In the world of cryptocurrency, two terms that often get mixed up are Bitcoin and blockchain. Beginners might hear them in the same breath and wonder if they mean the same thing. In reality, Bitcoin and blockchain are closely related but fundamentally different concepts. Bitcoin vs blockchain is not an either/or comparison of equals, but rather a comparison between a specific digital currency and the underlying blockchain technology that makes it possible. This article will clarify the difference, explain how blockchain works, explore blockchain use cases beyond Bitcoin, and discuss the investment perspective on both.

What Is Blockchain Technology?

At its core, a blockchain is a type of digital ledger – essentially a database that is distributed across multiple computers. The purpose of a blockchain is to record transactions or information in a secure, tamper-resistant way. Whenever a transaction occurs on a blockchain network, that transaction is grouped with others into a “block.” Each block is then added to a chain of previous blocks (hence the term block-chain), forming a continuous, chronological record of data. One of blockchain’s key innovations is that once information is added, it’s extremely difficult to alter, because changing a block would require changing all subsequent blocks on every copy of the ledger in the network.

Decentralization: Traditional ledgers (for example, a bank’s transaction record) are maintained by a central authority. In contrast, blockchains are typically decentralized, meaning no single entity is in charge. Instead, every participant in a blockchain network (often called a node) usually has a copy of the entire ledger and helps verify new entries. Transactions are validated through a consensus mechanism – common ones include Proof of Work (used by Bitcoin, requiring computational work by miners) and Proof of Stake (used by some newer blockchains, relying on validators who stake tokens). This decentralization makes blockchains very secure and censorship-resistant: there’s no single point of failure and no central authority that can falsify the records. If someone wanted to maliciously alter a blockchain’s records, they would have to control the majority of the network’s computing power or staked tokens, which in a large network is extraordinarily difficult.

Key Characteristics of Blockchains:

-

Distributed Ledger: Every node in the network keeps a copy of all transactions. This transparency allows anyone to audit the data.

-

Immutable Records: Through cryptographic linking of blocks, once data is recorded and confirmed on the blockchain, it cannot be changed or deleted unilaterally. This creates a high level of trust in the data’s integrity.

-

Use of Cryptography: Blockchains use cryptographic algorithms to secure transactions and control the creation of new units (in the case of cryptocurrencies). For example, digital signatures ensure that only someone with the correct private key can move the assets associated with a given address.

-

Pseudonymity or Anonymity: Public blockchain transactions are often tied to cryptographic addresses rather than real-world identities, providing a degree of privacy (although the transactions themselves are visible to all on the ledger).

In summary, blockchain technology is a novel way of recording information that emphasizes decentralization, security, and transparency. It was invented as the backbone of Bitcoin but has since been adapted for many other uses.

Different Types of Blockchains

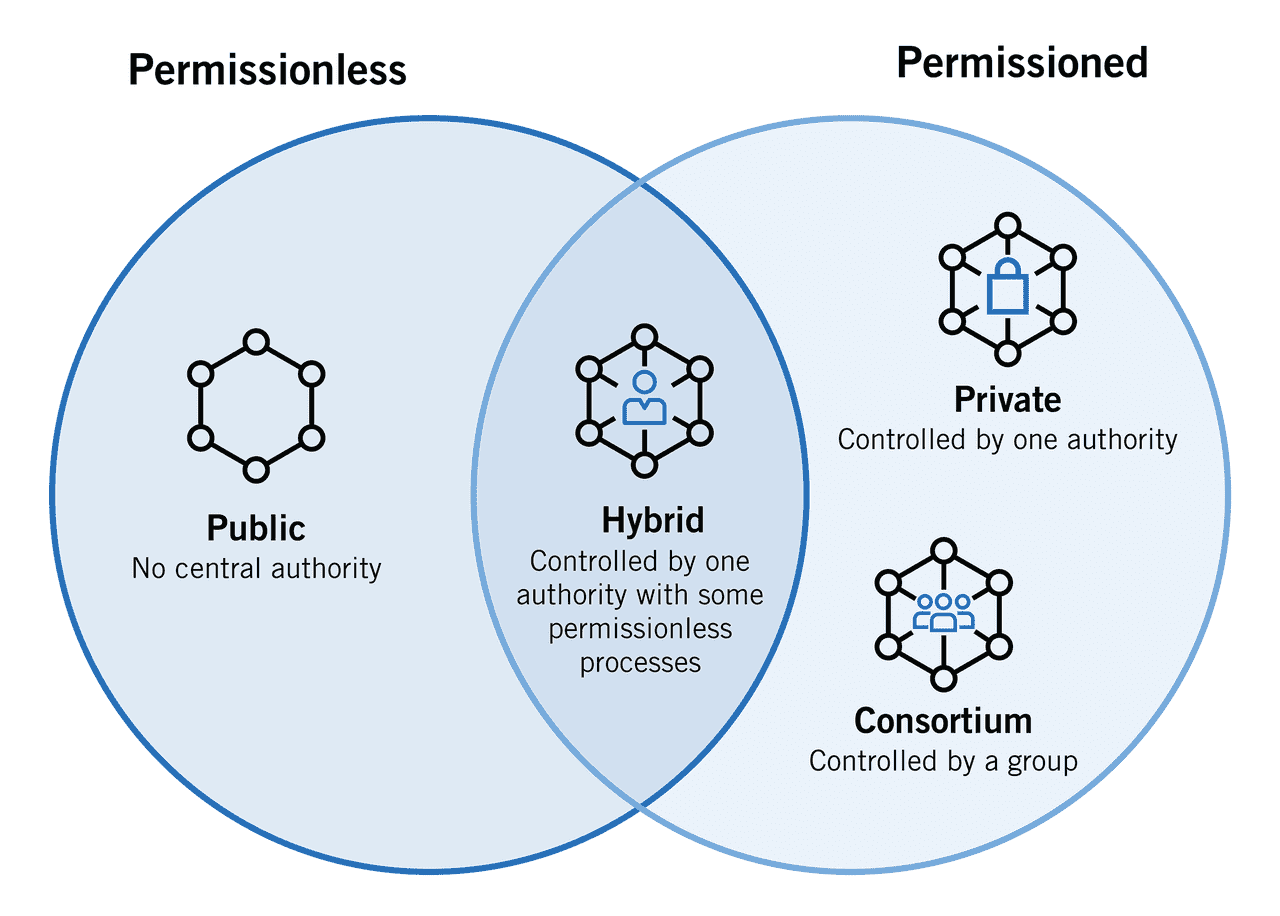

Not all blockchains are the same. There are different types of blockchains designed for various purposes:

-

Public Blockchains: These are open networks that anyone can access and participate in. Bitcoin itself runs on a public blockchain, as do other cryptocurrencies like Ethereum. In a public blockchain, transactions are visible to everyone, and the network is secured by a large decentralized group of participants (miners or validators). Public blockchains are generally permissionless, meaning no permission is needed to join and interact with the network. They rely on consensus mechanisms like Proof of Work or Proof of Stake to agree on the state of the ledger.

-

Private Blockchains: A private blockchain is a closed network, typically managed by a single organization or a specific group. In a private blockchain, the central entity decides who is allowed to access the ledger and serve as a node. These are often used internally by companies or consortia for record-keeping and don’t involve a cryptocurrency available to the public. Because they are centralized to some degree, private blockchains sacrifice some decentralization in exchange for more control and privacy. An example might be a company using a private blockchain for tracking supply chain inventory just among its trusted partners.

-

Consortium Blockchains: Also known as federated blockchains, these are somewhat in-between public and private. A consortium blockchain is operated by a group of institutions rather than a single entity. Only these select participants can run nodes and validate transactions. This setup is common in industries where multiple organizations need to share a common ledger (for instance, a group of banks each running nodes of a shared blockchain network for inter-bank settlements). Consortium blockchains aim to maintain some decentralization (no single entity controls the network) but are not open for anyone on the internet to join.

-

Permissioned Blockchains: The term “permissioned” can apply to private or consortium blockchains. It simply means that participants need permission to participate in certain activities on the network. For example, a permissioned blockchain might let anyone read the ledger but only authorized parties can create new transactions or validate blocks. Many enterprise blockchain solutions are permissioned, implementing strict access controls while still using blockchain protocols under the hood.

All these forms still use the fundamental blockchain structure of linked blocks of transactions, but the level of openness and decentralization differs. Blockchain technology isn’t limited to cryptocurrencies – it’s a versatile tool. Businesses and governments can implement blockchains in the way that best suits their needs, whether fully public or tightly controlled.

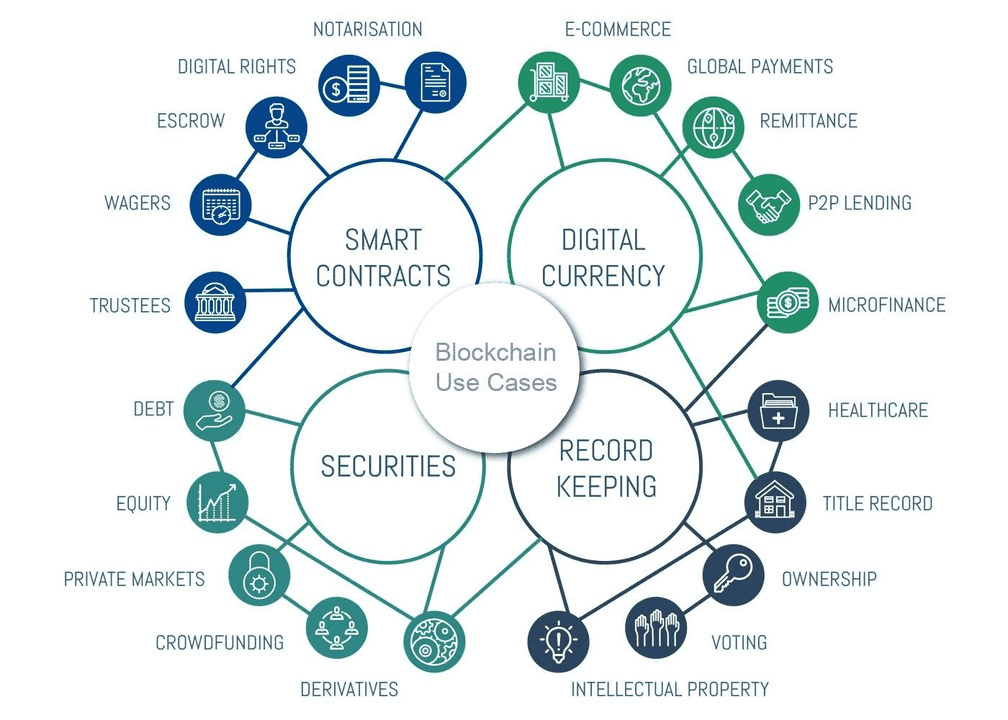

Blockchain Use Cases Beyond Bitcoin

Blockchain technology rose to prominence through Bitcoin, but its use cases now extend far beyond digital currency. Here are some prominent blockchain use cases across various industries:

-

Financial Services: Blockchain is transforming finance by enabling faster, cheaper cross-border payments and remittances without relying on intermediaries. It also underpins the growth of decentralized finance (DeFi) – a movement where financial applications like lending, borrowing, and trading occur on public blockchains (mostly on Ethereum and similar platforms) via smart contracts. Additionally, banks and stock exchanges are exploring blockchains for quicker trade settlement and clearance.

-

Supply Chain Management: Blockchains can improve supply chain transparency and efficiency. By recording the provenance and movement of goods on a shared ledger, companies can more easily track products from origin to store. For example, blockchain systems are used to verify the authenticity of luxury goods, track food safety (by tracing produce back to farms), and ensure that supply chain data is consistent for all parties.

-

Healthcare Records: In healthcare, blockchains can be used to securely manage patient records and consent. Because data on a blockchain cannot be easily altered, medical records stored or indexed via blockchain can prevent tampering and ensure that different providers see a consistent history (with patient permission). This can improve data sharing between hospitals while maintaining privacy and security.

-

Digital Identity and Security: Blockchain offers solutions for digital identity verification – allowing individuals to control their identity documents or credentials in a secure wallet, and then selectively share proof of their identity or qualifications without exposing all personal data. Additionally, blockchain-based systems can enhance cybersecurity by removing single points of failure and enabling tamper-evident logging of activities.

-

Smart Contracts and NFTs: Beyond currency, blockchains like Ethereum enable smart contracts – self-executing contracts with the terms written into code. These have countless applications, from automating insurance payouts to creating decentralized organizations. Blockchains have also given rise to non-fungible tokens (NFTs), which are unique digital assets representing ownership of items like digital art, music, or virtual real estate. NFTs use blockchain to prove a digital item is one-of-a-kind and owned by a specific person.

-

Governance and Voting: Some projects use blockchains for transparent and secure voting systems – both in the context of government elections and for shareholder or community governance votes. A blockchain-based voting system can theoretically allow voters to verify that their vote was counted while keeping identities private, and it becomes very difficult to alter or forge votes once recorded.

These examples are just a few of the many uses of blockchain. The technology essentially provides a way to increase trust in record-keeping and transactions in scenarios where multiple parties share data but might not fully trust each other. By the mid-2020s, global spending on blockchain solutions has skyrocketed – in 2020 it was around $4.5 billion, and by 2024 it’s forecasted to reach nearly $20 billion annually. Sectors like finance (banking, insurance) account for a large portion of this investment, but industries from agriculture to entertainment are exploring blockchain’s potential. In short, blockchain technology is being adopted well beyond Bitcoin, due to its promise of transparency, security, and efficiency.

What Is Bitcoin?

Now that we’ve explained blockchain, let’s define Bitcoin itself. Bitcoin is a digital currency – often called a cryptocurrency – that operates on a blockchain network. In fact, Bitcoin was the first successful application of blockchain technology. Proposed in 2008 and launched in 2009, Bitcoin was designed to be a form of electronic cash that is:

-

Decentralized: No government, company, or central bank controls Bitcoin. It runs on a network of computers (nodes) around the world. This is unlike traditional currencies, which are issued by central banks.

-

Peer-to-Peer: Bitcoin enables online payments to be sent directly from one person to another without going through a financial intermediary (like a bank or payment processor). This is made possible by its blockchain recording all transactions and the network verifying them.

-

Secure and Limited in Supply: Bitcoin transactions are secured by cryptography and the Proof-of-Work mining process. New bitcoins are minted as a reward to miners for validating blocks of transactions, but the rate of issuance is fixed and decreases over time (due to the halving events mentioned earlier). There will never be more than 21 million bitcoins in existence, which contrasts with regular fiat money that can be printed in unlimited quantities.

-

Pseudonymous: Users transact with Bitcoin using addresses (random strings of characters) rather than names, which provides privacy. However, all transactions are visible on the public blockchain, so Bitcoin is not completely anonymous – it’s pseudonymous.

Bitcoin’s blockchain is the original blockchain that started it all. Every Bitcoin transaction since January 2009 is recorded on that public ledger. People can acquire bitcoin by buying it on exchanges, accepting it as payment, or mining it. Bitcoin is often seen as both a currency and, increasingly, as a store of value (some call it “digital gold”). While you can use bitcoin to buy goods and services at many merchants now, its price has also made it popular as an investment or an asset to hold, expecting it might increase in value over time.

It’s important to note that Bitcoin uses blockchain technology, but not all blockchains have or need a Bitcoin. Blockchain is the infrastructure; Bitcoin is one very influential application of that infrastructure. Over time, Bitcoin has inspired thousands of other cryptocurrencies (often called “altcoins”) and blockchain projects, but Bitcoin remains the largest crypto asset by market capitalization and a household name synonymous with the crypto movement.

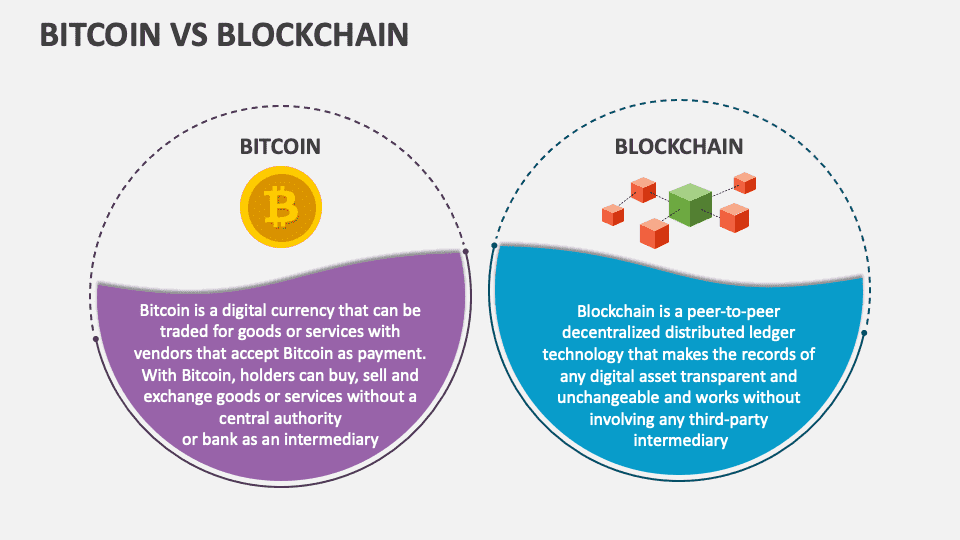

Bitcoin vs. Blockchain: Key Differences

To recap, here are the fundamental differences between Bitcoin and blockchain:

-

Nature: Bitcoin is a digital currency, whereas blockchain is a technology. Bitcoin (the currency) runs on the Bitcoin blockchain (the technology). Blockchain is the system that can power cryptocurrencies, but it can also be used in many other contexts that have nothing to do with digital money.

-

Purpose: Bitcoin’s purpose is to enable peer-to-peer financial transactions – it’s essentially an alternative form of money. Blockchain, on the other hand, is a method of record-keeping and can be purposed for countless applications: tracking transactions, storing data, executing smart contracts, and more. You can think of blockchain as a platform and Bitcoin as one specific product built on that platform.

-

Scope: There is only one Bitcoin (with a capital “B” referring to the network/protocol and lowercase “bitcoin” for the currency units), but there are many different blockchains. Bitcoin uses a specific blockchain protocol. Meanwhile, blockchain technology in general encompasses a wide variety of networks – from public ones like Ethereum or Solana, to private corporate ledgers. In short, Bitcoin has a narrower scope (digital money and its direct ecosystem), while blockchain’s scope is broad (any domain that can benefit from a decentralized ledger).

-

Control and Structure: The Bitcoin network is open to anyone and is maintained by a decentralized community. Its rules (consensus rules) are hard to change and only evolve slowly over time via community agreement. In contrast, if a company sets up its own blockchain for internal use, that blockchain might be centrally controlled and its rules can be changed by that company as needed. Thus, talking about “blockchain” can mean very different things depending on context – it could be as decentralized as the Bitcoin network, or it could be a private database using blockchain tech but run by a single entity.

-

Tangible Asset vs. Technology Layer: When people invest in Bitcoin, they are buying a digital asset that has market value and can be traded. When people talk about investing in “blockchain,” they are usually referring to investing in companies building blockchain solutions or buying tokens of projects that utilize blockchain technology. One can directly own and use Bitcoin; in contrast, one doesn’t “own” a blockchain, one utilizes or builds on it.

Understanding these distinctions helps clear up why “Bitcoin vs Blockchain” isn’t an apples-to-apples comparison. Bitcoin depends on blockchain technology to function, but blockchain’s usefulness goes far beyond just Bitcoin.

Bitcoin vs. Blockchain (source)

Should You Invest in Blockchain Technology?

With blockchain being a popular topic, many wonder how to invest in it as a concept. While you can't buy shares of "blockchain" itself, you can invest indirectly in its growth. Here are some ways:

-

Cryptocurrencies and Tokens: Investing in cryptocurrencies like Ether or Solana indirectly supports the success of their respective blockchain networks. As adoption grows, the value of these tokens may increase.

-

Blockchain Companies: Consider buying stocks in companies heavily involved in blockchain development, including both established tech firms and startups focused on blockchain solutions.

-

Blockchain ETFs or Funds: Exchange-traded funds (ETFs) and mutual funds focusing on blockchain-related companies can provide diversified exposure to the sector.

-

Enterprise and Government Adoption: Increased adoption of blockchain by enterprises and governments (like the exploration of central bank digital currencies) indicates the technology's potential, which could benefit related service providers and infrastructure.

Investing in blockchain is about backing the applications and entities utilizing it. While many corporations are exploring blockchain solutions, it's crucial to assess the actual value being added and conduct due diligence, as not all blockchain implementations are a sound investment.

Should You Invest in Bitcoin?

Bitcoin offers a potential investment opportunity, but whether to invest depends on individual financial goals and risk tolerance. Here are key points:

-

Bitcoin’s Track Record: Bitcoin has been a top-performing asset over the past decade, rising from near $0 to around $69,000 by late 2021. However, it has faced significant volatility, including a drop of over 70% in 2022.

-

Digital Gold Narrative: Many view Bitcoin as “digital gold,” a store of value that can protect against inflation. Its capped supply of 21 million coins and decentralized nature appeal to investors wary of government control, bolstered by institutional adoption.

-

Adoption and Use Cases: Bitcoin has real-world applications such as cross-border transfers and online purchases. With growing infrastructure—like mobile wallets and Bitcoin ATMs—its ecosystem suggests it’s more than a fad.

-

Volatility and Risks: Bitcoin’s price is highly volatile, influenced by market sentiment and regulatory news. It is recommended to invest only what you can afford to lose, and be aware of competition from other cryptocurrencies and emerging technologies.

-

Long-Term Outlook: Bitcoin’s value may hinge on continued adoption and its role in finance. While it has shown resilience over 15 years, its future remains unpredictable. Those considering Bitcoin should approach it as a high-risk, high-reward asset and educate themselves thoroughly on secure storage and investment strategies.

In summary, investing in Bitcoin can be rewarding but requires a long-term perspective and the stomach for volatility. If one decides to invest in Bitcoin, it’s wise to educate oneself thoroughly and to approach it as a potentially high-growth but high-risk portion of an overall investment strategy.