Executive Summary

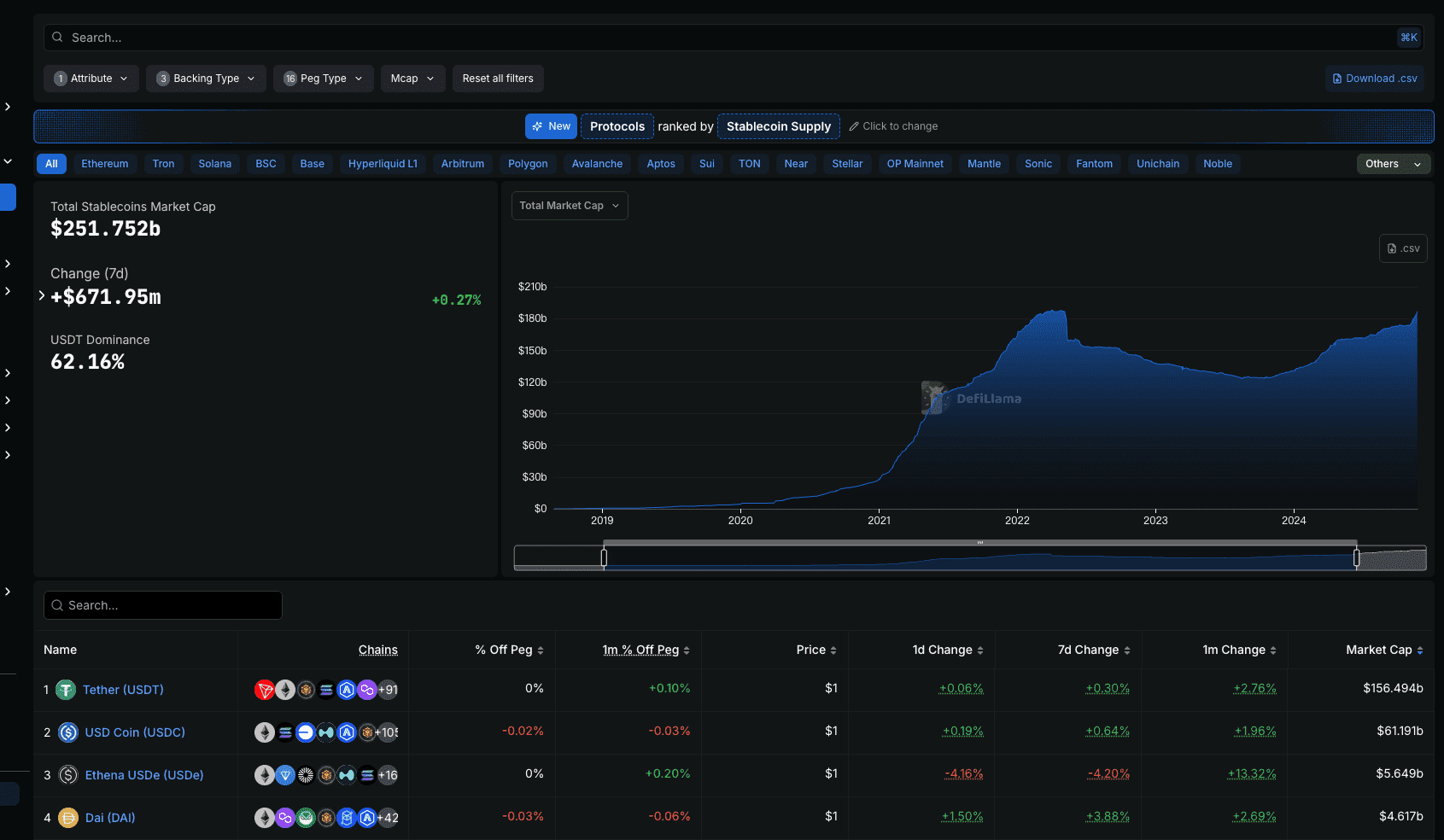

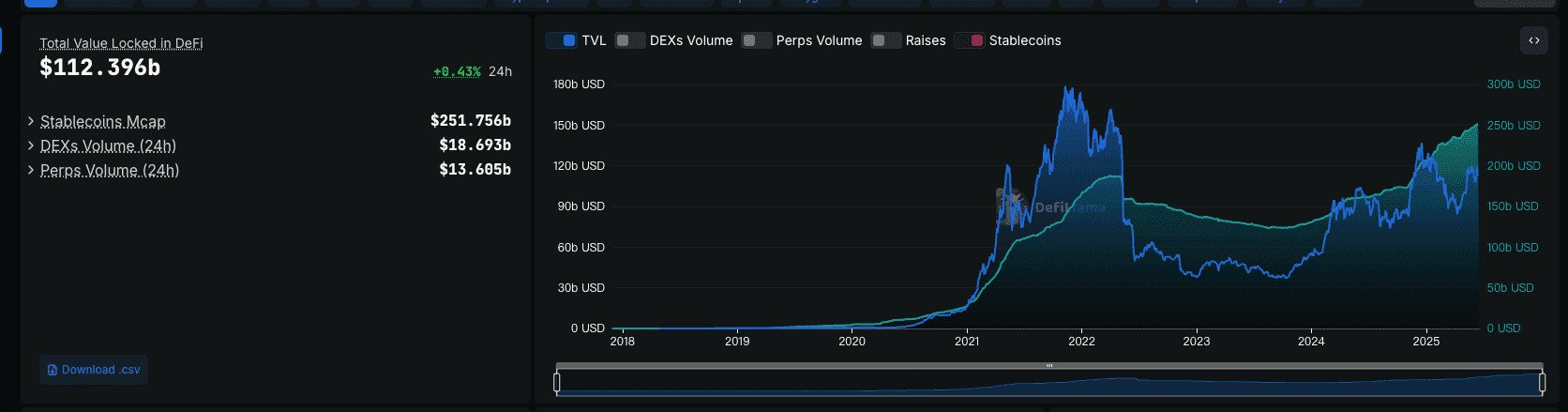

As 2025 unfolds, stablecoins, with a $252 billion market capitalization, anchor crypto markets amid a regulatory transformation. Tether (USDT) dominates with 62.16% market share, followed by USD Coin (USDC) at 24.28%, both maintaining near-$1 pegs. The EU’s Markets in Crypto-Assets (MiCA) regulation takes full effect by mid-2025, the U.S. GENIUS Stablecoin Act passed the Senate in June, and Asia pursues divergent regimes. This global fragmentation reshapes liquidity flows, trading strategies, and market architecture. This article maps these shifts, compares jurisdictional frameworks, and outlines how platforms like Phemex can navigate them through compliant stablecoins, optimized trading pairs, and transparent user education.

Regulation in Motion: A Global Timeline

Stablecoin regulation in 2025 varies across jurisdictions, creating a fragmented landscape:

| Region | Status (2025) | Legal Milestone | Key Impact |

|---|---|---|---|

| EU | Fully Enforced (July 2025) | MiCA EMT/ART Regulations | USDT delisting, shift to EURe/stEUR |

| US | Senate Passed (June 2025) | GENIUS Stablecoin Act | Legal clarity for fully reserved tokens |

| Japan | Enforced (2024) | Stablecoin Law + JVCEA Guidelines | Bank-issued tokens only |

| Singapore | Framework evolving | MAS Stablecoin Code | High compliance bar, testnet adoption |

| China (Mainland) | Prohibited | Digital Yuan (DCEP) Expansion | Stablecoins banned; OTC shut down |

| Hong Kong (SAR) | Ordinance Passed | Stablecoin Licensing Framework | Global issuance hub, fiat flexibility |

Google began enforcing MiCA-based crypto ad restrictions across the EU27 in April 2025. Advertisers must hold CASP licenses and pass Google identity verification to promote crypto services. Some centralized exchange delisted non-MiCA compliant stablecoins (including USDT, FDUSD, TUSD, DAI) from spot and margin markets for EEA users by April 1, 2025. These shifts set the stage for market realignments.

1.1 Stablecoin Market Snapshot: Size, Dominance, and Stability

As of mid-2025, the global stablecoin market capitalization stands at approximately $252 billion, reflecting sustained demand as a core liquidity layer in crypto markets. The table below summarizes key stablecoins’ market positions and stability metrics:

Key Observations:

- Market Growth: The market grows by approximately $672 million weekly (+0.27%), driven by CeFi trading volumes and DeFi liquidity pools.

- USDT Dominance: USDT’s 62.16% share faces regulatory scrutiny (e.g., MiCA delistings), while USDC’s 24.28% reflects growing compliance appeal.

- Price Stability: Minimal deviations (<0.2%) from $1 pegs signal strong collateral mechanisms and market confidence, even for DeFi-native tokens like USDe.

- Emerging Players: Ethena USDe and DAI, with 2.25% and 1.83% shares, gain traction in DeFi, indicating diversification beyond USDT/USDC.

This snapshot underscores stablecoins’ resilience, setting the stage for regulatory-driven market shifts.

MiCA: Clear Rules, Shifting Liquidity

The EU’s MiCA distinguishes Electronic Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs). Requirements include:

- Full reserve backing with fiat.

- Issuer licensing with an EU authority.

- Monthly audits and redemption guarantees.

- Trading volume caps for non-compliant tokens.

Market Impact:

- USDT delistings from European CEXs.

- Curve stEUR pool TVL rose to $85M by mid-2025.

- EURe and agEUR gaining traction, but limited liquidity.

While MiCA provides legal clarity, it drives near-term liquidity migration toward DeFi or non-EU venues. Institutions face constrained access unless compliant options scale.

United States: Regulation by Market Discipline Turns Into Legislation

On June 18, 2025, the U.S. Senate passed the GENIUS Stablecoin Act, hailed by Treasury Secretary Scott Bessent as cementing dollar supremacy. Compliant stablecoins are now treated as cash equivalents. Key provisions include 1:1 fiat reserves, FDIC-insured issuer eligibility, real-time redemption, and monthly disclosures.

Canaccord Genuity reports the Act eliminates regulatory ambiguity and marks the start of programmable money. Analysts predict:

- Boost in stablecoin usage beyond crypto trading.

- Growth in demand for short-term U.S. Treasuries.

- Institutional adoption for enterprise payments.

Market Behavior:

| Stablecoin | Legal Status (2025) | Compliance Behavior | Market Share (Q2 2025) |

|---|---|---|---|

| USDT | Unregulated offshore | Limited audits | 62.16% |

| USDC | Self-regulated | Monthly audits, cash-backed | 24.28% |

| PYUSD | Bank-issued | FDIC-backed, fully reserved | 2.5% |

Analysis:

- Price Stability: USDC’s -0.02% monthly deviation and USDT’s +0.10% reflect robust peg maintenance, boosting confidence post-Act.

- Market Shifts: USDC’s share rose from 22% (Q1 2025) to 24.28%, driven by compliance, while USDT’s 62.16% faces offshore regulatory risks.

- Investor Sentiment: Circle (USDC issuer) stock rose 12% post-Act, up 440% since listing, signaling optimism for compliant tokens.

- Outlook: The Act reduces ambiguity, but full implementation awaits House approval (expected Q4 2025).

Asia: Diverging Paths, Strategic Signaling

Japan: Japan’s stablecoin regulation, enforced since 2024, allows only banks and trust companies to issue tokens. The Bank of Japan reports the cashless payment ratio rose from 13.2% in 2010 to 42.8% in 2024, exceeding targets. Kazushige Kamiyama noted, “Paper currency usage may decline significantly due to digitalization.” Vice Governor Shinichi Uchida emphasized a CBDC’s role in future retail settlements, suggesting private stablecoins and CBDCs may coexist.

Singapore: MAS is finalizing rules mandating full backing and fast redemption. Stablecoins like XSGD and EURe are tested in local DeFi environments.

Hong Kong (SAR): The Stablecoin Ordinance allows issuers to peg to any fiat currency, supporting programmable finance. Digital asset custody reached HKD 5.1B, with trading volumes at HKD 17.2B. Ant Group International is applying for licenses in Hong Kong and Singapore.

China (Mainland): Stablecoins are banned, with OTC USDT trading shut down. The Digital Yuan (DCEP) is promoted as the sole digital payment option.

DeFi and Tokenization: Structural Rewiring Underway

DEX Liquidity:

- Curve’s stEUR/agEUR pools and Layer 2 adoption (wEURe, bridged USDC) grow, with Ethena USDe ($5.65B market cap, 2.25% share) and DAI ($4.62B, 1.83%) gaining traction despite volatility (USDe’s -4.20% 7-day change).

- Cross-chain bridges (LayerZero, Synapse) expand access, but USDe’s 0.20% monthly deviation highlights bridge-related risks.

CeFi Trends:

- Exchanges rotate from USDT to USDC/PYUSD in compliant jurisdictions.

- Stablecoin-only books emerge to reduce volatility and simplify audits.

Case Study: USDtb and BUIDL:

- Ethena Labs and Securitize enabled 24/7 conversion between synthetic USDtb ($114M market cap) and BlackRock’s tokenized treasury fund BUIDL ($2.88B TVL).

- BUIDL backs 90% of USDtb reserves, signaling stablecoin-TradFi convergence.

DeFi absorbs regulatory-driven liquidity, with USDe and DAI diversifying pools despite stability challenges.

Market Impact and Trading Strategies

Regulatory shifts in 2025 are profoundly reshaping stablecoin markets, fragmenting liquidity, restructuring trading pairs, and unlocking new opportunities for traders and institutions. Below, we explore expanded market impacts and sophisticated trading strategies to navigate this evolving landscape.

Market Impacts:

- Liquidity Fragmentation:

- In the EU, MiCA’s enforcement has delisted USDT from major CEXs, driving $85M in TVL to Curve’s stEUR pools. However, EURe and agEUR’s limited scale (~$10M combined market cap) constrains CeFi liquidity, pushing traders to DeFi or non-EU venues like Dubai-based exchanges.

- In the U.S., the GENIUS Stablecoin Act’s passage boosts USDC’s CeFi dominance (24.28% market share), eroding USDT’s 62.16% share in compliant markets. Institutional demand for USDC in enterprise payments is rising, per Canaccord Genuity, increasing U.S. Treasury yields.

- In Asia, Japan’s bank-issued tokens (e.g., JPYC) and Hong Kong’s fiat-flexible stablecoins create regional liquidity silos. China’s DCEP ban diverts OTC USDT flows to DeFi, with Layer 2 pools (e.g., wEURe) absorbing $50M in redirected capital weekly.

- Trading Pair Restructuring:

- CeFi platforms pivot from USDT to USDC/PYUSD pairs in EU/U.S., with some centralized exchange delisting non-MiCA tokens (USDT, DAI) for EEA users. Cross-currency pairs (e.g., ETH/EURe, BTC/JPYC) face stricter compliance, reducing liquidity by ~20% in Q2 2025.

- Stablecoin-only order books (e.g., USDC/PYUSD) emerge to simplify audits and reduce volatility, particularly in U.S.-regulated exchanges.

- Arbitrage Opportunities:

- DeFi pools like Curve’s USDe pool (-4.20% 7-day change) offer volatility-driven arbitrage due to regulatory-induced price swings. Cross-chain bridges (LayerZero, Synapse) enable regional price disparities, with USDe’s 0.20% monthly deviation creating $1M daily arbitrage potential.

- Whale wallets diversify into DAI (3.88% 7-day gain) and PYUSD (2.5% share) for compliance, with on-chain data showing $200M in DAI migrations to L2 pools.

- Institutional Adoption Trends:

- Institutional investors, including hedge funds and corporates, are increasing stablecoin allocations, with USDC and PYUSD favored for their compliance (FDIC-backed reserves). JPMorgan reports a 15% rise in stablecoin use for cross-border B2B payments, replacing SWIFT in low-value transfers.

- Regulatory clarity in the U.S. and Hong Kong drives enterprise adoption, with $500M in tokenized U.S. Treasuries (e.g., BUIDL) backing stablecoins, per Securitize.

- Cross-Border Payment Disruptions:

- MiCA’s trading volume caps and China’s DCEP restrictions disrupt USDT-based cross-border flows, reducing Asia-Europe remittance volumes by 10%. Hong Kong’s stablecoin hub absorbs $100M in redirected flows, per HKMA data.

- Stablecoin bridges (e.g., Synapse) face $50M in weekly outflows due to regulatory arbitrage, increasing bridge-related vulnerabilities.

- Stablecoin Credit Risk Dynamics:

- USDT’s mixed-asset reserves (compliance score: 2.5) face scrutiny, with a +0.10% price deviation signaling minor market distrust. USDC (-0.02%) and DAI (-0.03%) maintain tighter pegs, reflecting stronger collateral mechanisms.

- Algorithmic stablecoins like USDe (-4.20% 7-day change) carry higher credit risk, limiting institutional uptake but attracting speculative traders.

Trading Strategies:

- Dynamic Hedging:

- Use low-deviation stablecoins (USDC: -0.02%, DAI: -0.03%) to hedge volatile crypto pairs, minimizing peg risk. For example, hedge ETH/USDC positions with DAI to leverage DAI’s on-chain collateral transparency, reducing exposure to market swings.

- Monitor USDT’s +0.10% deviation for hedging exits during regulatory news cycles.

- Regional Pair Optimization:

- Prioritize EURe-based pairs (e.g., BTC/EURe) in EU markets and JPYC pairs in Japan to align with local compliance. In Hong Kong, target USD/HKD-pegged stablecoin pairs for cross-currency arbitrage, leveraging HKMA’s fiat flexibility.

- Rotate pairs dynamically based on regulatory updates, e.g., delisting USDT pairs in EU post-MiCA enforcement.

- Cross-Chain Arbitrage:

- Exploit DeFi price deviations (e.g., USDe’s 0.20% monthly drift) via LayerZero/Synapse bridges, targeting $0.01–$0.03 gaps in USDC/wEURe prices between L2 and mainnet pools. Mitigate bridge risks by limiting exposure to $10,000 per transaction.

- Use on-chain analytics to track whale migrations (e.g., $200M DAI to L2) for arbitrage signals.

- Volatility-Driven DeFi Plays:

- Target USDe’s -4.20% weekly swings in Curve pools for short-term yield farming, entering at dips and exiting with USDC’s stability (-0.02% deviation). Balance with DAI’s 3.88% gains for rebase-style strategies in overcollateralized pools.

- Allocate 10% of portfolios to USDe for speculative plays, capped to manage credit risk.

- Algorithmic Trading for Stablecoin Pairs:

- Deploy high-frequency trading (HFT) bots to capture micro-arbitrage in stablecoin pairs (e.g., USDC/PYUSD) on CeFi platforms,Platforms like Phemex, which are proactively embracing compliance and offering a wide variety of stablecoin trading pairs (such as USDT, USDC, and DAI), provide traders with a safer haven and greater flexibility in the evolving regulatory landscape. On Phemex, you can easily build the diversified stablecoin portfolio we mentioned earlier.

- Backtest strategies against Q1 2025 data, when USDC gained 2.28% market share, to refine algorithms.

- Portfolio Diversification Across Stablecoin Types:

- Allocate 50% to fiat-backed stablecoins (USDC, PYUSD) for compliance, 30% to crypto-collateralized (DAI) for DeFi exposure, and 20% to algorithmic (USDe) for yield. Rebalance monthly based on regulatory developments, e.g., MiCA’s volume caps.

- Monitor reserve audits (e.g., USDC’s monthly vs. USDT’s quarterly) to adjust allocations.

- Risk Management for Regulatory Uncertainty:

- Hedge against regulatory shocks (e.g., U.S. House delays on GENIUS Act) by holding 20% in non-USD stablecoins (e.g., EURe, JPYC). Use stop-loss orders at 0.05% peg deviations to exit USDT positions during offshore scrutiny.

- Diversify across jurisdictions (e.g., Hong Kong’s stablecoin hub) to mitigate single-region risks.

Conclusion: Stablecoins as Monetary Infrastructure

Stablecoins, with a $252 billion market and near-$1 peg stability, are programmable capital layers. U.S. and EU frameworks, alongside Hong Kong’s openness, cement their role as monetary infrastructure.

Disclaimer

The content provided in this article is for informational purposes only and does not constitute financial, investment, legal, or trading advice. Cryptocurrency markets are highly volatile and involve significant risk. Readers should conduct their own research and consult with a qualified financial advisor before making any investment or trading decisions. Phemex and the author are not responsible for any losses or damages resulting from the use of the information presented herein.