-

Ticker Symbol: sUSDe

-

Chain: Ethereum (ERC-20)

-

Contract Address: 0x9d39a5de30e57443bff2a8307a4256c8797a3497

-

Circulating Supply: 2.84B sUSDe

-

Max Supply: ∞ (no fixed cap)

-

Primary Use Case: USD‑pegged yield-bearing stablecoin for on-chain savings and payments

-

Current Market Cap: $3.43B

-

Availability on Phemex: Not Yet

What Is sUSDe?

sUSDe, short for “Staked USDe,” is essentially the interest‑bearing version of Ethena’s synthetic dollar, USDe. Ethena Labs, founded in 2023, built a crypto‑native stablecoin system on Ethereum. In this system, USDe is a “synthetic dollar” whose value is backed by crypto assets and hedging, and sUSDe is what you get when you stake USDe into the protocol. Think of sUSDe as putting your dollars in a decentralized crypto savings account: each USDe you stake mints 1 sUSDe, which remains pegged at a 1:1 ratio to USD but automatically gains value over time. Unlike a yield farm that pays you extra tokens, sUSDe accrues yield directly into the token. In practice, your number of tokens stays the same, but each token is worth more as on‑chain rewards roll in.

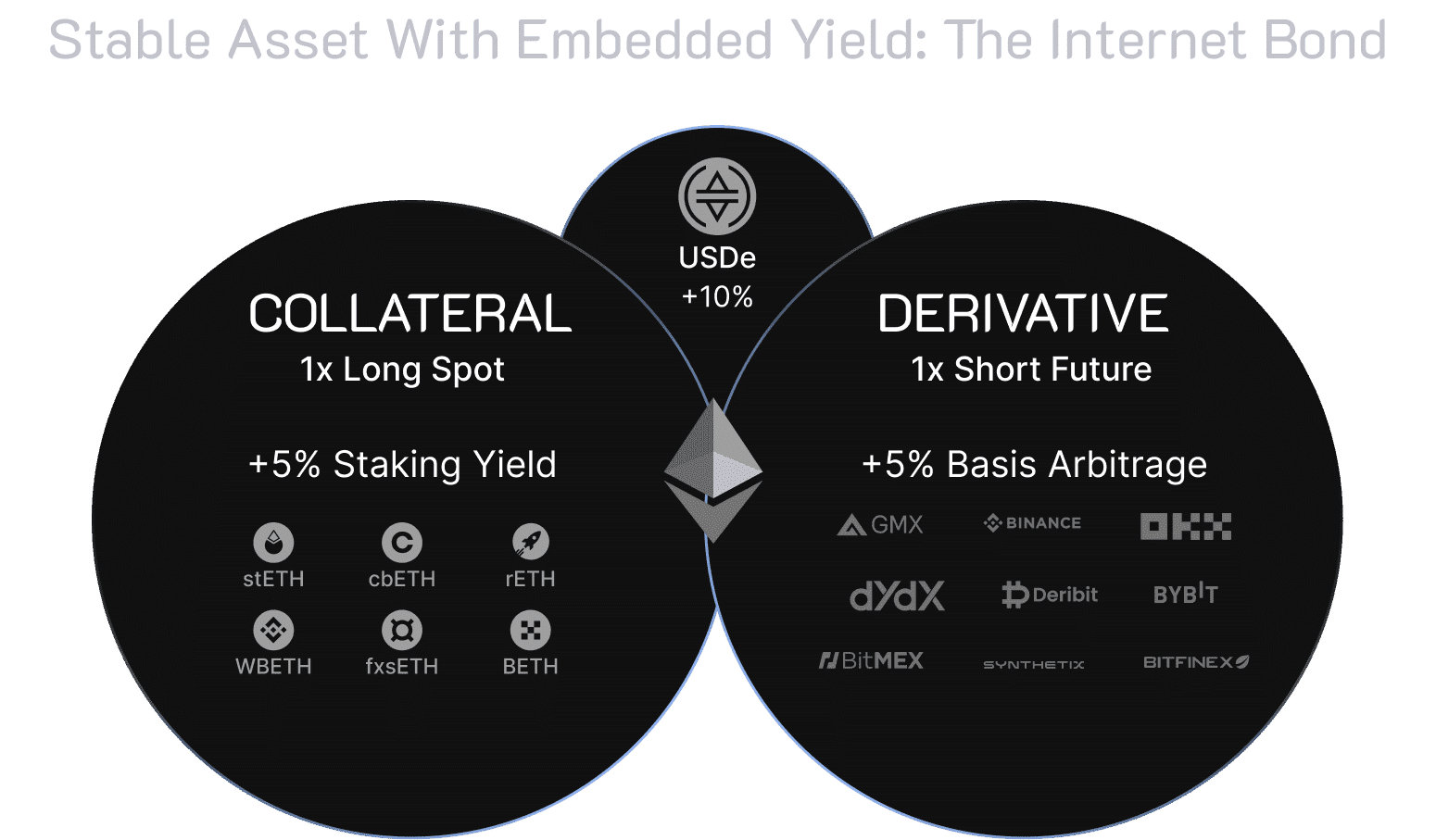

Behind the scenes, Ethena’s USDe is a fully-backed stablecoin that achieves its peg by a clever delta-neutral strategy (long ETH/stETH, short futures) rather than holding fiat reserves. sUSDe simply layers on top of that: it is minted whenever someone stakes USDe, capturing the protocol’s generated yield. Because of this design, sUSDe behaves like a crypto-native “Internet Bond” – a stable dollar with interest built in. Each sUSDe token represents one USDe of collateral plus a share of the earnings from funding rates and staking rewards. The Ethena docs even describe sUSDe as a globally accessible, dollar-denominated rewards instrument – essentially a stable, interest‑paying token to use anywhere on-chain. This unique setup lets holders “stay in dollars” on-chain while earning a return.

In summary, sUSDe is the Ethena staking token for USDe: a 1:1 USD‑pegged crypto coin that grows in value rather than supply. It offers a stable store of value (it tracks the dollar) and simultaneously yields passive income from the protocol’s on-chain trading activities.

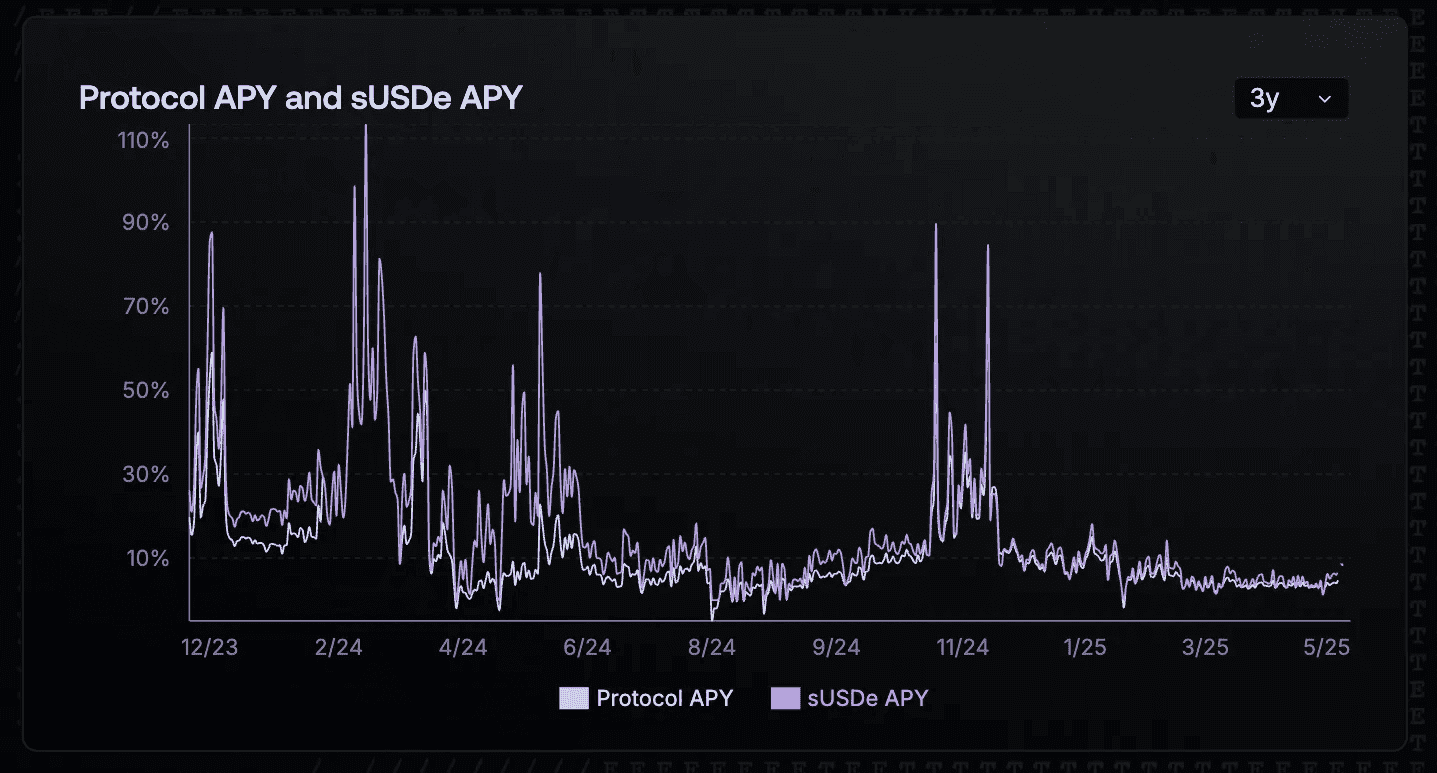

sUSDe APY (source)

How Many sUSDe Are There?

sUSDe’s supply is elastic. As of mid-2025, there are roughly 2.84 billion sUSDe tokens outstanding. This is both the total and circulating supply – since sUSDe is minted and burned through the staking process, the system has no hard cap (max supply is effectively ∞). In practice, whenever someone stakes 1 USDe, 1 new sUSDe is created, and conversely burning an sUSDe frees up 1 USDe of collateral. So the supply expands and contracts with demand.

Put another way: the protocol started with zero tokens, and every unit of sUSDe comes from user actions. Because yield is paid by increasing the value-per-token instead of issuing new tokens, the token count itself doesn’t inflate to pay rewards – instead, each sUSDe’s “exchange rate” in USDe gradually ticks upward. All told, around 2.84 B sUSDe are circulating now, but that number will grow if more people stake USDe. The unlimited max supply simply means Ethena can mint as many new sUSDe as needed to match staking (and burn them upon unstake).

sUSDe Use Case

The primary role of sUSDe is as a yield-bearing dollar in crypto. Its use case is straightforward: it lets users hold a stable, USD-pegged asset that also earns interest. In effect, sUSDe turns otherwise idle dollars into a productive asset. Stakers deposit USDe and receive sUSDe, then their crypto dollars grow automatically from the protocol’s revenue without any manual reinvestment. In regions or scenarios where banking is scarce, sUSDe could serve as a borderless dollar savings account. In more developed markets, it provides a stable on-chain savings vehicle – akin to a decentralized high-yield savings account.

Aside from savings, sUSDe can fuel DeFi in other ways. It functions as a stable collateral and medium of exchange. Because each sUSDe is pegged to $1, people can confidently use it in lending, borrowing, or trading without worrying about price swings. At the same time, liquidity providers and treasuries might prefer it over plain USDC/USDT, since it earns yield while serving as collateral. In short, it bridges the gap between no-yield stablecoins and volatile yield assets.

Ethena’s own material emphasizes this blend: users “have had to choose between stablecoins like USDC/USDT (stable but no yield) and volatile tokens like ETH (yield but price risk)”; sUSDe creates a “third category: a yield-bearing stablecoin”. Essentially, you get the stability of a dollar plus extra return from crypto markets. As one Ethena overview puts it, sUSDe is meant to be a self-compounding crypto dollar – a “stable, productive asset” that can act like on-chain base money or a risk-adjusted yield instrument.

Practically, think of sUSDe as crypto’s answer to interest-bearing bank deposits. It is useful for:

-

Long-term Savings: Park your value in a $1-pegged token that pays you interest on-chain.

-

Collateral & Liquidity: Use sUSDe in DeFi (lending pools, liquidity mining, etc.) to earn a yield rather than just holding cash.

-

Remittances/Payments: Move value stably across borders without losing to volatility, while still collecting yield en route.

By compounding the protocol’s real trading revenues into each token, sUSDe offers a new kind of financial primitive: a default choice for on-chain savings and treasury management, all without exiting the crypto ecosystem.

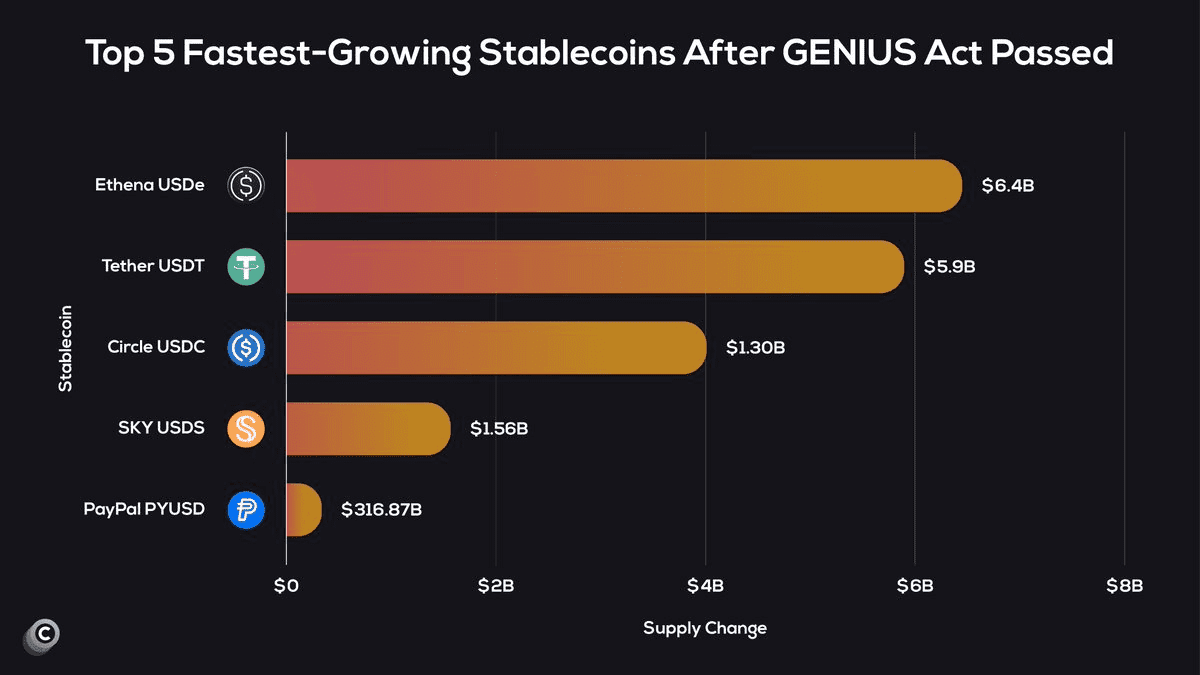

USDe Growth by September 2025 (source)

sUSDe vs Bitcoin

Compared to Bitcoin (or Ethereum), sUSDe is in a different league altogether: it’s stable and steady, not a high-octane risk‑reward play. Bitcoin and Ether have a value defined by market sentiment – they can double or halve in price in a few weeks. sUSDe, on the other hand, aims to stay around $1.00 USD at all times. Volatility is its enemy by design. In return, sUSDe’s “upside” comes not from price appreciation (since it’s pegged) but from yielding income.

Put plainly, betting on Bitcoin is like strapping a rocket to your portfolio: big upside, big downside. Holding sUSDe is more like parking cash in a money-market fund – low volatility, steady but modest returns. As OSL’s analysis notes, stablecoins give you $1 preserved but no income, and ETH gives yield but big risk; sUSDe carves a middle path by offering stability plus yield. For someone seeking a stable crypto dollar with a bonus, sUSDe is the one to consider, whereas Bitcoin investors are chasing growth.

So when we compare: Bitcoin’s value can swing 10–20% daily and has big bull/bear cycles. sUSDe’s price, by contrast, has tiny fluctuations (it trades around $1.20 typically). From an investor’s standpoint, sUSDe is not a speculative token like BTC. It’s more akin to a yield-bearing alternative to cash. This makes it fundamentally different in both risk and use case: one is a volatility-driven store of value, the other a steady-dollar with built-in earnings.

The Technology Behind sUSDe

Technologically, sUSDe is straightforward: it’s an ERC‑20 token (an ERC‑4626 vault token, to be precise) on Ethereum. It relies on Ethereum’s security and smart-contract infrastructure. In practical terms, Ethereum’s blockchain (now proof-of-stake PoS for efficiency) records all sUSDe mints, burns, and redemptions. Because it’s on Ethereum, sUSDe inherits crypto’s decentralization and composability: it can plug into wallets, DEXes, lending platforms, and any smart contract that supports ERC-20 tokens.

Under the hood, Ethena’s smart contracts implement the staking mechanism. Technically, sUSDe is an ERC-4626 vault: staking 1 USDe mints 1 sUSDe, and burning 1 sUSDe redeems 1 USDe (after a short delay). There is no fixed supply – the token count adjusts with demand. Instead of paying out new tokens for interest, every sUSDe gradually earns more USDe in value. The DropsTab summary puts it succinctly: “Each sUSDe represents one USDe plus accrued yield”. That means if you hold 100 sUSDe today, a year from now you might be able to redeem them for 105 USDe, even though your balance stayed at 100.

The real innovation is in the delta-hedging engine behind USDe (and thus sUSDe). The protocol deposits crypto like ETH or staked ETH as collateral, and simultaneously takes offsetting futures positions on those assets. This neutralizes price moves while capturing funding fees. In effect, the protocol automatically sells the volatility of ETH and buys the stability of the dollar. All of Ethena’s yield – from perpetual-futures funding and restaking collateral – flows back into sUSDe holders. Because Ethereum’s smart contracts handle all this trustlessly, sUSDe’s peg is maintained in a censorship‑resistant way.

Security is also a focus: Ethena uses institutional-grade custodians for on-chain collateral and performs audits. And because sUSDe’s logic is code, it’s transparent and composable. The blockchain’s immutability prevents tampering with balances or interest. In short, sUSDe leans on Ethereum’s proven tech stack (PoS consensus, verified smart contracts) while adding a novel financial layer of hedged stablecoin issuance.

Team & Origins

Ethena Labs is the team behind sUSDe (and USDe). Founded in 2023, the company is led by CEO Guy Young, who positioned the project as a blend of traditional finance and crypto innovation. Young’s background spans Wall Street and crypto trading, and he’s surrounded by a “sharp team of quant traders, engineers and DeFi strategists”. Notably, Ethena attracted high-profile backers: early seed funding ($6M) came from investors like Dragonfly Capital and BitMEX co‑founder Arthur Hayes. Other institutional partners include Avon Ventures (Fidelity-affiliate), Brevan Howard, Franklin Templeton, and more.

This pedigree matters because sUSDe’s mechanics are complex. The team’s quant-trading and engineering focus shows in the project’s design. Ethena’s press releases even boast that the protocol’s new stablecoin (USDe) reached $1B supply in record time. Beneath that success is the team’s expertise in hedging and liquidity strategies. In short, sUSDe is not some random meme coin – it comes from a deep‑tech startup with crypto veterans and serious VC backing.

For reference, Ethena Labs’ “About” section confirms all this: “Founded in 2023, Ethena Labs is a research, development, and engineering firm building infrastructure supporting the first-ever scalable synthetic dollar alongside a value accruing ‘Internet bond’.”. So the origins of sUSDe lie in a concerted effort by a professional team to reinvent the stablecoin, and their progress is well-documented in whitepapers and press.

Interest-Earning Crypto Dollars and Assets (source)

Key News & Events

For those following news about sUSDe (and Ethena), here are the milestone events so far:

-

Feb 2024: Ethena Labs publicly launches USDe (the crypto-native stablecoin) and simultaneously introduces sUSDe as its staking instrument. From day one, staking USDe mints sUSDe, making the “Internet Bond” concept live.

-

Mar 2024: Less than a month after launch, USDe’s circulating supply tops $1 billion – the fastest any dollar-based crypto asset had ever done so. This early adoption spike underscores demand for a stablecoin that pays yield.

-

Nov 2024: Ethena expands its ecosystem by launching USDtb, a new stablecoin backed by tokenized U.S. Treasuries (BlackRock’s $500M BUIDL fund) to hedge USDe’s risks. This marked Ethena’s entry into real-world asset-backed stablecoins, a sibling project to USDe/sUSDe.

-

Oct 2025: The market endured the “Black Friday” crypto crash. Ethena’s USDe was stress‑tested as roughly $1.9B was redeemed over Oct 10–11 (users converted USDe back to collateral). In three weeks, USDe’s market cap plunged over 40% (about $5 billion). The event showed USDe/sUSDe’s mechanisms in action (burning redeemed tokens stabilized the peg), and it drew significant media attention to the project’s resilience.

These bullet points highlight sUSDe’s journey from a novel idea to a product in the wild. The whitepaper and docs detail the technical roadmap, and media coverage (e.g. on CoinDesk, The Defiant) has covered both triumphs and challenges. In brief, Ethena (USDe/sUSDe) sprinted from launch to ~$6B TVL by mid-2025 and even weathered extreme market turmoil later in 2025. The project continues to evolve (with new token launches and partnerships), so the news is an ongoing story for crypto-investors.

Is sUSDe a Good Investment? (Not financial advice)

Deciding whether sUSDe is a good investment depends on what you’re looking for. On the plus side, sUSDe fills a unique niche: it offers dollar stability with interest. If you believe in Ethena’s model, staking in sUSDe could be appealing. It means turning volatile crypto risk into stable income. This might suit conservative crypto holders who want yield without switching to CeFi.

However, several caveats apply. Remember that sUSDe’s yield comes from crypto market activity, so returns can fluctuate. As one analysis notes, if crypto futures funding rates turn negative, the strategy could “bleed, threatening peg stability.” In other words, in a bear market or unusual conditions, sUSDe might earn much less (or even lose peg momentarily). The protocol also relies on centralized custodians for collateral; any issues there (hacks, bankruptcies) could jeopardize your funds. Ethena has undergone audits, but the design is complex – complexity brings risk. Finally, regulatory uncertainties loom: some jurisdictions restrict these synthetic assets (for example, EU bans), which could affect accessibility.

On the other hand, historical yields have been attractive. Early adopters saw yearly returns in the double digits, and even a normalized crypto market still gives sUSDe holders several percent per year through automated funding fees. Because sUSDe compounds automatically, sticking with it long-term can boost returns without extra work. If Ethena’s hedge works as intended, sUSDe income could outperform what you’d get in traditional finance for dollar deposits – but again, without FDIC insurance or bank backing.

In sum, sUSDe isn’t a get-rich-quick scheme. It’s a decentralized savings product. For crypto-curious investors who want exposure to the dollar with a twist, it might be worth a look. But there are real risks: never stake more than you can afford to handle, and keep in mind that all blockchain investments can go to zero. As always, do your own due diligence.