Summary

-

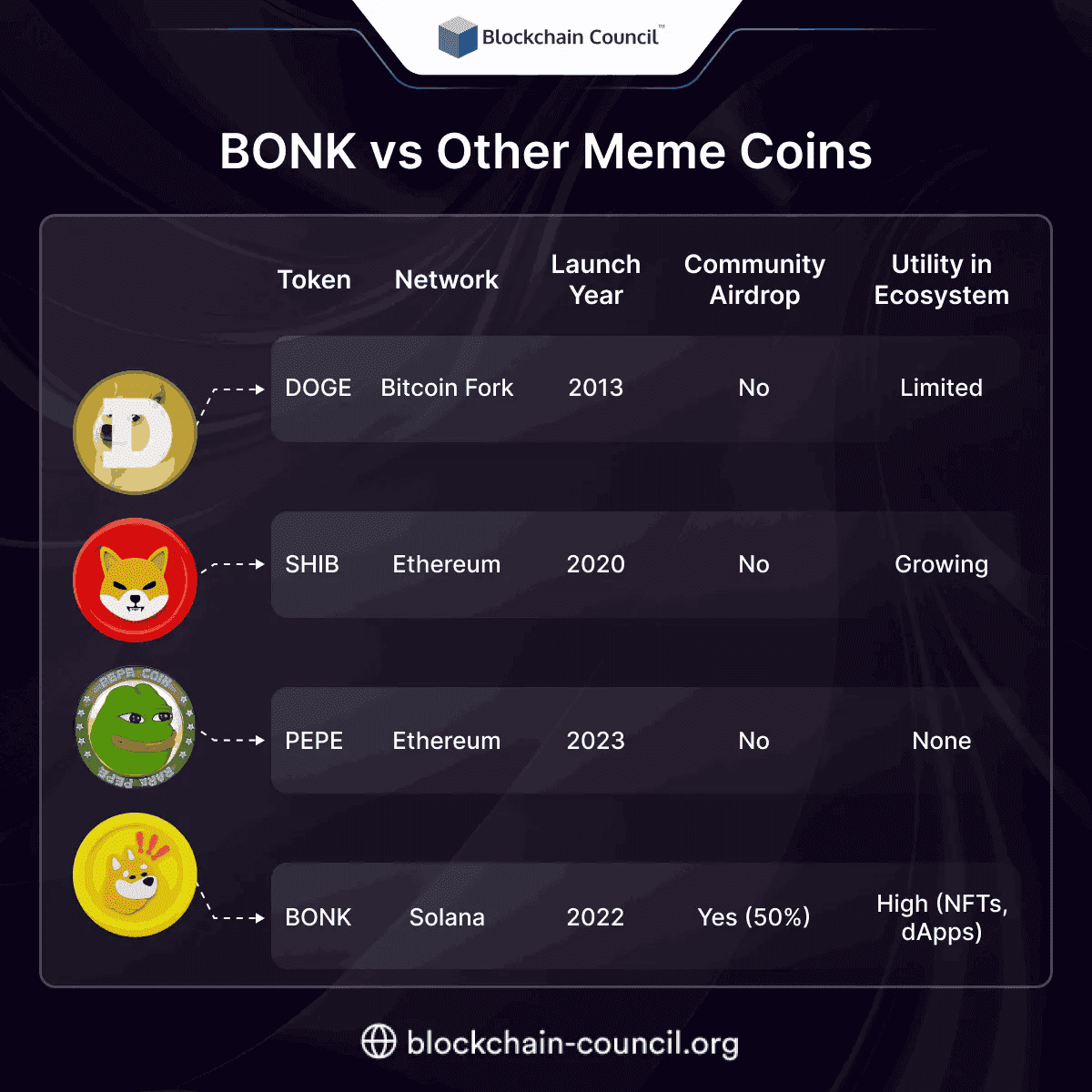

Dogecoin (DOGE) – The original meme cryptocurrency, created as a joke in 2013, now a top-10 digital asset. It’s a fun, community-driven coin used mainly for tipping and payments. Runs on its own blockchain with Proof-of-Work mining, unlimited supply, and low transaction fees.

-

Bonk (BONK) – Solana’s homegrown “dog coin of the people,” launched via a massive airdrop in Dec 2022. It’s a Solana-based token (Proof-of-Stake network) aimed at injecting liquidity and excitement into the Solana ecosystem. BONK has a capped supply (~100 trillion tokens originally) with community burns reducing it over time.

-

Key Difference: Dogecoin runs on its own Proof-of-Work blockchain (like a lighter, faster Bitcoin), while Bonk is an SPL token on the Solana blockchain, leveraging Solana’s high-speed Proof-of-Stake infrastructure. In other words, DOGE is a standalone currency, whereas BONK rides on Solana’s tech rails.

What Is DOGE?

Dogecoin is the OG meme coin – a cryptocurrency born from an internet joke that evolved into a worldwide phenomenon. Created in late 2013 by software engineers Billy Markus and Jackson Palmer, DOGE was inspired by the popular Shiba Inu “Doge” meme. What started as a tongue-in-cheek parody of Bitcoin quickly grew into a vibrant digital currency community. Dogecoin’s primary function is simple: it’s a peer-to-peer cryptocurrency that makes sending value on the internet fun and easy. People initially used it for tipping (think rewarding someone for a funny comment or helpful post online) and other small payments. Over the years, it gained surprising traction as a payment coin, accepted by more than 3,000 businesses globally (from tech merch shops to airline services) as of 2025.

On the technical front, Dogecoin runs on its own blockchain that is a fork of Litecoin. It uses a Proof-of-Work mining mechanism (specifically the Scrypt algorithm) to secure the network. Blocks are created every 1 minute on average – much faster than Bitcoin’s 10 minutes – which allows Dogecoin to process about 30–40 transactions per second. This gives DOGE an edge in speed over Bitcoin and many older coins. Transactions are also extremely cheap: Dogecoin’s average fees are around $0.002 or less, making it practical for micro-transactions. There is no hard cap on Dogecoin’s supply; instead, the network issues 5 billion new DOGE each year as a mining reward, which works out to about a 3.6% inflation rate in 2025.

What Is BONK?

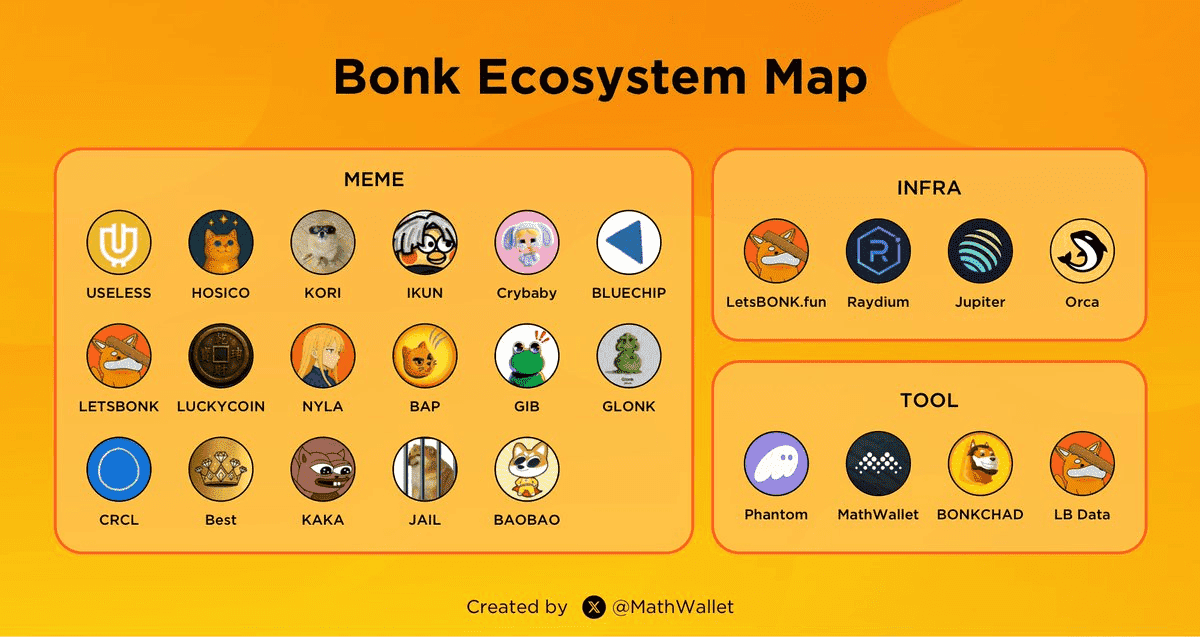

Bonk is the new kid on the block(chain) – a meme coin with a Solana twist. Bonk (BONK) proudly proclaims itself the first dog-themed coin on Solana, “for the people, by the people”. Launched on Christmas Day 2022, Bonk burst onto the scene in the aftermath of the FTX collapse, almost like a rallying cry for the Solana community. At a time when Solana’s morale (and SOL’s price) was at a low, Bonk’s creators (a group of 22 anonymous developers) decided to inject some much-needed levity and liquidity into the ecosystem. They did so by airdropping 50% of BONK’s total supply to the Solana community – effectively giving free BONK tokens to Solana developers, NFT artists, collectors, and DeFi users as a holiday gift. This wide distribution (tens of trillions of tokens scattered to hundreds of thousands of Solana addresses) created instant buzz and a broad base of holders. In fact, over 400,000 individuals held BONK within its first couple of years, thanks to that generous airdrop and subsequent integrations.

Technologically, BONK is not its own blockchain but an SPL token on the Solana network. This means it inherits Solana’s high-performance capabilities. Solana uses a combination of Proof-of-Stake and Proof-of-History, enabling very fast block times (around 400 milliseconds) and the ability to process up to 50,000 transactions per second in theory. BONK transactions utilize Solana’s infrastructure, so they are blazingly fast and cost fractions of a penny in fees – effectively instant and feeless for the end-user. This is a stark contrast to Dogecoin’s Proof-of-Work model; in the world of Solana, BONK doesn’t require mining at all, and transactions confirm almost as quickly as you refresh your feed.

Key Similarities between Dogecoin and Bonk

Despite their different origins and tech, DOGE and BONK share quite a few traits as meme coins:

-

Doggy Meme Origins: Both are dog-themed meme coins born from internet culture and humor. Dogecoin’s Shiba Inu inspiration set the template, and Bonk followed with its own Solana puppy mascot – each leveraging a lighthearted brand that helped them go viral in their communities. If you love coins with cute dog logos and an army of meme-sharing fans, you’ll find that in both projects.

-

Community-Driven Spirit: DOGE and BONK both owe their success to passionate communities rather than any corporate backer or fancy tech breakthrough. They were distributed widely (Doge through mining and early tipping, Bonk through huge airdrops) to ensure grassroots adoption. Each has an almost cult-like following on Twitter, Reddit, and beyond – with users constantly promoting, tipping, and finding new uses for the coins. In both cases, the community is the project.

-

Low-Cost, Fast Transactions: One big practical appeal of these coins is that they are actually usable for everyday transactions. Dogecoin transactions typically cost fractions of a penny (around $0.002 on average) and confirm in about a minute. Bonk, running on Solana, takes this even further – we’re talking near-instant confirmations and fees so low you’d need a microscope to see them. Sending either coin to someone is almost effortless compared to slower, expensive chains. They’re both viable for microtransactions and payments in a way many top coins aren’t.

-

Explosive Price Histories: As meme coins, both have demonstrated jaw-dropping price volatility and gains. Dogecoin famously took years of dormancy then shot to the moon in 2021 (at one point over 15,000% up in a few months), turning some holders into millionaires overnight. Bonk launched and immediately rocketed by over 2,000% in its first week of trading, and later in 2023 had another meteoric 100x-type rally. Both coins have made headlines for their spectacular rallies – and subsequent heavy crashes – reminding everyone that meme-fueled gains can be as ephemeral as the memes themselves.

-

Accessibility on Exchanges: Both DOGE and BONK are now easy to trade on major exchanges (including Phemex), which has helped broaden their appeal. In the early days, Dogecoin got popular on forums and smaller platforms; today it’s listed on well over a hundred exchanges worldwide. Bonk, too, quickly moved from just Solana DEXs to being listed on big centralized exchanges within its first year. This means anyone can buy or sell them with a few clicks, injecting liquidity and letting average traders join the fun. In short, availability is no issue – you can get your hands on either coin on a reputable platform like Phemex without breaking a sweat.

Major Differences between DOGE and BONK

While they share meme DNA, Dogecoin and Bonk differ in significant ways. Let’s break down the key differences across technology, speed, adoption, security, and liquidity:

Technology

Dogecoin and Bonk operate on very different tech frameworks. Dogecoin runs on its own Layer-1 blockchain using a Proof-of-Work (PoW) consensus model, similar to Bitcoin and Litecoin. It relies on miners solving cryptographic puzzles to validate transactions, adding 10,000 new DOGE per block. While Dogecoin is decentralized and has proven stability, it lacks features like smart contracts, supports around 33 transactions per second, and has a continuously inflationary supply.

In contrast, Bonk is an SPL token on Solana’s Layer-1 blockchain, benefiting from Solana's advanced hybrid Proof-of-Stake and Proof-of-History consensus, enabling thousands of transactions per second and full Web3 capabilities. Bonk can easily integrate with decentralized applications and platforms without the need for forks. However, it is dependent on Solana’s network, which has faced downtime issues.

In terms of supply models, Dogecoin is inflationary, minting new tokens indefinitely, while Bonk has a fixed supply with frequent burns, reflecting differing philosophies on scarcity and long-term value. Overall, Dogecoin offers a simpler, secure PoW network, while Bonk leverages modern smart contract features for greater functionality.

Transaction Speed & Fees

Dogecoin and Bonk differ significantly in speed and cost. Dogecoin, with ~1 minute block times and 33 transactions per second (TPS), allows quick transactions compared to Bitcoin’s 10-60 minute confirmations. The average transaction fee for DOGE is around $0.002, making it ideal for small payments, though it can slow down during high demand.

In contrast, Bonk, built on Solana, processes transactions in under 1 second at a cost of about $0.0001, enabling nearly real-time transfers. Solana can handle up to 50,000 TPS, far exceeding Dogecoin’s capabilities.

In essence, Dogecoin confirms in 1-2 minutes with low fees, while Bonk confirms in 1-2 seconds with virtually no fees. Both are efficient, but Bonk’s speed is advantageous for high-frequency trading. Reliability is another factor; Dogecoin’s Proof-of-Work structure offers predictable timing, while Solana may experience occasional congestion. Overall, Bonk provides an almost seamless experience, emphasizing its speed and low costs within the Solana ecosystem.

Adoption & Community

Dogecoin and Bonk are both meme coins, but they have distinct adoption paths and communities. Dogecoin has achieved broad, mainstream acceptance, with over 3,100 businesses worldwide accepting it as payment, including notable names like Tesla and the Dallas Mavericks. Its community is large and known for its generosity, supported by a revival of development since 2021 with the re-establishment of the Dogecoin Foundation.

In contrast, Bonk is primarily recognized within the Solana ecosystem. Its adoption is more focused internally within crypto, having integrated with over 140 projects in its first two years, particularly in DeFi and NFT. Outside of the Solana community, you won’t find many merchants accepting BONK. Bonk’s community grew rapidly through an initial airdrop, establishing a niche following that actively engages on Twitter and through the Bonk DAO.

While Dogecoin benefits from celebrity endorsements and broader cultural recognition, Bonk relies on its strong Solana community, appealing to a younger, more crypto-savvy audience. Overall, Dogecoin excels in merchant adoption and mainstream visibility, whereas Bonk shows deeper integration within the Solana ecosystem. Both communities are passionate and committed to their coins, but they operate in different spheres of the crypto world.

Security & Transparency

Security in crypto encompasses network security and project trustworthiness. Dogecoin excels in network security due to its robust decentralized Proof-of-Work network, boasting a hash rate in the trillions of hashes per second by 2025. This strength makes it impractical for a 51% attack, and merged mining with Litecoin further enhances its security. The open-source code, linked to Bitcoin and Litecoin, is simple and secure.

However, Dogecoin has some centralization concerns, with about 27% of all DOGE held in one wallet and the top 10 wallets holding over 30%. Despite this, large wallets are believed to belong to exchanges rather than individuals. The Dogecoin community is transparent about its activities, and regulatory clarity means it’s not considered a security, adding to its appeal.

In contrast, Bonk's security relies on Solana’s blockchain, which has around 1,900 validators. Although considered secure, Solana has faced network outages in the past. Bonk’s smart contract security is solid, having undergone audits.

However, Bonk is less transparent than Doge, as its developers remain anonymous. Investors must trust an unnamed team with a basic roadmap and tokenomics. The allocation of tokens for the team and marketing raises some transparency concerns, unlike Dogecoin’s community-driven approach.

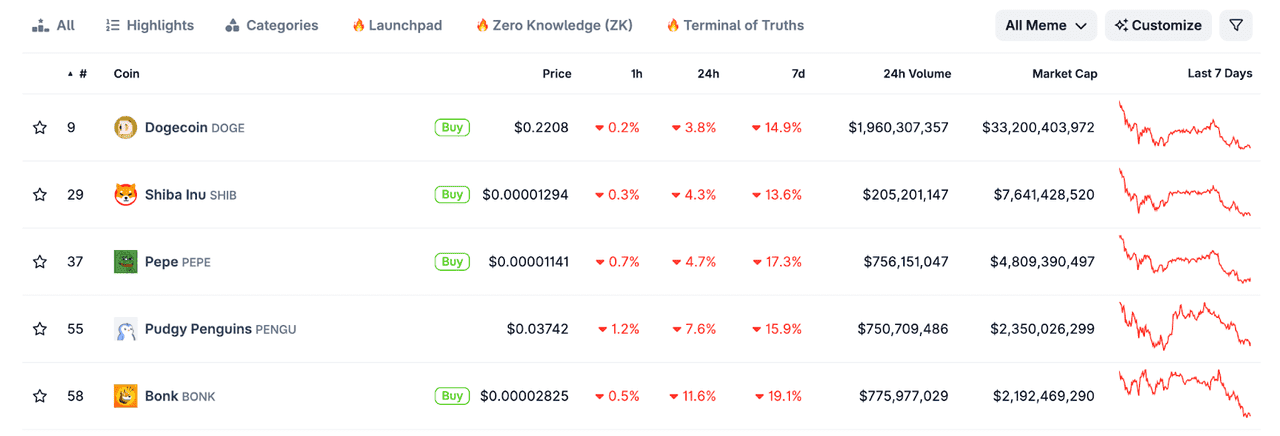

Trading Liquidity

Liquidity is essential for any tradeable asset, and Dogecoin clearly outshines Bonk in this aspect. Dogecoin boasts deep trading liquidity, consistently ranking among the top cryptocurrencies by market cap. It has vast daily trading volumes, averaging around $950 million in Q1 2025 and spiking above $1.4 billion during rallies. This high liquidity allows for large trades with minimal price impact and supports a robust derivatives market.

In contrast, Bonk started with lower liquidity, primarily traded on Solana DEXs. However, after being listed on major exchanges by late 2023, its liquidity improved significantly, reaching hundreds of millions in daily volume during peak periods. As of mid-2025, Bonk’s market cap is around $1 billion with daily volumes in the tens of millions. While Bonk's liquidity suffices for moderate trading, significant orders could noticeably impact its price.

Dogecoin offers a wider range of trading pairs and venues, trading against USD, USDT, and even fiat, making it more versatile. Bonk is primarily traded against USDT or USDC and lacks widely available derivatives. However, it does retain unique liquidity through Solana’s 24/7 trading.

From a trader’s viewpoint, Dogecoin's established market is more accessible and less volatile, while Bonk's smaller market can be more sensitive to large trades. Both coins are easily traded on Phemex, with Dogecoin being the more liquid option. In conclusion, while Dogecoin is the dominant liquidity player, Bonk is rapidly growing and remains suitable for retail trading.

Which One Should You Choose?

Dogecoin is for those who value stability and a proven track record. With years of community building and recognition, it's the established choice in the meme coin space. If you prefer a coin with mainstream appeal and want a lower volatility option, Dogecoin could be your pick. It’s suitable for long-term holding, blending fun with a sense of security.

BONK, on the other hand, appeals to thrill-seekers looking for high-risk, high-reward opportunities. As part of the Solana ecosystem, it’s great for those who enjoy cutting-edge blockchain projects and quick transactions. If you're eager to be an early adopter and are comfortable with volatility, Bonk might be the way to go.

Essentially, if Dogecoin is the reliable golden retriever, Bonk is the adventurous husky pup. You don't have to choose one over the other; holding both can balance your portfolio, with DOGE offering stability and BONK the potential for rapid growth. Remember, both are speculative investments and should align with your financial goals and risk tolerance. Always do your own research and invest responsibly!

Conclusion

In the grand showdown of DOGE vs BONK, there isn’t a one-size-fits-all answer – both have carved out their own niches in 2025’s crypto landscape. Dogecoin remains the confident elder statesman of meme coins, offering a blend of humor and surprising resilience. Bonk is the upstart contender, injecting new energy into the meme coin arena with Solana-powered speed. Ultimately, the “better” investment depends on your style: the seasoned Doge or the daring Bonk each can shine under the right conditions.

What’s certain is that both coins have captivated traders and hodlers alike, and both are available for you to explore on Phemex. If you’re curious, you don’t have to sit on the sidelines – you can dive in and compare DOGE and BONK performance yourself, trade either token, or even hold a bit of both on Phemex’s secure exchange. As always, approach these opportunities with a level head and a sense of adventure. Meme coins, with their witty communities and wild rides, remind us that crypto is as much about culture and community as it is about technology. Whether you’re joining the Dogecoin pack or the Bonk brigade, remember to have fun and stay safe.

For any inquiries contact us at support@phemex.com

Trade crypto on the go: Download for iOS | Download for Android

Phemex | Break Through, Break Free

Read More

- Dogecoin (DOGE) Price Outlook on Phemex: Key Trading Strategies for May 2025

- What is Dogecoin: Crypto’s Most Valuable Joke

- Dogecoin vs. Shiba Inu: Which Is Better?