RWA Market Overview – December 5, 2025

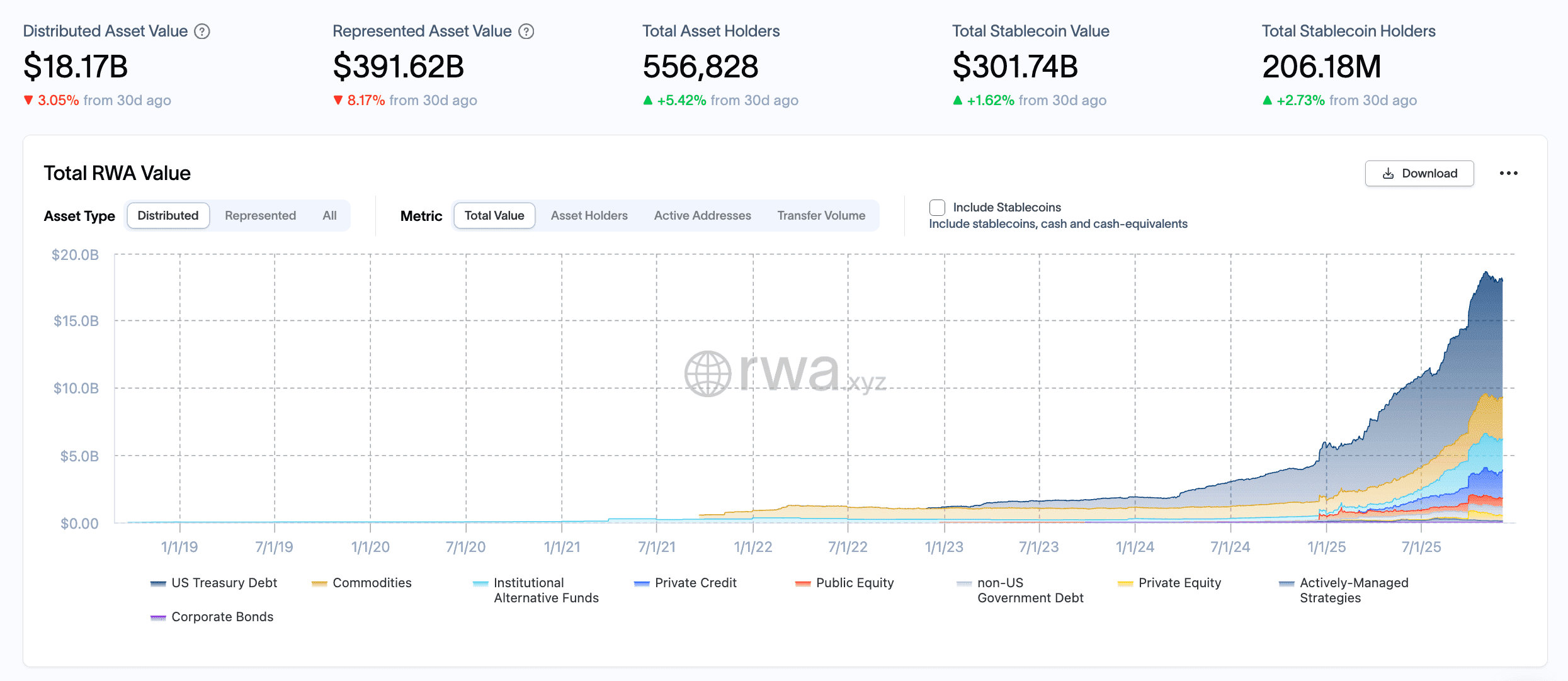

According to the latest RWA.xyz dashboard (December 5, 2025), the tokenized RWA market shows distributed asset value at $18.17 billion (down 3.05% over 30 days), represented asset value at $391.62 billion (down 8.17%), and total stablecoin value at $301.74 billion (up 1.62%). Stablecoin holders grew to 206.18 million (up 2.73%). The ecosystem includes 556,828 unique asset holders (up 5.42% in 30 days), with Ethereum dominating at 65.73% market share. This reflects 2025 picture combines short-term volatility in represented assets with continued stablecoin resilience and rising regulatory scrutiny.

Takeaway: The distributed value dip highlights short-term market pressure, but holder growth (+5.42%) and stablecoin expansion (+1.62%) signal sustained interest. For traders, this means focusing on stablecoin-linked RWAs for liquidity, while issuers should prioritize Ethereum for visibility. Overall, the market's resilience points to a consolidation phase before Q1 2026 rebound, with opportunities in tokenized treasuries for yield-seeking investors.

Top 5 Tokenized Real-World Assets – Live Ranking

The table below lists the top five tokenized assets by total value as of December 5, 2025, per RWA.xyz:

| Rank | Token | Issuer | Value | 7-Day | 30-Day | Asset Class |

|---|---|---|---|---|---|---|

| 1 | BUIDL | BlackRock / Securitize | $2.03B | –12.4% | –28.3% | U.S. Treasuries |

| 2 | XAUT | Tether | $1.64B | +1.1% | +4.9% | Tokenized Gold |

| 3 | syrupUSDC | Maple | $1.44B | +6.8% | +16.5% | Private Credit |

| 4 | PAXG | Paxos | $1.43B | +2.7% | +7.3% | Tokenized Gold |

| 5 | USYC | Circle | $1.20B | –0.1% | +20.9% | U.S. Treasuries |

Takeaway: U.S. Treasuries and commodities lead 2025 RWA trends, with syrupUSDC's 16.51% surge underscoring private credit's appeal for yield in volatile markets. Readers should note BUIDL's dominance as a safe-haven play, but XAUT and PAXG's gains suggest diversification into commodities for inflation hedging. For investors, this table highlights opportunities in high-growth private credit, where 30-day returns outpace treasuries.

Top 5 RWA Infrastructure Tokens

The following table presents the top five RWA protocol tokens by market cap, supporting tokenized asset platforms, as of December 5, 2025, sourced from market data platforms:

| Rank | Token | Price | Market Cap | 7-Day | Role |

|---|---|---|---|---|---|

| 1 | LINK | $14.41 | $10.05B | –3.97% | Oracle & data feeds |

| 2 | XLM | $0.2685 | $8.62B | –2.19% | Cross-border settlement |

| 3 | HBAR | $0.1615 | $6.86B | –3.60% | Enterprise infrastructure |

| 4 | AVAX | $15.94 | $6.84B | –4.63% | RWA smart-contract platform |

| 5 | ONDO | $0.6030 | $1.91B | –1.65% | Treasury & credit governance |

Takeaway: These tokens underpin 2025 RWA tokenization trends, with LINK's oracle role essential for real-world data integrity in tokenized treasuries. Despite 7-day dips, XLM and HBAR's stability makes them ideal for cross-border plays, while AVAX's hosting capabilities suit DeFi integrations. For readers, ONDO stands out for treasury governance, offering exposure to high-yield RWAs; consider allocating 10-20% of portfolios to these for ecosystem stability.

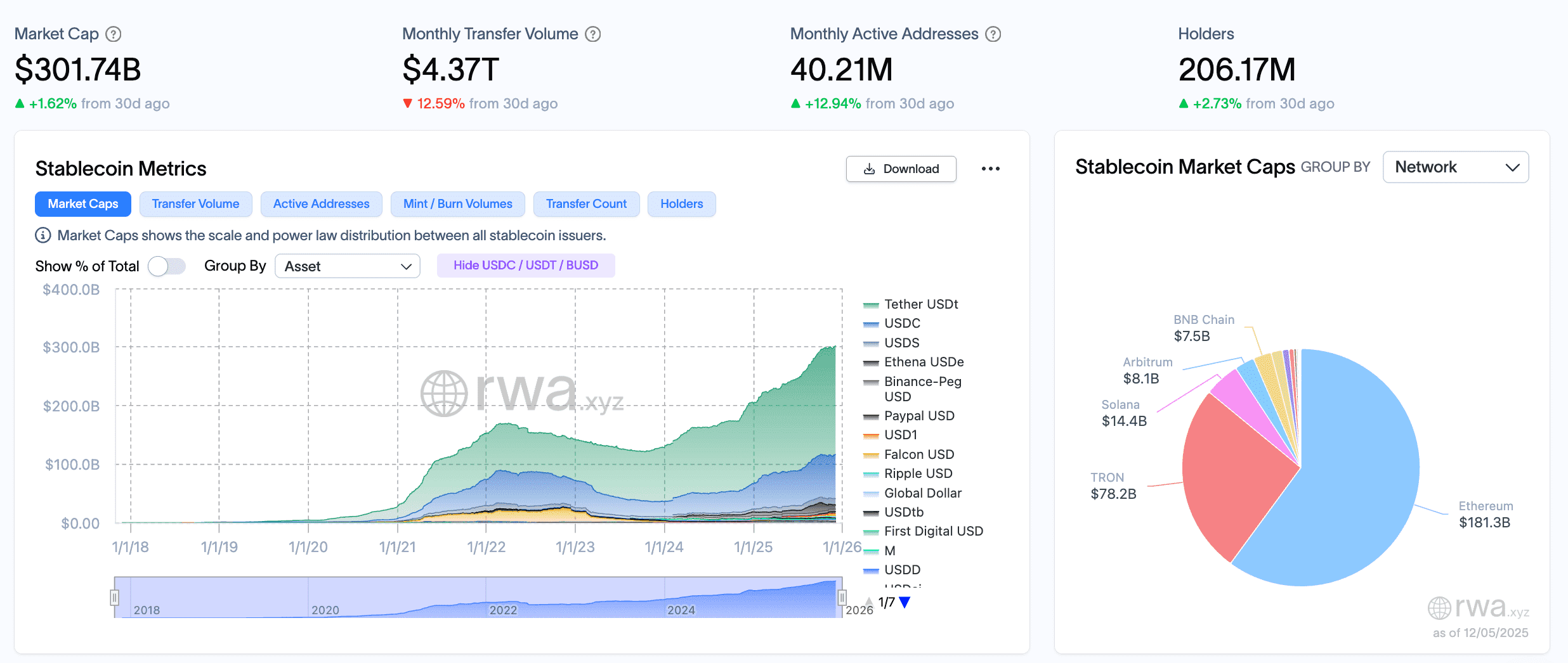

Stablecoin Trends

Stablecoins enhance RWA transactions with instant settlement and cross-border functionality. As of December 5, 2025, USDT leads with a $187.3 billion market value (up 0.58% weekly), followed by USDC at $76.8 billion (up 1.65%), per RWA.xyz. USDS rose 1.77% to $10.9 billion, while USDe fell 5.4% to $6.9 billion.

In 2025 RWA trends, stablecoins enable tokenized real estate and DeFi lending, with a 1.62% monthly value rise and 2.73% holder growth per RWA.xyz. Regulatory clarity, like IMF calls for unified oversight, integrates stablecoins deeper into blockchain real estate investments, boosting trust and yield. Tokenized risk pools using stablecoins also surged 10% this quarter, expanding insurance funding in DeFi for institutions.

Takeaway: Stablecoins' weekly gains (up 0.58% for USDT) contrast with RWA volatility, making them a safe entry point for tokenized assets. USDC's 1.65% rise reflects institutional preference for regulated options, ideal for U.S. Treasury plays. For readers, this trend suggests pairing stablecoins with high-growth RWAs like syrupUSDC for balanced portfolios—aim for 30-50% stablecoin allocation to mitigate risks while capturing yield.

This Week's Biggest RWA News (November 29–December 5, 2025)

Institutional Moves

- Kraken and Deutsche Börse Group Announce Strategic Partnership: Kraken partnered with Deutsche Börse to bridge traditional and digital markets, enabling tokenized asset trading for European institutions. This collaboration combines regulated infrastructure with crypto-native expertise, delivering frictionless institutional access across regulated crypto, tokenized markets, and derivatives. The partnership establishes a framework for geographical access, with Kraken offering U.S. capabilities to Deutsche Börse's clients and vice versa, while integrating with 360T for enhanced FX liquidity and enabling distribution of tokenized securities from Clearstream custody.

- MoneyGram Taps Fireblocks to Expand Stablecoin Use: MoneyGram integrated Fireblocks for stablecoin payments and treasury operations, enhancing cross-border RWA efficiency. Fireblocks provides secure stablecoin infrastructure and a programmable settlement layer, allowing MoneyGram to move value across multiple blockchains in real-time, reduce capital requirements through continuous funding, and streamline reconciliation. This supports low-cost, near-instant transactions across 200+ countries, serving 50 million customers annually and aligning with MoneyGram's strategy to unify fiat and stablecoin rails.

- Finternet Picks Capital Markets for First Rollout in 2026: Finternet selected capital markets for its initial 2026 launch, focusing on tokenized securities and funds. This move targets institutional-grade RWA infrastructure, enabling seamless tokenization of equities, bonds, and alternative assets.

Regulation & Policy

- IMF Economists Call for Unified Stablecoin Oversight: IMF urged global coordination on stablecoin risks, emphasizing regulatory frameworks to support RWA tokenization without arbitrage. The paper "Understanding Stablecoins" reviews approaches in the U.S., UK, Japan, and EU, highlighting fragmented rules that create inefficiencies and gaps. It warns of currency substitution in emerging markets and calls for harmonized reserve requirements and cross-border monitoring, with stablecoins holding more U.S. Treasuries than Saudi Arabia.

- UK Proposes Regulating Systemic Stablecoins: The UK advanced proposals for systemic stablecoin rules, aiming to integrate them into tokenized deposit systems. The Bank of England consultation sets prudential standards, reserve requirements, and redemption rights, with HM Treasury designating systemic issuers for joint BoE-FCA oversight.

Tech & Integrations

- BNY, iCapital, Nasdaq, S&P Invest in Digital Asset: BNY and partners invested in digital asset infrastructure, targeting tokenized funds and equities for institutional use. This $100M+ commitment focuses on compliant RWA platforms, enabling tokenized securities distribution.

- Hedera Enters Georgia's Land Registry Modernization: Hedera partnered with Georgia for blockchain-based land registry, advancing tokenized real estate transparency. The MoU with the Ministry of Justice explores migrating the National Agency of Public Registry database to Hedera, ensuring greater protection of property rights and enabling real estate tokenization.

- Deutsche Bank-Backed Taurus Integrates Staking Solutions: Taurus added staking to its platform, supporting tokenized assets with yield generation. This enhances RWA utility by combining custody with DeFi features for institutional users.

RWA Events Calendar – Next 7 Days

| Date | Event | Why It Matters |

|---|---|---|

| Dec 8 | IMF Stablecoin Oversight Forum | Expected to shape 2026 global stablecoin rules |

| Dec 10 | UAE Digital Asset & Stablecoin Summit | VARA to announce final 2026 RWA framework |

Summary

The RWA tokenization market has hit $18.17 billion distributed value, supported by 556,828 holders, reflecting steady growth amid volatility. IMF oversight calls, Kraken's partnership with Deutsche Börse, and Hedera's land registry integration underscore the sector's progress.

Trade trade top RWA tokens like LINK, XLM, HBAR on Phemex to engage with this evolving market.