Introduction: Beyond Staking - The New Frontier of Stablecoin Yield

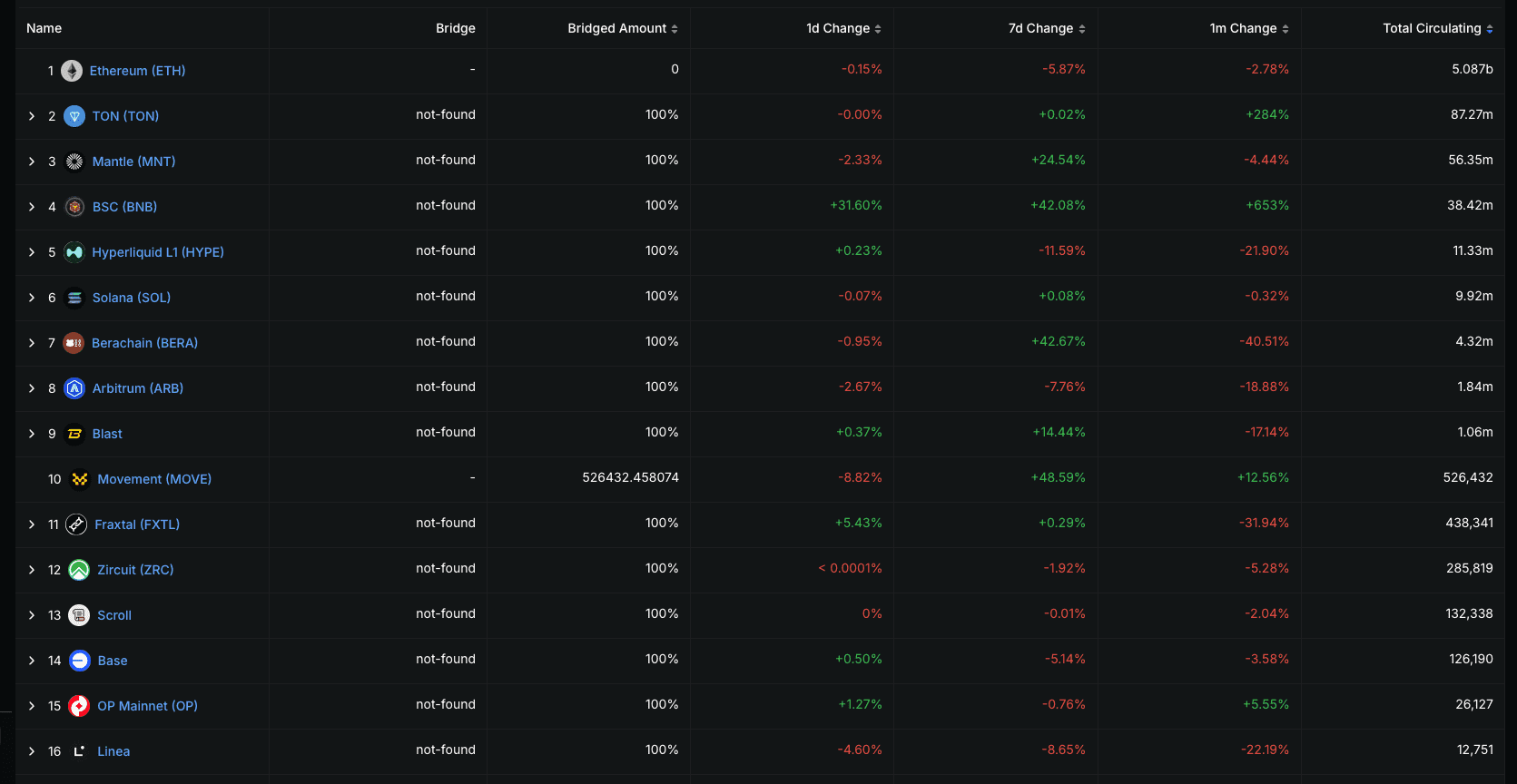

Stablecoins have long been the bedrock of decentralized finance (DeFi), providing a dollar-pegged haven amidst the crypto market’s notorious volatility. Traditional yield strategies—such as staking stETH at 2.64% APY (per Defilama data as of June 2025) or lending on platforms like Aave—typically offer modest single-digit returns, appealing to conservative investors. However, Ethena’s USDe has disrupted this paradigm, introducing a synthetic dollar model that has delivered staggering double-digit APYs, peaking at 113% in March 2024 and stabilizing around 12–29% by late 2024, with its market capitalization soaring to $4.77 billion. As of June 30, 2025, USDe continues to capture the attention of the DeFi community, driven by its innovative delta-neutral strategy that blends staking with perpetual futures arbitrage.

This article is not a surface-level introduction but a rigorous, technical analysis crafted for seasoned DeFi practitioners, crypto hedge fund analysts, and professional traders. It delves into the intricate mechanics of USDe, evaluates its potential to reshape the DeFi landscape, and scrutinizes the systemic risks that accompany its high-yield promise. For traders looking to navigate this terrain, Phemex’s perpetual futures markets offer a robust platform to hedge positions and capitalize on arbitrage opportunities, making this a must-read for those engaged in high-stakes DeFi strategies.

Anatomy of a Synthetic Dollar: How USDe Generates "Internet Native Yield"

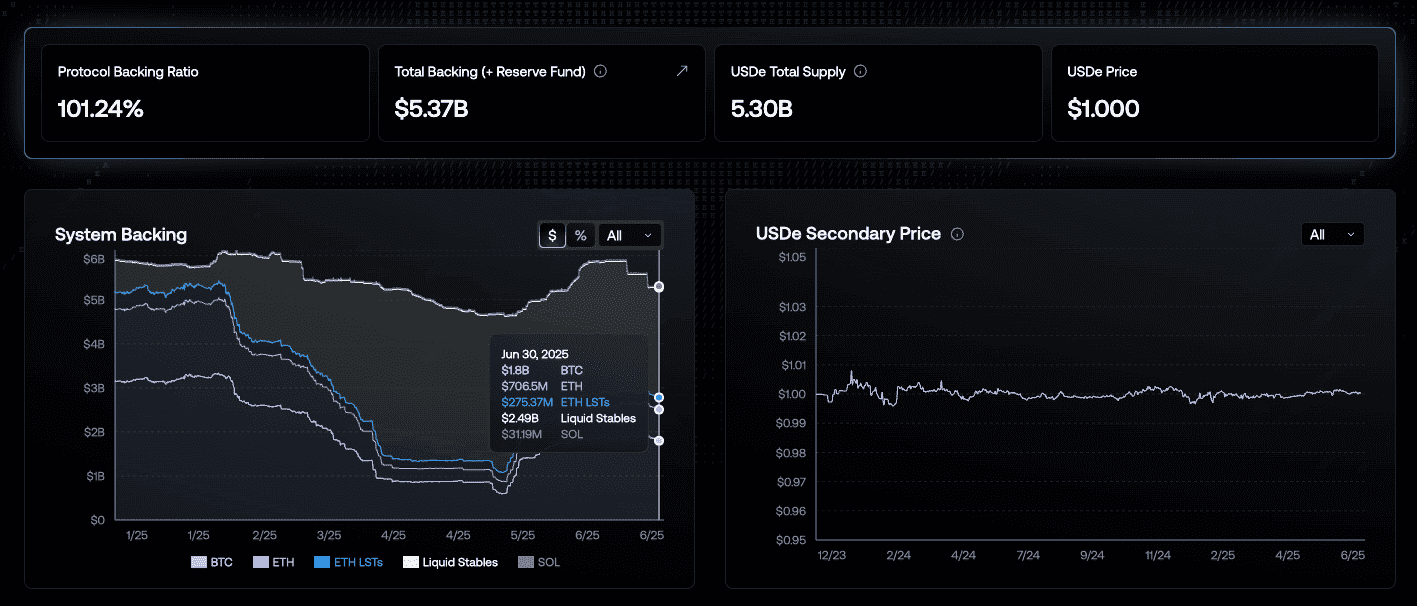

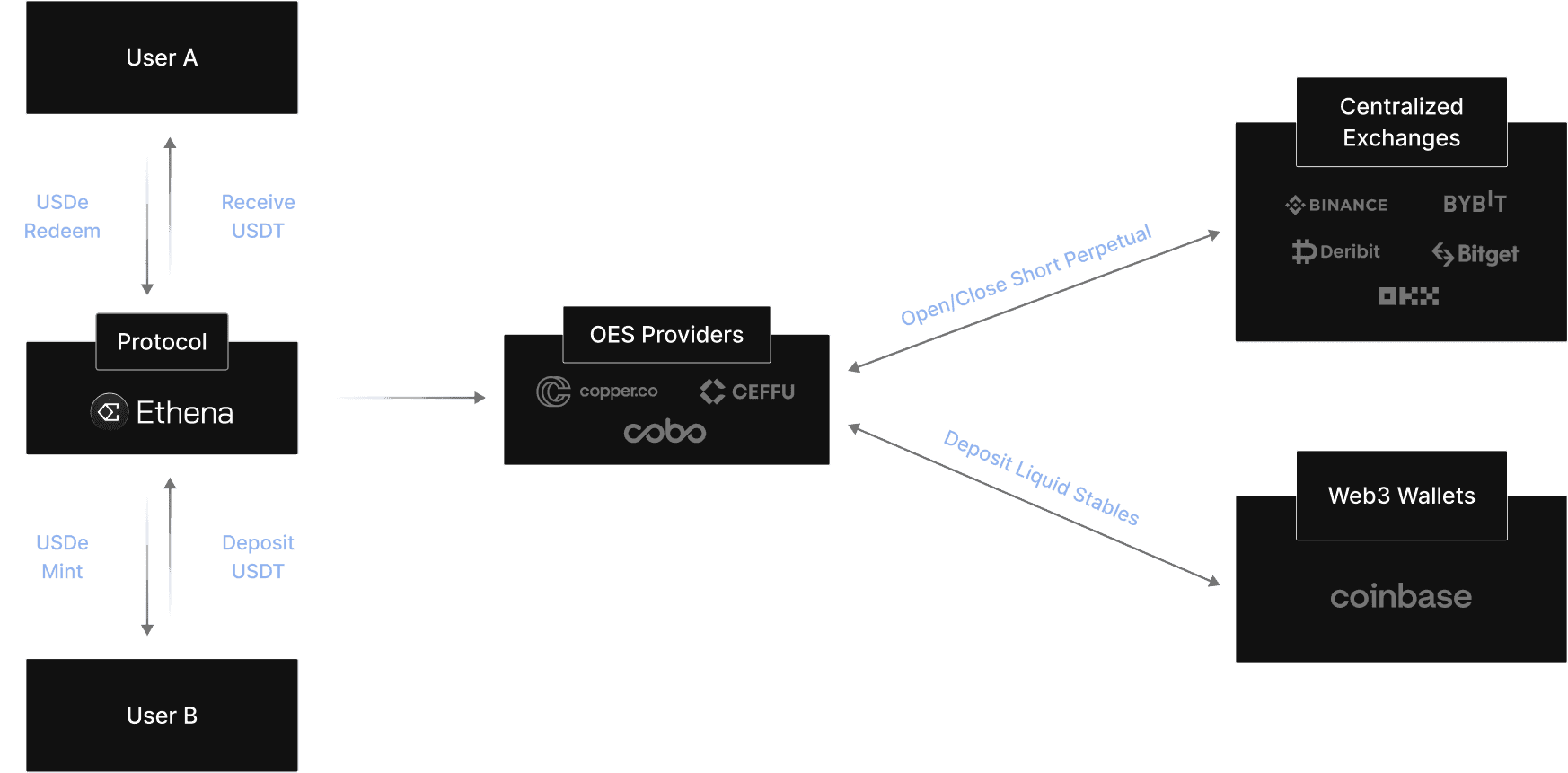

Unlike traditional stablecoins such as USDT or USDC, which rely on fiat reserves held in banks, USDe is a synthetic dollar fully collateralized by crypto assets—ETH, stETH, BTC, and liquid stables—managed through off-exchange custody enhanced by zero-knowledge proofs for transparency. As of June 30, 2025—the date of this writing—the collateral breakdown stands at $1.8 billion in BTC, $706.63 million in ETH, and $282.24 million in ETH liquid staking tokens (LSTs), providing a current and comprehensive view of its financial backbone.

The Delta-Neutral Mechanism

-

Collateral Composition: USDe’s backing leverages stETH (yielding 2.64% per Yield Rankings), ETH, BTC, and liquid stables, secured via off-exchange custody to mitigate counterparty risks while employing zero-knowledge proofs to ensure on-chain verifiability.

-

Short Perpetual Futures: Ethena utilizes this collateral to establish short positions in ETH and BTC perpetual futures on centralized exchanges (CEXs) . For instance, depositing $100 worth of stETH (at 1 ETH = $3,000) results in the minting of 100 USDe, with a corresponding short position designed to offset price fluctuations. Should ETH’s price surge to $3,300, the $300 gain from stETH is neutralized by a $300 loss on the futures position, maintaining delta neutrality.

-

Yield Sources:

- Staking Rewards: The stETH component contributes a baseline yield of 2.64% APY (as of June 2025), though this figure varies with Ethereum’s staking participation and network conditions.

- Funding Rate Arbitrage: The short positions collect funding fees when rates are positive. As of 08:00:00 JST today, the BTCUSD BTC-Margin funding rate is 0.0097% (paid every 8 hours), a slight decline from 0.0100% at 00:00:00 JST, with a recent low of -0.0032% on June 28, 2025. In bullish market phases, these rates can annualize to 3–5%, but they introduce significant risk during downturns.

-

Internet Bond and sUSDe: Users can stake USDe to receive sUSDe, a yield-bearing token that compounds returns directly into its value. At a hypothetical 20% APY, 1,000 sUSDe could appreciate to redeem for 1,200 USDe over a year, provided funding rates remain favorable.

Capital Efficiency and Scalability

USDe’s design achieves capital efficiency through 1:1 collateralization, with recent trends suggesting a backing ratio potentially exceeding 101%, a stark contrast to over-collateralized models like DAI. Its seamless integration with DeFi protocols such as Curve (offering 1.90% APY on ETH-stETH pools) and AAVE v3 amplifies its composability, enabling applications in lending, yield farming, and trading.

Phemex Perpetual Futures: A Trader’s Tool for USDe Strategies

Phemex’s BTC and USD-denominated perpetual futures provide traders with powerful instruments to engage with USDe’s risk-reward profile. Unlike traditional futures contracts that expire, perpetual futures have no expiry date, trading close to the index price with margin-based leverage. This structure amplifies potential gains but also heightens the risk of liquidation if asset prices fall to the initial margin level.

Mechanics of Phemex Perpetual Futures

- BTC Perpetual Futures: Each contract represents 1 USD of BTC (e.g., 1 USD / current BTC price). Profit is calculated as (1 USD / Open BTC Price - 1 USD / Close BTC Price) × Quantity, while Loss is (1 USD / Close BTC Price - 1 USD / Open BTC Price) × Quantity. This nonlinear function mirrors BTC’s price volatility.

- USD Perpetual Futures: Each ETHUSD contract equals 0.005 ETH, and XRPUSD equals 5 XRP. Profit and Loss are computed as (Close Price - Open Price) × Quantity, reflecting a linear relationship with a constant rate of change.

How to Start Trading on Phemex

- Fund Transfer: Transfer BTC to a BTC futures account or convert assets to USD in your spot wallet (since USD deposits are not supported) to fund a USD futures account.

- Trading: With funds in the futures account, traders can open positions, leveraging Phemex’s deep liquidity in ETH and BTC futures markets.

Funding Rate Insights

As of June 30, 2025, BTCUSD BTC-Margin funding rates are:

- 08:00:00 JST: 0.0097%

- 00:00:00 JST: 0.0100%

- 16:00:00 JST (June 29): 0.0100%

- 08:00:00 JST (June 28): -0.0032%

This volatility, accessible via Phemex’s Funding Rate History tool, is a critical factor for traders aligning with USDe’s arbitrage strategy.

The Bull Case: Why Ethena Could Reshape DeFi

USDe’s market capitalization surged to $5.3 billion by the end of June 2025, cementing its position as the third-largest stablecoin behind USDT and USDC. Its key competitive advantages include:

- High Yields: Offering 12–29% APY, significantly outpacing stETH’s 2.64%.

- Censorship Resistance: Reliance on crypto collateral eliminates dependence on traditional banking systems.

- DeFi Integration: Seamless compatibility with protocols like Curve and AAVE enhances its utility.

- Innovation: The “Internet Bond” concept introduces a novel savings mechanism for the on-chain economy.

Phemex’s perpetual futures markets empower traders to leverage these opportunities, whether through yield optimization or risk mitigation.

The Bear Case: A Trader’s Guide to Systemic Risks

USDe’s allure is tempered by a spectrum of systemic risks that demand thorough scrutiny. This section, a pivotal resource for professional traders, provides an in-depth analysis of each risk, enriched with scenarios, historical precedents, trading strategies, and quantitative insights.

Funding Rate Risk: What Happens When Funding Turns Deeply Negative?

The cornerstone of USDe’s yield generation lies in the funding rates derived from short perpetual futures positions. As of 04:57 PM JST on June 30, 2025, the BTCUSD BTC-Margin funding rate is 0.0097% (every 8 hours), a marginal decrease from 0.0100% earlier today. However, recent volatility is evident, with a low of -0.0032% on June 28, 2025, and a high of 0.0100% on June 29. A deeply negative funding rate—where shorts pay longs—threatens the protocol’s profitability.

- Scenario Analysis: Should funding rates plunge to -0.1% daily, a scenario observed during extreme bear markets, the annualized impact could reach -36.5%, dwarfing stETH’s 2.64% staking yield. For a $100 million USDe position, this equates to a $3.65 million monthly loss, potentially tapping into Ethena’s $32.7 million reserve fund (as of late 2024). If reserves are exhausted, Ethena may need to halt deposits, unwind positions, or risk a peg deviation, undermining investor confidence.

- Historical Context: The 2022 crypto winter saw ETH funding rates drop to -0.05% daily for extended periods, severely impacting arbitrage-based yields. With USDe’s $2.3 billion short interest, a similar downturn in 2025 could precipitate significant pressure.

- Trading Strategy: Traders can mitigate this risk on Phemex by opening long BTCUSD futures positions to offset negative funding costs. A proactive approach involves monitoring the Funding Rate History for three consecutive negative intervals (e.g., -0.0032% on June 28), signaling a potential trend reversal.

- Quantitative Insight: The break-even threshold is reached when negative funding exceeds the staking yield plus the reserve fund’s capacity. With a 2.64% staking yield and a $32.7 million buffer, a sustained -0.04% daily rate could deplete reserves in approximately 80 days, assuming no additional capital infusion.

Liquidity & Slippage Risk During a Crisis

USDe’s liquidity resilience is tested during redemptions, which require closing short perpetual positions and liquidating collateral such as stETH. The current allocation of $282.24 million in LSTs, alongside stETH’s $22.78 billion TVL (per Yield Rankings), suggests a strong liquidity base, but a crisis could reveal vulnerabilities.

- Scenario Analysis: Consider a hypothetical black swan event, such as a major CEX hack, triggering a 10% redemption of USDe’s $4.77 billion market cap ($477 million). Liquidating $231.5 million in short interest (half of the $2.3 billion total) could drive ETH prices up by 2–3% due to supply constraints, inflating slippage costs. A 5% sell-off of stETH’s $282.24 million allocation ($14.1 million) within its $22.78 billion pool might be absorbed, but slippage could escalate to 0.5–1% per transaction, adding $2.35–$4.77 million in costs.

- Historical Context: The Terra-Luna collapse in May 2022 saw stETH de-peg by 5%, with Curve pools experiencing 10% slippage on $10 million trades. A comparable shock could exacerbate USDe’s liquidity challenges.

- Trading Strategy: Phemex’s high-liquidity ETHUSD futures allow traders to pre-position against slippage. Monitor USDe redemption volumes on Curve—daily spikes exceeding $50 million indicate potential liquidity strain.

- Quantitative Insight: Liquidity depth can be modeled using Kyle’s Lambda (λ = Price Impact / Order Size). A 1% impact on a $50 million order yields λ ≈ 0.00002, suggesting moderate liquidity but susceptibility to large-scale outflows.

Exchange Counterparty Risk: What If a Major CEX Fails?

Ethena’s dependence on CEXs for executing perpetual futures introduces significant counterparty risk. The FTX collapse in November 2022, which resulted in an $8 billion loss of client funds, serves as a stark reminder of this vulnerability. Although Ethena employs off-exchange custody, operational risks persist.

- Scenario Analysis: If CEX, potentially holding 30% of Ethena’s $2.3 billion short interest ($690 million), fails, Ethena would need to migrate positions to another CEX. This process could incur a 1% transfer fee plus a 2% price swing, totaling approximately $20.7 million in costs, which could strain the $32.7 million reserve fund. Should a custody provider like Fireblocks become insolvent, collateral access might freeze, risking a cascading peg failure.

- Historical Context: The 2022 Celsius freeze immobilized $1.2 billion in assets, illustrating how CEX failures can ripple through the ecosystem. USDe’s $4.77 billion market cap amplifies its exposure to such events.

- Trading Strategy: Diversify exposure by utilizing Phemex’s BTCUSD and ETHUSD futures, minimizing reliance on a single CEX. Track CEX solvency through open interest data—levels exceeding 50% of total market open interest warrant caution.

- Quantitative Insight: Counterparty risk can be quantified as Expected Loss = Probability of Default × Loss Given Default × Exposure. With a 5% default probability (post-FTX prudence) and a 50% loss given default, a $690 million exposure translates to a $172.5 million risk, partially offset by custody diversification.

Collateral Risk: The Danger of an stETH De-Peg

stETH, a critical component of USDe’s $282.24 million LST allocation, is susceptible to de-pegging despite its $22.78 billion TVL (June 2025). This risk could undermine the protocol’s stability.

- Scenario Analysis: A 5% stETH de-peg (e.g., 0.95 ETH) reduces the $282.24 million allocation’s value to $268.13 million, creating a $14.11 million shortfall against the 1:1 peg. In a 10% Ethereum price drop during a market panic, stETH could lag, widening the gap to 7–8%, or $19.76–$22.58 million. While the observed 101%+ backing ratio might cushion this, mass redemptions could overwhelm the buffer.

- Historical Context: In June 2022, stETH de-pegged to 0.95 ETH during the Terra collapse, with 10% slippage on $20 million trades, highlighting its vulnerability.

- Trading Strategy: Hedge with Phemex’s ETHUSD futures by taking long positions to offset stETH losses. Monitor the stETH/ETH ratio on Uniswap—a drop below 0.98 signals immediate action.

- Quantitative Insight: De-peg risk can be evaluated through deviation variance: σ = √(Σ(Price_t - Mean Price)^2 / n). A 5% historical variance indicates a 95% confidence interval of ±10%, underscoring significant exposure.

On-Chain Monitoring: Key Metrics to Watch

- Funding Rates: BTC at 0.0097% (Phemex, 08:00:00 JST).

- stETH Peg: Below 0.98 on Uniswap.

- USDe Peg: ±15 basis points on Binance.

- TVL: $5.37 billion (2025).

Conclusion: Revolution or Time Bomb?

USDe’s $5.37 billion market cap and pioneering yield model establish it as a potential DeFi revolution, with Phemex’s perpetual futures offering essential tools to manage its inherent risks. Nevertheless, the challenges posed by funding rate volatility, liquidity crunches, CEX failures, and stETH de-pegging demand vigilant risk management. For traders, mastering real-time monitoring and strategic hedging on Phemex will be decisive in determining whether USDe emerges as a transformative asset or a precarious time bomb.

Disclaimer: The information presented in this article is for educational and informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not treat any of the article's content as such. Phemex does not recommend that any specific cryptocurrency should be bought, sold, or held by you. The cryptocurrency market is subject to high market risk and volatility. Past performance is not indicative of future results. All investment strategies and investments involve risk of loss. You should conduct your own due diligence and consult a qualified financial advisor before making any investment decisions. Phemex is not responsible for any investment decisions you make based on the information provided in this article.