Key Takeaways

-

This week, from June 9-13, 2025, four key US economic indicators—CPI, PPI, Jobless Claims, and Consumer Sentiment—will be released, potentially shaping crypto market trends.

-

The Consumer Price Index (CPI) on June 11 may signal inflation trends, influencing Federal Reserve policy and Bitcoin prices.

-

The Producer Price Index (PPI) and Initial Jobless Claims on June 12 provide insights into producer costs and labor market health, affecting crypto stability.

-

The Consumer Sentiment Index on June 13 will reflect public confidence, offering clues about risk appetite for crypto assets.

-

Understanding these indicators is essential for informed trading; Phemex offers tools like conditional orders to navigate these events.

Introduction

The cryptocurrency market is entering a decisive phase this week, June 9-13, 2025, with the release of four critical US economic indicators: the Consumer Price Index (CPI) on June 11, the Producer Price Index (PPI) and Initial Jobless Claims on June 12, and the Consumer Sentiment Index on June 13. These metrics are already impacting Bitcoin (BTC) and Ethereum (ETH) prices and could guide the Federal Reserve’s interest rate decisions, driving shifts in crypto trading trends.

The CPI, in particular, may serve as a key driver for the crypto market this week. Stay alert to how this data, alongside other indicators, might influence Federal Reserve policy and digital asset valuations. This could be a defining moment for crypto trading—approach your decisions with careful analysis.

This guide delivers a clear overview of how these economic indicators affect crypto trading on Phemex, equipping you with the knowledge to analyze data and make strategic choices. For deeper insights and trading tools, explore Phemex’s platform at Phemex.

Upcoming Economic Events

Stay informed with the schedule of economic indicators influencing crypto trading on Phemex:

|

Indicator |

Release Date |

Time (ET) |

Period Covered |

|

Consumer Price Index (CPI) |

June 11, 2025 |

8:30 AM |

May 2025 |

|

Producer Price Index (PPI) |

June 12, 2025 |

8:30 AM |

May 2025 |

|

Initial Jobless Claims |

June 12, 2025 |

8:30 AM |

Week ending June 7, 2025 |

|

Consumer Sentiment Index |

June 13, 2025 |

10:00 AM |

Preliminary June 2025 |

Note: Times are in Eastern Time (ET).

Key Indicators Explained

Understand how these indicators could shape BTC price trends:

Consumer Price Index (CPI)

-

Release Date and Time: June 11, 2025, at 8:30 AM ET (May 2025 data)

-

Overview: Tracks consumer price changes, signaling inflation trends, released tomorrow.

-

Forecasts: Consensus estimates 0.2% month-over-month (MoM); Core CPI at 0.27% MoM.

-

Implications:

-

If CPI Goes Up: May prompt rate hikes, lowering BTC prices short-term. This strengthens the US dollar, reducing demand for BTC as an alternative asset.

-

If CPI Goes Down: Could weaken the dollar, boosting BTC prices. This suggests a dovish Fed stance, increasing liquidity for risk assets.

Producer Price Index (PPI)

-

Release Date and Time: June 12, 2025, at 8:30 AM ET (May 2025 data)

-

Overview: Tracks producer cost changes, hinting at future inflation.

-

Implications:

-

If PPI Goes Up: May lead to tighter policy, reducing BTC demand. This signals rising costs that could trigger inflation concerns and stronger dollar strength.

-

If PPI Goes Down: Could ease pressure, raising BTC prices. This indicates lower inflation risks, encouraging investment in BTC.

Initial Jobless Claims

-

Release Date and Time: June 12, 2025, at 8:30 AM ET (week ending June 7, 2025)

-

Overview: Tracks new unemployment claims, reflecting labor market strength.

-

Recent Data: Dropped to 139,000 in May from 177,000 in April.

-

Implications:

-

If Jobless Claims Go Up: May boost BTC as a safe haven. This suggests economic weakness, driving investors to BTC during uncertainty.

-

If Jobless Claims Go Down: Could reduce BTC prices short-term. This indicates a strong economy, potentially leading to tighter policy and lower risk asset demand.

Consumer Sentiment Index

-

Release Date and Time: June 13, 2025, at 10:00 AM ET (preliminary June 2025 data)

-

Overview: Measures consumer confidence via surveys.

-

Recent Data: May 2025 final index was 52.2.

-

Implications:

-

If Consumer Sentiment Goes Up: May encourage BTC investment. This reflects increased risk appetite, driving demand for BTC.

-

If Consumer Sentiment Goes Down: Could lower BTC prices. This signals caution among investors, reducing interest in risk assets like BTC.

Trading Strategies on Phemex

Leverage these insights with Phemex trading strategies focused on BTC:

Pre-Release Preparation

-

Forecast Analysis: Before the June 9-13, 2025, releases, review consensus forecasts for CPI, PPI, Jobless Claims, and Consumer Sentiment. Based on their potential impact on BTC prices:

-

CPI and PPI: If forecasted above consensus (e.g., CPI above 0.2% MoM), consider a short position on BTC on Phemex to hedge potential price declines due to tighter policy. If below consensus (e.g., CPI below 0.13% MoM), a long position may support BTC price gains.

-

Jobless Claims: If forecasted above consensus (e.g., above 140,000), consider a long position on BTC, as economic weakness may prompt looser policy. If below consensus, a short position may hedge price drops.

-

Consumer Sentiment: If forecasted above consensus (e.g., above 52.2), consider a long position on BTC to capture price gains. If below consensus, a short position may hedge declines.

-

Tool Setup: Configure Phemex conditional orders to execute trades automatically based on your analysis, ensuring flexibility.

-

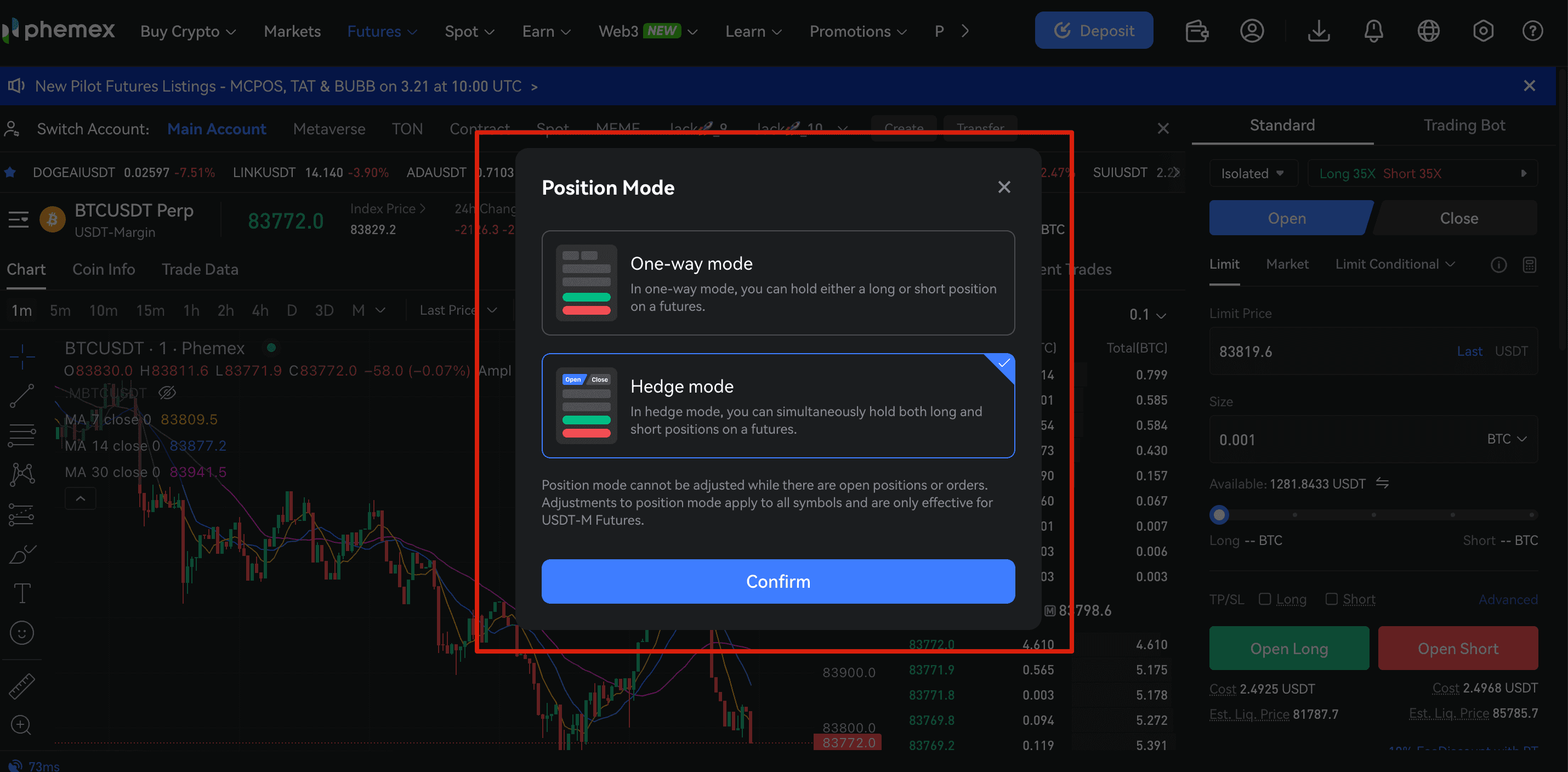

Tips to trade on Phemex: In Phemex’s hedge mode, you can simultaneously hold both long and short positions on futures. You can modify position mode in settings. Learn more about its benefits.

Further reading: Step-by-step guide on how to use Hedge Mode on Phemex

Post-Release Actions

-

Data Response:

-

If an indicator’s result is below the consensus forecast of 0.2% MoM (e.g., CPI at 0.1%), it might trigger a buy order for Bitcoin on Phemex, suggesting cooling inflation and a potential BTC price increase.

-

If above consensus (e.g., CPI at 0.3%), it could suggest a sell or short position due to anticipated rate hikes and BTC price drops. Monitor Bitcoin’s immediate reaction to the data release, focusing on price movements, trading volume, and technical indicators like RSI to confirm trends.

-

Position Adjustments: After the data release, refine your strategy by adjusting stop-loss levels or closing positions if the market moves against your thesis. For example, if CPI surprises to the upside (e.g., 0.3% MoM), tighten stop-losses to manage risk or scale into a position if it aligns with your forecast.

Volatility Consideration

-

Options Approach: Use call options on Phemex—where you profit if BTC rises (e.g., after a low CPI below 0.2% MoM)—or put options—where you profit if BTC falls (e.g., after a high CPI above 0.3% MoM)—to manage volatility exposure. Call options let you buy BTC at a set price if it rises, while put options let you sell if it falls, offering a hedge without owning the asset.

-

Derivatives Use: Phemex offers up to 100x leverage on perpetual contracts, which can amplify BTC gains during volatile periods like the June 11 CPI release. However, this significantly increases loss risk, so use leverage cautiously and assess your risk tolerance carefully.

Phemex Conditional Orders

-

Definition: Conditional orders on Phemex trigger automatically when a specified price level is reached, helping you manage risk and capitalize on BTC movements without constant monitoring. Learn more at Phemex Conditional Orders.

-

Stop-Loss: Set at $105,000 for a long BTC position (near current support with BTC at ~$107,000) to limit losses if the price drops after a high-impact indicator like CPI.

-

Take-Profit: Establish at $110,000 to secure gains if BTC rises after a low-impact release, aligning with potential resistance.

-

Conditional Orders: Buy at $102,000 if BTC dips post-high-impact release (e.g., CPI above 0.3% MoM), anticipating a rebound, or sell at $112,000 post-low-impact data (e.g., CPI below 0.1% MoM) to capitalize on strength.

Risk Management

Protect your investments on Phemex during these releases:

-

Limit BTC trades to 1-2% of your portfolio to handle volatility.

-

Use a $105,000 stop-loss to cap losses during rapid BTC price shifts.

-

Adjust tolerance settings on Phemex to avoid slippage, especially for the June 11 CPI release.

-

Spread investments across BTC and stable assets on Phemex to reduce risk.

Advanced Tips for Phemex Users

Enhance your Phemex experience:

-

Use Phemex charting tools post-CPI to analyze BTC trends.

-

Test strategies in Phemex’s demo mode.

-

Stay updated via Phemex Academy for indicator revisions.

Conclusion

The four US economic indicators releasing from June 9-13, 2025, offer critical insights into BTC price shifts, with CPI holding particular significance as of June 10, 2025. Phemex provides tools like conditional orders and leverage to navigate these trends, but success hinges on analyzing their impact on BTC prices and altcoins. This week could shape the cryptocurrency landscape—visit Phemex Academy for more and access the Phemex futures trading guide. Act with caution and informed judgment.

Disclaimer: The information provided in this article is for educational and informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile and involve significant risk. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. Phemex is not responsible for any losses incurred due to trading or investing based on the content of this article.