Introduction: The Grown-Up in the Room

Forget the short-term dopamine hits of meme coins and the unsustainable yields of early DeFi protocols. The next multi-trillion-dollar crypto narrative is here, and it’s not loud or flashy. It's the sound of global finance’s foundational plumbing being ripped out and rebuilt on-chain. This is the era of Real-World Asset (RWA) tokenization.

For years, crypto promised to bank the unbanked and democratize finance. RWAs are where that promise finally gets real. We're talking about tangible, revenue-generating assets—U.S. Treasury bills, real estate, private credit—migrating onto public blockchains. Not for hype, but for ruthless efficiency. They offer stable yield, 24/7 liquidity, and a programmable layer that makes legacy systems look archaic.

This isn't a distant future. In the last 30 days alone, the on-chain RWA market swelled by over 5.6%, with more than 211,000 asset holders now participating. This is a quiet, powerful revolution happening right now. Pay attention, because it’s about to reshape both your crypto and traditional portfolios.

Disclaimer: This article is for informational purposes only and should not be construed as financial, investment, or legal advice. The crypto market, including RWA tokens, is highly volatile and carries significant risk. Always conduct your own research (DYOR) and consult with a qualified professional before making any investment decisions.

What Are RWAs? The Bedrock of the New Financial Internet

So, what exactly are these assets? Think of RWAs as the digital twins of valuable off-chain items, anchored by law and cash flow. Unlike native crypto assets like Bitcoin or Ether, which derive their value from the network itself, RWAs derive their value from legally enforceable claims on real-world cash flows.

Here’s a breakdown of the key categories:

| Asset Category | Examples | Core Value for Investors |

| Sovereign Debt | U.S. Treasury Bills (T-bills) | Stable, low-risk, on-chain yield. |

| Private Credit | SME Loans, Trade Finance | Higher yield than government debt, direct link to the real economy. |

| Commodities | Tokenized Gold, Carbon Credits | Inflation hedge, store of value, ESG investment opportunities. |

| Real Estate | Fractional Ownership of Buildings | Access to high-value property, potential for rental income. |

| Equities & Funds | Tokenized ETFs, VC Fund Shares | Liquid access to traditionally illiquid or gated markets. |

For traders and investors, this means one thing: access to reliable, and potentially non-crypto-correlated yield, directly on-chain. They are the essential bridge, bringing the stability and scale of Traditional Finance (TradFi) to the transparent, borderless world of Decentralized Finance (DeFi).

The On-Chain Assembly Line: How a Treasury Bill Becomes a Token

Bringing a real-world asset onto the blockchain isn't magic; it's a meticulously engineered chain of trust and technology. Here’s the five-step blueprint:

-

Legal Fortress (Origination & SPV): An asset is legally ring-fenced within a Special Purpose Vehicle (SPV). This bankruptcy-remote entity shields the asset and ensures token holders have a real, enforceable claim. This is the legal bedrock.

-

Verified Custody: A licensed custodian holds the physical asset or its legal documentation (e.g., the T-bills are held with a regulated bank). This provides verifiable proof that the asset exists and is secure.

-

Minting the Digital Twin (Tokenization): A smart contract mints tokens on a blockchain (like Ethereum or Aptos) that represent ownership or a claim on the asset's yield. Each token is a digital certificate of ownership.

-

The Oracle's Pulse (Data Feed): Oracles, predominantly Chainlink (LINK), securely feed crucial off-chain data—like interest rate changes or asset valuations—to the smart contract. This keeps the token’s value synchronized with its real-world counterpart.

-

Borderless Distribution: Investors can now mint, redeem, or trade these tokens 24/7 on DeFi protocols or through centralized platforms like Phemex, bypassing traditional gatekeepers and time zones.

Case Study: Ondo Finance (ONDO) & BlackRock (BUIDL) — The Titans of Tokenized Treasuries

Theory is good, but traction is better. Look no further than tokenized U.S. Treasuries, the undisputed "killer app" of the current RWA landscape.

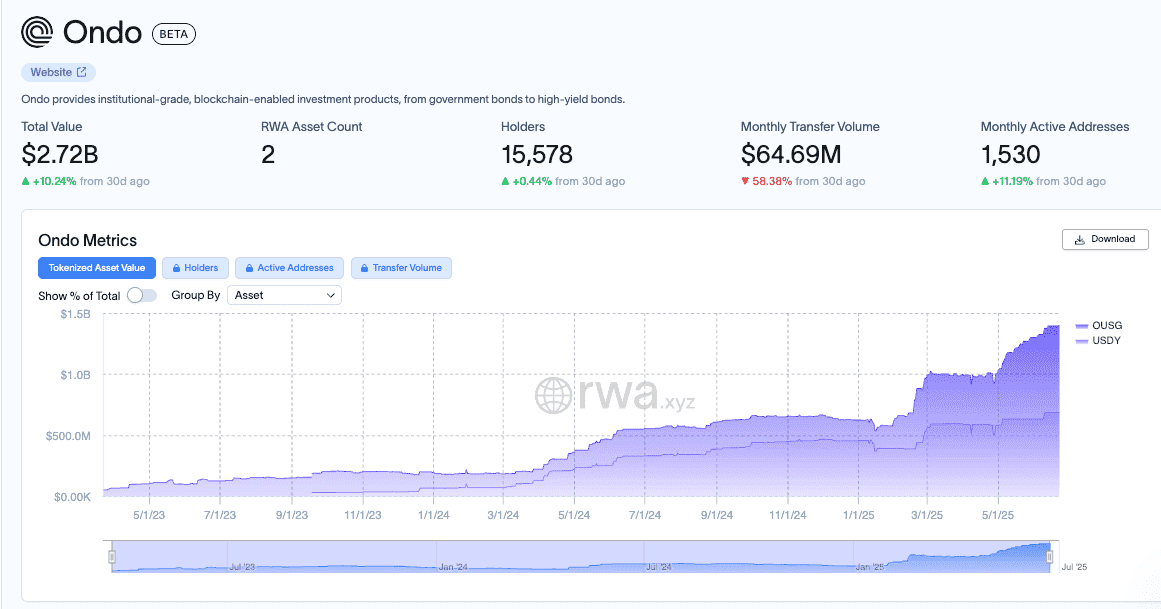

Ondo Finance (ONDO) has rapidly emerged as a DeFi powerhouse with its OUSG token, offering tokenized access to U.S. short-term government bonds.

-

The Product: A stable, yield-bearing token backed by real Treasuries held in regulated SPVs.

-

The Yield: A competitive ~4.1% APY, paid out directly on-chain.

-

The Scale: With a TVL of ~$2.72 billion and strategic integrations with platforms like Ripple and Mastercard, ONDO isn't just a project; it's becoming critical financial infrastructure. Its model proves you can successfully marry regulatory compliance with DeFi's composability.

Meanwhile, TradFi giant BlackRock sent shockwaves through the industry with its BUIDL fund, a tokenized U.S. government money market fund on Ethereum. In just a few months, it surpassed $1 billion in assets under management.

The takeaway is clear: When the world's largest asset manager and a leading DeFi native protocol are both racing to tokenize the same asset class, you're not witnessing a trend. You're witnessing a paradigm shift.

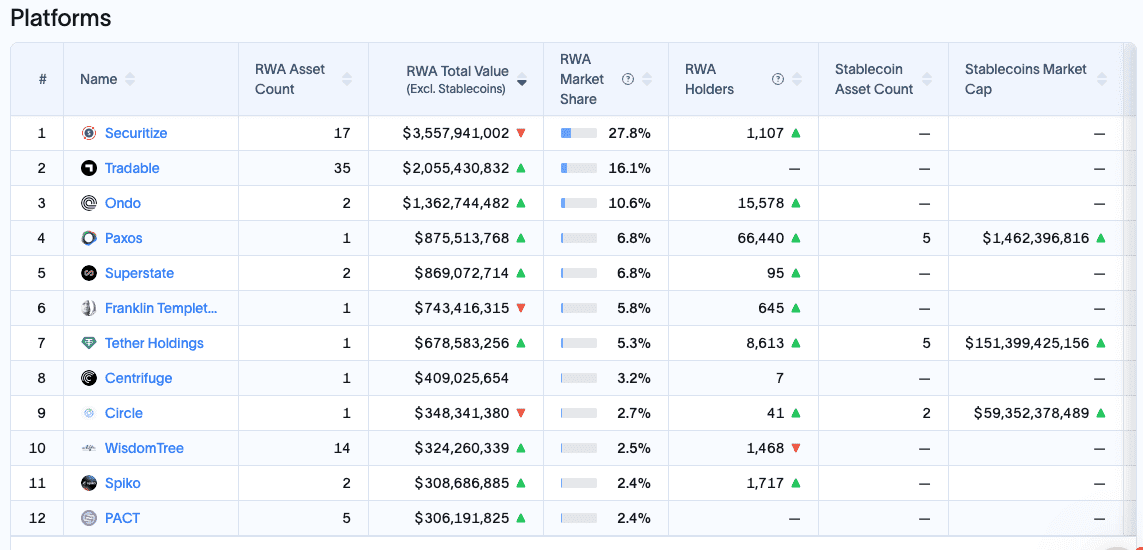

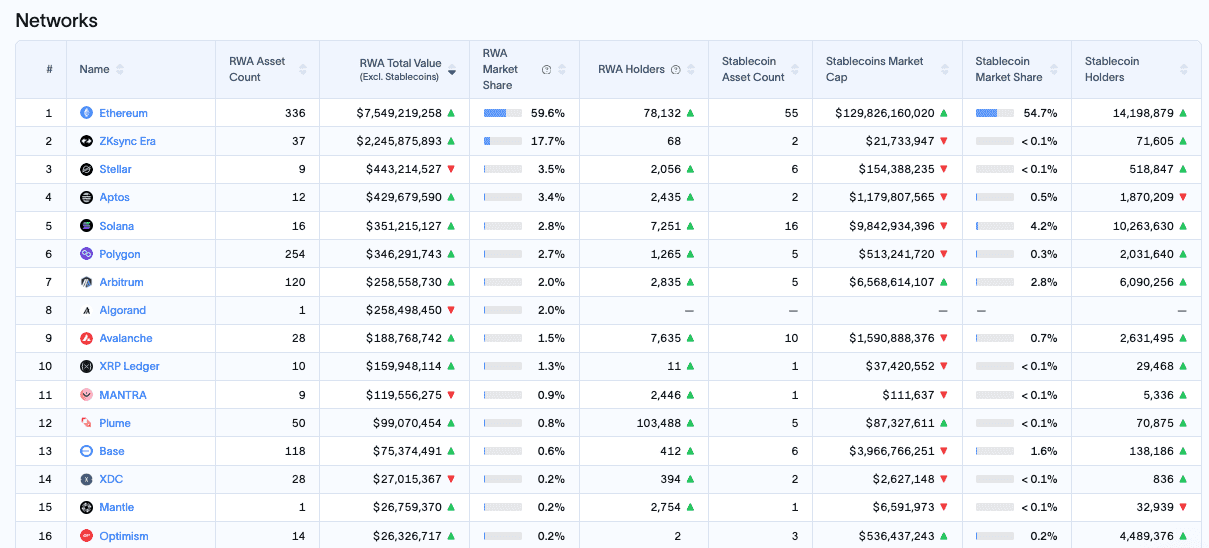

The Arena: Which Chains and Tokens Are Winning the RWA Race?

A multi-chain battle for RWA dominance is heating up. While Ethereum remains the heavyweight champion, scalability and low fees are paramount for future growth.

Battle of the Chains: Where RWAs Live(As of June25,2025)

| Chain | RWA Count | Total Value | 30D Growth | Market Share |

| Ethereum | 313 | $7.55B | ▲ 5.1% | 59.38% |

| ZKsync Era | 37 | $2.25B | ▲ 1.73% | 17.67% |

| Stellar | 9 | $442.8M | ▼ 8.57% | 3.48% |

| Aptos | 12 | $429.7M | ▲ 24.13% | 3.38% |

| Solana | 16 | $351.2M | ▲ 3.7% | 2.76% |

| Polygon | 488 | $346.3M | ▲ 3.0% | 2.72% |

Analysis: Ethereum is still the "Wall Street" of RWAs, but L2s like ZKsync Era and high-speed L1s like Aptos are gaining ground at a blistering pace. The future of RWA is multi-chain, and the race is on for the most secure, scalable, and compliant platform.

The RWA Token Economy: The Picks and Shovels

The $36.94 billion market cap of RWA-related tokens isn't just speculation; it's a bet on the future of finance. For traders on Phemex, these tokens are picks-and-shovels plays on this new financial system.

| Token | Market Cap | Use Case |

| LINK | $8.89B | The undisputed oracle backbone for secure RWA data pricing. |

| ONDO | $2.43B | A direct play on the largest RWA vertical—tokenized U.S. T-bills. |

| XLM | $7.73B | Infrastructure for tokenized payments and cross-border asset flows. |

| QNT | $1.43B | Enterprise-grade blockchain interoperability for regulated assets. |

| BUIDL | $2.89B | BlackRock's tokenized fund, a symbol of institutional validation. |

RWA Tokenization vs. Traditional Finance: A Side-by-Side Comparison

This isn't just about making finance faster or cheaper. It's about making it fundamentally better.

| Comparison Point | RWA Tokenization | Traditional Asset Management |

| Investment Access | Extremely low barrier, as little as $100. | Extremely high, often requiring private banking status. |

| Liquidity | Global 24/7 markets with near-instant trading. | Limited by exchange hours, with T+1 or T+2 settlement. |

| Transaction Costs | Significantly lower due to disintermediation. | Higher due to multiple layers of fees (brokers, custodians). |

| Ownership | Fractional, direct, and verifiable on-chain. | Indirect ownership via complex legal structures. |

| Transparency | Extremely high; all transactions on a public ledger. | Low, relies on opaque quarterly or annual reports. |

The Hurdles: Building Trust in a Trustless World

The path to a $30 trillion market is not without obstacles. The core challenge is a paradox: how do you create enforceable, real-world trust in a system designed to be trustless?

-

Regulatory Maze: The biggest bottleneck is navigating a patchwork of global laws. Frameworks like Europe's MiCA are a step forward, but uncertainty in the U.S. (from the SEC and CFPB) and elsewhere creates complexity for cross-border issuance.

-

Counterparty Risk: This is the elephant in the room. What happens if the off-chain custodian holding the assets fails? The legal "wrapping" of the asset within the SPV must be ironclad to protect token holders, a legal stress test that has yet to be fully proven at scale.

-

The Oracle Problem & Data Verifiability: The entire system's integrity hinges on oracles feeding accurate, tamper-proof data. This isn't just a technical challenge; it's a "garbage in, garbage out" problem with billion-dollar consequences.

-

Lack of Standardization: Without universal standards for token creation (beyond basic formats like ERC-20) and legal frameworks, true interoperability between different RWA platforms remains a significant challenge.

Your Playbook: How to Invest in the RWA Revolution

The opportunity set is expanding rapidly. Here’s how you can gain exposure, from conservative to aggressive strategies:

-

The Institutional Route (Low Risk): Buy into tokenized funds from giants like BlackRock (BUIDL) or Franklin Templeton. This is the most regulated and straightforward path for accredited investors.

-

The Direct Yield Play (Medium Risk): For eligible investors, purchase yield-bearing RWA tokens like Ondo's OUSG directly from their platform to earn stable, on-chain returns.

-

The Protocol Play (Medium-High Risk): Invest in the governance tokens of the protocols building the infrastructure, such as Centrifuge (CFG) or Goldfinch (GFI). Here, you're betting on the growth of the entire ecosystem and its ability to attract assets.

-

The Trading Play (Variable Risk): Actively trade key RWA-related tokens like ONDO, LINK, and XLM on platforms like Phemex. This allows you to capitalize on market volatility and narrative shifts as the sector evolves. When trading, monitor metrics like TVL growth, new institutional partnerships, and changes in token utility (e.g., staking rewards).

Conclusion: Tokenizing the World, One Asset at a Time

RWA tokenization is the single most important bridge being built between the $100 trillion traditional finance world and the innovative, transparent realm of blockchain. It's the long-awaited merger of TradFi’s scale with DeFi’s transparency, creating the blueprint for what could be called Finance 3.0.

Financial titans like Citibank and Boston Consulting Group are not throwing around numbers like 16-30 trillion by 2030 lightly. They see the inevitable convergence. We are witnessing a system that is more inclusive, automated, and anchored in reality being built before our eyes.

The quiet revolution has begun. The only question is whether you'll be a part of it.

Frequently Asked Questions (FAQ) about RWA Tokenization

1. Is RWA tokenization safe?

RWA tokenization carries unique risks, including counterparty risk from custodians, smart contract vulnerabilities, and regulatory uncertainty. While protocols build legal and technical safeguards, it is not risk-free. Always conduct thorough due diligence.

2. Can I invest in RWA tokens with a small amount of money?

Yes, one of the key benefits of RWA tokenization is fractional ownership, which significantly lowers the investment barrier. This allows retail investors to access asset classes like real estate or private credit with small amounts of capital.

3. What is the difference between an RWA token and a stablecoin?

A stablecoin (like USDT or USDC) is a token designed to maintain a stable value pegged to a currency, typically the US dollar. An RWA token represents ownership or yield from a specific, non-currency asset like a government bond, a loan, or a piece of property. While both are backed by off-chain assets, their purpose and value proposition are different.

4. Which blockchain is best for RWAs?

Currently, Ethereum is the leader in terms of total value locked. However, layer-2 solutions like ZKsync and high-throughput L1s like Aptos and Solana are gaining traction due to their lower fees and higher scalability, which are crucial for the mass adoption of RWAs. The future is likely to be multi-chain.

Disclaimer and Risk Warning

The information provided in this article is for general informational and educational purposes only. It is not intended as, and should not be understood or construed as, financial advice, investment recommendations, or a solicitation to buy or sell any assets.

High-Risk Investment: Trading and investing in digital assets, including Real-World Asset (RWA) tokens and related cryptocurrencies, are highly speculative activities and involve substantial risk of loss. The market is volatile, and prices can fluctuate dramatically in a short period. You should not invest more money than you can afford to lose.

Not Financial Advice: The content of this article does not constitute financial, investment, legal, or tax advice. Phemex is not a financial advisor. You should consult with a professional financial advisor, attorney, or tax professional to obtain advice with respect to your particular situation.

Accuracy of Information: While we strive to provide accurate and up-to-date information, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, or completeness of any information in this article. Market data, statistics, and projections are subject to change without notice.

Third-Party Links and Protocols: This article may contain links to third-party websites or content, including RWA protocols like Ondo Finance, Centrifuge, etc. Such links are provided for convenience only. Phemex does not endorse, approve, or control these third-party protocols and is not responsible for their content, security, or any loss or damage that may arise from your use of them. Interacting with smart contracts and DeFi protocols carries inherent risks, including but not to limited to smart contract bugs, exploits, and regulatory risks.

Do Your Own Research (DYOR): Past performance is not indicative of future results. Before making any investment decision, you should conduct your own independent research and due diligence, and consider your own investment objectives and risk tolerance.