Key Takeaways

Definition: "Buying the dip" is the practice of purchasing Bitcoin after a price decline based on the expectation that the price will eventually rebound.

Historical Risk: Bitcoin's high volatility means "dips" can often be deep cycles; since 2014, major drawdowns have averaged roughly 80% declines from peak to trough.

2026 Market Context: The "buy the dip" strategy has evolved beyond a retail habit due to the influence of U.S. spot Bitcoin ETFs, institutional demand flows, and macro policy expectations.

Defining Dip Magnitude: A structured approach classifies declines into micro dips (2–5%), standard pullbacks (5–12%), corrections (12–30%), and major liquidation crashes (30%+).

"Falling Knife" Warning: Traders must distinguish between a temporary pullback and a "falling knife," which occurs when buying into a violent selloff triggered by leverage flushes or negative macro catalysts.

Buying “the dip” in Bitcoin sounds simple: when price drops, you buy because you expect it to rebound. The idea has become a core meme of crypto culture, and sometimes it’s been spectacularly profitable. But it’s also a fast way to “catch a falling knife” when you mistake a temporary pullback for a trend change, or when leverage liquidations turn a normal dip into a cascade.

A modern Bitcoin “dip” is not just a chart pattern. Since 2024, Bitcoin has been influenced by an expanding menu of forces: U.S. spot Bitcoin ETFs (approved January 10, 2024), options on those ETFs, a more institutional investor base, and an increasingly visible link to broad “risk sentiment” in tech stocks and macro policy expectations.

Why “Buy the Dip” Became a Bitcoin Habit

The logic behind dip-buying is rooted in mean reversion: after a sharp selloff, price often rebounds—either because sellers exhaust themselves, because bargain-hunters step in, or because leveraged shorts get squeezed. In Bitcoin, that dynamic can be amplified by 24/7 trading, a high share of speculative participation, and the presence of perpetual futures/levered products that can accelerate moves both down and up.

Historically, Bitcoin’s volatility has been extreme compared to traditional assets. One institutional research note highlighted that since 2014 Bitcoin experienced multiple drawdowns over 50%, and the largest drawdowns averaged around ~80% declines. These aren’t small “buy the dip” events; they’re deep cycles that require a different mindset and risk plan than buying a 5% pullback in an index fund.

Bitcoin’s cyclical drawdowns have often clustered around halving cycles. Research summarizing Bitcoin’s major cycles notes peaks in 2011, 2013, 2017, and 2021, each followed by extended drawdowns of roughly 75% or more from peak to trough. The most recent halving occurred on April 20, 2024 at block height 840,000, reducing the block subsidy from 6.25 BTC to 3.125 BTC—an event many market participants treat as a structural change in supply flow.

But the 2024–2026 cycle also introduced a new structure: spot Bitcoin ETFs in the U.S. were approved and began trading in January 2024, bringing a new channel of demand and new behavior patterns (flows, outflows, and institutional hedging). Later, options on certain spot Bitcoin ETFs received regulatory approvals, expanding hedging and speculation tools.

The result means that buy the dip is no longer just a retail slogan. It has become a behavior practiced (and sometimes exploited) across a broader market ecosystem that includes ETFs, derivatives, systematic funds, and large corporate holders.

Buying the Dip in Crypto (source)

What Counts as a “Dip” in Bitcoin

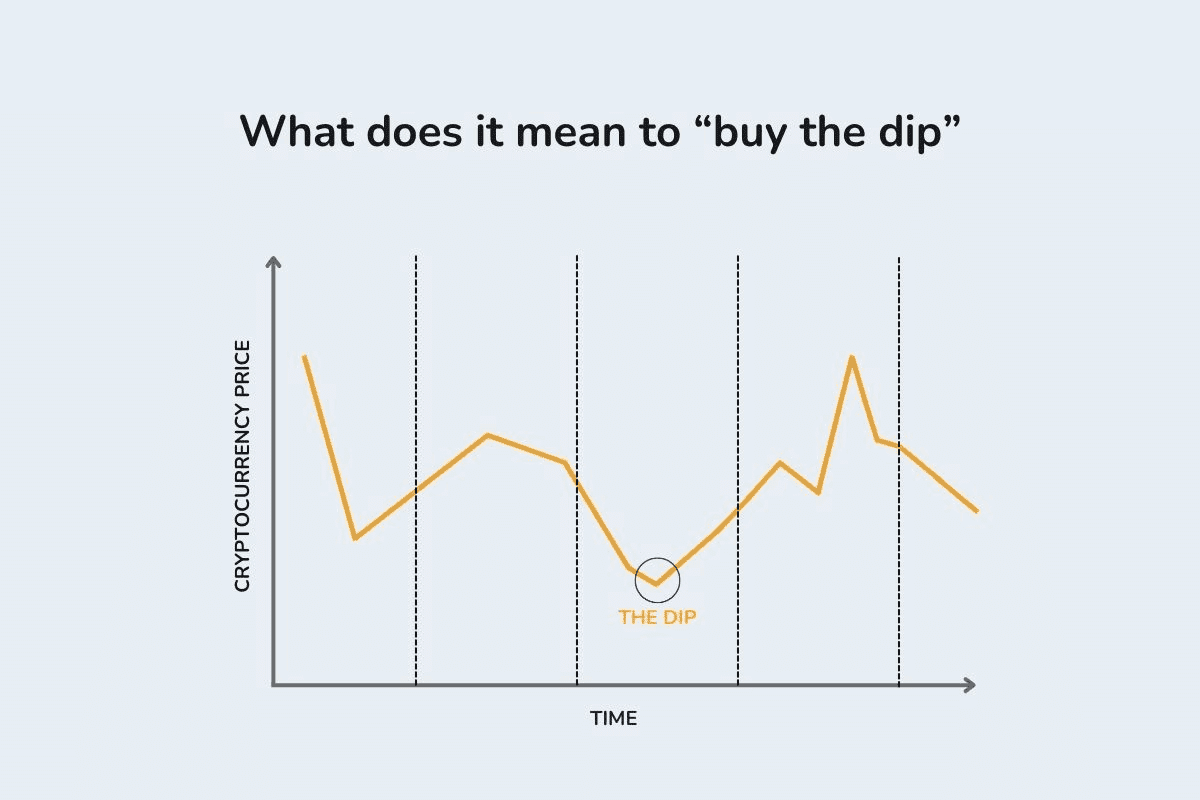

Most traders casually call any red candle a dip. That’s not helpful. A better approach is to define the dip by magnitude, context, and regime.

A foundational risk metric is drawdown, generally described as the peak-to-trough decline over a given period. Drawdown helps you stop thinking in one-off candles and start thinking in “What’s the market currently doing to my capital?”

In traditional markets, a “correction” is often defined as a decline of more than 10% but less than 20%, while a “bear market” is typically 20%+ down. Those definitions come from equity indices like the S&P 500, but they anchor intuition: a 10% Bitcoin move may be “normal,” while a 30% move is not “just a dip” for most risk budgets.

In Bitcoin, you can use a practical classification:

Micro dip: ~2% to 5% move (common intraday / weekly noise in active periods).

Standard dip: ~5% to 12% pullback (often a shakeout).

Correction: ~12% to 30% decline (requires more caution; may be a regime shift).

Crash / liquidation event: 30%+ (often involves leverage cascades, macro shocks, or structural stress).

In February 2026, for example, Reuters reported Bitcoin plunged to around $63,295 - its weakest level since October 2024 - and noted roughly $1 billion in Bitcoin positions liquidated in 24 hours, illustrating how “dip” can quickly become “forced selling.”

The key point: a dip is not defined by price being lower than yesterday. A dip is defined by being lower than a prior reference point and by whether the market structure still supports a rebound.

Three Ways to Buy Bitcoin Dips

There is no single “best” dip-buy method, because different methods solve different problems. Your choice should match your time horizon, temperament, and ability to execute.

Dollar-cost averaging into dips

Dollar-cost averaging (DCA) means investing equal amounts at regular intervals regardless of price, reducing the emotional pressure of timing. DCA is often presented as a “dip strategy,” but it is more accurately a discipline strategy—it makes you participate even when sentiment is ugly (and discourages you from going all-in at peaks).

A regulator-adjacent investor education page explains DCA as investing equal portions at regular intervals “regardless of the ups and downs in the market.” The main benefit is behavioral: it reduces the risk of making emotionally driven decisions when the chart turns red (FUD) or green (FOMO).

However, DCA is not guaranteed to outperform lump-sum buys, especially in strongly trending upward markets. A major asset manager’s analysis found lump-sum investing outperformed cost averaging about two-thirds of the time historically across markets—yet cost averaging reduced “regret risk” for investors uncomfortable with timing.

How DCA becomes “buy the dip”: Many crypto investors use baseline DCA (weekly/monthly buys) plus opportunistic add-ons when price falls by a threshold (e.g., add 0.5x the usual amount at a 10% drawdown, 1x at 20%, etc.). The advantage is that you keep a consistent plan but still respond to volatility without improvising.

DCA Trading Bots on Phemex (source)

Start DCAing Phemex Trading Bot

Staged limit “ladder” buys

A ladder approach uses multiple limit orders below current price—small tranches at predefined levels. This method tries to solve the classic dip-buy problem: you don’t know how deep the dip will go.

Ladders work best when:

You have a clear level framework (prior support zones, high-volume nodes, or psychologically important levels).

You assume volatility could intensify (so you want fills deeper).

You accept that some orders may never fill (that’s the cost of not chasing).

This method is often safer than “all-in at the first red candle,” because it reduces the probability of spending your entire dip budget before the market finds its real bottom.

Trend-filtered dip buying

This approach treats “buy the dip” as a subset of trend-following. You only buy dips when broader signals still say the market is in an uptrend, and you avoid dip-buying in confirmed downtrends.

Why? Because dip-buying is, by nature, contrarian since you’re buying as price falls. In traditional markets, quant research has found many “buy the dip” implementations underperform buy-and-hold over long horizons, partly because they fight momentum. That doesn’t mean dip-buying can’t work in Bitcoin, but it does mean you should respect the fact that “dips” in downtrends often keep dipping.

A trend-filter can be simple:

Only buy dips if price is above a long-term moving average or the market is making higher highs/higher lows.

Or only buy dips if on-chain profitability metrics are not in deep distribution (see below).

This filter reduces the number of trades and forces you to avoid the common mistake of “BTFD” all the way down.

A Safer “Buy the Dip” Framework for 2026

A useful 2026 framework combines three lenses: market structure, liquidity/leverage, and valuation/profitability.

Market structure lens

Ask: “Is this dip happening inside an uptrend, or is it a breakdown?”

A dip inside an uptrend often looks like:

A pullback that respects prior support and then reclaims key levels.

Selling pressure that fades quickly rather than intensifying.

A recovery that holds over multiple sessions (not just a single wick).

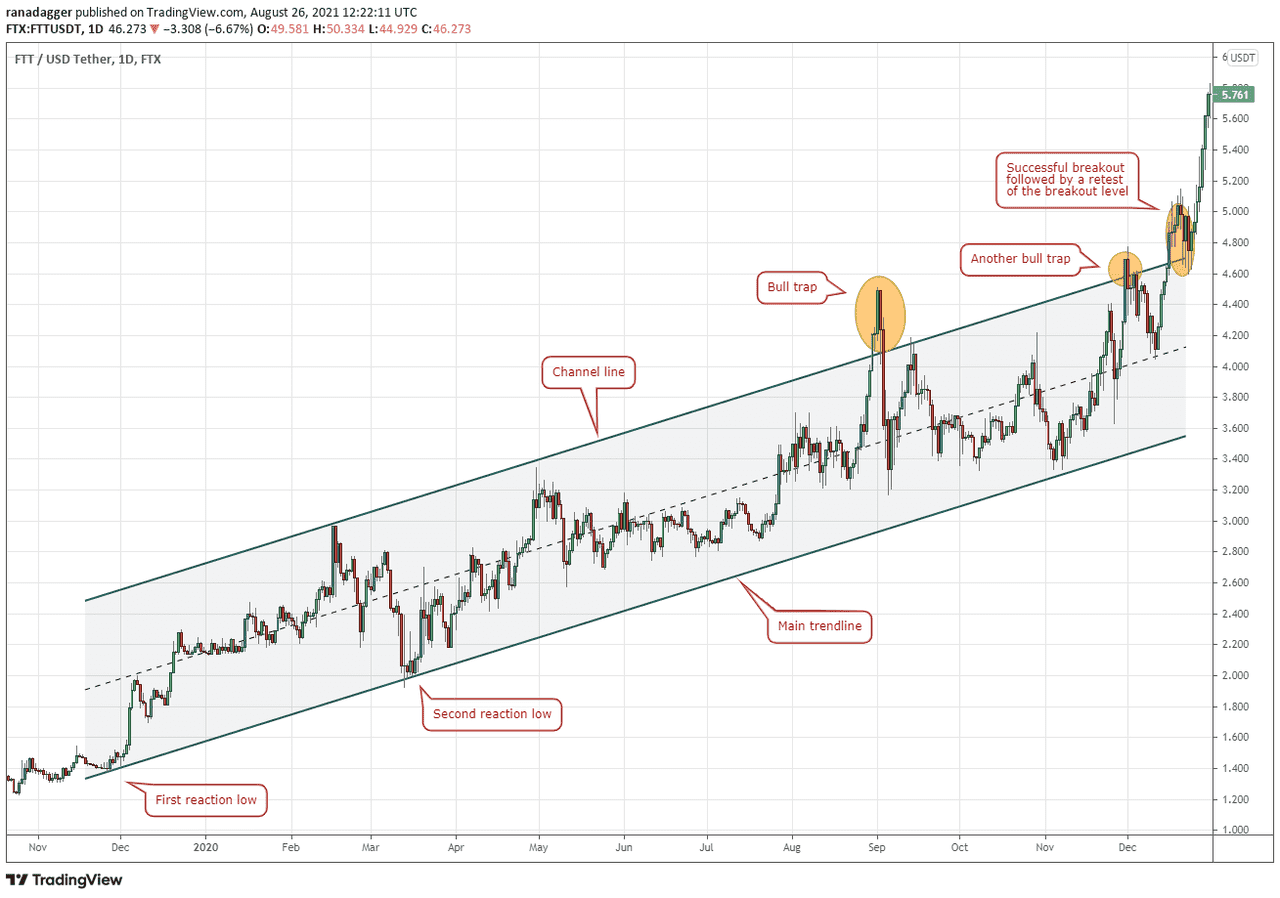

A breakdown that’s not “just a dip” often looks like:

Rapid failure after a breakout (a bull trap dynamic).

Lower highs after the drop (trend deterioration).

Major catalysts changing the narrative (macro tightening, large ETF outflows, crisis events).

Liquidity and leverage lens

In crypto, many sharp dips are intensified by leverage mechanics. In early February 2026, Reuters described large liquidations (e.g., ~$1B in Bitcoin positions in 24 hours) during the drop. Liquidations can create a feedback loop: falling price triggers forced selling, which pushes price down further.

That matters for dip buyers because:

A “cheap price” can get cheaper fast if liquidation cascades are still active.

Once liquidations exhaust, rebounds can be sharp (creating the “dip-buy win” everyone talks about).

If you track derivatives sentiment, the academic literature on perpetual futures describes funding rates and the futures-spot relationship as important “anchoring” mechanisms (the funding rate often reflects the average futures-spot spread over the preceding interval). You don’t need to run complex models—just understand that leverage positioning can dominate short-term price action.

Valuation and profitability lens

Unlike stocks, Bitcoin doesn’t have earnings. But it does have on-chain “profitability” metrics that can help you estimate whether the market is overheated or depressed.

One well-known metric is MVRV (market value to realized value). Glassnode describes MVRV as comparing market capitalization to realized capitalization, and notes that extreme deviations have historically lined up with market tops and bottoms by reflecting unrealized profit/loss conditions.

Dip buyers can use this lens to avoid a common mistake: buying a “dip” in an overheated market where most holders are still deep in profit (and thus prone to sell into strength), versus buying in a depressed market where many holders are underwater and selling pressure may be closer to exhaustion.

Risk Management: How to Avoid Turning “Dip Buying” Into Disaster

A dip-buy strategy is not complete until you define your risk budget, your invalidation point, and your time horizon.

First, define what you’re buying for.

A 2-hour trade needs different rules than a 2-year accumulation plan. Forced day-to-day decisions are where most dip buyers lose: they have a long-term story but a short-term stomach.

Second, treat “falling knife” risk as real.

A “falling knife” describes buying into a market still dropping hard, where trying to pick the bottom is dangerous. In Bitcoin, falling knives often coincide with leverage flushes, macro shock headlines, or structural events at exchanges.

A dramatic illustration: Reuters reported on February 7, 2026 that South Korean exchange accidentally distributed an enormous amount of Bitcoin due to a system error and then restricted trading/withdrawals, with the incident causing a brief sharp drop in Bitcoin price on that venue before rebounding. Even though this was exchange-specific, it shows how “unexpected operational events” can trigger sudden whipsaws—exactly the environment where sloppy dip-buying gets punished.

Third, decide how much you can be wrong.

If the “dip” becomes a 50% drawdown, can you hold? Institutional commentary has emphasized that Bitcoin’s historical drawdowns are frequent and deep. If you can’t hold through that, you shouldn’t deploy funds that require you to hold through that.

Fourth, plan the tax and reporting reality.

If you buy dips and later sell (or trade into other assets), you may create taxable events depending on jurisdiction. In the U.S., the stated that broker reporting on digital asset sales/exchanges is required on the (new) Form 1099-DA beginning with transactions on or after January 1, 2025, with additional guidance and transitional relief issued. That doesn’t change whether gains are taxable, but it does increase reporting visibility and record-keeping importance—especially for active dip traders who take many partial profits.

Fifth, use a “rules before feelings” checklist.

Here’s a compact checklist you can adapt (keep it as a note on your phone, not in your head):

What dip category is this (micro dip, correction, crash)?

Is the major trend up, down, or uncertain?

Are liquidations/fear driving the move (high risk of overshoot)?

Do I have a pre-planned ladder/DCA schedule?

What would prove me wrong (price breaks a major level, trend flips, etc.)?

Dip buying without rules is just “panic buying red candles.”

Crypto Chart Analysis (source)

Case Studies: 2024 to 2026

The ETF era changed dip-buying narratives

On January 10, 2024, the approved the listing and trading of spot Bitcoin exchange-traded products, a landmark shift after years of denials. That policy development changed Bitcoin’s market plumbing: it enabled new demand from brokerage accounts and created a flow-driven layer on top of the native crypto market.

It also created “headline sensitivity.” On January 9, 2024, a hacked SEC social account posted a false ETF approval message; the incident briefly moved Bitcoin’s price before the SEC publicly denied it and clarified the account compromise. For dip buyers, this episode is a reminder that news-driven pumps and dumps can create “fake dips” and “fake breakouts” that are not fundamentally informative.

February 2026: a real-world “dip or regime change?” moment

In early February 2026, Reuters reported Bitcoin plunged sharply (to around $63k), with liquidations and a major drop in overall crypto market value since prior peaks. Major media also described rebounds and “relief rallies” after the sharp selloff, a classic whipsaw environment.

This is exactly where dip buyers get split into two groups:

Those with pre-planned accumulation (DCA/ladder) and a long horizon who can buy calmly into fear.

Those chasing “BTFD” with leverage or no stop discipline—often experiencing liquidation or panic-selling the bottom.

The lesson isn’t “always buy.” The lesson is: if you want to buy dips, you must already know what you’ll do when the dip becomes a cascade.

FAQ: Buy the Dip in Bitcoin

Is buying the dip a good Bitcoin strategy? It can be, but it depends on the market regime and your execution method. Bitcoin has experienced very large drawdowns historically, so “dip buying” can work during long-term adoption uptrends, but it can also underperform or cause heavy losses if you repeatedly buy in a sustained downtrend.

What does BTFD mean? BTFD is slang for “Buy the [expletive] Dip,” a more aggressive version of “buy the dip” often used to encourage dip-buying during selloffs. (As a mindset, it increases risk because it encourages oversized bets rather than planned accumulation.)

How do I avoid catching a falling knife? Use staged buys (DCA or ladders), require confirmation (trend filter or reclaiming key levels), and avoid high leverage. “Falling knife” risk is real in violent selloffs with liquidations.

What indicators help with dip buying?

On-chain: MVRV and realized price frameworks are commonly used to assess profitability extremes.

Market sentiment: the Crypto Fear & Greed Index is often referenced as a simplified sentiment gauge (fear vs greed).

Technical: support/resistance, breakout confirmation, and volume.

Is it safer to DCA instead of trying to time dips? DCA is designed to reduce timing pressure and help investors stay consistent through volatility. Investor-education sources describe it as investing in equal portions at regular intervals regardless of market ups and downs. Research suggests lump-sum investing may outperform cost averaging in many historical scenarios—but DCA may better match investors who value discipline and reduced regret risk.

Conclusion

“Buy the dip” can be a rational approach to Bitcoin accumulation—but only when it’s treated as a structured risk process, not a meme. Bitcoin’s history includes deep drawdowns; modern Bitcoin includes ETF-era flow dynamics, leverage-driven liquidation cascades, and headline-driven whipsaws.

If you want a durable 2026 dip strategy, focus on what you control: DCA or ladders, trend filters, risk limits, and emotional discipline. The dip is not the opportunity—the plan is the opportunity.

Disclaimer: This article is for informational purposes only and does not constitute investment, legal, or tax advice. Digital asset prices are volatile; never invest money you cannot afford to lose.