The cryptocurrency market thrives on innovation, volatility, and bold promises. Among the rising stars is Ethena, a synthetic dollar protocol capturing attention in the decentralized finance (DeFi) space. Its native token, ENA, has sparked debates among traders and analysts: Can it redefine stablecoin utility, or will it falter under market pressures? This in-depth analysis explores Ethena’s price trajectory, growth potential, and risks for 2025–2030, blending technical insights, market sentiment, and fundamental drivers. Whether you’re a seasoned trader or a curious newcomer, this article unpacks why ENA matters and what its future might hold.

Summary Box (Fast Facts)

- Ticker Symbol: ENA

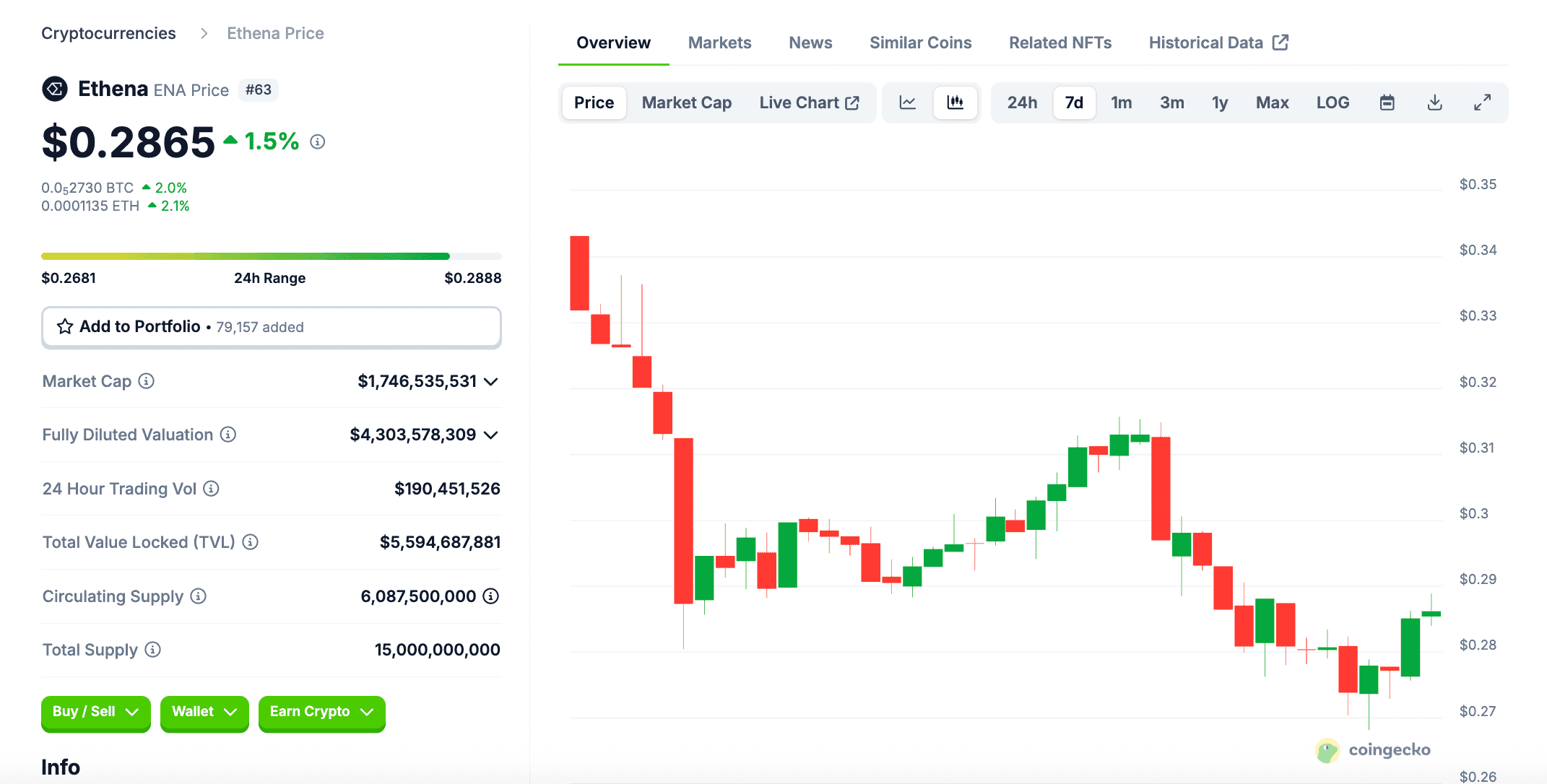

- Current Price: $0.2872 (as of June 19, 2025)

- Chain: Ethereum

- Contract Address: 0x57e114b691db790c35207b2e685d4a43181e6061

- Market Cap: $1.74B

- Circulating/Max Supply: 6.08B / 15B

- ATH / ATL Price: $1.52 (April 11, 2024) / $0.1953 (September 2024)

- All-Time ROI: -51.05% (year-over-year as of June 17, 2025)

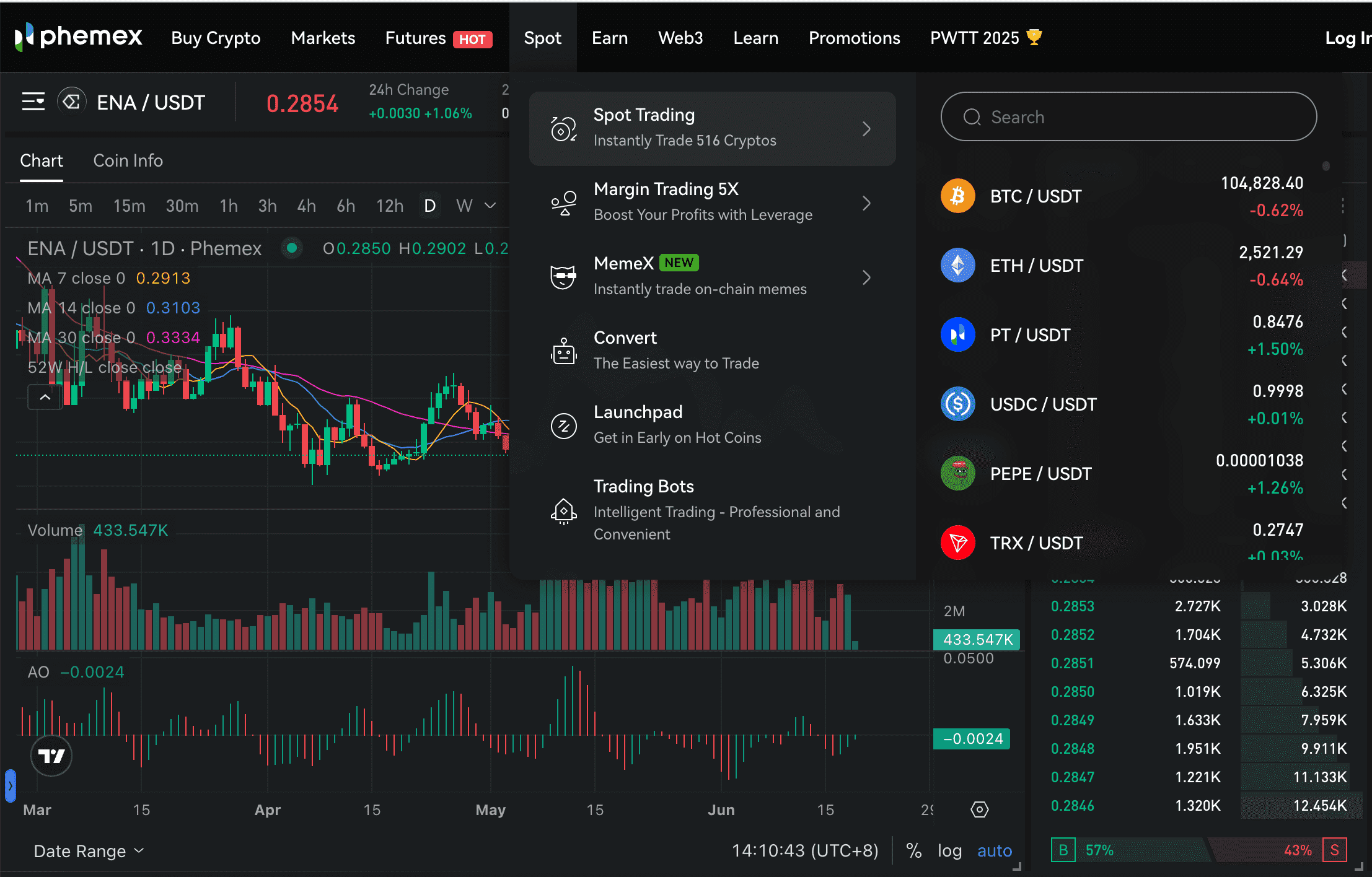

- Availability on Phemex: Yes (Spot, Futures)

What Is Ethena?

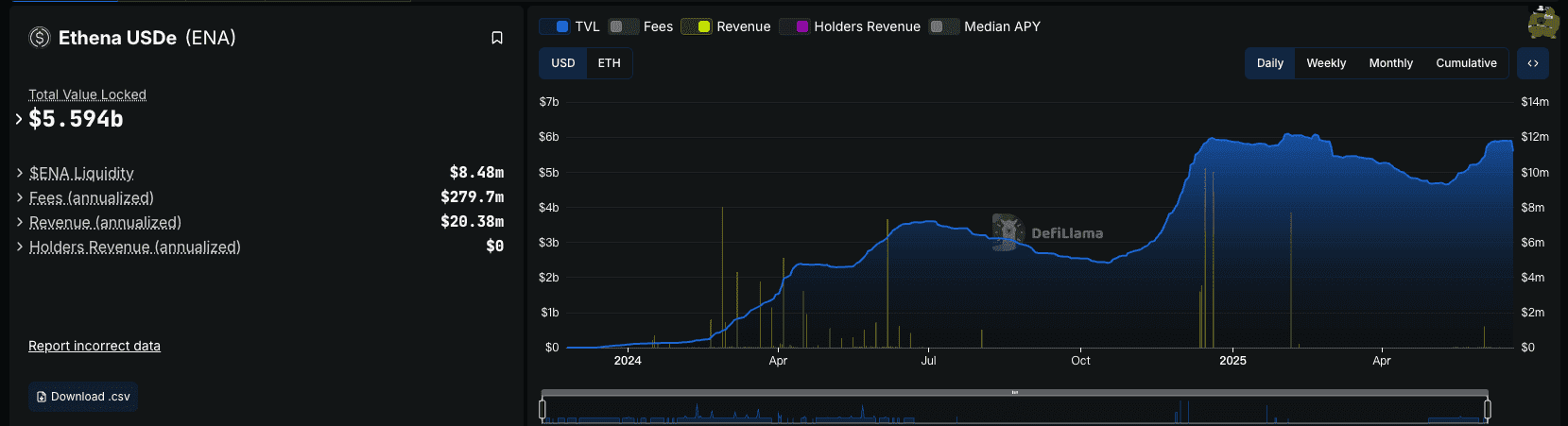

Ethena is a DeFi protocol built on Ethereum, pioneering a crypto-native synthetic dollar called USDe. Launched in 2024, Ethena has swiftly risen as a powerful innovator, with USDe growing from $100 million to an impressive $5.8 billion in supply, securing the third position among stablecoins by market capitalization. Unlike traditional stablecoins like USDT or USDC, which rely on fiat reserves, USDe uses cryptocurrency collateral and delta-neutral strategies to maintain stability. It’s dubbed the “Internet Bond,” offering a dollar-denominated savings instrument that’s censorship-resistant and globally accessible. Ethena solves a critical problem: providing a stable, scalable financial tool independent of traditional banking infrastructure.

In December 2024, Ethena expanded its stablecoin offerings with USDtb, a stablecoin backed 1:1 by cash and cash equivalents, with 90% of reserves held in BlackRock’s USD Institutional Digital Liquidity Fund via Securitize. This move enhances its appeal as a crypto-native alternative to established stablecoins, promising enhanced on-chain transparency. The ENA token powers governance within the Ethena ecosystem, allowing holders to vote on protocol decisions like risk management and asset backing. With a focus on yield generation through staking and derivatives, Ethena positions itself as a cornerstone for DeFi innovation. Curious about what is Ethena? Let’s dive deeper into its market performance and potential.

Current Price & Market Data (as of June 19, 2025)

Ethena’s ENA token is trading at $0.2872, reflecting a modest 1.54% increase over the past 24 hours. This uptick contrasts with a 3.02% drop in 24-hour trading volume to $163.79M, suggesting cautious optimism. Over the last 7 days, ENA is down 22.9%, while the 30-day gain stands at 33.08%. The three-month trend shows a 20.36% decline, and the year-over-year drop from $0.734466 remains at 51.05%. The market cap has risen slightly to $1.74B, maintaining its #46 rank on CoinGecko, buoyed by a total value locked (TVL) of $5.8B and a market cap/TVL ratio of 0.3063.

The 24-hour volume-to-market-cap ratio of 9.38% indicates solid liquidity, though it’s down from recent highs. Compared to its all-time high of $1.52 (April 11, 2024), ENA is down 81.1%. Yet, it trades 47.1% above its all-time low of $0.1953 (September 2024). ENA’s remarkable 550% price surge over the last five months underscores its momentum, placing Ethena among the top 10 DeFi protocols by TVL. For real-time insights, check ENA’s live chart on Phemex. These platforms highlight ENA’s price action and technical patterns, critical for traders eyeing entry points.

Price History & Performance Overview

ENA launched on March 28, 2024, with an airdrop that sparked immediate interest. Its initial price surged to $1.52 by April 11, 2024, driven by hype around its USDe stablecoin and DeFi integrations. However, a bearish trend followed, with ENA dropping to $0.1953 by September 2024 as market sentiment cooled. A brief recovery in October 2024, fueled by a proposal to add Solana to its reserves, pushed prices above $1 before a decline in early 2025.

The past five months have been transformative, with ENA delivering a 550% price surge, reflecting robust market confidence in USDe’s growth to $5.8 billion and the launch of USDtb in December 2024. Year-over-year, ENA’s ROI is -51.05%, but its recent performance highlights a strong rebound. Its volatility profile is high, with a 30-day price volatility of 12.6% and an Average True Range (ATR) of 0.0743, suggesting significant price swings. Key events influencing ENA’s price include its Phemex listing, which boosted liquidity, and partnerships like the proposed Converge network with Securitize, targeting institutional adoption. These catalysts highlight Ethena’s ambition but also expose it to market fluctuations.

Whale Activity & Smart Money Flows

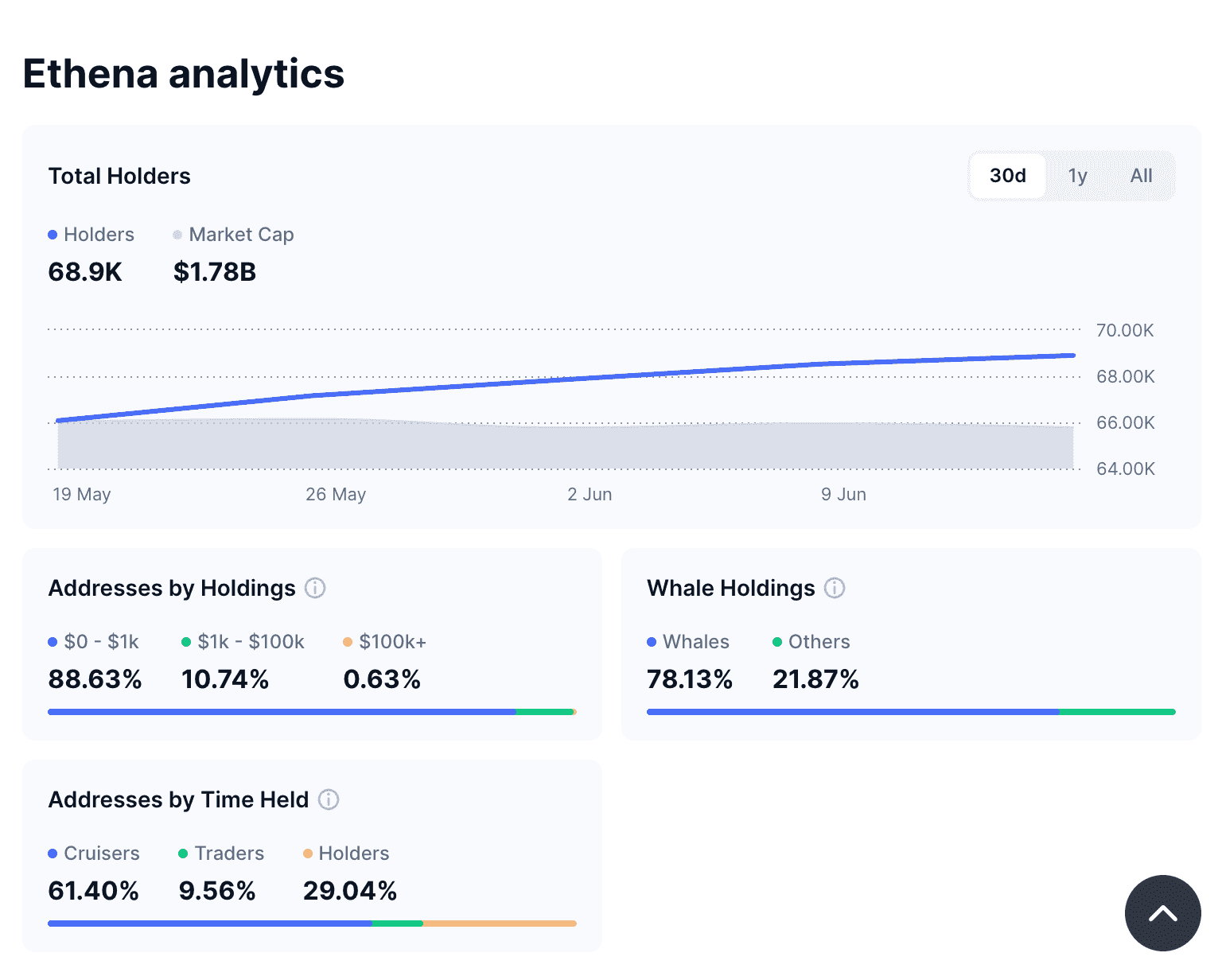

Whale activity in Ethena reveals a dynamic landscape. Recent data shows whales hold 78.13% of the supply, while others account for 21.87%, according to on-chain analytics. A notable transaction saw Arthur Hayes deposit 7.85M ENA tokens ($6.46M) to exchanges, tracked by Lookonchain, contributing to recent volatility. However, the steady growth in total holders—from 64K to 68.9K over 30 days—suggests accumulation by smaller wallets.

On-chain data from Etherscan indicates consistent smart contract interactions, particularly around USDe staking and governance voting. The number of wallets holding 1%+ of supply remains stable, reflecting confidence among large holders. Sudden inflows to exchanges often precede price dips, as seen in early 2025. Platforms like Arkham and Nansen confirm active whale participation, but no clear trend of mass accumulation or dumping has emerged. Smart money tracking for ENA remains a critical factor for price stability.

On-Chain & Technical Analysis

Technical analysis for Ethena incorporates fresh on-chain insights. The total holder count of 68.9K, up from 64K a month ago, signals growing interest. Addresses by holdings show 88.63% hold less than $1K, 10.74% hold $1K–$100K, and 0.63% hold over $100K, indicating a broad but concentrated distribution. Whale holdings dominate at 78.13%, per recent analytics.

Technical analysis indicates that ENA has formed a notable “triple bottom” around the $0.25 area, suggesting robust buying interest at this support level. On the daily chart, ENA trades below its 50-day Simple Moving Average (SMA) of $0.374357, signaling a bearish short-term trend. The 200-day SMA, projected to hit $0.502791 by July 3, 2025, suggests potential resistance. Support levels lie at $0.247 and $0.261, with resistance at $0.279, $0.288, and a strong $0.37 zone. A break above $0.37 could target $0.50, a key psychological level, while a drop below $0.25 risks testing the ATL of $0.1953.

The Relative Strength Index (RSI) at 44.34 indicates neutral momentum, neither oversold nor overbought. The Moving Average Convergence Divergence (MACD) shows a bearish crossover, aligning with the 50-day SMA’s downward slope. Volume analysis reveals declining trading activity, with a 3.02% drop in 24-hour volume to $163.79M, hinting at reduced market enthusiasm. Fibonacci retracement levels suggest $0.313 as a key pivot, with 61.8% retracement at $0.455 as a potential target in a bullish reversal.

Short-Term Price Prediction (2025–2026)

Bull Case

If Ethena’s USDe adoption accelerates, particularly with USDtb’s institutional backing and integrations like BlackRock’s BUIDL fund, ENA could rally to $1.20–$1.50 by mid-2025. A bullish breakout above the $0.37 resistance, supported by increasing trading volume, could target $0.50, with potential to reach $1.88 by 2026. Pro tips: Enter positions on a confirmed breakout above $0.37, place stop-losses below $0.24–$0.25, and consider partial profit-taking near $0.50.

Neutral Case

Assuming stable macro conditions, ENA may enter a consolidation phase between $0.25 (support) and $0.37 (resistance), reflecting market indecision and accumulation. Prices could average $0.80 in 2025, reaching $1.20–$2.50 by 2026 as DeFi integrations expand. Pro tips: Use grid trading to benefit from oscillations and monitor volume for breakout signals.

Bear Case

Regulatory pressures or token unlocks could push ENA to $0.146–$0.1876 by late 2025 if it breaks below $0.25 support with high volume, signaling a bearish trend. Prices might slide to $0.1134 by 2026, especially if whale sell-offs intensify. Pro tips: Explore short-selling below $0.25 with tight stop-losses to manage exposure.

Long-Term Price Forecast (2027–2030)

Looking ahead, Ethena’s long-term outlook hinges on its ability to scale USDe and USDtb adoption and compete with stablecoin giants like Tether. By 2027, bullish forecasts predict ENA reaching $3.00–$5.00, driven by DeFi dominance and institutional interest. By 2030, prices could hit $7.34–$12.80 in a strong bull market, assuming Ethena captures a significant DeFi niche.

In a bearish scenario, ENA could stagnate at $0.82–$1.17 by 2027 if competitors like Sky Protocol’s USDS outpace it. By 2030, prices might range from $1.81–$2.08 if adoption slows or regulatory hurdles emerge. These projections are speculative and not financial advice. Always conduct thorough research before investing, as crypto markets are highly volatile.

Fundamental Drivers of Growth

Ethena’s strength lies in its innovative tokenomics and DeFi integration. USDe’s delta-neutral strategy, combining ETH staking and derivatives, generates yields up to 37% annually, attracting investors seeking passive income. The launch of USDtb, with 90% of reserves in BlackRock’s USD Institutional Digital Liquidity Fund, enhances its institutional-grade appeal, promising advanced risk mitigation amid regulatory scrutiny on traditional stablecoins.

Recent integrations with BlackRock’s BUIDL fund and Telegram’s wallet ecosystem signal mainstream potential. The proposed Ethena Network aims to support new financial products like perpetual contracts and lending platforms, enhancing ecosystem value. Governance through ENA empowers holders, fostering community-driven development. Partnerships with Securitize and infiniFi further bolster Ethena’s credibility, positioning it as a leader in DeFi innovation.

Key Risks to Consider

Investing in Ethena carries risks. Competitive threats from stablecoins like USDS could erode market share. Token unlocks, with 30% allocated to core contributors and 25% to investors, may increase selling pressure. Regulatory scrutiny of DeFi protocols, particularly for synthetic assets like USDe and USDtb, remains a concern. Weakening developer activity or community engagement could also stall growth. The crypto market’s cyclical nature means bear markets could slash ENA’s value by 80–90%, as seen historically. Always weigh these risks of investing in Ethena before diving in.

Analyst Sentiment & Community Insights

Analyst sentiment is mixed but leans bearish in the short term. CoinCodex predicts a 24.13% drop to $0.241169 by June 29, 2025, citing bearish technicals (21/3 bearish/bullish indicators). Conversely, Coinpedia forecasts a bullish $2.37 by year-end, driven by altcoin season optimism. Community sentiment on X is optimistic, with posts highlighting USDe’s $5.8B circulation and USDtb’s institutional backing. Reddit discussions praise Ethena’s yield potential but caution against volatility. Google Trends shows moderate interest, while CoinGecko rates ENA’s community sentiment as bullish.

Is Ethena a Good Investment?

Ethena’s long-term use case as a crypto-native stablecoin protocol is compelling, with USDe’s $5.8B supply and USDtb’s institutional backing adding strength. Its innovative yield model and DeFi integrations position it for growth, but token dilution and competition pose risks. Macro factors like regulatory changes or bear markets could hinder progress. The Ethena investment potential remains promising heading into 2025–2030, but it’s not financial advice. Research thoroughly and assess your risk tolerance before investing.

Why Trade Ethena on Phemex?

Phemex is a top-tier centralized exchange renowned for its security, lightning-fast execution, and trader-centric tools. With a user-friendly interface and robust infrastructure, it’s a go-to platform for both novice and seasoned crypto enthusiasts. Phemex offers a suite of products tailored to maximize trading potential:

- Spot Trading: Access ENA and over 100 assets with deep liquidity for instant trades.

- Futures Contracts: Trade ENA perpetual contracts with up to 100x leverage for amplified returns.

- Trading Bots: Automate ENA strategies with AI-powered bots, optimizing profits in volatile markets.

- Phemex Earn: Earn passive income on ENA with flexible or fixed savings products.

- Pulse (SocialFi): Engage with the Phemex community, share ENA insights, and earn rewards via this Web3-native social trading app.

Arm your trading arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution. ENA is listed on Phemex for spot trading and futures, offering traders versatile options to capitalize on its price movements. Whether you’re HODLing or scalping, Phemex’s tools empower you to navigate Ethena’s volatility with confidence. Start trading ENA on Phemex today.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. All investment strategies involve risk, including loss of capital. Please conduct your own research (DYOR) and consult with a licensed financial advisor if needed. Phemex does not guarantee returns or endorse third-party platforms mentioned.