Summary

-

What is Unrealized PnL: Let’s say you bought shares and keep holding the shares when the price go up, your profit is said to be “unrealized,” as it only exists on paper.

-

What is Realized PnL: Once you sell the shares, any profit or loss you make on the investment becomes a realized profit or loss.

One of the most important aspects of investing in or trading cryptocurrencies is understanding the difference between realized and unrealized profits and losses (PnL). Firstly, because they have implications on how much you actually gain or lose on your cryptocurrency transactions, but secondly, because of potential tax obligations as well.

Bitcoin profit and loss (P&L) analysis is crucial for traders and investors seeking to understand market conditions. Realized PnL refers to actual gains or losses locked in by selling Bitcoin, while unrealized PnL (paper profit/loss) refers to the gain or loss on holdings still in hand. In other words, unrealized PnL is the profit or loss “on paper” based on the current market price, whereas realized PnL becomes fixed when a position is closed. Traders track both metrics to gauge performance and market sentiment. Unrealized profit or loss is simply the difference between the current market value of your holdings and the cost basis of acquiring them, whereas realized PnL is the actual gain or loss from positions you have sold.

Where Does Realized vs. Unrealized PnL Come From?

What is Unrealized PnL?

Let’s say you bought ten shares of Tesla for $500 each or a total investment of $5,000. The share price then goes up by $50. Your investment is now worth $5,500. As long as you keep holding the shares, your profit is said to be “unrealized,” as it only exists on paper.

Similarly, if the share price goes down by $50, your Tesla investment will now be worth $4,500, which is an unrealized loss as long as you’re still holding the shares.

What is Realized PnL?

Once you sell the shares, any profit or loss you make on the investment becomes a realized profit or loss.

Most importantly, as a general rule, unrealized gains and losses don’t trigger a taxable event. When you sell assets for a profit, it can be subject to capital gains tax, depending on the jurisdiction. When you sell at a loss, it may also be possible to deduct the capital loss from your tax obligation.

So let’s say you sell your Tesla shares while you’re in profit. Assuming capital gains tax applies, then it would be levied only to your $500 profit. If you sold when the price was down, you’d be able to apply a tax deduction based on the $500 loss that you could offset against other gains.

Taxes on realized and unrealized gains

Realized vs. Unrealized PnL in Bitcoin

Cryptocurrencies are a little more complicated than shares due to the variable ways they’re treated for tax purposes in different jurisdictions.

Furthermore, share transactions are relatively straightforward because shares aren’t tradeable between one another. Using the example above, if you wanted to swap your Tesla stocks for Apple stocks, you’d have to sell your Tesla stocks for cash and then use the proceeds to buy shares in Apple.

With cryptocurrencies, you could use fiat currencies to buy BTC and then trade the BTC for other cryptos without ever needing to convert back to cash.

Therefore, it’s often the case that trades between cryptocurrencies are considered a realized profit or loss and taxed as such.

Let’s work through a few examples to illustrate how this works in practice.

A Realized Profit from Long-term Buy and HODL

Alice is an investor who adopts a long-term buy and HODL strategy. She bought one BTC for $5,000 using fiat during the 2018 crypto winter. In early 2021, when the price of BTC went up to $58,000, she had an unrealized profit of $53,000. She decided to sell. She wasn’t quite quick enough to catch the peak, but she managed to sell her one BTC for $55,000, making a realized profit of $50,000.

In this straightforward case, assuming Alice is subject to capital gains tax, it would be calculated based on $50,000 (her realized profit).

A Realized Profit from Short-term Trading

Bob is a trader who speculates on the short-term volatility of cryptocurrencies. Bob buys one BTC for $5000. The next day, BTC’s value against ETH goes up, so Bob decides to take advantage. He trades his one BTC for $8,000 worth of ETH. However, it was a bad move as ETH prices undergo a correction. The following day, Bob decides to cut his losses and exits his ETH position, trading it for $7,000 worth of USDT.

Although he hasn’t converted any funds back to fiat, the exchanges that Bob made in this sequence are considered realized gains and losses.

By trading his BTC, Bob made a realized gain of $3,000 in the first transaction. Recall he bought BTC for $5,000 and traded for $8,000 worth of ETH. As a realized profit, the $3,000 is subject to capital gains tax.

In the next trade, Bob had a realized loss of $1,000 by selling his $8000 worth of ETH for $7000 worth of USDT. He can offset the tax deduction for the capital loss against his tax obligation on the capital gain.

Learn How to Calculate PnL with This PnL User Guide

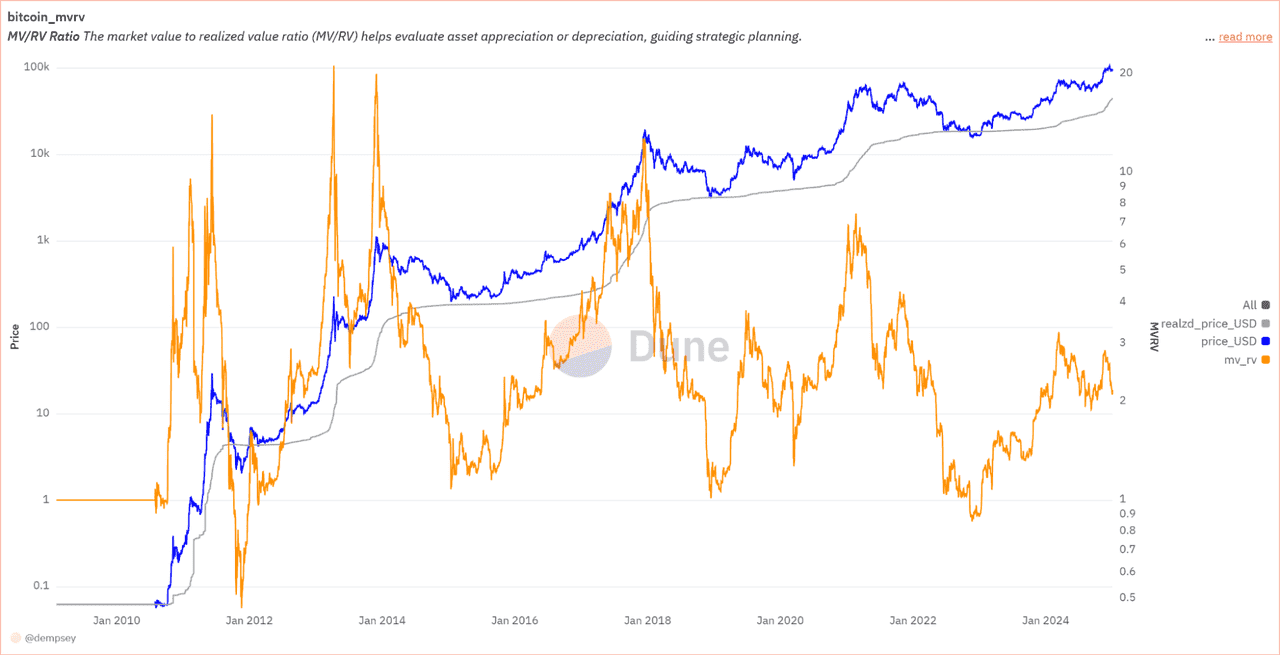

Example of Bitcoin MVRV (source)

Popular On-Chain PnL Indicators: NUPL, MVRV, SOPR

Cryptocurrency analysts rely on several derived metrics based on realized/unrealized PnL to gauge market conditions:

-

Net Unrealized Profit/Loss (NUPL). As noted, NUPL = (Market Cap – Realized Cap) / Market Cap. It effectively measures the net paper profit of the entire market. A high NUPL (close to 1) means most investors are in profit; a negative NUPL means most are at a loss. NUPL was popularized by Adamant Capital and tracks emotions: values above ~0.75 typically correspond to euphoria (overheat), while values near 0 correspond to fear/capitulation. During late 2024, Bitcoin’s NUPL reached ~0.72 – signaling a bullish but not yet extreme state. When NUPL enters the red “greed” zone, it suggests that the market cap is rising much faster than coins are being sold for profit, a classic setup to distribute gains. Conversely, a plunge in NUPL signals accumulation.

-

Market-Value-to-Realized-Value (MVRV) Ratio. MVRV = Market Capitalization / Realized Capitalization. It compares current price to the aggregate cost basis of coins. High MVRV means market value greatly exceeds cost basis – implying large unrealized profits in the system – while low MVRV means prices are near or below cost basis. Glassnode shows that historically, MVRV values above ~3.5 or 4 have coincided with late-cycle tops (heavy distribution). On the flip side, MVRV dropping below 1 (market cap below realized cap) typically signals a market bottom and undervaluation. In practical terms, a rising MVRV alerts traders that the market is entering “warm” or “hot” territory (often accompanied by high realized profits), whereas a falling MVRV indicates increasing unrealized losses and potential buying zones.

-

Spent Output Profit Ratio (SOPR). SOPR looks at coins that are sold (“spent outputs”) and measures the ratio of their selling price to their purchase price. In formula terms, SOPR = (sum of USD value of all coins at sale) / (sum of USD value of those coins at original purchase). A SOPR above 1 means coins moving that day were on average sold at a profit (the sell price exceeded buy price). A SOPR below 1 means coins were sold at a loss. SOPR is useful to see daily profit-taking behavior. As Glassnode notes, higher SOPR values and consecutive peaks indicate a bullish distribution phase (many realize gains), whereas a SOPR declining towards or below 1 suggests profits are going unsold and losses are being realized – a sign of market weakness or capitulation. For example, during the 2024 bull run, SOPR repeatedly spiked above 1 as investors sold into strength, whereas during corrections SOPR dropped toward 1 as sellers were predominantly those holding losses.

Other related on-chain metrics include Realized Price/Cap (the average buy price of coins) and address profit counts, but NUPL, MVRV, and SOPR are the most commonly cited. Together, they offer a composite view of realized and unrealized PnL on the network. For convenience, the table below summarizes how these indicators are interpreted:

|

Metric

|

What It Measures

|

High vs. Low (Signals)

|

|

Bitcoin Unrealized PnL

|

Total paper profit/loss of current holdings.

|

High: Most coins in profit (market price ≫ cost basis) – often indicates an overheated market with many eager to sell. Low: Many coins at loss (market price ≲ cost basis) – can signal capitulation or bottom.

|

|

Bitcoin Realized PnL

|

Profit/loss actually locked in by sales.

|

High realized profit: Large net gains from sales – typically during bull rallies, suggests distribution and potential local top (profit taking). High realized loss: Large net losses from sales – indicates panic selling or capitulation (bearish bottoms).

|

|

NUPL (Net Unrealized)

|

(Market Cap – Realized Cap) / Market Cap.

|

High (>0.75): Extreme net profit (greed/euphoria). Historically coincides with market tops; caution (take profit). Low (~0): Net loss (fear/cap), often bottoms; possible accumulation zone.

|

|

MVRV Ratio

|

Market Cap / Realized Cap.

|

High (>~3.5): Market cap greatly above cost basis – large unrealized gains across holders; often signals bubble top. Low (<1): Market cap below cost basis – indicates undervaluation/major losses; historically a strong bottom signal.

|

|

SOPR (Spent Output P/L)

|

Ratio of sell price to buy price of spent coins.

|

Above 1: Coins sold at profit (price > cost); rising SOPR suggests active profit-taking and distribution (bullish rally topping). Below 1: Coins sold at loss; indicates capitulation and selling pressure.

|

Using PnL Data in Trading Decisions

Traders and analysts use realized/unrealized PnL and related indicators to time Bitcoin buys and sells. Here are some practical approaches:

-

Identifying Buy Zones: Many view extended periods of unrealized losses or low investor profitability as opportunities to buy Bitcoin. For example, when SOPR falls below 1 (indicating coins selling at a loss) or when a low fraction of addresses are in profit, it can mean the market has been oversold. Historically, such conditions have preceded recoveries. Similarly, an MVRV dipping near 1.0 or NUPL approaching zero suggests extreme fear – these have often marked cycle bottoms, providing savvy traders with low entry points.

-

Spotting Overheated Markets: Conversely, when PnL metrics show over-exuberance, traders may lock in gains. High NUPL (close to 1), MVRV well above historical norms, or successive days of SOPR >> 1 are red flags. For instance, if NUPL enters the euphoria band or SOPR values remain high for weeks, many strategists consider it a signal that the market is overheated. A disciplined trader might sell or hedge some positions during these phases. The CoinDesk August 2025 analysis illustrates this: despite Bitcoin’s all-time high, low realized PnL showed that most holders weren’t selling aggressively, implying that the rally had room to run. But if that situation reversed (e.g. realized profits jumped sharply), it could have indicated a top.

-

Monitoring Long-Term Holder (LTH) Behavior: Analysts often distinguish between short-term and long-term holder profit-taking. Long-term holders controlling large supply can influence the market. Glassnode’s data shows LTHs usually drive realized profit in late rallies. When LTH spending intensifies (for example, a binary indicator shows many days of net LTH selling), it suggests the uptrend may be approaching exhaustion. Traders use this to gauge market phase: heavy LTH distribution often coincides with final rally stages.

-

Using Profit Calculators and Trackers: On a micro level, individual traders use tools (sometimes called BTC profit calculators) to project their specific gains/losses at different price targets. These calculators input buy and sell prices, quantities, and outputs PnL, helping traders set objectives. While these personal tools are useful for portfolio management, combining them with on-chain metrics provides a fuller picture. For example, your BTC profit calculator might say you have a $10k unrealized gain now, but on-chain data might warn that market-wide unrealized gains are at historic highs – prompting caution.

-

Risk Management: By keeping an eye on realized and unrealized PnL, investors can manage risk. For example, setting stop-loss orders based on maximum tolerated unrealized losses, or rebalancing as NUPL thresholds are crossed. Knowledge of when many traders are underwater can help in contrarian buying, while seeing crowds in profit can prompt taking some off the table.

In practice, Bitcoin trading strategies increasingly incorporate these analytics. For instance, a trader might plan to buy if SOPR drops under 1.0 and NUPL enters a fear zone (anticipating a rebound), or might plan to sell as MVRV spikes into the red zone. These decisions are often automated or guided by alerts from on-chain analysis platforms. It’s worth noting that metrics like realized cap, NUPL, MVRV and SOPR don’t predict exact prices; instead they indicate market sentiment extremes. Thus they are used to support when to enter or exit positions, not as guarantees.

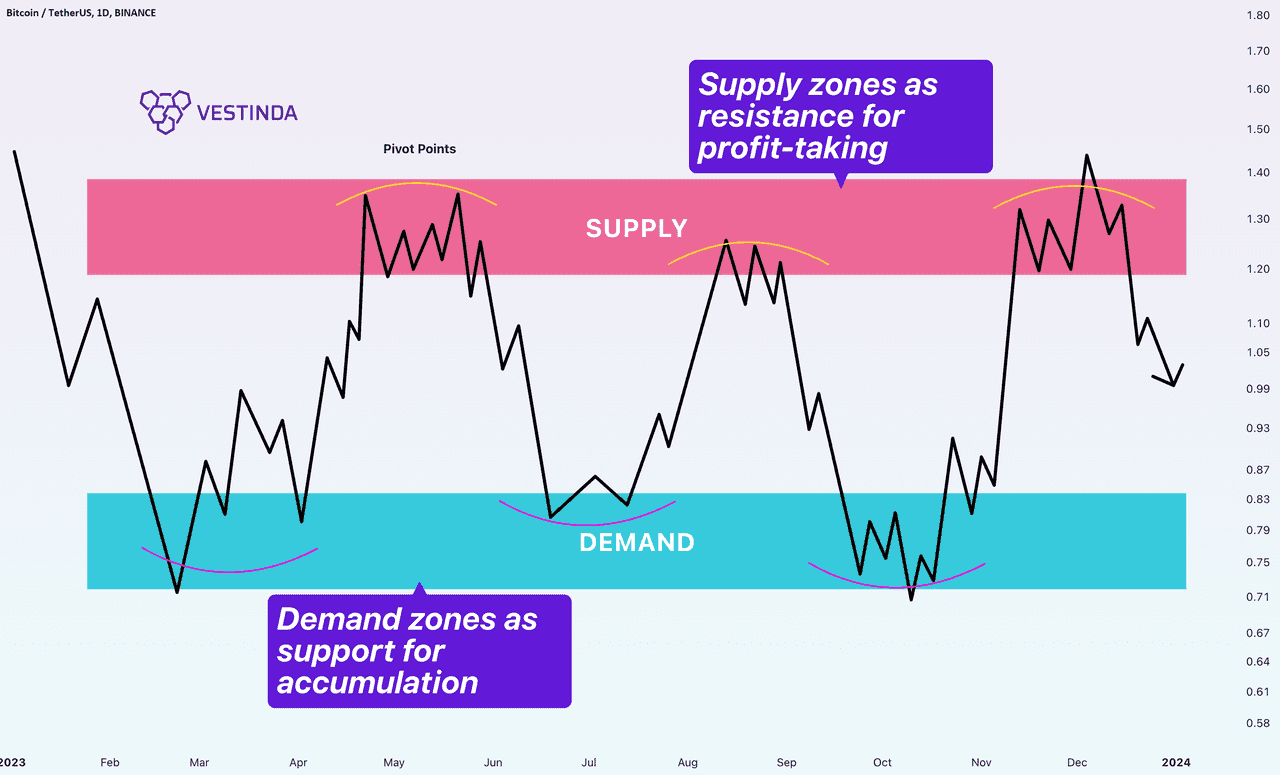

Bitcoin supply and demand zones (source)

How to track your Realized and Unrealized Profits and Losses?

Crypto Gains and Tax Reporting

Particularly for traders, it can be challenging to keep track of all of these transaction details manually. Failing to report cryptocurrency gains and losses accurately can be extremely risky, as crypto tax authorities may treat it as fraud. Therefore, many cryptocurrency users choose to use different crypto tax tools and platforms to help them remain compliant.

Portfolio trackers and cryptocurrency tax software are two of the most popular applications to help manage your realized and unrealized PnL. Delta, CryptoCompare, and Blockfolio are all examples of all-in-one solutions for crypto traders. However, there are plenty of others on the crypto market.

In many cases, these tools can also help optimize your tax position by keeping tabs on your unrealized PnL. Tax-loss harvesting is a strategy that can help you sell some positions for a realized loss as a way of reducing your capital gains burden.

Be aware that some crypto tax platforms only cover certain jurisdictions, so you’ll want to make sure that the one you choose can support your tax obligations.

Conclusion

It’s essential to be aware that tax rules and regulations for cryptocurrencies can vary significantly between jurisdictions. This article’s information is designed to give you a general understanding and should not be construed as tax advice. You should make sure you understand the tax rules that apply to your own circumstances before trading cryptocurrencies.

By August 2025, as Bitcoin hovered near record highs, realized profit-taking has been relatively muted – suggesting market participants are broadly confident. Traders looking to buy Bitcoin might wait for indicators to cool (e.g. SOPR dropping or NUPL declining), while those looking to protect gains will watch for sustained high unrealized profits to consider selling. Overall, realized and unrealized PnL metrics are powerful tools in the arsenal of crypto investors, providing a deeper view of market health beyond the price chart.

Unlock Passive Income with Phemex Earn

Want to do more with your crypto? Phemex Earn offers a secure and easy way to grow your portfolio. Earn competitive, high-yield APYs on a wide range of assets, including Bitcoin, Ethereum, stablecoins, and more.

It’s the smartest way to put your assets to work while you trade, hold, or simply watch the market.