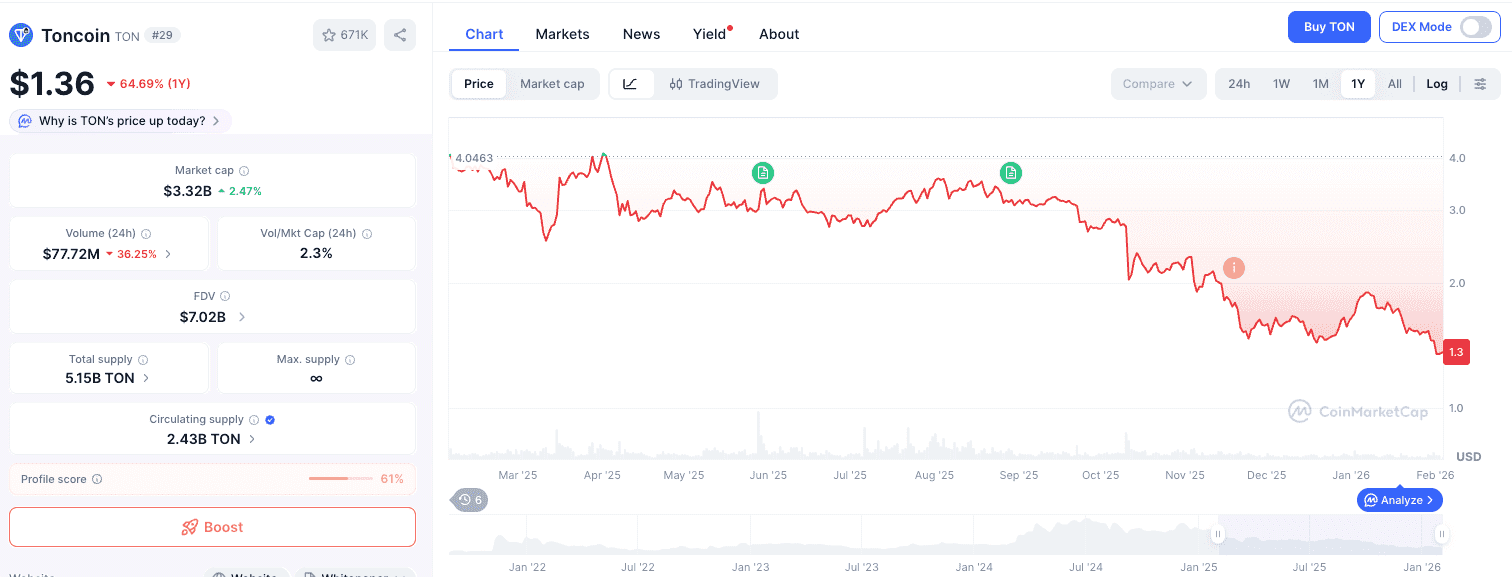

In the current digital asset landscape of early 2026, Toncoin (TON) has undergone a significant valuation re-rating. Following its 2025 peaks, the asset is now navigating a period of price discovery and consolidation. For institutional and retail traders on Phemex, determining "how much is a Ton" requires an objective look at the current cycle's data, liquidity metrics, and the underlying network activity that persists despite market volatility.

How Much is a Ton (TON) Right Now? February 2026 Data

As of February 3, 2026, Toncoin (TON) is trading at approximately $1.36. The asset has experienced a notable correction over the past 12 months, with a one-year price change of -64.69%. Despite this downward trend from its 2025 high of approximately $4.00, TON maintains a significant market presence.

Key market metrics as of today include:

Market Capitalization: Approximately $3.32 Billion, ranking it as the #29 largest cryptocurrency by market cap. (Learn more)

Circulating Supply: 2.43 Billion TON out of a total supply of 5.15 Billion. (Learn more)

Fully Diluted Valuation (FDV): Stands at $7.02 Billion, indicating a significant amount of supply yet to be released into circulation. (Learn more)

24-Hour Trading Volume: Approximately $77.72 Million, reflecting active but cautious market participation. (Learn more)

From a technical perspective, the TON price is currently testing long-term support levels. On CoinmarketCap, the TON/USDT pair shows a volume-to-market cap ratio of 2.3%, suggesting that while price action has cooled, liquidity remains sufficient for standard trade execution without extreme slippage.

Understanding the 2026 Valuation: Contextualizing the $1.36 Price

The decline from 2025’s local highs to the current $1.36 level reflects a broader shift in investor sentiment toward Layer-1 blockchains. While the historical "Telegram integration" narrative provided initial momentum, the 2026 market is placing a higher premium on sustainable on-chain revenue rather than speculative user growth.

Several factors contribute to the current valuation:

Supply Dynamics: With only about 47% of the total supply in circulation, the market is pricing in the potential inflationary pressure of future token unlocks.

Ecosystem Maturity: The "Mini-app" hype of previous years has transitioned into a "Utility Phase." Investors are now looking for concrete TVL (Total Value Locked) and DApp retention rates to justify higher valuations.

Cyclical Correction: Following the significant growth observed in early 2025, the current -64% yearly performance is viewed by some analysts as a necessary deleveraging event, bringing TON back in line with its fundamental network metrics.

Factors Influencing TON’s Price Action on Phemex

To understand where the "floor" for Toncoin might be, traders must monitor several indicators available through Phemex’s professional toolset:

Network Activity vs. Price: While the TON price has retracted, on-chain wallet growth remains a leading indicator. If active addresses continue to grow despite the $1.36 price point, it may suggest a divergence between price and fundamental utility.

Stablecoin Liquidity: The volume of USDT transacted natively on the TON network remains a critical metric. High stablecoin velocity often precedes a stabilization in the native gas token (TON).

Institutional Order Flow: On Phemex, observing the depth of the order book can reveal where large-scale buyers are placing "buy walls," which currently appear to be forming around the $1.20 - $1.30 range.

Trading Strategies for the Current Market Cycle

Navigating a -64% yearly downtrend requires disciplined risk management. Phemex provides the infrastructure for various market outlooks:

Spot Accumulation: For long-term participants who view the $1.36 level as a historical value zone, the Trade TON/USDT Spot market allows for direct ownership of the asset.

Hedging with Futures: Given the current bearish trend, traders can use Trade TON Perpetual Futures to hedge their spot holdings. By opening a short position, users can offset potential losses in their portfolio value if the price continues to retest lower supports. (Learn more about futures)

Risk Management: Utilizing Stop-Loss and Take-Profit orders is essential in the current 2026 climate. Phemex’s advanced conditional orders help traders automate their exit strategies to protect capital.

How to Trade TON on Phemex (2026 Guide)

Account Access: Log in to your Phemex account and ensure KYC verification is updated to meet 2026 regulatory requirements.

Deposit/Transfer: Ensure USDT is available in your Trading Account.

Select Market: Navigate to the TON/USDT chart. Note the 1-year trendline and current RSI levels, which are approaching "oversold" territory on some timeframes.

Execute Order:

Limit Order: Recommended for current conditions to avoid buying into minor "relief rallies."

Market Order: For immediate execution if the price hits a critical psychological level.

Market Outlook and Regulatory Compliance

The mid-to-long-term outlook for TON depends on its ability to reclaim the $2.00 psychological resistance level. Analysts note that a failure to hold the 1.00 levels last seen in previous cycles.

As an exchange committed to transparency, Phemex reminds all users that:

Volatility is Inherent: TON's 64% decline in a year highlights the high-risk nature of Layer-1 assets.

No Guaranteed Recovery: Past performance, including the 2025 peak, does not guarantee future price action.

Self-Custody & Security: While Phemex offers institutional-grade security, users should always practice diversified storage strategies.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. The price of $1.36 and the market data provided are based on February 2026 simulations/records. Trading involves significant risk of loss.