A market correction is a short-term drop in the market’s performance that is less severe than a market crash. Given the volatility of the crypto market, corrections are a common occurrence.

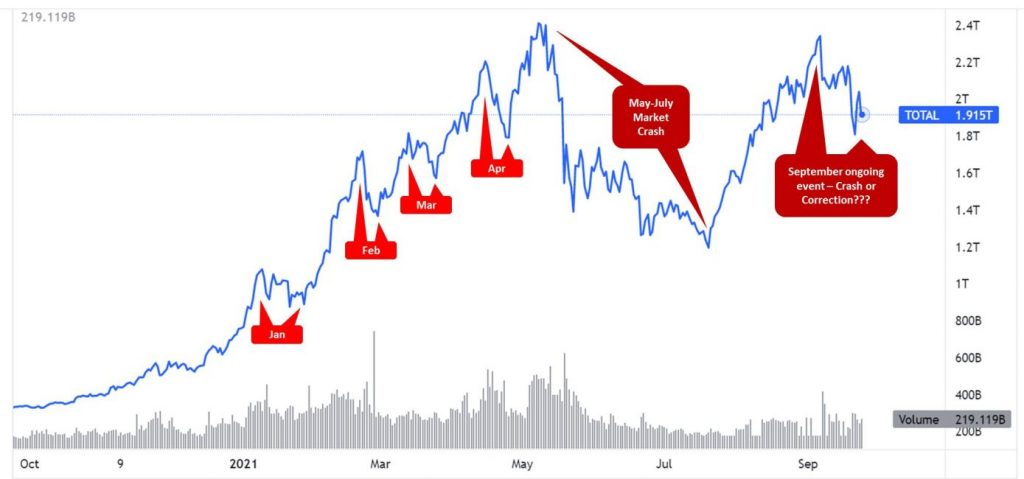

In the first nine months of 2021 alone, the cryptocurrency market experienced four corrections, in addition to one severe market crash, and one more ongoing market event that may be a correction or, possibly, the early stage of another crash.

For investors it’s important to know what a crypto market correction is, explain the reasons why corrections happen, and provide details of all the corrections in 2021.

What Is a Market Correction?

A market correction is a relatively short-term drop of between 10% and 20% from the most recent local peak in the market’s performance. Market corrections are followed by an upward movement in the chart. Corrections can last a few days, weeks, or even months. Corrections are less severe market declines than crashes. They also need to be distinguished from market dips and market reversals.

What Is the Difference Between Crypto Corrections and Other Market Events?

Crypto Market Correction vs Crypto Market Crash

While a correction is a temporary event of a less severe nature, a market crash is a drastic (over 20%) decline in the market that can happen in a single day or over a period of days, weeks, or even months.

Following a crash, if the market continues to decline for many months or a few years, it is classified as a bear market. For example, the early 2018 crypto market crash led to a year-long bear market that lasted until January 2019.

Overall Cryptocurrency Market Cap from 2017 to 2021 (Source: adapted from TradingView.com)

Unlike the 2018 bear market, the May-July 2021 market decline was a relatively short, but still very severe, crash. It started in mid-May, and by late June, the market was again on an upward trajectory.

An example of a severe one-day crash is the Black Thursday event of March 12, 2020, when BTC lost 37% of its value during the trading day.

Crypto Market Correction vs The Dip

A market dip is a very short-term slight decline in the market that is less severe than a correction, i.e., it results in a less than 10% decline and happens over one day or at most, a few days. However, continual small daily declines may result in a correction if, cumulatively, these declines result in over 10% depreciation of the market over the period.

Crypto Market Correction vs Reversal

A reversal happens when the market changes the direction of its long-term trend. Unlike a correction, which is a temporary short-term decrease, a market reversal sets the new longer-term, typically multi-year, direction for the market.

Since its beginnings in 2009, the cryptocurrency market has been growing strongly as measured by multi-year long-term trends, and a reversal has never happened in it.

What Are the Causes of Crypto Market Corrections?

Since market corrections are temporary, short-lived, and less severe than crashes, it is often difficult to single out an obvious cause of them. A number of factors, some of relatively minor prominence, can lead to a market correction.

The reasons could be as diverse as:

- Buyers running into supply issues. This can happen in the cryptocurrency markets more often than in the traditional stock market.

- A stronger sell sentiment caused by market news such as hacker attacks on blockchain platforms or upcoming government regulations.

- A stronger sell sentiment driven by analysts’ opinion that the market is “overheated.” While these kinds of opinions can lead to outright crashes, they are more often the cause of minor events such as corrections.

- The market shaking off an unsustainable growth trajectory caused by overly-enthusiastic, short-term-oriented investors.

- Finally, and most importantly, a myriad of other factors, both in the cryptocurrency world and outside of it. It is important to stress that corrections are notoriously hard to explain and even harder to predict since a number of less-than-significant events can cause them.

Can I Predict an Upcoming Market Correction?

A simple answer to this question is a resounding “NO.” Market corrections are extremely hard to predict, nor are they worth losing your sleep over.

Corrections cause only temporary and relatively minor declines in the market. They are followed by an upward trend in the charts and the market typically rebounds to the pre-correction levels within days, weeks, or at most a few months. If the rebound does not happen soon, as was the case in 2018, we are in for a longer-term market decline, not a correction.

For a prudent investor with a long-term view of the market, corrections are best ignored. Nor should you change your investment strategy as a result of a correction or in anticipation of it.

Cryptocurrency Market Corrections of 2021

Since the start of the year, there have been four corrections in the cryptocurrency market as well as one market crash, and one more ongoing market development that is either a correction or the beginning stage of another crash.

Due to the dominance of BTC, and to a lesser degree ETH, in the overall market, the corrections resulted from the impact on these top two cryptocurrencies. Other crypto assets, in most cases, follow suit when BTC and ETH fall appreciably. The top two pairs also share a very strong correlation of around 0.9, meaning that their price charts move similarly.

January 2021 Correction

The year’s first correction started to unfold on January 11. BTC lost 7% on that day, but ETH plunged 14%. A relatively gentle declining trend continued for the next 10 days. However, on the last day of the correction – January 21 – BTC shed 13% of its value from the day before, while ETH lost 19%.

From January 22, the market sprang back to growth. The correction lasted 11 days in total. The total capitalization of the cryptocurrency market dropped from $1.08 trillion to around $870 million, a decrease of 19%. It took the market only around two weeks to recover these losses, and by early February, the cryptocurrency market was worth $1.1 trillion.

February 2021 Correction

It did not take the market long to bump a second correction, which started on February 22. In the first two days of the correction, BTC and ETH lost 15% and 19% respectively of their pre-correction value.

The February correction lasted only a week, but resulted in the same 19% market drop as the January correction. The overall market cap went from $1.7 trillion down to about $1.38 trillion.

BTC and ETH celebrated the end of the correction with 10% daily increases on the first day of March. Eleven days later, on March 11, the market was back to its pre-correction total value.

March 2021 Correction

Two weeks after the end of the February correction, the cryptocurrency market’s growing trend was halted by another correction that started on March 14. This correction turned out to be somewhat less damaging than the first two of the year.

The market lost 14% of its value during the 12 days of the March correction, with the total market cap declining from slightly over $1.8 trillion to around $1.57 trillion. It took the market around a week, from the end of the correction on March 25 to April 1, to jump back to its pre-correction levels.

April 2021 Correction and the Subsequent May-July Market Crash

The cryptocurrency market’s penchant for corrections continued in April. Between the 16th and 25th of the month, a 10-day correction took the market from $2.2 trillion down to $1.8 trillion, an overall decline of 18%.

The correction ended on April 26, with BTC and ETH gaining 10% and 9%, respectively, on that day. By early May, the total market cap was back at the pre-correction level of $2.2 trillion.

Less than a month after this correction ended, the cryptocurrency market got hit with the mother of all crashes, which halved the market’s total worth, taking it from $2.4 trillion to $1.2 trillion in the period from May 12 to July 20. This has been the worst crypto market crash in history as measured by the total value lost.

Unlike the 2018 crash that brought about a year-long bear market, the 2021 crash was relatively brief, even if no less brutal. In late July, a strong positive trend returned to the market.

September 2021 – Correction or Crash?

Following the May-July crash, a largely positive market trend lasted for 48 days from July 21 to September 6. From the 7th of September, the crypto market turned to a negative trend again. Since then, the market has been largely declining for twenty days.

During this period, the market went down from around $2.3 trillion to $1.93 trillion, a decline of 16%. Technically, this figure is within the range of a correction (10% – 20%). However, the overall market is still largely trending downwards. Therefore, it is too early to call this ongoing event a correction. If the market returns to a positive trend in the coming weeks, we may have just observed another correction of 2021. If the market keeps trending downwards, and losses larger than the current 16% materialize, we may be witnessing the initial stage of another market crash.

Market Corrections and Crashes of 2021 (Source: adapted from TradingView.com)

Conclusion

Market corrections are less severe, shorter-term declines in the market’s overall performance. Typically, declines between 10% and 20% over a period of a few days, weeks, or, rarely, months are classified as corrections.

It is extremely difficult to find reliable causes of market corrections due to their relatively minor and common nature. Their presence is normally ignored by savvy crypto investors with a long-term investment strategy. Changing your investment strategy on the basis of a market correction, or anticipation of it, is not recommended.

In the first nine months of 2021, four market corrections, in January, February, March, and April, have graced the cryptocurrency market with their presence. The April correction was soon followed by a massive market crash that unfolded between May and July.

Soon after the crash ended and the market limped back into growth territory, another decline on the charts began to emerge in early September. The market has been declining for around 20 days as of now and has, so far, suffered an overall loss of 16% of the total market cap. Whether this latest development is another correction, or the beginning of 2021’s second market crash, will become obvious very soon.

Read More

- The 2021 Crypto Crashes Explained: What do they Mean for the Future?

- What Is a Market Pullback: What To Do During a Crypto Pullback?

- May 2021 Crypto Market Analysis

- July Crypto Market Analysis

- What is Crypto Market Cycle: Identifying Market Highs

- Crypto Crash of 2022: The Connection Between Interest Rate Hikes & Crypto Prices

- How To Trade Crypto: The Ultimate Investing Guide

- April Crypto Market Analysis