Traders use harmonic patterns as a form of technical analysis to identify specific types of price chart patterns. These patterns are used to predict future price movements of an underlying asset. Harmonic patterns can be applied to all types of assets, including cryptocurrencies.

Harmonic patterns are among the most advanced yet rewarding chart patterns in a trader’s toolkit. They rely on precise geometric shapes and Fibonacci ratios to predict future price movements. Unlike basic patterns that just rely on visual shapes, harmonic patterns use specific Fibonacci retracement and extension levels to signal where a trend might reverse. This gives traders a method to enter high-probability trades with well-defined risk/reward. In the volatile world of crypto trading, harmonic pattern trading can elevate your analysis to a professional level and empower you to anticipate big market turns before they happen. Why are these patterns useful in crypto? Cryptocurrencies often exhibit repetitive boom-and-bust cycles and sharp swings, which can fit well into harmonic structures. Harmonic patterns, such as the Gartley or Butterfly, help traders identify potential trend reversal zones. In this article, we’ll break down what harmonic patterns are, delve into the theory behind why they work, show you how to spot the common harmonic chart patterns, and discuss how to trade them.

What Are Harmonic Patterns?

Harmonic patterns represent specific formations that arise frequently in price charts. They help traders understand price action and predict price direction. In addition, these patterns are used to identify trend reversal patterns so that traders can initiate a trade with a high probability of success.

Harmonic patterns represent various price action points of an asset, like a cryptocurrency or stock. These patterns are highly structured and rely upon the application of Fibonacci ratios. By identifying patterns of varying lengths and magnitudes, Fibonacci ratios can be applied to predict future movements of the asset.

Harmonic patterns illustrate a progression of up and down legs or price movements. Most common harmonic patterns include a progression of four legs or four pricing movements. These legs or pricing movements are defined by five price points in time.

The lengths of these legs follow strict mathematical ratios. These mathematical ratios are represented by Fibonacci levels and represent the main retracement levels used for harmonic patterns.

The pricing movements of different harmonic patterns can have different Fibonacci ratios. Fibonacci retracements and extensions are used to identify potential reversal zones: where there is a high probability that the price will reverse.

Fibonacci Levels and Harmonic Patterns

Harmonic patterns rely on the Fibonacci numerical sequence and ratios that are derived from this sequence. The sequence starts with 0 and 1 and is generated by adding two previous numbers in the sequence to arrive at the next number.

For example, the sequence begins with 0+1=1, 1+1=2, 1+2=3. Repeatedly applying this algorithm results in the following: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987 . . .

Various Fibonacci ratios can be derived from this sequence. What is amazing about this sequence of numbers is how these Fibonacci ratios are present in many things in our daily lives and things throughout the universe, from their application to the human body, to galaxy formations, to architecture, and to DNA structures.

These ratios play a significant role in the financial markets, especially in the area of technical analysis. For example, these ratios are studied to provide clues as to where a given financial market will move.

Certain key Fibonacci ratios include 61.8%, 38.2%, and 23.5%:

-

The 61.8% ratio is found by dividing one number in the sequence by the number that follows it. For example, 21 divided by 34 equals 0.6176, and 55 divided by 89 equals 0.61797.

-

The 38.2% ratio is derived by dividing a number in the sequence by the number located two positions to the right of that number. For instance, 89 divided by 233 equals approximately 0.38197.

-

The 23.6% ratio is found by dividing a number in the sequence by the number that is three positions to the right of that number. For example, 21 divided by 89 equals about 0.23595.

Higher-order Fibonacci ratios include 1.272, 1.618, and 2.24.

Traders use these ratios to predict price actions by applying Fibonacci retracements and extensions to pricing patterns that meet predefined criteria.

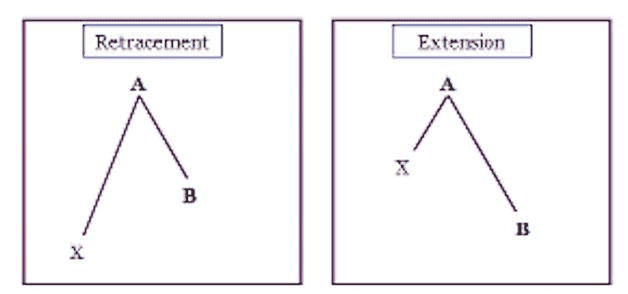

As illustrated in the figure on the left, a price pattern is represented by an initial swing or leg designated at XA. From this swing XA, a retracement — leg AB — represents a minor pullback or change in the direction of the swing XA.

Fibonacci extensions — illustrated on the right — measure impulse waves in the direction of a trend. From the swing XA, the extension AB extends more than 100% of the length of the swing XA.

For example, assume the price of a cryptocurrency starts at $100 and goes up to $200 during a first leg. The currency then falls back down to $150 during a second leg. The price movement back down to $150 is a Fibonacci retracement. This price movement in the second leg “retraces” half-way back to the original price of $100.

If the price then starts to increase and pushes back towards $200, this is an extension of the original price increase from $100 to $200.

Why Are Harmonic Patterns Important?

Technical traders study price patterns and apply various Fibonacci ratios to determine critical points.

Fibonacci retracement levels are horizontal lines that identify locations of support and resistance levels. Each level is associated with one of the Fibonacci ratios or percentages. It shows how much of a prior move the price has retraced. The direction of the previous trend is likely to continue. However, the price usually retraces to one of the Fibonacci ratios before that trend continues.

Fibonacci retracements and extensions are important harmonic trading indicators that identify support lines, identify resistance levels, place stop-loss orders, and set target prices.

What Are Different Types of Harmonic Patterns?

There are many types of harmonic patterns. The more popular harmonic patterns rely on five price points that are visualized together to define a specific geometrical structure. Parts of this structure must define specific Fibonacci ratios among the five price points. These five price points are typically represented as X, A, B, C, and D.

Popular five price point harmonic patterns include: the Gartley, the butterfly, the bat, and the shark. Each pattern includes both a bullish and a bearish version. The bullish versions identify a possible buying situation whereas the bearish versions identify a possible selling situation.

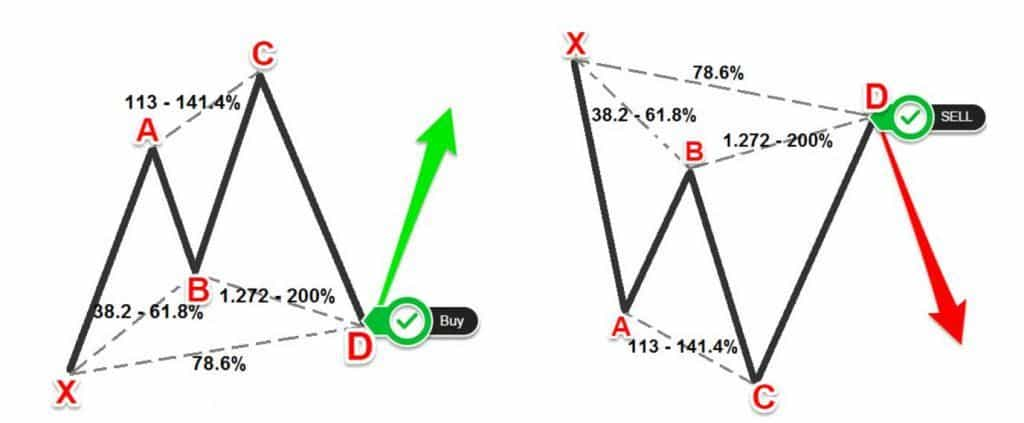

The Gartley

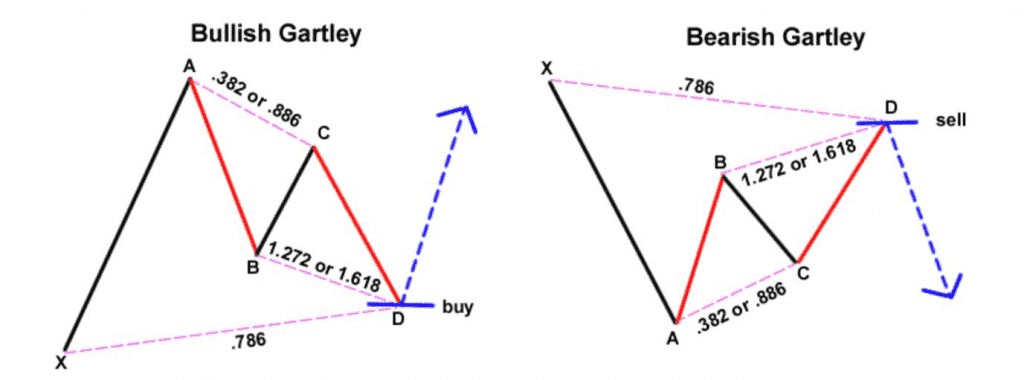

Both the Bullish Gartley and Bearish Gartley patterns are illustrated below.

Focusing on the Bullish Gartley pattern, initially, the price moves or swings from an initial price point X up to a second price point A. Price then corrects or retraces to B. This Bullish Gartley pattern requires that B is a 0.618 Fibonacci retracement of swing XA. In other words, B must retrace back to 61.8% of the price X.

From B, the price moves up via leg BC which is a 0.382 to 0.886 Fibonacci retracement of AB. In other words, the price C represents 38.2% to 88.6% of the price A.

The next move is down via the leg CD. CD is a 1.272 to 1.618 Fibonacci extension of AB. CD is 127.2% to 161.8% of leg AB.

D is also a 0.786 Fibonacci retracement of swing XA.

Most harmonic patterns will reverse in direction after the CD leg. Here, the Bullish Gartley pattern predicts a reversal in a positive direction as illustrated by the blue “buy” arrow. This identifies a potential trade opportunity referred to as a Potential Reversal Zone (PRZ) or a Pattern Completion Zone (PCZ).

For example, point D is where a trader might consider entering a long position. Most traders will want to wait for some price action to confirm that the price is starting to rise. A stop-loss can be placed below the trader’s entry point.

In the Bullish Gartley, point D is where short positions could be entered.

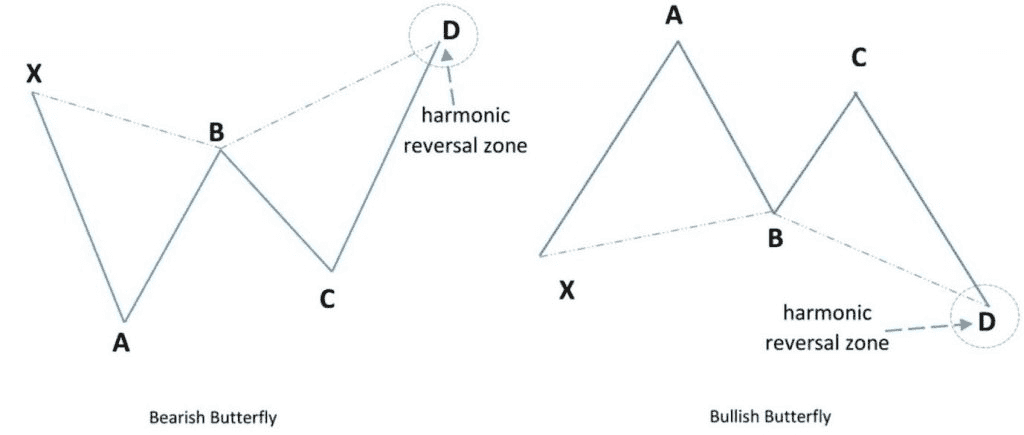

The Butterfly

Here we will look at the Bearish Butterfly harmonic pattern.

Reviewing the Bearish Butterfly, the price initially swings down from X to A. The up wave of leg AB is a 0.786 retracement of the XA swing. BC is a 0.382 to 0.886 retracement of AB. CD is a 1.618 to 2.24 extension of AB. D is a 1.27 – 1.618 extension of the XA swing. D — the reversal zone — is an area to consider a short trade.

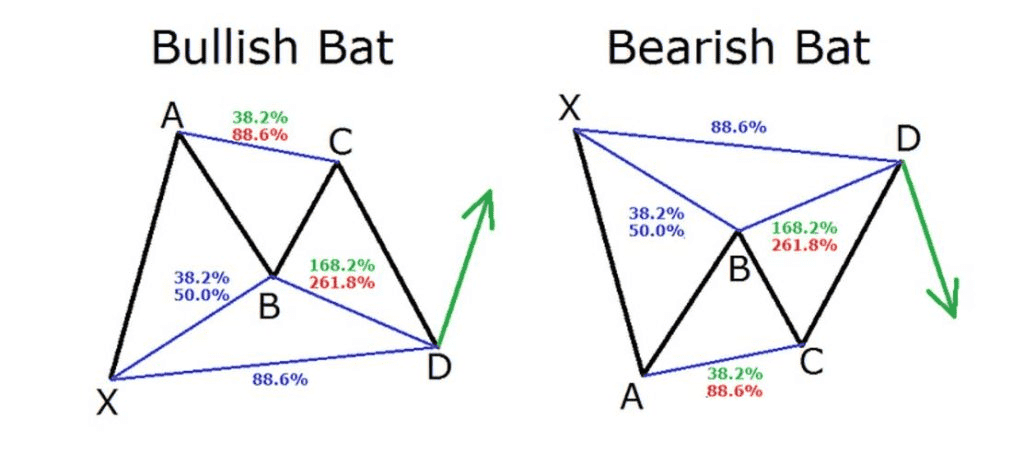

The Bat

Let’s look at a Bearish Bat example.

Initially, there is a drop in price via swing XA. B retraces 38.2% to 50% of XA. BC then retraces 38.2% to 88.6% of AB. CD is a 168.2% to 261.8% extension of AB. D is an 88.6% retracement of XA. D is the area to look for a short.

The Shark (Harmonic Impulse Wave)

This five-point harmonic pattern gets its name from its middle hump that looks like a shark’s dorsal fin. This pattern is also called the Harmonic Impulse Wave. The bullish pattern is provided on the left, the bearish pattern provided on the right.

How to Trade Harmonic Patterns

Trading harmonic patterns revolves around entering at point D (the Potential Reversal Zone) and then riding the anticipated reversal. Here are the key steps and considerations for trading harmonic chart patterns:

-

Entry at PRZ (Point D): When trading harmonic patterns, the goal is to enter at point D, the Potential Reversal Zone. For bullish patterns, place a buy order near D; for bearish patterns, sell/short. Look for confirmation, like a bullish candlestick pattern, before entering. Aggressive traders may set limit orders at Fibonacci levels.

-

Stop Loss Placement: One advantage of harmonic patterns is their natural stop-loss levels. Place your stop just beyond the PRZ. For example, if the PRZ is between $100 and $102, a stop at $98 is typical. This minimizes losses if the pattern fails.

-

Profit Targets: Common targets include Point C (last swing before D) and Point A (natural resistance). Traders often take partial profits at these levels, with more ambitious targets beyond A, such as a 1.618 extension.

-

Risk/Reward: Harmonic patterns often yield excellent risk/reward ratios, usually 3:1 or better. Calculate this ratio before entering. Even a 40% success rate can be profitable with favorable ratios.

-

Trade Example: For instance, if Ethereum forms a Bearish Bat pattern with D at $2000, a trader might short ETH around $1990-$2000, placing a stop at $2025. Targets would be $1900 and $1800. If ETH reverses, the trader locks in profits at these levels.

-

Multiple Timeframe Alignment: Checking higher timeframes can provide additional confidence. If a bullish pattern aligns with a strong support level on a higher timeframe, it increases the likelihood of a successful trade.

-

Partial Positions and Scaling: For uncertainty, consider scaling in at the PRZ. Enter smaller portions at different Fibonacci levels to manage risks effectively.

-

Use of Trading Bots: Some traders automate the process using bots to execute harmonic patterns. Bots can be programmed to place trades upon hitting specified Fibonacci levels, streamlining execution.

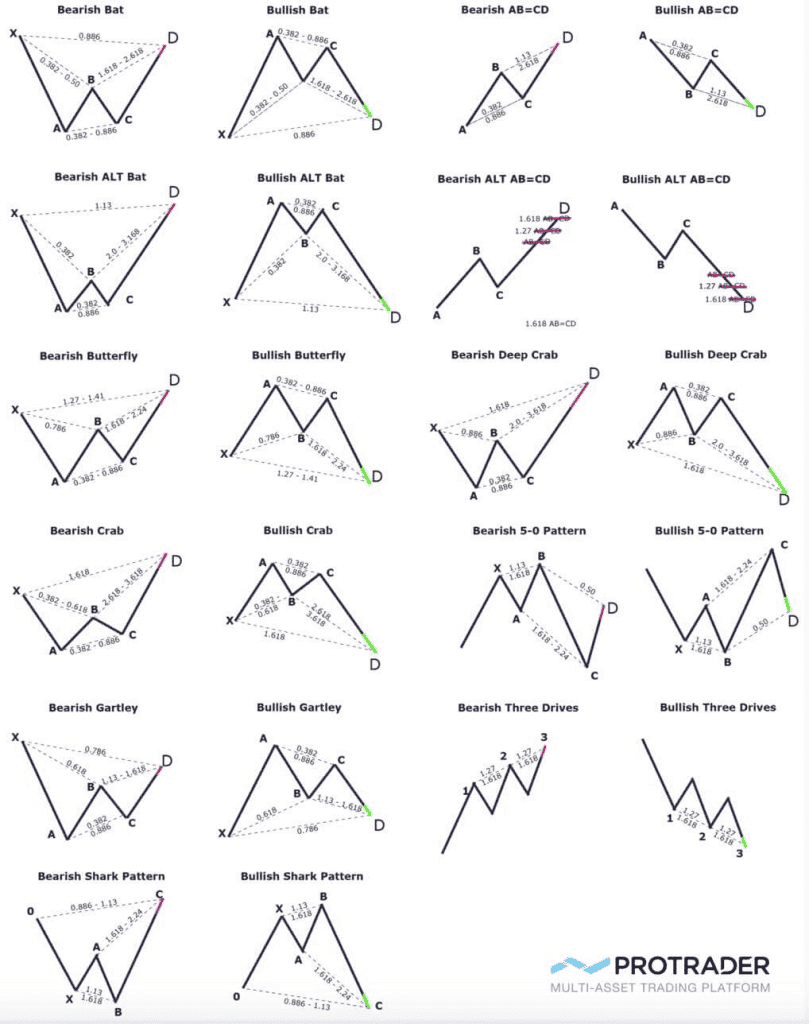

What Is A Harmonic Pattern Cheat Sheet?

There are a lot of different harmonic patterns with specific price actions that need to be monitored. To aid pattern recognition and to simplify identifying the correct harmonic pattern, some traders use harmonic pattern cheat sheets.

These sheets illustrate various different harmonic patterns, both bearish and bullish versions, along with the required Fibonacci ratios between the various price swings and legs.

A Harmonic Pattern Cheat Sheet example is illustrated below:

What Is A Harmonic Pattern Scanner?

A harmonic pattern scanner is a software tool that aids the harmonic pattern trader. These software tools use algorithms (artificial intelligence or machine learning) that scan pricing histories and automatically identify harmonic patterns. The tools aid traders by providing real time identifications and notifications.

Scanners provide an accurate trade signal to traders as soon as harmonic patterns are recognized. Once a pattern is recognized, these tools provide easy to read and understand marked up charts and descriptions, labeling key price points and Fibonacci levels.

Some scanners include a dashboard that allows traders to generate a watchlist for preferred types of harmonic patterns.

One advantage of harmonic pattern scanners is that they can scan and review a large number of patterns quickly and can provide a ranking to identify patterns of higher interest.

What Are the Advantages of Harmonic Patterns?

These patterns frequently occur and have a history of being repeatable and reliable, thereby producing a high probability of success. Therefore, these patterns provide a clear structure for entry and exit points.

Using harmonic patterns removes subjectivity from trading. These patterns must match the harmonic patterns exactly to be a valid trading indicator. This can make trading straightforward: do the price movements and Fibonacci ratios indicate an identifiable harmonic pattern? If not, then other trading tools may need to be used.

What Are the Disadvantages of Harmonic Patterns?

The actual price points and calculated Fibonacci ratios often do not exactly align with the clear structure required by a given harmonic pattern. This can make the proper harmonic pattern difficult to identify.

In addition, it takes time for these five-point defined harmonic patterns to materialize. Some anxious traders may enter their trades early before all required price legs and swings are defined.

Conclusion

Harmonic patterns bring a precise and methodical approach to the art of trading - one that can significantly enhance your ability to forecast market moves. By learning to recognize structures like the Gartley, Butterfly, Bat, or Shark, you transform what might appear to casual observers as random price squiggles into well-defined setups with high probability outcomes. It allows you to plan trades well in advance, execute entries and exits with confidence, and manage your risk with clarity. Keep in mind that success with harmonic pattern trading requires practice and patience. The first few patterns you attempt might not work out – you could misidentify a level or encounter a pattern failure. Over time through DYOR, you’ll also get a sense of which patterns work best for which coins or timeframes.

As you elevate your trading to a pro level, it’s crucial to have the right platform. This is where Phemex comes into play as an ideal partner for harmonic traders. Phemex offers a robust trading environment with advanced charting and deep liquidity for major crypto pairs, ensuring you can enter and exit around point D without excessive slippage. With spot trading for straightforward buys/sells and futures trading for shorting or leverage, Phemex gives you the flexibility to act on both bullish and bearish harmonic patterns. Moreover, Phemex’s features like Trading Bots can help automate your harmonic strategy. Don’t forget to take advantage of Phemex Earn to grow your capital in between trades as the interest you earn could supplement your trading profits or offset some trading fees over time.