Summary Box (Fast Facts)

-

Ticker Symbol: TAO

-

Current Price (June 9, 2025): $390.13

-

Chain: Independent Substrate (AI-focused L1 blockchain)

-

Contract Address: 0x77E06c9eCCf2E797fd462A92B6D7642EF85b0A44 (Ethereum wTAO)

-

Market Cap: $3.436 billion (rank #31)

-

Circulating/Max Supply: 8,807,335 / 21,000,000 TAO

-

ATH / ATL Price: ~$759 (Mar 2024) / ~$0.126 (Mar 2023)

-

All-Time ROI: ≈+310,000% (from initial price in 2023 to today)

-

Availability on Phemex: Yes (listed for spot trading; deep liquidity)

What Is Bittensor?

Bittensor is a decentralized blockchain-based machine learning network that rewards participants for contributing AI models and data. It functions as a peer-to-peer “intelligence marketplace” where developers, or “miners,” are compensated in TAO tokens based on the value of their models. Bittensor addresses the centralization of AI research by allowing anyone with computing power to collaboratively train models, promoting open access and decentralized governance.

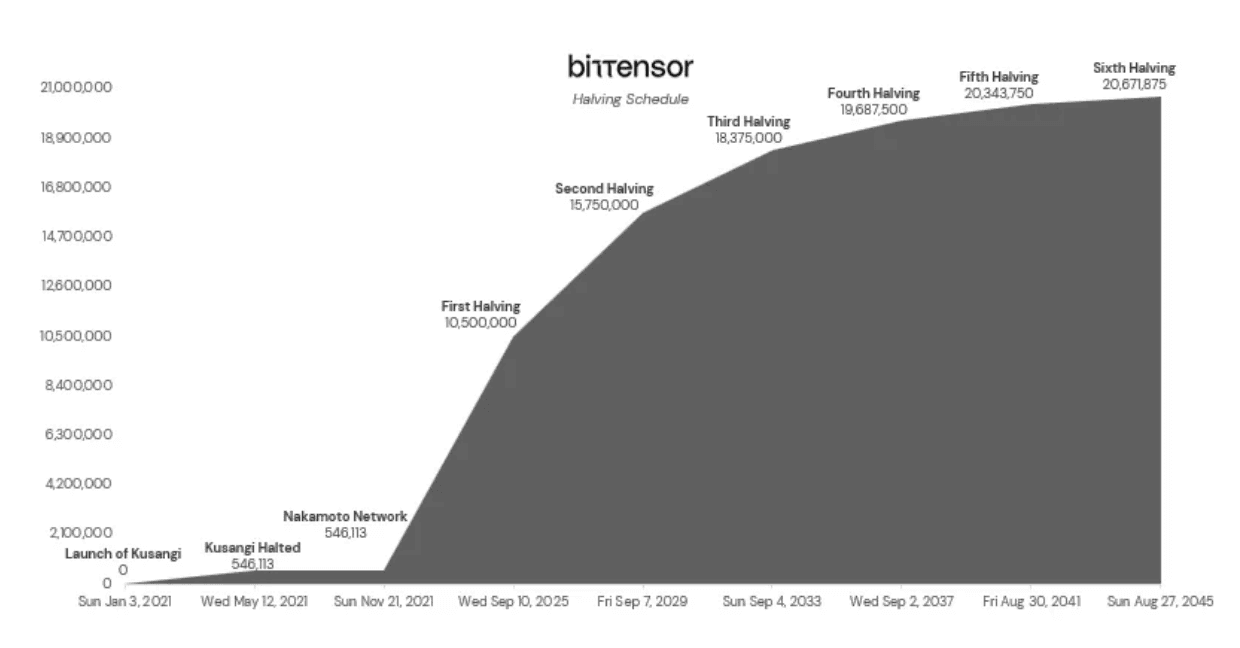

Validators assess model performance using a “Proof of Intelligence” consensus mechanism, while TAO serves as both an incentive and governance token. With a fixed cap of 21 million coins and halving events every four years, TAO's tokenomics are similar to Bitcoin’s, making it a scarce and potentially deflationary asset. Essentially, Bittensor combines AI and cryptocurrency with a Bitcoin-like economic model, drawing interest from both the AI and blockchain communities.

Current Price & Market Data (as of June 2025)

Bittensor’s TAO token is currently trading around $390, with a market capitalization of about $3.4 billion, making it the largest AI-focused cryptocurrency by market cap. It has a trading volume of approximately $72 million over 24 hours, reflecting strong liquidity. TAO is available on Phemex and as a wrapped token (wTAO) on Ethereum.

Recently, TAO has experienced volatility, up about 2-3% in the last day and 13% over the past month, though it’s down roughly 5% over the past week. It’s also about 50% below its all-time high of $750 from March 2024 but over 1,150% above its all-time low of $0.13 from early 2023, showcasing substantial gains for early investors.

Market sentiment is cautiously optimistic, with around 8.8 million TAO in circulation out of a total supply of 21 million, and over 72% staked in the network. This suggests strong long-term commitment among holders. Bittensor has over 200,000 active accounts and has been operational for over 1,300 days, indicating a stable project.

In summary, TAO is a large-cap asset within the emerging AI-crypto niche with significant price fluctuations. It would need to rally about 100% to reach its all-time high, while still being far above its previous lows. However, past performance does not guarantee future results, and traders should expect continued volatility as the market evolves.

Price History & Performance Overview

Bittensor’s price history has been dramatic. After a quiet launch in late 2021, TAO became publicly available in March 2023 at around $0.126. By the end of 2023, TAO surged to $266, marking a staggering 211,000% increase within the year, driven by rising interest in decentralized AI and a strong crypto bull run.

In early 2024, TAO reached an all-time high of approximately $759, fueled by media coverage and speculation. However, it faced a significant correction, dropping nearly 80% to around $165 during a broader market slump. By late 2024, TAO recovered to approximately $441.78, showing a year-over-year gain of about 65%.

In 2025, TAO experienced volatility, peaking at about $587 in January, boosted by Bitcoin's performance and new partnerships. However, it fell to around $170 by April due to profit-taking and regulatory concerns. By early June 2025, TAO climbed back to the $380-$400 range, demonstrating resilience despite the swings.

Overall, TAO has shown explosive growth, marked by substantial volatility. Each growth phase has been followed by sharp declines, but its trajectory indicates an overall uptrend, with significant price influences including exchange listings, technological advancements, and market cycles. Investors should be aware of the potential for large drawdowns as part of this emerging asset's nature.

Whale Activity & Smart Money Flows

Bittensor's token distribution shows significant whale concentration, with a few large holders controlling a substantial portion of TAO's supply. The largest wallet holds about 1,554,550 TAO, roughly 20% of the total supply. This concentration implies that a handful of addresses wield considerable influence over governance and market liquidity.

Recently, indicators suggest whales are accumulating TAO rather than dumping it. Over 70% of TAO is staked, primarily by large holders looking to earn rewards, indicating long-term commitment. New institutional players, like Oblong, Inc., are entering the ecosystem, further solidifying this trend. Oblong raised $7.5 million to accumulate TAO, viewing Bittensor as a foundation for future intelligence networks.

Major crypto infrastructure support, such as BitGo's partnership with Yuma for institutional staking, enhances confidence among whales. Currently, there are no signs of massive sell-offs, with large holders keeping funds either staked or engaged in DeFi through wrapped TAO (wTAO).

While whale concentration poses risks if sentiments change, the prevailing trend shows whales are accumulating or holding TAO, accompanied by new institutional interest. As of mid-2025, the outlook remains positive for Bittensor, with strong alignments suggesting stability and growth.

On-Chain & Technical Analysis

On-chain metrics for Bittensor indicate an active network and a token with interesting supply dynamics. The current 72% staking rate constrains circulating supply, increasing potential price volatility during demand spikes. With over 202,000 active accounts and a recent record of 118 subnets, there’s significant participation from miners, validators, and users, pointing to healthy network growth.

TAO's issuance halving, expected in late 2025, will reduce block rewards significantly, presenting both risks and potential bullish catalysts due to annual inflation of 3–4 million TAO currently. Despite token dilution concerns, the network’s growth has supported price appreciation.

From a technical perspective, TAO has shown both bullish and bearish signals, trading above key moving averages and maintaining an upward bias since early 2023. The $400 support level has been defended, while resistance levels are identified at $467 and the psychological $500 mark. If TAO breaks above $500, it could signal a strong bullish trend.

Momentum indicators were bearish during Q1 2025 but improved with a subsequent rebound, leading to a cautiously bullish outlook. Trading volume supports this view, with increased activity on up days and significant spikes during sell-offs. Traders will watch for volume patterns to confirm future price movements.

Short-Term Price Prediction (2025–2026)

When projecting Bittensor's price in the short term (2025–26), three scenarios can be considered:

? **Bull Case**: In a bullish scenario, Bittensor solidifies its position as a leading decentralized AI platform amid a favorable crypto environment. Key catalysts like the 2025 TAO halving may increase scarcity, driving demand. Successful technical upgrades and major partnerships could push TAO's price beyond its previous highs, possibly reaching $800-$1,000 by the end of 2026. This scenario assumes strong market dynamics and heightened interest from investors.

? **Neutral Case**: A neutral scenario envisions modest growth for TAO, with price oscillating between $250 and $500 over 2025-26. Development continues without major breakthroughs, resulting in incremental gains, with market sentiment mixed due to broader crypto market fluctuations. TAO may end 2025 around $450-$550 and possibly $600+ by 2026.

? **Bear Case**: In a bearish scenario, adverse developments like regulatory crackdowns or increased competition could lead to stagnation or price declines. If the market turns against crypto, TAO might drop below key supports, potentially revisiting the $165 level or lower, especially if whales sell off their holdings.

In crafting a short-term price forecast, it’s prudent to stay balanced. If Bittensor executes well and the crypto market turns bullish, TAO looks poised to soar to new heights (bull case). If it delivers only incremental progress and faces a lukewarm market, it may stall in a wide trading range (neutral). And if serious risks manifest, TAO’s price could retreat significantly (bear). As always, these outcomes are not guarantees but educated scenarios.

Long-Term Price Forecast (2027–2030)

Projecting Bittensor's future from 2027 to 2030 carries significant speculation. The long-term outlook depends on ecosystem adoption and competitive positioning in the AI+blockchain space.

In an optimistic scenario, Bittensor could serve as essential decentralized AI infrastructure, similar to Ethereum's role in DeFi/NFTs. A potential "global brain" concept might see TAO tokens used extensively for various AI tasks, making TAO highly valuable. If even a small portion of global AI services shifts to Bittensor, TAO could experience substantial growth, potentially reaching a price of $2,000 by 2030 and a market cap of around $40 billion.

Alternatively, Bittensor might perform well but remain in a competitive landscape alongside other decentralized AI networks, leading to more modest growth. In this case, TAO could be valued in the high hundreds of dollars, with a market cap in the single-digit billions.

On the pessimistic side, Bittensor’s vision may not materialize, facing challenges like declining developer interest or technological hurdles, which could result in TAO trading lower or the project becoming defunct.

A reasonable price forecast for TAO could range from quadruple digits in a success scenario to lower triple digits in case of challenges. A middle estimate might place it between $500 and $800 by 2028.

Fundamental Drivers of Growth

Several key factors could drive Bittensor's growth and TAO's price in the coming years:

-

Technological Differentiation: Bittensor innovatively merges blockchain with machine learning, featuring a Proof-of-Intelligence consensus and subnet architecture that provides a first-mover advantage in decentralized AI networks. Its unique tokenomics, akin to Bitcoin's, enhance its value as a cutting-edge AI utility. Continued advancements in technology and developer engagement will be crucial for maintaining this edge.

-

Network Adoption & Usage: The long-term value of TAO will depend on Bittensor's network utilization. With over 200k active accounts and 118 active subnets, each added subnet enhances TAO's utility, driving demand as miners and validators invest in hardware and stake TAO. If subnet growth continues significantly, it signals an expanding ecosystem. Moreover, real-world applications utilizing Bittensor's AI services would create organic demand. Key metrics to monitor include transaction volumes, queries served, and on-chain AI data exchange, indicating Bittensor's network value beyond speculation.

-

Integrations and Partnerships: Bittensor's integration into the broader crypto and AI sectors can act as a growth driver. A notable partnership is BitGo's collaboration for TAO staking, enhancing security for institutional investors and instilling confidence in TAO's future. Potential integrations into AI marketplaces, cloud platforms, or DeFi protocols could expand TAO's use, while bridging to other chains like Polkadot or Cosmos may attract new communities. Partnerships with AI companies or research institutions could validate Bittensor’s utility and drive adoption, making every collaboration an endorsement that brings in new users.

-

Community and Governance: A strong and passionate community is crucial for Bittensor's success, fostering network effects and raising awareness. The community, active on platforms like Reddit and Twitter, contributes through initiatives like dashboards and podcasts, helping educate newcomers. Bittensor's decentralized governance will also be vital, allowing TAO holders to influence the network's direction. If governance is effective and inclusive, it will engage more users, while stagnation could pose risks. Recent trends indicate a vibrant community, with TAO ranking as a top cryptocurrency on CoinGecko and rising searches reflecting growing popularity.

-

Macro Trends in AI and Crypto: Bittensor is positioned at the intersection of the AI revolution and the expanding cryptocurrency market. The predicted increase in AI spending this decade could benefit related projects like Bittensor as interest and capital flow rise. The maturation of the crypto market suggests a larger audience for novel projects by 2030. If narratives linking AI and crypto take hold, Bittensor could lead this movement, with endorsements suggesting it may even surpass Bitcoin as a global store of value by leveraging AI to address world challenges.

Key Risks to Consider

Investing in Bittensor and its token TAO carries notable risks:

-

Competitive Threats: Bittensor has first-mover advantage in blockchain-based AI, but the market could become competitive with projects like Gensyn and Fetch.ai. If competitors offer more efficient solutions or secure key partnerships, Bittensor's growth may falter. Additionally, the platform faces competition from centralized AI systems like those of Google and OpenAI.

-

Token Dilution & Emission: TAO is currently in a high-emission phase until the 2025 halving, which could lead to price suppression if demand doesn’t keep pace with the influx of new tokens. With only ~42% of the max supply currently in circulation, the total supply will increase significantly, potentially diluting token value even if the network succeeds.

-

Regulatory Impact: The regulation of AI and cryptocurrencies is still developing. Bittensor could face scrutiny concerning crypto mining or compliance with evolving AI data-sharing laws. Unfavorable regulatory classification could limit exchange access or participation, resulting in unpredictable impacts on TAO's value and usability.

-

Execution and Adoption Risks: Bittensor is a complex project facing execution challenges. It must attract high-quality AI models and maintain a strong infrastructure; otherwise, users may lose interest. There's a centralization risk, as many validators are linked to the project team, creating potential points of failure or censorship. If development slows or community engagement declines, it could signal stagnation and jeopardize Bittensor’s relevance.

-

Market Volatility and Liquidity: TAO is highly volatile, with dramatic price swings driven by market sentiment. In a bear market, TAO's price could drop significantly, regardless of Bittensor's progress. While TAO has decent volume, it lacks widespread exchange listings, which can lead to high slippage during a sale. Events that impact liquidity, like exchange delistings, could further increase volatility and downside risk.

Analyst Sentiment & Community Insights

Analyst and community sentiment around Bittensor has been notably vibrant, with bullish opinions from industry figures like Barry Silbert, who likened it to early Bitcoin and suggested TAO could outperform BTC as a store of value. Technical analysis from Decode projected a potential price of $1,000 for TAO by 2025, reflecting optimism about the token. The project has garnered interest from investment funds, indicating that "smart money" is considering Bittensor.

However, sentiment has fluctuated, particularly during a market correction in early 2025 when bearish indicators led to a decline in TAO's price from $500 to below $200, causing mixed reactions on social media. Despite this, by mid-2025, engagement around Bittensor improved, with active discussions and a rise in Reddit posts.

On Crypto Twitter, Bittensor is gaining traction, with influencers highlighting increased search interest. Media coverage from outlets like FXStreet and BeInCrypto has also contributed to a generally positive sentiment around the project, recognizing its strong fundamentals and potential despite short-term uncertainties.

Overall, there's a sense of cautious optimism within the community, as many view Bittensor as a serious player in the "AI crypto" space. While voices of caution exist due to market volatility, there haven't been major negative incidents impacting the project.

Is Bittensor a Good Investment?

Is Bittensor a good investment? It depends on your risk tolerance, time horizon, and belief in the project's vision. Here's a quick summary of pros and cons:

Pros: Bittensor operates at the intersection of artificial intelligence and decentralized networks, making it a compelling long-term investment if you believe in these trends. The TAO token has clear utility (rewarding contributors and staking), and its fixed supply creates a scarcity similar to Bitcoin. There’s growing user engagement and a committed community, along with institutional interest. Bittensor has a first-mover advantage with a functioning network, positioning it well in the "Web3 AI" space.

Cons: However, Bittensor remains a speculative investment. TAO's price has risen significantly, raising concerns about whether good news is already factored in. The project must consistently progress to maintain its value, as any setbacks could lead to declines. Broader market conditions and competition pose additional risks.

In summary, while Bittensor has strong fundamentals, uncertainty remains high. Investors should conduct their own research and only invest what they can afford to lose. Bittensor holds promising potential for 2025–2030, but it's crucial to be prepared for volatility.

Why Trade Bittensor on Phemex?

Phemex is a top-tier centralized exchange offering a secure and user-focused trading experience, making it an excellent choice for trading Bittensor. Here is a guide on how to buy Bittensor TAO token on Phemex. Known for its robust security and high performance, Phemex provides a seamless environment for traders. Key features for TAO traders include:

-

Deep-Liquidity Spot Trading: Trade TAO and over 500 other crypto assets with strong liquidity, tight spreads, and minimal slippage. The intuitive interface supports both beginners and experienced traders with advanced charting tools.

-

Advanced Derivatives & High Leverage: Phemex excels in futures trading, offering up to 100x leverage on major coins. When TAO futures are launched, traders can expect a world-class trading environment with low latency for executing strategies.

-

AI-Powered Trading Bots: Automate your TAO trading strategies with Phemex's user-friendly AI bots, allowing for grid trading and smart rebalancing, perfect for those wanting to trade without constant attention.

-

Phemex Earn – Passive Income: HODL TAO with the potential to earn passive yield through various flexible and fixed saving plans. This allows you to grow your holdings while you trade.

-

Phemex Social Trading (Pulse): Engage in Pulse, a social trading platform where users share insights and analyses about the market, allowing you to follow experienced traders and participate in community discussions.

In summary, trading TAO on Phemex offers the best of both worlds: institutional-grade exchange reliability and an innovative suite of trader tools. Phemex listing TAO means you have a trustworthy venue to access Bittensor’s market, and it’s easy to learn how to buy TAO on the platform. Whether you want to execute a quick trade on a price breakout or invest for the long term, Phemex is a top exchange to trade Bittensor.

Disclaimer:

The information provided in this article is for educational and informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile and involve significant risk. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. Phemex is not responsible for any losses incurred due to trading or investing based on the content of this article.