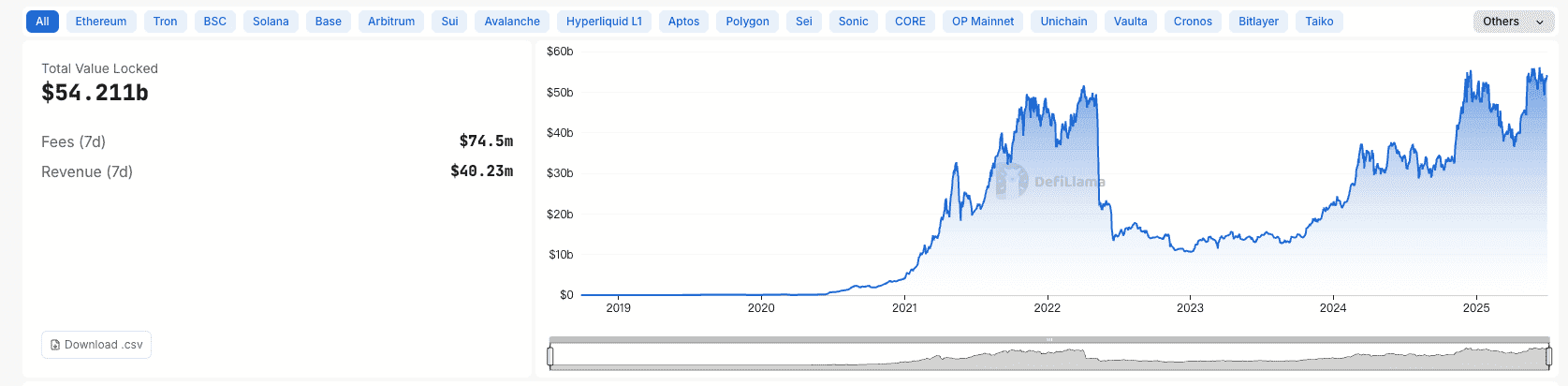

The crypto lending space has become a cornerstone of the digital asset ecosystem, offering investors diverse opportunities to earn passive income on their holdings. As of July 1, 2025, DeFi lending alone commands a Total Value Locked (TVL) of $54.211 billion, with 7-day fees reaching $74.5 million and 7-day revenue at $40.23 million. Whether you hold Bitcoin, Ethereum, or stablecoins like USDT, lending platforms provide yields that often outpace traditional financial products. However, the choice between Centralized Finance (CeFi) and Decentralized Finance (DeFi) lending is critical, as each offers distinct advantages, risks, and operational models. This article delivers a balanced, in-depth comparison to help you decide which lending approach aligns with your financial goals, risk tolerance, and technical expertise.

By examining the mechanics, benefits, and challenges of CeFi and DeFi lending, we aim to equip you with the knowledge to make informed decisions. Whether you’re a beginner seeking simplicity or an experienced investor chasing higher yields, understanding these ecosystems is essential for optimizing returns while managing risks.

What Is CeFi Lending?

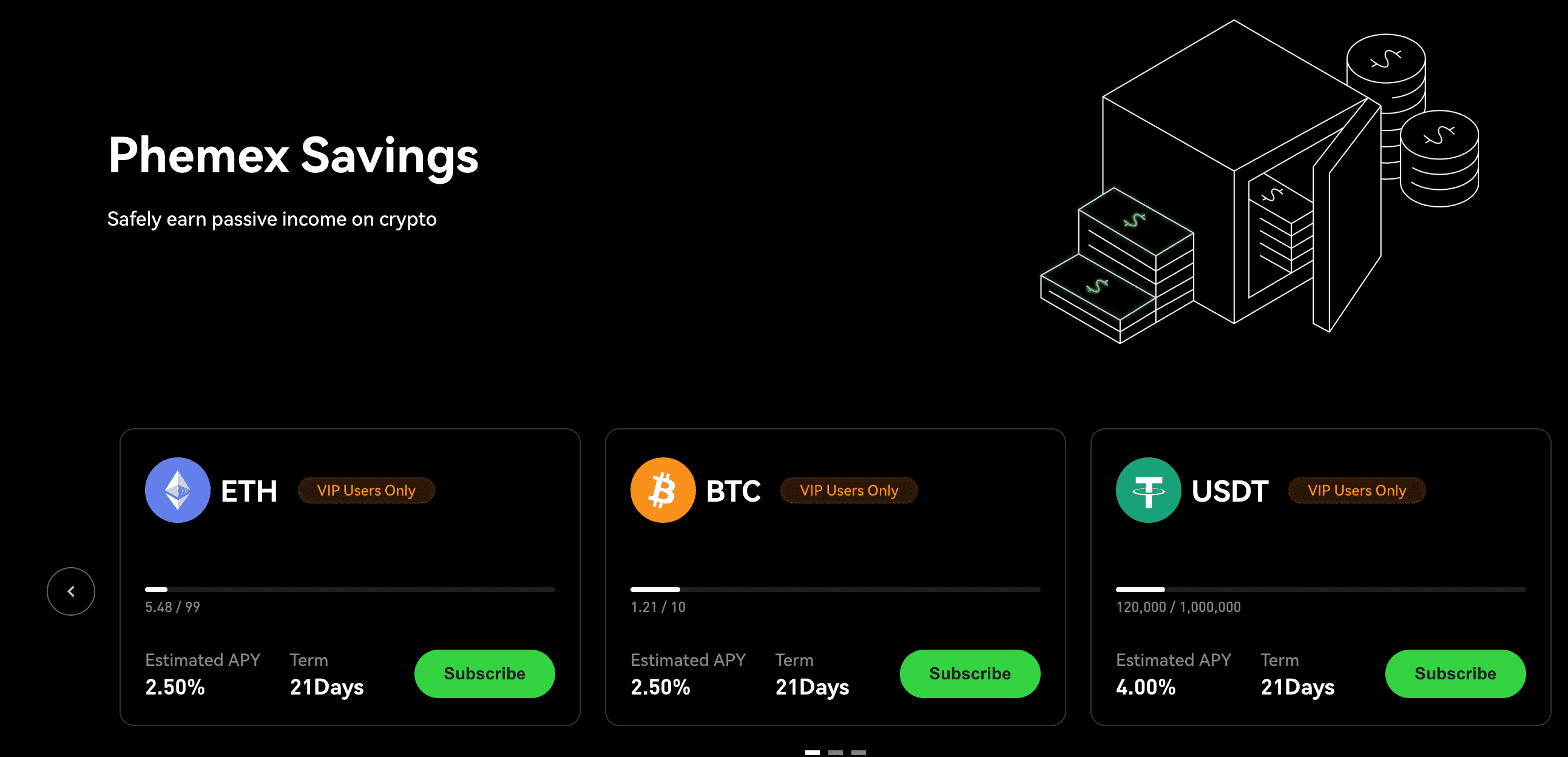

Centralized Finance (CeFi) lending involves platforms operated by centralized entities, such as Phemex, which act as intermediaries between lenders and bo rrowers. Users deposit their crypto assets into the platform, which then lends those assets to generate yields, typically for institutional or retail borrowers. The platform manages loan origination, risk assessment, and payouts, mirroring traditional banking systems.

For example, Phemex Savings allows users to deposit assets like Bitcoin (BTC), Ethereum (ETH), or USDT into flexible or fixed-term savings products, earning interest paid out daily, weekly, or monthly. CeFi platforms handle asset custody, providing convenience and customer support, but require users to trust the platform’s security and management. Most CeFi platforms comply with regulatory requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, which add oversight but demand personal information.

Key Features of CeFi Lending

- Centralized Control: A single entity oversees the platform, funds, and lending processes.

- Custodial: The platform holds your private keys, simplifying management but requiring trust.

- Regulatory Compliance: Adheres to KYC/AML regulations, offering legal protections but limiting privacy.

- User-Friendly: Intuitive interfaces require minimal technical knowledge, ideal for beginners.

- Stable Yields: Fixed or predictable interest rates ensure consistent returns.

What Is DeFi Lending?

Decentralized Finance (DeFi) lending operates on blockchain-based protocols, eliminating intermediaries through smart contracts—self-executing code that automates lending and borrowing. Platforms like Aave, Compound, or Morpho enable peer-to-peer lending by allowing users to deposit assets into liquidity pools, earning interest based on market dynamics. DeFi is non-custodial, meaning you retain control of your private keys, but it requires familiarity with wallets (e.g., MetaMask) and blockchain concepts like gas fees.

For instance, depositing USDT into an Aave lending pool allows borrowers to access those funds, paying interest that fluctuates with the pool’s utilization rate (borrowed vs. supplied assets). DeFi’s permissionless nature means anyone with a compatible wallet can participate globally without KYC, but users must navigate technical complexities and market volatility.

Key Features of DeFi Lending

- Decentralized: Smart contracts govern transactions, removing central authorities.

- Non-Custodial: You control your private keys, ensuring asset ownership but requiring self-management.

- Permissionless: Open to all with a wallet, promoting financial inclusion.

- Technical Complexity: Requires understanding wallets, gas fees, and blockchain interactions.

- Variable Yields: Interest rates fluctuate with market supply and demand, offering higher potential returns.

CeFi vs. DeFi Lending: A Detailed Comparison

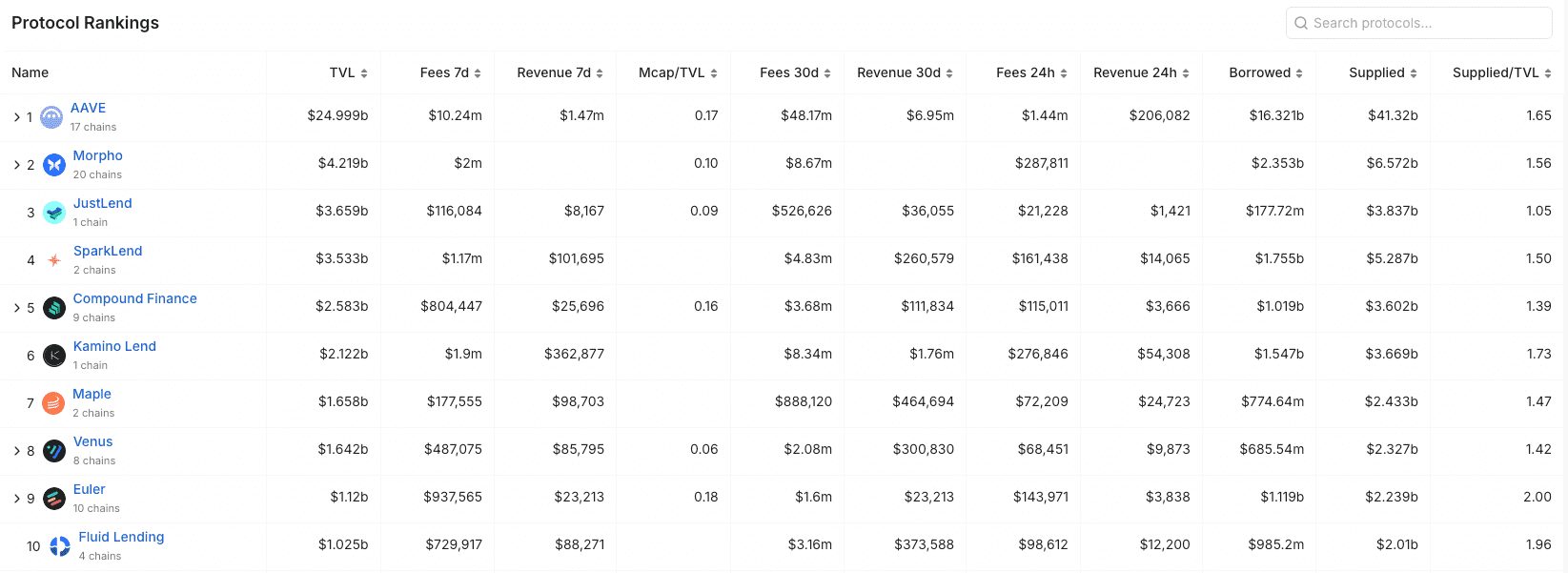

To help you evaluate CeFi and DeFi lending, we’ve outlined key differences across critical factors, supported by a comparison table. The data reflects the DeFi lending landscape as of July 1, 2025, with a TVL of $54.211 billion, driven by top protocols like Aave ($24.999 billion TVL), Morpho ($4.219 billion), JustLend ($3.663 billion), SparkLend ($3.533 billion), and Compound ($2.583 billion).

| Factor | CeFi Lending (e.g., Phemex Savings) | DeFi Lending (e.g., Aave) |

|---|---|---|

| Custody | Platform holds private keys (custodial) | You hold private keys (non-custodial) |

| Security | Platform’s security measures (e.g., cold storage) | Smart contract audits, code integrity |

| Ease of Use | Simple, beginner-friendly UI | Requires wallet setup, gas fee knowledge |

| Yields & Rates | Stable, predictable (5–10% APY for stablecoins) | Variable, market-driven (e.g., Aave: 1.13%, Morpho: 1.55%) |

| Accessibility | KYC/AML required, geographic restrictions | Permissionless, globally accessible |

| Customer Support | Dedicated support teams | Community-based or no formal support |

| Regulatory Oversight | Regulated, legal protections | Unregulated, varying by jurisdiction |

| Liquidity & Scale | Platform-dependent | High liquidity (e.g., Aave: $24.999B TVL, $16.321B borrowed) |

1. Custody: Who Controls Your Assets?

In CeFi lending, platforms like Phemex Savings take custody of your assets, holding your private keys. This simplifies the process—you deposit funds and let the platform handle the rest, akin to a bank. Reputable CeFi platforms employ robust security, such as Phemex’s cold storage and multi-signature wallets. However, custodial models mean you relinquish control, and historical failures like Celsius (2022) highlight risks of platform mismanagement or insolvency.

In DeFi lending, you retain full control via non-custodial wallets. For example, depositing into Aave’s $24.999 billion TVL pool requires connecting a wallet like MetaMask, ensuring you hold your keys. This aligns with the crypto principle of “not your keys, not your crypto” but demands responsibility. Losing your private key or seed phrase results in permanent fund loss, with no recourse via customer support. DeFi suits those prioritizing autonomy but requires vigilance.

2. Security: Platform vs. Protocol Risks

CeFi security relies on the platform’s infrastructure. Phemex, for instance, uses offline storage, multi-factor authentication, and regular audits to safeguard funds. However, centralized platforms are hacker targets, and a breach could compromise user assets. Regulatory compliance may include insurance funds, but users remain exposed to platform risks, as seen with BlockFi’s $100 million SEC fine and service restrictions in 2022.

DeFi security depends on smart contract integrity. Aave, with $24.999 billion in TVL and $16.321 billion in active loans, undergoes rigorous audits by firms like ChainSecurity to minimize vulnerabilities. Morpho, with $4.219 billion TVL, supports 450 pools and benefits from similar audit practices. However, DeFi protocols face risks like flash loan attacks or code exploits. In 2024, DeFi platforms reported $19.1 billion in open borrows, reflecting trust but also exposure to smart contract risks. Users must rely on protocol audits and their own security practices.

3. Ease of Use: Simplicity vs. Technical Expertise

CeFi platforms prioritize accessibility. Phemex Savings offers a streamlined interface where users can deposit funds, choose flexible or fixed-term products, and earn interest (e.g., 5–10% APY on USDT) with minimal effort. Dedicated support teams assist with issues, and KYC verification, while mandatory, ensures compliance. This makes CeFi ideal for beginners or those seeking a low-maintenance experience.

DeFi lending requires technical proficiency. Using Aave (179 pools tracked) or Morpho (450 pools) involves setting up a wallet, managing gas fees (which can range from $10–$100 on Ethereum), and navigating blockchain interfaces. For example, JustLend on the TRON network, with $3.663 billion TVL, requires understanding TRX staking for bandwidth. DeFi’s learning curve can deter novices, but tech-savvy users appreciate the control and flexibility.

4. Yields & Rates: Stability vs. Opportunity

CeFi yields are stable and predictable. Phemex Savings offers fixed APYs, often 5–10% for stablecoins, set by the platform to ensure consistency. These rates are lower than DeFi’s peak yields but appeal to risk-averse users. For instance, CeFi platforms like Nexo reported stable 8% APY on USDC in 2024, compared to DeFi’s fluctuating rates.

DeFi yields are market-driven and variable. As of July 1, 2025:

- Aave: 1.13% average APY across 179 pools, $24.999 billion TVL, $16.321 billion borrowed.

- Morpho: 1.55% average APY across 450 pools, $4.219 billion TVL, $2.353 billion borrowed.

- JustLend: 0.72% average APY across 18 pools, $3.663 billion TVL, $177.64 million borrowed.

- SparkLend: 1.53% average APY across 25 pools, $3.533 billion TVL, $1.755 billion borrowed.

- Compound: 0.7% average APY across 122 pools, $2.583 billion TVL, $1.019 billion borrowed.

DeFi’s higher yields (e.g., Morpho’s 1.55%) reflect market dynamics, with rates rising during high borrowing demand. However, volatility can reduce returns, and gas fees impact profitability for smaller deposits. Additional rewards, like AAVE or MORPHO tokens, add complexity but enhance potential returns.

5. Accessibility: Gatekeepers vs. Open Access

CeFi platforms often require KYC/AML compliance, limiting access in regions with strict regulations (e.g., the U.S.). Phemex may restrict services due to regulatory hurdles, but it supports fiat-to-crypto conversions and diverse assets, including non-ERC20 tokens like Bitcoin. This makes CeFi versatile for users comfortable with compliance.

DeFi platforms are permissionless, requiring only a wallet and internet connection. Aave’s multi-chain support (Ethereum, Polygon, Avalanche) and Morpho’s 450 pools make DeFi globally accessible, ideal for the unbanked or privacy-focused users. However, high gas fees and reliance on specific networks (e.g., JustLend on TRON) can create barriers. DeFi’s $54.211 billion TVL reflects its broad reach, but technical hurdles remain.

6. Customer Support: Human Touch vs. Community Reliance

CeFi platforms offer robust support. Phemex provides email, live chat, and social media assistance for issues like account access or transaction errors, making it beginner-friendly.

DeFi platforms lack formal support. Aave, Morpho, and Compound rely on community forums or Discord for troubleshooting. For example, resolving a failed transaction on SparkLend ($3.533 billion TVL) requires self-research or community help, which can frustrate less experienced users.

7. Regulatory Oversight: Protection vs. Freedom

CeFi platforms operate under regulatory scrutiny, offering legal protections but requiring KYC. Incidents like Voyager’s 2022 bankruptcy highlight the importance of compliance but also platform risks.

DeFi platforms exist in a regulatory gray area, offering privacy but no legal recourse. Aave’s $219.03 million treasury and Compound’s $38.26 million treasury fund protocol improvements, but users bear full responsibility for losses due to hacks or errors.

Who Is CeFi Lending For?

CeFi lending suits users who:

- Value Simplicity: Prefer a user-friendly platform with minimal setup.

- Seek Stability: Favor predictable yields (e.g., 5–10% APY) over volatile returns.

- Need Support: Rely on customer service for guidance.

- Want Fiat Integration: Value fiat conversions and diverse asset support.

- Are Beginners: Benefit from regulatory protections and intuitive interfaces.

CeFi, like Phemex Savings, is ideal for those prioritizing convenience over control, but users must trust the platform’s security and management.

Who Is DeFi Lending For?

DeFi lending is best for users who:

- Prioritize Control: Want full ownership of assets and private keys.

- Chase Higher Yields: Accept volatility for APYs like Morpho’s 1.55% or SparkLend’s 1.53%.

- Value Privacy: Avoid KYC for anonymity.

- Are Tech-Savvy: Can manage wallets, gas fees, and blockchain interactions.

- Support Decentralization: Align with DeFi’s ethos of financial inclusion.

DeFi appeals to experienced users comfortable with technical complexities and market risks, leveraging platforms like Aave’s $24.999 billion TVL for high liquidity and returns.

Making Your Decision: Key Considerations

Choosing between CeFi and DeFi lending depends on your priorities:

- Control vs. Convenience: CeFi simplifies management but sacrifices control; DeFi offers autonomy but demands responsibility.

- Risk Tolerance: CeFi’s stable yields suit conservative investors; DeFi’s higher APYs (e.g., Morpho’s 1.55%) attract risk-takers.

- Technical Expertise: CeFi requires minimal knowledge; DeFi demands wallet and blockchain proficiency.

- Privacy Needs: CeFi’s KYC contrasts with DeFi’s permissionless access.

- Liquidity Goals: DeFi’s $54.211 billion TVL, led by Aave, offers deep liquidity; CeFi varies by platform.

A hybrid approach may balance stability and opportunity. For example, allocate stablecoins to Phemex Savings for consistent yields and a portion to Morpho for higher APYs, diversifying risk.

The Future of CeFi and DeFi Lending

As of July 1, 2025, DeFi lending’s $54.211 billion TVL, $74.5 million in 7-day fees, and $40.23 million in 7-day revenue underscore its dominance, nearly doubling CeFi’s $11 billion in open borrows. Aave’s $24.999 billion TVL and $16.321 billion in active loans highlight its market leadership, while Morpho ($4.219 billion TVL) and SparkLend ($3.533 billion) drive innovation with peer-to-peer and vault-based models. CeFi platforms are enhancing security and compliance to compete, while DeFi improves user interfaces and cross-chain support. Hybrid “CeDeFi” models may emerge, blending CeFi’s simplicity with DeFi’s autonomy.

Conclusion

CeFi and DeFi lending offer distinct paths to earn passive income in crypto. CeFi, like Phemex Savings, provides simplicity, stability, and support, ideal for beginners. DeFi, led by Aave, Morpho, and others, offers higher yields (e.g., 1.55% APY on Morpho) and control but requires technical expertise and risk tolerance. With DeFi’s $54.211 billion TVL and growing adoption, both ecosystems play vital roles. Evaluate your goals, diversify your strategy, and conduct thorough research to navigate this dynamic landscape effectively.

Disclaimer and Risk Warning

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency lending, whether CeFi or DeFi, carries significant risks, including platform insolvency, smart contract vulnerabilities, market volatility, and potential loss of funds. Data cited, such as TVL, APYs, and fees, reflects market conditions as of July 1, 2025, and may change. Always conduct independent research and consult a qualified financial advisor before investing. Phemex is not responsible for losses incurred based on this article.