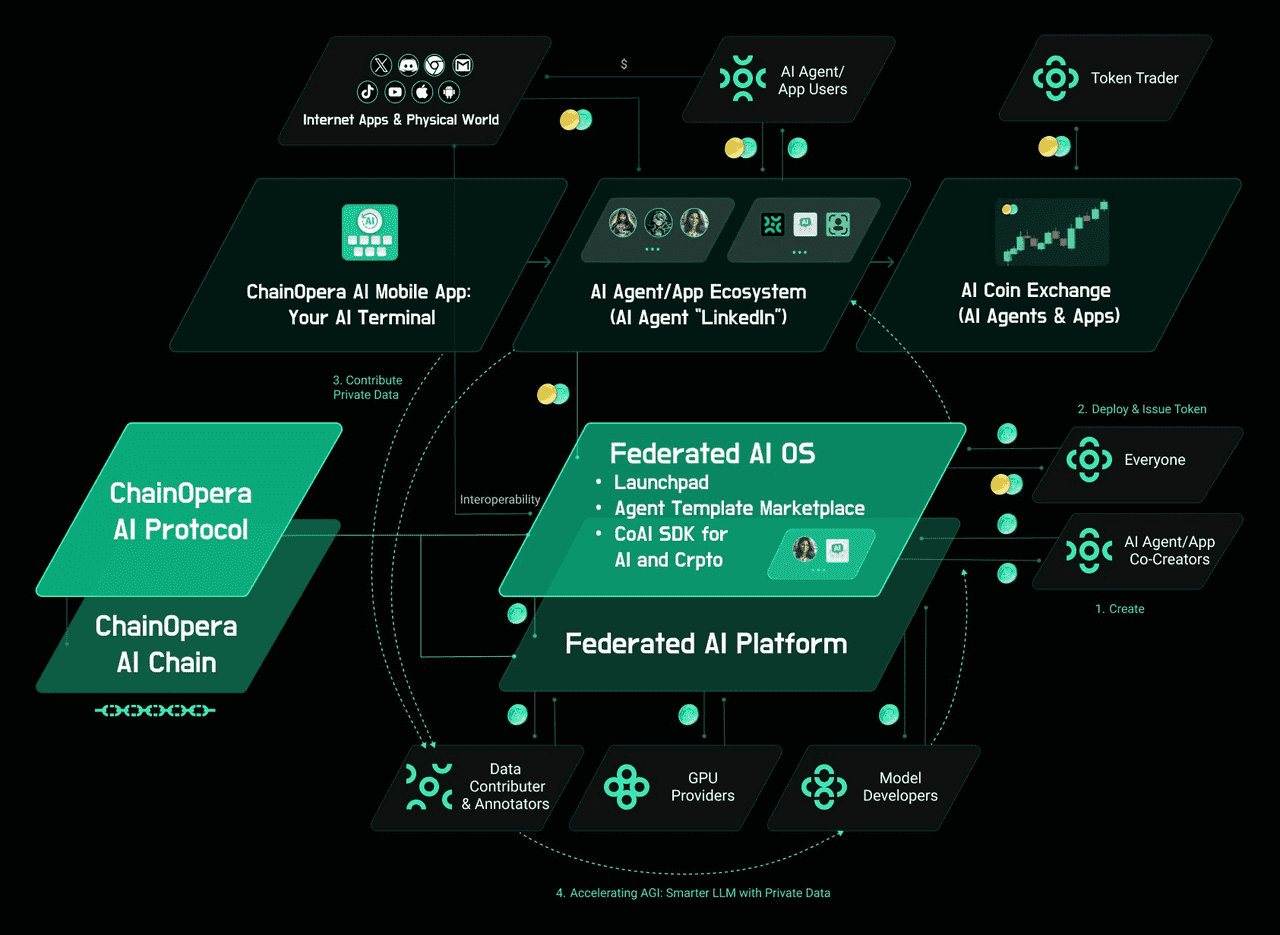

What is ChainOpera AI (COAI)?

ChainOpera AI (COAI) is a next-generation AI and blockchain infrastructure project that combines decentralized computation with intelligent agent technology. Built on Binance Chain (BSC), it empowers developers and users to create, deploy, and monetize AI models in a permissionless ecosystem - essentially becoming a decentralized OpenAI for the Web3 era. ChainOpera AI sits at the intersection of Artificial Intelligence (AI) and DeFi-enabled infrastructure. It leverages blockchain to decentralize ownership and access to powerful AI tools, transforming how models are trained, shared, and rewarded across a global network.

In today’s AI landscape, innovation is dominated by centralized tech giants that control data, algorithms, and compute power. This centralization limits transparency and stifles open collaboration. ChainOpera AI solves this by creating a trustless AI network where model ownership is transparent, user data remains private, and creators are fairly compensated. Its native token, COAI, powers this economy by rewarding model training, inference requests, and ecosystem participation without middlemen.

The ChainOpera ecosystem includes several layers of innovation:

-

AI Terminal: a user-friendly interface where anyone can interact with decentralized AI models and agents.

-

Agent Social Network: a collaborative marketplace for AI agents to communicate, learn, and transact using COAI.

-

Developer Platform: tools and SDKs for developers to build custom AI services integrated with blockchain data.

-

Tokenized Economy: COAI fuels all network activities, from staking for resource access to governance participation.

By aligning AI creation with Web3 incentives, ChainOpera AI democratizes artificial intelligence, giving individuals, developers, and enterprises the ability to share in the value of the AI revolution.

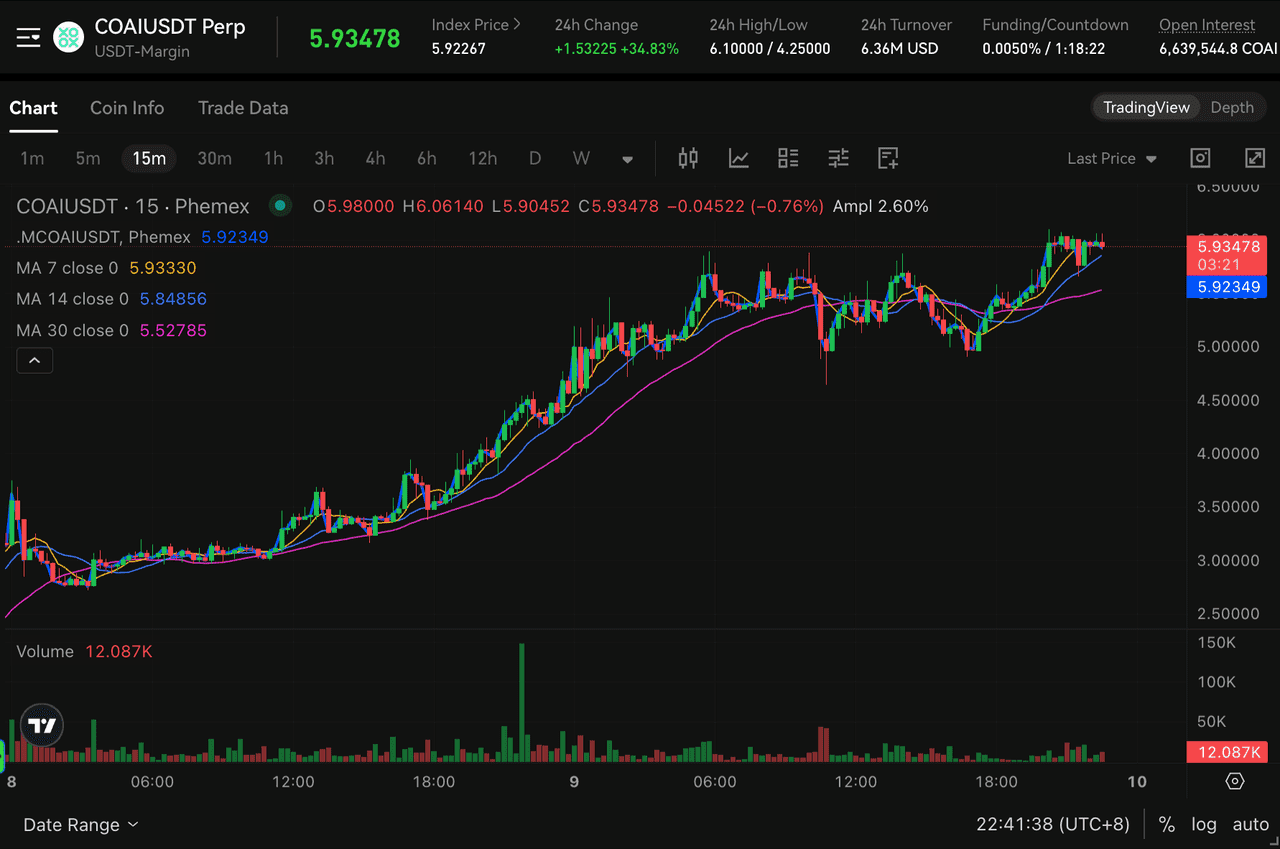

Current Price and Market Statistics (Oct 9, 2025)

As of October 9, 2025, ChainOpera AI (COAI) is trading around $5.54 per coin, after a meteoric rise over the past two weeks. Its market capitalization now sits near $1.09 billion, ranking COAI roughly in the low 200s by size among cryptocurrencies. The 24-hour trading volume remains extremely high at about $320 million, reflecting intense market activity. COAI’s circulating supply is approximately 196.48 million tokens, which is only about 19.6% of its 1 billion max supply (the rest remains locked). This limited float contributes to its volatility.

All-Time High/Low: COAI hit a historic peak of $5.77 on October 8, 2025, essentially overnight becoming one of the top-performing crypto assets of the year. In stark contrast, its all-time low occurred just weeks earlier on September 26, 2025 at $0.138, likely around its initial exchange listings. From that ATL, COAI has skyrocketed nearly 40× (+3,929%) to current prices – an almost unheard-of gain in such a short span. Even from its ATH, it’s only a few percent off (currently ~3.5% below the peak), showing how strong upward momentum has sustained.

Latest Performance: The recent returns have been staggering. In the past 24 hours, COAI is up about +43–47%, making it a top daily gainer. Over the past 7 days, the token has exploded over +1,200% (a 13× increase in one week). Even on a 14-day basis, it’s up around +1,717%. Because COAI only launched in late September, a full 30-day track record isn’t available; essentially all of its price history is contained in these two volatile weeks. However, CoinMarketCap data shows COAI trending +1040% for the month, reflecting its entire October rally. This breathtaking surge has catapulted COAI into the spotlight – it even became the #20 most-viewed crypto on CoinMarketCap recently, underscoring the enormous attention it’s garnered.

COAI/USDT Futures Chart on Phemex (source)

Whale Holdings and Smart Money Flows

COAI’s supply is extremely concentrated among a few large holders, a critical point for investors to note. In fact, the top 10 wallets control over 96% of the total supply, while the top 100 addresses hold 99.74% of all COAI. This implies that only a tiny fraction of tokens are in the hands of regular retail traders, and any movement by those top holders (“whales”) can profoundly sway the price. Such a distribution is often seen when most tokens belong to project team wallets, early investors, and vesting contracts. Indeed, roughly 80% of COAI’s supply is locked until late 2026 as part of team and backer allocations. These are likely sitting in a few known addresses, which explains the high concentration. The upside is that many whales are probably unable to sell in the near term due to lockups, reducing immediate sell pressure. The downside is that if any major holder unloads tokens, liquidity is thin – as one observer warned, a coordinated dump could “collapse [the] price to zero… in seconds”. So far there are no signs of the top wallets distributing to exchanges (no huge outflows reported), suggesting whales have largely held or accumulated during the run-up. This holding pattern could be due to lockups or simply strategic patience as the project gains traction.

On-chain analytics also reveal a potential centralization risk: community watchdogs noted that the COAI smart contract retains developer privileges such as minting or freezing tokens. This means the team (who are effectively the ultimate whales) has technical control that could be abused – a neutral flag, but one that skeptics point out when evaluating whale trustworthiness. So far, no such interventions have occurred. Additionally, whale trading activity on derivatives platforms has been intense. COAI’s futures became so popular that on October 6 it ranked 3rd among all crypto futures in liquidation volume (behind only BTC and ETH), with $20.97M liquidated in 24 hours – mostly short positions getting blown out as COAI’s price spiked. This indicates “smart money” influx on leveraged trades, with big players aggressively positioning long on COAI and squeezing out shorts. Overall, on-chain data shows a story of concentrated ownership and heavy speculative flows: a few early whales hold the lion’s share, and savvy traders are riding the momentum via futures. Any future large token unlocks (for example, ~8.3 million COAI scheduled to unlock on Oct 25, 2025) will be important to watch for shifts in whale behavior.

Technical Analysis: On-Chain Metrics & Price Chart Signals

Support & Resistance: With such a young price history, COAI is charting new territory. One key support level identified by analysts is around $1.80, which corresponds to a Fibonacci retracement zone and the area of consolidation after the initial pump. In early October, after COAI’s first big spike, it pulled back to roughly $1.80, and analysts flagged that level as critical – if $1.80 were to break, the next support might be all the way down near the prior low (~$0.13). Fortunately for bulls, COAI never fell that far; the $1.8 zone held briefly before the next leg up. On the upside, traders are watching Fibonacci extension targets given the lack of historical resistance levels. Using trend-based Fib analysis, $4.78 and $6.67 have been cited as possible next resistance zones if the rally extends. Indeed, COAI already blasted through the first target (~$4.78) and nearly hit $6 before cooling. Above $5.77 (the recent ATH), that $6.67 level is a theoretical target where some profit-taking may occur per Fibonacci models.

Momentum Indicators: Technical indicators swung from extremely bullish to briefly bearish, and back again, within days – reflecting COAI’s wild swings. On October 6–7, RSI (relative strength index) on the shorter timeframes hit overbought extremes then reset to around 50 (neutral) as the price consolidated. This RSI cooling off to mid-range suggested the initial euphoria was being worked off without a total collapse – often a constructive sign if bulls re-enter. Meanwhile, the MACD (moving average convergence divergence) flashed a bearish crossover around Oct 6 when COAI’s first spike lost steam. Red histograms appeared on the MACD, indicating waning upward momentum at that time. Similarly, the Aroon indicator showed Aroon Down spiking to ~93%, while Aroon Up lagged ~35%, confirming a short-term downtrend signal as of Oct 7. These bearish divergences foreshadowed a 30% pullback from ~$2.8 to ~$1.9. However, by Oct 8–9 the technical picture flipped again as COAI roared to new highs. On the hourly chart, ADX – which measures trend strength – reached an astonishing 71.8, signifying a very strong uptrend in force. In other words, momentum came rushing back with even greater intensity.

Moving Averages & Volumes: Because COAI has barely two weeks of trading, standard moving averages (50-day, 200-day, etc.) don’t exist yet. Traders have instead focused on lower-period MAs on hourly charts, which generally all trended upward during breakouts. Volume profiles show liquidity clustering at recent breakout levels – for example, the surge above ~$3 was accompanied by a 1200% spike in daily volume to over $423M, confirming strong conviction behind the move. Volume tapered during the mid-week dip, then ramped up again to $300M+ as price approached $5. This positive volume-price correlation (high volume on up moves) is a healthy technical sign. On-chain, the number of holders has grown to over 42,000 addresses in a short time, reflecting fast-growing interest (many likely from an airdrop – see below). The caveat is most of those holders own tiny amounts; the real volume power lies with whales, as discussed.

In summary, COAI’s technicals show extreme volatility but also strength: new supports have formed higher and higher (from $0.13 to $1.80 to now above $4), and momentum indicators, while occasionally flashing caution, continue to reset and allow further rallying. Traders are keeping an eye on $6–$7 as the next resistance, while ensuring that $4 and $2 are levels of support on any steep corrections. Given the thin order books, these levels can be tested quickly. Caution is warranted, but so far COAI has weathered each pullback and resumed its upward trajectory.

ChainOpera AI Structure (source)

Key Historical Price Milestones and Events

Though barely a month old, ChainOpera AI’s journey has been packed with notable milestones:

-

Launch and Airdrop (Sept 2025): The project began with a token generation event (TGE) on Sept 1, 2025, offering an airdrop to Binance Alpha community users who held at least 200 Binance Alpha Points, allowing them to claim 250 COAI tokens. This initiative attracted around 40,000 participants and initiated trading at a low price (cents). On Sept 26, COAI's price plummeted to $0.14 as early sellers took profits.

-

Early October Surge: Around late September and early October, a major bull cycle began, influenced by momentum in Binance Smart Chain (BSC) projects. COAI surged from under $0.20 to over $2.50, reaching an interim peak of $2.82 by Oct 1, achieving over a 10x gain in less than a week. However, by Oct 6, COAI experienced a 30% retrace to approximately $1.94.

-

Major Exchange Listings and Hype (First Week of Oct): Key events during this period included COAI's listing on Aster Exchange on Oct 6, leading to a 1200% increase in trading volume and a 642% intraday price rally. The coin was also listed on Bybit and supported by Binance’s Alpha program, heightening speculation for a full Binance listing. This period was further buoyed by news from AMD and OpenAI, which spurred a broad rally in AI tokens.

-

Parabolic Blow-Off to $5+ (Oct 7–9, 2025): COAI's price soared from the mid-$2 range to over $5.50 in just days, peaking at $5.77 on Oct 8 and achieving a market cap of over $1.1 billion, marking it as a "unicorn." Momentum trading and positive news drove the euphoria, including the AI Terminal app reaching 3 million users.

-

High-Volatility Consolidation: Following Oct 9, technical signs indicated COAI might cool off, as past major pumps on BSC were often followed by corrections. The project’s high valuation raised concerns about sustaining such levels without delivering real utility.

Community Sentiment and Analyst Insights

Social Buzz: ChainOpera AI (COAI) has gained significant attention on social media, especially on Reddit and X (Twitter), where mixed but passionate sentiments prevail. Enthusiasts praise COAI’s vision of a “decentralized OpenAI” and the team’s qualifications, while the token has a high positive rating on CoinMarketCap and is trending on CoinGecko. However, skepticism exists regarding token distribution, with 96% held by insiders, leading some to label COAI’s price action as speculative and hype-driven. Despite fears of a potential crash or rug-pull, dedicated supporters remain optimistic about COAI’s future.

Analyst & Media Coverage: Analysts are weighing in as COAI gains prominence. CoinMarketCap’s CMC Insights team highlights the balance between AI hype’s potential and concerns about supply unlocks. BeInCrypto pointed out the risks of concentrated holdings, while The Block praised COAI's strategic launch timing. Technical analysis sites have cautioned about bearish signals, though others reported COAI’s climb and strong bullish sentiment in futures markets. The consensus reflects divided opinions: optimistic retail traders versus cautious analysts focused on fundamentals. Overall, COAI enjoys a noteworthy buzz as it navigates this polarized landscape.

In summary, sentiment is a tale of two extremes: FOMO-driven optimism from many retail traders and community members who see COAI as the flagship of the “AI coin” trend, versus caution (or outright doubt) from analysts focusing on fundamentals like token unlock schedules and technical signals. CoinMarketCap’s own community sentiment tool likely shows a positive score at the moment (driven by the rapid gains), but the consensus among analysts is mixed.

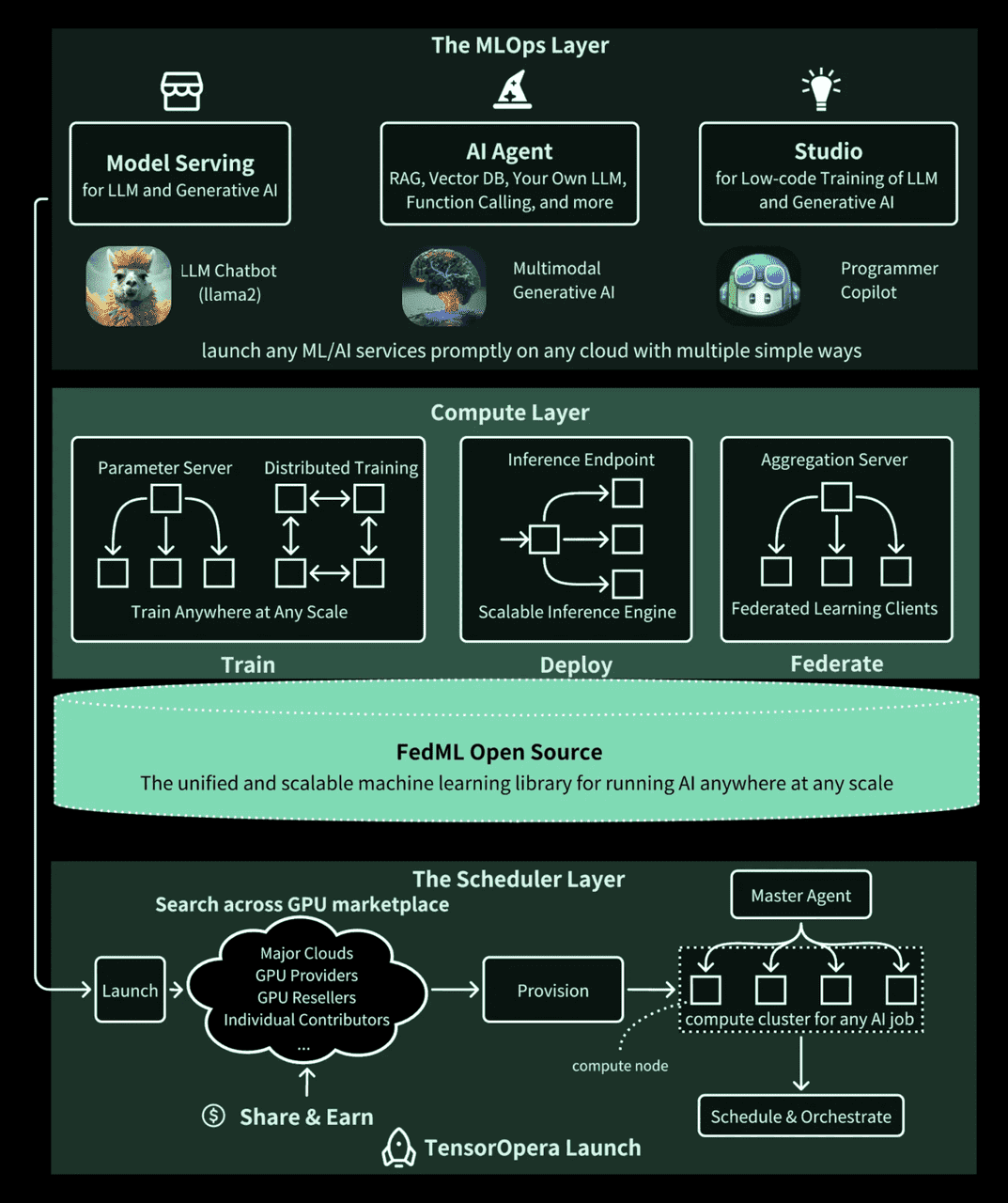

Protocol Layers (source)

Upcoming Catalysts and Roadmap Events

Looking ahead, several upcoming catalysts and fundamental developments could influence COAI’s price and adoption:

-

Platform Testnet (Q4 2025): ChainOpera AI's public testnet will launch by the end of 2025, enabling developers to build AI agents. Positive developer engagement could boost COAI's appeal, while delays or issues might dampen enthusiasm.

-

Mainnet Launch (Early 2026): The mainnet deployment will mark a major milestone for real-world use of ChainOpera’s blockchain. This transition could validate COAI as a utility token, potentially driving demand. However, high expectations mean any underwhelming performance could lead to disappointment.

-

Continued Exchange Listings: COAI is already listed on multiple exchanges, with speculation about a potential Binance listing. Such news typically leads to price spikes, but lack of major listings might cause some investors to lose interest.

-

Partnerships and Integrations: Collaborations with AI developers and enterprises will be crucial. The launch of the "CO-AI Alliance" suggests increasing partnerships that could enhance COAI's utility. Community initiatives like new airdrops may also boost engagement.

-

Token Unlock Schedule: Team and investor token unlocks starting in Q3 2026 could create selling pressure, especially if COAI’s price remains high. Market reactions to minor unlocks before then will also be key.

-

Product Updates and Expansion: Continued roadmap developments will be monitored for further updates on growth and utility.

In summary, the next 6–12 months for COAI will be defined by delivering on its roadmap promises. Major catalysts to watch include the testnet and mainnet releases, potential big exchange listings, and how the project navigates token unlocks and further community growth initiatives.

COAI on Phemex: Availability and Trading Support

The Phemex exchange is known for its derivatives offerings, and has embraced COAI early on. Phemex has listed a COAI/USDT perpetual futures contract. This USDT-margined futures allows traders on Phemex to long or short COAI with leverage. Importantly, Phemex enables hedge mode on this contract, so users can hold simultaneous long and short positions – a feature useful for advanced hedging strategies. The COAI futures listing on Phemex went live just as COAI’s initial rally began, which likely contributed to the surge by making it easier for traders to gain exposure and add leverage. Indeed, as mentioned, COAI quickly rose into the top ranks of futures trading activity.

Phemex offers built-in trading bots on its platform, and COAI’s futures pair should be compatible with these automated strategies. For example, users could set up a grid trading bot on COAI/USDT perps to try to capitalize on its volatility. The Phemex Trading Bots feature supports futures markets, meaning one could algorithmically trade COAI 24/7 using Phemex’s tools. Given COAI’s wild price swings, any bot strategy would need careful parameters, but the high liquidity on the Phemex contract (especially during peak volatility) provides a playground for quantitative traders.

In summary, Phemex supports COAI via its COAI/USDT perpetual futures, offering a leveraged trading avenue. Spot trading on Phemex is not yet available for COAI, and there are no dedicated Phemex Earn products for COAI at this time. Nonetheless, the presence of COAI on Phemex futures with substantial volume means Phemex traders can engage with COAI’s price action easily. The exchange’s robust trading engine and features like hedge mode and bots give traders flexibility in how they want to play this highly volatile asset. As COAI grows, it’s possible Phemex could add more support to cater to user interest. For now, anyone looking to trade COAI on Phemex can head to the futures market, where COAI/USDT is live and highly active.