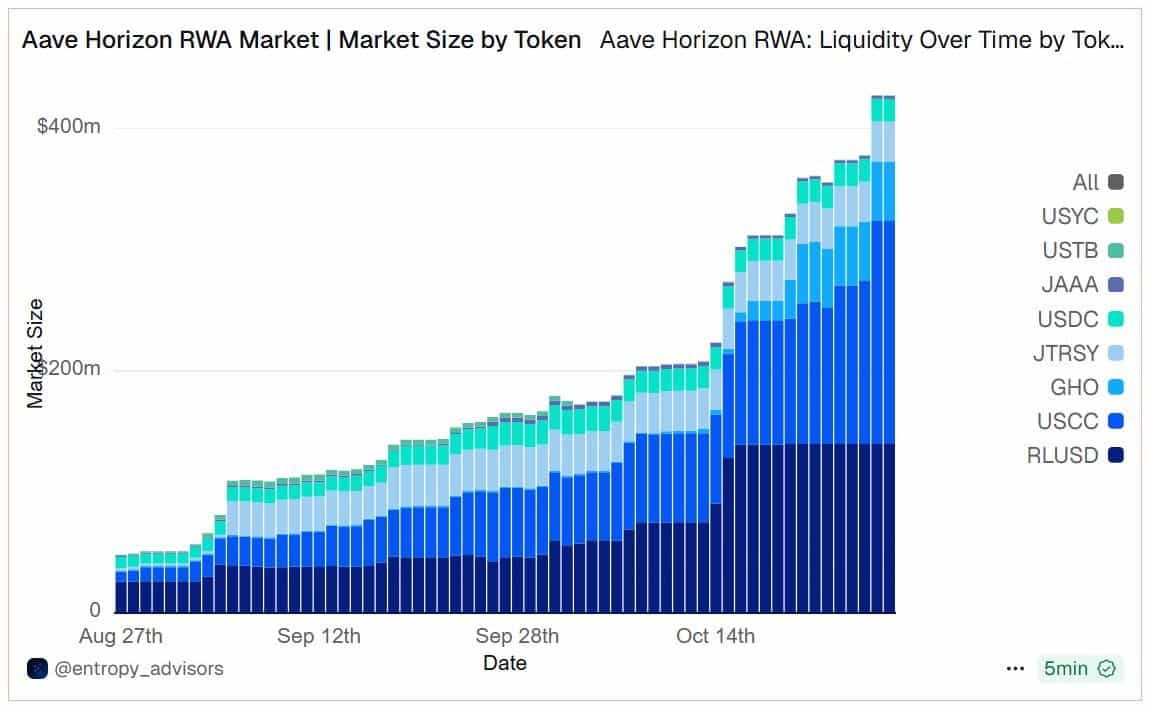

In 2025, the conversation has irrevocably shifted from speculative JPEGs to the $35.5 billion Real-World Asset (RWA) market, according to data from rwa.xyz as of early 2025. This isn't just a fleeting trend; it's a fundamental migration of value, an institutional-led revolution that has found its footing. This is the story of how RWA went from a theoretical concept to one of crypto's most dominant and fastest-growing investment narratives.

RWA Global Market Overview, source: rwa.xyz

But this explosion didn't happen in a vacuum. It was the result of a perfect storm—a convergence of market forces that created an undeniable turning point. In this definitive guide, we will move beyond a simple list to dissect the catalysts behind the RWA revolution. We will analyze the current state of this multi-chain, multi-asset ecosystem, and explore the five core investment theses that will define the next wave of growth, along with the key players and top coins pioneering each path.

The Tipping Point: Why RWA Ignited in 2024-2025

For years, RWA was a promising but dormant narrative, a perennial "next year" story. The "why now?" is a story of three powerful catalysts converging to create an unstoppable force, transforming the market from a niche experiment into a multi-billion dollar reality.

-

The New Macroeconomic Reality: The end of the zero-interest-rate policy (ZIRP) era was the single most important driver. As global interest rates rose, DeFi's old model of generating yield from inflationary token rewards and speculative leverage became unsustainable. Protocols and users were starved for real, sustainable yield. U.S. Treasury bonds, offering a nearly risk-free 4-5% APY, became the benchmark for the entire global financial system. RWAs provided the essential bridge to bring this real-world yield on-chain. It was a lifeline for a DeFi ecosystem in desperate need of a new, non-crypto-correlated engine for growth.

-

TradFi's Grand Entry: The psychological turning point for the market occurred in March 2024 when BlackRock, the world's largest asset manager with over $10 trillion AUM, launched its BUIDL fund on Ethereum in partnership with Securitize. This was not a tentative experiment; it was a resounding declaration that tokenization was the future of finance. This single move provided the institutional "seal of approval" and validation that the RWA space needed. It signaled to every other financial institution that the technology was ready and the market was real, opening the floodgates for other TradFi giants like Franklin Templeton to follow and for serious capital to begin taking the sector seriously.

-

Technological Maturity: The underlying blockchain infrastructure finally became ready for institutional-grade finance. The "gas wars" of previous cycles made high-frequency trading or managing large portfolios on Ethereum prohibitively expensive. The rise of high-throughput, low-cost Layer 1s and L2s like Solana, Avalanche, and Aptos proved they could offer the speed and transaction finality required for real-world finance. As Bitwise CIO Matt Hougan noted, Solana's incredible speed makes it a "top choice for Wall Street" for tokenization. Simultaneously, the maturation of critical infrastructure like Chainlink's oracle networks ensured that off-chain data—from asset prices to proof of reserves—could be brought on-chain with the institutional-grade reliability that multi-billion dollar funds demand.

State of the Market: A $35.5B Multi-Chain Ecosystem

The result of this tipping point is the vibrant, multi-layered ecosystem we see today, as detailed by platforms like rwa.xyz. It is a market defined by asset diversity and a fierce multi-chain competition for dominance.

A Diversified Asset Base: Beyond a Monolithic Market

The current $35.54 billion on-chain RWA value is not a monolith. It's a diversified portfolio demonstrating a mature and sophisticated market with over 514,000 asset holders.

-

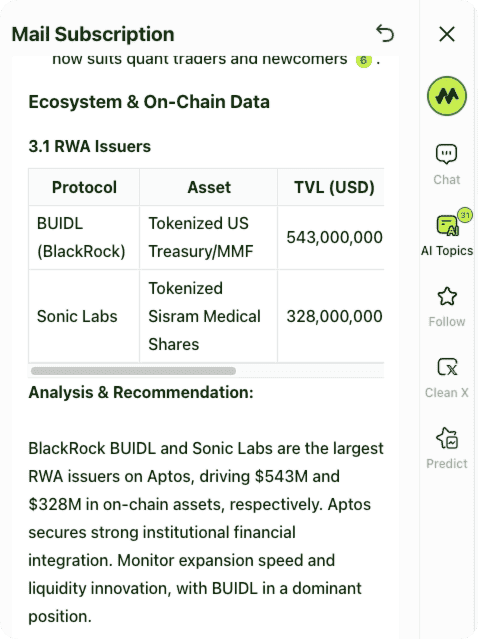

Private Credit ($18.4B): The silent giant and the largest single category. This represents tokenized loans to businesses and consumers, a core pillar of the traditional financial system, now providing yield to DeFi. The growth of RWA markets on protocols like Aave Horizon, which recently surpassed $425 million primarily due to the influx of private credit funds, is a testament to this sector's expansion.

The Aave Horizon RWA market just crossed $425M. source: Aave Protocol data

-

U.S. Treasury Debt ($8.6B): The second-largest and fastest-growing category, serving as the "risk-free" bedrock for the entire on-chain economy. This is the primary on-ramp for institutional capital and the collateral base for a new generation of DeFi products.

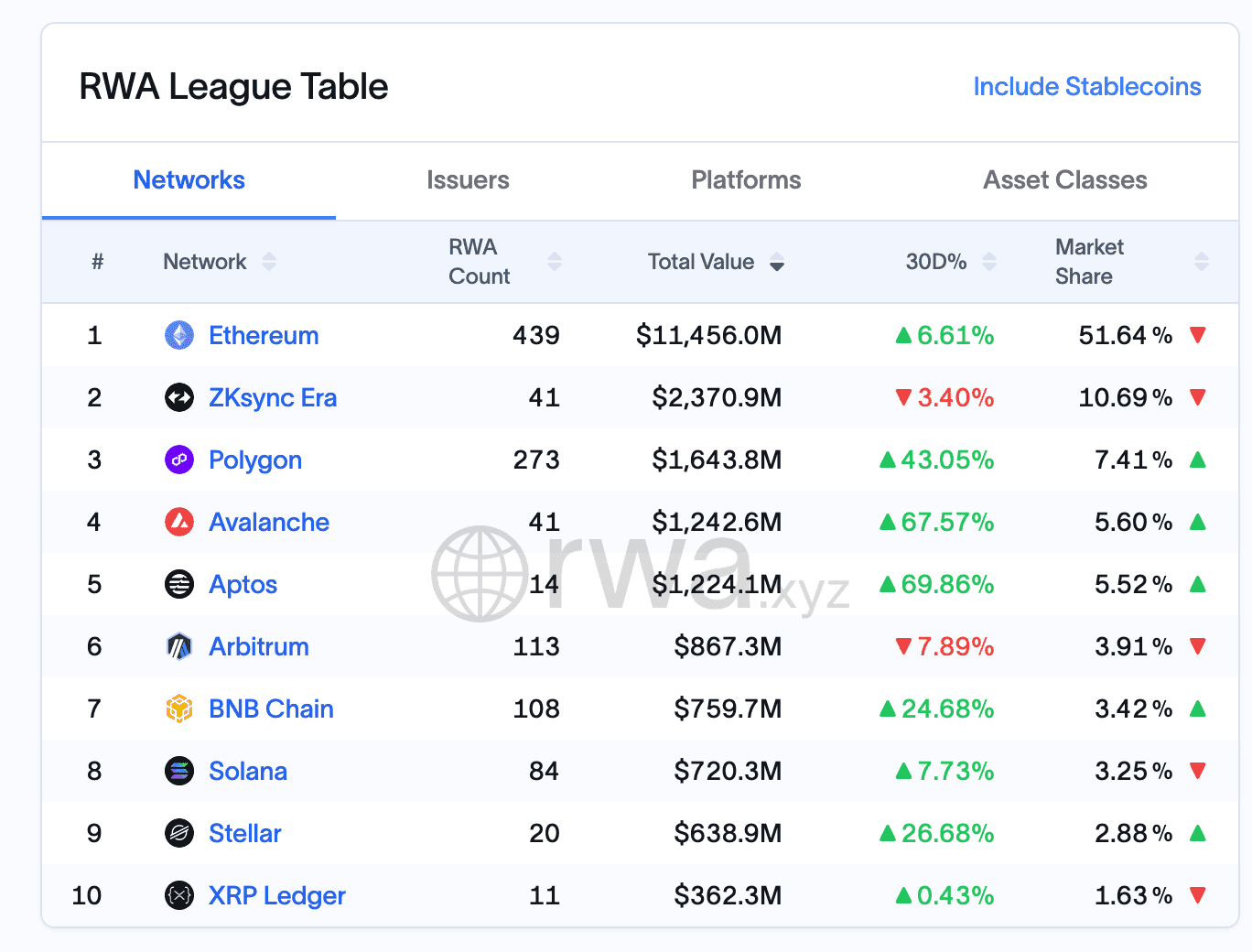

A Multi-Chain Battleground: The War for RWA Dominance

The "RWA League Table" reveals a dynamic, multi-chain world where the war for RWA dominance is being fought, not just by protocols, but by the underlying blockchains themselves.

RWA League Table, source: rwa.xyz

-

Ethereum ($11.4B): The undisputed king, with 51.6% market share, serving as the primary, high-security settlement layer for high-value assets like BUIDL.

-

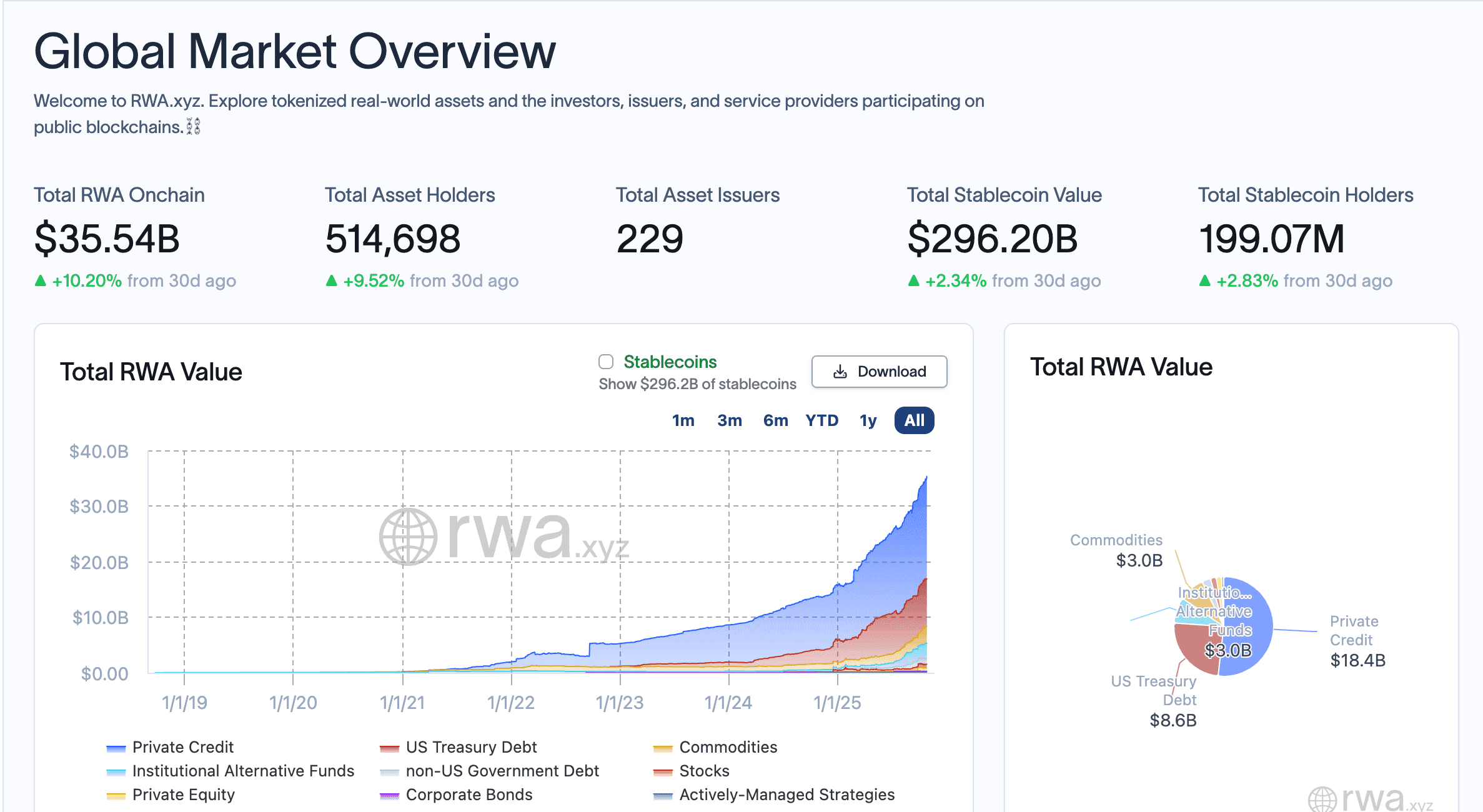

The L2s & Competing L1s: This is where the most explosive growth is happening. The data shows staggering 30-day value growth on Avalanche (+67.6%), Aptos (+69.9%), and Polygon (+43.1%). This trend is accelerating, as evidenced by BlackRock's recent, game-changing $500 million BUIDL deployment to Aptos. This move, which made Aptos the second-largest home for BUIDL, was a massive vote of confidence in the chain's security and performance, instantly catapulting it into the top tier of RWA blockchains.

Aptos RWA moves, source:MOSS

The 5 Core RWA Investment Theses for 2025 (And the Coins Leading Them)

Investing in RWA requires moving beyond a simple list of coins. It requires understanding the distinct strategies and technological battlegrounds where value is being created. Here are the five core investment theses for the modern RWA landscape, and the key players within each.

Thesis *1: The Yield Foundation - Tokenizing the World's Safest Asset

This is the most straightforward and institutionally-accepted RWA thesis: bringing the world's most important collateral asset, U.S. government debt, on-chain at scale to serve as the foundational yield layer for the entire DeFi ecosystem.

BlackRock USD Institutional Digital Liquidity Fund (BUIDL): The Institutional Bedrock

-

Category: Tokenized Financial Product (U.S. Treasuries)

-

Market Cap: ~$2.8 Billion

-

Core Thesis: The ultimate "legitimacy layer" of RWA, representing a direct, regulated stake in a BlackRock-managed fund. Its growth is the primary bullish catalyst for the entire RWA ecosystem.

BlackRock's BUIDL is not a speculative crypto token; it is a stable-value token pegged 1:1 to the US dollar, representing a share in a fund holding cash, U.S. Treasury bills, and repurchase agreements. Launched in partnership with tokenization platform Securitize, it is a fully regulated, permissioned instrument designed for institutional clients.

-

Why BUIDL's Growth Matters for the Ecosystem:

-

Unparalleled Validation: As the world's largest asset manager, BlackRock's entry has single-handedly legitimized the entire RWA space for traditional finance.

-

Multi-Chain Standard Setter: Its deployment first on Ethereum and then its significant expansion to Aptos sets a powerful precedent, forcing other L1s to upgrade their security and compliance features to attract similar institutional-grade assets.

-

Unlocking Institutional DeFi: BUIDL provides the high-quality, liquid collateral that institutional-focused DeFi protocols need to build a new generation of financial products.

-

-

Trend Alignment:

BUIDL is not just aligned with the institutional adoption trend; it is the trend. Its growth is a direct measure of institutional capital flowing into the on-chain world. -

Risks:

The primary risk is centralization. BUIDL's operation is entirely dependent on BlackRock as the asset manager and Securitize as the tokenization agent. It is a fully permissioned ecosystem. -

Investment Outlook:

One cannot "invest" in BUIDL for price appreciation. Instead, BUIDL's growth should be viewed as a powerful bullish indicator for the blockchains it deploys on (like Aptos) and the infrastructure it uses (like Chainlink). The investment thesis is to bet on the ecosystem that BUIDL validates and builds upon.

Ondo Finance (ONDO): The Institutional Gateway for Tokenized Treasuries

-

Category: Tokenized Financial Products (U.S. Treasuries)

-

Market Cap: ~$2.3 Billion

-

Core Thesis: An investment in the primary on-ramp for bringing the global "risk-free" rate on-chain, serving as the foundational yield layer for DeFi.

Ondo Finance has masterfully positioned itself as the market leader for providing crypto-native access to institutional-grade, yield-bearing assets. Its flagship product, OUSG, is a tokenized representation of a short-term U.S. Treasuries ETF managed by BlackRock. This isn't just another token; it's a compliant, bankruptcy-remote, and fully-audited financial instrument that allows DeFi protocols, stablecoin issuers, and crypto-native treasuries to earn stable, low-risk yield.

-

Why ONDO Has Long-Term Potential:

-

First-Mover Advantage: It was one of the first to market with a high-quality, compliant product, capturing significant market share and brand recognition.

-

Institutional DNA: The project is deeply focused on compliance and partnerships, leveraging established TradFi products to build trust.

-

Ecosystem Integration: ONDO is becoming a core building block across DeFi, serving as the primary destination for protocols looking to diversify their treasuries into real-world yield.

-

-

Trend Alignment:

The entire RWA narrative was ignited by the market's desperate search for "real yield." ONDO is the purest expression of this trend, directly channeling U.S. Treasury yields onto the blockchain. -

Risks:

ONDO's strength is also its weakness. Its reliance on traditional financial rails (BlackRock, custodians, banks) introduces centralization risk. A regulatory crackdown could significantly impact its operations. -

Investment Outlook:

An investment in ONDO is a bet on the "financialization layer" of RWA. Its success depends on maintaining its regulatory compliance and expanding its integrations across the multi-chain landscape.

Thesis *2: The DeFi Engine - Building an On-Chain Credit Market

This is the largest RWA category, bringing the multi-trillion dollar real-world lending and borrowing market to the blockchain.

Figure Heloc (FIGR_HELOC): The Vertically Integrated Credit Giant

-

Category: Tokenized Private Credit (Home Equity)

-

Market Cap: ~$13.3 Billion

-

Core Thesis: A bet on a vertically integrated model where the entire lifecycle of a financial product (origination, servicing, tokenization) happens within a single, purpose-built ecosystem.

Figure Technologies is a fintech company first, a crypto company second. It originates real-world home equity lines of credit and then tokenizes these credit assets on its own purpose-built L1, the Provenance Blockchain. This is not an open protocol; it's a highly controlled, closed-loop system designed for maximum compliance and quality control.

-

Why FIGR_HELOC Has Long-Term Potential:

-

Total Control: The vertical integration model minimizes counterparty risk and makes it easier to meet complex regulatory requirements, which is highly attractive to institutions.

-

Proven Scale: With a market cap exceeding $13 billion, it has already proven that this model can achieve massive scale, far beyond most other RWA projects.

-

Fintech Bridge: Its structure is familiar to traditional financial institutions, making it an easier partner for banks and credit funds looking to enter the on-chain world.

-

-

Trend Alignment:

This aligns perfectly with the institutional push for private credit and the demand for compliant, controllable blockchain solutions. It's a "walled garden" approach that provides the safety and predictability that large, regulated entities require. -

Risks:

The model is highly centralized and its success is tied to the performance of a single company (Figure) and a single asset class (the US housing market). It is less "crypto-native" and may not integrate as easily with the permissionless DeFi world. -

Investment Outlook:

An investment in this ecosystem is a bet on a specific fintech's success in tokenizing its own balance sheet. Its massive market cap shows this model works. Long-term success will depend on Figure's execution and the health of the US housing market.

Centrifuge (CFG): The Credit Market Innovator

-

Category: Tokenized Private Credit

-

Market Cap: ~$120 Million

-

Core Thesis: An investment in the open protocol layer that unlocks the multi-trillion dollar private credit market for the blockchain, providing DeFi with its largest source of non-crypto-correlated yield.

Centrifuge is one of the earliest RWA platforms, pioneering the concept of asset pools backed by real-world debt like invoices, trade receivables, or mortgages. Through its Tinlake protocol, businesses (Asset Originators) can tokenize these future cash flows and access liquidity from a global pool of DeFi investors.

-

Why CFG Has Long-Term Potential:

-

First-Mover and Pioneer: It has a proven track record, having financed over $500 million in assets and survived multiple market cycles.

-

Deep DeFi Integration: Its role as a key collateral provider for MakerDAO's DAI stablecoin positions it at the center of DeFi's leading stablecoin ecosystem.

-

Real-World Impact: It provides a tangible solution for SME financing, a massive, underserved market.

-

-

Trend Alignment:

As private credit expands globally, Centrifuge's open protocol model is perfectly positioned to capture the "long-tail" of assets that larger, centralized players might ignore. -

Risks:

Credit default risk is inherent. The performance of Centrifuge's pools relies on the quality of the underwriting and the off-chain legal enforcement capabilities of the Asset Originators. -

Investment Outlook:

An investment in CFG is a bet on the emergence of a true on-chain debt capital market. Its success hinges on attracting high-quality institutional credit originators and maintaining a robust risk management framework.

Thesis *3: The Critical Infrastructure - The "Picks and Shovels" Play

This thesis is a bet on the entire ecosystem's growth, regardless of which specific RWA protocol wins.

Chainlink (LINK): The Indispensable Oracle for RWA Integrity

-

Category: Oracle & Interoperability Infrastructure

-

Market Cap: ~$12.7 Billion

-

Core Thesis: A foundational "picks and shovels" play on the entire RWA ecosystem's growth, security, and interoperability.

Chainlink is the undisputed market leader providing this essential service. For RWA, its Proof of Reserve is critical for transparently verifying off-chain collateral. Its Cross-Chain Interoperability Protocol (CCIP) is the key to moving RWAs between chains.

-

Why LINK Has Long-Term Potential:

-

Unrivaled Network Effects: It is the industry standard, integrated with virtually every significant protocol.

-

Technology-Agnostic: Chainlink is blockchain-agnostic, meaning it will thrive regardless of which L1 or L2 wins the RWA race.

-

Essential for Institutional Trust: It provides the institutional-grade trust layer that multi-billion dollar funds demand.

-

-

Trend Alignment:

As the RWA market grows, the need for trusted, decentralized data and seamless cross-chain communication will grow exponentially. -

Risks:

While dominant, Chainlink faces competition from other solutions. Its own smart contracts represent a potential systemic risk point. -

Investment Outlook:

An investment in LINK is the most diversified and fundamental way to gain exposure to the RWA narrative's long-term success.

Stellar (XLM): The Original Asset Tokenization Network

-

Category: RWA-Focused Layer 1 Blockchain

-

Market Cap: ~$10.1 Billion

-

Core Thesis: An investment in a battle-tested, low-cost blockchain specifically designed from day one for the issuance and settlement of any asset.

Stellar's network was designed from the ground up for the efficient issuance and exchange of digital assets representing real-world value. It has been used for years by companies like Franklin Templeton for one of the first tokenized money market funds.

-

Why XLM Has Long-Term Potential:

-

Proven Reliability: Decades of operation give it a track record of stability that newer chains lack.

-

Low, Fixed Fees: Its low transaction costs are highly attractive for high-volume payment and settlement applications.

-

Clear Focus: It is optimized for asset issuance and payments, not general-purpose smart contracts.

-

-

Trend Alignment:

As RWA moves into real-world utility like cross-border payments and remittances, Stellar's architecture becomes highly relevant. -

Risks:

Competition from newer, faster L1s and Ethereum's L2 ecosystem. It is sometimes perceived as "older tech" and has less DeFi activity than newer chains. -

Investment Outlook:

A bet on Stellar is a bet that efficiency, reliability, and a clear focus on asset issuance will win out for specific use cases. It's a more conservative, infrastructure-level play on the growth of stablecoins and tokenized currencies.

Thesis *4: The L1 Ecosystem Play - The Race for RWA Dominance

This is a bet on an entire ecosystem's strategy to become the primary settlement layer for the RWA market.

Avalanche (AVAX): The L1 Ecosystem for Institutional Tokenization

-

Category: RWA-Focused Layer 1 Ecosystem

-

Market Cap: ~$15 Billion (Ecosystem-wide)

-

Core Thesis: An investment in a specific Layer 1's strategy to win the institutional RWA race through customization, compliance features, and aggressive business development.

The battle for RWA dominance is not just between protocols, but between the Layer 1 blockchains competing to become the primary settlement layer for this multi-trillion dollar market. Avalanche is a prime example of a chain with a dedicated RWA strategy. It leverages its unique "Subnet" architecture, which allows institutions to create their own customized, permissioned blockchains that can be tailored to specific compliance needs. This is a powerful selling point for large financial players. This strategy is backed by the "$50 million Avalanche Vista" fund, designed to bootstrap and accelerate the growth of RWA projects on its network.

Why AVAX Has Long-Term Potential:

-

Customization via Subnets: This technology allows institutions to operate in a controlled, KYC-compliant environment while still connecting to the broader DeFi ecosystem.

-

Strong Institutional Focus: Avalanche has actively courted traditional finance, with partnerships involving major players like Securitize and private equity giant KKR.

-

Proven Performance: The chain offers high throughput and fast finality, which are critical for financial applications.

Trend Alignment:

This thesis aligns with the multi-chain future of RWA, where different chains will likely specialize in different use cases. Avalanche is positioning itself as the specialist for institutional and enterprise-grade tokenization.

Risks:

The primary risk is intense competition. Avalanche is in a fierce battle with other high-performance L1s like Solana and Aptos, as well as Ethereum's growing L2 ecosystem (Arbitrum, Polygon), all of whom are aggressively pursuing the same RWA prize.

Investment Outlook:

A bet on AVAX in the context of RWA is a bet on its ecosystem strategy. It's a belief that its Subnet technology and focused business development will successfully attract a critical mass of high-value asset issuers, making it a dominant hub for institutional tokenization.

Solana (SOL): The High-Speed Settlement Layer for Wall Street

-

Category: RWA-Focused Layer 1 Ecosystem

-

Market Cap: ~$80 Billion (Ecosystem-wide)

-

Core Thesis: A bet that raw speed and low transaction costs will make it the preferred blockchain for high-frequency trading and settlement of tokenized financial assets.

As highlighted by the Bitwise CIO, Solana's sub-second finality and ability to handle tens of thousands of transactions per second make it uniquely suited for the demands of modern finance. Its vibrant and battle-tested DeFi ecosystem provides a ready-made environment for RWA products to plug into.

-

Why SOL Has Long-Term Potential:

-

Unmatched Performance: Its speed is an order of magnitude higher than many competitors, which is critical for market makers and exchanges.

-

Strong Institutional Interest: Its performance has attracted pilots and projects from major TradFi players like Visa.

-

Vibrant Ecosystem: It has a large and active developer community building a wide range of financial applications.

-

-

Trend Alignment:

Aligns with the needs of financial players who prioritize speed and efficiency above all else. As RWA markets become more liquid, they will require this level of performance. -

Risks:

Past network outages are a significant concern for institutions that require 100% uptime and reliability. -

Investment Outlook:

An investment in SOL is a bet that performance will be the single most important factor for the adoption of on-chain finance by Wall Street.

Aptos (APT): The Institutional-Grade L1 for Security and Scalability

-

Category: RWA-Focused Layer 1 Ecosystem

-

Market Cap: ~$15 Billion (Ecosystem-wide)

-

Core Thesis: A bet that institutional-grade security, formal verification, and a developer-friendly environment will attract the most risk-averse, high-value asset issuers.

The key differentiator for Aptos is its use of the Move programming language, which was designed at Meta (formerly Facebook) for enhanced security and formal verification of digital assets. This focus on safety is precisely what attracts top-tier institutions.

-

Why APT Has Long-Term Potential:

-

Security-First Architecture: The Move language is designed to prevent common smart contract vulnerabilities, which is paramount when dealing with trillions of dollars in assets.

-

Ultimate Institutional Validation: The decision by BlackRock to deploy a significant portion of its BUIDL fund on Aptos is the single strongest endorsement an L1 could receive.

-

Strong Pedigree: The team's background from Meta's Diem project gives it a deep understanding of building scalable, compliant blockchain infrastructure.

-

-

Trend Alignment:

Aligns perfectly with the institutional push for safety, compliance, and verifiability. BlackRock's choice has created a powerful narrative that Aptos is the "safe choice" for serious institutions. -

Risks:

It's a newer ecosystem compared to Solana or Avalanche and has less organic DeFi activity. It needs to bootstrap a user base beyond just its institutional partners. -

Investment Outlook:

A bet on APT is a bet that security and verifiability will ultimately be more important to institutions than raw speed. The BlackRock partnership gives it a powerful head start in this race.

Thesis *5: The Next Wave - Specialized Blockchains & Platforms

This thesis focuses on the emerging L2s and specialized platforms aiming to provide all-in-one, user-friendly environments.

Plume Network (PLUME): The Modular L2 for All RWAs

-

Category: RWA-Specific Layer 2 Blockchain

-

Market Cap: ~$210 Million

-

Core Thesis: An investment in the user-friendly, all-in-one infrastructure designed to simplify the complex tokenization process and onboard the next wave of asset issuers.

While L1s provide the base security, a new wave of specialized Layer 2s are emerging to solve the specific problems of RWA. Plume Network is a leading example. It is a modular L2 blockchain built on the Arbitrum stack, designed specifically to provide an integrated solution for asset tokenization. It aims to handle the complex aspects of compliance, KYC, and asset onboarding at the chain level, allowing any project to launch RWA products quickly and efficiently.

Why PLUME Has Long-Term Potential:

-

Ease of Use: By simplifying the technical and compliance hurdles, Plume can significantly lower the barrier to entry for asset issuers, potentially unlocking a "long-tail" of smaller, more diverse RWAs.

-

Ecosystem Focus: It aims to create a vibrant, interconnected ecosystem of RWA dApps, from marketplaces to lending protocols, all within a single, optimized environment.

-

Cost Efficiency: As an L2, it offers significantly lower transaction fees than Ethereum, which is crucial for the high-volume activity associated with liquid RWA markets.

Trend Alignment:

This thesis aligns with the broader trend of modularity and specialization in the blockchain space. Just as there are specialized L2s for gaming and social media, a specialized L2 for RWA is a logical and powerful evolution.

Risks:

As a newer project, Plume faces significant adoption risk. It must convince both asset issuers and users to build on its nascent ecosystem instead of more established chains. It also faces direct competition from other emerging RWA-focused L2s.

Investment Outlook:

An investment in PLUME is a bet on the future of specialized blockchain infrastructure. It's a belief that a purpose-built, user-friendly environment will ultimately win out for the majority of RWA projects. Its success depends on its ability to execute its vision and build a thriving, liquid ecosystem from the ground up.

Zebec Network (ZBCN): The Real-Time Cash Flow Protocol

-

Category: RWA Application & L1 Platform

-

Market Cap: ~$359 Million

-

Core Thesis: An investment in the tokenization of a novel asset class: real-time, streaming cash flows.

Zebec's core product is a protocol that enables continuous, second-by-second settlement of payments, such as salaries, subscriptions, or royalties. This transforms a future revenue stream—a traditionally illiquid asset—into a liquid, tradable on-chain asset that can be used as collateral or sold upfront.

-

Why ZBCN Has Long-Term Potential:

-

First-Mover in a Massive Category: Every recurring payment in the global economy is a candidate for tokenization via a protocol like Zebec.

-

Clear Real-World Use Case: It solves a tangible problem for the gig economy, creators, and businesses that rely on subscription models.

-

Ecosystem Evolution: It is evolving from a simple application into its own L1, aiming to become the financial layer for the streaming economy.

-

-

Trend Alignment:

Aligns with the broader trend of making all forms of value more liquid and programmable. It's a specific, application-driven RWA play that goes beyond traditional assets. -

Risks:

High execution risk. It needs to achieve mass adoption with real-world businesses to generate significant cash flows and prove its model at scale. It faces competition from both traditional fintech payroll providers and other crypto payment solutions. -

Investment Outlook:

A more speculative, high-upside bet on a novel RWA category. Its success depends on its ability to onboard real-world businesses and demonstrate the value of streaming finance.

How to Build Your RWA Portfolio on Phemex

The RWA landscape is dynamic, but Phemex provides a curated and powerful gateway to participate in its growth.

-

Step 1: The Foundation - Acquire Core Infrastructure Tokens: Begin by gaining exposure to the protocols building the future. On the Phemex Spot Trading market, you can find key infrastructure tokens like ONDO, CFG, AVAX, and LINK.

-

Step 2: Gain Direct Asset Exposure with xStocks: Complement your protocol investments with direct exposure to tokenized real-world equities. This provides diversification and access to the performance of some of the world's most successful companies, available 24/7 on-chain.

-

Step 3: Explore Yield Opportunities: Keep an eye on Phemex Earn for potential staking and savings products for RWA tokens, allowing you to earn passive income on your long-term holdings.

Ready to build your portfolio for the new financial era? Start trading the top RWA coins on Phemex today.

Conclusion: RWA — The Bedrock of the Next Financial System

The RWA narrative has officially moved from theory to reality. It is a powerful, data-backed convergence of TradFi's stability with DeFi's transparency and efficiency. While the Robinhood CEO rightly notes that we are still in the early innings of adoption, the "era-defining train" of tokenization has already left the station.

This is not a short-term trend. Investing in the core infrastructure, the leading asset protocols, and the burgeoning L1 ecosystems of RWA is a long-term opportunity to be part of building the next generation of finance. The tokenization of the world's assets is just beginning.