Imagine you have a crypto trading tool that reveals whether a Bitcoin rally has real strength or is running on fumes. Twiggs Money Flow is exactly that: a technical indicator that blends price and volume to gauge buying vs. selling pressure in the market. In one glance, it shows if bulls truly dominate or if bears lurk behind the scenes. This makes Twiggs Money Flow invaluable in crypto trading, where explosive moves can sometimes be deceiving. In this guide, we’ll demystify what Twiggs Money Flow means in technical analysis, how to trade Twiggs Money Flow in crypto, and share a step-by-step strategy for beginners. By the end, you’ll know how to use Twiggs Money Flow on Bitcoin charts to trade smarter and more confidently.

What Is Twiggs Money Flow?

Twiggs Money Flow (TMF) is a volume-based indicator that measures the flow of money into and out of an asset. In simple terms, it tells you when buyers are in control (positive values) and when sellers are in control (negative values) by tracking both price movement and trading volume. Visually, Twiggs Money Flow appears as a single oscillating line on a chart, typically placed in a separate panel below the price candles. Imagine a wavy line that hovers around a zero midpoint – climbing above zero when buying pressure prevails, and dipping below zero when selling pressure dominates.

When and where does it appear? Twiggs Money Flow is an indicator you add to any chart – it doesn’t “appear” like a candlestick pattern, but rather is calculated continuously from price and volume data. You can apply it to Bitcoin, Ethereum, other crypto, or any asset with volume. It’s visible on all timeframes, though it tends to be most insightful on intermediate to higher timeframes (e.g. 4-hour, daily, weekly charts) where volume trends are more established. Traders often use TMF in swing trading and trend following strategies. For example, a swing trader might check the daily TMF to confirm if a week-long uptrend in Bitcoin is backed by solid volume. While short-term scalpers can use it on lower timeframes, the Twiggs Money Flow strategy for beginners typically shines in catching medium-term moves and confirming breakout trends rather than hyper-fast day trades.

Source: Quantified Strategies

The Psychology Behind Twiggs Money Flow

Every technical indicator has human psychology under the hood, and Twiggs Money Flow reflects the tug-of-war between buyers and sellers. Think of it as a sentiment meter born from real trades. When TMF is rising or positive, it signals that buyers are consistently pushing prices to the upper half of the trading range on high volume, which means demand is outpacing supply. This bullish behavior often means optimism or accumulation: big players or lots of traders are quietly loading up on Bitcoin, confident the price will rise. On the flip side, a falling or negative TMF shows sellers are driving prices toward the low end of the range on strong volume, indicating distribution or bearish sentiment – traders are eager to sell, perhaps out of fear the price will drop.

Bullish vs. bearish interpretations: A high positive Twiggs Money Flow suggests bullish conviction. You’ll see this when Bitcoin rallies on increasing volume and closes strongly day after day; the TMF line will be well above zero, telling us the crowd (and likely some “smart money”) is greedily buying. A deep negative TMF points to bearish control – for instance, during a sharp sell-off or downtrend, Bitcoin might close near daily lows on heavy volume, pulling TMF below zero as fearful selling takes hold. Traders view these extremes as confirmation of trends: a strongly positive TMF confirms a robust uptrend, while a very negative TMF confirms a serious downtrend.

How to Identify Twiggs Money Flow on Your Charts

Identifying and using Twiggs Money Flow is straightforward even if you’re new to technical analysis. Follow these step-by-step instructions to add TMF to your Bitcoin chart and recognize its key signals:

-

Add the Twiggs Money Flow indicator: Open your trading platform (for example, TradingView or Phemex’s charting interface) and find the Indicators menu. Search for “Twiggs Money Flow (TMF)” - many platforms have it built-in or shared publicly. Click to add it to your chart. It will appear as a separate panel below the price chart, typically as a line oscillating around zero.

-

Observe the zero line and baseline behavior: The central feature of TMF is the zero line. When the Twiggs Money Flow line is above 0, it means bullish money flow (buying pressure). When it’s below 0, it indicates bearish money flow (selling pressure). The further above or below zero the line goes, the stronger the imbalance. For instance, a TMF reading of +0.40 (or +40% in some scales) is a strong bullish signal, whereas –0.40 is strongly bearish. A flat or gently wavering line near zero means the market’s volume pressure is neutral or indecisive.

-

Recognize formation of signals: There are two primary Twiggs Money Flow signals to watch for – zero-line crossovers and divergences. A zero-line crossover happens when the TMF line crosses from negative to positive or vice versa. For example, imagine Bitcoin has been drifting downward in a pullback; TMF is below zero during the dip. Suddenly, Bitcoin bounces off a support level and TMF crosses above zero – this flip to positive is a clue that buyers are back in force. Conversely, if Bitcoin is rallying but TMF crosses below zero, it warns that sellers might be gaining ground. Divergences occur when the price and the indicator disagree: if price makes a new high but TMF makes a lower high, that’s a bearish divergence (buyers are losing enthusiasm despite the price rise). If price makes a new low but TMF makes a higher low, that’s a bullish divergence (selling pressure is easing even though price fell). These divergences often foreshadow reversals.

-

Confirm with other tools: Twiggs Money Flow is powerful alone, but it’s best used alongside other analysis for confirmation. Combine TMF with classic indicators like RSI or MACD to validate momentum. For instance, if TMF shows bullish divergence and around the same time RSI flashes oversold and turns upward, the case for a bounce strengthens. Use trendlines and support/resistance on the price chart, too.

Source: Market Volume

How to Trade Twiggs Money Flow (Entry and Exit Strategies)

Knowing how to read TMF is half the battle, now let’s translate those readings into trade decisions. Below are some practical strategies for how to trade Twiggs Money Flow in crypto, including entries, exits, and risk management:

-

Entering a Trade - Follow the Volume Trend: One popular Twiggs Money Flow strategy for beginners is to enter trades in the direction of a new TMF signal. For example, go long when Twiggs Money Flow crosses above zero and price breaks a resistance or forms a bullish candlestick pattern (like an engulfing candle) at the same time. This double confirmation with volume flow turning bullish and price action turning bullish, increasing the odds of a successful trade. Conversely, go short when TMF crosses below zero on a breakdown of support or after a bearish pattern, signaling distribution by sellers. The key is patience: wait for that alignment between TMF and price. A practical example: suppose Bitcoin has been trading sideways and Twiggs Money Flow was hugging zero. Suddenly, BTC’s price surges above a consolidation range and TMF spikes into positive territory – this is your green light that the breakout might have legs, and you could enter a long position targeting the next resistance level.

-

Stop-Loss Placement: Even with a strong TMF signal, never skip a stop-loss. Since TMF itself doesn’t give a price level for a stop, use technical price levels. Place your stop-loss below a recent swing low or support if you’re going long on a bullish TMF signal. That way, if the bullish signal fails and price falls through support (invalidating the TMF cue), you exit with minimal damage. For a short trade, put a stop just above the recent swing high or resistance level that price shouldn’t break if the TMF bearish signal is valid.

-

Take-Profit Targets: Plan your exit in advance. Take-profit levels can be set at the next major resistance zones, or you can use technical indicators to guide you – for example, if price approaches a Fibonacci retracement level or previous high, consider taking profit there.

-

Risk Management Tips: Avoid overtrading on every tiny blip of the indicator; focus on significant moves or divergence on higher timeframes to increase probability. Remember that no indicator is infallible. TMF can sometimes give false positives (e.g., a brief cross above zero that quickly reverses), especially in choppy markets, so it’s wise to wait for a candle close or a bit of confirmation rather than jumping in mid-signal.

A simulated BTC and TMF chart

When Not to Use It (Limitations of Twiggs Money Flow)

No indicator works everywhere, and Twiggs Money Flow has its limitations. Here are scenarios and conditions where TMF can mislead, and how to cope:

-

Sideways, Low-Volatility Markets: In a dull, range-bound market, TMF can whipsaw above and below zero frequently, giving false signals. For example, if Bitcoin spends two weeks stuck between $30k and $31k on moderate volume, TMF might flip positive one day and negative the next without a true trend forming. In such conditions, it’s often best to step back or use a longer TMF period to filter out noise.

-

Low Volume or Illiquid Assets: Twiggs Money Flow relies on volume, so it’s less reliable on assets or timeframes with sparse volume. In crypto, major coins like Bitcoin and Ethereum typically have consistent volume, but low-cap altcoins or overnight sessions can see thin trading. A big trader could skew volume one way on a single candle, making TMF spike erroneously.

-

False Positives and “Respecting Zero”: As mentioned earlier, a one-off volume spike can push TMF briefly into positive or negative territory and then it drifts back toward zero without follow-through. To avoid such false positives, you can require that TMF “respects the zero line”, meaning once it crosses, it stays on that side and forms a clear peak or trough.

In summary, don’t use Twiggs Money Flow blindly in environments where it’s prone to give erratic readings. Recognize when the market conditions are suitable (trending or building towards a breakout) versus when TMF is being “chopped up” by noise. By filtering out those unreliable scenarios, you’ll sharpen the indicator’s effectiveness in your trading.

Bonus: History, Developer, and Pro Tips

Every indicator has a backstory and a few extra tricks up its sleeve. Here’s some bonus knowledge about Twiggs Money Flow:

-

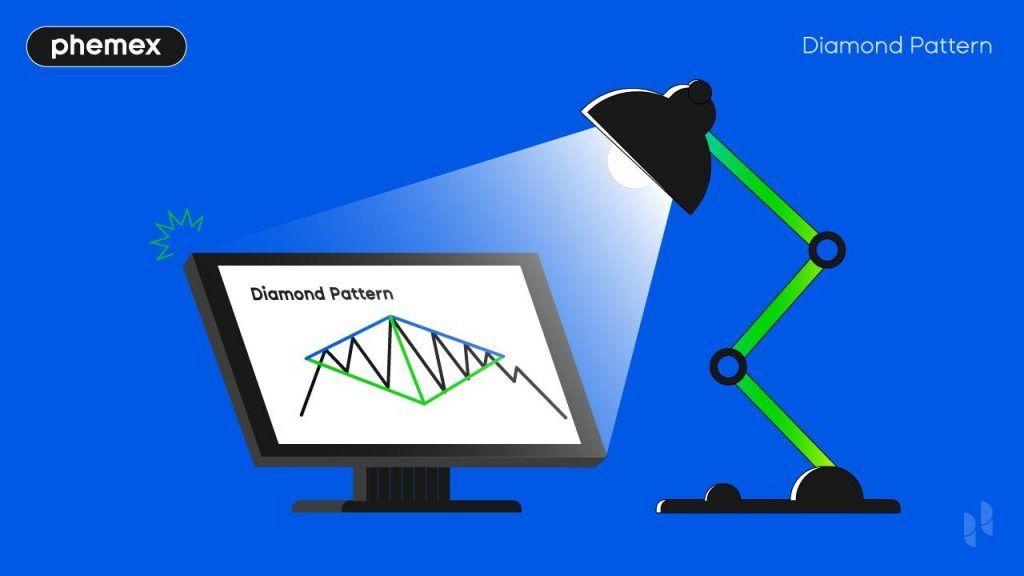

Origin and Developer: The Twiggs Money Flow indicator was developed by Colin Twiggs, a technical analyst and the founder of Incredible Charts. Colin introduced TMF in the mid-2000s as an improvement on the well-known Chaikin Money Flow (CMF) oscillator. He noticed CMF had weaknesses – it didn’t account for price gaps and could give misleading spikes due to the way old data dropped out of its calculation. So Twiggs tweaked the formula by using True Range (to capture gaps and more realistic price movement) and exponential moving averages for smoothing. The result was a smoother, more responsive money flow line. Today, TMF carries his name and is used by traders who appreciate those refinements.

Source: Incredible Charts

-

Difference from Other Indicators: How does Twiggs Money Flow compare to its cousins? Unlike the Money Flow Index (MFI), which is an RSI-like bounded oscillator incorporating volume, TMF is unbounded and centers around zero, focusing purely on volume-weighted price momentum. Versus On-Balance Volume (OBV), TMF is less blunt - OBV just adds or subtracts volume based on up or down days, while TMF weights the volume by how strongly the price closed (high or low). The most direct comparison is Chaikin Money Flow vs. Twiggs Money Flow: both aim to measure accumulation/distribution, but TMF’s use of true range and EMA smoothing means it’s slower to overreact on one-day anomalies and “respects” the zero line more consistently. In practice, many traders find TMF gives clearer, more reliable signals for trend confirmation than CMF.

-

Who Uses Twiggs Money Flow: While not as universally famous as RSI or MACD, savvy crypto and stock traders who focus on volume swear by TMF. It’s a favorite among some swing traders who want a volume confirmation tool in their arsenal.

-

Ideal Timeframes & Assets: TMF is versatile so you can apply it to any timeframe, but generally a 21-period TMF on daily or 4H charts is a sweet spot for crypto trend trading (21 days is about a month of trading, capturing medium-term money flow). If you’re day trading, you might shorten the period (say 14 or even 7) on a 5-minute or 15-minute chart to capture quicker swings, but expect more noise. TMF works best on assets with robust volume (Bitcoin, large-cap altcoins, popular stocks or indices).

Conclusion: Volume is Truth – Use It Wisely

In the wild world of Bitcoin and crypto trading, the Twiggs Money Flow indicator serves as a reliable compass, pointing to where the real buying and selling pressure lies. It adds depth to your analysis by confirming whether a price move is backed by substantive volume – a crucial insight that pure price indicators might miss. We’ve learned what Twiggs Money Flow means in technical analysis, and how it’s best used: to confirm breakouts, spot divergences that hint at reversals, and overall to ensure “the trend has fuel.” Remember that the best usage is in tandem with other tools – always use this indicator with confirmation from price patterns or other signals. For example, pair TMF with an RSI momentum check or watch it around support and resistance levels to validate breakouts. By now, you should be equipped to add Twiggs Money Flow to your Bitcoin trading strategy on Phemex. You know how to interpret its twists and turns, when to act on its signals, and when to be cautious.