Summary

- DeGods is a Solana-based NFT project made of 10,000 deflationary PFP NFTs.

- The DeGods NFT collection is one of the most popular and valuable NFT collections on the market, and bills itself as Solana’s top NFT collection.

- Like other NFT projects, DeGods tries to cultivate an engaged, passionate community, but it is distinctive in that it discourages “flipping” (which is how most NFT traders profit) and instead encourages investors to HODL their DeGods NFTs.

What Is DeGods NFT? From Rocky Beginnings to Top-Ranking Project

DeGods NFT is one of the hottest PFP NFT projects on the scene, with one of the highest trading volumes. It is hosted on Solana, featuring some 10,000 NFTs which, according to its profile on the OpenSea NFT marketplace, is “A deflationary collection of degenerates, punks, and misfits. Gods of the metaverse & masters of our own universe.”

The DeGods NFT collection (Source: OpenSea)

Although it now enjoys the confidence and interest of investors, DeGods’ beginnings were marked by events that nearly terminated the project in its infancy.

The creators of DeGods first released the DeGods NFT collection to an exclusive list of potential investors who had to complete and share an online challenge to be included in the list. However, an army of bots and fake NFTs joined this process, which ended with the almost instant “sale out” of the assets. This provoked enough distrust about the project that its price plummeted and put the entire project in danger of being snuffed out.

However, the DeGods team did not lose faith and saved the project by implementing several key upgrades.

As for DeGod’s vision, the style of these digital artworks is quite interesting and unconventional, which is entirely in keeping up with the whole venture. Generally speaking, DeGods are avatars of the project’s “gods,” an amalgam of mythological deities transformed into a modern style with a distinct punk element.

There are 5 NFT categories by the rarity of their features—Common, Uncommon, Rare, Super Rare, and Mystic.

What’s Special About DeGods NFT?

In record time, the ultra-saturated NFT space has seen the emergence of projects. The continued offering of new NFT ventures means that developers face the Herculean task of having to provide something exciting if they want to attract investors’ attention and, above all, money.

It seems that the people behind DeGods have found the right formula as this project offers interesting features that support and grow its value.

A snapshot of DeGods’ characteristic roadmap (Source: DeGods.com)

DeGods NFT Burn

DeGods was designed to be a deflationary asset so that it becomes more valuable over time for HODLers. One of the main ways they achieve this appreciation of their NFT assets is through “burning.”

And here’s where they got a bit experimental.

Paper Hands Bitch Tax

The term “paper hands” is a derogatory term for investors who sell their assets at the slightest sign of market unrest, even if it means selling below purchase value.

The opposite term is “diamond hands”—investors that resist the pressure to sell even when market conditions change. The idea is that diamonds are created under great pressure, while paper yields even with minimal effort.

In order to discourage “paper hand” investors who will reduce DeGods’ value as they panic-sell, the DeGods project team charged a so-called Paper Hand Bitch Tax. This was a 33.3% fee levied on DeGods NFT holders who sold their non-fungible tokens on the secondary markets at a price lower than what they bought them for or below DeGods NFT’s floor price.

PHBT was a first-of-its-kind experiment…which the team later on acknowledged was a flawed approach.

Moving forward, there will be a standard 9.99% royalty fee charged on every sale.

Low-Value NFT Buyback

While this was a significant step toward maintaining value for the DeGods project, the team behind it wasn’t ready to settle for just that measure.

The proceeds of the Paper Hands Bitch Tax fees were deposited into the DeGods treasury. They were then used to purchase and burn those DeGods NFTs that traded on the secondary markets for the lowest price. Thus 535 tokens were burned, meaning there are currently less than 10,000 NFTs. This made the project’s NFTs even rarer.

DeGods DUST Utility Token

DUST is the Solana utility token, which can only be minted by burning NFTs or staking a DeGod NFT. DUST tokens give DeGods NFT holders the opportunity to generate passive income from staking their collections. This staking and burning process is what props up the DUST token value (besides the member perks that can be purchased with it.)

Celebrity attention

Last but not least, DeGods succeeded in attracting the attention of a number of highly bankable celebrities. TV personality Howie Mandel, football stars David Beckham and Wayne Rooney, and basketball legend Shaquille O’Neal are among the famous investors in DeGod’s Solana NFT project.

Where to Buy DeGods NFT?

DeGods can currently be bought from OpenSea as well as Solana’s biggest NFT marketplace, Magic Eden. After purchasing a DeGod, a holder can join the collection’s exclusive Discord Community and gain access to DeDAO channels.

Who’s Behind DeGods NFT?

As with many projects in the NFT space, DeGods is helmed by a pseudonymous individual who simply goes by the name “Frank” which is apparently also the collective name given to the community of DeGods’ loyal supporters.

DeGods DAO

DeDAO is the project’s governing body, funded through the marketplace fee imposed on all DeGods NFT transactions. DeGod’s DAO consists of:

- The DAO Leads—leaders of the DeGods community.

- The Divine Council—elected leaders from the community.

- The DeAlpha Team—the team behind the project.

One of the more interesting moves by DeGod’s DeDAO was purchasing a basketball team at rapper Ice Cube’s Big3 basketball league.

How to Earn DeGods DUST and What to Do With It?

DeGods’ DUST staking page (Source: stake.deadgods.com)

One of the big changes for DeGods was the release of the project’s utility token DUST, which offers some pretty interesting functionality. Through these DeGods tokens, investors can upgrade their NFTs.

The idea of the DeGods DUST token and revamped NFTs was implemented in early 2022 but quickly gained popularity among investors.

The idea is as follows: the DeGods have released so-called DeadGods—visually enhanced versions of the DeGods NFT collection, which are available for 1000 DUST. In fact, DeadGods NFTs are not separate tokens but are linked to the original NFTs. This means holders retain their unique asset, which is burned out of circulation and replaced by the corresponding DeadGod.

For NFT holders to upgrade from DeGods to DeadGods, they must purchase StarDust for 1000 DUST. On the other hand, the DeGods DUST coins can only be created by DeadGods or DeGods staking or burning. They are also available to purchase on certain exchanges though they tend to offer low liquidity.

DeGods Staking

So why would DeGods holders upgrade to DeadGod? Higher staking rewards.

The DUST token is used to buy premium perks like art upgrades, merch, access to community events, games, and products. In addition, DUST tokens give holders the right to participate in prize draws and to mint upcoming DeGods collections.

Is It Worth Buying DeGods? Value, Price, and Outlook

When the DeGods NFT collection was launched in October last year, the price per token was 3 SOL. At the time of writing, DeGods NFT’s floor price (the lowest price of an NFT in the collection) is 365 SOL or just over $12,000. The floor price subsequently soared to 596 SOL by September.

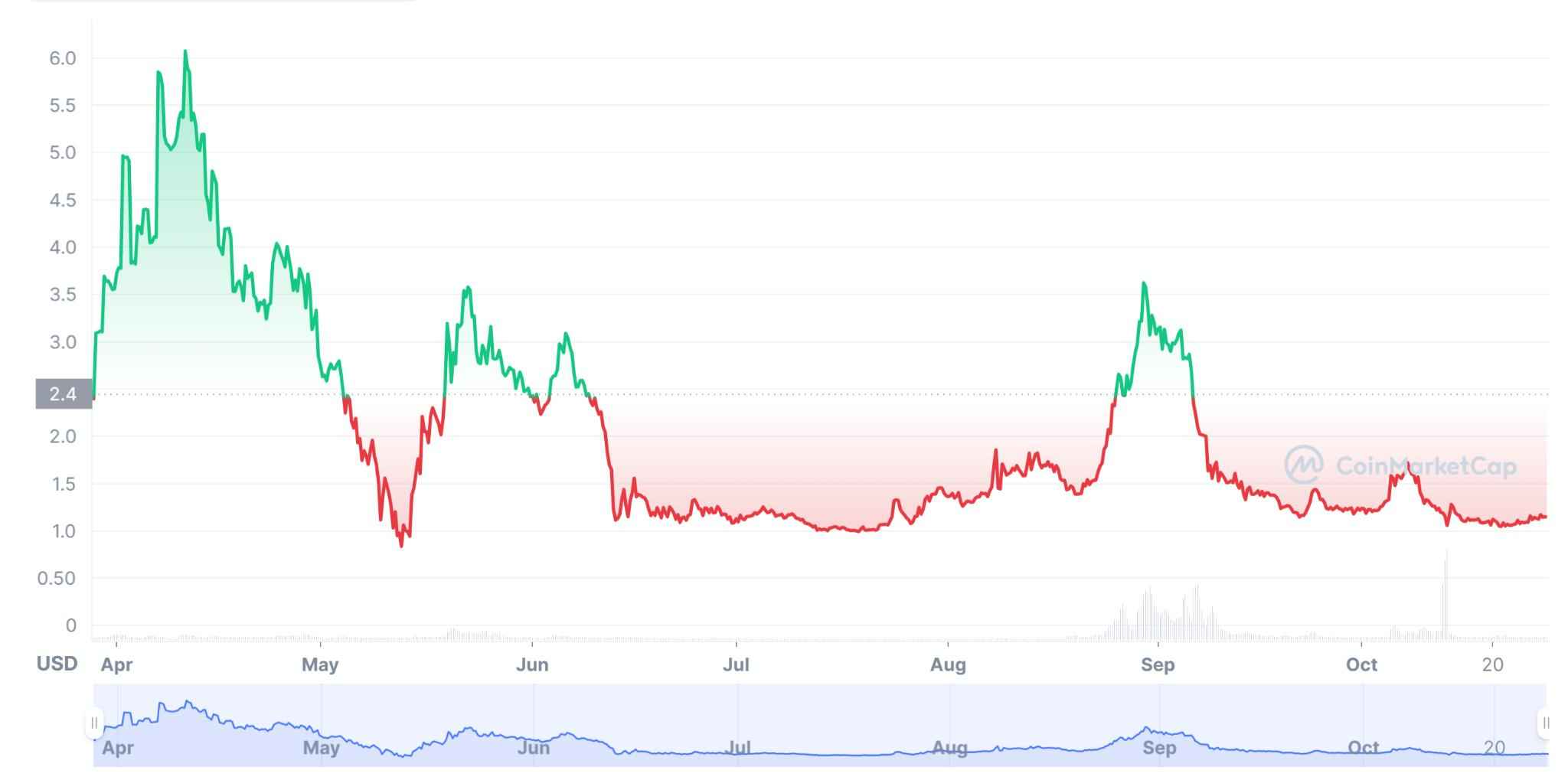

DUST’s price chart since the beginning of 2022 (Source: Coinmarketcap.com)

Some ways that DeGods maintains its high-value status include the aforementioned burning mechanisms, as well as encouraging NFT holders to burn their DeGods tokens to obtain the higher rewards from DeadGods staking.

Also, the DUST token was launched with zero supply as yet another deflationary measure. The plan is to limit the circulation of these coins to 33,300,000, which is not a lot, considering the high interest in the project. This, in turn, aims to maintain the high value of the coins.

Another important point is that two out of three halvings have already taken place for the DeGods DUST utility token, which cuts staking rewards (i.e., issued supply) in half. This again, results in a limited supply of tokens, keeping prices high.

Looking at the development of the project and future plans, DeGods looks like a promising venture. However, keep in mind that this project encourages long-term investments, with mechanisms in place to incentivize long-term holding and make it punitive to sell at a low price or to depreciate assets.

Conclusion

You don’t have to spend much time in the NFT world to see that not all NFT projects are created equal. In fact, it is justified to say that most of these ventures fail for many reasons. Some projects even turn out to be complete scams.

Fortunately for investors, however, crypto NFT projects still regularly emerge that bring real and meaningful value to stakeholders. From its inception in 2021 until now, DeGods has proven to be one such success.

Despite its rocky beginnings, this NFT venture has become one of the field’s most sought-after and valued projects, bouncing back stronger and more resilient with each setback.

Read More

- What is Gods Unchained (GODS): Earn Money Playing NFT Card Games

- What Are Non-Fungible Tokens (NFTs): Introduction to NFTs

- What Is DeFi: How To Be Your Own Bank With $100

- https://phemex.com/academy/defi

- Top 7 Best Play-To-Earn Crypto NFT Games 2022

- What Are Decentralized Applications (dapps)?

- How to DYOR (Do Your Own Research): A Comprehensive Guide

- What is A DAO: Decentralizing Organizational Governance