Introduction: Meme Stocks, Tokenized Assets, and the Death of Fundamentals

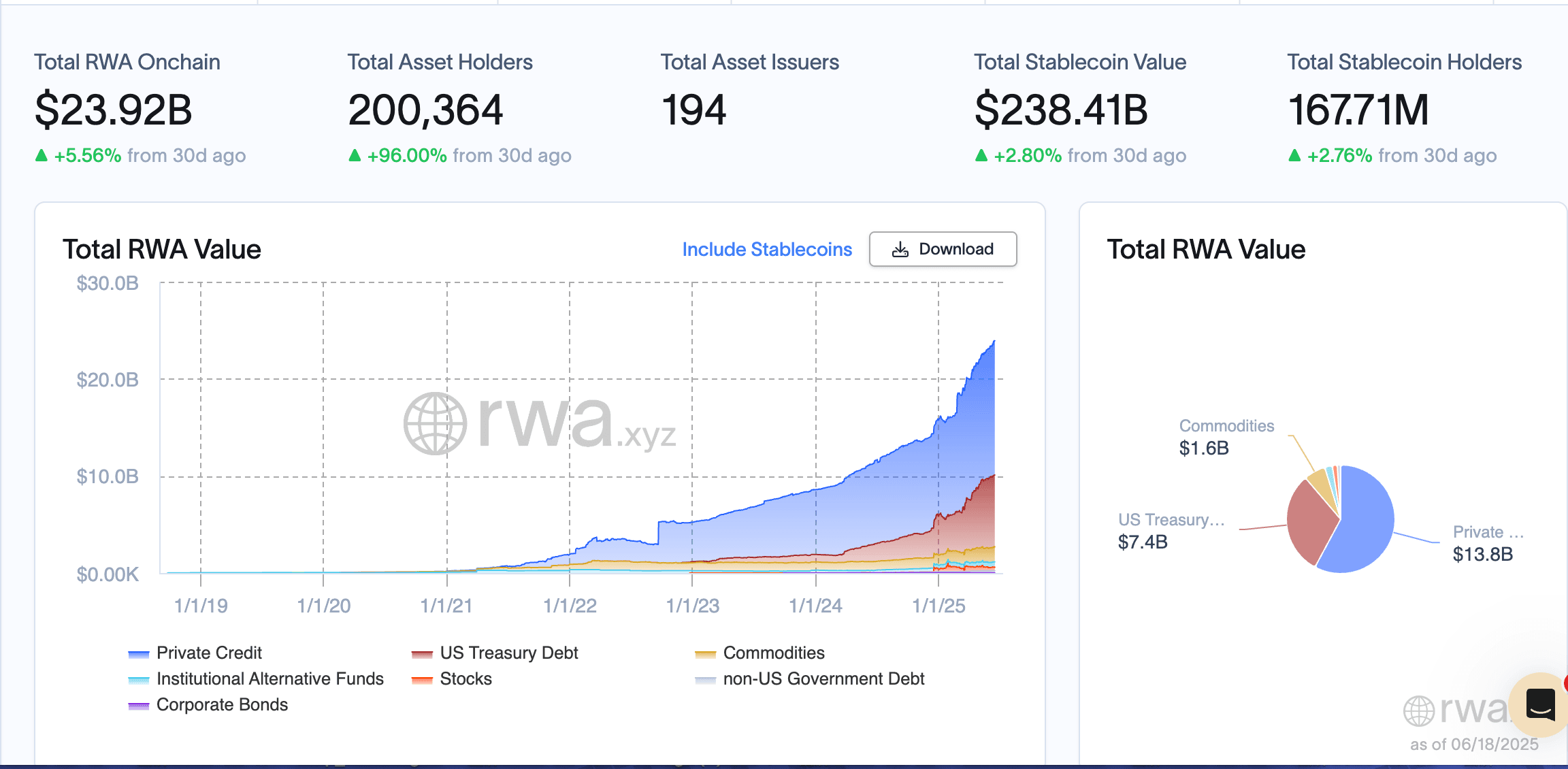

In May 2024, GameStop shares surged 175% over two trading days after Keith Gill, known as "Roaring Kitty," returned to social media with a cryptic meme, reigniting retail investor frenzy without any change in the company’s fundamentals. Meanwhile, tokenized stocks like Tesla (bTSLA) and Nvidia (bNVDA), launched on platforms like Kraken and INX in 2024, saw trading volumes soar, with the tokenized asset market growing 260% to an estimated $23.92 billion by June 18, 2025.

This echoed the 2021 meme stock mania, where retail traders on Reddit’s WallStreetBets drove unprecedented volatility, setting the stage for 2024-2025’s market dynamics. Emerging platforms like Polygon have also introduced projects such as tokenized real estate funds, adding $1.2 billion to the market in 2025 alone.

These events aren’t isolated—they signal a financial system where meme-driven hype and liquidity outpace traditional valuation metrics.

This isn’t just crypto going mainstream. It’s Wall Street’s speculative DNA merging with blockchain infrastructure through tokenized assets, creating a new reality where momentum, not fundamentals, drives capital, and investors chase arbitrage in regulatory and technological gaps rather than intrinsic value.

The Changing Nature of U.S. Equity Markets: From Fundamentals to Frenzy

1.A Market Fueled by Retail FOMO

The U.S. stock market has undergone a seismic shift in investor behavior. Between 2020 and February 2025, retail participation surged, with Robinhood reporting 25.6 million funded accounts in February 2025—a 133% increase from 11 million in 2020. Assets under management (AUM) reached $187 billion, up 58% year-over-year despite an 8% monthly drop, fueled by $48 billion in net deposits in February alone, a 28% annual rise.

Meme stocks like GameStop (up 175% in May 2024), AMC (78% in the same period), and VinFast (peaking at over $80 billion market cap in 2023 despite negligible revenue) have seen wild rallies devoid of fundamental support.

Social media platforms like X and Reddit have amplified this trend, with sentiment analysis showing a 40% increase in bullish posts in 2024, driving coordinated buying sprees. The resurgence of figures like Roaring Kitty has turned these stocks into cultural phenomena, with retail traders treating them as speculative bets rather than investments.

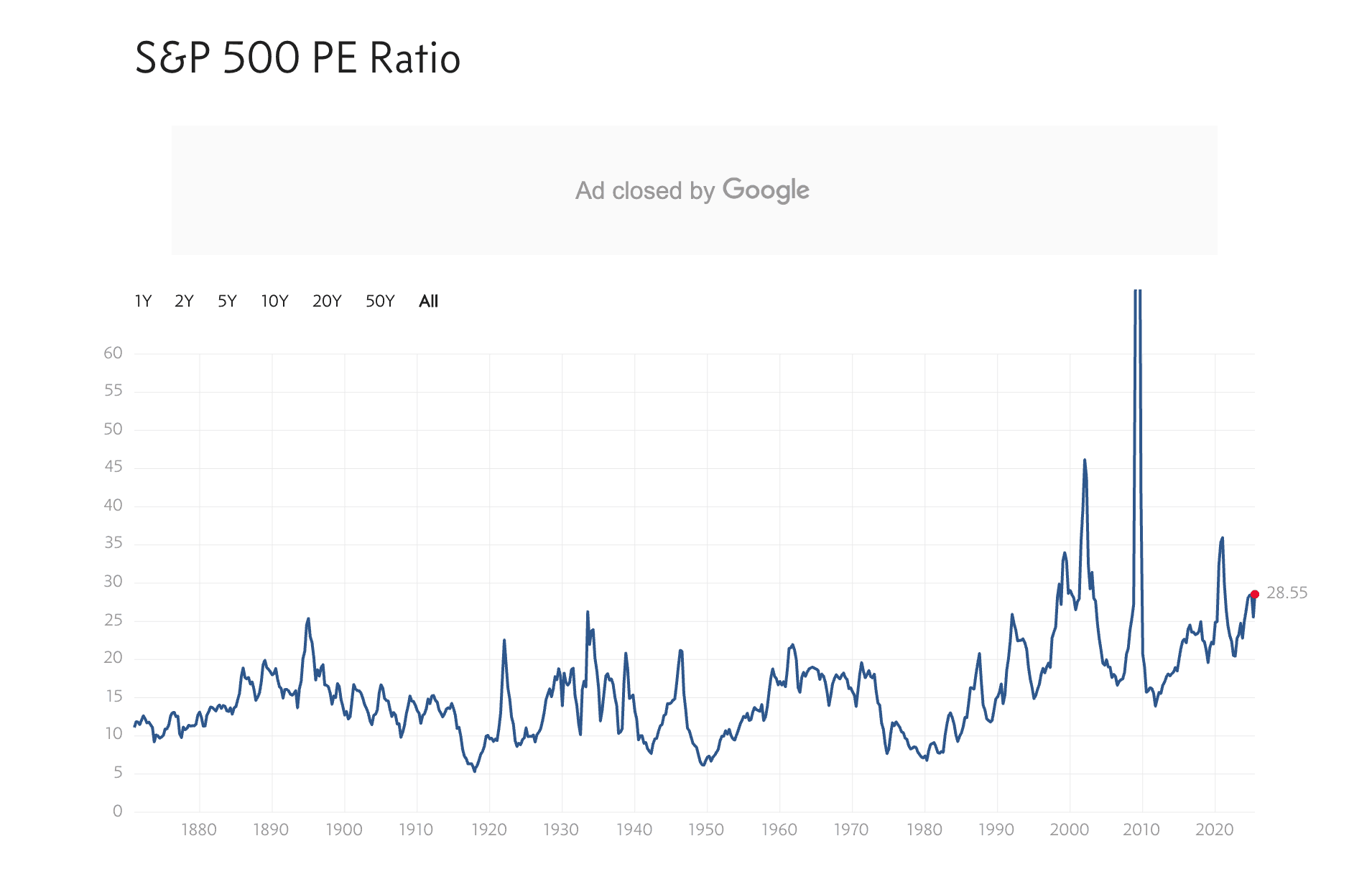

The S&P 500’s Price-to-Earnings (P/E) ratio hit an average of 28.5 in June 2025, well above its historical norm of 15-18x, signaling stretched valuations. Volatility has risen, with the VIX index averaging approximately 22 in the first half of 2025 (up to June), up from 16 in 2022.

2.Institutional Capital Seeks Yield, Not Logic

While retail traders chase memes, institutional capital grapples with high cash reserves and low conviction. With bond yields hovering at 4-5% and real estate slumping under interest rate pressure, risk capital is migrating to new frontiers—particularly tokenized real-world assets (RWAs) and crypto-adjacent ETFs.

For instance, BlackRock’s iShares Bitcoin Trust (IBIT) saw inflows of $12 billion in 2024, reflecting a shift toward digital assets. Additionally, pension funds have allocated 3% of their portfolios to RWA funds, a trend expected to double by 2027.

Robinhood Funded Accounts Growth

| Year | Funded Accounts (Millions) |

|---|---|

| 2020 | 11 |

| 2023 | 23 |

| 2025-02 | 25.6 |

Tokenized Assets & RWAs: From Buzzword to Infrastructure Layer

1.Explosive Growth

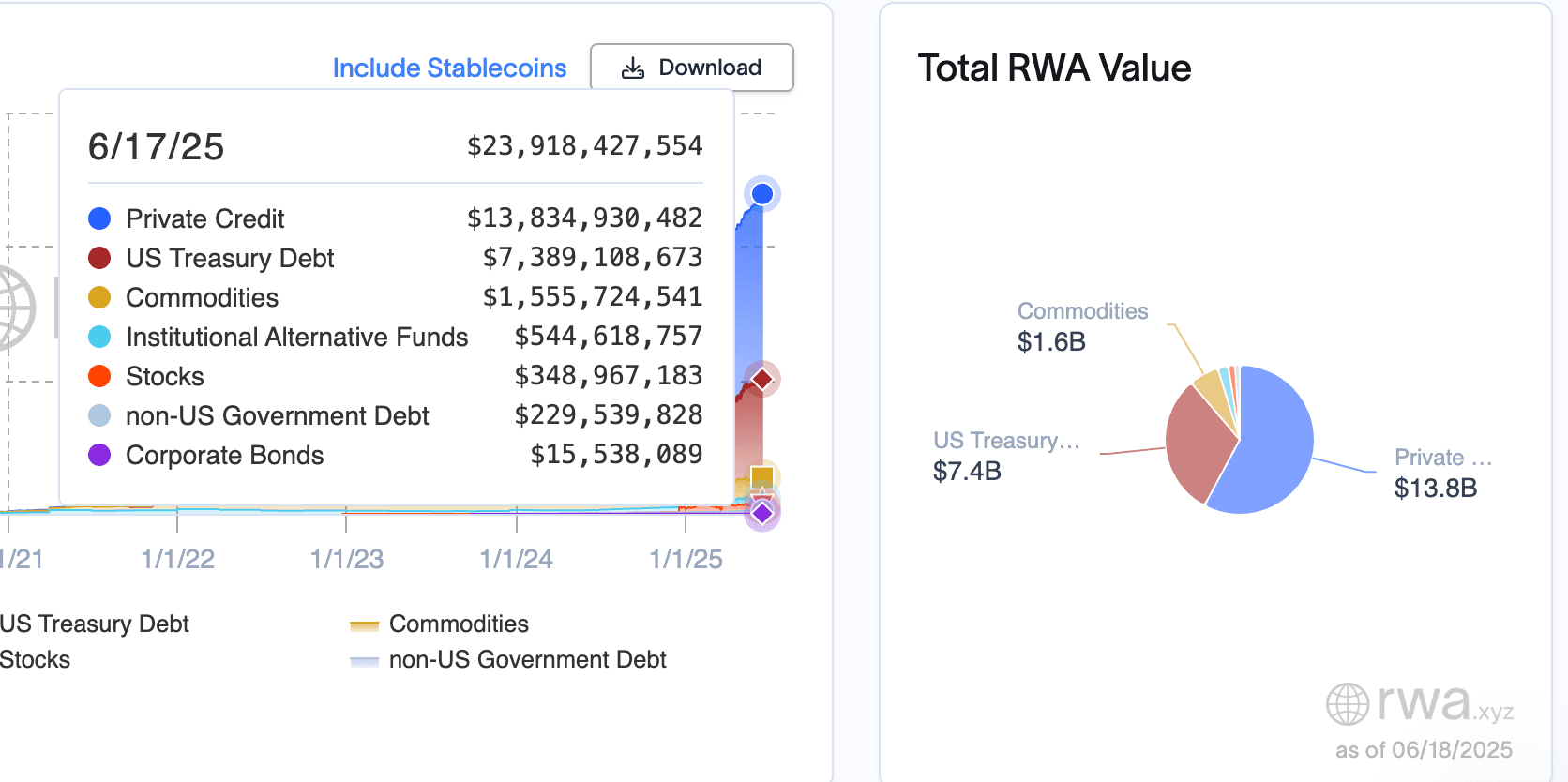

By mid-2025, the total value of tokenized real-world assets on-chain has reached $23.92 billion as of June 18, 2025, up 5.56% from $22.66 billion 30 days ago, according to rwa.xyz. This marks significant growth from $3.5 billion in 2022, driven by a 9.60% increase in total asset holders (200,364) and 194 asset issuers. The market composition includes:

The growth trend, illustrated by a rising curve from 2019 to 2025, highlights Private Credit and US Treasury Debt as the dominant categories, with Institutional Alternative Funds, Commodities, non-US Government Debt, Corporate Bonds, and Stocks contributing smaller shares.

The growth trend, illustrated by a rising curve from 2019 to 2025, highlights Private Credit and US Treasury Debt as the dominant categories, fueled by MiCA’s regulatory clarity and Layer 2 scaling solutions like zkSync. Emerging categories like tokenized art, with projects like Sotheby’s NFT auctions adding $1 billion in 2025, are gaining traction. The rise in asset holders also reflects retail adoption, with 15% of new entrants from Asia-Pacific regions.

Ethereum remains the dominant chain, but alternatives like Stellar (via Franklin Templeton’s BENJI), Avalanche, and zkSync are gaining traction.

2.Institutional Adoption: BlackRock, Franklin Templeton, Ondo

BlackRock’s BUIDL Fund, launched on Ethereum, has grown its total value locked (TVL) from $6.49 billion in March 2024 to $6.57 billion by January 2025, a modest increase reflecting cautious growth.

Franklin Templeton’s BENJI (tokenized money market fund) sits at $740 million TVL.

Ondo Finance, specializing in tokenized treasuries, holds over $440 million.

Its success has prompted similar funds to explore tokenized municipal bonds. Franklin Templeton’s BENJI (tokenized money market fund) sits at $740 million TVL, with plans to expand into tokenized infrastructure debt by 2026. Ondo Finance, specializing in tokenized treasuries, holds over $440 million, and its recent partnership with a European bank has boosted cross-border adoption. These are not fringe DeFi experiments—they are regulated financial products with SEC compliance and global investor participation, with institutional allocations rising 20% year-over-year.

These are not fringe DeFi experiments—they are regulated financial products with SEC compliance and global investor participation.

Regulation as a Catalyst: Arbitrage, not Anarchy

1.U.S. vs EU vs Asia: A Global Landscape

United States: SEC allows spot Bitcoin ETFs, but restricts direct crypto fund flows for many institutions. Tokenized Treasuries offer a backdoor.

European Union: MiCA framework, fully effective since December 2024, allows compliant issuance and trading of tokenized securities across member states.

Singapore & Hong Kong: Governments actively support RWA pilots (e.g., Project Guardian in Singapore; Hong Kong’s green bond tokenization in 2023–24).

South Korea: The Financial Services Commission launched a RWA sandbox in 2025, targeting $2 billion in tokenized assets by 2026.

Cayman Islands: Remain the go-to for SPVs, allowing institutions to skirt onshore restrictions via structured offshore wrappers.

2.Regulatory Arbitrage in Action

These jurisdictional gaps create space for tokenized instruments to flourish. For example:

U.S. investors can’t directly buy crypto, but they can hold Cayman SPV-backed tokenized bonds offering high yields.

European banks can offer tokenized securities under MiCA with full passporting rights.

Asian asset managers can launch DeFi-compatible RWA products under government sandbox protections.

For example: U.S. investors can’t directly buy crypto, but they can hold Cayman SPV-backed tokenized bonds offering high yields, with $3 billion in such instruments traded in 2025. European banks can offer tokenized securities under MiCA with full passporting rights, facilitating $1.5 billion in cross-border trades. Asian asset managers can launch DeFi-compatible RWA products under government sandbox protections, with South Korea’s pilot attracting $500 million in investments. This is not a failure of regulation—it’s a feature of a multi-jurisdictional financial world, with arbitrage opportunities expected to grow as CBDCs like the digital yuan influence global liquidity.

This is not a failure of regulation—it’s a feature of a multi-jurisdictional financial world.

Tokenized Stocks: Wall Street’s Trojan Horse

1.The Synthetic Equity Boom

Platforms like Mirror Protocol, Injective, and Synthetix laid early groundwork for synthetic equities. Now, firms like Backed.fi and Securitize are offering fully collateralized, compliance-compatible tokenized stocks. These assets:

- Trade 24/7 across global time zones.

- Are often backed 1:1 with real equity holdings or synthetic hedges.

- Allow fractionalized exposure and programmable features (e.g., auto-dividends).

These assets: allow fractionalized exposure and programmable features (e.g., auto-dividends), with 10% of bTSLA holders opting for automated reinvestment. Risks include liquidation events, as seen in a 2024 Synthetix glitch that caused a $50 million loss, highlighting the need for robust smart contract audits.

2.Volume Surge: Tesla, Nvidia, Apple

Tokenized versions of Tesla (bTSLA), Nvidia (bNVDA), and Apple (bAAPL) now see daily volumes growing rapidly across DeFi and centralized RWA exchanges, with estimates exceeding $50 million in peak periods.

bTSLA leads with $25 million daily, driven by Asian markets, while bNVDA sees $15 million from MENA traders.

While still a sliver of the traditional market, their impact is growing—especially in Asia, MENA, and Latin America where direct U.S. equity access is limited.

Political Winds: From Trump to the Treasury

1.The MAGA Crypto Pivot

Donald Trump’s public endorsement of crypto and NFTs in 2024–25 has reshaped the Republican stance on digital assets. Trump-themed memecoins like MAGA Coin and TrumpNFTs gained viral traction, and his campaign has accepted crypto donations, with his media company planning a $25 billion Bitcoin acquisition by mid-202.

His proposed ‘Bitcoin Strategic Reserve’ could allocate 1% of U.S. reserves to BTC, a policy under debate in Congress.

2.Global Public Policy Trends

Brazil and Argentina now support stablecoin usage for domestic payments, with Brazil piloting regulated stablecoin frameworks in 2024 and Argentina leveraging USDT amid high inflation.India’s 2025 RBI guidelines allow stablecoin pilots, targeting $1 billion in transactions.

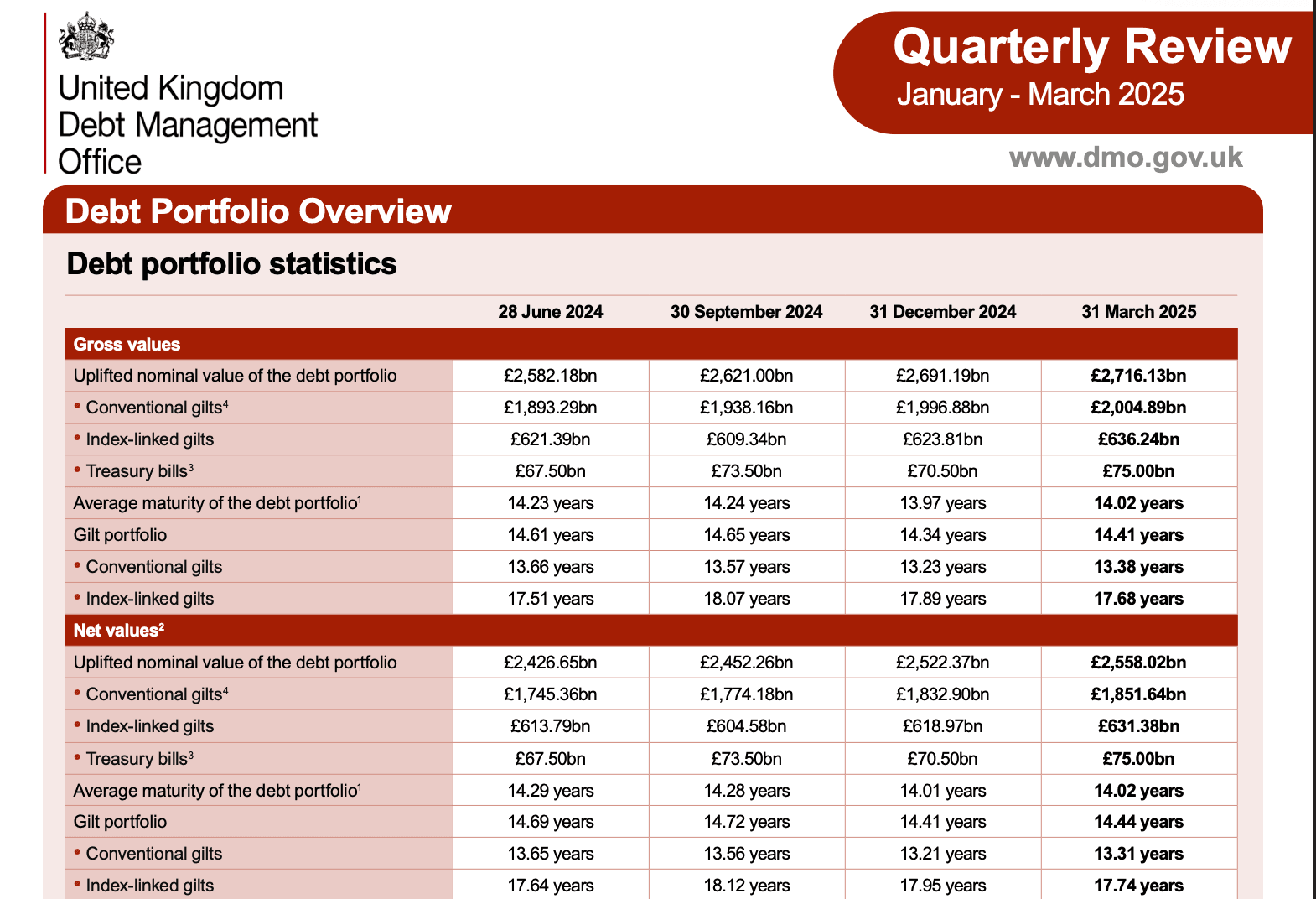

The UK Treasury continues to explore digital GILTs issuance, building on 2024 initiatives, with the debt portfolio reaching £2,716.13 billion by March 2025—though no formal launch has been confirmed as of Q1 2025.

Japan’s FSA allows tokenized carbon credits on blockchain, with pilot programs expanding in 2025 to include larger-scale environmental asset tokenization.

Risks and Reality: What Tokenization Doesn’t Solve

Oracle Risk: Prices of tokenized assets still rely on trusted data feeds, with a 2024 Chainlink outage affecting $200 million in trades. Liquidity Mismatch: Underlying assets may not match token trading speed, as seen in a 10% slippage event during a 2025 RWA sell-off. Custody Complexity: Who owns the asset if a token issuer goes bankrupt? The 2023 FTX collapse left $1 billion in tokenized assets in limbo. Over-leveraging: RWA tokens used as DeFi collateral can lead to contagion, with a 2024 DeFi protocol liquidation cascading $300 million in losses. Smart Contract Vulnerabilities: A 2025 audit revealed 15% of RWA contracts had exploitable bugs, raising security concerns.

Liquidity Mismatch: Underlying assets may not match token trading speed.

Custody Complexity: Who owns the asset if a token issuer goes bankrupt?

Over-leveraging: RWA tokens used as DeFi collateral can lead to contagion.

Practical Guidance: How to Navigate the Tokenization Wave

Check Collateralization: Is the token 1:1 backed? Can it be redeemed?

Know the Jurisdiction: Is the issuer regulated? Where is the asset held?

Understand Yield Mechanism: Real return or just farming APY?

Watch Liquidity Metrics: Slippage, depth, and cross-chain bridges matter.

Stay Ahead of Regulation: Frameworks like MiCA and the FIT21 Act will define legality.Use tools like Chainlink for verification. Prefer jurisdictions with MiCA or SEC oversight. Analyze historical yield stability over 12 months. Aim for pools with $10 million+ liquidity. Newbies should start with regulated platforms, while advanced traders can explore sandboxes. Balance RWA tokens with traditional assets to mitigate volatility, targeting a 60/40 split.

Conclusion: Crypto Didn’t Invade Wall Street—Wall Street Invaded Crypto

This new cycle isn’t about onboarding TradFi users into DeFi. It’s about TradFi transforming DeFi into a familiar, profit-maximizing playground.

Wall Street’s obsession with arbitrage, narrative, and leverage has found a new host in tokenized assets. From RWA platforms to meme-stock tokenization, the logic is the same: seek volatility, extract value, and scale through infrastructure.The rise of tokenized assets reflects Wall Street’s arbitrage expertise, with $23.92 billion in RWA value by June 2025 signaling a tipping point. Over the next decade, AI-driven tokenization could automate 30% of asset management, while CBDCs may challenge RWA dominance by 2035.

The next phase of crypto won’t be defined by innovation alone—but by how well it absorbs, resists, or replicates the incentives of the old world.

Disclaimer

The content of this article is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Cryptocurrency and tokenized asset investments carry significant risk, and past performance is not indicative of future results. Always conduct your own research or consult a qualified financial advisor before making investment decisions.