Bitcoin remains the cornerstone of cryptocurrency, but its Layer 1, limited to roughly seven transactions per second (TPS), faces scalability hurdles that challenge its potential as a global financial system. In 2025, Layer 2 (L2) solutions like rollups and meta-protocols such as Alkanes are breaking these barriers, delivering enhanced throughput, lower costs, and advanced programmability. From Bitcoin Core v29.0’s proposed OP_RETURN limit removal to Alkanes’ WebAssembly (WASM)-powered smart contracts, this article explores Bitcoin’s evolving ecosystem. Platforms like Phemex enable users to engage with these innovations through trading and market insights, reflecting Bitcoin’s growing adoption. Here’s a deep dive into the technologies and trends shaping Bitcoin’s scalable future.

Key Takeaways

- Scalability Leap: Rollups like ZK-Rollups and Optimistic Rollups achieve thousands of TPS, reducing fees by up to 99% while leveraging Bitcoin’s Layer 1 security.

- Alkanes’ Innovation: Launched in 2025, Alkanes introduces WASM-based smart contracts, enabling DeFi, NFTs, and dApps natively on Bitcoin.

- Bitcoin Core v29.0: Enhances P2P networking and proposes removing the 80-byte OP_RETURN limit, streamlining rollups and meta-protocols.

- Institutional Growth: Mergers like American Bitcoin-Gryphon and ETFs like Grayscale’s BCOR signal corporate Bitcoin adoption.

- Future Outlook: The OYL AMM (2026) and BitVM2 could position Bitcoin as a programmable DeFi hub, rivaling Ethereum.

The Scalability Challenge: Why Layer 2 Matters

Bitcoin’s Layer 1 prioritizes security and decentralization, but its 4MB block size (post-SegWit and Taproot) and Proof of Work (PoW) consensus limit throughput, causing congestion and high fees during demand spikes. Layer 2 solutions process transactions off-chain, settling only critical data on-chain, enabling scalability without sacrificing Bitcoin’s core strengths. By implementing larger and faster blocks, Bitcoin L2s offer significantly higher transaction throughput than Layer 1. These advancements support diverse use cases, from micropayments to DeFi and NFTs, positioning Bitcoin for global adoption.

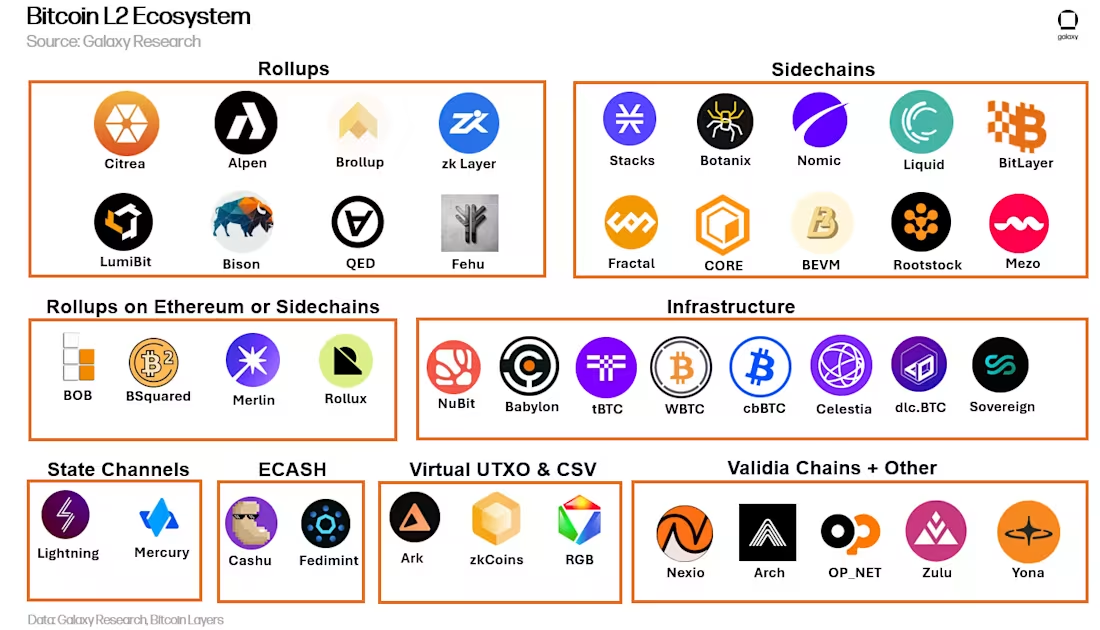

In 2025, rollups and meta-protocols like Alkanes lead this transformation, with projects like Merlin Chain, SatoshiVM, and Spiderchain pushing boundaries. Institutional developments, like the American Bitcoin and Gryphon Digital Mining merger for a public listing, reflect growing confidence in Bitcoin’s scalable ecosystem. Platforms like Phemex provide access to these assets, offering tools for traders to navigate this evolving landscape.

Rollups: Scaling Bitcoin Without Compromise

Rollups aggregate thousands of transactions into a single batch, process them off-chain, and submit a compact cryptographic proof to Layer 1, minimizing data usage while maintaining security. As independent execution environments, Bitcoin L2s circumvent Layer 1’s technical limitations, such as the lack of Turing-completeness, by using their own consensus mechanisms, security frameworks, and virtual machines. For instance, many Bitcoin L2s in production are EVM-equivalent or compatible, enabling integration with apps from other EVM blockchains (for more on EVM equivalency, see Christine Kim’s report on Ethereum ZK-Rollups). Two rollup types dominate in 2025: Zero-Knowledge (ZK) Rollups and Optimistic Rollups.

Zero-Knowledge Rollups (ZK-Rollups)

ZK-Rollups use zk-SNARKs to validate off-chain transactions, achieving up to 9,000 TPS with enhanced privacy. Merlin Chain, launched in February 2024, integrates ZK-Rollups with decentralized oracles and fraud proofs, supporting dApps like NFTs and DeFi. SatoshiVM, an EVM-compatible ZK-Rollup, enables Ethereum-style smart contracts on Bitcoin, fostering cross-chain innovation.

Optimistic Rollups

Optimistic Rollups assume transaction validity, computing fraud proofs only if challenged, reducing complexity but introducing withdrawal delays. Rollkit adapts sovereign rollups for Bitcoin, leveraging BitVM2, a 2025 breakthrough that simulates complex off-chain logic. BitVM2, an off-chain Turing-complete virtual machine compatible with Bitcoin, supports modular rollup stacks with EVM compatibility and trustless BTC bridging, navigating Bitcoin’s scripting limitations.

Bitcoin Core v29.0: OP_RETURN Evolution

Bitcoin Core v29.0, released in 2025, improves P2P networking, block synchronization, and mempool policies, introducing new orphan transaction handling. A proposed removal of the 80-byte OP_RETURN limit addresses outdated constraints, as private mining accelerators often ignore it, creating skewed incentives. This change could enhance rollup and meta-protocol efficiency by allowing more transaction data, supporting platforms like Phemex that facilitate trading of Bitcoin-based assets.

Bridge Mechanisms in Bitcoin L2s

A defining feature of Bitcoin L2s is their bridge mechanisms, which enable users to move BTC from Layer 1 to Layer 2. Bitcoin L2s employ diverse bridge frameworks, including multi-signature (multi-sig) and multi-party-custody (MPC) wallet schemes, as well as third-party bridges. Some utilize multi-sig/MPC schemes with BitVM, which involves a 1-of-n trust assumption, requiring only one honest bridge operator to be online for users to exit. In contrast, traditional MPC and multi-sig bridges typically need over 50% of signers to be honest for exits. Unlike Ethereum L2 bridges, which use smart contract accounts, Bitcoin L2 bridges rely on Bitcoin public key addresses controlled by private keys. However, Bitcoin L2 bridges for sidechains and rollups lack unilateral exits, meaning users must trust intermediaries to withdraw funds. Ethereum rollups often include forced withdrawals, allowing direct L1 submissions if sequencers fail, a feature absent in Bitcoin L2s except for state channels like the Lightning Network, which offers trustless unilateral exits based on the latest balance state.

Alkanes: A New Era of Bitcoin Programmability

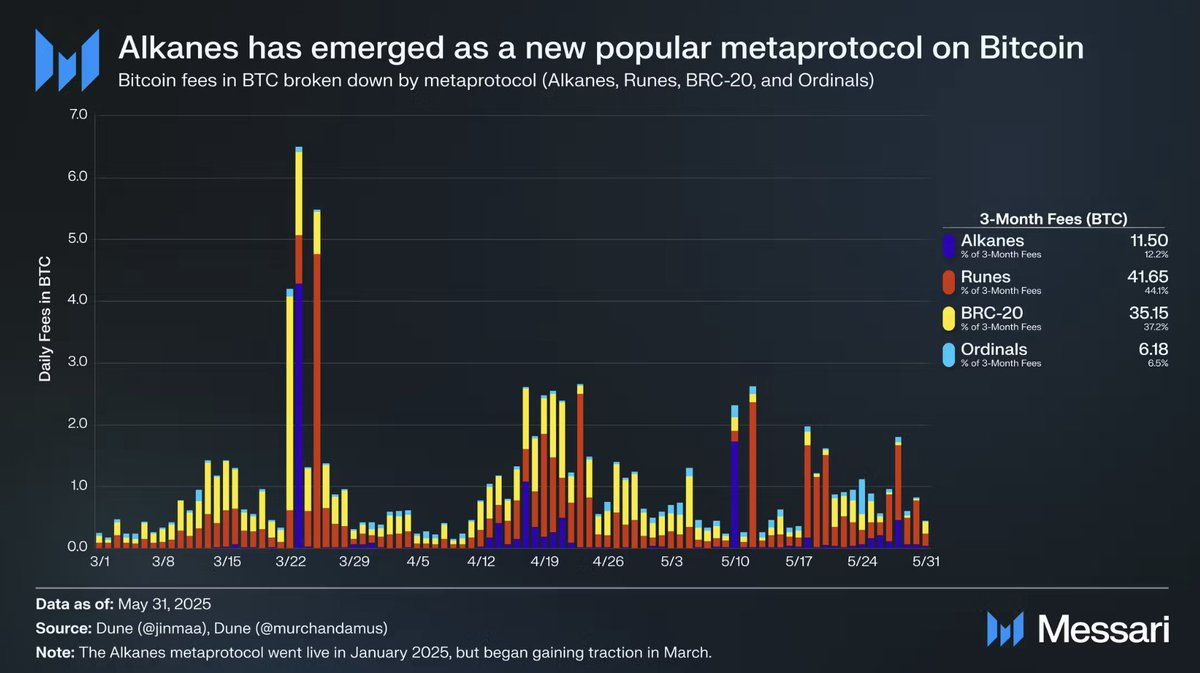

Meta-protocols embed custom data in Bitcoin transactions to enable advanced functionalities. Ordinals and Runes popularized NFTs and fungible tokens, but their limited programmability has slowed innovation. Alkanes, developed by @oylwallet and launched in January 2025, introduces WASM-based smart contracts, enabling dApps like automated market makers (AMMs), lending protocols, and derivatives on Bitcoin’s Layer 1 and L2.

Alkanes’ Ecosystem

Since March 2025, Alkanes has generated 11.5 BTC in gas fees, outpacing Ordinals (6.2 BTC) but trailing Runes (41.7 BTC) and BRC-20 tokens (35.2 BTC). Key activities include:

- Alkanes Token Standard: Fungible tokens like $DIESEL and $METHANE (@MethaneFund).

- Orbitals NFTs: Collections like @AlkanePandas and @OylyOnAlkanes.

- ClockInSystem: A smart contract by @jin_maa where users “clock in” to special blocks, earning leaderboard rankings.

Transactions primarily occur on iDclub (@idclub_ord), a PSBT-based marketplace similar to Runes and Ordinals trading. The forthcoming OYL AMM in 2026 will introduce native liquidity pools, eliminating manual order matching and enabling seamless DeFi. Platforms like Phemex are well-positioned to support trading of Alkanes-based assets as this ecosystem grows.

Alkanes vs. Ordinals and Runes

Alkanes’ WASM contracts offer dynamic programmability, surpassing the token-centric focus of Ordinals and Runes. Its reward systems, like XP for trading volume, boost engagement, positioning Alkanes as a foundation for Bitcoin-native DeFi and dApps.

Institutional and Market Developments

Bitcoin’s technical progress aligns with institutional adoption:

- American Bitcoin-Gryphon Merger: A 2025 merger targets a public listing, signaling Bitcoin’s maturing market.

- Grayscale Bitcoin Adopters ETF (BCOR): Tracks firms holding Bitcoin as treasury reserves across industries, with a 0.59% expense ratio.

- Bloomberg Bitcoin & Gold Blend Indices: The BBIG and BBUG indices combine Bitcoin, gold, and USD, offering customizable weightings.

- Trump Bitcoin Plus ETF: Analyst Eric Balchunas highlights plans for a potential ETF linked to former President Trump, underscoring Bitcoin’s political relevance.

These developments reflect Bitcoin’s growing financial integration, with platforms like Phemex providing market access and insights for investors exploring these opportunities.

Leading Layer 2 Projects in 2025

Beyond rollups and Alkanes, key L2 projects include:

- Lightning Network: Achieves up to 50,000 TPS for micropayments, dominant in remittances with trustless unilateral exits, but limited to payments.

- Rootstock (RSK): An EVM-compatible sidechain with RIF Rollup, supporting DeFi and NFTs via merged mining.

- Stacks: Uses Proof of Transfer (PoX) and Clarity contracts for secure DeFi and NFT applications.

- Merlin Chain: Combines ZK-Rollups with oracles for dApp support.

- Spiderchain (Botanix Labs): Modular rollups with Ethereum-style functionality, anchored to Bitcoin.

Benefits and Trade-Offs

- Scalability: Rollups deliver thousands of TPS; Alkanes enhances Layer 1 programmability.

- Affordability: Off-chain processing reduces fees by up to 99%.

- Programmability: Alkanes’ WASM and rollup-enabled EVM support enable advanced dApps.

- Privacy: ZK-Rollups and Alkanes’ cryptography improve transaction privacy.

- Challenges: Bitcoin’s scripting limits require complex solutions like BitVM2. L2 bridges for sidechains and rollups lack unilateral exits, relying on trust assumptions (e.g., multi-sig requiring over 50% honest signers). Alkanes’ adoption trails Runes, needing better onboarding. Off-chain risks demand robust security.

Bitcoin’s Scalable Future

In 2025, rollups and Alkanes are transforming Bitcoin into a scalable, programmable platform. The OYL AMM in 2026 could rival Ethereum’s DeFi ecosystem, while Bitcoin Core v29.0 and BitVM2 unlock new possibilities. Institutional moves, from BCOR to Bloomberg’s indices, highlight Bitcoin’s legitimacy. As SatLayer, GOAT Rollup, and Alkanes’ Orbitals NFTs and ClockInSystem drive innovation, platforms like Phemex enable users to explore these assets and trends, positioning Bitcoin as a multi-layered financial hub.

Conclusion: Bitcoin’s Next Frontier

Bitcoin’s Layer 2 solutions and meta-protocols like Alkanes are redefining its capabilities, balancing scalability, cost, and programmability. From rollups enabling high-throughput transactions to Alkanes powering DeFi and NFTs, Bitcoin is evolving beyond a store of value. Whether tracking ZK-Rollups, exploring Orbitals NFTs, or monitoring institutional trends like the Trump Bitcoin Plus ETF, 2025 marks a turning point for Bitcoin’s scalable, programmable future. Platforms like Phemex offer a gateway to engage with these developments, connecting users to Bitcoin’s dynamic ecosystem.