Intro: Volatility Is the New Normal

Let’s be honest—crypto isn’t what it used to be. Gone are the days when you could 20x long a memecoin and brag about it in a Telegram group. Today, with Bitcoin flirting with $107K and regulatory spotlights everywhere, survival means thinking smarter—not louder.

If you're tired of riding the emotional rollercoaster of price charts and want a strategy that actually works while you sleep, stablecoins might be the tool you’ve been ignoring.

They’re not just a safety net anymore—they're a core building block for steady, strategic gains.

What Are Stablecoins and Why They Matter in 2025

Stablecoins are crypto’s version of chill mode. Pegged to fiat currencies (usually USD), they offer a calm harbor in a sea of volatility. In 2025, their role has shifted from “just a bridge token” to “core portfolio layer.”

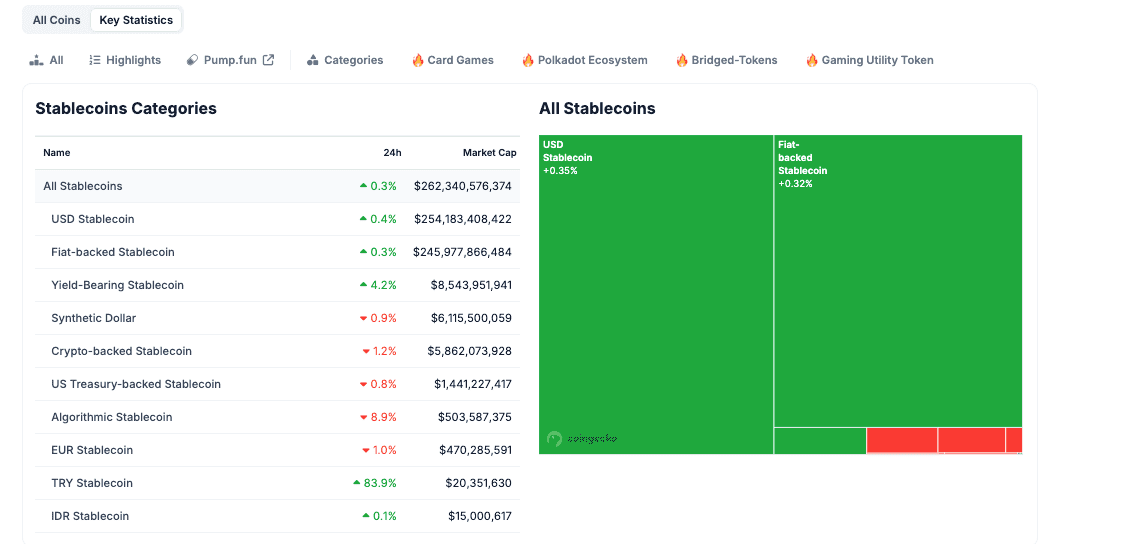

Total market cap: $262.3B as of June 2025. Still growing, still evolving.

They come in flavors now:

-

Fiat-backed (e.g., USDT, USDC)

-

Yield-bearing (e.g., SUSDS)

-

Synthetic (e.g., USD1)

-

Crypto-collateralized (e.g., DAI)

-

Real-world backed (e.g., USDTB via U.S. Treasuries)

Think of stablecoins as programmable dollars—but smarter. And when used right, they pay you for holding them.

What’s Driving Stablecoin Momentum (2024–2025)

There’s a reason you keep hearing “USDC is up,” “Circle IPO,” or “MiCA this, MiCA that.” Stablecoins are having their moment—and not just in the crypto bubble.

-

Circle IPO’d in Q1 2025, bringing real transparency to USDC. Wall Street now watches Circle like it’s the next PayPal.

-

MiCA regulation is live in the EU, and it’s forcing stablecoin projects to act like grown-ups. Reserve transparency, redemption rules—finally, accountability.

-

U.S. lawmakers are catching up. A new draft bill is floating in Congress, and while it hasn’t passed, it’s a clear sign: fiat-backed coins are under serious scrutiny.

-

Meanwhile, Treasury-backed and yield-bearing stablecoins are booming—giving investors new ways to combine yield with security.

The big picture? Stablecoins are no longer just for parking your funds. They’re regulated, transparent, and ready for the institutional stage.

Stablecoin Use Cases by Investor Type

Stablecoins aren’t one-size-fits-all. Here’s how different investors are putting them to work in 2025:

New to Crypto?

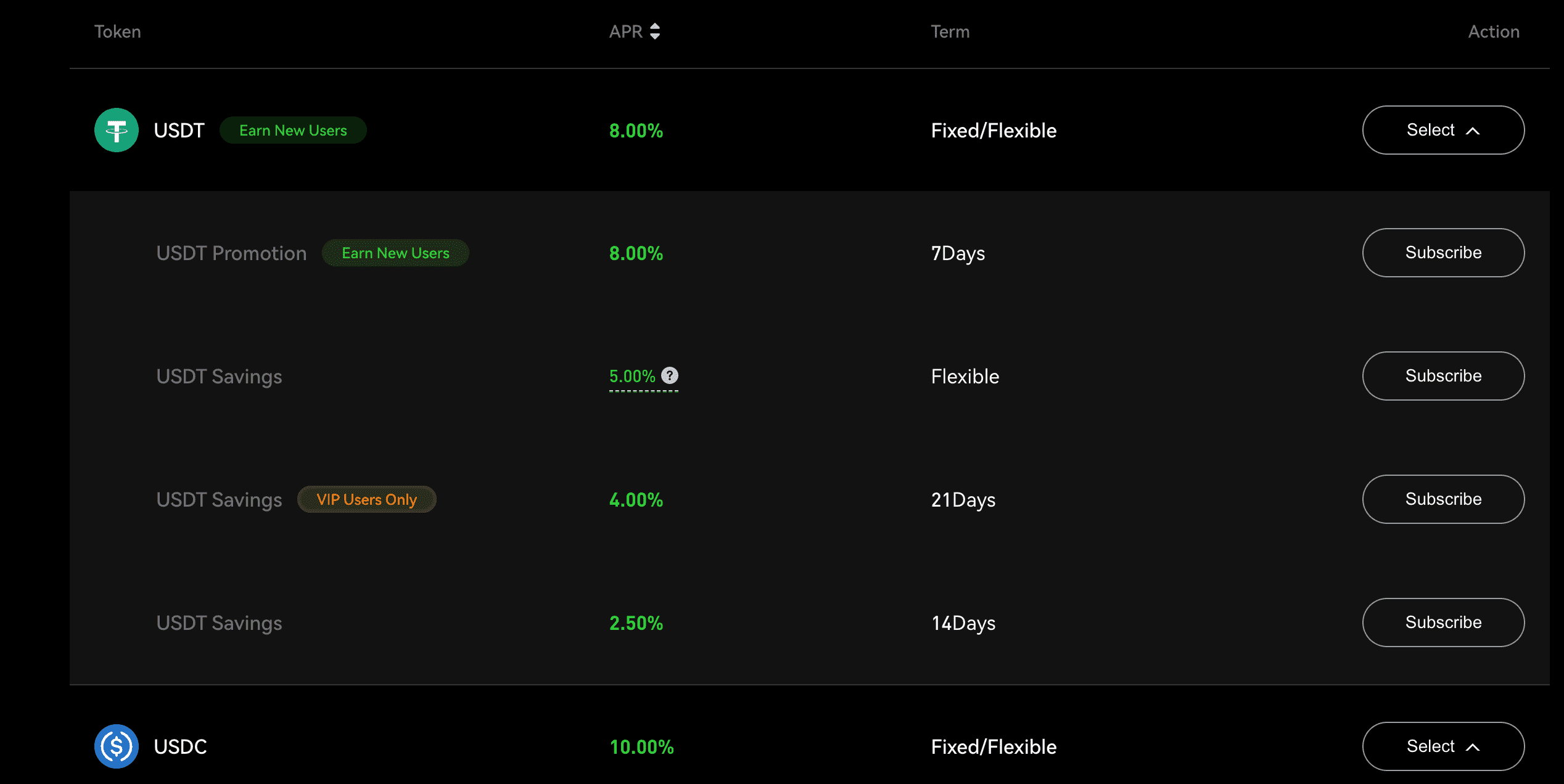

You want simplicity, safety, and returns without reading 30 DeFi docs. Phemex’s Flexible Savings lets you earn 8% on USDT and 10% on USDC—no lock-up, no stress. It's plug-and-play yield for your stablecoins.

Active Trader?

You’re in and out of the market, scalping, managing risk. Stablecoins are your dry powder. You use them as margin, fund TWAP/Grid bots, or stack yield while sidelined. Pendle lets you lock in rates, Curve adds extra juice, and you’re always a click away from re-entering the market.

Institution or DAO Treasury?

Capital preservation is priority 1. You want audited reserves, regulatory compliance, and risk modeling. That means USDC, PYUSD, and platforms like Ondo or Maple. Some even split reserves between Phemex and tokenized T-Bills. You’re running a crypto-native balance sheet, not a degen playbook.

Bottom line: Your strategy should match your risk profile—not your Twitter feed.

Why Stablecoins Beat Sitting on the Sidelines

Crypto isn’t about being all-in or all-out. Stablecoins offer a powerful middle ground—capital that earns yield while you wait for better entries.

They’re not just a “safe place” to sit. They’re a yield engine.

Lending & Borrowing

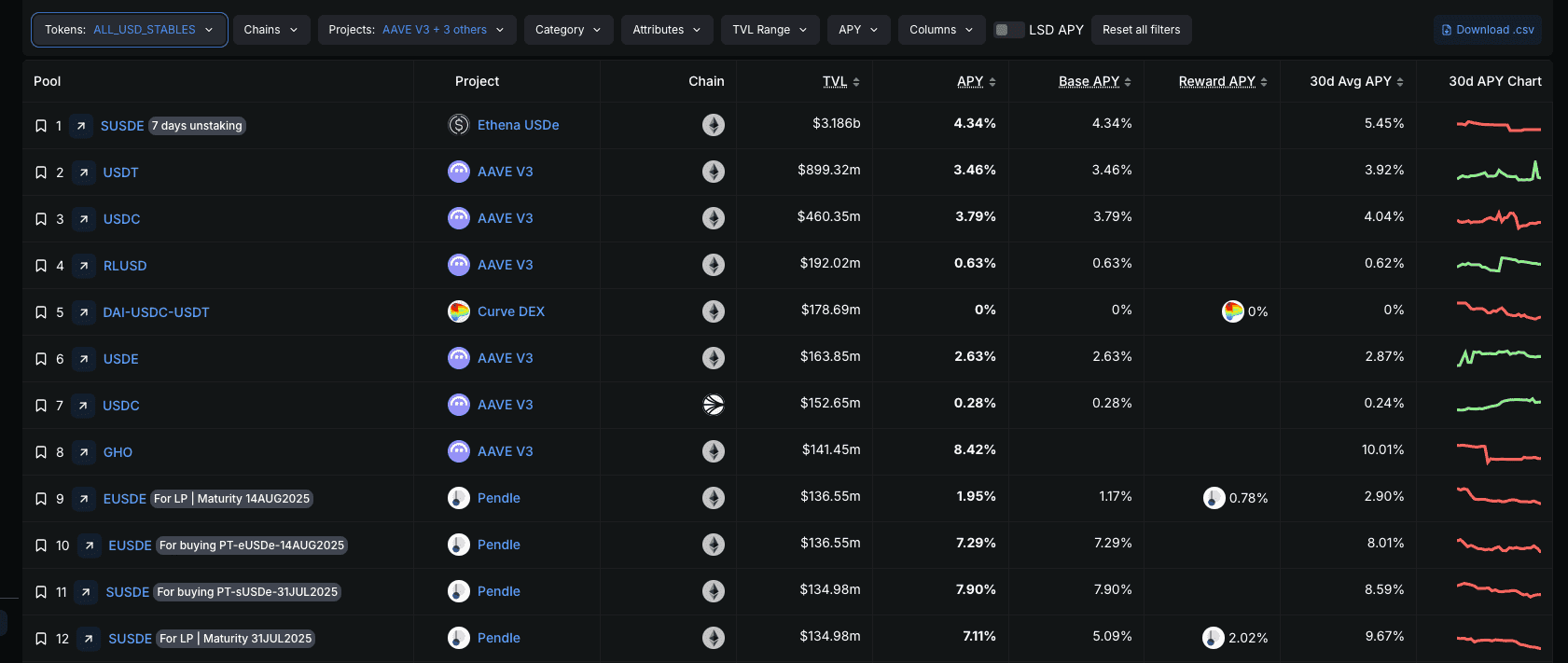

Stablecoin lending is the most time-tested form of passive income in crypto. CeFi platforms like Phemex offer flexible, no-lock-up savings with up to 10% APR. On-chain, protocols like Aave, Morpho Blue, and Sky Protocol (formerly MakerDAO) provide variable or fixed returns, often ranging from 3% to 12%.

Rates spike during bull markets due to borrower demand. Flexible rates move with market activity, while fixed lending like Pendle locks in high APRs—perfect for those managing long-term stablecoin portfolios. You’ll also find innovative lending tools: rate-tranched lending (Element, Notional), leveraged lending products, or even institutional-backed platforms like Maple’s Syrup pools.

Want high, simple yield? Euler now offers 17.8% APY on USDC lending—no fancy LP-ing required.

Yield Farming

DEXs like Curve and Uniswap offer LP incentives for stablecoin pools, but yields are usually low (1–2%) and may not offset gas fees unless you deploy large capital. Newer chains like Solana are seeing higher returns thanks to incentive programs—e.g., SyrupUSDC on Exponent offers 18.05% APY, capped at $2M liquidity.

Market-Neutral Strategies

Not all returns need exposure to price direction. Funding rate arbitrage (e.g., via Ethena) and cash-and-carry strategies lock in delta-neutral profits. You mint USDe with stETH, short the same amount on CEX, and earn passive funding premiums. Retail-friendly. Transparent. Often over 10% APR.

RWA-Powered Stablecoins

Stablecoins backed by U.S. Treasury bills like Ondo’s USDY and Usual’s USD0++ earn ~4–6% APR from real-world yield, bringing TradFi security to DeFi access. Some protocols add DeFi yield layers on top—like liquidity mining or governance rewards—but base yield still competes with trad banks.

Structured Products

Options-based vaults like Sell Put strategies let you earn premium income on USDT while setting lower entry targets for BTC or ETH. These are especially effective in ranging markets, but come with risk in trending or collapsing markets.

Phemex Flexible Savings: Passive Income, Simplified

Here’s what you get on Phemex right now:

Highlights:

-

No lock-up = Full liquidity

-

Insured reserves = Real peace of mind

-

Free transfers = Seamless trading/savings integration

Pro tip: Park your trading capital here between setups. Earn while you strategize.

Want Higher Yields? DeFi’s Got You

If you're comfortable with smart contracts and MetaMask, DeFi opens the door to higher APRs.

-

Aave: 4–6% yield on USDC/DAI with deep liquidity

-

Curve Finance: Stablecoin pools with 6–8% yield, boosted with CRV voting

-

Pendle: Lock in fixed yields (up to 12%) till year-end

-

Ondo/Maple: Real-world asset backing, 5–6% yield with regulatory oversight

Heads up: higher returns come with trade-offs—smart contract risk, depeg events, and longer lockups.

Beyond the blue chips like Aave and Curve, several emerging stablecoin strategies are worth watching closely in mid-2025. These aren’t just speculative longshots—they’re already live and generating impressive yields:

Falcon Assets Go Live on Euler: 17.84% APY for USDC Lenders

Euler Finance recently expanded support to a suite of Falcon Finance assets, including USDf, sUSDf, and PT-sUSDf. These assets typically carry higher base yields than market norms, and with Euler’s lending vaults now open, savvy users can deploy looping strategies to amplify returns.

For advanced users familiar with Principal Token (PT) looping, this unlocks high-leverage plays on yield-bearing stablecoins.

For passive participants? Simply deposit USDC into the vault and enjoy a juicy 17.84% APY—thanks to incentive programs now live on Euler.

SyrupUSDC Expands to Solana: Earn 18.05% APY on Exponent

SyrupUSDC, the yield-bearing stablecoin issued by institutional lending protocol Maple Finance, officially launched on Solana this month. While Syrup’s Pendle pools on Ethereum are already attractive, its arrival on Exponent—the Solana-native equivalent of Pendle—has unlocked even more alpha.

Current APY: 18.05%, boosted by Maple’s targeted incentives.

Note: The pool has a hard cap of $2 million, so early participation is key.

Unitas Mining Goes Live: 12.85% APY from USDu Staking

On June 10, Unitas, a new stablecoin project spun off from Unipay, launched its staking-based mining campaign. The protocol allows users to mint USDu, then stake it to earn yield from arbitrage-style mechanisms similar to Ethena.

-

Current Real-Time APY: 12.85%

-

Unstaking Period: 7 days

-

Best for: Small-cap early adopters looking to speculate on a high-potential stablecoin model

mirage protocol Launches on Movement: $500K Mint Window Now Open

mirage protocol, a Movement-native stablecoin backed by early funding from Robot Ventures, Selini Capital, and former Aptos co-founder Mo Shaikh, has launched Phase 1 of its mainnet.

-

Up to $500,000 in mUSD minting is now available

-

Still early stage: UI is minimal, no live APY metrics shown

-

Recommendation: Only for users looking to claim early positioning, not yet suitable for conservative yield seekers

These opportunities highlight just how diverse and creative stablecoin yield mechanisms have become in 2025—from composable DeFi loops to institutional-grade Solana pools.

Whether you’re chasing 18% APYs or testing new minting models, always balance innovation with caution—and start with small amounts while evaluating risk.

Risk? Always There — But Not Always Obvious

Let’s be clear: stablecoins may be steady, but the risks haven’t magically disappeared in 2025. They’ve just evolved—and if you’re paying attention, you can stay several steps ahead.

Silent Slippage: Not all pegs break with a bang. Some stablecoins gradually drift off parity due to weak backing or low liquidity. Don’t just trust the 1:1 claim—monitor price feeds and redemption mechanisms.

Custodial Overconfidence: “Insured” doesn’t mean “immune.” Even top CeFi platforms can face insolvency or withdrawal freezes under pressure. Stick to platforms with live proof-of-reserves (like Merkle trees) and transparent risk policies.

Smart Contract Fatigue: Audits are essential, but not infallible. Protocols that once looked bulletproof may accumulate complexity and risk over time. Reassess regularly—what was safe a year ago might now be ticking.

Yield Traps: Not all double-digit APYs are real income—some are just unsustainable token emissions. If the reward token has no utility or demand, your yield is melting ice.

Exit Illusions: Got into a DeFi vault with 90-day lockup? If market sentiment turns, your funds might be the last to leave. Always model your liquidity options before entering.

Pro Move: Build a layered strategy—CeFi for flexibility, DeFi for enhanced returns, and diversified stablecoins (USDC, USDT, PYUSD, DAI) to hedge systemic risks.

Risk isn't the enemy—complacency is. Trade like you’ve seen this movie before.

Final Take: Stablecoins Aren’t Boring—They’re Bulletproof

You don’t need to ape into the next altcoin meta to grow your capital. Sometimes, the most powerful strategy is staying solvent, stacking passive income, and being ready to strike when the market hands you a discount.

In 2025, stablecoins give you that edge. They let you hedge chaos, earn while idle, and protect your time and peace of mind.

Start smart. Stay steady. Stack yield.

This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including possible loss of capital. Always do your own research (DYOR) and consult a licensed advisor before making any investment decisions. Platforms and yields mentioned are subject to change and are not guaranteed by Phemex.