Key Takeaways

- Singapore’s central bank, MAS, mandates all crypto firms to secure an MAS DTSP License 2025 under Singapore Crypto Regulations 2025 for safe trading.

- Crypto firms and freelancers trading or managing digital tokens must obtain a Singapore crypto license by June 30, 2025.

- Firms must comply with stringent Crypto AML Compliance Singapore and anti-terrorism financing (CFT) rules.

Introduction

Singapore is tightening its grip on cryptocurrency with the Singapore Crypto Regulations 2025 set to reshape the industry. The Monetary Authority of Singapore (MAS) introduced the Licensing for Digital Token Service Providers under the Financial Services and Markets Act (FSM Act) to ensure transparent and secure crypto trading.

These Singapore crypto laws impact large firms, startups, freelancers, and investors. This guide explores the MAS crypto rules, their implications, and how to navigate the evolving Singapore blockchain regulations landscape.

What Are the Singapore Crypto Regulations 2025?

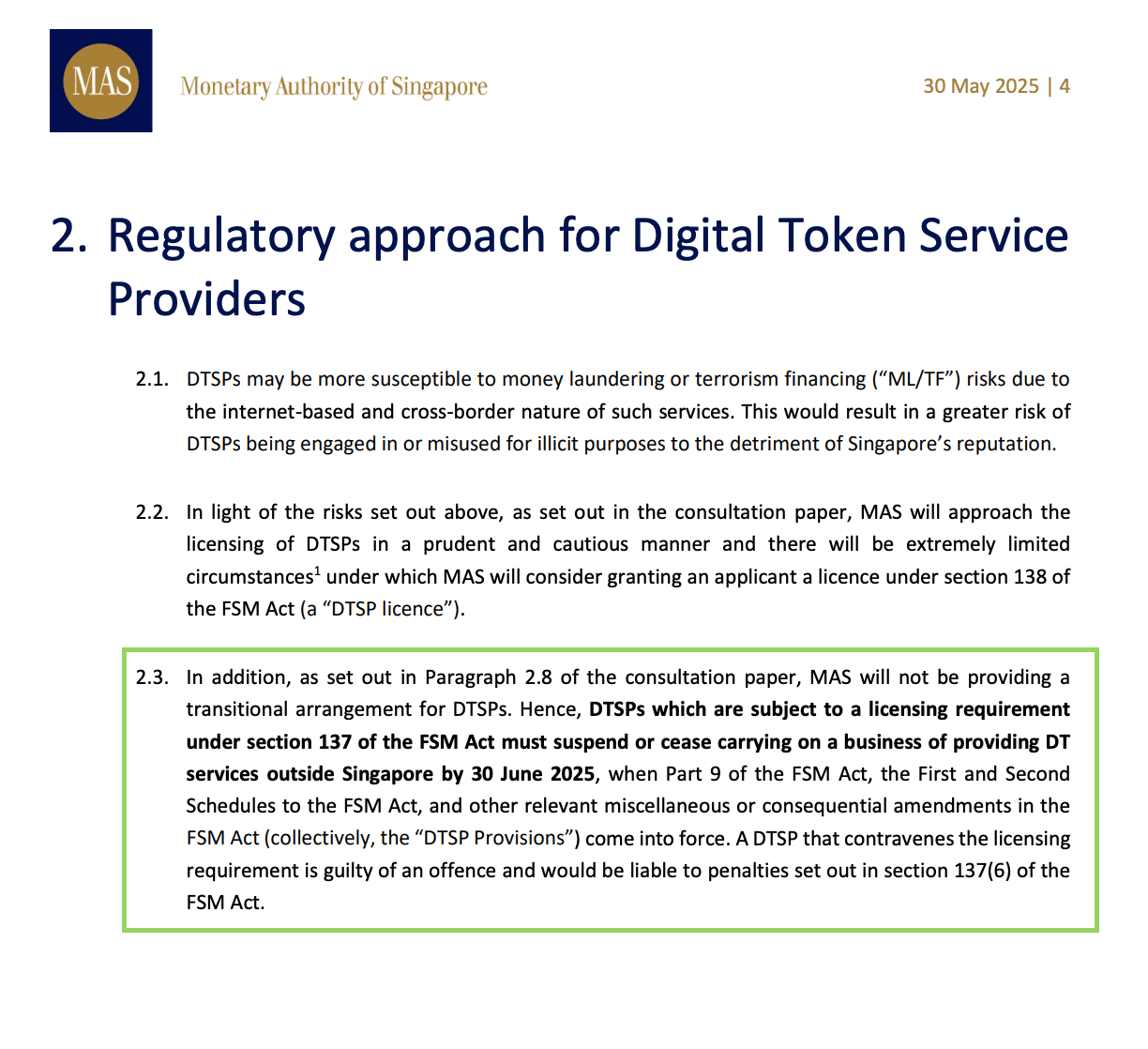

On May 30, 2025, MAS finalized its framework for Digital Token Service Providers (DTSPs), balancing innovation with financial security. The Singapore Crypto Regulations 2025 include:

-

Licensing Mandate: All crypto firms, including those operating globally from Singapore, must secure an MAS DTSP License 2025 by June 30, 2025. Unlicensed operations face SGD 250,000 fines or three years’ imprisonment.

-

Annual Fees: Licensed DTSPs pay SGD 10,000 annually and undergo audits for Crypto AML Compliance Singapore.

-

AML/CFT Standards: Firms must follow strict anti-money laundering (AML) and counter-terrorism financing (CFT) rules, including for overseas operations, aligning with FATF crypto rules Singapore.

-

No Grace Period: Full compliance is required by June 30, 2025.

Detailed Overview of the Regulations

Introduction to the Guidelines

On May 30, 2025, the Monetary Authority of Singapore (MAS) finalized the Guidelines on Licensing for Digital Token Service Providers under the Financial Services and Markets Act (FSM Act) 2022, specifically Section 137.

Effective June 30, 2025, these guidelines build on the Payment Services Act 2019 (PS Act) to establish a robust framework for Digital Token Service Providers (DTSPs). The rules apply to firms and individuals in Singapore, including those operating globally, aiming to curb fraud, money laundering, and other illicit activities in the crypto sector.

Licensing Requirements

All crypto-related businesses—such as exchanges, wallet providers, and trading platforms—must obtain a DTSP license by the June 30, 2025 deadline. Operating without a license incurs severe penalties, including fines of up to SGD 250,000 (approximately USD 194,000) and up to three years’ imprisonment. To secure a license, firms must submit detailed applications, demonstrate financial stability, and implement robust AML/CFT systems. For instance, exchanges must verify customer identities, a process that can be resource-intensive and time-consuming. Licensed firms are also required to pay an annual fee of SGD 10,000 and undergo regular audits to ensure ongoing compliance.

Compliance Standards

DTSPs must comply with strict AML and CFT regulations, tracking fund flows and reporting suspicious activities, even for overseas operations. The scope of regulated activities includes buying and selling digital tokens, operating exchanges, and providing custody services. The absence of a transitional period underscores MAS’s emphasis on swift compliance, with all requirements effective by June 30, 2025. Smaller firms may find the SGD 10,000 annual fee and associated compliance costs challenging, potentially leading to market consolidation as larger players dominate.

Implications for the Crypto Industry

Singapore’s rigorous regulatory framework sets a high standard for the crypto industry, reinforcing its position as a trusted global financial hub. While these rules enhance transparency and security, they may pose challenges for smaller firms or Web3 projects, potentially reshaping the competitive landscape. As the June 30, 2025 deadline approaches, businesses and traders must adapt to meet these stringent requirements, balancing compliance costs with opportunities in Singapore’s dynamic crypto market.

Impact of Singapore Crypto Regulations on Web3 and Freelancers

The Singapore Crypto Regulations 2025 elevate standards, reinforcing Singapore’s role as a trusted financial hub. While boosting transparency, they challenge smaller Web3 projects. Key impacts include:

-

Crypto Firms: Firms must pause overseas operations until licensed. Startups face hurdles with fees and audits, potentially leading to mergers.

-

Singapore Crypto Regulations for Freelancers: Freelancers managing tokens (e.g., Bitcoin trades for foreign platforms) need a license. Non-regulated roles like marketing are likely exempt. Review MAS guidelines to stay compliant.

-

Investors: Licensed platforms must disclose transaction records, reducing scam risks. However, unlicensed firms’ exit may limit niche services.

These changes foster a safer crypto trading Singapore market but challenge smaller players. Let’s explore Singapore’s role in the global crypto landscape.

Singapore’s Crypto Scene and Global Trends

Singapore’s forward-thinking regulation has solidified its status as a Singapore crypto hub. The city-state hosts over 700 Web3 companies and leads in crypto jobs, with 68 roles per million residents. Despite crypto ownership falling from 40% in 2024 to 29% in 2025, awareness is high at 94%, especially among younger users. Events like Token2049 Singapore fuel growth.

Singapore’s Crypto Hub

Singapore’s ecosystem includes blockchain startups, DeFi platforms, and the Blockchain Centre of Excellence. Government-backed fintech initiatives and a clear legal framework attract global firms. The Singapore crypto regulations 2025 enhance this position by balancing safety and innovation.

Global Perspective

The global cryptocurrency landscape is increasingly divided between regulated, transparent systems and unregulated, offshore networks. Singapore’s robust crypto regulations exemplify this shift, emphasizing compliance while fostering a balanced environment. The UK’s exchange laws, while aligned with Singapore’s licensing framework, often place a heavy burden on smaller firms. Hong Kong, by contrast, imposes stringent rules that restrict retail access, whereas Singapore strikes a delicate balance, maintaining openness alongside rigorous, yet costly, compliance requirements.

In the U.S., regulatory ambiguity continues to hinder growth, contrasting sharply with Singapore’s clear and structured approach, though some argue this clarity may stifle innovation. Emerging markets like Vietnam and Thailand are gaining traction, but Singapore’s mature and established ecosystem positions it as a regional leader, often favoring larger players. The EU’s MiCA framework is set to standardize regulations across member states, while Japan’s well-developed regulatory system continues to drive steady growth.

Looking ahead, the Singapore Exchange’s proposed Bitcoin futures, pending approval from the Monetary Authority of Singapore (MAS), could attract significant institutional investment. However, this move may marginalize smaller participants, further consolidating the dominance of larger entities in Singapore’s crypto market.

What’s next for Singapore’s crypto future? Let’s look ahead.

What’s Coming for Crypto in Singapore?

The MAS crypto regulations will shape Singapore’s crypto landscape. The MAS may introduce guidelines for staking, yield farming, or tokenized securities, fostering innovation with firm oversight. Firms and freelancers will need compliance teams, potentially leading to consolidation. Investors should diversify and monitor licensed platforms to adapt to service changes.

Wrapping Up

The Singapore Crypto Regulations 2025, driven by the MAS DTSP License 2025, mark a transformative step for digital finance. By enforcing licenses and Crypto AML Compliance Singapore, MAS protects investors while fostering innovation. Firms, freelancers, and traders must comply by June 30, 2025, to avoid penalties. Phemex provides tools and insights to thrive in this market. Join Phemex today to stay ahead in Singapore’s crypto future.