The decentralized finance (DeFi) ecosystem has revolutionized how we interact with financial systems, offering permissionless access to lending, borrowing, and trading without intermediaries. However, DeFi’s reliance on volatile crypto-native assets like Ethereum (ETH) and Bitcoin (BTC) has exposed it to significant risks, including price volatility and systemic instability. Enter Real-World Assets (RWAs), a burgeoning sector that tokenizes tangible and financial assets—such as real estate, government bonds, commodities, and even intellectual property—onto blockchain networks. By integrating RWAs into DeFi, the ecosystem gains stability, diversification, and new opportunities for innovation. This article explores how RWAs address DeFi’s inherent challenges, their transformative potential, and the technical and regulatory considerations shaping their adoption.

The Volatility Challenge in DeFi

DeFi’s meteoric rise, with total value locked (TVL) surpassing $250 billion at its peak in 2021 (DeFillama, 2025), has been driven by its ability to offer high-yield opportunities and democratize financial services. However, the ecosystem’s dependence on crypto-native assets introduces significant volatility. For instance, during the 2022 market crash, major DeFi protocols like Aave and Compound faced liquidations due to sharp declines in collateral values, with ETH dropping over 60% in months. This volatility undermines user confidence and limits DeFi’s appeal to risk-averse investors, including institutions and retail users seeking stable returns.

Moreover, DeFi’s asset pool is relatively narrow, dominated by cryptocurrencies like ETH, BTC, and stablecoins. This homogeneity exacerbates systemic risks, as a downturn in one asset class can cascade across protocols. The collapse of Terra’s UST in 2022, which wiped out $40 billion in market value, highlighted the fragility of over-leveraged, crypto-centric systems. RWAs offer a solution by introducing assets with intrinsic value and lower correlation to crypto markets, thereby enhancing DeFi’s resilience and appeal.

RWAs: A Bridge to Stability

Real-World Assets refer to tokenized representations of physical or financial assets on blockchain networks. These include real estate (e.g., tokenized property shares), financial instruments (e.g., government bonds, money market funds), commodities (e.g., gold, carbon credits), and even intangibles like intellectual property. By anchoring DeFi to assets with stable cash flows or intrinsic value, RWAs mitigate the volatility inherent in crypto-native ecosystems.

Case Study: MakerDAO’s RWA Integration

MakerDAO, one of DeFi’s largest protocols, exemplifies RWA’s stabilizing potential. Traditionally reliant on ETH and Wrapped BTC (WBTC) as collateral for its DAI stablecoin, MakerDAO began integrating RWAs in 2021 to diversify its collateral pool. By 2025, over 30% of DAI’s collateral consists of tokenized U.S. Treasury bonds and real estate-backed assets, according to MakerDAO’s governance reports. These RWAs, facilitated by partnerships with firms like Centrifuge, provide predictable cash flows and lower volatility compared to ETH, which saw 40% annualized volatility in 2024 (CoinMarketCap).

The inclusion of RWAs has reduced DAI’s exposure to crypto market swings, ensuring its peg to the U.S. dollar remains robust even during turbulent periods. For example, during a 15% ETH price drop in Q1 2025, DAI’s stability was maintained, partly due to its RWA-backed vaults, which cushioned liquidation risks. This stability attracts risk-averse users, including institutional investors, who value predictable returns over speculative gains.

Broader Implications

The integration of Real-World Assets (RWAs) into DeFi not only enhances stability and diversity but also reshapes the financial landscape by bridging traditional markets with blockchain technology. The tokenization of assets like stocks, as exemplified by initiatives such as xStocks and Robinhood’s recent advancements, illustrates how RWAs are redefining asset ownership, accessibility, and trading efficiency. These developments signal a convergence of traditional finance (TradFi) and DeFi, with profound implications for global markets, investor access, and the evolution of financial infrastructure.

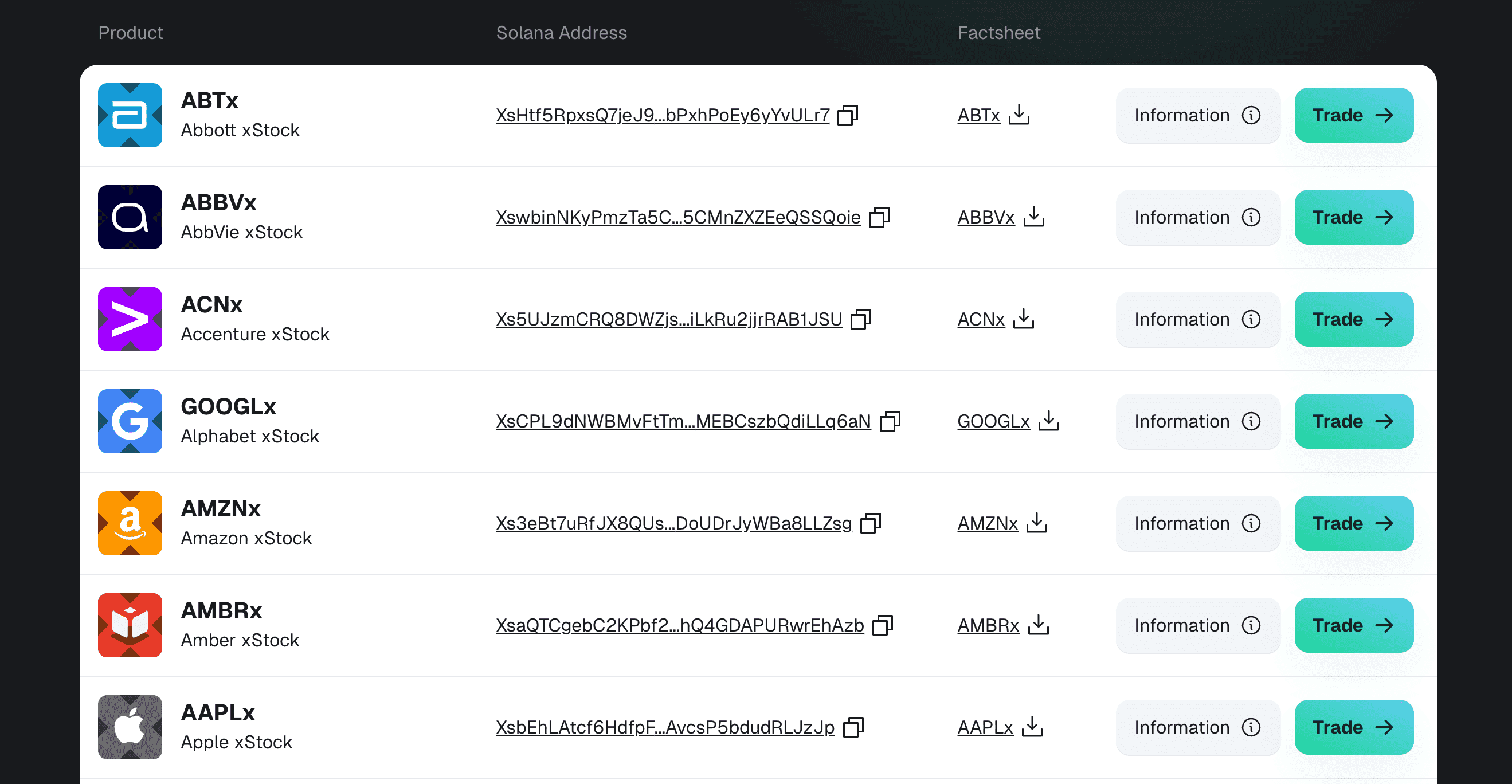

xStocks: A Case Study in Stock Tokenization

One notable example of RWA tokenization is xStocks, a platform that brings U.S. equities to the Solana blockchain. Operated by Backed Finance, a Switzerland-registered company, xStocks controls Backed Assets in Jersey, which facilitates the purchase of real U.S. stocks through Interactive Brokers’ IBKR Prime channel. These stocks are then transferred to segregated accounts managed by Clearstream, a custody institution under Deutsche Börse. Once the purchase, transfer, and custody processes are complete, a smart contract on the Solana blockchain is triggered to mint tokens, such as TSLAx, on a 1:1 basis with the underlying shares—for instance, 1000 Tesla shares result in 1000 TSLAx tokens. These tokens, controlled by Backed’s smart contract address, can be listed for spot or derivatives trading on third-party exchanges. Investors or market makers holding at least one TSLAx token can redeem it through Backed for the actual Tesla shares held in custody, completing a full cycle of collateralization, minting, issuance, and redemption. This process, as outlined by Backed Finance, ensures transparency and trust by maintaining a 1:1 backing with real assets, offering a model for seamless integration of TradFi and DeFi.

The xStocks model highlights several broader implications. First, it democratizes access to U.S. equities for global investors, allowing fractional ownership starting at $1, compared to the high minimums of traditional brokerages. Second, the use of Solana’s high-throughput blockchain enables 24/7 trading with low fees, challenging the inefficiencies of traditional stock markets. However, regulatory compliance, such as Know Your Customer (KYC) requirements, introduces friction to DeFi’s permissionless ethos, raising questions about the balance between accessibility and oversight.

Robinhood’s Tokenization and Product Expansion

Robinhood’s recent announcements further underscore the transformative potential of RWAs. In July 2025, Robinhood launched tokenized U.S. stocks and ETFs for European users on Arbitrum, an Ethereum Layer-2 blockchain, with plans to migrate these assets to its own Arbitrum-based Layer-2 blockchain optimized for tokenized assets. This blockchain will support 24/7 trading, self-custody, and cross-chain bridging, enhancing accessibility and efficiency. Additionally, Robinhood introduced tokenized shares of private companies like OpenAI and SpaceX for EU users, marking a significant step toward democratizing private equity investments. These tokens, issued with zero commissions and 24/5 trading, are backed 1:1 by real shares, ensuring price parity.

Robinhood’s broader crypto push includes perpetual futures with up to 3x leverage for EU users, routed through its acquired Bitstamp exchange, and crypto staking for Ethereum and Solana in the U.S., aligning with recent SEC guidance that staking is not a securities offering. These moves position Robinhood as a bridge between traditional brokerage and DeFi, offering intuitive interfaces and regulatory compliance to attract both retail and advanced traders. The distribution of OpenAI and SpaceX tokens to EU users as an onboarding incentive further illustrates the growing appeal of tokenized private assets.

Market and Industry Impacts

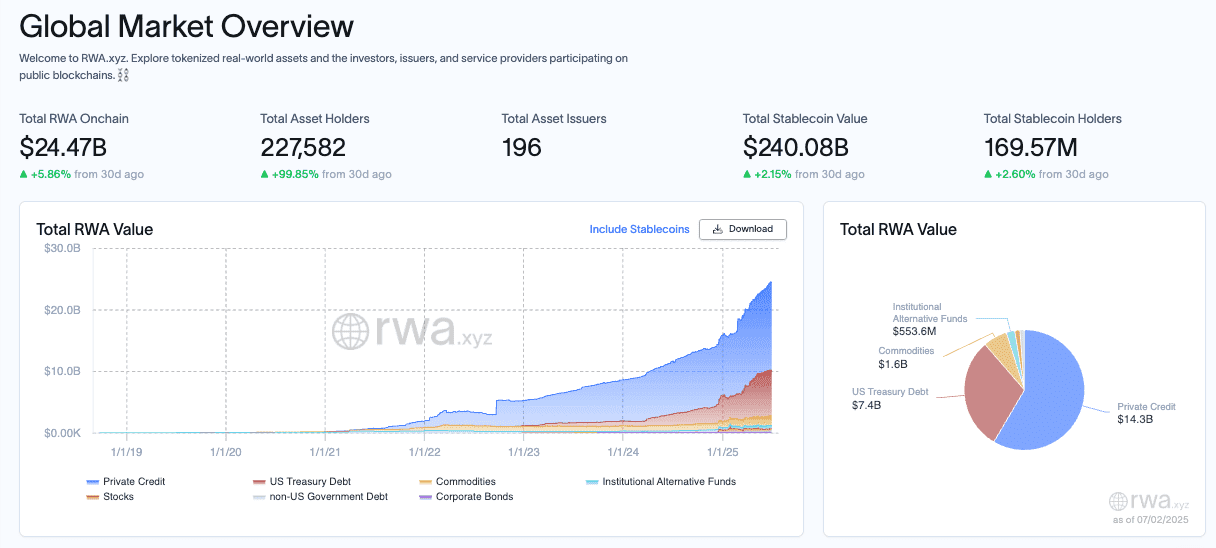

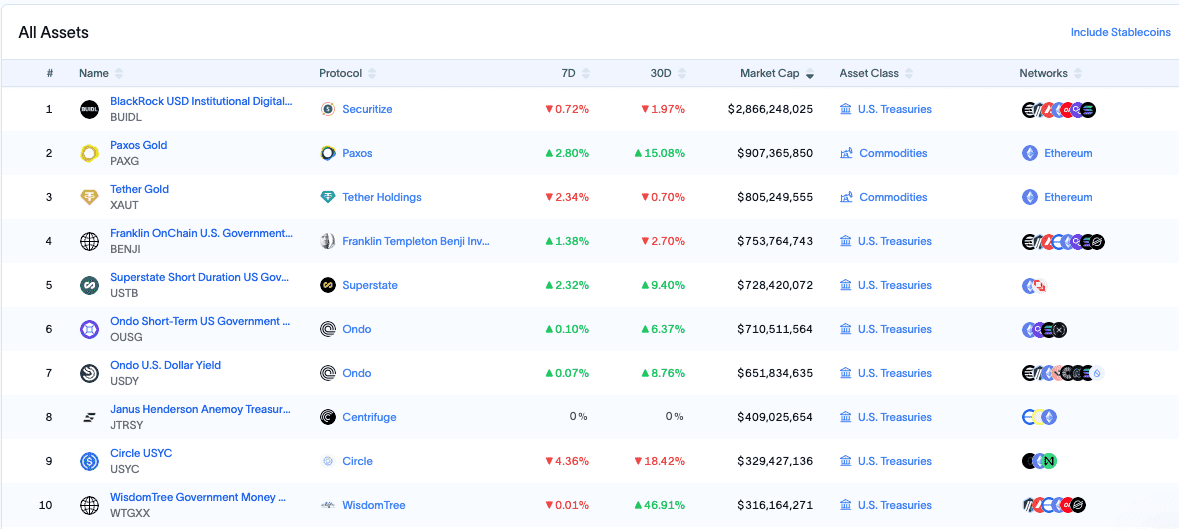

The tokenization efforts of xStocks and Robinhood reflect a broader trend toward integrating real-world assets into blockchain ecosystems. As of July 2025, the tokenized asset market (excluding stablecoins) reached $24.47 billion, with a 5.86% increase over the past 30 days, driven by private credit at $14.3 billion and tokenized U.S. Treasury debt at $7.4 billion (RWA.xyz). This growth, representing an 85% year-over-year increase, positions RWAs as one of crypto’s fastest-growing sectors, with projections estimating a $30 trillion market by 2034 (RedStone, Gauntlet, RWA.xyz). Tokenized stocks, though currently a smaller segment at $11.4 million, show significant potential for disrupting traditional equities markets by enabling instant settlement and fractional ownership.

These initiatives also challenge the traditional financial system’s exclusivity. By enabling fractional ownership and global access, tokenized stocks make high-value assets like Tesla, Nvidia, or private company shares available to a wider audience. For instance, xStocks’ integration with DeFi protocols allows users to use tokenized assets in liquidity pools or lending platforms, creating new yield opportunities. Similarly, Robinhood’s self-custody options and 24/7 trading capabilities empower users to manage their assets without intermediaries, aligning with DeFi’s ethos of financial sovereignty. Amid this wave of enthusiasm, Phemex may soon introduce products enabling users to tap into the benefits of tokenized U.S. stocks, offering seamless trading experiences.

Challenges and Considerations

Despite their promise, tokenized stocks face challenges. Regulatory hurdles, such as varying securities laws across jurisdictions, complicate global adoption. For example, xStocks’ KYC requirements and Robinhood’s EU-specific offerings reflect the need to navigate complex compliance landscapes. Additionally, liquidity in tokenized stock markets remains lower than in traditional exchanges, with TSLAx and similar tokens trailing the trading volumes of major cryptocurrencies. Protocols must incentivize liquidity through yield farming or market-making rewards to compete with established systems.

Technical risks also persist. Smart contract vulnerabilities, as seen in past DeFi hacks, could undermine trust in tokenized assets. Robust auditing and decentralized oracle solutions, like those provided by Chainlink for xStocks’ pricing data, are critical to ensuring security. Furthermore, the costs of tokenization—legal fees, custody services, and blockchain operations—can be substantial, potentially limiting scalability for smaller assets.

Future Outlook

The rise of tokenized stocks signals a paradigm shift toward a hybrid financial system where TradFi and DeFi coexist. By offering stable, diversified assets, RWAs like xStocks and Robinhood’s tokenized equities reduce DeFi’s reliance on volatile cryptocurrencies, attracting institutional and retail investors alike. The integration of private company tokens, such as OpenAI and SpaceX, further expands investment opportunities, addressing long-standing inequities in access to high-growth assets. As blockchain infrastructure matures and regulatory frameworks evolve, tokenized RWAs could redefine global finance, making it more inclusive, efficient, and resilient.

Diversifying DeFi’s Asset Pool

RWAs not only stabilize DeFi but also expand its asset diversity, unlocking new use cases and user demographics. The current DeFi landscape is heavily skewed toward cryptocurrencies, with stablecoins like USDT and USDC accounting for over 60% of DeFi TVL (DeFillama, 2025). RWAs introduce a broader range of assets, enabling DeFi to mirror the diversity of traditional financial markets.

Real Estate: Democratizing Access

Real estate, one of the largest asset classes globally (valued at $379 trillion in 2024, per Savills), is a prime candidate for tokenization. Platforms like RealT and Lofty tokenize property shares, allowing users to invest in fractional ownership with as little as $50. In DeFi, these tokenized properties serve as collateral for loans or yield-generating assets. For instance, Centrifuge’s Tinlake protocol enables real estate firms to tokenize rental income streams, which DeFi users can stake for yields of 3-7%. This democratizes access to real estate, traditionally a high-barrier asset class, and attracts retail investors seeking stable returns.

Financial Instruments: Bridging TradFi and DeFi

Tokenized financial instruments, such as government bonds and money market funds, are among the fastest-growing RWA categories. BlackBlack’s BUIDL fund, launched on Ethereum in 2024, tokenizes U.S. Treasury-backed securities, managing over $2.9 billion in assets by July 2025 (Forbes). In DeFi, these assets serve as low-risk collateral, enabling protocols like Clearpool to offer institutional-grade lending pools with yields of 2-4%. Unlike crypto-native assets, these instruments are backed by government or corporate credit, reducing default risks. As of July 2025, tokenized U.S. Treasury debt accounts for $7.4 billion of the $24.47 billion RWA market, reflecting a 5.86% 30-day growth (RWA.xyz).

Commodities and Beyond

Commodities like gold svi gold and carbon credits further diversify DeFi’s offerings. Tokenized gold, offered by platforms like Paxos (PAXG), provides a hedge against inflation and crypto volatility. Meanwhile, carbon credits, tokenized by firms like Toucan Protocol, appeal to environmentally conscious investors. These assets, integrated into DeFi protocols like Curve Finance, allow users to stake or trade RWAs with real-world utility, expanding DeFi’s appeal beyond speculative trading.

Data Insights

The growth of RWAs in DeFi is evident in market data. As of July 2025, the RWA market’s total value (excluding stablecoins) reached $24.47 billion, with private credit leading at $14.3 billion (58% of the market) and U.S. Treasury debt at $7.4 billion (34%) (RWA.xyz). Non-stablecoin RWAs, such as real estate and commodities, grew by 85% year-over-year, signaling rising diversity. DeFi protocols integrating RWAs have seen TVL increases of 80-100% since 2023, driven by demand for stable, diversified assets.

Technical and Regulatory Considerations

While RWAs promise stability and diversity, their integration into DeFi faces technical and regulatory hurdles. Understanding these challenges is crucial to assessing their long-term viability.

Technical Infrastructure

Tokenizing RWAs requires robust blockchain infrastructure. Smart contracts must ensure secure ownership, transferability, and compliance with legal frameworks. Protocols like Chainlink play a critical role by providing decentralized oracles to verify off-chain asset data, such as property valuations or bond yields. For example, Chainlink’s integration with Ondo Finance ensures real-time pricing for tokenized Treasuries, enabling trustless DeFi interactions.

However, smart contract vulnerabilities remain a concern. The 2023 Euler Finance hack, which resulted in $197 million in losses, underscores the risks of complex RWA integrations. Protocols must adopt rigorous auditing and stress-testing to mitigate these risks. Additionally, interoperability between blockchains (e.g., Ethereum, Polygon, XDC Network) is essential to ensure RWAs can move seamlessly across DeFi ecosystems.

Regulatory Landscape

Regulatory uncertainty is a significant barrier to RWA adoption. Different jurisdictions treat tokenized assets differently. In Hong Kong, the Securities and Futures Commission (SFC) classifies RWAs as “non-complex products,” facilitating retail access, while the EU’s MiCA framework imposes strict disclosure requirements. In the U.S., the SEC’s cautious stance on tokenized securities creates compliance challenges for DeFi protocols. For instance, Robinhood’s 2024 proposal to the SEC highlighted the need for clearer RWA regulations to protect retail investors.

Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) rules also poses challenges. While DeFi’s ethos emphasizes permissionless access, RWAs often require identity verification to comply with securities laws. Protocols like Aave Pro, which caters to institutional users, have implemented KYC for RWA-backed pools, potentially alienating retail users who value anonymity.

Balancing Innovation and Compliance

To navigate these challenges, hybrid models are emerging. Polymesh, a blockchain designed for security tokens, offers built-in compliance features, such as transfer restrictions and identity verification, while maintaining DeFi’s efficiency. Similarly, TRON’s stUSDT, a tokenized stablecoin backed by real-world assets, operates under regulatory oversight in Hong Kong, balancing innovation with compliance.

Opportunities for DeFi Users

RWAs open new avenues for DeFi users, from retail investors to institutions. By integrating stable, diversified assets, DeFi protocols can offer predictable yields, lower-risk lending, and exposure to real-world markets. For example, Goldfinch’s lending pools, which use tokenized invoices as collateral, provide yields of 5-10% with lower volatility than ETH-based pools. Similarly, Curve Finance’s RWA-backed stablecoin pools offer competitive APYs with minimal slippage, appealing to yield farmers.

The rise of RWAs also aligns with the growing interest in financial inclusion. By lowering investment thresholds—e.g., fractional real estate ownership via RealT—DeFi enables retail investors to access markets previously reserved for high-net-worth individuals. This democratization aligns with DeFi’s core mission of financial empowerment.

Challenges to Scale

Despite their promise, RWAs face scalability hurdles. Liquidity remains a concern, as tokenized assets often have lower trading volumes than crypto-native tokens. For instance, ONDO’s market cap grew to $2.8 billion in 2025, but its daily trading volume lags behind major cryptocurrencies (CoinGecko). DeFi protocols must incentivize liquidity provision, perhaps through yield farming or staking rewards, to ensure RWA markets thrive.

Additionally, the cost of tokenization—legal fees, audits, and oracle services—can be prohibitive for smaller projects. Platforms like Centrifuge estimate that tokenizing a $1 million real estate asset costs $50,000-$100,000 in upfront expenses. Reducing these costs through standardized protocols or regulatory clarity will be critical to scaling RWA adoption.

The Road Ahead

RWAs represent a pivotal evolution for DeFi, addressing its volatility and homogeneity while unlocking new markets. By integrating assets with intrinsic value and stable cash flows, DeFi can attract a broader user base, from retail investors seeking low-risk yields to institutions looking for blockchain efficiency. The growth of RWA-backed protocols, with TVL rising from $13 billion in 2023 to over $100 billion in 2025 (DeFillama), underscores their transformative potential.

However, realizing this potential requires overcoming technical, regulatory, and liquidity challenges. Protocols must invest in secure infrastructure, while regulators must balance investor protection with innovation. For users, RWAs offer a chance to diversify portfolios and engage with real-world markets in a decentralized manner. As the RWA sector matures, it could redefine DeFi as a stable, inclusive, and globally accessible financial system.

Key Takeaways

- Stability: RWAs like tokenized bonds and real estate reduce DeFi’s reliance on volatile crypto assets, enhancing systemic resilience.

- Diversity: From real estate to carbon credits, RWAs expand DeFi’s asset pool, mirroring traditional financial markets.

- Challenges: Technical vulnerabilities and regulatory hurdles must be addressed to scale RWA adoption.

- Opportunities: DeFi users can access stable yields and democratized investments, with platforms like Phemex potentially offering new RWA-related products.

As RWAs bridge the gap between TradFi and DeFi, they pave the way for a more robust and inclusive financial ecosystem. Explore RWA trends, track tokenized assets, and stay informed to seize the opportunities in this rapidly evolving space.

Disclaimer

The content of this article is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. Cryptocurrency and tokenized asset investments carry significant risk, and past performance is not indicative of future results. Always conduct your own research or consult a qualified financial advisor before making investment decisions.