The cryptocurrency landscape is a ceaseless ocean of innovation and competition, where only the most resilient and utilitarian projects survive the test of time. Among a sea of contenders, Hedera (HBAR) emerges not just as another blockchain, but as a distinct enterprise-grade network powered by its unique hashgraph consensus technology. As institutional interest in distributed ledger technology (DLT) deepens, investors are keenly observing Hedera, posing a critical question for the years ahead: What is the true growth potential of HBAR, and can it deliver on its promise of becoming a foundational layer for the global economy?

This in-depth analysis offers a comprehensive Hedera price forecast for 2026 and beyond. We will dissect its current market standing, explore its technological underpinnings, analyze whale activity, and evaluate both the fundamental drivers and inherent risks. This data-driven exploration aims to provide a clear, engaging, and realistic outlook for both seasoned crypto traders and new investors considering an entry into this top-tier digital asset.

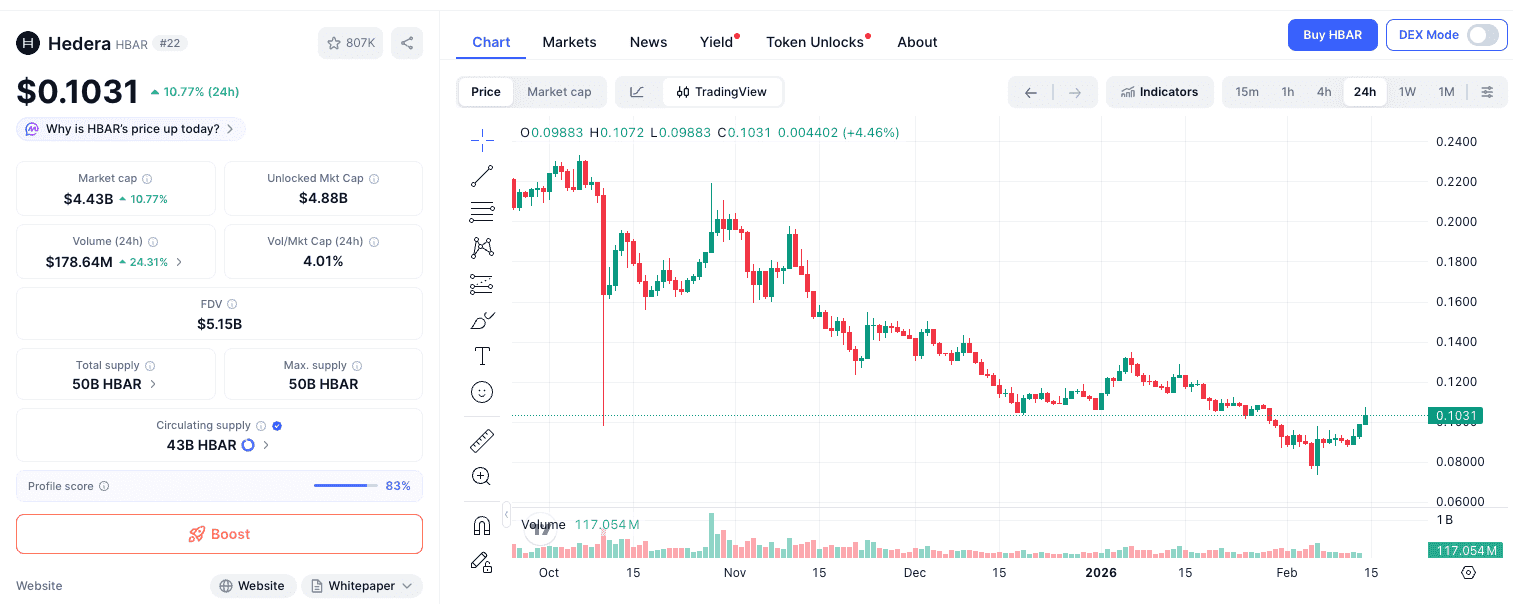

Summary Box (Fast Facts)

Ticker Symbol: HBAR

Current Price: ~$0.1031

Market Cap: ~$4.43B

Total Supply: 50 Billion HBAR

Circulating Supply: ~43 Billion HBAR

All-Time High (ATH): ~$0.5701

All-Time Low (ATL): ~$0.009861

All-Time ROI: Over 930% from its all-time low

Trade Now on Phemex!

What Is Hedera?

Hedera is a third-generation public distributed ledger that moves beyond traditional blockchain architecture to offer a more scalable, fair, and energy-efficient platform. It belongs to the Layer 1 (L1) category, meaning it is a foundational network upon which developers can build a vast array of decentralized applications (dApps).

The core innovation that answers the question "What is Hedera?" is its patented hashgraph consensus algorithm. Unlike blockchains that process transactions in a linear, block-by-block sequence, the hashgraph uses a Directed Acyclic Graph (DAG) to record information non-linearly. This allows for transactions to be processed in parallel, enabling Hedera to achieve exceptionally high throughput—boasting a capacity of over 10,000 transactions per second (TPS)—with transaction finality in just 3-5 seconds and average fees of a mere $0.0001.

Problem It Solves: Hedera directly addresses the "blockchain trilemma" of achieving scalability, security, and decentralization simultaneously. By providing high performance at a low, stable cost, it becomes a viable solution for real-world, enterprise-scale applications such as complex supply chains, micropayments, and the tokenization of real-world assets (RWAs), which are often impractical on slower, more expensive blockchains.

Ecosystem Value: Hedera’s most unique value proposition is its governance model. The network is overseen by the Hedera Governing Council, a group of up to 39 term-limited, world-leading organizations from diverse industries. Esteemed members have included Google, IBM, Boeing, Deutsche Telekom, and Dell, providing a level of institutional credibility and stable, decentralized governance that is unparalleled in the space. This structure is designed to prevent forks and ensure the long-term stability that large enterprises require, making Hedera a powerful contender for the future of institutional DLT adoption.

Current Price & Market Data (as of February 2026)

As of early February 2026, Hedera (HBAR) is navigating a complex market environment. Its price reflects both the broader sentiment across the crypto space and its own unique ecosystem developments.

Latest Price Performance: HBAR is currently trading around $0.1031. Its recent performance has been mixed; while showing some short-term gains, it has experienced a broader 30-day decline. For example, some reports in mid-February noted a 7-day gain of over 13%, while the 30-day performance showed a correction of around 27%.

Market Cap & Rank: With a market capitalization of approximately $4.43 billion, Hedera holds a firm position among the top 30 cryptocurrencies by market value, ranking around #22.

Volume and Liquidity: The 24-hour trading volume hovers around $178 million, with a volume-to-market-cap ratio of about 4%, indicating moderate and healthy liquidity for a top-tier digital asset.

Comparison to ATH and ATL: Trading over 930% above its all-time low of approximately $0.01, HBAR has delivered significant returns to early believers. However, it remains more than 80% below its all-time high of $0.57, a peak reached during the 2021 bull market. This wide gap between its current price and its peak suggests substantial room for growth should the network's adoption accelerate and market conditions turn favorable. For real-time data, traders often utilize live charts from platforms like TradingView.

Price History & Performance Overview

Hedera's journey through the crypto markets is a tale of steady building followed by explosive growth and subsequent correction. After its ICO in 2018, which raised $124 million, HBAR entered the market and, like many new assets, navigated a challenging bear market, hitting its all-time low in early 2020.

The bull market of 2021 was a watershed moment for Hedera. The price of HBAR surged to its all-time high of $0.5701, propelled by a confluence of powerful catalysts:

Exchange Listings: Increased availability on major global exchanges, including Phemex, exposed HBAR to a wider pool of international investors.

Governing Council Expansion: Announcements of world-renowned corporations like Google joining the Governing Council acted as powerful endorsements, bolstering investor confidence.

Ecosystem Growth: The emergence of dApps and tangible use cases on the network began to demonstrate the real-world utility of the hashgraph technology.

Following the market-wide downturn in 2022, HBAR entered a prolonged correction. Despite this bear cycle, the project continued to build and secure major partnerships. Throughout 2025, Hedera made significant strides in institutional adoption, with developments in regulated finance, aviation systems, and sovereign experiments, including partnerships with Truist Bank and the Bank of Ghana. While this fundamental progress did not immediately translate into a new price ATH, it solidified Hedera's position as a serious enterprise-grade network and set a strong foundation for potential future growth.

Whale Activity & Smart Money Flows

Analyzing the behavior of Hedera's largest holders, or "whales," provides valuable clues about smart money sentiment. While specific, granular data on whale wallets can be elusive without specialized tools like Arkham or Nansen, the overarching trend observed in market analysis points towards strategic accumulation rather than widespread selling. "Whale activity in Hedera" often intensifies during periods of price weakness, suggesting that large, long-term investors view market dips as prime opportunities to increase their HBAR positions.

This pattern of accumulation signals a strong conviction in Hedera’s long-term value proposition, which is rooted in its enterprise adoption and technological prowess. While inflows to exchanges can sometimes precede selling pressure, for HBAR, these movements are frequently associated with activities like staking to secure the network or providing liquidity to its growing DeFi ecosystem. "Smart money tracking for HBAR" therefore involves looking beyond simple wallet movements and considering the context of network utility. An increase in Total Value Locked (TVL) on Hedera-native DeFi platforms like SaucerSwap, coupled with rising transaction volumes, are stronger indicators of positive smart money engagement. However, it's crucial to note that recent on-chain data from early 2026 has shown a decline in TVL and dApp revenue, signaling a cooling of on-chain activity that has weighed on investor sentiment.

On-Chain & Technical Analysis

The technical analysis for Hedera presents a mixed picture in early 2026. While the long-term fundamentals remain robust, the price chart reflects the recent market-wide bearish pressure.

Support/Resistance Levels: HBAR is currently contending with a critical support zone. The area around 0.090 has acted as a floor in recent trading sessions. A breakdown below this level could expose deeper support near $0.072. On the upside, immediate resistance is found near the psychological $0.10 mark, with a more significant hurdle in the 0.177 range. A decisive break above this zone would be required to shift the trend back to bullish.

Moving Averages and Key Indicators: The HBAR price is currently trading below key moving averages (20, 50, and 200-day), which is a bearish signal for technicians. A "death cross" pattern, where the 50-day moving average crosses below the 200-day, was confirmed on the weekly chart in early February 2026, accelerating selling pressure. Momentum indicators like the MACD remain negative, although the RSI (Relative Strength Index) is approaching oversold levels, which could imply a potential for a short-term bounce.

Volume Analysis: Trading volume has been moderate. A significant price move, either up or down, would need to be accompanied by a substantial increase in volume to be considered decisive. The current balanced volume suggests a period of consolidation and indecision in the market.

Source:CoinMarketCap

Short-Term Price Prediction (2026–2027)

This table outlines three potential scenarios for HBAR's price performance over the next 12-24 months, based on different market conditions and ecosystem developments.

| Scenario | Price Target (2026-2027) | Key Drivers / Catalysts |

| Bull Case | $0.45 – $1.05 | • Strong bull market across all cryptocurrencies. • Major real-world asset (RWA) tokenization project launched by a Governing Council member. • A breakout dApp on Hedera achieves mass user adoption, driving significant network traffic. |

| Neutral Case | $0.15 – $0.30 | • Broader crypto market trends sideways without major volatility. • Steady, incremental growth in network adoption and enterprise partnerships. • Price appreciation is driven by fundamental utility rather than speculative hype. |

| Bear Case | $0.07 – $0.10 | • A prolonged crypto winter or major market downturn. • Negative regulatory actions targeting enterprise DLTs or the crypto space in general. • Failure to reverse the decline in on-chain metrics (TVL, dApp revenue, user activity). |

Long-Term Price Forecast (2027–2030)

This table provides a speculative outlook for HBAR's price towards the end of the decade. These projections are contingent on Hedera's successful execution of its long-term vision and widespread enterprise adoption.

Disclaimer: This is a speculative forecast and is not financial advice. The crypto market is highly volatile.

| Year | Potential Price Range (Speculative) | Key Factors for Growth |

| 2027 | $0.25 – $0.55 | • Maturation of early enterprise partnerships into full-scale commercial use. • Increased developer activity and a more robust dApp ecosystem. |

| 2028 | $0.40 – $0.80 | • Hedera establishes a dominant position in key sectors like supply chain, finance, or RWA tokenization. • Beginning of network effects as more institutions build on Hedera. |

| 2029 | $0.50 – $1.20 | • Widespread recognition of hashgraph technology as a viable alternative to blockchain for enterprise needs. • Significant portion of network transactions driven by real-world, non-speculative utility. |

| 2030 | $0.65 – $1.50+ | • Hedera becomes a foundational layer for parts of the global digital economy. • High intrinsic demand for HBAR driven by network fees from trillions of dollars in transactional value. |

Source:CoinMarketCap

Fundamental Drivers of Growth

Technological Differentiation: The hashgraph consensus mechanism is a core driver, offering speed, security, and low costs that are superior to many traditional blockchains for enterprise needs.

World-Class Governance: The Hedera Governing Council, featuring names like Google, IBM, and Boeing, provides unmatched credibility and ensures stable, long-term-oriented network management.

Real-World Asset (RWA) Tokenization: Hedera is positioning itself as a leader in the RWA space, a sector projected to be worth trillions of dollars. Active projects include tokenizing commercial real estate and carbon credits.

Enterprise Adoption: Live pilots and partnerships with major financial institutions like Lloyds Banking Group and Truist Bank demonstrate tangible progress in integrating Hedera into the global financial system.

Network Utility: Every transaction, smart contract execution, and token creation on Hedera requires HBAR for fees, creating intrinsic, utility-based demand for the native token.

Key Risks to Consider

No investment is without risk, and it is crucial to consider the potential challenges facing Hedera.

Competitive Threats: The Layer-1 landscape is intensely competitive. Hedera must continually innovate to maintain its edge against well-funded and rapidly evolving platforms like Ethereum, Bitcoin, Solana, and others who are also targeting enterprise clients.

Centralization Concerns: While the Governing Council provides stability, some critics argue that it introduces a degree of centralization that runs counter to the core ethos of blockchain.

Regulatory Impact: The global regulatory framework for digital assets is still taking shape. Unfavorable regulations could pose a significant risk to Hedera and the broader crypto market.

Weakening On-Chain Activity: As seen in late 2025 and early 2026, a decline in developer and user engagement, reflected by falling TVL and dApp revenue, can negatively impact investor sentiment and create downward pressure on price. This is a critical risk to monitor.

Analyst Sentiment & Community Insights

The sentiment surrounding Hedera is a tale of two cities. On one hand, long-term fundamental analysts and its dedicated community (the "HBARbarians") are extremely bullish, often pointing to its "alien tech" and elite partnerships as evidence of its inevitable success. They believe the market is simply early in recognizing its true value.[

On the other hand, short-term technical analysts and on-chain data paint a more cautious, even bearish, picture for early 2026. Reports highlight the declining network metrics and persistent bearish price structure as reasons for concern.This creates a fascinating divergence: a project with arguably some of the strongest enterprise fundamentals in crypto is facing challenging technical headwinds. The key question is which of these forces—long-term adoption or short-term market structure—will dictate the price in the coming years.

Is Hedera a Good Investment?

Disclaimer: This section provides a summary of viewpoints and is not financial advice. Always conduct your own thorough research before making any investment decisions.

So, is Hedera a good investment? The answer depends heavily on your investment horizon and risk tolerance. For investors seeking a project with a strong, long-term use case and deep ties to real-world institutions, Hedera presents a compelling argument. Its powerful technology, unparalleled governance, and focus on the multi-trillion dollar enterprise market give it a unique and durable value proposition.

However, the "Risks of investing in Hedera" are real and should not be overlooked.The token is subject to high market volatility, faces stiff competition, and is currently navigating a bearish technical trend. The recent slowdown in on-chain activity is a significant headwind that needs to be reversed.

Ultimately, the Hedera investment potential remains highly promising heading into 2026–2030. It is an asset that may reward patient, long-term investors who believe that fundamental utility and enterprise adoption will eventually triumph over short-term market speculation.

Why Trade Hedera on Phemex?

For those looking to trade or invest in Hedera (HBAR), choosing the right platform is paramount. Phemex stands out as a top-tier centralized exchange, renowned for its institutional-grade security, high-performance trading engine, and user-centric approach to innovation. It provides a secure and efficient gateway to the world of digital assets.

Phemex offers a comprehensive suite of tools designed to empower every type of trader:

Spot Trading: Instantly buy and sell HBAR with deep liquidity and an intuitive interface, ensuring you get the best execution for your trades.

Futures Contracts: Amplify your trading strategies with up to 100x leverage on HBAR perpetual contracts, allowing you to capitalize on market movements in either direction.[

Trading Bots: Automate your HBAR trading with sophisticated, AI-powered bots. Effortlessly deploy strategies like grid trading to take advantage of market volatility 24/7.

Phemex Earn: Put your HBAR to work and earn passive income through flexible and fixed savings products, allowing you to grow your holdings even when you're not actively trading.

Hedera (HBAR) is fully supported on Phemex, available for both spot and futures trading. By offering a secure, versatile, and low-fee environment, Phemex provides the ideal platform to build your Hedera position and navigate the exciting future of this enterprise-grade cryptocurrency.