cent fees are common), making micro-payments between AI agents feasible. The platform has a growing suite of developer SDKs and grant programs to attract AI-related projects. Notably, NEAR’s architecture is designed to let smart contracts act as “backends” for AI user interfaces.

-

Internet Computer (ICP)

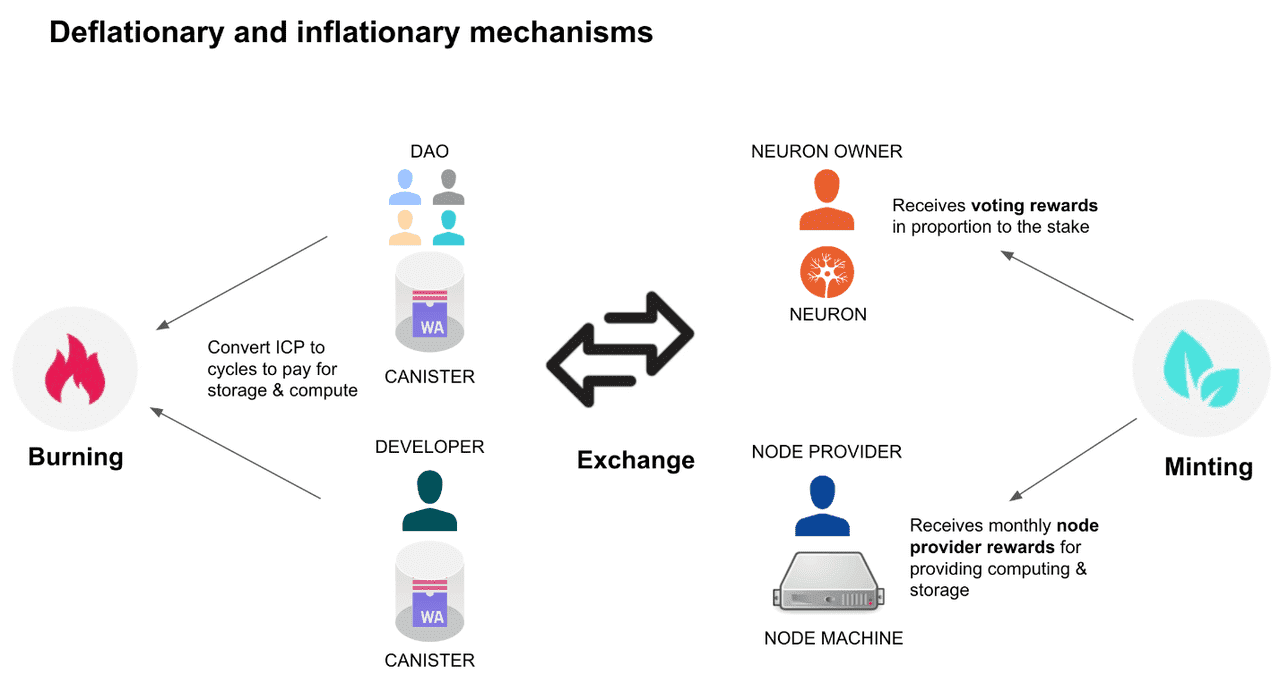

Developed by the DFINITY Foundation, the Internet Computer (ICP) is a unique blockchain that aims to extend the internet itself with decentralized computing power. It’s sometimes called the “world computer”. Technically, ICP is a high-performance chain with multi-terabyte memory, capable of running web apps entirely on-chain. Notably, ICP “is able to run AI models as tamperproof smart contracts,” a feature the project describes as game-changing.

Role in AI: ICP’s key claim is enabling on-chain AI inference. In practice, this means developers can deploy AI models (like neural networks) directly in smart contracts, without relying on external oracles. For example, a decentralized app could contain an image-recognition model on-chain. This positions ICP as a host for novel AI applications that require high security or transparency. Its large on-chain memory and compute also let multiple dApps share data for AI tasks.

Key Features: The Internet Computer introduces “canisters”, which are smart contracts with integrated computation and storage. These canisters can collectively work on large computations. ICP’s consensus (Threshold Relay + Chain Key) is designed for speed. Crucially, ICP can scale to web speeds: some marketing claims enable the Internet Computer to achieve “10k queries per second” for smart contracts. This underpins its AI focus, since many AI models are compute-intensive.

ICP Token Mechanism (source)

-

Render Token (RNDR)

Render Network (RNDR) is a decentralized GPU compute platform. It connects artists and developers who need heavy GPU power (for 3D rendering, VFX, or AI model training) with node operators who provide idle GPUs. In short, Render is a distributed marketplace for graphics and AI computing. According to Render’s description and analysis, it is “the world’s first decentralized GPU rendering platform,” which “harnesses unused GPUs around the world”. Its focus includes generative AI, making it relevant to both art and AI communities.

Role in AI: As AI (especially generative AI and machine learning) demands enormous GPU resources, Render helps supply those resources via a crypto-enabled marketplace. AI developers can submit compute jobs (e.g. training a neural network or generating images) and receive compute from GPU nodes. Because it is decentralized, Render aims to offer more affordable and scalable GPU access than centralized providers.

Key Features: Render runs on top of blockchains (initially Ethereum, now also Solana) and uses its RNDR token for payments. The network enforces compute jobs via smart contracts: a customer pays RNDR to the node when the job is done. Render also includes support for popular 3D engines (like Blender, Autodesk) and can deploy AI workloads. The project even trials “dedicated compute subnets” for specialized tasks such as edge inference for AI.

-

Fetch.ai (FET)

Fetch.ai is a platform that combines AI and blockchain to create an economy of autonomous agents. In this context, an “agent” is a software entity that can negotiate, transact, or search on behalf of a user. Fetch.ai’s vision is to enable millions of these agents to perform tasks automatically – for example, optimizing supply chains or coordinating IoT devices. As one analysis summarizes: “Fetch.ai’s mission is to build a decentralized digital economy where autonomous agents can interact and transact without human intervention”.

Role in AI: Fetch.ai’s core product is a multi-layer network for Autonomous Economic Agents (AEAs). These are AI-driven programs built on Fetch’s infrastructure. Key use cases include smart traffic systems (agents negotiate for transport routes), decentralized finance automation (agents trade assets), and smart home energy coordination. Unlike other platforms that directly train ML models, Fetch emphasizes agent orchestration and data exchange between agents.

Key Features: Fetch.ai uses a hybrid approach: its ledger combines blockchain with a directed acyclic graph (DAG) to enhance throughput. It includes an AI toolkit and an SDK for building agents. Notably, Fetch.ai introduced ASI-1 Mini, a Web3-native large language model designed for integration with its agent framework. It has also joined the so-called “Artificial Superintelligence Alliance”, merging efforts with projects like SingularityNET and Ocean (though that alliance is more of a branding initiative than a single protocol).

-

SingularityNET (AGIX)

SingularityNET is a blockchain-based platform aiming to create a global AI marketplace. Founded by AI researchers (including the creators of Hanson Robotics’ Sophia), it aspires to let developers publish AI algorithms that others can call and pay for. In essence, SingularityNET allows anyone to “create, share, and monetize” AI services via its network. It is often associated with long-term goals like artificial general intelligence (AGI) research.

Role in AI: SingularityNET’s vision is broad: it wants to be the “knowledge layer of the internet” by decentralizing AI development. Users can browse and test AI services (such as voice recognition, image generation, data analysis) on the SingularityNET marketplace. The platform also facilitates combining services: for example, one AI service can call another. This composability is intended to accelerate new AI applications. Notably, it also spun off an image AI project (DeepFalcon) and is working on other AI initiatives.

Key Features: The network initially launched on Ethereum and later integrated with Cardano. A key feature is its AI service registry, where each service is indexed with metadata. Payments between users and providers happen in the AGIX token. SingularityNET also supports staking on agents (users can stake AGIX on specific AI services to boost their visibility). Technically, it includes protocol layers for service discovery and metadata.

-

Ocean Protocol (OCEAN)

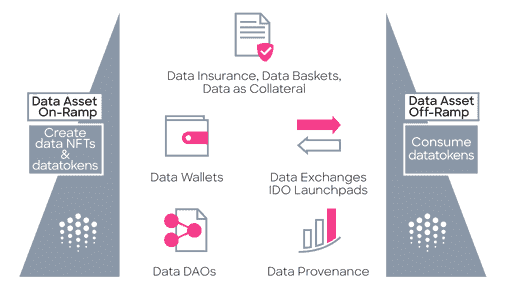

Ocean Protocol is a decentralized data marketplace. It lets data owners publish and sell datasets or AI models as “datatokens” on-chain. In practice, it enables secure sharing and monetization of data for AI training and other uses. A crypto primer explains: “Ocean Protocol connects data providers and consumers in a blockchain-based marketplace by tokenizing datasets… Data providers create ERC-20 tokens called datatokens; Ocean’s OCEAN token is used to buy those datatokens”.

Role in AI: Since AI is hungry for data, Ocean’s main contribution is providing the raw fuel for AI: high-quality datasets. For example, a company with proprietary images or models can use Ocean to control access via token payments, rather than open sale or piracy. AI developers can then purchase these data feeds to train or validate models. Ocean also includes “compute-to-data” features, meaning developers can run algorithms on data without exposing the raw data itself, preserving privacy.

Key Features: Ocean uses two token layers: datatokens (representing access to a specific dataset) and the OCEAN token (the currency of the network). Data providers stake OCEAN to list datasets and earn it when users buy access. Ocean has a permissioned pool for whitelisted data (like research data) and a public pool. It also has on-chain liquidity pools and staking mechanisms, blending DeFi with data markets. The platform supports multi-chain and cross-chain through bridges.

Ocean Protocol on-ramp and off-ramp (source)

-

Numeraire (NMR)

Numeraire (NMR) is the token of Numerai, a crowdsourced hedge fund that uses AI models. Numerai’s system is unusual: data scientists around the world build predictive models on encrypted stock market data, submit their forecasts, and stake NMR to back their confidence. Those with the best predictions earn NMR rewards. As one description notes, “Numerai is a blockchain-powered and AI-enabled hedge fund... Contributors are rewarded in Numeraire (NMR)… for submitting original and accurate market predictions”.

Role in AI: Numeraire is essentially the reward currency in a prediction market. While it’s not a data marketplace or compute network, it’s an AI token insofar as it incentivizes machine-learning in finance. The “AI” aspect is that thousands of models (including neural networks, gradient boosting, etc.) are being combined to drive a real investment fund. The platform uses modern machine learning techniques to aggregate the winning models into a Meta Model, which the hedge fund uses to trade.

Key Features: Numerai provides encrypted data (to protect proprietary info) and organizes weekly tournaments. Participants submit predictions for hundreds of stocks; accuracy is measured after real market movement. Participants can stake NMR on their models to increase potential payouts (and risk losing stake if wrong). The hedge fund’s profits are then paid out to participants.

-

The Graph (GRT)

The Graph is a decentralized indexing and query protocol for blockchain data. While not exclusively “AI”, it is often mentioned in AI contexts because it makes large on-chain datasets accessible (a prerequisite for any on-chain analytics or AI). The Graph’s own summary: “a decentralized protocol that indexes and organizes blockchain data, enabling efficient querying for developers building applications”. In practice, The Graph is like a Google for blockchain data.

Role in AI: AI and data analytics rely on fast access to structured data. The Graph provides that for blockchain data. For example, an AI model on Ethereum might need historical token transfer data or NFT metadata; The Graph lets developers efficiently fetch this information via open APIs called subgraphs. Some AI projects use The Graph to retrieve labeled data (e.g. sentiment analysis from social network subgraphs) or to process on-chain info.

Key Features: The Graph network has Indexers (nodes that index data and serve queries) and Curators (signal which data is useful by staking GRT). Developers write subgraph definitions (graphQL schemas) that tell Indexers what to index. Rewards in the GRT token pay Indexers for queries and Curators for accurate curation. The Graph supports multiple blockchains (Ethereum, Arbitrum, Polygon, etc.) and is open-source.

-

Filecoin (FIL)

Filecoin is a decentralized storage network that incentivizes users to rent out unused hard drive space. It’s one of the largest crypto projects by market cap. As one crypto education site puts it, “Filecoin ($FIL) is a decentralized, open-source cloud storage system… allowing users to have greater access and control over their data”. Think of it as a blockchain for file storage, akin to a decentralized Dropbox.

Role in AI: AI often requires massive datasets to train on (images, text, etc.). These datasets need secure, persistent storage. Filecoin provides this in a decentralized way. For AI projects, large data (like medical images or academic papers) can be stored on Filecoin and accessed as needed. The token incentivizes storage and retrieval, so it can host large-scale AI corpora. Some AI teams might choose Filecoin to ensure data immutability and distribution rather than trusting a central cloud.

Key Features: Filecoin uses proof-of-replication and proof-of-spacetime to verify files are stored correctly. Anyone can become a Storage Provider by pledging disk space; they earn FIL tokens by holding and serving files. Retrieval Providers earn FIL for quick file downloads. The network has its own blockchain for deals and payments. FIL has integrated with Ethereum (via Filecoin Virtual Machine) and even layer-2 solutions to expand its ecosystem.

Trends Shaping the AI Token Landscape in 2025

The AI crypto niche does not exist in a vacuum. Several trends are influencing it:

-

Regulatory Scrutiny and Clarity: Regulators are trying to catch up as AI and crypto intersect. Key policies like the EU’s MiCA may soon clarify utility tokens, allowing for better revenue models. However, tokens with security-like features could face legal challenges.

-

DeFi and On-Chain AI: There’s growing interest in integrating AI into blockchain. For example, Coinbase’s Base allows smart contracts to execute AI agents for autonomous token trading, prompting regulators to adapt.

-

Interoperability and Data Oracles: Protocols like Chainlink and The Graph enhance the ability of smart contracts to access external data, facilitating cross-chain AI transactions and promoting better network connectivity.

-

On-Chain AI Compute: Blockchains are increasing computational power, with platforms like Internet Computer (ICP) running AI models in smart contracts. This trend includes the DePIN movement, which utilizes blockchain for decentralized AI inference.

-

Institutional and Research Interest: Major financial players are entering the crypto space, enhancing legitimacy and drawing new investors to AI tokens. Academic partnerships are also fostering innovation in decentralized data and AI fairness.

Conclusion

The landscape of AI tokens in 2025 is diverse and evolving. Projects range from decentralized ML networks (Bittensor) to data marketplaces (Ocean), from AI agent platforms (Fetch.ai) to traditional data storage (Filecoin). This diversity is a strength – AI use cases are varied – but it also means there is no single “winner”. Each project has its niche, and none is risk-free. All carry technical, regulatory, and market risks, so any interest in them should be tempered by caution. Phemex lists many of these tokens and it is one of several venues where retail users can trade AI tokens (no endorsement is implied by listing it).

In summary, we have provided an overview of ten prominent AI-related crypto projects based on current information and market data. Again, this is not investment advice. We strongly advise readers to do their own research and consider their own risk tolerance before getting involved. Stake safely, stay informed, and treat any investment decision as taking on significant risk. Good luck, and may your journey into blockchain and AI be an educational one.