When many investors look at cryptocurrencies and consider investing, they first look at coins like Bitcoin, Ethereum, and Solana, also known as the major layer 1s – and then they move on to other altcoins that have tremendous upside. However, there is another subset of cryptocurrencies that are considered safe havens during bear market times like these – stablecoins.

The stablecoin market cap is very large, and two stablecoins are in the top five cryptocurrencies by market cap, and three in the top 10 – thus signaling their importance and market position. For a list of the top 10 stablecoins by market cap see the image below.

(Source: Messari)

(Source: Messari)

In particular, Tether (USDT) and Circle’s USDC are the two largest and most popular stablecoins that are both time-tested and battle-hardened. USDT was created in 2014, so it has the longest life cycle of all stablecoins. USDC launched in 2018, so it’s relatively younger.

But to expand on USDT, it’s a 1:1 Dollar backed stablecoin that often serves as the quote currency for many trading pairs on exchanges such as Phemex. For example, to spot buy Bitcoin, you’d go to the BTC/USDT trading pair and buy Bitcoin with USDT. Really, USDT has come to play a hugely important role in cryptocurrency trading and adoption worldwide. It’s simply easier to send someone USDT rather than USD or another local currency.

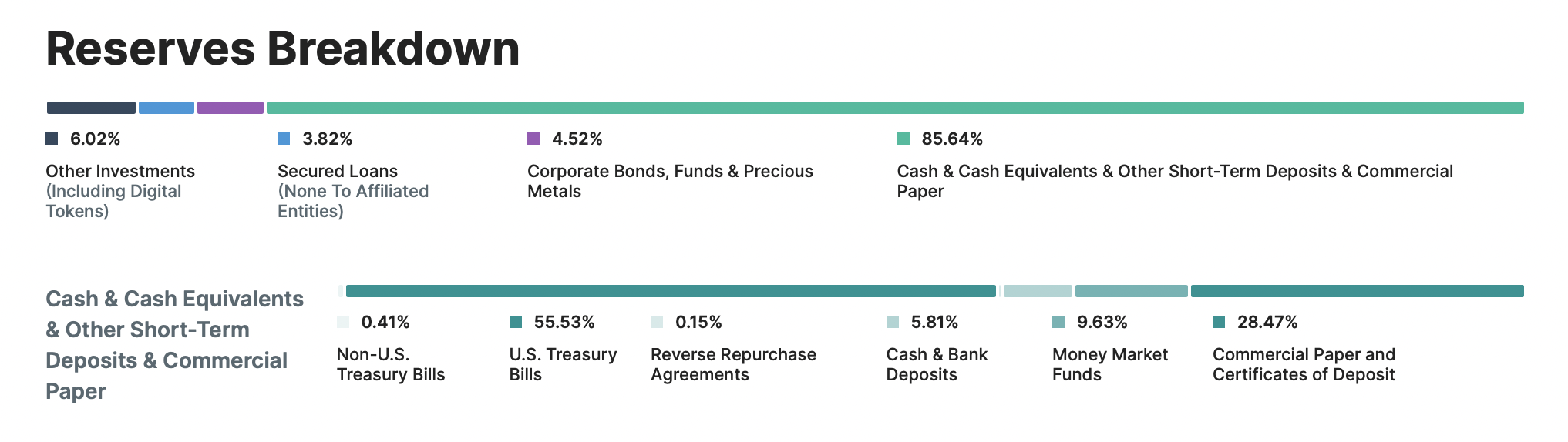

(Source: USDT’s reserves are 86% cash and cash equivalents, with the remaining 14% in other investment vehicles.)

(Source: USDT’s reserves are 86% cash and cash equivalents, with the remaining 14% in other investment vehicles.)

Investing In USDT On Phemex

On exchanges like Phemex, investors can invest in USDT by creating an interest-earning savings account through Phemex’s Earn Crypto program. In fact, Phemex is currently running a promotion for USDT savings where for 7 days we’re offering a rate of 18.8% APY on USDT. So for those interested in exploring different ways to invest in USDT with a high return, this product is worth consideration.