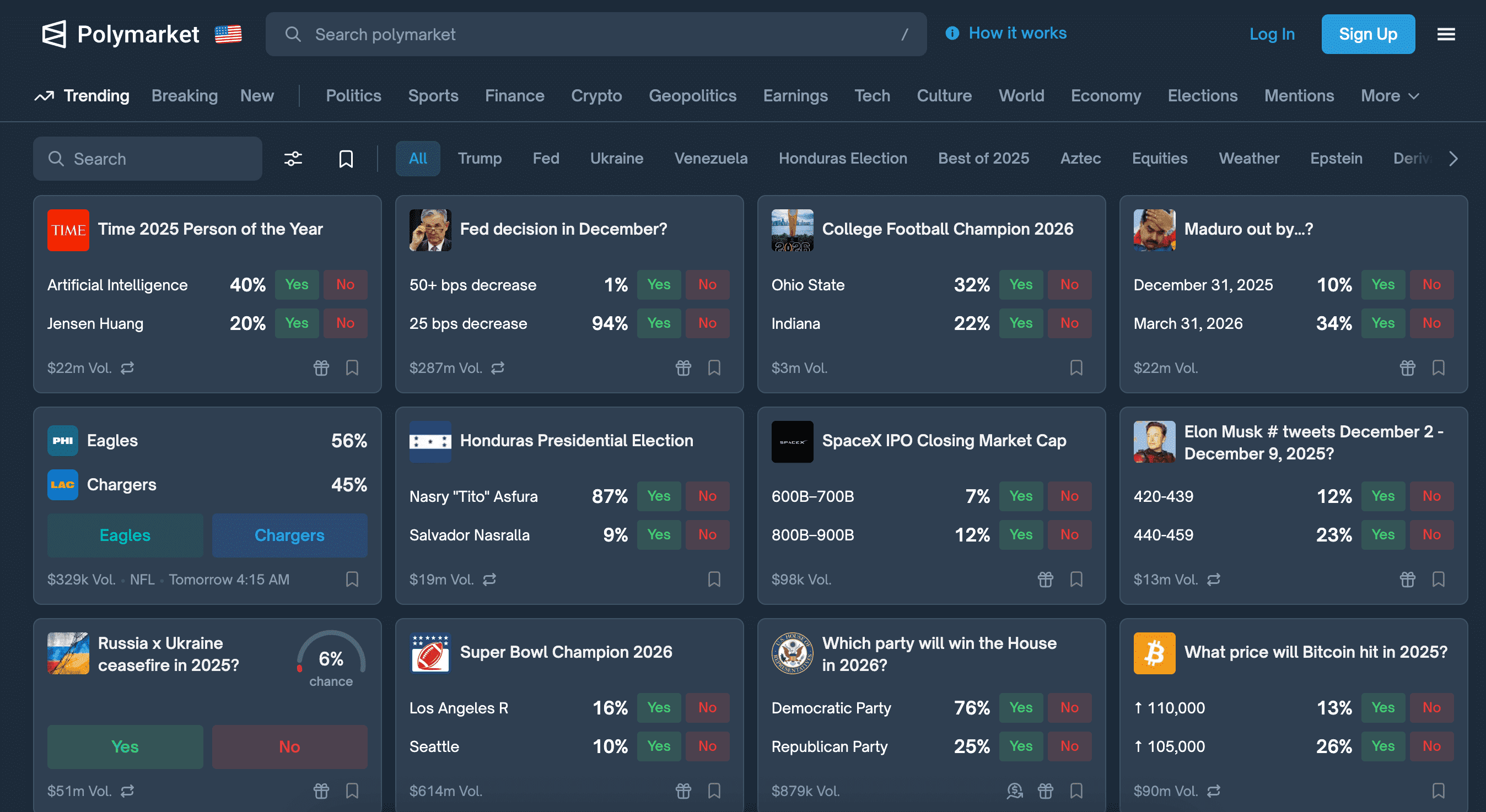

Prediction markets are platforms that facilitate trading of contracts based on the outcomes of future events, such as Bitcoin price levels, Federal Reserve rate decisions, or Super Bowl results. In 2025, these markets have experienced notable expansion, with cumulative trading volume across major platforms exceeding $27.9 billion from January to October, and November surpassing $10 billion amid sports and economic activity. Leading platforms include Polymarket, a decentralized exchange on Polygon and Solana, and Kalshi, a CFTC-regulated platform primarily serving U.S. users.

This guide examines prediction markets in 2025, including a step-by-step explanation of how Kalshi operates, the CNN partnership with Kalshi for incorporating live odds into broadcasts (announced December 2, 2025), and investor interest in Kalshi stock after its $1 billion funding round at an $11 billion valuation. Participants in crypto trading utilize these markets to hedge against regulatory developments or assess sentiment, where peer-to-peer structures have demonstrated higher accuracy than some traditional polls in certain cases. Developments like MetaMask's native integration with Polymarket, launched on December 4, 2025, have contributed to increased accessibility

What Exactly Is a Prediction Market?

A prediction market is a decentralized or regulated exchange where participants trade yes/no contracts tied to verifiable future events. The price of a "Yes" share ($0.00–$1.00) represents the collective probability assessment—e.g., $0.68 suggests a 68% likelihood. These differ from gambling as peer-to-peer mechanisms: Platforms such as Polymarket and Kalshi apply 0–2% fees, without a house edge.

Adoption in 2025 has increased due to regulatory progress, including Kalshi's 2024 CFTC ruling permitting nationwide event contracts, and media collaborations like CNN's exclusive partnership with Kalshi on December 2, 2025, to include live odds on politics, news, culture, and weather, spearheaded by CNN Chief Data Analyst Harry Enten. Examples of active markets include:

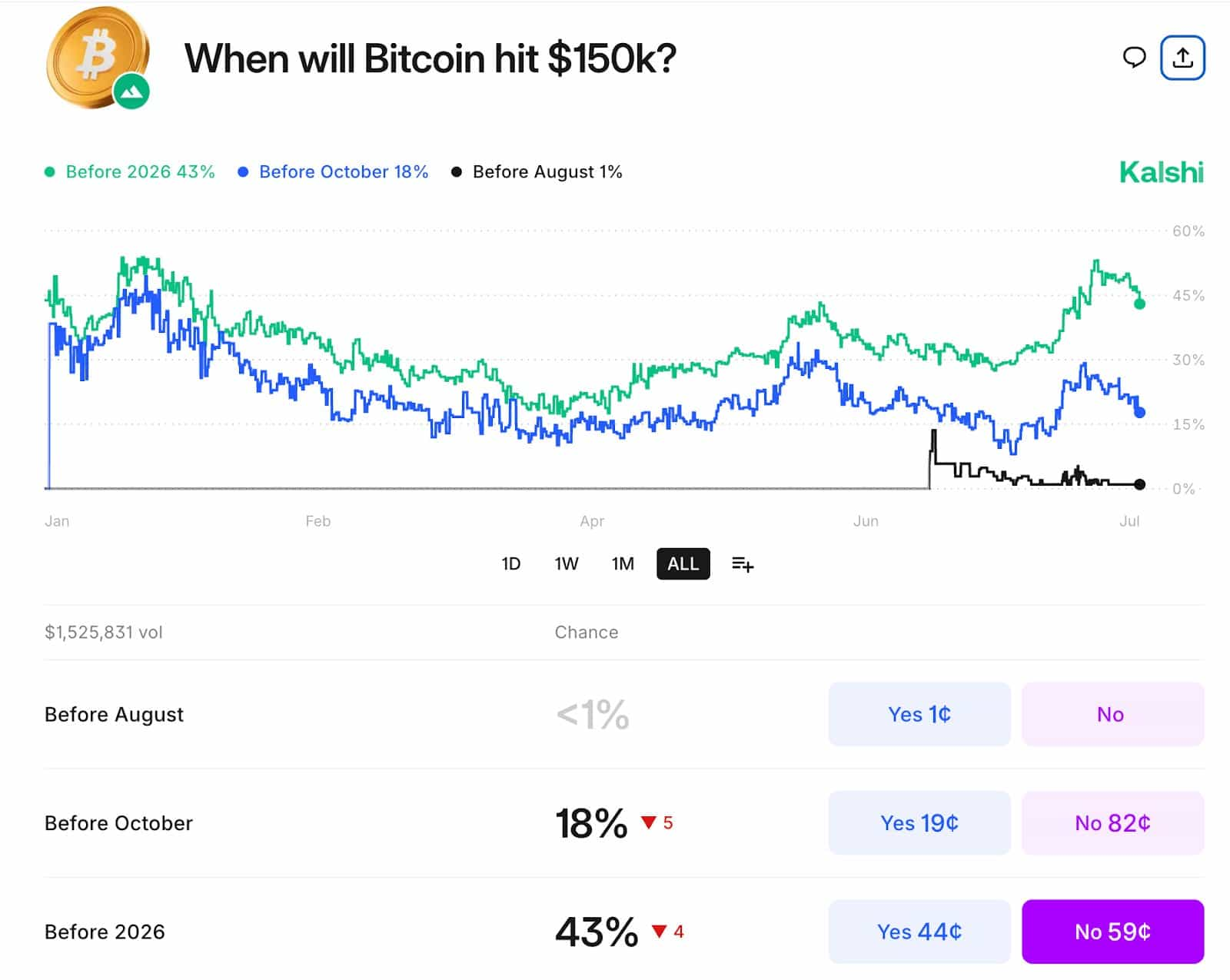

- "Will Bitcoin close above $150,000 by March 31, 2026?"

- "Will the Fed cut rates by 50 bps in March 2026?"

- "Who wins Super Bowl LIX?"

Traders apply these for hedging (e.g., "No" shares on rate hikes to manage BTC exposure) and arbitrage opportunities across platforms.

Quick Stats at a Glance

| Platform | 2025 Volume (Cumulative) | Key Features | Settlement |

|---|---|---|---|

| Polymarket | ~$18 billion | Decentralized, 85K+ markets (politics, crypto, sports) | USDC/USDT |

| Kalshi | $9–10 billion | CFTC-regulated, sports-heavy (NFL/NBA) | USD/USDC |

| Overall Market | $27.9B+ (Jan-Oct) | 20–120% APY yields for liquidity providers | Wallet-direct |

How Prediction Markets Work: A Step-by-Step Overview

Access is relatively simple, with no KYC needed for decentralized platforms like Polymarket. The standard process is:

- Market Creation: A yes/no question is submitted with a verifiable resolution source (e.g., CoinGecko for BTC prices or official Fed statements).

- Funding & Trading: Deposit USDC/USDT (or USD on Kalshi) to acquire Yes/No shares through an order book or automated market maker.

- Price Discovery: Probabilities adjust with emerging information—e.g., Polymarket's Ethereum ETF probabilities increased from 35% to 78% prior to a SEC disclosure, aligning with a 12% ETH price rise.

- Resolution: Oracles such as UMA or Chainlink validate results using official sources.

- Settlement: Correct shares redeem at $1, transferred automatically to wallets including MetaMask, Phantom, or Coinbase.

In detail, how does Kalshi work? As a CFTC-regulated exchange, Kalshi pairs buyers and sellers on yes/no contracts (e.g., "S&P 500 up today?"). Prices signal probabilities (e.g., $60 Yes = 60% chance), settling at $1/$0. Margin trading is unavailable; limits reach $7 million for significant events; fees cover trades only. It operates in 39 U.S. states (excluding 11 restricted ones), supporting USD/USDC deposits and connections with Robinhood and the NHL.

Why Prediction Markets Grew Significantly in 2025

Activity rose in 2025, with November volumes surpassing $10 billion. Contributing elements include:

- 2024–2025 U.S. Election Aftermath: Polymarket achieved $3.6 billion on one outcome, exceeding some polls in precision and receiving media attention.

- Regulatory Progress: Kalshi's CFTC success; Polymarket's acquisition of a licensed exchange and 2025 no-action letter.

- Institutional Funding: Intercontinental Exchange committed up to $2 billion to Polymarket; Kalshi secured $1 billion at $11 billion valuation, prompting interest in Kalshi stock (pre-IPO shares at ~$340–$345 on markets like Hiive and EquityZen).

- Wallet & Media Integrations: MetaMask introduced Polymarket access on December 4, 2025; Phantom and Backpack soon after. CNN's partnership with Kalshi adds real-time data for broader validation.

- Sports Expansion: Kalshi and Azuro markets for NFL/NBA/UFC surpassed $100 million weekly.

Forecasts suggest 46–50% yearly growth into 2026, tempered by concerns including manipulation (e.g., 2025 oracle front-running) and 85–90% retail loss rates.

Top Prediction Market Platforms in 2025

Ranked by reported 2025 trading volume – latest data as of December 8, 2025.

1. Polymarket

Polymarket is a decentralized prediction market platform operating on Polygon and Solana with USDC settlement. It reported approximately $18 billion in cumulative trading volume in 2025, based on on-chain data from Dune Analytics and TokenTerminal.

The platform hosts over 85,000 active markets, including politics, cryptocurrency price targets (such as BTC/ETH milestones), Fed policy decisions, entertainment outcomes, and weather events. Weekly open interest has ranged between $300 million and $600 million. Direct wallet access became available via MetaMask starting December 4, 2025. Transaction fees are 0–1 %. Direct access for U.S. residents remains restricted, though a beta relaunch through licensed exchanges is in progress.

2. Kalshi

Kalshi is a CFTC-regulated centralized exchange available nationwide in the United States, except in 11 restricted states. It recorded $9–10 billion in cumulative volume in 2025, with sports contracts (NFL, NBA, UFC, NHL) accounting for the majority of activity during peak seasons, per TokenTerminal and company reports. The platform accepts both USD and USDC deposits and has partnerships with Robinhood, StockX, and the NHL. It is the only fully licensed prediction market for U.S. residents, providing regulatory compliance.

How Crypto Traders Actually Use Prediction Markets in 2025

- Hedging Macro Risk

Traders holding long Bitcoin positions have used "No" shares on contracts like “Fed funds rate above 5 % at year-end” to offset potential downside from interest rate hikes. For instance, during Fed meetings in 2025, such hedges helped mitigate losses when Bitcoin dipped 5–7 % post-announcement. - Monitoring Early Signals

Prediction odds have often shifted before official news. On Polymarket, the probability for “Spot Ethereum ETF approved by May 31, 2025” rose from 35 % to 78 % two days before the SEC filing leaked, allowing traders to position in ETH ahead of a 12 % price surge. - Arbitrage Between Platforms

Price differences on identical events can create arbitrage opportunities. For example, during the 2025 NFL season, the same game-outcome contract was observed trading at $0.61 on Kalshi and $0.67 on an Azuro-powered front-end. Traders were able to buy the cheaper contract on one platform and sell the more expensive one on the other, locking in a risk-free profit of approximately 6–8 % (before fees).

- Providing Liquidity for Yield

Users add USDC to high-volume markets and earn fees. Liquidity on a $50 million Super Bowl market on Azuro or a Fed meeting market on Polymarket yielded 40–120 % APY during peak weeks in 2025, based on platform reports. - Gauging Market Sentiment

Traders reference specific contracts as indicators. Polymarket’s “Bitcoin above $200k by 2026” market has been used alongside the fear/greed index, with odds providing a more granular view of long-term expectations than broader sentiment tools.

Traders commonly integrate these with centralized exchanges like Phemex for spot conversions and perpetual hedges, utilizing options such as zero-fee spot trading for premium users and rapid USDT wallet transfers.

5 Key Benefits of Prediction Markets for Crypto Traders

- Higher forecasting accuracy in tested events

Showed greater accuracy than major polling averages in the 2024–2025 U.S. election and moved ahead of several Federal Reserve announcements. - Ability to hedge macro and regulatory risk

Traders can purchase “No” shares on rate hikes, ETF delays, or geopolitical events to offset exposure in Bitcoin or Ethereum positions. - Liquidity-provider yields of 20–120 % APY

Adding USDC to high-volume markets on Polymarket, Drift BET, or Azuro has produced reported annualized yields in this range on select contracts. - Direct wallet integration

Decentralized platforms require no KYC. Polymarket became accessible with one click from MetaMask, Phantom, and Coinbase Wallet starting December 4, 2025. - Peer-to-peer price discovery

Participants trade directly with each other; platforms charge only a small fee (0–2 %), resulting in no house edge.

5 Major Risks & Challenges Every Trader Must Know

- Manipulation and Wash-Trading Incidents

Multiple cases were reported in 2025, including one instance where a trader reportedly earned $30 million by front-running an oracle vote. - Regulatory Bans and Geographic Restrictions

Prediction markets are fully banned in France, Singapore, Romania, Switzerland, and 11 U.S. states. Polymarket still restricts direct access for most U.S. residents. - High Retail Loss Rate

Approximately 85–90 % of retail accounts on Polymarket and Kalshi ended 2025 with net losses, comparable to statistics seen in perpetual futures trading. - Oracle Disputes and Delayed Payouts

At least five high-profile markets in 2025 required manual resolution or experienced delays of days to weeks. - Price Volatility in Low-Liquidity Markets

Newly created or niche markets can experience swings of 10–20 % on single trades of $50,000 or less.

Final Thoughts

Prediction markets act as crowd-sourced forecasting mechanisms with hedging applications, distinct from gambling. Emphasis on high-volume contracts (>$1M open interest) enhances reliability. With over 314K monthly active users on Polymarket/Kalshi and 46–50% expected growth for 2026, they align with spot and perpetual trading. CNN's partnership with Kalshi highlights broader acceptance, while Kalshi stock and Polymarket's U.S. expansion indicate ongoing development. Decisions should rely on probabilities rather than conjecture.

Create Account & Claim Rewards

FAQ – Prediction Markets 2025

- Are prediction markets legal in 2025? Generally yes, in most countries. Kalshi holds CFTC regulation for U.S. users; Polymarket is available globally outside restricted areas.

- Can I trade from MetaMask? Yes—Polymarket integration active since December 4, 2025.

- Do they pay in crypto? Yes, USDC/USDT to wallets.

- Gambling or derivatives? Classified as derivatives under 2024–2025 CFTC decisions.

- How does Kalshi work for sports? Trade yes/no on NFL outcomes; prices indicate probabilities, correct settlements at $1.

- What's with CNN partners with Kalshi? Exclusive December 2025 data integration for live TV odds on events.

- Kalshi stock details? Private pre-IPO; ~$340/share on secondary markets following $1B raise at $11B valuation