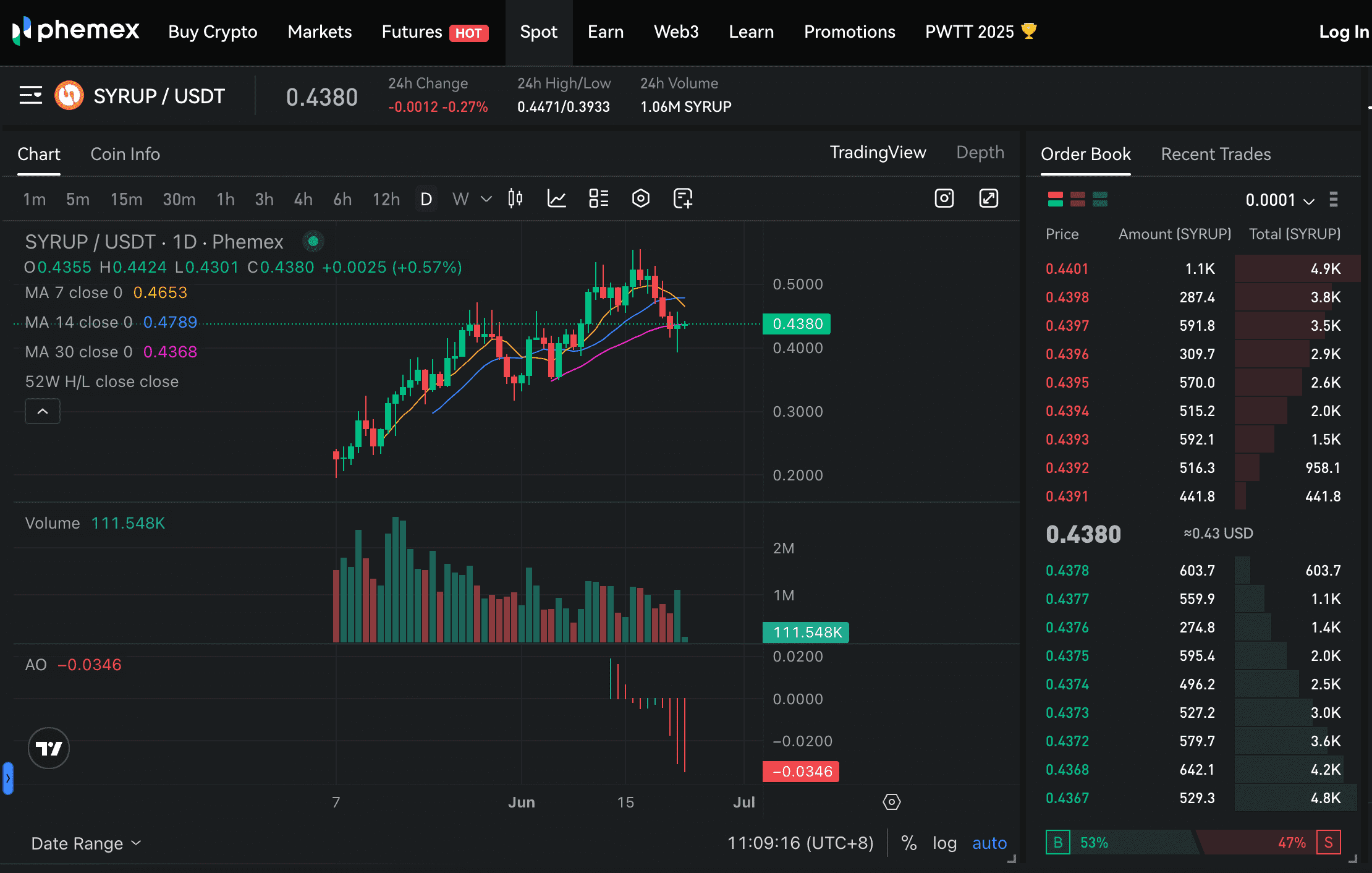

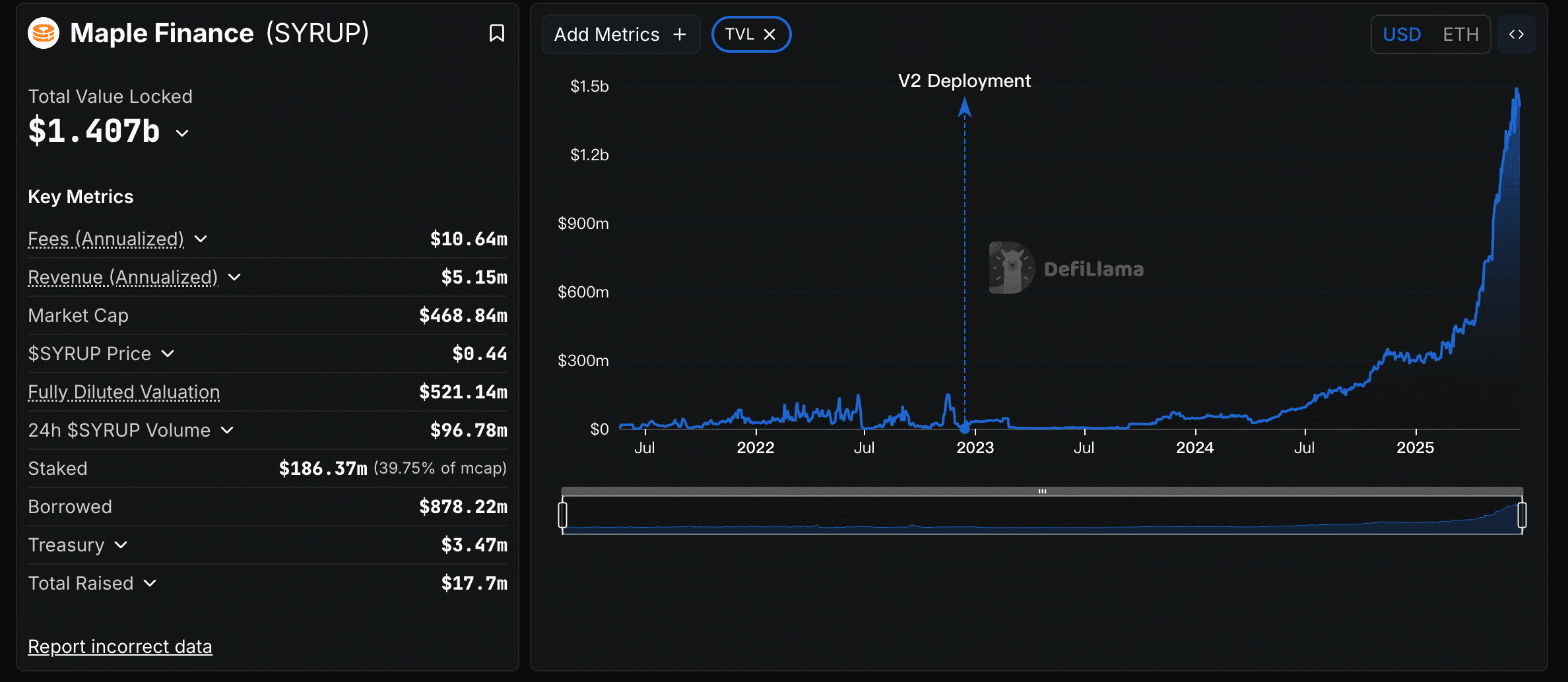

Decentralized finance (DeFi) is a dynamic frontier, blending innovation with opportunity to redefine how capital flows. At the heart of this evolution is Maple Finance, a protocol revolutionizing corporate credit markets with its native token, SYRUP ($SYRUP). But what is Maple Finance, and why is SYRUP capturing the attention of investors and institutions alike? This Phemex Academy deep dive explores Maple’s vision, technology, and ecosystem, offering insights into how to buy SYRUP and trade SYRUP on Phemex. With a total value locked (TVL) of $1.407 billion and a market cap of $468.84 million as of June 2025, Maple is a force to watch in DeFi.

Disclaimer: This article is for informational purposes only and not financial advice. Cryptocurrency investments carry significant risks, including volatility and regulatory uncertainties. Always conduct your own research before investing.

Quick Facts: SYRUP ($SYRUP) Snapshot

- Ticker Symbol: $SYRUP

- Chain: Ethereum

- Contract Address: 0x643C4E15d7d62Ad0aBeC4a9BD4b001aA3Ef52d66

- Circulating Supply: ~10 million (estimated)

- Max Supply: Uncapped (inflationary)

- Total Supply:1.18B

- Primary Use Case: Governance, incentives, protocol access

- Current Market Cap: $468.84M

- Availability on Phemex: Yes (Spot, Futures)

What Is Maple Finance ($SYRUP)? A Beginner’s Guide

What is Maple Finance? It’s a decentralized credit market that brings institutional-grade lending to the blockchain, powered by its native token, SYRUP. SYRUP explained: it’s an ERC-20 token that fuels governance, incentives, and access within Maple’s ecosystem, which facilitates both uncollateralized and overcollateralized loans. Unlike traditional DeFi platforms like Aave, which rely heavily on overcollateralization, Maple bridges traditional finance (TradFi) and DeFi by enabling undercollateralized lending, a model tailored for institutions like hedge funds and crypto businesses.

Maple’s value proposition is clear: it offers transparent, efficient financing for borrowers and sustainable yields for liquidity providers (LPs). With $1.407 billion in TVL and $878.22 million in loans issued, Maple is tapping into a multi-trillion-dollar credit market. SYRUP aligns stakeholders by rewarding participation and empowering governance, making it a cornerstone of Maple’s mission to democratize credit. X posts highlight Maple’s growing traction, with some predicting SYRUP could reach a $5-10 billion valuation, underscoring its relevance in DeFi’s credit revolution.

How Many SYRUP Tokens Exist?

SYRUP’s tokenomics are designed for flexibility and growth. The circulating supply is approximately 10 million tokens, with no fixed max supply, marking SYRUP as inflationary. This allows Maple to mint new tokens to incentivize LPs, borrowers, and pool delegates, ensuring the protocol attracts capital. As of June 2025, SYRUP’s market cap stands at $468.84 million, with a fully diluted valuation of $521.14 million.

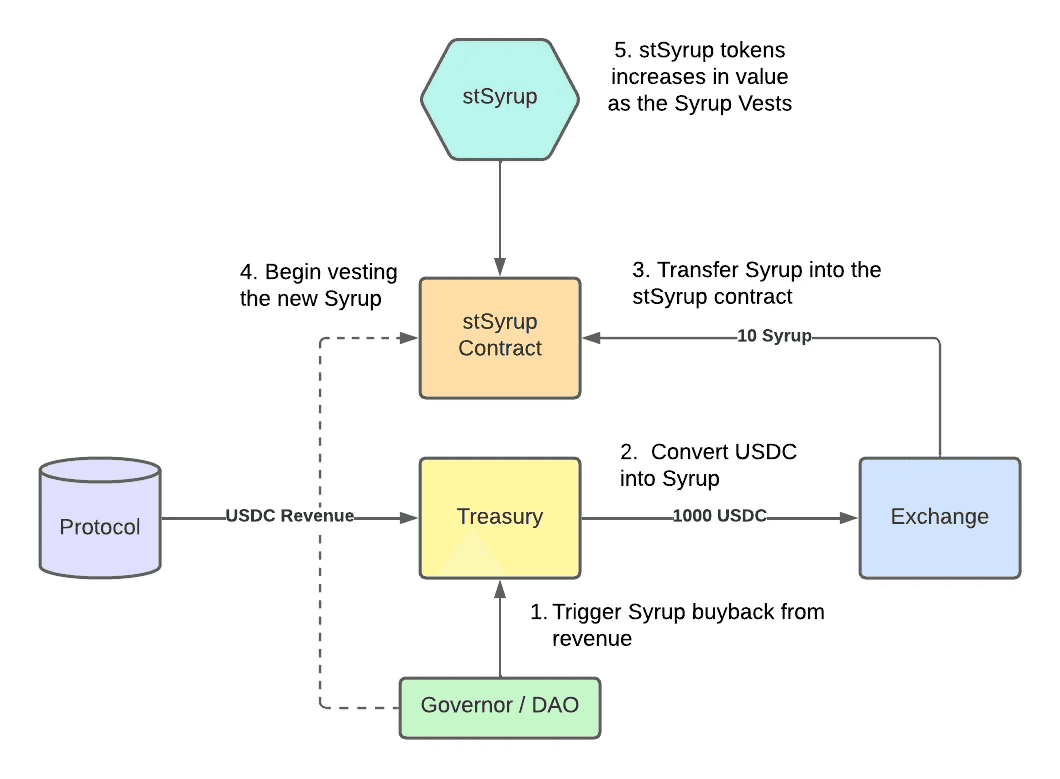

To counter inflation, Maple employs a buyback-and-burn mechanism, using a portion of its $5.15 million annualized revenue to repurchase SYRUP tokens. These are either redistributed to stakers or burned, creating deflationary pressure. With 39.75% of the market cap ($186.37 million) staked, SYRUP’s token model balances growth with value preservation, supporting long-term sustainability.

What Does SYRUP Do? Key Use Cases

SYRUP’s use case is integral to Maple’s decentralized credit ecosystem, serving three core functions:

- Governance: SYRUP holders vote on protocol upgrades, loan terms, and pool parameters, shaping Maple’s evolution.

- Incentives: Tokens reward LPs, borrowers, and pool delegates, driving participation. For instance, LPs in the syrupUSDC pool earn SYRUP alongside stablecoin yields.

- Access: Holding SYRUP unlocks premium features, such as priority pool access or lower fees, incentivizing long-term commitment.

Maple’s ecosystem offers borrowers on-chain financing with terms enforced by smart contracts, while LPs enjoy diversified yields through professionally managed pools. The protocol’s $10.64 million in annualized fees and $878.22 million in borrowed capital highlight its real-world impact. Partnerships with institutions like Bitwise Invest and Cantor Fitzgerald, coupled with integrations like Chainlink for price feeds, enhance SYRUP’s utility. Tradable on Phemex, SYRUP is a bet on the future of on-chain credit.

SYRUP vs Aave: A Comparative Analysis

How does SYRUP stack up against Aave, a leading DeFi lending protocol? The table below compares key aspects:

| Feature | SYRUP (Maple Finance) | AAVE(Aave) |

|---|---|---|

| Technology | ERC-20 token on Ethereum; hybrid lending model | ERC-20 token on Ethereum; fully decentralized lending |

| Speed & Fees | Tied to Ethereum’s gas fees; batching reduces costs | Ethereum gas fees; optimized for low-cost transactions |

| Use Case | Institutional credit (uncollateralized loans) | Retail and institutional overcollateralized lending |

| Decentralization | Hybrid (pool delegates manage loans) | Fully decentralized with algorithmic rates |

| TVL (June 2025) | $1.407B | ~$22.794B (estimated) |

SYRUP’s hybrid model, blending centralized expertise via pool delegates with blockchain transparency, contrasts with Aave’s fully decentralized, algorithm-driven approach. While Aave caters to a broader retail audience, Maple targets institutional borrowers, offering uncollateralized loans—a niche but high-value market. SYRUP’s governance empowers holders to influence loan terms, unlike Aave’s more automated system. Both rely on Ethereum, but Maple’s focus on credit markets positions SYRUP as a specialized player in DeFi.

The Technology Behind Maple Finance

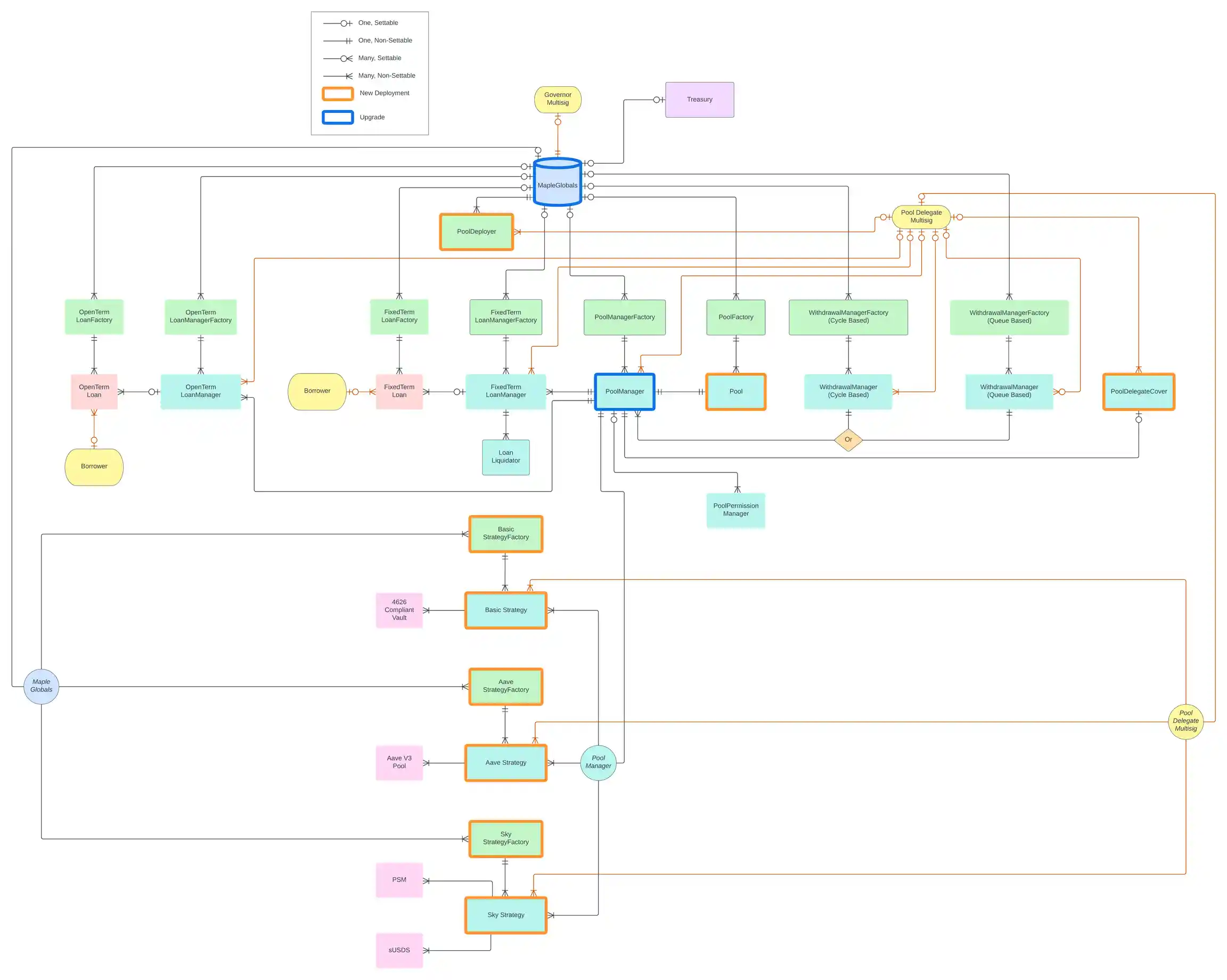

Maple’s technical architecture is robust yet pragmatic, built on Ethereum’s secure infrastructure. SYRUP, an ERC-20 token, integrates seamlessly with wallets and exchanges like Phemex. Maple’s smart contracts, audited by firms like PeckShield, handle loan origination, repayment, and token distribution with precision.

Key components include:

- Pool (ERC-4626): Simplifies LP interactions for deposits and withdrawals, delegating logic to the PoolManager.

- PoolManager: Manages administrative functions, loan funding, and pool parameters, ensuring operational efficiency.

- LoanManagers: Track loan accounting for fixed-term and open-term loans, enabling flexible yield strategies.

- External Strategies: Integrate with protocols like Aave to generate secondary yields for pools.

Maple’s hybrid lending model relies on pool delegates—trusted entities like Maple Direct—to underwrite loans, reducing risk while enabling uncollateralized lending. Chainlink oracles provide accurate price feeds, and proxy contracts with upgradeability ensure scalability. With $1.407 billion in TVL, Maple’s tech stack is battle-tested, supporting its ambition to redefine credit markets.

Team & Origins: The Minds Behind Maple

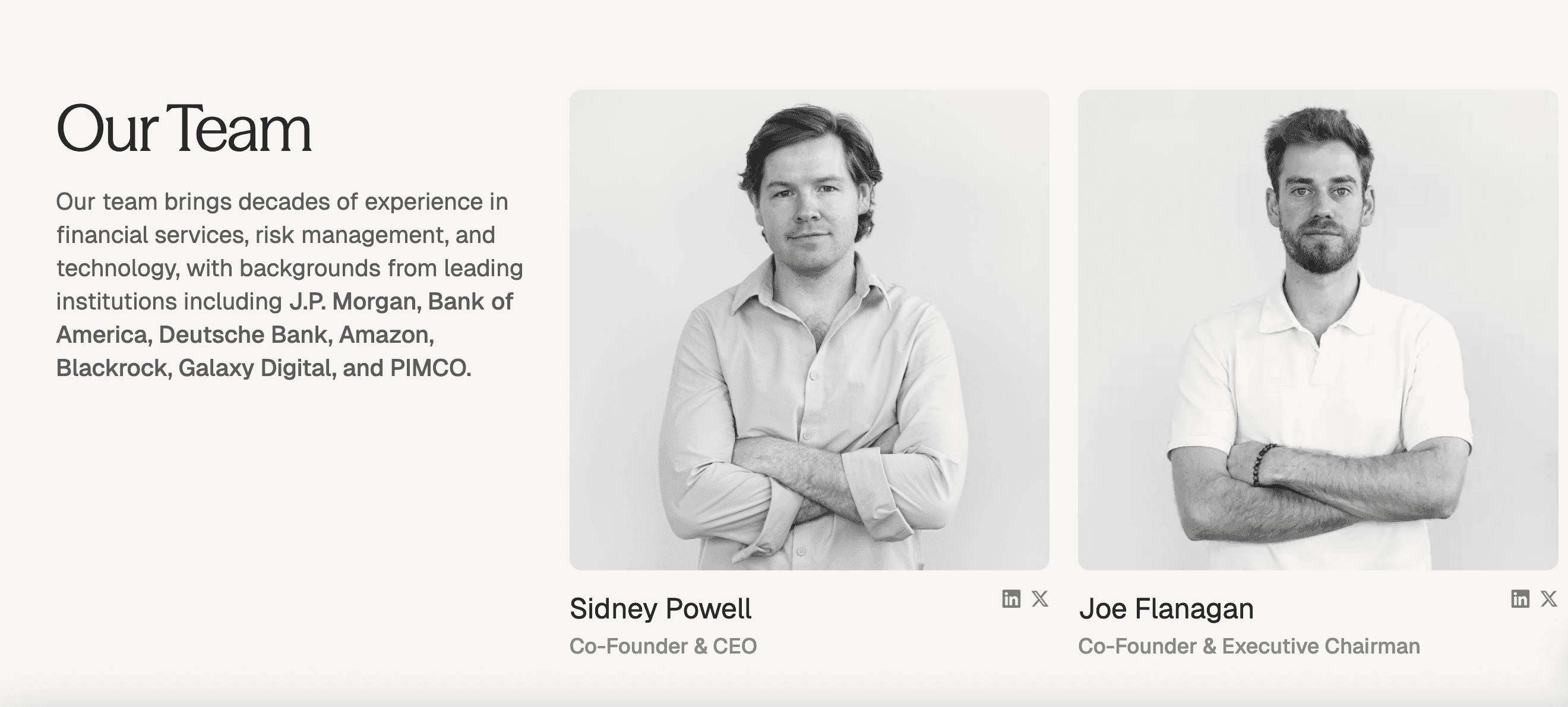

Founded in 2019 by Sidney Powell and Joe Flanagan, Maple Finance combines TradFi expertise with blockchain innovation. Powell, a former bond trader, and Flanagan, a credit risk specialist, launched Maple to bring structured credit on-chain. Headquartered in Melbourne, Australia, the team has raised $50.7 million from investors like Coinbase Ventures and Polychain Capital.

Maple’s mainnet went live in 2021, with SYRUP introduced in June 2024 to support its expanding ecosystem. Partnerships with Cantor Fitzgerald and Bitwise Invest have bolstered its TradFi ties, while a $3.47 million portfolio underscores financial stability. The team’s transparency and institutional backing lend SYRUP credibility in a volatile DeFi space.

Key News & Milestones

- 2024: SYRUP launches, driving 200% AUM growth and $100M TVL in syrupUSDC pools.

- June 2025: Maple’s TVL hits $1.407 billion; $878.22 million in loans issued.

- June 2025: Partnerships with Bitwise and Cantor Fitzgerald expand institutional reach.

- June 17, 2025: SYRUP lists on dYdX, boosting 24h volume to $78M.

No significant regulatory hurdles have emerged, but DeFi’s evolving legal landscape warrants caution.

Risk Warning: Regulatory changes could impact DeFi protocols like Maple. Stay informed about potential legal developments.

Is SYRUP a Good Investment?

Disclaimer: This is not financial advice. Cryptocurrency investments are highly volatile and carry significant risks, including potential loss of capital. Always conduct your own research.

SYRUP’s investment potential hinges on Maple’s dominance in on-chain credit. The SYRUP price surged from a low of $0.084 on April 7, 2025, to a high of $0.55 on June 17, 2025, reflecting a 554% increase. Maple’s $5.15 million annualized revenue and $10.64 million in fees support its buyback program, stabilizing value. Community sentiment on X is bullish, with 39.75% of tokens staked ($186.37 million).

Risks include:

-

Volatility: SYRUP’s price swings, as seen in its 2025 range of $0.084–$0.55, highlight market risks.

-

Inflation: Uncapped supply could dilute value if mismanaged.

-

Regulation: Scrutiny of uncollateralized lending may intensify.

Maple’s $1.407 billion TVL and partnerships with Bitwise and Cantor Fitzgerald signal longevity, but diversification is crucial. SYRUP offers exposure to a high-growth credit market, appealing to risk-tolerant investors.

Risk Warning: Cryptocurrency prices are subject to extreme fluctuations. Regulatory and market risks could impact SYRUP’s value. Invest cautiously and only with funds you can afford to lose.

How to Buy SYRUP on Phemex?

Ready to explore SYRUP? It’s live on Phemex for spot and futures trading. Check out Phemex’s how to buy SYRUP guide for step-by-step instructions on account setup, funding, and trading. Phemex’s low fees and user-friendly platform make trading SYRUP seamless.

Risk Warning: Trading cryptocurrencies involves significant risks, including loss of funds. Ensure you understand the risks before trading.

Conclusion: SYRUP’s Role in DeFi’s Future

Maple Finance, with SYRUP at its core, is reshaping how credit operates in DeFi. By blending TradFi expertise with blockchain transparency, Maple offers a compelling alternative to traditional lending, with $1.407 billion in TVL and $878.22 million in loans. SYRUP’s governance, incentives, and access features align stakeholders, while its inflationary model, tempered by buybacks, supports growth. Despite risks like volatility and regulation, Maple’s partnerships and revenue signal a bright future. Stay updated on news about SYRUP and monitor SYRUP price on Phemex to seize opportunities in this dynamic market.

Disclaimer: Investing in cryptocurrencies is speculative and carries high risks. Past performance is not indicative of future results. Always research thoroughly and consider your risk tolerance before investing.