In the world of crypto trading, the price chart is king. It tells a compelling, visual story of where the market has been—its epic rallies, its dramatic falls, and its periods of quiet consolidation. But for all its utility, the chart tells you only about the past. If you want to understand what is happening right now, and what might happen in the next crucial seconds and minutes, you need to look at the market's living, breathing heart: the order book.

To a new trader, the order book can look like an intimidating, rapidly-flashing wall of red and green numbers. But to a professional, it is the most transparent source of information available, a real-time ledger of supply and demand. It is the battlefield where every trade is fought, and understanding its dynamics is the fundamental step in transitioning from a casual speculator to a serious trader.

While other guides tell you what an order book is, this Phemex Academy masterclass will teach you how to read it on a live trading platform to gain a real-time edge. We will take you from the absolute basics of bids and asks to the advanced strategies of order flow trading, using the Phemex interface as our classroom every step of the way. By the end of this guide, you will no longer see a confusing list of numbers; you will see the very pulse of the market.

What is an Order Book? The Heartbeat of the Market

At its core, an order book is a real-time, electronic list of all the open buy and sell orders for a specific trading pair (e.g., BTC/USDT) on a particular exchange.

Imagine a massive, digital auction house that is open 24/7.

-

On one side, you have all the buyers, each shouting out the maximum price they are willing to pay for an asset and the quantity they wish to buy. In the language of the market, these are the bids.

-

On the other side, you have all the sellers, each shouting out the minimum price they are willing to accept for their asset and the quantity they wish to sell. These are the asks (or offers).

The order book simply organizes all these "shouts" into a neat, ordered list, providing a complete, transparent view of the market's supply and demand at every single price level. It is the fundamental mechanism that allows buyers and sellers to find each other and execute trades.

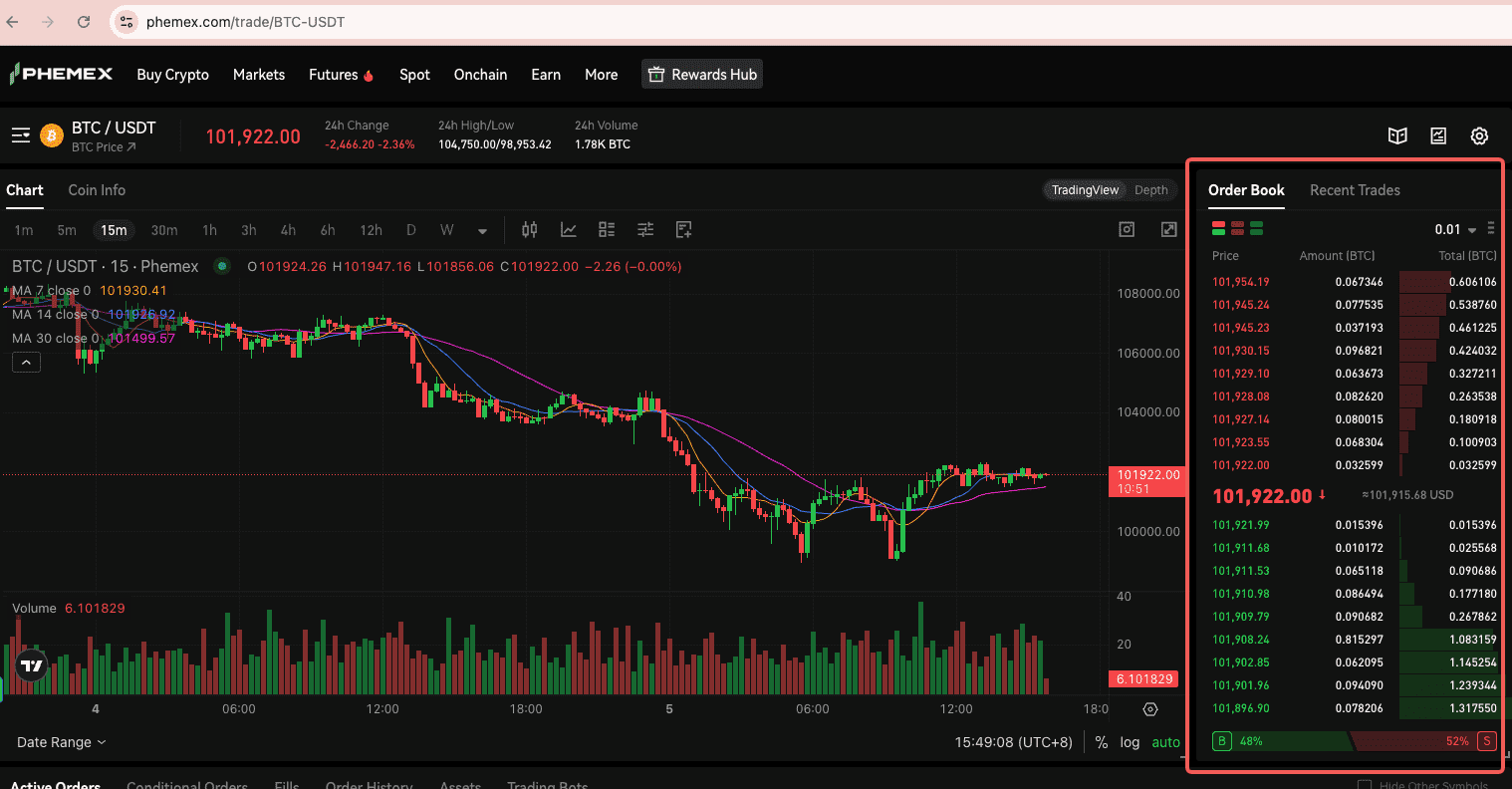

Anatomy of the Phemex Order Book: A Visual Breakdown

Let's move from theory to practice by dissecting the Phemex order book, as seen in our Spot and Futures trading interfaces. It is comprised of several key components that work together to paint a picture of the market.

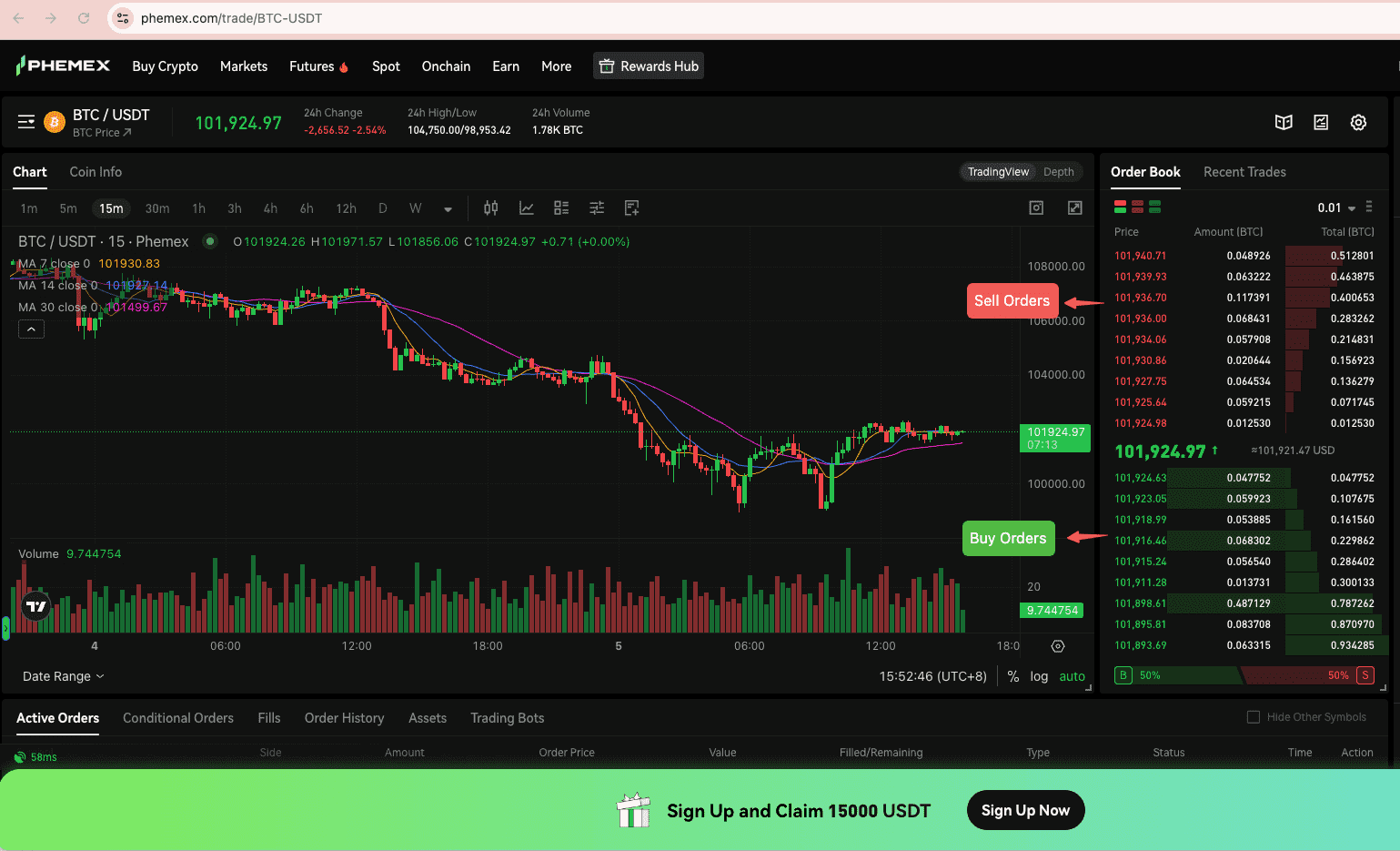

The Two Sides of the Market: Bids (Demand) and Asks (Supply)

The order book is always split into two distinct sides, representing the fundamental forces of market demand and supply. A table provides the clearest way to compare them:

| Feature | The Bid Side (Buy Orders) | The Ask Side (Sell Orders) |

| Purpose | To buy an asset at a specific price or lower. | To sell an asset at a specific price or higher. |

| Represents | Market Demand | Market Supply |

| Color on Phemex | Green | Red |

| Sorting Order | Highest price on top, decreasing downwards. | Lowest price on top, increasing downwards. |

| "Best" Order | Best Bid: The highest price any buyer is willing to pay. | Best Ask: The lowest price any seller is willing to accept. |

The Core Columns: Price, Amount, and Total

As you can see on the Phemex interface, each side of the order book has three crucial columns:

-

Price: This column shows the specific price level of the limit orders. For BTC/USDT, this is the USDT price at which traders have placed their buy or sell orders.

-

Amount (or Size): This column shows the total quantity of the asset available at that specific price level. For BTC/USDT, this would be the amount of BTC.

-

Total (or Cumulative): This column is a running total, showing the cumulative value or size of all orders from the best price up to that specific price level. This is extremely useful for quickly gauging the total liquidity available within a certain price range.

The Spread: The Gap Between Buyer and Seller

The spread is the difference between the best bid (the highest buy price) and the best ask (the lowest sell price). In our Phemex screenshot, you can see this gap between the top green number and the top red number.

The spread is a critical, real-time indicator of a market's liquidity.

-

A tight spread (a small difference, e.g., $0.01 for an altcoin) indicates high liquidity. There are many buyers and sellers competing closely, making it easy to trade large sizes with minimal costs.

-

A wide spread (a large difference) indicates low liquidity. Trading is more difficult and expensive, as buying at the market price or selling at the market price will result in a less favorable execution, a cost known as "crossing the spread."

How Does the Crypto Order Book Work? The Magic of the Matching Engine

The order book is not just a static list; it's a dynamic environment where trades are constantly being executed by the exchange's matching engine. This powerful algorithm follows a simple set of rules to match buy orders with sell orders, a process that happens millions of times per second.

| Feature | Limit Order | Market Order |

| Core Function | You set the exact price you want to trade at. | You trade immediately at the best available price. |

| Execution | Price is guaranteed, but execution is not. | Execution is guaranteed, but price is not. |

| Role in Market | Market Maker: You add liquidity to the order book. | Market Taker: You remove liquidity from the order book. |

| Analogy | Setting a price tag on an item in a shop. | Walking into a shop and saying "I'll take it, whatever the price." |

| Best For | Patience, price sensitivity, and trading illiquid assets. | Speed, urgency, and trading highly liquid assets. |

How to Read an Order Book: From Raw Data to Actionable Intelligence

This is the most important question. Reading the order book is the art of translating this raw data into actionable market intelligence. It's about seeing the story behind the numbers.

Gauging Market Depth: How to Spot "Thin" vs. "Thick" Books

Market depth refers to the market's ability to absorb large orders without significantly impacting the price. By looking at the "Total" or "Cumulative" column, you can quickly see how much capital is sitting at various price levels.

- A "thick" book has large cumulative values close to the current price. This means the market is deep and liquid. A large market order will have a minimal price impact.

- A "thin" book has small cumulative values. This means the market is illiquid. Even a moderately sized order can cause a large price swing, a phenomenon known as slippage.

Identifying "Walls": How to Read Support and Resistance in Real-Time

When you see an unusually large buy order at a specific price level on the bid side, this is known as a "buy wall." This large order acts as a temporary support level because the price cannot move below it until the entire order is filled by sellers. Conversely, an unusually large sell order on the ask side is a "sell wall," which acts as temporary resistance. Identifying these walls can give you clues about where the price might stall, bounce, or reverse.

Analyzing the "Tape": An Introduction to Reading Order Flow

The order book shows the intent to trade. The "Recent Trades" feed (often called the "tape") shows the executed trades. The real magic happens when you watch both simultaneously. This is the essence of reading order flow.

- Are you seeing a continuous stream of large green (buy) market orders hitting the ask side? This indicates aggressive buying pressure and bullish short-term sentiment.

- Are you seeing a stream of large red (sell) market orders hitting the bid side? This indicates aggressive selling pressure and bearish short-term sentiment.

Beyond the Basics: Advanced Order Book Concepts for Serious Traders

Once you've mastered the fundamentals, you can begin to understand the more subtle games played within the order book.

Spotting Manipulation: An Introduction to "Spoofing" and "Layering"

"Spoofing" is a deceptive trading practice where a large trader places a large buy or sell order with no intention of letting it execute. The goal is to create a false impression of supply or demand to trick other traders. For example, a spoofer might place a huge buy wall to induce buying, then cancel their order and sell into the rally they created. While illegal in traditional markets and against exchange terms of service, spotting potential spoof orders (large orders that appear and disappear without being traded) is a key skill.

Uncovering Hidden Orders: The Concept of "Iceberg" Orders

Large institutional traders who want to buy or sell a huge position without spooking the market often use "iceberg" orders. Only a small fraction (the "tip of the iceberg") of their total order is visible on the order book at any given time. Once that small part is filled, another small part is automatically placed. You can spot a potential iceberg order when you see a specific price level on the bid or ask side continuously getting "refilled" with new size, even as trades are executing against it.

Spot vs. Futures Order Books: A Professional's View

As you can see in the Phemex interface, we offer an order book for both Spot and Futures (Perpetual Contracts) markets. While they look identical, a professional trader interprets them with a different lens.

Spot Order Book: A Barometer of Ownership Demand

The spot order book represents direct demand for owning and holding the underlying asset (e.g., BTC). Large buy walls here can indicate a strong desire for long-term accumulation or institutional buying. The sentiment is often more long-term in nature.

Futures Order Book: A Barometer of Speculative Sentiment

The futures order book represents demand for leveraged speculation. The sentiment here is often more short-term and can be heavily influenced by factors that don't exist in spot markets, such as the Funding Rate and Open Interest. For example, a very high positive funding rate might discourage new longs and encourage shorts to place sell orders, which can change the dynamics of the order book pressure.

The Million-Dollar Question: Can You Make $1000 a Day from Trading?

This is a common and important question that deserves a responsible and realistic answer. The technical answer is yes, it is mathematically possible for elite, full-time professionals to have highly profitable days. However, the reality is that achieving such results is exceptionally rare and requires a combination of four critical pillars:

-

Significant Capital: To make $1,000 in a day on small price movements, you need to be trading with a very large capital base.

-

Exceptional Skill: This includes the ability to read order flow in real-time, understand complex market microstructure, and execute with split-second timing.

-

Ironclad Risk Management: This is the most important skill of all. The best traders are not those who are always right; they are masters at cutting their losses instantly and mercilessly.

-

Psychological Fortitude: The ability to remain disciplined and unemotional during periods of intense stress, losses, and uncertainty.

The most important takeaway is this: The order book is not a magic money-making machine. It is a professional tool for making better-informed, higher-probability trading decisions. It gives you an edge by providing a transparent view of the market's real-time supply and demand. Your profitability will ultimately be determined not by the tool itself, but by how you use it within a well-defined and rigorously managed trading strategy.

Conclusion: Your Window into the Market's Soul

The order book is one of the most fundamental yet misunderstood tools in trading. It is your direct, unfiltered window into the raw mechanics of the market. While the price chart is a map of the past, the order book is your live satellite feed of the present, showing you the real-time ebb and flow of buy and sell pressure.

Learning to read and interpret the order book is a journey. It requires practice, observation, and a deep understanding of market dynamics. But it is a journey worth taking. By moving beyond the chart and embracing the depth of information the order book provides, you take a significant step from being a passive observer to becoming an active, informed participant in the market.

The theory is learned in the Academy, but the skill is built in the market. Go to the Phemex trading interface now, open a chart, and start observing the order book in action. See the story it tells, and start trading with an edge the competition doesn't have.